SUSHI/USDT — Decision Zone! Accumulation or Breakdown Oblivion?SUSHI has returned to its major historical support zone between 0.553 – 0.44 USDT, an area that has held firm since 2022.

Each time price has entered this block, the market has shown signs of a relief bounce and potential accumulation — but the more a level is tested, the weaker it tends to become.

Since its 2021 peak, SUSHI has remained in a long-term downtrend, forming consistent lower highs and lower lows.

However, the presence of deep long wicks beneath the current range indicates liquidity sweeps — a classic signature of hidden accumulation by strong hands preparing for a potential reversal.

---

📊 Pattern & Structure

Primary trend: Long-term downtrend (bearish structure)

Major Support Zone (yellow block): 0.553 – 0.44 USDT

Potential Pattern: Double Bottom or Spring Phase (if the price rebounds strongly from this zone)

Key Resistance Levels (target zones):

1.0017

1.4129

1.7897

2.7216

4.8626

---

Bullish Scenario

Price holds the yellow block and rejects any breakdown below 0.44.

A strong confirmation would come from a weekly close above 0.553 with rising volume.

Formation of a higher low would signal the start of structural reversal.

A decisive breakout and weekly close above 1.00 USDT would confirm a major trend shift.

Gradual bullish targets: 1.00 → 1.41 → 1.78 → 2.72 → 4.86 USDT.

Additional narrative:

This area could represent an institutional accumulation zone, similar to previous DeFi cycle reaccumulation phases.

If DeFi narratives regain momentum, SUSHI could emerge as one of the stronger comeback tokens.

---

Bearish Scenario

A weekly close below 0.44 would confirm a structural breakdown.

The 0.553–1.00 zone would flip into a strong supply area, likely acting as resistance on any retest.

Price could then slide further toward the psychological zone of 0.30–0.28 USDT or even lower if selling pressure continues.

---

Conclusion

SUSHI now stands at a make-or-break point in its multi-year cycle.

The yellow block at 0.553 – 0.44 is not just a support zone — it’s the final line of defense that has protected this structure since 2022.

If it holds, a major reversal could unfold.

If it breaks, a new phase of capitulation may begin.

The next weekly close will define SUSHI’s fate.

Traders should wait for clear confirmation before committing to any large directional move.

#SUSHI #SUSHIUSDT #Crypto #DeFi #TechnicalAnalysis #SupportResistance #SwingTrading

Sushiusdtidea

SUSHI/USDT – Symmetrical Triangle Compression Near Key Flip Zone🔎 Market Overview

SUSHI is currently trading around $0.799, consolidating within a symmetrical triangle pattern that has been forming since mid-July. This setup reflects a period of decreasing volatility and volume, where the market is accumulating energy for the next major move.

The $0.72–0.83 zone is acting as a critical support-resistance flip area, tested multiple times since March. This is the battlefield where bulls and bears are fighting for dominance. The eventual breakout from this zone will likely dictate the mid-term trend.

---

📐 Technical Pattern Breakdown

Symmetrical Triangle: Converging trendlines (lower highs + higher lows). Neutral by nature, direction depends on breakout.

Historical Context: Prior to the triangle, price rallied from $0.45 → $1.05, hinting this could be a bullish continuation pattern if an upside breakout occurs. Still, the broader macrotrend has been bearish since the start of the year, so both outcomes remain on the table.

Key Levels:

Major Supports: $0.72 → $0.67 → $0.45

Major Resistances: $0.89 → $0.94 → $1.02 → $1.14 → $1.28 → $1.72

---

🚀 Bullish Scenario (Upside Breakout)

If price manages to close a daily candle above the $0.85–0.89 resistance trendline with strong volume, upside potential is significant. Bullish targets include:

🎯 Target 1: $0.945

🎯 Target 2: $1.02

🎯 Target 3: $1.14

🎯 Target 4: $1.28

🎯 Extended Target: $1.72

This would represent a possible +100% upside if momentum builds.

Bullish Confirmation Signals:

Daily close above $0.89–0.94

Increasing breakout volume

Successful retest holding above former resistance

---

🐻 Bearish Scenario (Downside Breakdown)

Failure to hold the $0.72–0.75 flip zone would likely trigger a bearish continuation. Downside targets are:

🎯 Target 1: $0.67

🎯 Target 2: $0.59

🎯 Target 3: $0.45 (yearly low & major psychological support)

A confirmed breakdown could mean a -30% to -40% drop from current levels.

