TAO in flow — will it rise or slow? TAO surprised me a bit this time — after it broke the invalidation zone I mentioned in my earlier post about this coin, it’s now hinting at another potential upward move.

As usual, I’m watching a few possible scenarios — marked by the orange and purple arrows on the chart.

🎯For now, my short-term target is around $426, and globally, I’m keeping an eye on $500 🚀

❌The invalidation zone remains at $369.34.

⚠️ Disclaimer: This analysis is not financial advice or a signal to take action.

Always make trading decisions based on your risk management, and never trade without stop-losses.

💬 What do you think — will TAO continue to grow, or is it just a temporary bounce?

Share your thoughts in the comments.

📈 Follow me for updates on TAO and other crypto analyses.

Taousdtidea

TAO/USDT — Bearish Structure Broken, But Can Support Hold?After months trapped beneath a major descending trendline, TAO finally broke out with strong bullish momentum — hinting at a potential trend reversal.

However, price has now pulled back to retest the golden zone (386–355), which serves as the final defense line for the bulls.

This yellow zone is more than just a support area — it’s the intersection of horizontal support and the old downtrend line, making it the most decisive structure on the current chart.

In simple terms: this is where conviction meets fear — the battlefield between buyers and sellers.

---

🟢 Bullish Scenario

If the price holds firmly above 386–355 and forms a clear bullish rejection or engulfing candle, it would confirm strong buyer presence and likely trigger another leg up.

Bullish confirmation: 2D candle close above 415–430.

Upside targets:

🎯 464 → first resistance & partial profit zone.

🎯 561 → key supply area & mid-range target.

🎯 698–744 → swing target & major resistance zone.

A clean breakout above 430 would signal that the bearish market structure has been fully broken, paving the way for sustained bullish momentum.

---

🔴 Bearish Scenario

If the price fails to hold 355 and closes below it, the bullish structure becomes invalidated, opening room for a deeper retracement toward 330–290.

Such a move would confirm that the previous breakout was just a classic bull trap, where liquidity was swept before resuming the dominant downtrend.

Bearish continuation would be reinforced by increasing sell volume and lack of any strong bullish reaction around the support zone.

---

📈 Technical Structure Overview

Dominant pattern: Descending trendline breakout + retest confluence support.

Mid-term bias: Neutral–bullish while price stays above 386–355.

Momentum: currently consolidating — potentially forming a base for the next expansion phase.

Market psychology: bulls are being tested — holding this zone keeps the bullish structure alive; losing it gives bears back control.

---

⚙️ Trading Plan

Conservative entry: wait for a 2D close above 415 for confirmation.

Aggressive entry: accumulate within 386–355, stop loss below 350.

Targets: 464 / 561 / 698.

Risk-reward: favorable setup (1:3 – 1:5) if the bullish scenario plays out.

---

🧠 Conclusion

TAO stands at a decisive crossroads.

The 386–355 golden zone is not just technical support — it’s the psychological frontier between hope and fear.

As long as this zone holds, the bullish narrative remains alive.

But once it breaks, the bears will take command again.

Whichever direction wins, this is the most important battleground for TAO this quarter.

#TAO #TAOUSDT #CryptoAnalysis #Breakout #SupportResistance #TrendlineBreakout #PriceAction #SwingTrade #TechnicalAnalysis #CryptoTrading

TAO to Glow — Just Like DASH FlowTAO is showing a price structure very similar to DASH, which makes me expect a strong upward move ahead.

I currently see two growth scenarios for TAO — following the purple and orange arrows on my chart.

Both lead to the same target zone:

🎯 Target 1: 580

🎯 Target 2: 640

🎯 Target 3: 720

❌ Invalidation Zone: 481.44

Both scenarios remain valid unless the price closes below that red level.

🚀 If you want more forecasts — leave a reaction!

🔔 Follow me so you don’t miss my daily updates — I post new analyses almost every day!

TAO/USDT — Triangle: Ready to Explode After Long Consolidation?TAO is currently standing at one of its most critical crossroads since forming a large structure earlier this year. The 2D chart reveals a Symmetrical Triangle pattern, a classic formation that signals the market is coiling energy for a major move ahead.

