TAO/USDT - Breakout or Deeper Decline?TAO is currently trading in a critical decision zone. Price remains capped below a major descending trendline that has controlled the market for weeks. Every recovery attempt has been rejected, confirming that sellers are still in control.

However, tightening price action signals volatility compression, often preceding a powerful directional move. The market is no longer asking if it will move — only which direction it will choose.

---

Market Structure & Psychology

Repeated Lower Highs → clear bearish dominance

Weak rebounds → lack of strong buyer commitment

Tight consolidation between 295 – 308 → breakout or breakdown zone

This is a classic decision point, where a single impulsive candle can define the next trend.

---

Technical Pattern Analysis

Descending Trendline (Dynamic Resistance)

The descending trendline acts as:

Primary dynamic resistance

Seller control zone

Psychological barrier for buyers

As long as price remains below this line, all upward moves are corrective rallies, not trend reversals.

Compression Zone — “Before the Storm”

The narrowing range suggests:

Volatility is being compressed

Liquidity is being absorbed

A sharp expansion move is approaching

---

Bullish Scenario — Trend Reversal Confirmation

Key Conditions:

Clean breakout and strong 4H close above the trendline

Follow-through above 308 → 332

Bullish Confirmation:

Successful retest of the trendline as support

Impulsive candles (not wick-based breakouts)

Upside Targets:

332 → structural shift

355 – 365 → major supply zone

397 → bullish extension target

Meaning:

> A confirmed breakout would mark TAO as an early trend reversal candidate.

---

Bearish Scenario — Downtrend Continuation

Key Conditions:

Rejection at the trendline

Strong breakdown below 295

Bearish Confirmation:

High-momentum bearish close

Rising volume with no meaningful bounce

Downside Targets:

275 → interim support

254 → major demand zone

Meaning:

> A breakdown below support could trigger a capitulation move toward lower demand.

---

Primary bias remains bearish

Price is at a make-or-break level

Breakout = high-potential opportunity

Breakdown = elevated downside risk

Professional traders wait for confirmation, not predictions.

#TAOUSDT #CryptoAnalysis #MarketStructure #TrendlineBreak #PriceAction

#BearishMarket #BullishReversal #SupportResistance

TAOUSDC

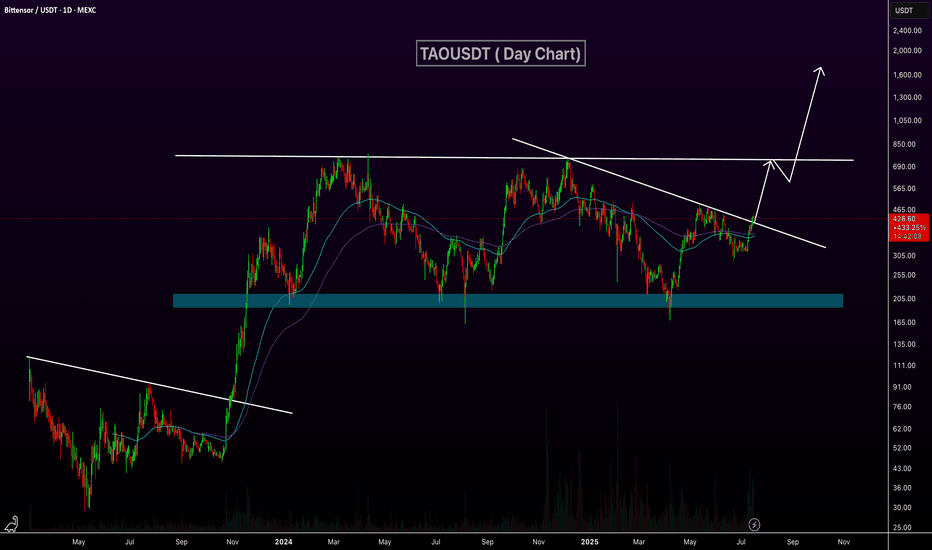

TAO/USDT — 215–180 Demand Zone Will Decide the Next Major Move?TAO is entering one of the most decisive moments in its multi-month structure. After losing its mid-range support and gradually sliding lower, the price is now approaching the same demand zone that has repeatedly launched strong macro rallies since 2024 — the 215–180 zone.

This zone is not just another support level.

It is a “liquidity engine” where institutions, swing traders, and smart money previously stepped in aggressively, triggering explosive recoveries back toward major resistances (459 → 700 → 777).

Now, the market is once again descending into this energy zone.

The question is: Will TAO bounce one more time, or will this be the first decisive breakdown that shifts the entire macro structure?

---

Market Structure & Price Pattern

Macro range has dominated since 2024 → alternating phases of accumulation and distribution.

Repeated rejections near 700–777 signal a strong supply ceiling.