Bearish Confirmation Signals:

Daily close below $0.72

Strong selling volume

Retest rejection at $0.72 (new resistance)

---

⚖️ Trading Strategy & Risk Management

Conservative traders: Wait for a confirmed breakout + retest before entering.

Aggressive traders: Consider entries near triangle support (~$0.75) with tight SL below $0.70.

Risk control: Limit exposure to 1–3% of total capital per trade, use disciplined stop-losses, and take profits in stages at key levels.

Risk/Reward: Look for setups with at least a 2:1 or 3:1 ratio.

---

📌 Conclusion

SUSHI is at a critical crossroads. The symmetrical triangle suggests a powerful move is imminent. A breakout to the upside opens the door for a rally toward $1.72, while a breakdown could drag price back toward $0.45.

Traders should focus on confirmation signals before committing, as the next breakout will likely define the mid-to-long term trend.

---

#SUSHI #SUSHIUSDT #SushiSwap #CryptoAnalysis #TechnicalAnalysis #TrianglePattern #BreakoutTrading #SupportResistance #CryptoTrading #Altcoins

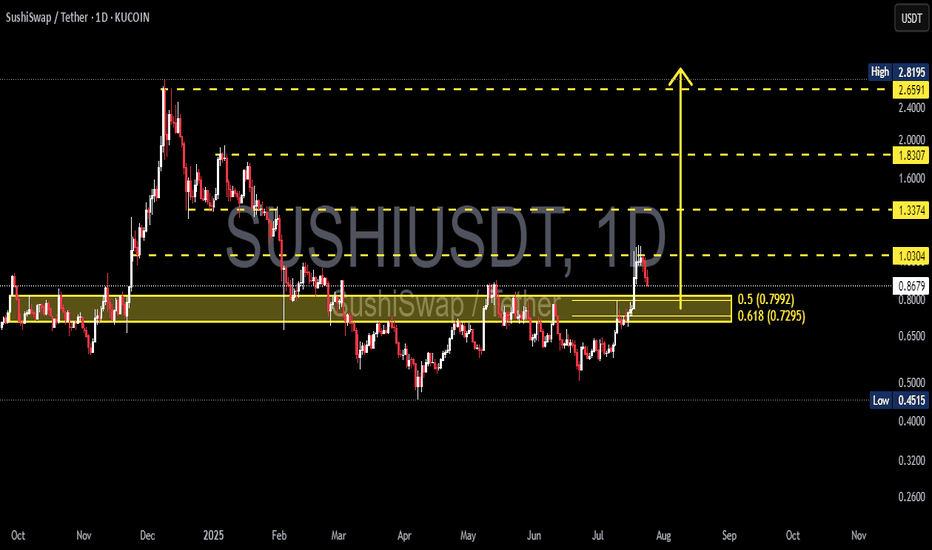

SUSHIUSDT at a Critical Pivot Golden Pocket Retest or Bull Trap?📊 Full Daily Chart Analysis (1D) — KuCoin

After months of dull sideways movement, SUSHI is finally showing signs of life! A strong breakout above a long-term consolidation range has pushed price up to the key resistance at $1.03, raising the possibility of a mid-term trend reversal.

However, the price is now entering a pullback phase. The key question:

Is this just a healthy correction before the next leg up—or the beginning of another downward move?

---

🔍 Structure & Pattern Breakdown:

Rounded Bottom Formation:

Formed from April to July 2025, this pattern signals a shift from accumulation to potential bullish expansion.

Confirmed Breakout:

A breakout above the neckline at $0.80, supported by increasing volume, suggests this move is legitimate—not a fakeout.

Golden Pocket Retest (Key Fibonacci Zone):

Price is currently pulling back into the Fibonacci Golden Pocket (0.5 at $0.7992 and 0.618 at $0.7295) — the most ideal technical zone for a bullish re-entry. This area also aligns with a strong historical demand zone.

---

📈 Bullish Scenario (Primary Case):

If daily candles hold above the $0.7295–$0.7992 zone and form a strong reversal signal (e.g. bullish engulfing or hammer):

Price is likely to retest $1.03 (minor resistance).