Each swing low keeps climbing higher, reflecting growing buying pressure — while the sequence of lower highs shows sellers are still defending strongly. These two forces are now colliding right around the key zone between ₮428 – ₮464.

---

Technical Structure Overview

Pattern: Symmetrical Triangle – pressure building toward an explosive breakout.

Key Resistance: ₮464 (confirmation once 2D candle closes above).

Bullish Targets: ₮563 → ₮614 → ₮701 → ₮744.

Dynamic Support: ascending trendline near ₮350–₮370.

Invalidation Level: daily/2D close below the rising trendline.

---

Bullish Scenario – “Pressure Before Expansion”

If TAO manages to break through the descending resistance and close above ₮464 with strong volume, it will confirm a breakout from this multi-month consolidation.

Such a breakout could trigger an impulsive rally, targeting ₮563 – ₮614, and potentially extending to ₮744, which is the previous major supply zone.

The strength of this setup lies in its duration — the longer the compression, the stronger the expansion.

---

Bearish Scenario – “Rejected and Retraced”

If TAO fails to break through the ₮428 – ₮464 confluence zone and gets rejected at the upper boundary, price may pull back sharply.

A breakdown below the rising support trendline could send TAO back toward ₮300 – ₮250, with extended downside risk to ₮167 if selling momentum accelerates.

This scenario gains validity only if a 2D candle closes below the ascending support with strong volume confirmation.

---

Conclusion

TAO is entering the final accumulation phase within this large triangle pattern — a period of calm that often precedes a powerful move.

At this stage, patience and confirmation matter more than prediction. Smart traders wait for the direction to reveal itself, then follow with discipline and tight risk management.

> “The bigger the base, the higher the breakout — or the harder the fall.”

TAO is now at the edge of its next major decision.

---

#TAO #TAOUSDT #CryptoBreakout #SymmetricalTriangle #TAOAnalysis #CryptoChart #TechnicalAnalysis #BreakoutSetup #TrianglePattern #CryptoTrading #PriceAction #Bittensor #AltcoinSetup #SwingTrade

TAOUSDT: Bullish Breakout From Symmetrical TriangleTAO is showing a strong breakout setup on the 4H timeframe after consolidating within a symmetrical triangle pattern. Price has been forming higher lows while testing descending resistance multiple times - a classic sign of bullish pressure building up.

The breakout candle is now pushing above the trendline with increasing volume and EMAs (50/100/200) acting as dynamic support, indicating potential continuation to the upside.

Cheers

Hexa

TAO Eyes Next Leg Toward $700!BINANCE:TAOUSDT is breaking through a key resistance zone, signaling a strong shift in momentum.

This breakout not only confirms buyer strength but also opens the door for a potential move toward the $700 region, where the next major resistance lies.

As long as TAO holds above this breakout zone, the structure remains bullish and continuation toward higher levels looks likely.

DYOR, NFA

THANKS FOR THE READ

TAO/USDT – Demand Zone: Potential Double Bottom or Breakdown🔎 Market Overview

TAO/USDT is currently trading around 324 USDT, sitting right inside the key demand zone (305–345) that has been tested multiple times since late 2024. This area has repeatedly acted as a strong defensive wall for buyers, and once again the market is waiting for a big decision: bounce or breakdown.

From April to August 2025, the chart shows a series of lower highs, reflecting continued selling pressure. However, the repeated defense of this demand zone suggests accumulation is possible if a strong bullish reaction appears.

---

🧩 Price Structure & Pattern

Current pattern: Consolidation within the demand zone (305–345).

Key characteristics:

Buyers have successfully defended this level multiple times → potential accumulation area.

Larger structure still shows minor downtrend (lower highs).

A confirmed breakdown could trigger deeper sell-offs.

In short, this is the battle zone between bulls and bears that will determine the medium-term direction.

---

📈 Bullish Scenario

If price holds and bounces from the demand zone:

Confirmation: Daily bullish candle closing above 345–350 with strong volume.

