Bittsensor TAO price analysis#TAO is still trading in a tight consolidation zone, and honestly — this structure looks very intentional.

There’s a strong feeling that someone is quietly building a large position here.

The price behavior reminds a lot of early-stage CRYPTOCAP:ETH , when it spent months moving sideways before the real expansion phase.

🔹 Minimum scenario:

A clean range trade OKX:TAOUSDT.P between $250 – $500, which already gives nearly 100% volatility without any global trend.

🔹 Maximum scenario:

= wait for a confirmed breakout and consolidation above $470

= continue gradual accumulation

= and then hold mid-term, targeting at least $1800

📈 This scenario only works if the broader market doesn’t break down — but structurally, #TAO looks very healthy.

🤔 Do you believe #Bittensor can become one of the core AI-crypto narratives of this cycle, or is this just another hype phase?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

TAOUSD

TAO/USDT - Breakout or Deeper Decline?TAO is currently trading in a critical decision zone. Price remains capped below a major descending trendline that has controlled the market for weeks. Every recovery attempt has been rejected, confirming that sellers are still in control.

However, tightening price action signals volatility compression, often preceding a powerful directional move. The market is no longer asking if it will move — only which direction it will choose.

---

Market Structure & Psychology

Repeated Lower Highs → clear bearish dominance

Weak rebounds → lack of strong buyer commitment

Tight consolidation between 295 – 308 → breakout or breakdown zone

This is a classic decision point, where a single impulsive candle can define the next trend.

---

Technical Pattern Analysis

Descending Trendline (Dynamic Resistance)

The descending trendline acts as:

Primary dynamic resistance

Seller control zone

Psychological barrier for buyers

As long as price remains below this line, all upward moves are corrective rallies, not trend reversals.

Compression Zone — “Before the Storm”

The narrowing range suggests:

Volatility is being compressed

Liquidity is being absorbed

A sharp expansion move is approaching

---

Bullish Scenario — Trend Reversal Confirmation

Key Conditions:

Clean breakout and strong 4H close above the trendline

Follow-through above 308 → 332

Bullish Confirmation:

Successful retest of the trendline as support

Impulsive candles (not wick-based breakouts)

Upside Targets:

332 → structural shift

355 – 365 → major supply zone

397 → bullish extension target

Meaning:

> A confirmed breakout would mark TAO as an early trend reversal candidate.

---

Bearish Scenario — Downtrend Continuation

Key Conditions:

Rejection at the trendline

Strong breakdown below 295

Bearish Confirmation:

High-momentum bearish close

Rising volume with no meaningful bounce

Downside Targets:

275 → interim support

254 → major demand zone

Meaning:

> A breakdown below support could trigger a capitulation move toward lower demand.

---

Primary bias remains bearish

Price is at a make-or-break level

Breakout = high-potential opportunity

Breakdown = elevated downside risk

Professional traders wait for confirmation, not predictions.

#TAOUSDT #CryptoAnalysis #MarketStructure #TrendlineBreak #PriceAction

#BearishMarket #BullishReversal #SupportResistance

TAOUSDT UPDATE#TAO

UPDATE

TAO Technical Setup

Pattern: Falling Wedge Pattern

Current Price: $287.9

Target Price: $540.0

Target % Gain: 87.60%

Technical Analysis: TAO is breaking out of a falling wedge pattern on the 4H chart, signaling a bullish reversal after an extended corrective move. Price has successfully pushed above the descending resistance trendline, showing improving market structure and renewed buying momentum. The breakout opens the door for a continuation move toward the projected upside target, as long as price holds above the breakout zone and invalidation support remains intact.

Time Frame: 4H

Risk Management Tip: Always use proper risk management.

FireHoseReel | TAO: Breakout Loading Don’t Be Late This Time🔥 Welcome FireHoseReel !

Let’s break down what’s happening with TAO (Bittensor) right now.

👀 TAO – Price Action Overview

After the recent drop, TAO has formed a strong support at $267.6. From this level, buy volume increased and price started pushing upward toward its resistances. Along the way, TAO managed to break several multi-timeframe resistances, showing that seller pressure has weakened and buyers are stepping in more confidently.

Our long trigger is at $310, and a clean breakout above this level can give us a valid long setup.

