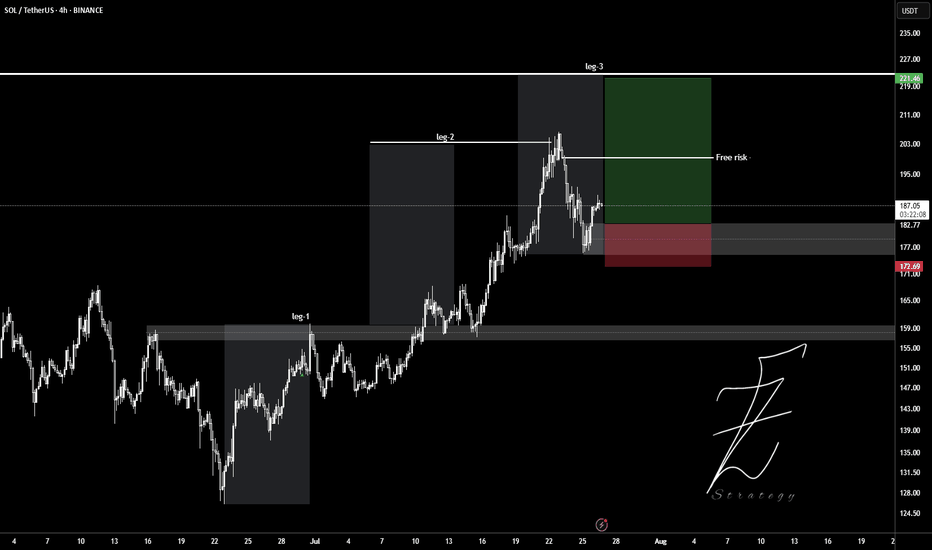

SOLUSDTSOLUSDT | 4H | Bullish Bias

🔑 Key Structure Update:

Price tapped into demand zone + FVG, marking a strong POI for potential reversal. Previous bearish leg may shift if buyers defend this level.

📍 POI Level (Demand Zone + FVG):

$175 – $178 range.

Reason: Overlap of demand zone + fair value gap, acting as liquidity zone.

📊 Trade Plan:

Wait for bullish confirmation (reversal pattern or BOS on lower timeframe) before entry.

🎯 Targets:

TP1: $190

TP2: $205

TP3: $220 (extended target if momentum sustains)

❌ Invalidation (SL):

Below $170 (clear demand failure).

SOLUSDTPERP

#SOL/USDT Golden Pocket Retest ?#SOL

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 174.85.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 173, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 181.

First target: 183.

Second target: 186.

Third target: 190.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

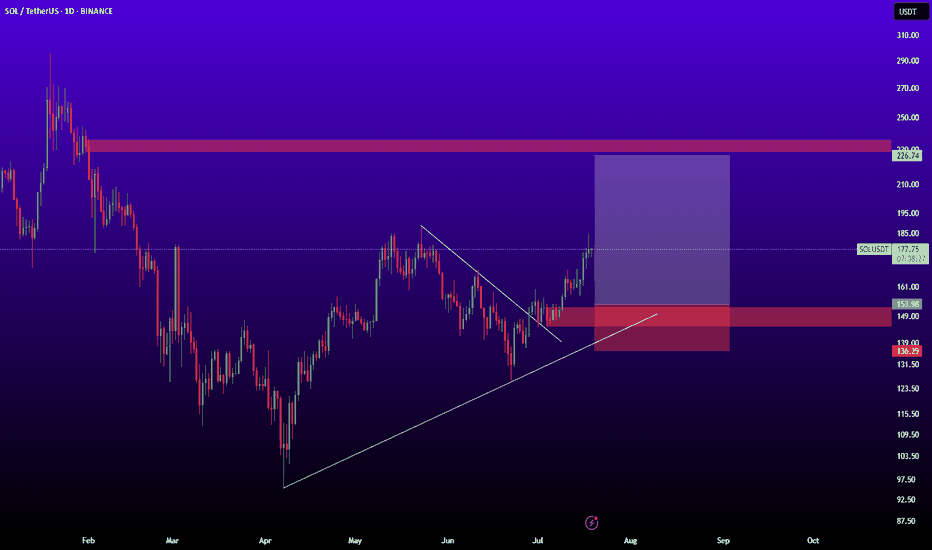

#SOL/USDT Is This the Perfect Time for a Solana Bullish Heist?#SOL

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 180.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 178, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the moving average of 100.

