QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Risk-on Phase 1, high-volatility zone

Risk-on Phase 2, high-volatility zone.

Critical Sensitivity Zone

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SSO

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Risk-on Phase 1, high-volatility zone

Risk-on Phase 2, high-volatility zone.

Critical Sensitivity Zone

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

A signal for catching a bounce has emerged.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

A signal for catching a bounce has emerged.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positions (QLD, TQQQ)- System metrics show the market transitioning into the initial phase of overheating.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positions (2x leverage)- System metrics show the market transitioning into the initial phase of overheating.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

$QQQ Getting Over Sold?NASDAQ:QQQ I am stalking a bounce on the Q’s. From an intraday high (all time high) to an intraday low on this chart is about 6.2%. I would expect at least a dead cat bounce in the short term, but the market may not deliver for me. Having said that, I have an alert set on this 30-minute chart on the Downtrend line. “If” that triggers, I will go to a 5- or 10-minute chart to see if there is a good risk reward entry. And if I take the trade, it will be meant to be a day trade (of which I am not a fan) but it could turn to a swing trade “if” it gives me at least a 2% cushion.

I know I have a lot of "ifs" on this one, but isn't that the way it is?

I had posted another chart on the NASDAQ:QQQ index with a link below. I had said in that one that a pullback to the 510 “area” would not negate the longer-term uptrend. But one must be open to all outcomes.

S&P (SPX500USD): Make this Money Printer Go Brrr!✨ We provide charts every day ✨

Like and Follow to help us grow family! 🎉

---

Let's see if that money printer can make it rain friends!

Today we are looking to see if the uptrend can continue with the S&P (SPY, SPX, SPX500USD, etc). Longing the uptrend in equities has been profitable recently, let's assume that trend continues and talk about entries, exits, and key levels.

---

1. S&P is currently in an uptrend within a channel as illustrated on the chart. We recently saw a reaction off the bottom of the channel which produced a long signal.

2. With the strategy in use we want to go long ONLY when Fractal Trend signals an uptrend (Green background color) AND Breakaway Scalper then signals an uptrend (Green bar color).

3. With a long signal having been recently produced, we are watching R1 and R2 for reactions. If rejected at R1 we will watch for a retest of the trend line or even a trip down to S1. If price can get past R1, then the levels to watch above are R2 and R3.

4. If the uptrend channel is broken, S1 and S2 are the next levels to watch for support.

5. Regardless of which way the price goes, we will be using the built in trailing stop on Breakaway Scalper to reduce risk and lock in profits if we move to the upside.

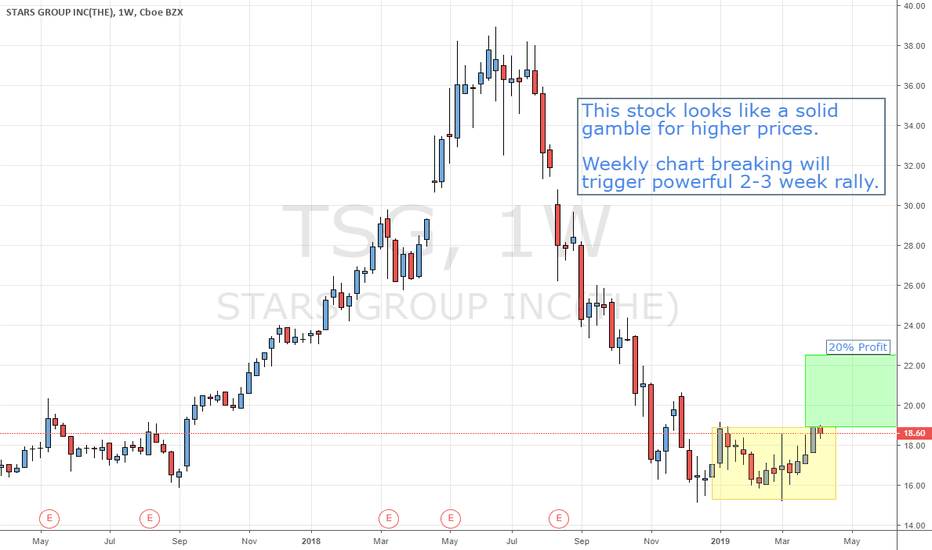

$iwm $tsg $tna VIDEO ANALYSIS powerful 2-3 week rally Any Day.Bit money has been moving into these stop options looking for higher prices in the next 10 days!

This stock looks like a solid gamble for higher prices.

Weekly chart breaking will trigger powerful 2-3 week rally.