TAO/USDT — Bearish Structure Broken, But Can Support Hold?After months trapped beneath a major descending trendline, TAO finally broke out with strong bullish momentum — hinting at a potential trend reversal.

However, price has now pulled back to retest the golden zone (386–355), which serves as the final defense line for the bulls.

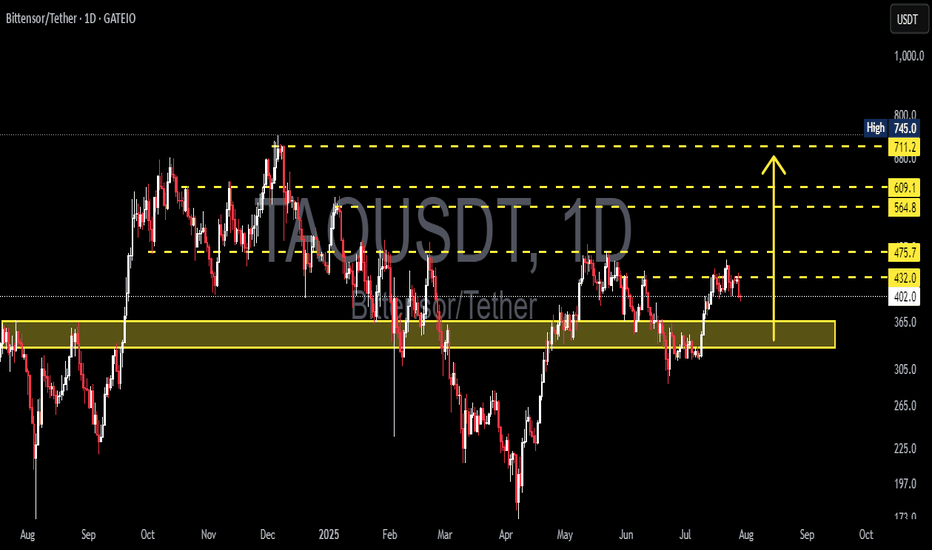

This yellow zone is more than just a support area — it’s the intersection of horizontal support and the old downtrend line, making it the most decisive structure on the current chart.

In simple terms: this is where conviction meets fear — the battlefield between buyers and sellers.

---

🟢 Bullish Scenario

If the price holds firmly above 386–355 and forms a clear bullish rejection or engulfing candle, it would confirm strong buyer presence and likely trigger another leg up.

Bullish confirmation: 2D candle close above 415–430.

Upside targets:

🎯 464 → first resistance & partial profit zone.

🎯 561 → key supply area & mid-range target.

🎯 698–744 → swing target & major resistance zone.

A clean breakout above 430 would signal that the bearish market structure has been fully broken, paving the way for sustained bullish momentum.

---

🔴 Bearish Scenario

If the price fails to hold 355 and closes below it, the bullish structure becomes invalidated, opening room for a deeper retracement toward 330–290.

Such a move would confirm that the previous breakout was just a classic bull trap, where liquidity was swept before resuming the dominant downtrend.

Bearish continuation would be reinforced by increasing sell volume and lack of any strong bullish reaction around the support zone.

---

📈 Technical Structure Overview

Dominant pattern: Descending trendline breakout + retest confluence support.

Mid-term bias: Neutral–bullish while price stays above 386–355.

Momentum: currently consolidating — potentially forming a base for the next expansion phase.

Market psychology: bulls are being tested — holding this zone keeps the bullish structure alive; losing it gives bears back control.

---

⚙️ Trading Plan

Conservative entry: wait for a 2D close above 415 for confirmation.

Aggressive entry: accumulate within 386–355, stop loss below 350.

Targets: 464 / 561 / 698.

Risk-reward: favorable setup (1:3 – 1:5) if the bullish scenario plays out.

---

🧠 Conclusion

TAO stands at a decisive crossroads.

The 386–355 golden zone is not just technical support — it’s the psychological frontier between hope and fear.

As long as this zone holds, the bullish narrative remains alive.

But once it breaks, the bears will take command again.

Whichever direction wins, this is the most important battleground for TAO this quarter.

#TAO #TAOUSDT #CryptoAnalysis #Breakout #SupportResistance #TrendlineBreakout #PriceAction #SwingTrade #TechnicalAnalysis #CryptoTrading

Taoanalysis

TAO/USDT: Price Likely to Retest Key Support Block 330–365 USDT?🟨 Key Zone: Yellow Support Block (330 – 365 USDT)

This zone has served as a major demand area since May 2025, acting as the base for the recent bullish move toward 475 USDT.

It represents a strong accumulation zone, where significant buying interest previously stepped in.

Given the current rejection from the 475 resistance, price is likely to revisit this block to test buyer interest and liquidity.

---

📉 Bearish Scenario: Breakdown Risk

After failing to break above 475.7 USDT, price shows signs of a short-term correction.

If bearish momentum continues:

🔽 A retest of the yellow support zone (330–365 USDT) is highly probable.

If this zone fails to hold:

📉 Next downside targets:

305 USDT – previous local low

265 USDT – next major demand level

A breakdown of the yellow block would invalidate the current bullish structure and open a new bearish leg.

---

📈 Bullish Scenario: Successful Retest and Bounce

If the price retests the yellow zone and forms a strong bullish reaction:

Confirmation signals:

Bullish reversal candles (hammer, bullish engulfing, etc.)

Increasing volume near the support zone

A successful retest could lead to:

✅ Continuation of the bullish trend

✅ Higher-low structure remains intact

Upside targets:

432 USDT – minor resistance

475.7 USDT – strong resistance zone

564.8, 609.1, and up to 711–745 USDT – extended targets

---

📌 Key Technical Levels:

Level Significance

330–365 USDT 🔲 Yellow Support Block / Demand Zone

432 USDT Minor Resistance / Previous Breakout

475.7 USDT Major Resistance (Recent Rejection)

564.8 USDT Mid-Term Resistance

609.1 USDT Next Key Resistance

711–745 USDT Long-Term Target / Supply Zone

305 USDT Support if Breakdown Happens

265 USDT Next Demand Zone Below

---

📊 Structure & Market Behavior:

No clear classic pattern (e.g., H&S or double bottom), but:

Current price is moving within a range-bound structure

Holding the 330–365 block would form a new higher low, strengthening the bullish outlook

Market is watching how price responds on retest of the yellow support

---

🧠 Notes for Traders:

Watch for volume and candle structure as price enters the 330–365 zone

This zone is a classic re-entry / reload area for institutional buyers

Conservative entry: Wait for bullish confirmation candle above 365

Aggressive entry: Ladder buys inside 330–365 with stop loss below 330

---

🏁 Conclusion:

TAO/USDT is undergoing a healthy pullback after rejection at 475.7 USDT. A retest of the yellow support zone (330–365 USDT) is highly likely. This area is crucial for the next move — either a bullish continuation with a strong bounce or a bearish breakdown signaling trend reversal.

#TAOUSDT #TAO #CryptoAnalysis #RetestSupport #DemandZone #BullishScenario #BearishScenario #AltcoinWatch #TechnicalAnalysis #PriceAction #TradingView #SupportAndResistance #GateIO #ReentryZone