Lower highs in recent swings indicate sustained short-term bearish momentum.

Demand Zone 215–180 remains the final stronghold for buyers before the macro bias turns fully bearish.

Recent candles show increased sell pressure as price approaches the zone → highlighting how critical buyer reaction will be here.

---

Bullish Scenario (Rebound From TAO’s Strongest Zone)

A highly anticipated scenario among swing traders:

1. Price enters the 215–180 demand zone and forms a clean reversal signal:

Bullish Engulfing

Strong Pin Bar / Hammer

Momentum bullish divergence

2. A confirmed break and close above 313 shifts the mid-term structure back to bullish.

3. Upside targets if the reversal holds:

459 → minor resistance

700 → major supply zone

777 → previous distribution top

This would replicate the market behavior seen multiple times before — TAO “recharging” in this zone before initiating multi-week rallies.

---

Bearish Scenario (Break Below the Strongest Demand Zone)

This scenario would change everything.

1. A 3D candle close below 180

2. Retest of 180 turning into resistance

3. Increasing sell volume → confirming distribution

If confirmed, TAO enters a territory with limited support below, opening the door to deeper markdown levels.

This would officially end the multi-year range structure and begin a major downward phase.

---

Core Conclusion

TAO is not simply “pulling back”.

It is testing the foundation of its entire trend.

The 215–180 demand zone is:

⭐ The highest-probability region for a measured long

⭐ The boundary between a major macro rebound and a macro breakdown

⭐ The zone that will define TAO’s trajectory for months ahead

TAO’s reaction here will act as the catalyst for its next explosive move — up or down.

---

#TAO #TAOUSDT #Bittensor #CryptoAnalysis #DemandZone #SmartMoney #PriceAction #SwingTrading #TechnicalAnalysis #CryptoOutlook

TAO/USDT — Breakout Incoming or Breakdown Imminent?TAO/USDT is now sitting on one of the most critical price zones of its entire mid-term structure.

On the 2D timeframe, price has returned to the Golden Demand Zone at 340–305 — an area that previously acted as accumulation, breakout base, and institutional defense line.

Now the market is testing it again, which means:

> How price reacts here will determine the next major directional wave.

---

🔶 Why the 340–305 Zone Is Extremely Important

A proven demand zone where buyers consistently stepped in with strength.

A flip zone (old resistance → new support).

A region where institutions filled liquidity before previous rallies.

Multiple long wicks were created here → indicating liquidity sweeps and strong buy absorption.

In simple terms:

This zone is the foundation of the current trend cycle.

---

📈 Bullish Scenario — “Institutional Rebound Setup”

If 340–305 holds firmly, the market may form a strong bullish reversal:

1. Bullish confirmation from the zone

Look for:

Strong bullish 2D candle

Long lower wick

Rejection from 305 followed by a close above 340

This would indicate aggressive buy-side defense.

2. Upside targets (layered resistances)

385 → first resistance, local take-profit zone

460 → key supply zone

560 → major resistance from previous distribution

725 → high-range target if bullish continuation strengthens

Bullish narrative:

> If the 305–340 zone is defended again, TAO is likely preparing for a multi-wave bullish move toward upper-range resistances.

---

📉 Bearish Scenario — “Breakdown = Trend Reset”

If price closes below 305 on the 2D chart, the structure shifts into a deeper corrective phase:

1. Breakdown of the Golden Zone

Buyers lose control

A failed retest of 305–340 → confirmation of bearish dominance

2. Downside targets

260–220 → next minor support

163 → major structural low and liquidity magnet in a full breakdown scenario

Bearish narrative:

> Losing 305 is not a simple breakdown — it signals a trend cycle reset and opens the door for deeper distribution.

---

🔍 Market Mood & Pattern: Range, Traps, and Energy Compression

TAO has been forming a large multi-month range

Repeated fakeouts and long wicks → liquidity hunting, not trending

This type of structure usually forms before a major breakout or major dump

Price is sitting at the tail end of compression — the next move out of 340–305 will define the coming trend direction.

#TAOUSDT #TAO #CryptoAnalysis #KeyLevels #MarketStructure #DemandZone #Breakout #Liquidity #SwingTrading #CryptoOutlook

TAO/USDT — Bearish Structure Broken, But Can Support Hold?After months trapped beneath a major descending trendline, TAO finally broke out with strong bullish momentum — hinting at a potential trend reversal.

However, price has now pulled back to retest the golden zone (386–355), which serves as the final defense line for the bulls.

This yellow zone is more than just a support area — it’s the intersection of horizontal support and the old downtrend line, making it the most decisive structure on the current chart.

In simple terms: this is where conviction meets fear — the battlefield between buyers and sellers.