Entry price: 192.

First target: 196.

Second target: 202.

Third target: 209.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Long!!!!!I bought more Solana, opened a leveraged long position and also opened an option trading over the weekend.

I think Solana is about to end the 18th month's consolidation and is getting ready to move to the upside.

Reasons for my directional bias:

1) RSI lines crossed at 50 area and are moving to the upside.

2) MACD stayed in the bull zone and lines have crossed to the upside.

3) EMA 55 crossed above EMA200 on 24th July. As I said in the previous articles, when they cross, the price often pulls back significantly and retests some key areas. The price dropped to Fib 0.618, found support and it is now moving to the upside. (green vertical line in the chart)

4) EMA21>EMA55>EMA200 - all EMAs are pointing to the upside (not horizontal)

5) $185 -$200 has been working as a strong liquidity zone. It has been difficult to break above and stay above, but I think it has enough momentum to start the next leg up.

6) In the monthly chart, RSI lines and MACD lines are above to cross to the upside. The last time that happened was Oct 2023. The price consequently moved from $20 ro $210 (Fib 0.786) in a matter of 6 months. And it was when EMA55 crossed above EMA200 in the daily chart and price pulled back and retested Fib 0.618. (Red vertical line)

SOL Volatility Period: Around August 18

Hello, traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

(SOLUSDT 1M Chart)

If the price stays above the M-Signal indicator on the 1M chart, the uptrend is expected to continue.

If it falls below 126.36, you should stop trading and observe the movement.

Since the HA-High indicator is forming at 179.74, the key question is whether it can find support near this level and rise.

The start of a stepwise uptrend is likely to begin with a rise above 237.60, the DOM (60) indicator level.

Therefore, the key point to watch is whether it can find support in the 179.74-237.60 range.

The DOM (60) indicator indicates the end of a high, while the HA-High indicator indicates a decline from a high.

Therefore, the 179.74-237.60 range can be considered a high boundary zone.

When the DOM (60) or HA-High indicator first forms, a decline is likely.

If the decline is followed by a rise near the HA-High or DOM (60) indicator, the likelihood of an upward breakout increases.

Therefore, if support is found around 179.74 this time, it is highly likely to lead to an attempt to rise above 237.60.

-

(1W chart)

The key area to watch on the 1W chart is whether the price can break above the 202.45-222.61 level.

If the price breaks above the 202.45-222.61 level and maintains its upward momentum, a stepwise uptrend is likely to begin.

-

(1D chart)

The key area to watch on the 1D chart is whether the price can find support around 179.53-183.04 and rise above 205.70.

The 183.04 point is the HA-High indicator level, and the 205.70 point is the DOM (60) level.

If it falls below 183.04, it is expected to meet the M-Signal indicator on the 1W chart and re-establish the trend.

Ultimately, the price must remain above the M-Signal indicator on the 1M chart to maintain a strong uptrend.

Therefore, looking at the bigger picture, we need to determine whether the 126.36-179.53 range provides support and allows for an upward movement.

SOL's current volatility period is around August 18th (August 17th-19th).

At this time, we should look for a direction in which it deviates from the 183.04-205.70 range.

-------------------------------------------------

Only the concept of price moving averages, which I learned while studying chart analysis, is applied to the M-Signal indicator on the 1M, 1W, and 1D charts.

The rest of the explanation cannot be interpreted using existing chart analysis techniques.

