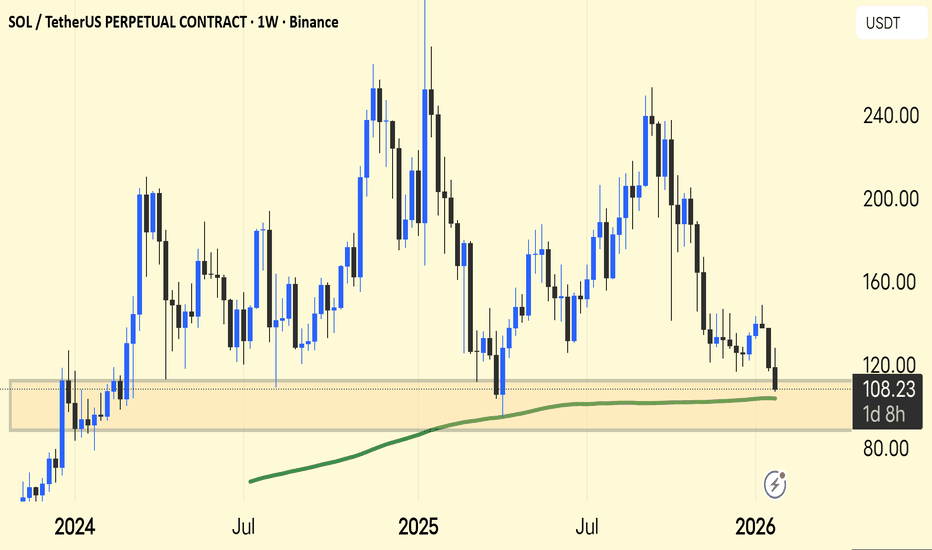

SOL/USDT — Weekly Chart Update. SOL/USDT — Weekly Chart Update

SOL is testing a major demand zone around $100–110, right where price has reacted multiple times before.

The 200-week MA (green) is just below price — a key long-term support area.

Market structure is still lower highs after the $240 peak → medium-term pressure remains.

Hold above $100 = base building & potential bounce toward $130–150.

Weekly close below $100 = risk of deeper pullback toward $80–90.

Summary: This is a make-or-break zone for SOL. Bulls need to defend here to flip momentum.

Solusdtlong

#SOL/USDT Final Liquidity Zone Before Expansion ?#SOL

The price is moving within a descending channel on the hourly timeframe. It has reached the upper boundary and is heading towards breaking it. A retest of this boundary is expected.

The Relative Strength Index (RSI) is showing an upward trend, as it has approached the upper boundary. A bearish reversal is expected.

There is a key support zone in green at 114.50. The price has bounced from this zone several times and is expected to bounce again.

A consolidation trend is observed above the 100-period moving average, which we are approaching. This trend supports a decline towards this level.

Entry Price: 116.78

Target 1: 117.96

Target 2: 119.91

Target 3: 122.82

Stop Loss: Above the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

SOLUSDT 1,360% profits potential with 8X leverage —LONG tradeMany projects crashed in October or November 2025, new major lows, new all-time lows; pretty bad. Solana remains really strong, just like Bitcoin, Ethereum and some others.

The last low happened mid-December last year and this low ended as a higher low compared to early April 2025. This is a strong bullish signal.

SOLUSDT now has a flat bottom with decreasing bearish volume. This type of chart setup supports a trend reversal. This chart setup supports change. This chart setup supports a bullish wave. We are going up next. And, for this reason, I am sharing with you this set of trade-numbers... I hope you find them useful.

_____

LONG SOLUSDT

Leverage: 8X

Potential: 1360%

Allocation: 5%

Entry zone: $116 - $126

Targets:

1) $137

2) $149

3) $169

4) $185

5) $201

6) $224

7) $253

8) $286

9) $306

10) $338

Stop: $112

_____

Thank you for reading. Your continued support is highly appreciated.

Namaste.