Upside targets:

🎯 TP1: 389.8 (first resistance & short-term supply zone)

🎯 TP2: 432.0 (mid-term supply zone)

🎯 TP3: 475.7 (major resistance – key to shift medium-term trend)

🎯 Extensions: 564.8 – 608.5 – 710.9 – 745.0

➡️ A successful bounce could form a double bottom / base formation.

---

📉 Bearish Scenario

If price fails to hold the demand zone (daily close below 305):

Confirmation: Breakdown candle with strong volume + failed retest.

Downside targets:

🎯 265 – 235 (nearest supports)

🎯 167.7 (historical low – potential final target if strong selling pressure continues)

➡️ This would form a major support breakdown, potentially triggering a larger distribution phase.

---

⚖️ Technical Conclusion

Current bias: Neutral to Bearish – downtrend structure remains, but bulls are still defending.

305–345 is the make-or-break zone.

Bounce → potential rally towards 389–475.

Breakdown → possible drop to 235 or even 167.

---

🛡️ Risk Management Notes

Clear stop-loss levels:

Bullish setup: SL below 305.

Bearish setup: SL above 345–350 after breakdown.

Scale into positions rather than going all-in.

Watch for volume confirmation & momentum indicators (RSI/MACD) to avoid false breakouts.

---

📌 Extra Insights

The 305–345 zone is not only a technical level but also a psychological price floor, tested multiple times.

The structure of lower highs vs. strong support often resolves with a major breakout — meaning the next move could be very aggressive.

Patience is key: traders should wait for a clear daily close confirmation before entering to avoid being trapped in a fake move.

#TAO #Bittensor #TAOUSDT #CryptoAnalysis #TechnicalAnalysis #SupportResistance #Breakout #CryptoTrading #SwingTrading #PriceAction

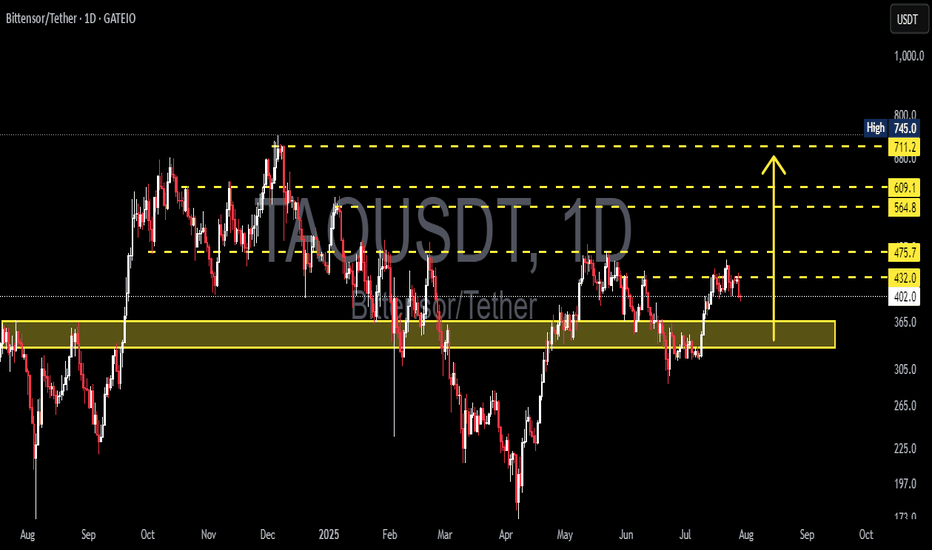

TAO/USDT: Price Likely to Retest Key Support Block 330–365 USDT?🟨 Key Zone: Yellow Support Block (330 – 365 USDT)

This zone has served as a major demand area since May 2025, acting as the base for the recent bullish move toward 475 USDT.

It represents a strong accumulation zone, where significant buying interest previously stepped in.

Given the current rejection from the 475 resistance, price is likely to revisit this block to test buyer interest and liquidity.

---

📉 Bearish Scenario: Breakdown Risk

After failing to break above 475.7 USDT, price shows signs of a short-term correction.

If bearish momentum continues:

🔽 A retest of the yellow support zone (330–365 USDT) is highly probable.