This is because the HA-Low and HA-High indicators were developed for trading on Heikin-Ashi charts, while the DOM(60) and DOM(-60) indicators are a comprehensive evaluation of the DMI, OBV, and MOMENTUM indicators.

Therefore, to interpret my charts, you must apply the concepts of support and resistance points.

It's not that my chart explanations lack logic; they simply seem illogical because they can't be interpreted using existing interpretation methods.

Chart analysis should be as simple and concise as possible.

If you spend too much time analyzing charts or trying to apply complex theories, you will lack time to develop a trading strategy, increasing the likelihood of your trades going in the wrong direction.

To interpret my chart, all you need is a basic understanding of price moving averages and support and resistance.

Support and resistance points are determined by the horizontal lines of the DOM(60), HA-High, HA-Low, and DOM(-60) indicators.

The DOM(60) and HA-High indicators mark highs, while the HA-Low and DOM(-60) indicators mark lows.

Therefore, a basic trading strategy can be used: buy when the price rises from the DOM(-60) to HA-Low range, and sell when it reaches the HA-High to DOM(60) range.

However, if the price rises above the HA-High to DOM(60) range, a stepwise uptrend is likely, while if the price falls below the DOM(-60) to HA-Low range, a stepwise downtrend is likely.

Therefore, a segmented trading strategy should be adopted.

-

The basic chart for chart analysis is the 1D chart.

Therefore, it's best to trade in line with the trend of the 1D chart.

Therefore, the position that matches the trend of the 1D chart becomes the main position.

So, since the current trend of SOL's 1D chart is up, the LONG position becomes the main position.

To trade based on the trend of the 1D chart when trading futures, you need to set low leverage.

Therefore, when trading based on the timeframe chart you're viewing, increase your investment proportion when trading in line with the trend of the 1D chart. Conversely, when trading in the opposite direction, reduce your investment proportion and execute short, quick trades.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain in more detail when the bear market begins.

------------------------------------------------------

#SOL/USDT coin market structure analysis#SOL

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 175, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 174.

Entry price: 181.

First target: 187.

Second target: 195.

Third target: 205.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Solana (SOL): Bullish Continuation after Neckline BreakoutWhat I see:

Chart Patterns (Head and Shoulders): The chart illustrates a classic "Head and Shoulders" pattern. The left shoulder, head, and right shoulder are formed, and the neckline (the blue dashed line) has been broken, which suggests that the price could rise towards the target zone above the broken neckline.

Target Price: Based on the pattern and technical analysis, the potential target for the price could be around $219.84, as indicated by the box in the upper right corner. This target aligns with the upward trend continuation from the broken neckline.

Support Zones: There are several key support levels below the current price, including the lower zone marked in blue around $95.50 and the potential demand area in the middle blue zone (around $136.34). These could act as areas for price to rebound from if there's a pullback.

Trend Line and Movement: The dotted blue trend line suggests an ascending trend, showing higher lows, and the price is likely to continue upward after the recent breakout above the neckline.

Given the broken neckline and the formation of the Head and Shoulders pattern, the bullish scenario appears more likely. A price target of around $219.84 seems feasible if the upward momentum continues. However, if the price fails to hold above the neckline or reverses, the support zones could provide areas for potential price bounces, with the $136.34 region as a significant level to watch for possible buying opportunities. Therefore, the most probable outcome aligns with the bullish scenario (towards $219.84).

SOL Institutional Capital Fuels Bull Run SpeculationSolana's Ascent: A Perfect Storm of Adoption and Institutional Capital Fuels Bull Run Speculation

A powerful and rare confluence of tangible real-world adoption, significant institutional investment, and bullish technical indicators is generating a palpable buzz around Solana (SOL). The high-performance blockchain, often touted as a leading "Ethereum killer," is experiencing a resurgence that has captured the market's attention. After a period of sideways consolidation, SOL has decisively broken through key psychological and technical price levels, igniting speculation that this may be the start of a sustained and powerful bull run.