📊 Volume Analysis

Following the recent declines, TAO’s volume temporarily dropped. However, during the last sell-off, buy volume noticeably increased, causing a sharp move and breaking the $310 support earlier.

For a proper breakout this time, we need strong buy volume to trigger a short squeeze above the resistance zone.

✔️ Price Behavior Near Resistance

TAO is currently interacting with this resistance for the first touch, which often leads to rejection.

Better long setups typically form after the second touch and onward, when buyers show stronger control and volume convergence improves.

🔗 TAO/BTC Pair Perspective Looking at the TAO/BTC pair, price is approaching a key resistance zone sitting at the top of its previous trading range.

A breakout above this level can create a high-momentum move, especially if Bitcoin dominance rises.

This alignment increases the probability of continuation on the TAO/USDT pair as well.

✍️ Long Scenario

A long setup becomes valid if the following conditions align:

• Breakout above $310

• Increase in Bitcoin dominance (BTC.D)

• Decrease in USDT dominance (USDT.D)

• Strong buy volume and clean multi-timeframe volume convergence

• Ideally entering after the second touch into resistance

If these conditions are met, the long scenario becomes much stronger and more reliable.

🛞 Risk Management & Disclaimer

Please remember to always use proper risk management and position sizing. Nothing in this analysis is financial advice. The market can change quickly, so always trade based on your own strategy, research, and risk tolerance. You are fully responsible for your own trades.

TAO/USDT — 215–180 Demand Zone Will Decide the Next Major Move?TAO is entering one of the most decisive moments in its multi-month structure. After losing its mid-range support and gradually sliding lower, the price is now approaching the same demand zone that has repeatedly launched strong macro rallies since 2024 — the 215–180 zone.

This zone is not just another support level.

It is a “liquidity engine” where institutions, swing traders, and smart money previously stepped in aggressively, triggering explosive recoveries back toward major resistances (459 → 700 → 777).

Now, the market is once again descending into this energy zone.

The question is: Will TAO bounce one more time, or will this be the first decisive breakdown that shifts the entire macro structure?

---

Market Structure & Price Pattern

Macro range has dominated since 2024 → alternating phases of accumulation and distribution.

Repeated rejections near 700–777 signal a strong supply ceiling.

Lower highs in recent swings indicate sustained short-term bearish momentum.

Demand Zone 215–180 remains the final stronghold for buyers before the macro bias turns fully bearish.

Recent candles show increased sell pressure as price approaches the zone → highlighting how critical buyer reaction will be here.

---

Bullish Scenario (Rebound From TAO’s Strongest Zone)

A highly anticipated scenario among swing traders:

1. Price enters the 215–180 demand zone and forms a clean reversal signal:

Bullish Engulfing

Strong Pin Bar / Hammer

Momentum bullish divergence

2. A confirmed break and close above 313 shifts the mid-term structure back to bullish.

3. Upside targets if the reversal holds:

459 → minor resistance

700 → major supply zone

777 → previous distribution top

This would replicate the market behavior seen multiple times before — TAO “recharging” in this zone before initiating multi-week rallies.

---

Bearish Scenario (Break Below the Strongest Demand Zone)

This scenario would change everything.

1. A 3D candle close below 180

2. Retest of 180 turning into resistance

3. Increasing sell volume → confirming distribution

If confirmed, TAO enters a territory with limited support below, opening the door to deeper markdown levels.

This would officially end the multi-year range structure and begin a major downward phase.

---

Core Conclusion

TAO is not simply “pulling back”.

It is testing the foundation of its entire trend.

The 215–180 demand zone is:

⭐ The highest-probability region for a measured long

⭐ The boundary between a major macro rebound and a macro breakdown

⭐ The zone that will define TAO’s trajectory for months ahead

TAO’s reaction here will act as the catalyst for its next explosive move — up or down.

---

#TAO #TAOUSDT #Bittensor #CryptoAnalysis #DemandZone #SmartMoney #PriceAction #SwingTrading #TechnicalAnalysis #CryptoOutlook

TAO/USDT — Breakout Incoming or Breakdown Imminent?TAO/USDT is now sitting on one of the most critical price zones of its entire mid-term structure.

On the 2D timeframe, price has returned to the Golden Demand Zone at 340–305 — an area that previously acted as accumulation, breakout base, and institutional defense line.

