TCS – Momentum Shifting Upwards?1. Key Zones

Demand Zone: ₹2,850 – ₹3,000

Supply Zone: ₹3,600 – ₹3,720

2. Structure

Price has bounced strongly from the major weekly demand zone.

The descending trendline is broken, indicating a potential shift in momentum.

Price is now retesting the breakout zone for support.

3. Possible Move

If buyers hold above the ₹3,000–₹3,100 region:

→ Upside targets: ₹3,450 → ₹3,600 → ₹3,720

If price loses the ₹2,850–₹3,000 demand zone, weakness can resume.

4. Summary

TCS is showing early signs of a trend reversal after breaking the falling trendline.

Holding above the retest zone may lead to a push toward the upper supply area.

⚠️ Disclaimer

This analysis is for educational purposes only and not financial advice. Always do your own research and manage risk.

Tcsanalysis

TCS Hourly Trend AnalysisAs per technical study and price patterns and timing methods, I expect TCS to take a strong bull move towards the resistance of 3273. Increasing volume supports this bull trend till November 17, 2025.

There may be a possibility of profit booking post Nov 17.

This is my personal view based on my analysis. Traders are suggested to conduct own technical studies for entries and exits with proper risk management.

TCS - H1 - Triangle Breakout (19.10.2025)📊 Setup Overview:

TCS is showing a Triangle Breakout formation on the H1 chart. Price has been consolidating within converging trendlines, and a cloud crossover hints at a possible momentum shift. This setup could lead to a directional breakout opportunity for short-term traders.

📈 Trade Plan:

Bias: Bearish below the breakout zone

Sell Entry Zone: Below 2950 (after candle close confirmation)

1st Target: 2877 ✅

2nd Target: 2814 🎯

Resistance Zone: 3010 – 3030

🧩 Technical Confluence:

1.Price rejected from upper trendline multiple times

2.Ichimoku Cloud crossover signals short-term weakness

3.Lower highs formation confirms loss of bullish momentum

4.Volume profile shows high interest near 2900, indicating potential liquidity zone

#TCS #NSE #StockMarketIndia #TechnicalAnalysis #TriangleBreakout #Ichimoku #PriceAction #SwingTrading #StocksToWatch #IndianStocks #Nifty50 #TradingView #ChartsDontLie #Kabhi_Ta_Trading #BearishSetup

💡 Fundamental View:

TCS, India’s leading IT services giant, remains fundamentally strong with consistent revenue from global clients and robust digital transformation projects.

However, recent IT sector consolidation and global tech budget tightening could create short-term selling pressure. The stock’s medium-term outlook remains positive, but near-term corrections may occur before a fresh rally.

⚠️ Disclaimer:

This analysis is for educational and informational purposes only and should not be considered as financial advice. Always use proper risk management and confirm setups with your own analysis before trading or investing.

💬 Support the Analysis:

If this chart helped you — LIKE 👍, COMMENT 💬 your views, and FOLLOW ✅ for daily market insights, chart patterns, and trade setups!

TCS Under Pressure – Will Visa Heat Trigger ₹3000 Levels..?Currently, TCS is trading near the crucial resistance zone of ₹3200, which also carries high open interest. From a technical perspective, if the stock breaks and closes below the short-term support of ₹3150, we can look for a short entry on retest, with targets:

* 🎯 Target 1: ₹3080

* 🎯 Target 2: ₹3000

📰 Fundamental / News Catalyst

The recent US H-1B visa policy update imposing a $100,000 fee on new petitions triggered a knee-jerk reaction in IT stocks:

* U.S.-listed Indian IT firms saw an immediate 2-5% decline.

* Analysts expect the impact on TCS to be limited, since a large part of its U.S. workforce is locally hired and renewals/existing visas are exempt.

* Worst-case estimates suggest a 3-5% downside in the short term, but not a structural collapse for large, diversified players like TCS.

📊 Impact Outlook on TCS

Short Term (days–weeks):

* Investor sentiment may turn negative, causing selling pressure.

* Margin compression possible due to new visa costs.

* Analysts could revise earnings growth expectations lower.

* Offsetting factors: Renewals exempt, TCS has a solid U.S. local workforce, and offshore flexibility.

Medium Term (months):

* New contracts may factor in higher costs.

* Shift to offshore delivery could reduce higher-margin onsite revenues.

* More local U.S. hiring may raise costs.