The narrative driving this optimism is not based on fleeting hype but on two concrete, fundamental pillars. The first is the global shipment of Solana Mobile's second-generation smartphone, the "Seeker," a device engineered to onboard millions into the Web3 ecosystem by seamlessly integrating crypto into the user's daily life. The second is a powerful vote of confidence from the traditional finance world, where a growing number of publicly traded companies are aggressively accumulating SOL for their corporate treasuries, treating it as a strategic reserve asset. As these foundational tailwinds gather force, technical charts are beginning to align, suggesting that the path of least resistance for Solana's price may soon be sharply upward.

The Seeker Phone: Solana's Trojan Horse for Mass Adoption

Perhaps the most visible and innovative catalyst is the global rollout of the Seeker smartphone. Following up on its first-generation "Saga" device, Solana Mobile has initiated the shipment of tens of thousands of pre-ordered Seeker phones to a global audience. The market's reception has been nothing short of explosive, with pre-orders soaring past 150,000 units—a dramatic increase from the 20,000 total sales of its predecessor. This overwhelming demand underscores a pent-up desire for a mobile-native Web3 experience.

But the Seeker is far more than just a piece of hardware; it represents a strategic masterstroke to solve the persistent problem of user experience in the crypto space. For years, interacting with decentralized applications (dApps) on mobile has been a clunky, insecure, and fragmented process, creating a high barrier to entry for the average consumer. The Seeker directly addresses these pain points. It features a built-in crypto wallet and a hardware-isolated "Seed Vault," which secures a user's private keys in a protected environment within the phone, drastically enhancing security and simplifying transactions.

This mobile-first approach creates a powerful economic flywheel. Priced accessibly, the phone is projected to generate substantial revenue for Solana Mobile. However, its true value lies in its ability to foster a vibrant, self-sustaining ecosystem. Each device includes a "Genesis NFT," a digital key that unlocks exclusive airdrops, rewards, and early access to new applications. This model, which proved incredibly successful with the Saga phone and the famous BONK memecoin airdrop, gamifies participation and incentivizes users to actively explore and engage with the Solana network. It transforms the phone from a passive communication tool into an active portal for decentralized finance (DeFi), NFT marketplaces, and Web3 gaming.

Furthermore, the Seeker boasts its own decentralized dApp store, presenting a direct challenge to the incumbent duopoly of Apple and Google. By offering developers a platform with lower fees and fewer restrictions, Solana is cultivating an environment where innovation can flourish. This attracts builders to the ecosystem, leading to a richer and more diverse array of applications, which in turn attracts more users. The Seeker phone, therefore, is not just a product—it's a Trojan Horse designed to embed the Solana network into the fabric of daily life, driving network utility, transaction volume, and ultimately, sustained demand for the SOL token.

The Institutional Stampede: Big Money Places Its Bet on Solana

While the Seeker phone provides a compelling grassroots adoption narrative, it is the concurrent wave of institutional investment that adds a powerful layer of validation and financial firepower. A growing cohort of publicly traded companies is now strategically adding SOL to their corporate treasuries, signaling deep-seated, long-term confidence in the network's technology and economic potential. This trend moves Solana beyond the realm of speculative trading and into the domain of strategic corporate finance.

Leading this charge is DeFi Development Corp (DFDV), a firm that has made headlines with its aggressive accumulation strategy. The company recently purchased an additional 110,466 SOL, bringing its total holdings to a staggering 1.29 million SOL. This move is part of a publicly stated ambition to hold one SOL per outstanding company share by 2028, a strategy explicitly modeled after MicroStrategy's high-conviction Bitcoin treasury plan. By securing a multi-billion dollar line of credit for these purchases, DeFi Dev Corp is making a clear and unequivocal bet on Solana's future.