Now the market is testing it again, which means:

> How price reacts here will determine the next major directional wave.

---

🔶 Why the 340–305 Zone Is Extremely Important

A proven demand zone where buyers consistently stepped in with strength.

A flip zone (old resistance → new support).

A region where institutions filled liquidity before previous rallies.

Multiple long wicks were created here → indicating liquidity sweeps and strong buy absorption.

In simple terms:

This zone is the foundation of the current trend cycle.

---

📈 Bullish Scenario — “Institutional Rebound Setup”

If 340–305 holds firmly, the market may form a strong bullish reversal:

1. Bullish confirmation from the zone

Look for:

Strong bullish 2D candle

Long lower wick

Rejection from 305 followed by a close above 340

This would indicate aggressive buy-side defense.

2. Upside targets (layered resistances)

385 → first resistance, local take-profit zone

460 → key supply zone

560 → major resistance from previous distribution

725 → high-range target if bullish continuation strengthens

Bullish narrative:

> If the 305–340 zone is defended again, TAO is likely preparing for a multi-wave bullish move toward upper-range resistances.

---

📉 Bearish Scenario — “Breakdown = Trend Reset”

If price closes below 305 on the 2D chart, the structure shifts into a deeper corrective phase:

1. Breakdown of the Golden Zone

Buyers lose control

A failed retest of 305–340 → confirmation of bearish dominance

2. Downside targets

260–220 → next minor support

163 → major structural low and liquidity magnet in a full breakdown scenario

Bearish narrative:

> Losing 305 is not a simple breakdown — it signals a trend cycle reset and opens the door for deeper distribution.

---

🔍 Market Mood & Pattern: Range, Traps, and Energy Compression

TAO has been forming a large multi-month range

Repeated fakeouts and long wicks → liquidity hunting, not trending

This type of structure usually forms before a major breakout or major dump

Price is sitting at the tail end of compression — the next move out of 340–305 will define the coming trend direction.

#TAOUSDT #TAO #CryptoAnalysis #KeyLevels #MarketStructure #DemandZone #Breakout #Liquidity #SwingTrading #CryptoOutlook

TAO in flow — will it rise or slow? TAO surprised me a bit this time — after it broke the invalidation zone I mentioned in my earlier post about this coin, it’s now hinting at another potential upward move.

As usual, I’m watching a few possible scenarios — marked by the orange and purple arrows on the chart.

🎯For now, my short-term target is around $426, and globally, I’m keeping an eye on $500 🚀

❌The invalidation zone remains at $369.34.

⚠️ Disclaimer: This analysis is not financial advice or a signal to take action.

Always make trading decisions based on your risk management, and never trade without stop-losses.

💬 What do you think — will TAO continue to grow, or is it just a temporary bounce?

Share your thoughts in the comments.

📈 Follow me for updates on TAO and other crypto analyses.

TAO to Glow — Just Like DASH FlowTAO is showing a price structure very similar to DASH, which makes me expect a strong upward move ahead.

I currently see two growth scenarios for TAO — following the purple and orange arrows on my chart.

Both lead to the same target zone:

🎯 Target 1: 580

🎯 Target 2: 640

🎯 Target 3: 720

❌ Invalidation Zone: 481.44

Both scenarios remain valid unless the price closes below that red level.

🚀 If you want more forecasts — leave a reaction!

🔔 Follow me so you don’t miss my daily updates — I post new analyses almost every day!

#TAO/USDT ranges for long term break out#TAO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 385, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 393.3