---

🟢 Bullish Scenario

If the price holds firmly above 386–355 and forms a clear bullish rejection or engulfing candle, it would confirm strong buyer presence and likely trigger another leg up.

Bullish confirmation: 2D candle close above 415–430.

Upside targets:

🎯 464 → first resistance & partial profit zone.

🎯 561 → key supply area & mid-range target.

🎯 698–744 → swing target & major resistance zone.

A clean breakout above 430 would signal that the bearish market structure has been fully broken, paving the way for sustained bullish momentum.

---

🔴 Bearish Scenario

If the price fails to hold 355 and closes below it, the bullish structure becomes invalidated, opening room for a deeper retracement toward 330–290.

Such a move would confirm that the previous breakout was just a classic bull trap, where liquidity was swept before resuming the dominant downtrend.

Bearish continuation would be reinforced by increasing sell volume and lack of any strong bullish reaction around the support zone.

---

📈 Technical Structure Overview

Dominant pattern: Descending trendline breakout + retest confluence support.

Mid-term bias: Neutral–bullish while price stays above 386–355.

Momentum: currently consolidating — potentially forming a base for the next expansion phase.

Market psychology: bulls are being tested — holding this zone keeps the bullish structure alive; losing it gives bears back control.

---

⚙️ Trading Plan

Conservative entry: wait for a 2D close above 415 for confirmation.

Aggressive entry: accumulate within 386–355, stop loss below 350.

Targets: 464 / 561 / 698.

Risk-reward: favorable setup (1:3 – 1:5) if the bullish scenario plays out.

---

🧠 Conclusion

TAO stands at a decisive crossroads.

The 386–355 golden zone is not just technical support — it’s the psychological frontier between hope and fear.

As long as this zone holds, the bullish narrative remains alive.

But once it breaks, the bears will take command again.

Whichever direction wins, this is the most important battleground for TAO this quarter.

#TAO #TAOUSDT #CryptoAnalysis #Breakout #SupportResistance #TrendlineBreakout #PriceAction #SwingTrade #TechnicalAnalysis #CryptoTrading

TAO/USDT — Triangle: Ready to Explode After Long Consolidation?TAO is currently standing at one of its most critical crossroads since forming a large structure earlier this year. The 2D chart reveals a Symmetrical Triangle pattern, a classic formation that signals the market is coiling energy for a major move ahead.

Each swing low keeps climbing higher, reflecting growing buying pressure — while the sequence of lower highs shows sellers are still defending strongly. These two forces are now colliding right around the key zone between ₮428 – ₮464.

---

Technical Structure Overview

Pattern: Symmetrical Triangle – pressure building toward an explosive breakout.

Key Resistance: ₮464 (confirmation once 2D candle closes above).

Bullish Targets: ₮563 → ₮614 → ₮701 → ₮744.

Dynamic Support: ascending trendline near ₮350–₮370.

Invalidation Level: daily/2D close below the rising trendline.

---

Bullish Scenario – “Pressure Before Expansion”

If TAO manages to break through the descending resistance and close above ₮464 with strong volume, it will confirm a breakout from this multi-month consolidation.

Such a breakout could trigger an impulsive rally, targeting ₮563 – ₮614, and potentially extending to ₮744, which is the previous major supply zone.

The strength of this setup lies in its duration — the longer the compression, the stronger the expansion.

---

Bearish Scenario – “Rejected and Retraced”

If TAO fails to break through the ₮428 – ₮464 confluence zone and gets rejected at the upper boundary, price may pull back sharply.

A breakdown below the rising support trendline could send TAO back toward ₮300 – ₮250, with extended downside risk to ₮167 if selling momentum accelerates.

This scenario gains validity only if a 2D candle closes below the ascending support with strong volume confirmation.

---

Conclusion

TAO is entering the final accumulation phase within this large triangle pattern — a period of calm that often precedes a powerful move.

At this stage, patience and confirmation matter more than prediction. Smart traders wait for the direction to reveal itself, then follow with discipline and tight risk management.

> “The bigger the base, the higher the breakout — or the harder the fall.”

TAO is now at the edge of its next major decision.

---

#TAO #TAOUSDT #CryptoBreakout #SymmetricalTriangle #TAOAnalysis #CryptoChart #TechnicalAnalysis #BreakoutSetup #TrianglePattern #CryptoTrading #PriceAction #Bittensor #AltcoinSetup #SwingTrade

TAO/USDT – Demand Zone: Potential Double Bottom or Breakdown🔎 Market Overview

TAO/USDT is currently trading around 324 USDT, sitting right inside the key demand zone (305–345) that has been tested multiple times since late 2024. This area has repeatedly acted as a strong defensive wall for buyers, and once again the market is waiting for a big decision: bounce or breakdown.