#SOL/USDT Final Liquidity Zone Before Expansion ?#SOL

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 132. The price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 133.50

First Target: 134.93

Second Target: 137.30

Third Target: 140.25

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#SOL/USDT Final Liquidity Zone Before Expansion ?#SOL

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 142.67, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 145.00

First Target: 145.80

Second Target: 147.77

Third Target: 150

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

SOL — High-Confidence Long Zone

This is one of the safest areas to look for longs on CRYPTOCAP:SOL , as long as price continues to hold above 121, which marks the monthly value area.

What I’m Looking For

Holding above 121: Keeps the bullish structure intact.

Target: A push toward just below 400 remains on the table.

Stronger continuation: If SOL manages to build a clean mode around 172, the odds of an accelerated move increase significantly.

I seriously doubt we’ll get another opportunity to long SOL anywhere near the 2023 close, which is why current levels are already attractive from a risk–reward perspective.

For now, this is a hold-and-build setup, not a chase.

SOL/USDT – This Reclaimed Level Could Send SOL Flying Again#SOL has finally reclaimed a major resistance zone, now acting as strong support. This level previously rejected price hard, and the successful reclaim signals a potential trend continuation.

Momentum is clearly shifting bullish, and as long as price holds above this reclaimed zone, the upside scenario remains highly favored. This is the type of structure that often leads to fast expansions once liquidity above gets targeted.

Bias: Bullish continuation

Invalidation: Loss of the reclaimed support zone

📊 Risk/Reward: 1:2

⚠️ DYOR (Do Your Own Research)

Solana Still Has Room to Run | Targets AheadHello traders! 🚀

Hope your week is off to a great start!

Today I’d love to share my thoughts on Solana (SOL) 💎

Even though SOL has already made a solid move to the upside, the chart is still sending bullish signals 📈 The structure suggests that the momentum may continue, and the party might not be over yet 😉

From current levels, I’m looking for a move toward 148.

❌ Invalidation level:

Any touch of the 141.6 area will invalidate this bullish scenario.

Let’s break down the targets step by step 👇

🎯 Target 1: 145

🎯 Target 2: 148

🎯 Bold target: (151.4) — a bit optimistic, so I’ll keep it in brackets 😄

If this idea resonates with you, hit the like 👍,

follow for more trading ideas, and

share your thoughts in the comments — where do you see SOL going next? 💬

Trade smart, manage your risk 🧠

Let’s watch the chart together! 🚀📊

#SOL/USDT IS AT DECISIVE POINT! WHO WILL WIN? BULLS OR BEARS?SOL/USDT – Daily Outlook

SOL is attempting a trend shift after forming a higher low near the lower boundary of the descending channel. Price has bounced with strength and is now trading above the short-term moving averages.

The 13 EMA (green) is leading the move and has crossed above the 21 EMA (blue), which typically signals improving momentum and short-term trend reversal. As long as price holds above these EMAs, bulls remain in control.

🔑 Major Resistance Zone:

$155–158 → a strong resistance cluster formed by prior support-turned-resistance and EMA congestion.

📈 Bullish Scenario:

A daily close above $158 would confirm a breakout and trend continuation, opening the path toward $175–180, followed by $ 190 or higher if momentum sustains.

⚠️ Risk / Invalidation:

Rejection from $155–158 may lead to short-term consolidation or a pullback toward $133 to 127.

Overall, the structure is constructive, momentum is improving, and $158 remains the key trigger level for the next leg higher.

If you like this chart, do hit the like button and share your views in the comments.