First target: 397.90

Second target: 405.90

Third target: 414

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

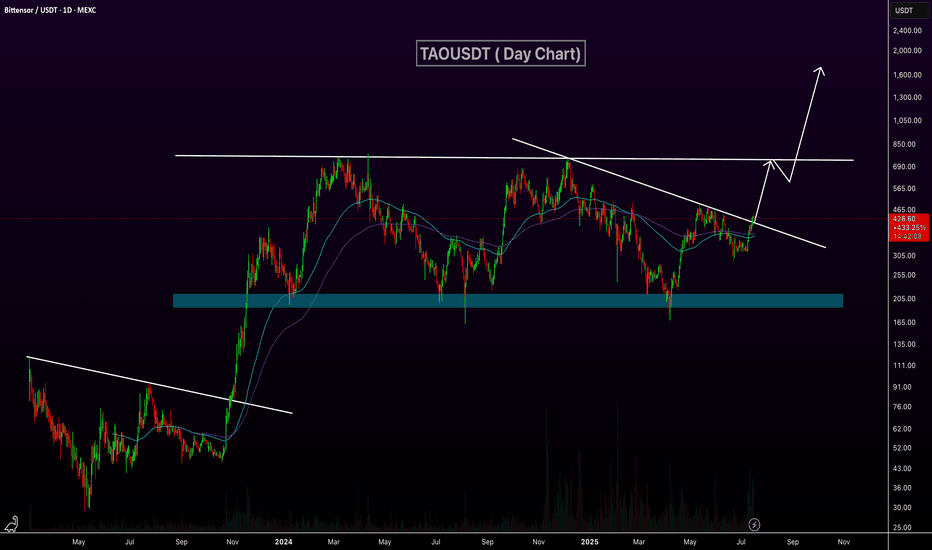

TAO/USDT — Triangle: Ready to Explode After Long Consolidation?TAO is currently standing at one of its most critical crossroads since forming a large structure earlier this year. The 2D chart reveals a Symmetrical Triangle pattern, a classic formation that signals the market is coiling energy for a major move ahead.

Each swing low keeps climbing higher, reflecting growing buying pressure — while the sequence of lower highs shows sellers are still defending strongly. These two forces are now colliding right around the key zone between ₮428 – ₮464.

---

Technical Structure Overview

Pattern: Symmetrical Triangle – pressure building toward an explosive breakout.

Key Resistance: ₮464 (confirmation once 2D candle closes above).

Bullish Targets: ₮563 → ₮614 → ₮701 → ₮744.

Dynamic Support: ascending trendline near ₮350–₮370.

Invalidation Level: daily/2D close below the rising trendline.

---

Bullish Scenario – “Pressure Before Expansion”

If TAO manages to break through the descending resistance and close above ₮464 with strong volume, it will confirm a breakout from this multi-month consolidation.

Such a breakout could trigger an impulsive rally, targeting ₮563 – ₮614, and potentially extending to ₮744, which is the previous major supply zone.

The strength of this setup lies in its duration — the longer the compression, the stronger the expansion.

---

Bearish Scenario – “Rejected and Retraced”

If TAO fails to break through the ₮428 – ₮464 confluence zone and gets rejected at the upper boundary, price may pull back sharply.

A breakdown below the rising support trendline could send TAO back toward ₮300 – ₮250, with extended downside risk to ₮167 if selling momentum accelerates.

This scenario gains validity only if a 2D candle closes below the ascending support with strong volume confirmation.

---

Conclusion

TAO is entering the final accumulation phase within this large triangle pattern — a period of calm that often precedes a powerful move.

At this stage, patience and confirmation matter more than prediction. Smart traders wait for the direction to reveal itself, then follow with discipline and tight risk management.

> “The bigger the base, the higher the breakout — or the harder the fall.”

TAO is now at the edge of its next major decision.

---

#TAO #TAOUSDT #CryptoBreakout #SymmetricalTriangle #TAOAnalysis #CryptoChart #TechnicalAnalysis #BreakoutSetup #TrianglePattern #CryptoTrading #PriceAction #Bittensor #AltcoinSetup #SwingTrade

Future is AI - win or lose but I hold and support it upto $3k" DYOR / NFA " ⚠️

i support BINANCE:TAOUSDT for future strong project , i don't care about time but I care only one target $3000 above for one COINBASE:TAOUSD .

Note - time and future price candle change the price forecast ,

so pls be updated by following the post 📯 .

With in range always BUY

‼️ Stop buy above _&_ below the box ☑️

1TAO = $3000+

#Bittensor ( $TAO ) Technical Overview — October 2025After the sharp correction on Oct 10, #TAO found solid support and quickly recovered,

indicating strong buying interest. The OKX:TAOUSDT.P chart now shows a clear consolidation range between $290–490.

📊 Within this range, algorithmic and bot-driven strategies can operate efficiently

Key technical zones:

Accumulation: $280–290

Breakout confirmation: Above $470

Potential upside targets: $1800 → $2900

From a structural standpoint, maintaining support above $290 keeps the bullish scenario intact.