From April to August 2025, the chart shows a series of lower highs, reflecting continued selling pressure. However, the repeated defense of this demand zone suggests accumulation is possible if a strong bullish reaction appears.

---

🧩 Price Structure & Pattern

Current pattern: Consolidation within the demand zone (305–345).

Key characteristics:

Buyers have successfully defended this level multiple times → potential accumulation area.

Larger structure still shows minor downtrend (lower highs).

A confirmed breakdown could trigger deeper sell-offs.

In short, this is the battle zone between bulls and bears that will determine the medium-term direction.

---

📈 Bullish Scenario

If price holds and bounces from the demand zone:

Confirmation: Daily bullish candle closing above 345–350 with strong volume.

Upside targets:

🎯 TP1: 389.8 (first resistance & short-term supply zone)

🎯 TP2: 432.0 (mid-term supply zone)

🎯 TP3: 475.7 (major resistance – key to shift medium-term trend)

🎯 Extensions: 564.8 – 608.5 – 710.9 – 745.0

➡️ A successful bounce could form a double bottom / base formation.

---

📉 Bearish Scenario

If price fails to hold the demand zone (daily close below 305):

Confirmation: Breakdown candle with strong volume + failed retest.

Downside targets:

🎯 265 – 235 (nearest supports)

🎯 167.7 (historical low – potential final target if strong selling pressure continues)

➡️ This would form a major support breakdown, potentially triggering a larger distribution phase.

---

⚖️ Technical Conclusion

Current bias: Neutral to Bearish – downtrend structure remains, but bulls are still defending.

305–345 is the make-or-break zone.

Bounce → potential rally towards 389–475.

Breakdown → possible drop to 235 or even 167.

---

🛡️ Risk Management Notes

Clear stop-loss levels:

Bullish setup: SL below 305.

Bearish setup: SL above 345–350 after breakdown.

Scale into positions rather than going all-in.

Watch for volume confirmation & momentum indicators (RSI/MACD) to avoid false breakouts.

---

📌 Extra Insights

The 305–345 zone is not only a technical level but also a psychological price floor, tested multiple times.

The structure of lower highs vs. strong support often resolves with a major breakout — meaning the next move could be very aggressive.

Patience is key: traders should wait for a clear daily close confirmation before entering to avoid being trapped in a fake move.

#TAO #Bittensor #TAOUSDT #CryptoAnalysis #TechnicalAnalysis #SupportResistance #Breakout #CryptoTrading #SwingTrading #PriceAction

TAOUSDT Breaks Descending Trendline!BINANCE:TAOUSDT daily chart is showing a potential bullish breakout as price moves above a long-term descending trendline. This breakout, combined with support from the 100 and 200 EMAs, indicates growing upward momentum. If price holds above this trendline, the next key resistance lies around the $750 level. A successful breakout and retest could pave the way for a major rally toward $2,000. GETTEX:TAO

Regards

Hexa

#TAO/USDT

#TAO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, this support is at 326.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 330

First target: 338

Second target: 347

Third target: 358

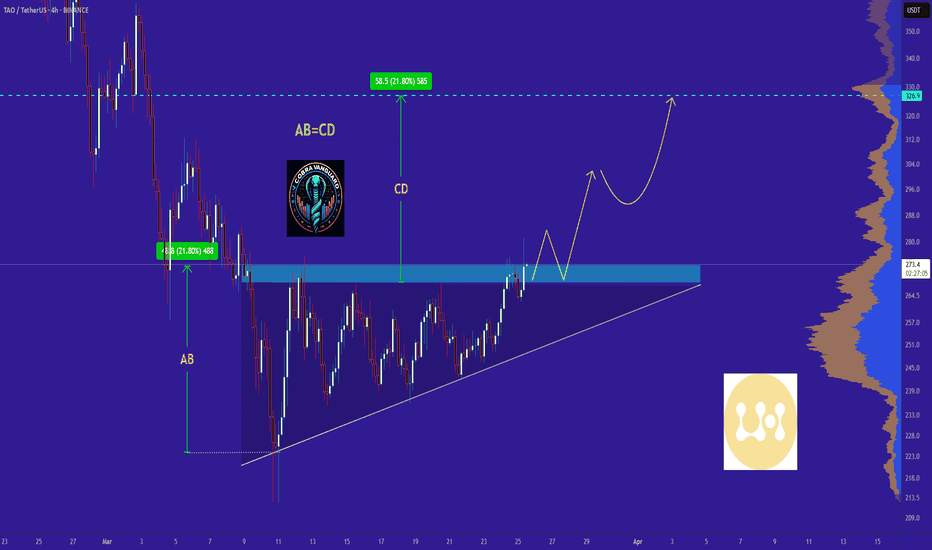

TAO in coming days ...Currently, TAO is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!