Thank you

#PEACE

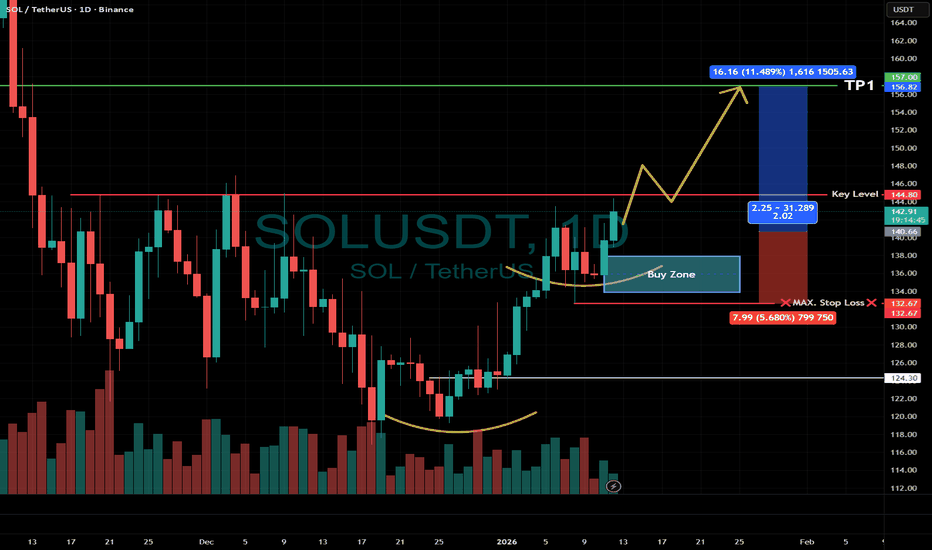

SOLUSDT Long Setup – Rounded Bottom Reversal in Play🚀 SOLUSDT Long Setup – Rounded Bottom Reversal in Play

The SOLUSDT Daily Chart is shaping up for a bullish breakout, with price action forming a classic rounded bottom pattern—a strong reversal signal in crypto markets. After weeks of consolidation, Solana has reclaimed momentum and is now trading near $138, just above the Buy Zone ($134–$140).

This zone has acted as a base of accumulation, and with volume picking up, the setup offers a clean structure for a long trade with attractive upside targets.

🟢 Trade Setup Details

- Buy Zone: $134.00 – $140.00

- MAX. Stop Loss: $132.67

- Key Resistance Level: $144.80

- Take Profit Targets:

- 🎯 TP1: $157.00

The projected move offers a risk/reward ratio of 2.30, with a potential gain of 11.49% from entry to TP1.

🔍 Technical Highlights

- The rounded bottom suggests a shift from bearish to bullish sentiment.

- Price is reclaiming the neckline zone around $144.80, which may act as a breakout trigger.

- Volume shows signs of accumulation, supporting the bullish thesis.

- The risk zone is tightly defined, allowing for precise SL placement below $132.67.

📈 Bullish Scenario

If SOL holds above the Buy Zone and breaks through $144.80, we could see a swift move toward TP1 at $157.00. Watch for:

- Bullish daily close above $145

- Volume spike confirming breakout

- Momentum indicators crossing into bullish territory

⚠️ Risk Management

- SL below $132.67 protects against invalidation of the rounded bottom.

- Consider scaling out near TP1 or trailing stops to capture extended moves.

- Avoid chasing if price runs too far—wait for pullbacks or retests of breakout levels.

💡 Summary: SOLUSDT is showing a textbook rounded bottom reversal, with price stabilizing in the $134–$140 Buy Zone and gearing up for a breakout. With a clean structure, layered targets, and tight SL, this setup offers precision and potential.

📊 Whether you're trading the breakout or positioning for a swing move toward $157+, this chart deserves your attention.

#SOL/USDT may continue its trend after correction#SOL

The price is moving in a descending channel on the 1-hour timeframe. It has reached the upper limit and is heading towards breaking it. A retest of the upper limit is expected.

We have an upward trend on the RSI indicator, which has reached near the upper limit. A downward reversal is expected.

There is a key support zone in green at 139.70. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend of consolidation above the 100-period moving average, as we are moving close to it. This supports a downward move towards touching this level.

Entry price: 137.70

First target: 136.15

Second target: 135.09

Third target: 133.66

Stop loss above the resistance zone in green.

Don't forget a simple thing: money management.

For inquiries, please leave a comment.

Thank you.