The upcoming sessions will reveal whether buyers are ready to push beyond resistance or reload for another dip.

🤔 What’s your outlook on #TAO — breakout soon or another retest first?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

TAO 4H Analysis - Key Triggers Ahead💀 Hey , how's it going ? Come over here — Satoshi got something for you!

⏰ We’re analyzing TAO on the 4-Hour timeframe.

👀 On the 4-hour timeframe for Bittensor (TAO), we can see that this coin belongs to the AI category on CoinMarketCap and currently holds rank #35. TAO had been moving inside a continuation descending channel, but it has now successfully broken out of this channel. With a completed pullback and a proper setup candle confirmation in multi-timeframe analysis, this could present a trade opportunity.

⚙️ Key RSI levels for this coin are at 70 (overbought threshold) and 35 (near oversold). At the start of the current leg, during the holiday session, volatility increased strongly, and TAO managed to break through its swing resistances. If RSI pushes above 70 and enters the overbought zone, the coin could experience a solid bullish move.

🕯 The number of green candles has been increasing, and TAO also reacted well to the channel top. At the same time, a major resistance at $322 was broken, with all sell orders at that level fully absorbed.

🪙 Looking at the TAO/BTC pair on the 4-hour timeframe, we can see that after breaking through its previous resistance, the pair is currently consolidating and completing a pullback at this zone. Once the pullback is confirmed with a setup candle, we could have a strong trade confirmation.

💡 The key alarm zones for this coin are:

Around $322, where a reaction followed by a bounce can push the price higher.

With a successful breakout above $327, TAO could gain momentum and continue its bullish trend.

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

TAO - BEARISH WEEKLY VIEW! GETTEX:TAO - Price Analysis 🐸📉

🧭 Structure: attempted daily double bottom, but sellers still in control below former major supports now acting as resistance.

📊 Ichimoku (1D): price and lagging span remain under the cloud → bearish bias intact until a clean reclaim.

🪙 Next key downside: $280–$285 demand zone if supports crack.

🔄 Invalidation: sustained daily close back above broken supports and the cloud would neutralize the bearish thesis.

Market context

🧱 TOTAL Crypto MCap (Alts): watching a potential bearish H&S; a confirmed neckline break could extend alt mcap downside by ~8–10%. ⚠️ .

Positioning

📉 Caution with longs for now, especially on large/medium caps.

🧪 Expect occasional random spikes on low/micro caps as liquidity rotates and volume clusters.

The plan here: wait for the sweep into $280–$285 or only flip bias on a strong reclaim? Drop your chart below 👇

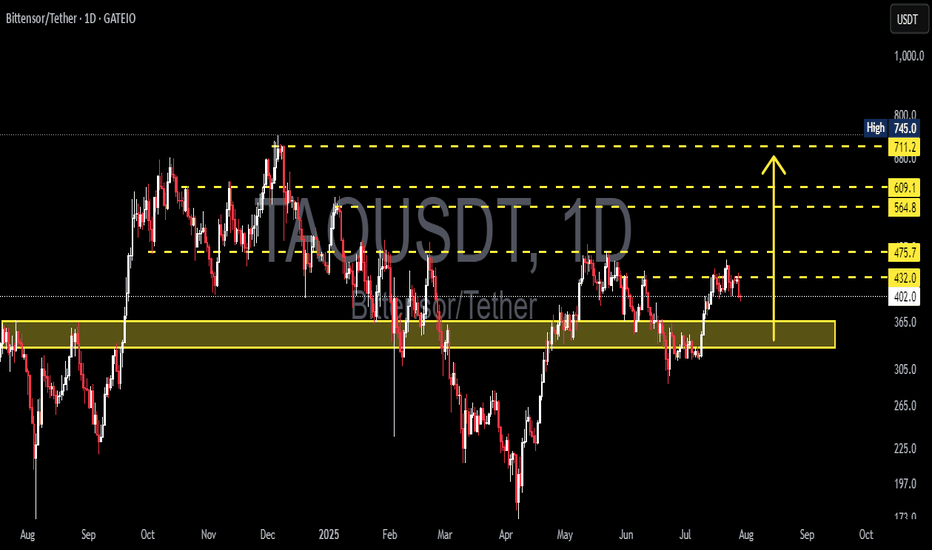

TAO/USDT – Demand Zone: Potential Double Bottom or Breakdown🔎 Market Overview

TAO/USDT is currently trading around 324 USDT, sitting right inside the key demand zone (305–345) that has been tested multiple times since late 2024. This area has repeatedly acted as a strong defensive wall for buyers, and once again the market is waiting for a big decision: bounce or breakdown.