If this zone fails to hold:

📉 Next downside targets:

305 USDT – previous local low

265 USDT – next major demand level

A breakdown of the yellow block would invalidate the current bullish structure and open a new bearish leg.

---

📈 Bullish Scenario: Successful Retest and Bounce

If the price retests the yellow zone and forms a strong bullish reaction:

Confirmation signals:

Bullish reversal candles (hammer, bullish engulfing, etc.)

Increasing volume near the support zone

A successful retest could lead to:

✅ Continuation of the bullish trend

✅ Higher-low structure remains intact

Upside targets:

432 USDT – minor resistance

475.7 USDT – strong resistance zone

564.8, 609.1, and up to 711–745 USDT – extended targets

---

📌 Key Technical Levels:

Level Significance

330–365 USDT 🔲 Yellow Support Block / Demand Zone

432 USDT Minor Resistance / Previous Breakout

475.7 USDT Major Resistance (Recent Rejection)

564.8 USDT Mid-Term Resistance

609.1 USDT Next Key Resistance

711–745 USDT Long-Term Target / Supply Zone

305 USDT Support if Breakdown Happens

265 USDT Next Demand Zone Below

---

📊 Structure & Market Behavior:

No clear classic pattern (e.g., H&S or double bottom), but:

Current price is moving within a range-bound structure

Holding the 330–365 block would form a new higher low, strengthening the bullish outlook

Market is watching how price responds on retest of the yellow support

---

🧠 Notes for Traders:

Watch for volume and candle structure as price enters the 330–365 zone

This zone is a classic re-entry / reload area for institutional buyers

Conservative entry: Wait for bullish confirmation candle above 365

Aggressive entry: Ladder buys inside 330–365 with stop loss below 330

---

🏁 Conclusion:

TAO/USDT is undergoing a healthy pullback after rejection at 475.7 USDT. A retest of the yellow support zone (330–365 USDT) is highly likely. This area is crucial for the next move — either a bullish continuation with a strong bounce or a bearish breakdown signaling trend reversal.

#TAOUSDT #TAO #CryptoAnalysis #RetestSupport #DemandZone #BullishScenario #BearishScenario #AltcoinWatch #TechnicalAnalysis #PriceAction #TradingView #SupportAndResistance #GateIO #ReentryZone

TAO/USDT Potential Reversal Zone – Major Bounce OpportunityTAO/USDT is currently testing a critical support zone (highlighted in yellow) between $220 – $280, which has historically acted as a strong accumulation area. The price has shown multiple reactions from this region throughout 2024 and 2025, signaling that bulls may be preparing for a reversal.

🔍 Key Technical Levels:

Major Support Zone: $220 – $280

Immediate Resistance Levels:

$350.9

$462.9

$560.8

$600

$719.1

Long-Term Resistance: $780 (local high)

🔄 Scenario: If TAO successfully holds this support zone, a bullish reversal could be triggered with a potential rally toward the $350 level first. A break and retest above this could open the door for a sustained move towards $560 and beyond. The bullish projection is illustrated with the yellow arrow path, showing a potential multi-stage rally through key Fibonacci and structural levels.

📉 Invalidation: A confirmed break below $220 would invalidate this bullish setup and could push TAO toward lower lows, potentially retesting $170 or even $127 support levels.

📌 Summary: TAO is approaching a historically strong support base. If the structure holds and volume supports the reversal, we could see a powerful leg up toward $560 and possibly $719 in the medium term. Risk management is essential, especially with volatility around macroeconomic events and Bitcoin price movements.

TAO / USDT Reclaims Strength After Trendline BreakLSE:TAO has broken above the key resistance level and is showing good strength.

After faking out on the previous trendline, buyers stepped in and pushed the price higher.

As long as TAO holds above this breakout zone, it has room to move higher.

If we see a clean retest and hold, the next leg up could follow.

For now, the breakout looks solid — one to keep on your watchlist.

