#SXP/USDT looking extremely bullish#SXP

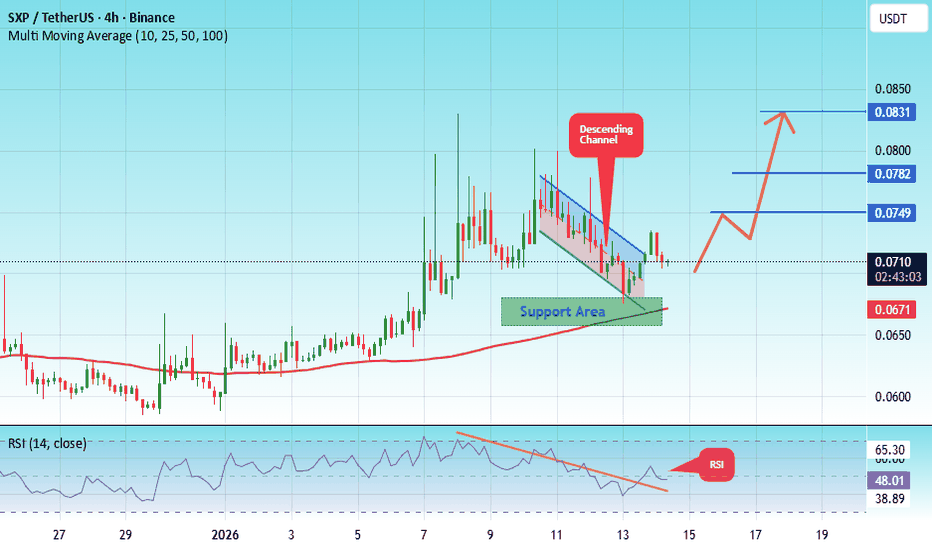

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.0665, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.0710

Target 1: 0.0750

Target 2: 0.0782

Target 3: 0.0831

Stop Loss: Below the green support zone.

SXPPERP

$SXP PERP WAITING FOR A LONG POSIt is unclear what BTC will do, so it is risky to open a long trade right now, I will use the Inverse Head and Shoulder Pattern as an opportunity to open a long trade, which might form at the bottom, if the prize drops between $1.40 - $1.50. Even though the formation target is $2.11, I set $2 resistance level as my target. Good luck to everyone in their trades.

BTC nin ne yapacağı belirsiz, o yüzden şu ara işlem açmak riskli ama ben BTC 48000 üzerinde tutunacağını düşünerek SXP nin $1.40 - $1.50 arasına geri çekilmesi ile dipte oluşacak OBO yu long işlem açmak için fırsat olacak kullanacağım. Formasyon hedefi $2.11 olsa da öncesindeki $2 seviyesini kendime hedef olarak belirlerim. Herkese işlemlerinde başarılar.

Long Swipe ($SXP)Looks like a possible Cup and Handle formation, which if correct would indicate a target of around $8. Fib extensions suggest a possible target of $6.90. Since I don't know 1) really anything about what this token is and 2) I don't use C&H much and also since 3) the market has had a few dips during the last couple days I will keep a tight stop loss and only open a small position.

In either case if BTC and the alt market continues to look strong I will probably add to this as this was in an obvious strong recent uptrend.