* Offsetting factors: TCS’s scale allows cost absorption; some costs may be passed to clients.

Long Term (year+):

* Delivery model may shift further to offshore/local U.S. hiring.

* Competitive pressure if peers adapt faster in the U.S. market.

* Margins could be under pressure.

*Offsetting factors: Strong global brand, diversified business, investments in AI & automation can offset long-term risks.

🔎 Scenarios for Share Price

* Mild Reaction: 3-5% decline → cautious investors, limited disruption.

* Moderate Reaction: 8-12% decline → project delays, client pushback, stricter visa rules.

* Severe Reaction: 15-20%+ decline → contract losses, earnings downgrades, tighter U.S. policy.

✅ Conclusion

* 📌 Technicals: Watch ₹3150 for breakdown confirmation; short entries possible below this with ₹3080 / ₹3000 as downside targets.

* 📌 Fundamentals: News-driven weakness is likely, but structural risk to TCS remains limited vs smaller IT peers.

* 📌 Strategy: Short-term bearish setup aligns with both technical chart structure and negative sentiment from visa policy changes.

📌 Sentiment: Bearish (Short Term)

TCS Chart Analysis: Key Trends and Predictions for August 2025**TCS Historical Pullbacks Analysis and Outlook**

Tata Consultancy Services (TCS) has exhibited a remarkable long-term uptrend, punctuated by a series of significant corrections. Your chart annotation highlights a compelling technical pattern: TCS has experienced three major pullbacks of approximately **27%** each over the past decade. These deep corrections have historically been followed by periods of robust recovery and new highs.

Interestingly, your chart also marks two exceptional occasions where the stock witnessed even deeper corrections, around **34%**, the most recent of which may still be in progress. The ability of TCS to consistently bounce back after such steep declines testifies to its underlying strength, market leadership, and the confidence of long-term investors.

**Key Insights From the Chart:**

- **Three 27% Pullbacks:** Marked by distinct blue boxes, each of these corrections provided attractive accumulation opportunities, and each was followed by renewed bullish momentum.

- **Rare 34% Corrections:** These are far less frequent, indicating abnormal market stress or broader corrections, but also highlight zones of potential capitulation and renewed accumulation.

- **Current Status:** The latest price action suggests another 34% pullback may be underway or nearing completion, as marked in orange annotation.

**Strategic Takeaway:**

Given TCS’s proven track record of recovery after such corrections, investors may view these deep pullbacks as strategic buying opportunities for the long term. Patience and discipline are critical, as the stock often rewards those who accumulate during periods of pessimism.

**Conclusion:**

TCS remains a robust large-cap IT pick. Historical patterns suggest that major corrections—while unnerving—tend to precede strong rallies. Investors should watch for signs of stabilization and reversal to position themselves for the next phase of growth, always aligning choices with personal risk tolerance.

"TCS Takes a COVID-Style Dive Again – Is It Time to Buy?"Price Action History:

During the COVID crash, TCS fell nearly 35% from its top, eventually taking support at the 100 EMA on the monthly chart and staging a strong bounce.

In 2022 (June,july,Sep,Oct), around 3000 zone was tested multiple times, followed by a significant rally.

📊 Current Scenario:

Once again, TCS is trading near the ₹2950–₹3000 zone, which coincides with the 100-month EMA – a historically proven support level.

Price action suggests we are at a critical inflection point similar to past major bottoms.

✅ Key Technical Levels:

Support Zone: ₹2950–₹3000 (100 EMA Monthly+ 2022 support level)

Immediate Resistance: ₹3300–₹3400

Upside Potential: A bounce similar to COVID & 2022 patterns could trigger a strong upside move.

Trading Strategy:

if you are short term trader Keep a strict stop-loss below ₹2900 (monthly close basis) or 100 monthly EMA

Position sizing is key – don’t over-leverage.

🔎 Conclusion:

For long term trader This zone has historically acted as a strong accumulation area for long-term investors. If history repeats, this could be a high probability buying opportunity for swing and positional traders.

Fundamental Factor

Net Profit (Q1 FY26) ₹12,760 cr (+6% YoY)

Revenue Growth +1.3% YoY (−3.1% in CC)

Operating Margin 24.5% (↑30 bps QoQ)

Trailing P/E 22× (vs 5‑yr average ~24‑26×)

Dividend Yield 2.0%

ROE /ROCE 52%/64%

TCS - D1 - Bearish Pennant 🧾 1. 📊 Q1 FY26 Earnings Summary

i. Revenue: ₹63,437 cr (~US $7.4 bn), up just 1.3% YoY, missing expectations of ~₹64,667 cr

ii. Profit/margin held up; revenue disappointed.