#SOL/USDT Final Liquidity Zone Before Expansion ?#SOL

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish bias in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 128, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 133

First Target: 134

Second Target: 137

Third Target: 140

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

Solana’s Not Done Yet — Hitting 136 Soon?🚀 Solana Update | TF 15M

Hey everyone! 👋

In my previous post, my targets were:

🎯 127.50 & 130

Before SOL reached the first target, it dipped slightly below my old cancellation zone. But that didn’t break the long picture it actually strengthened it 💪.

🔥🎯New targets:

➡️ 132

➡️ 135

➡️ 136 😎

❌New cancellation zone: 126.85

Two possible scenarios for this move:

🟢 Green arrow path

🟣 Purple arrow path

⚠️ Disclaimer: Not financial advice — just my personal view. Trade responsibly!

💖 If you like this, hit follow & react to support! Every ❤️ helps!

Solana (SOL) — 15m Local Bullish StructureHello, friends!

How did you celebrate the New Year? 🎉

I wish everyone a productive and profitable 2026!

I haven’t posted ideas on TradingView for a few weeks, but I’ve decided that starting from the very first day of 2026, I’ll be sharing ideas daily.

So here is my first one:

Despite my previous bearish outlook, Solana looks quite positive on the local timeframe right now 🐂

After a small pullback to the 124.76 area, I’m considering long positions.

🎯 Targets:

• 127.5

• 130

❌ Invalidation:

Any touch of 124.69 fully invalidates this setup.

As always, manage your risk and stay tuned for updates. 🚀

SOLANA (SOL) ANALYSIS: 3 MODELS TO TRADE THE SWEEP & BREAKOUTMARKET STRUCTURE & ANALYSIS

Solana (SOL) has been trading within a defined accumulation range. We are currently sitting in the middle "no-trade zone," waiting for a decisive move.

Smart money often hunts for liquidity before the real move begins. We have identified a High Time Frame (HTF) Sweep Zone & Order Block (Green Box) below us, and a breakout level above us.

Here are the 3 SPECIFIC MODELS to trade this setup, depending on your risk tolerance:

MODEL 1: ENTRY AT OB (HIGH RISK, HIGH REWARD) The Sniper Approach

This is the aggressive entry for traders who want the best possible price.

The Plan: Set limit orders directly inside the HTF Sweep Zone / Bullish Order Block (Green Box)

The Logic: You are "catching the knife" based on strong institutional demand in this area.

Risk: Price could continue lower. This model requires a strict Stop Loss but offers the massive Risk-to-Reward (R:R) potential.

MODEL 2: WAIT FOR THE SWEEP & TAKE ENTRY (CONSERVATIVE) The Confirmation Approach

This is the safer alternative to Model 1.

The Plan: Let the price drop into the Green Box to sweep liquidity. Do not buy yet.

The Trigger: Wait for the price to pump back up and close a 4H candle back inside the range (reclaiming the support level).

Entry: Enter on the close of that reclamation candle.

Logic: This confirms that the dip was just a "bear trap" and buyers have stepped back in.

MODEL 3: LONG AFTER BREAKOUT & RETEST (CONTINUATION) The Momentum Approach

This model plays the breakout of the upper resistance (White Line, ~$148).

The Plan: Wait for price to break clearly above the resistance.

The Trigger: Wait for a SUCCESSFUL RETEST. Price must come down, touch the old resistance, turn it into support, and bounce.

Entry: Long the bounce after the retest holds.

CRITICAL WARNING: THE "TOP LIQUIDITY SWEEP" TRAP Do not get trapped here.

Model 3 has a specific danger: The Fakeout. If price breaks above the resistance but FAILS to hold the retest (i.e., it crashes back down into the range), this was NOT a breakout. It was a Top Liquidity Sweep (a trap to catch early longs).

Rule: If the retest fails, Model 3 is invalid. Do not FOMO long at the highs without confirmation.

SUMMARY

Aggressive? Use Model 1 in the Green Box.

Conservative? Use Model 2 and wait for the reclaim.

Momentum? Use Model 3 but ONLY if the retest holds.

Which model fits your style? Let me know in the comments!