From April to August 2025, the chart shows a series of lower highs, reflecting continued selling pressure. However, the repeated defense of this demand zone suggests accumulation is possible if a strong bullish reaction appears.

---

🧩 Price Structure & Pattern

Current pattern: Consolidation within the demand zone (305–345).

Key characteristics:

Buyers have successfully defended this level multiple times → potential accumulation area.

Larger structure still shows minor downtrend (lower highs).

A confirmed breakdown could trigger deeper sell-offs.

In short, this is the battle zone between bulls and bears that will determine the medium-term direction.

---

📈 Bullish Scenario

If price holds and bounces from the demand zone:

Confirmation: Daily bullish candle closing above 345–350 with strong volume.

Upside targets:

🎯 TP1: 389.8 (first resistance & short-term supply zone)

🎯 TP2: 432.0 (mid-term supply zone)

🎯 TP3: 475.7 (major resistance – key to shift medium-term trend)

🎯 Extensions: 564.8 – 608.5 – 710.9 – 745.0

➡️ A successful bounce could form a double bottom / base formation.

---

📉 Bearish Scenario

If price fails to hold the demand zone (daily close below 305):

Confirmation: Breakdown candle with strong volume + failed retest.

Downside targets:

🎯 265 – 235 (nearest supports)

🎯 167.7 (historical low – potential final target if strong selling pressure continues)

➡️ This would form a major support breakdown, potentially triggering a larger distribution phase.

---

⚖️ Technical Conclusion

Current bias: Neutral to Bearish – downtrend structure remains, but bulls are still defending.

305–345 is the make-or-break zone.

Bounce → potential rally towards 389–475.

Breakdown → possible drop to 235 or even 167.

---

🛡️ Risk Management Notes

Clear stop-loss levels:

Bullish setup: SL below 305.

Bearish setup: SL above 345–350 after breakdown.

Scale into positions rather than going all-in.

Watch for volume confirmation & momentum indicators (RSI/MACD) to avoid false breakouts.

---

📌 Extra Insights

The 305–345 zone is not only a technical level but also a psychological price floor, tested multiple times.

The structure of lower highs vs. strong support often resolves with a major breakout — meaning the next move could be very aggressive.

Patience is key: traders should wait for a clear daily close confirmation before entering to avoid being trapped in a fake move.

#TAO #Bittensor #TAOUSDT #CryptoAnalysis #TechnicalAnalysis #SupportResistance #Breakout #CryptoTrading #SwingTrading #PriceAction

TAO/USDT: Price Likely to Retest Key Support Block 330–365 USDT?🟨 Key Zone: Yellow Support Block (330 – 365 USDT)

This zone has served as a major demand area since May 2025, acting as the base for the recent bullish move toward 475 USDT.

It represents a strong accumulation zone, where significant buying interest previously stepped in.

Given the current rejection from the 475 resistance, price is likely to revisit this block to test buyer interest and liquidity.

---

📉 Bearish Scenario: Breakdown Risk

After failing to break above 475.7 USDT, price shows signs of a short-term correction.

If bearish momentum continues:

🔽 A retest of the yellow support zone (330–365 USDT) is highly probable.

If this zone fails to hold:

📉 Next downside targets:

305 USDT – previous local low

265 USDT – next major demand level

A breakdown of the yellow block would invalidate the current bullish structure and open a new bearish leg.

---

📈 Bullish Scenario: Successful Retest and Bounce

If the price retests the yellow zone and forms a strong bullish reaction:

Confirmation signals:

Bullish reversal candles (hammer, bullish engulfing, etc.)