A successful breakout above $1.03 could lead to a rally toward:

🔸 $1.3374 – Previous horizontal resistance

🔸 $1.8307 – Key psychological level & March 2025 swing high

🔸 $2.6591 – Fibonacci extension target

🔸 $2.8195 – Major high from November 2024

This could mark the beginning of a mid-term bullish trend if volume continues to build.

---

📉 Bearish Scenario (Alternative Case):

If the price fails to hold above the Golden Pocket and breaks below $0.7295:

A deeper correction is likely, with price revisiting $0.60 or even retesting the bottom zone at $0.4515.

This would invalidate the bullish setup and confirm a bull trap.

---

🧠 Conclusion:

SUSHI is at a decisive moment. This retest of the Golden Pocket will determine whether this is simply a healthy pullback within a new uptrend, or the early sign of another bearish breakdown.

> Plan the trade, trade the plan. The $0.73–$0.80 zone is the battlefield for SUSHI’s next major move.

---

📌 Key Levels:

Level Description

$0.7295–$0.7992 Golden Pocket (Fibonacci Re-Entry Zone)

$1.03 Minor Resistance

$1.3374 Bullish Target 1

$1.8307 Bullish Target 2 (Mid Resistance)

$2.6591–$2.8195 Long-Term Bullish Targets

$0.60 / $0.4515 Bearish Supports if Breakdown Occurs

#SUSHIUSDT #CryptoBreakout #FibonacciTrading #GoldenPocket #AltcoinReversal #SushiSwap #CryptoSetup #TechnicalAnalysis #BullishScenario

SUSHI/USDT Reversal from Historical Demand ZoneThe SUSHI/USDT pair is showing strong potential for a bullish reversal from the long-term demand zone between $0.44 - $0.58, which has historically acted as a solid support area since 2021. Price has tested this zone multiple times and has bounced back, indicating significant buying interest.

🔍 Technical Overview:

Timeframe: Weekly (1W)

Key Support Zone: $0.44 - $0.58 (strong accumulation area)

Key Resistance Levels (Potential Targets):

$0.815

$1.392

$1.950

$2.765

$3.500+

Price Structure: Currently forming a possible double bottom or sideways accumulation near the macro support, often seen before bullish markup phases.

Bullish Signal: The yellow arrow illustrates a projected upward movement over the coming weeks/months if the support holds.

After a prolonged downtrend, SUSHI/USDT is now at a critical turning point, bouncing from a multi-year support zone. This accumulation phase may be the early stage of a major bullish trend. Traders should keep an eye on this setup as a breakout toward higher resistance levels could be imminent.

#SUSHI #SUSHIUSDT #CryptoAnalysis #Altcoins #CryptoReversal #TechnicalAnalysis #CryptoSupportResistance

#BullishReversal #CryptoSignals #PriceAction #ChartPattern

SUSHIUSDT Potentially BullishWe've seen some pretty significant move in the the crypto market in the last few days (maybe weeks) especially wiith BINANCE:BTCUSDT hitting the 104K area. It is more than expected that most coins will follow suit.

BINANCE:SUSHIUSDT is one of such coins and as it stands, it has broken a significant zone at the 0.7175 area and attempting a retest. If the zone holds as a new found support, we just might see another significant push phase targeting the 1.32 area. Until then, fingers crossed

Updates to follow!!!

Past results does not guarantee future results

SUSHIUSDT Potentially for a LongBINANCE:SUSHIUSDT broke slightly above the 1.7283 area. With the reversal pattern taking formation, BINANCE:SUSHIUSDT will likely be in for a long position. This does not mean that there may not be some further dips, but with the dips comes an opportunity to buy more.

Past results does not guarantee future results, do your due diligence before taking any trade idea.

SUSHIUSDT AnalysisHello friends.

Please support my work by clicking the LIKE button(If you liked).Thank you!

Everything on the chart.

open pos: market and lower

target: 12.5 - 15.5 - 19.5

after first target reached move ur stop to breakeven

stop: ~im w/o stop (depending of ur risk). ALWAYS follow ur RM .

risk/reward 1 to 4

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to your questions or suggestions.