Disclaimer: This analysis is for educational purposes only. Cryptocurrency trading involves high risk. Always manage your risk properly.

SOL/USDT – Accumulation or Continuation? Key Support!SOL/USDT on the 8-hour timeframe is still moving within a bearish corrective structure / broader downtrend, characterized by a series of lower highs and lower lows since the rejection from the 230+ area.

Currently, price is trading inside a strong historical demand zone at 127–121, which previously acted as a major accumulation and bounce area.

Price is now consolidating above this demand zone while pressing against a descending trendline, making this area a critical decision zone for the next major move.

---

Pattern & Price Structure

1. Descending Trendline (Bearish Pressure)

The descending trendline remains valid and unbroken

Each recovery move continues to be capped by this trendline

Indicates seller dominance is still present

2. Demand Zone / Support Base (127 – 121)

The yellow box marks a strong demand zone

Multiple lower-wick rejections indicate active buying interest

Price is forming a base / consolidation range above support

3. Compression Pattern (Range Tightening)

Price is compressed between:

Dynamic resistance (descending trendline)

Static support (demand zone)

This structure often leads to a high-momentum breakout

---

Key Levels

Dynamic Resistance: Descending trendline

Horizontal Resistances:

144

154.5

167

177

Major Support:

127

121

Invalidation Level:

Strong close below 121

---

Bullish Scenario

The bullish scenario is valid if:

1. Price holds above the 127–121 demand zone

2. A strong candle close breaks above the descending trendline

3. Volume expansion confirms the breakout

Upside Targets:

144 (minor resistance)

154.5 (key reaction level)

167 (mid-range resistance)

177 (major resistance)

A confirmed breakout above the trendline may signal a trend reversal or bullish continuation from a base structure.

---

Bearish Scenario

The bearish scenario occurs if:

1. Price fails to break the descending trendline

2. A strong breakdown and close below 121

3. The demand zone fails to absorb selling pressure

Downside Risk:

116.8 (previous low)

Further downside could form new lower lows, continuing the broader bearish trend

---

Conclusion

SOL/USDT is currently at a critical decision area.

The 127–121 demand zone is the key level to watch:

Holding support + trendline breakout → bullish reversal potential

Demand breakdown → bearish continuation

Patience is required. Wait for clear breakout or breakdown confirmation before committing to a directional trade.

---

#SOLUSDT #Solana #CryptoAnalysis #TechnicalAnalysis #DescendingTrendline #DemandZone #SupportResistance #AltcoinTrading #CryptoMarket

#SOL/USDT Final Liquidity Zone Before Expansion ?#SOL

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 122.00. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 124.00

First target: 125.48

Second target: 127.15

Third target: 129.63

Stop loss: Below the support zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

#SOL/USDT Final Liquidity Zone Before Expansion ?#SOL

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 123.66. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 126.20

First target: 127.76

Second target: 129.00

Third target: 130.74

Don't forget a simple thing: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

SOL at a Critical Decision Zone – Double Bottom vs ResistanceHi!

Market Context

Solana is trading near a key decision zone after a corrective move from recent highs. Price action suggests short-term bullish attempts, but the broader structure remains mixed.

Technical Structure

Broken Trendline: The descending trendline from the recent high has been broken, indicating a short-term momentum shift.

Double Bottom Formation: A clear double bottom has formed near the $121–$122 area, showing strong buyer reaction and short-term demand.

Support Zone: The horizontal support around $120 remains critical. This level has been tested multiple times and is still holding.

Resistance & Scenarios

Bullish Scenario: If price holds above $120 and continues higher, a move toward the $125–$126 supply zone is likely. This area previously acted as resistance and may trigger selling pressure.

Bearish Scenario: Failure to sustain above current levels, followed by a breakdown below $120, would invalidate the double bottom and open the door for a deeper correction.

Conclusion

While short-term bullish signs are present, confirmation requires continuation above resistance. Until then, SOL remains in a sensitive zone where both scenarios are possible. Risk management is essential around these levels.