Increasing volume near the support zone

A successful retest could lead to:

✅ Continuation of the bullish trend

✅ Higher-low structure remains intact

Upside targets:

432 USDT – minor resistance

475.7 USDT – strong resistance zone

564.8, 609.1, and up to 711–745 USDT – extended targets

---

📌 Key Technical Levels:

Level Significance

330–365 USDT 🔲 Yellow Support Block / Demand Zone

432 USDT Minor Resistance / Previous Breakout

475.7 USDT Major Resistance (Recent Rejection)

564.8 USDT Mid-Term Resistance

609.1 USDT Next Key Resistance

711–745 USDT Long-Term Target / Supply Zone

305 USDT Support if Breakdown Happens

265 USDT Next Demand Zone Below

---

📊 Structure & Market Behavior:

No clear classic pattern (e.g., H&S or double bottom), but:

Current price is moving within a range-bound structure

Holding the 330–365 block would form a new higher low, strengthening the bullish outlook

Market is watching how price responds on retest of the yellow support

---

🧠 Notes for Traders:

Watch for volume and candle structure as price enters the 330–365 zone

This zone is a classic re-entry / reload area for institutional buyers

Conservative entry: Wait for bullish confirmation candle above 365

Aggressive entry: Ladder buys inside 330–365 with stop loss below 330

---

🏁 Conclusion:

TAO/USDT is undergoing a healthy pullback after rejection at 475.7 USDT. A retest of the yellow support zone (330–365 USDT) is highly likely. This area is crucial for the next move — either a bullish continuation with a strong bounce or a bearish breakdown signaling trend reversal.

#TAOUSDT #TAO #CryptoAnalysis #RetestSupport #DemandZone #BullishScenario #BearishScenario #AltcoinWatch #TechnicalAnalysis #PriceAction #TradingView #SupportAndResistance #GateIO #ReentryZone

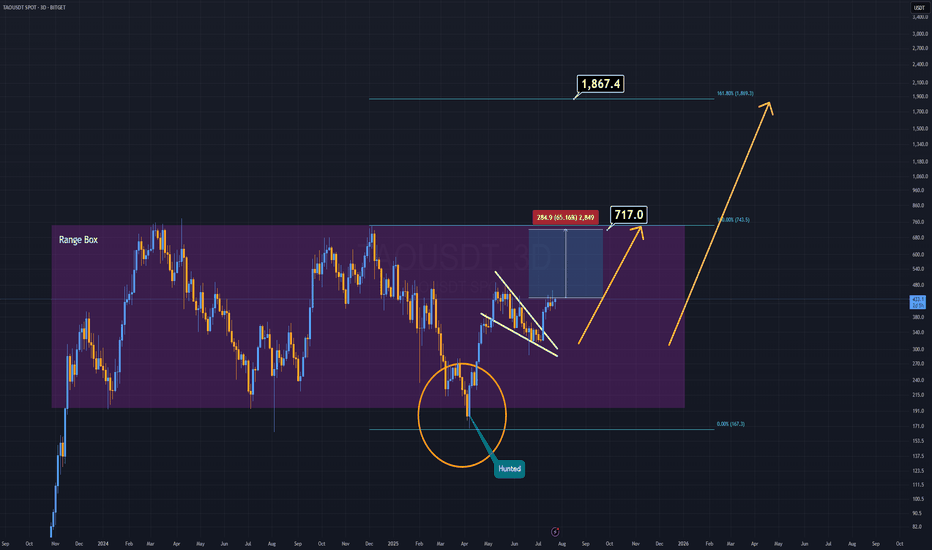

TAO Analysis (3D)Sometimes, there's no need for complex patterns or heavy indicators — and TAO is a perfect example of that.

For years, TAO has been consolidating inside a clearly defined accumulation box. Before the current bullish breakout, it liquidated all weak hands by sweeping the lows — convincing many that the project was dead.

Now, on the daily timeframe, we’re seeing a broken and active pennant formation, which is already being validated.

This structure alone is a strong technical buy signal.

With the upcoming AI-driven bull run, TAO has the potential to outperform many of its AI-sector peers.

This one might just fly ahead of the pack.

TAOUSDT Breaks Descending Trendline!BINANCE:TAOUSDT daily chart is showing a potential bullish breakout as price moves above a long-term descending trendline. This breakout, combined with support from the 100 and 200 EMAs, indicates growing upward momentum. If price holds above this trendline, the next key resistance lies around the $750 level. A successful breakout and retest could pave the way for a major rally toward $2,000. GETTEX:TAO

Regards

Hexa