This institutional embrace extends beyond a single entity. Upexi Inc., a consumer brand holding company, has significantly increased its SOL holdings and secured a $500 million credit line for further acquisitions. Bit Mining, a prominent player in the digital asset mining space, has not only purchased millions of dollars worth of SOL but has also launched its first Solana validator, contributing directly to the network's security and decentralization. Perhaps most surprisingly, Artelo Biosciences, a Nasdaq-listed pharmaceutical company, has pivoted to include SOL in its treasury, becoming the first public pharma firm to adopt a digital asset as a reserve.

These companies are drawn to Solana for its unique combination of high throughput, low transaction costs, and yield-bearing potential. The network's ability to process thousands of transactions per second at a fraction of a penny makes it a viable platform for enterprise-grade applications. Furthermore, the ability to stake SOL and earn a consistent annual yield of 7-8% presents a compelling alternative to holding depreciating fiat currencies or low-yield government bonds. This makes SOL an attractive treasury asset that can both appreciate in value and generate a recurring revenue stream. This institutional inflow provides robust price support and has an outsized market impact, as it effectively removes large quantities of SOL from the circulating supply, creating a potential supply shock as demand continues to grow.

Coiling for a Breakout: A Technical Perspective

This potent mix of fundamental catalysts is vividly reflected in Solana's price chart, which shows the asset coiling for a potentially explosive move. After establishing a solid foundation of support, SOL has demonstrated significant strength by breaking through the crucial $160 and $162 levels. The price is now trading firmly above its 100-hourly simple moving average, a key indicator that traders use to gauge short-term trend momentum. A price holding above this moving average is generally considered a sign of bullish health.

Currently, a key bullish trend line has formed on the hourly chart, with immediate and strong support located at the $165 mark. This level now acts as the first line of defense for the bulls; as long as the price remains above it, the upward trajectory is considered intact. However, the path higher is not without obstacles. The first major test awaits at the $172 resistance zone. A decisive and high-volume break above this level would signal that buyers are in firm control and could trigger a cascade of further buying.

Should the bulls conquer $172, the next significant hurdle lies near the $180-$182 range. Overcoming this area would open the door to a more sustained rally, with analysts eyeing subsequent targets at $192 and the psychologically important $200 level. While these technical levels present challenges, the underlying momentum indicators are encouraging. The Moving Average Convergence Divergence (MACD) is showing bullish acceleration, and the Relative Strength Index (RSI) is holding strong above the 50 midpoint, indicating that buying pressure is outweighing selling pressure.

Of course, no market moves in a straight line. A failure to break the $172 resistance could lead to a temporary pullback. If the $165 support level were to fail, the next support zones would be found near $160 and $155. A break below these levels could signal a short-term bearish reversal and would invalidate the immediate bullish thesis. However, given the powerful fundamental drivers at play, many analysts believe that any such dips would likely be viewed as buying opportunities.

The Verdict: Is This the Definitive Catalyst?

Solana currently finds itself in an exceptionally strong position. It is one of the few blockchain projects that can boast a clear, tangible strategy for mass adoption through its mobile initiatives. The Seeker phone is a game-changer, providing a seamless on-ramp to Web3 that could onboard a new generation of users.

This powerful fundamental narrative is being amplified and validated by a wave of institutional capital. The strategic accumulation of SOL by public companies lends the asset a new level of legitimacy and provides a powerful source of demand that is unlikely to waver based on short-term market fluctuations.

When these two forces are combined with a bullish technical structure, the result is a perfect storm of positive catalysts. While the broader crypto market will always be subject to macroeconomic factors and regulatory shifts, Solana has carved out a uniquely compelling growth story. The immediate challenge is for the bulls to maintain their momentum and decisively break through the upcoming resistance zones. If they succeed, this confluence of events may very well be remembered as the definitive catalyst that propelled Solana into its next major bull run, solidifying its position not just as a competitor, but as a leader in the new digital economy.