TAO/USDT.P Short Setup – Riding the Downtrend with PrecisionTrade Details:

Leverage: CROSS 15x - 20x

Entry: 348 - 351 USDT

Stop: 361.1 USDT

Targets:

TP1: 332 USDT

TP2: 319 USDT

TP3: 300 USDT

Why This Trade Makes Sense:

✅ Risk Management: Stop-loss placed at 361.1 USDT ensures protection above the supply levels.

✅ Strategic Targets: The targets are set at key support levels (332, 319, and 300 USDT), where price is likely to react.

Final Thought:

With tight risk management and logical profit-taking targets, it offers a solid chance to ride the market lower. Patience and discipline are key—keep an eye on price action and stick to the plan!

Crucial Zone Ahead: Will TAO Confirm a Bullish Reversal? TAO/USDT Daily Chart Analysis

Trend Line Breakout:

The chart shows a successful breakout above a long-term descending trend line, indicating a potential shift in momentum from bearish to bullish.

Fakeout Rejection:

A previous attempt to break above the trend line resulted in a fakeout and strong rejection, but this recent move looks more decisive.

Key Resistance Cleared:

The price has clearly broken above a key resistance level, suggesting renewed buying pressure. However, confirmation is still needed.

Current Price Action:

Price is now hovering above the trend line and testing the local resistance zone.

Watch for a breakout confirmation and retest of the marked zone (approx. $265–$275) to validate further upside movement.

Next Targets:

If the breakout holds, potential upside targets could be the previous high resistance zones between $305–$335.

📌 Strategy Tip:

Wait for a daily candle close above the marked zone for confirmation. If it fails, we could see a pullback into the local support range near $270–$290

TAO/USDT – Bullish Reversal Setup Taking Shape#TAOUSDT is showing early signs of a potential trend reversal following a prolonged downtrend. Price has recently rebounded from a key major support zone between $164 and $192, where a bullish divergence with the RSI has emerged—indicating a possible shift in momentum.

A well-defined descending trendline has been acting as dynamic resistance since the November 2024 high. Currently, price is approaching a critical resistance level around $284.7. A confirmed breakout above this area would be a strong signal that the market structure is beginning to shift in favor of the bulls.

If price breaks and holds above this resistance, the next upside targets are:

$468

$480

$495.9, in line with previous supply zones and structural highs.

Momentum is also improving, with RSI crossing back above the 50 level, supporting the bullish case. However, a clean breakout with sustained volume will be key to validating this setup.

Levels to Watch:

Support: $192.8 and $164.1

Resistance: $284.7, followed by $468–$495.9

Until we see a confirmed breakout, caution is warranted. Failure to clear the trendline may lead to another retest of support.

Summary:

#TAO is setting up for a potential bullish reversal, but confirmation above $284.7 is critical. A move beyond that level could open the door for a significant upside continuation. As always, manage risk accordingly and wait for confirmation.

TAOUSDT LONG 1H (2Target Done! Congratulation)An excellent situation from the trading plan.

The second goal has been achieved and the stop is at breakeven.

I would like to emphasize that the $320-322 block (break block) confirmed the retention level. You can move the stop order to this level and calmly wait for new variables from the market

UPdate:

1-st target:

TAOUSDT LONG 1H (1st Target Done! Congratulation)In this position, the first target from the update has been achieved. The stop order is moved to breakeven and new variables are expected to arrive from the market.

Initial review:

Update:https://www.tradingview.com/chart/TAOUSDT/tLc5vyIX-TAOUSDT-LONG-1H-Update/

TAOUSDT LONG 1H (Update)The position opened perfectly, as expected from the trading plan:

In connection with the resulting market variable in the form of the hh structure, I change the first target and move the stop a little higher.

Critical level 321.95 - 322.00$

If it is tested again and is not held, I will close the position at breakeven. The market is manipulative, you need to carefully evaluate its entire structure.

TAOUSDT LONG 1HLocal signs of a price reversal are forming on the TAO coin , which opens up new opportunities for finding good long entry points.

I'm waiting for confirmation of the POI block with the subsequent reaction of purchases. If the variables are positive, I will open a Long position with the following targets:

$342.50

$360.00

$392.30

Risk management - 1% on stop order