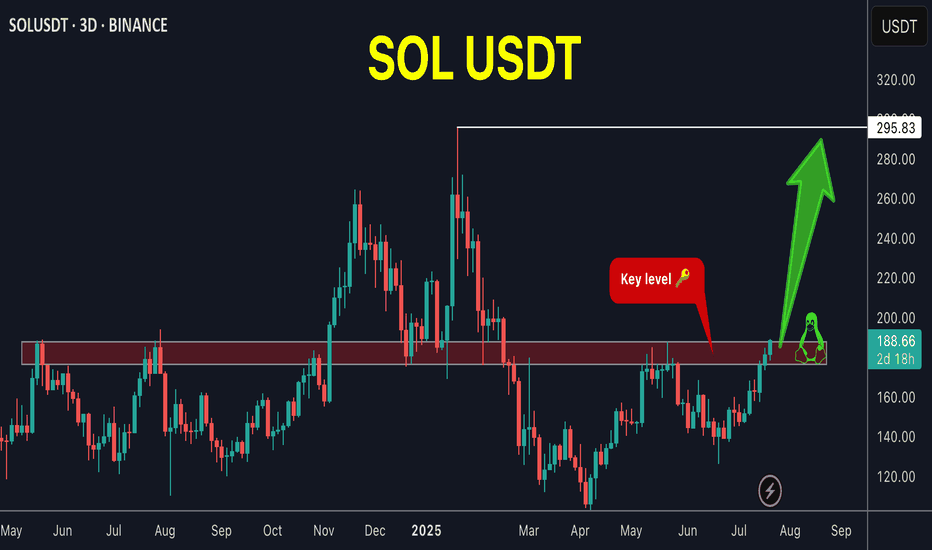

SOLUSDT- Golden Pocket Bounce: Bullish Phase or Another Fakeout?🔍 In-Depth Technical Analysis (1D Timeframe)

The SOL/USDT pair is currently showing a highly significant technical reaction as price bounces from the Fibonacci Retracement 0.5 - 0.618 zone (also known as the Golden Pocket), located between $166.63 - $157.13.

This level also aligns perfectly with a historical demand zone that has previously acted as a strong support during high-volume selloffs, creating a powerful confluence area.

---

🧩 Market Structure & Pattern

✅ Golden Pocket + Demand Zone: This overlap strengthens the probability of a valid bullish reversal.

🟠 Previous Movement: Price dropped from the recent swing high near $188 after failing to break through major resistance.

📉 Short-Term Downtrend: Currently in a corrective phase after an earlier bullish run.

---

🟢 Bullish Scenario (Rebound Confirmed from Golden Pocket)

If the price manages to hold above the $157 - $166 range and prints a bullish candle with volume confirmation:

1. A bullish breakout above $179 and more importantly $187.80 could open the door to further upside.

2. Potential midterm bullish targets:

🎯 Target 1: $205.69 (key psychological + structural level)

🎯 Target 2: $218.13 (previous reaction zone)

🎯 Target 3: $257.10

🎯 Target 4 (macro): $295.14

> The current zone offers an attractive risk-to-reward opportunity for swing traders, as long as the higher low structure is maintained.

---

🔴 Bearish Scenario (Breakdown from Key Support Zone)

Should the price break below $157 with strong selling volume:

1. That would invalidate the bullish setup and suggest a shift in structure.

2. Potential deeper correction targets include:

⚠️ Support 1: $140 (minor support from past structure)

⚠️ Support 2: $122 - $110 (major support zone from March–April 2025)

> A confirmed breakdown here would likely initiate a lower high – lower low structure, signaling a possible shift into a bearish medium-term trend.

---

📌 Additional Key Indicators to Watch

🔄 Volume Spike: Essential for validating any breakout or breakdown.

📉 Daily RSI: If RSI shows bullish divergence or bounces from oversold territory, that would strengthen the bullish case.

⏳ Daily Candle Close: Monitor the next 2–3 daily candle closes around this key zone for directional confirmation.

---

💡 Conclusion

SOL is at a crucial inflection point. The reaction around the $157 - $166 support confluence will likely determine the medium-term trend:

Bullish: If price reclaims $179–$188 zone with strong momentum

Bearish: If price breaks below $157 and closes with volume

This could be a high-reward opportunity for technical traders if confirmed properly.

---

🧠 Suggested Strategy:

🔹 Entry: Upon bullish confirmation in current demand zone

🔹 Stop Loss: Below $155 (for swing setups)

🔹 Take Profit Zones: $179 → $205 → $218 → $257+

#SOLUSDT #Solana #CryptoTechnicalAnalysis #FibonacciLevels #GoldenPocket #PriceAction #CryptoReversal #SwingTradeSetup #Altcoins #CryptoChart

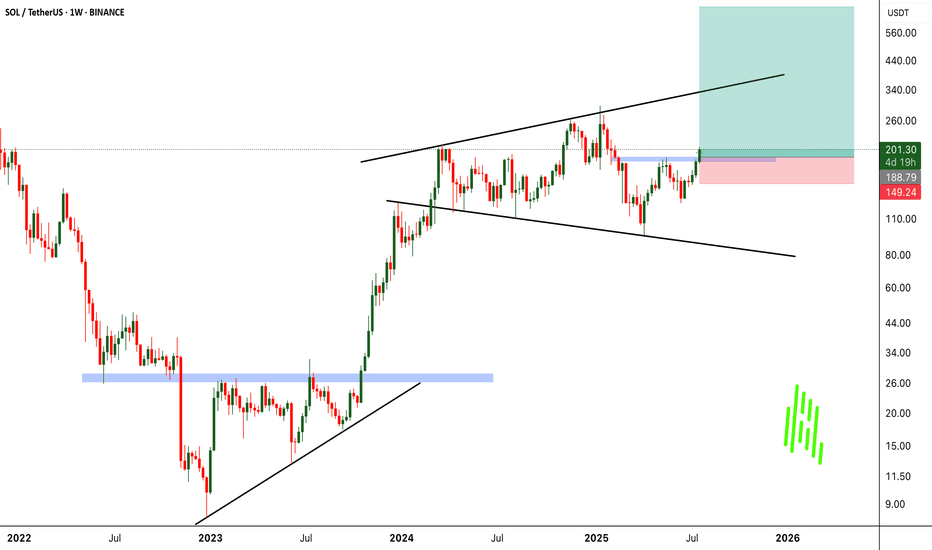

SOLUSDT Cup & Handle Formation CRYPTOCAP:SOL is forming a large Cup and Handle pattern on the weekly timeframe, a classic bullish continuation structure. Price is currently approaching the neckline resistance zone around the $250–$280 level. This area has acted as a major barrier in the past, rejecting the price multiple times, but the structure suggests it's now being retested with greater momentum.

If the neckline breaks cleanly with strong volume, the projected target could push SOL into the $600–$700+ range over the coming months.

Cheers

Hexa

BINANCE:SOLUSDT COINBASE:SOLUSD

SOL - Don't miss the breakout before it's too late!The symmetrical triangle pattern on the monthly timeframe is showing signs of weakening after multiple failed breakout attempts — and now, a breakout seems highly likely.

Once SOL breaks out of this triangle, it will enter price discovery mode , opening the door to a massive bullish move. At that point, most traders will start saying “it’s too late”, while SOL keeps rallying aggressively — fueled by FOMO and liquidity traps.

You'll see:

- People outside the market waiting for a pullback that never comes.

- Traders inside the move getting shaken out by small dips and volatility.

Right now, SOL is still in a fair trading zone and available at a reasonable price .

Don’t wait for it to explode and then chase. Get in before the breakout .

Best Regards:

Ceciliones🎯

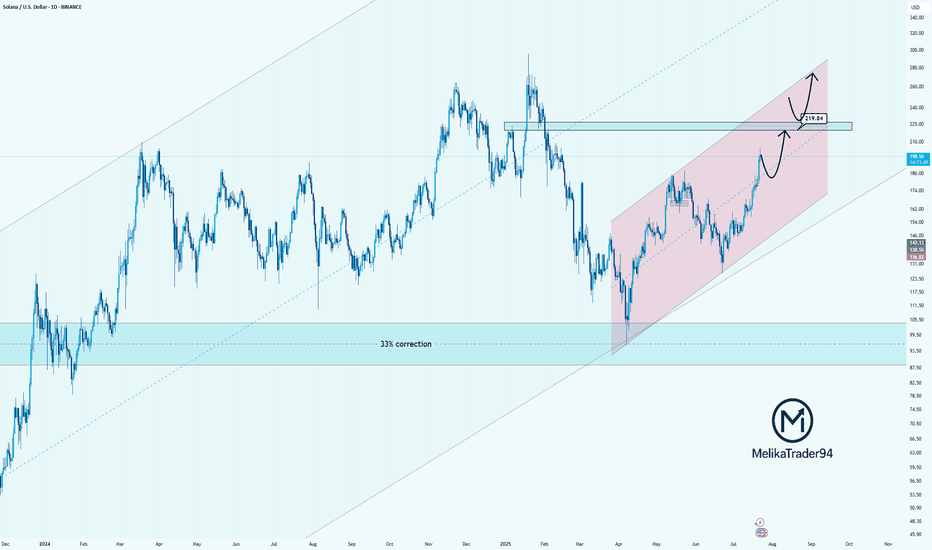

Solana Approaching Key Resistance: watch for $219Hello guys!

Solana has been trending strongly inside a rising parallel channel, recovering steadily after a significant 33% correction. The bullish momentum is clear, and the price is now approaching a key resistance zone near $219.84, which previously acted as a major turning point.

Here’s what I’m watching:

Strong uptrend within the pink channel shows controlled and healthy growth.

$219.84 is a critical decision zone. Price could:

React with a pullback before pushing higher,

Or break through it and flip the level into support for the next bullish leg.

The reaction in this zone will determine the next structure.

Whether we see a temporary correction or continuation to new highs.

SOLUSDT on Fire! Bullish Wedge Fuels INSANE Upside Potential!BINANCE:SOLUSDT has been exhibiting strong bullish momentum, currently trading within a broadening wedge pattern. This technical structure often signals increased volatility and the potential for decisive moves in either direction. In the present scenario, the breakout above the psychological $200 resistance level suggests that bulls are firmly in control, fueling hopes of further upside.

The continuation of momentum hints at the market preparing for another leg up. The immediate price target lies at $300, where traders may expect some profit-taking and resistance. However, should momentum sustain and buying pressure persist, BINANCE:SOLUSDT has the potential to surge toward the $700 region, aligning with the pattern’s projected price expansion.

As always, managing risk is key. Use a well-placed stop loss below the support level to protect your capital. Breakouts can be explosive, but discipline and proper risk management make all the difference.

BINANCE:SOLUSDT Currently trading at $201

Buy level : Above $200

Stop loss : Below $150

Target 1: $250

Target 2: $300

Target 3: $500

Target 4: $700

Max leverage 2x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

Solana UpdateHello friends🙌

After the price growth we had, the price hit the resistance level of $160 twice and failed to break it, which caused a double top pattern to form, which if confirmed, there is a possibility of falling to the specified areas.😉

The specified areas are good prices for buying in steps, of course, with capital and risk management.✔

🔥Join us for more signals🔥

*Trade safely with us*

Solana:Daily free signalhello friends👋

As you can see, after the drop that we had, insider buyers showed and were able to support the price well.

But it was not enough, and as you can see, a noisy pattern has formed, which can indicate a further decrease in the price.

Now we can take advantage of this opportunity and make step-by-step purchases with risk and capital management in the support areas that we have obtained for you and move to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

#SOL/USDT Loves THIS Pattern | BULLISH#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 143.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 142, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the moving average of 100.

Entry price: 149.

First target: 153.

Second target: 156.

Third target: 159.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.