📌 Key Takeaway: Profit and margin resilience, but weak revenue growth flagged caution—all aligning with cautious global client sentiment.

🔮 2. Upcoming Events & Catalysts :

Ex‑Dividend Date: Record date July 16, for interim dividend of ₹11/share.

Macro Cues: U.S. tariff developments, global IT spend trends, and sector peers (HCL, Infosys) Q2 reports. Reflation in IT services could shift sentiment.

TCS Investor Engagements: Gen‑AI STEM program (Jul 9); presence at global fintech & life‑sciences events through Sep (SIBOS, COBA) .

📆 3. Catalysts Ahead :

Global IT Budget Trends (esp. U.S. and Europe) → direction for next‑quarter bookings.

Peer Q2 Results (HCL, Infosys) → could provide broader sector cues.

New Deal Wins from BFSI/USD clients → margin & growth potential.

Macro Developments: Trade policies, Fed signals, and inflation data.

Thank you.

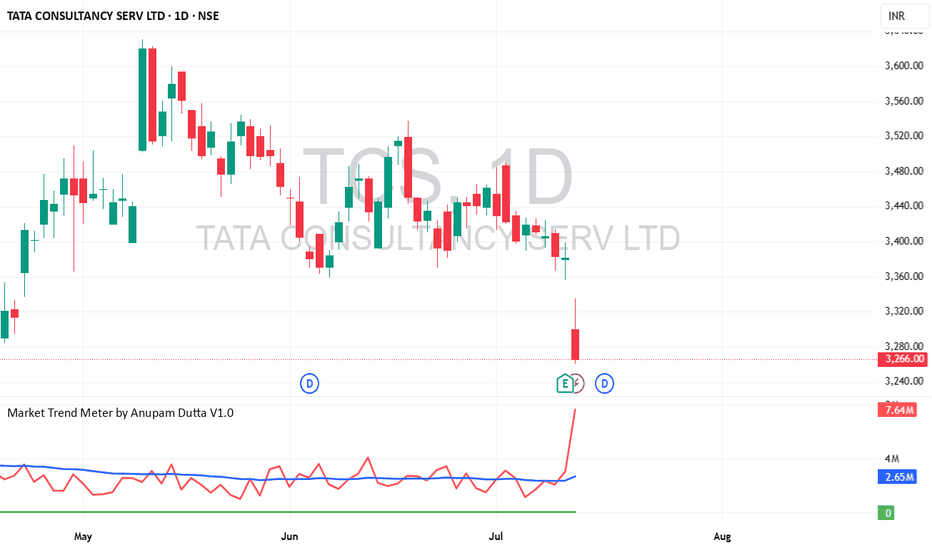

TCS Long Opportunity - Medium-Term Swing Trade📈 TCS Long Opportunity – Medium-Term Swing Trade

🔹 Entry : ₹3266 (Last Close)

🔹 Target : ₹3525

🔹 Qty : Up to 25 shares

🔹 Timeframe : ~6 months

🔹 Estimated ROI : ~16.49% annualized

A moderate-risk swing setup on Tata Consultancy Services . Technically and fundamentally aligned for gradual upside, assuming market conditions stay favorable. Entry near current levels with a well-defined target.

⚠️ Trade only if you're comfortable with the risk of capital loss. Position sizing is key.

Tata Consumer Products Ltd a bearish harmonic Gartley pattern Tata Consumer Products Ltd has formed a **bearish harmonic Gartley pattern, completing at point D near the 1.395 Fibonacci extension—typically a reversal zone. RSI is near overbought, suggesting caution. Based on this technical setup, the stock may face **selling pressure**, making it a sell recommendation with a target of ₹1,040 and a stop loss at ₹1,135. If the price breaks above ₹1,135 with strong volume, trend bias can shift bullish, but currently, it's best viewed with a short-term bearish outlook.

for educational purposes only

TCS POSITIONAL LONG TRADE

Here is the valid Source and its Destination which has violated its opposite Supply;

This is the Demand & Supply Equilibrium Curve according to the Fresh Demand and Supply available.

We have further sub-divided the Curve into 5 areas; considering we as traders are supposed to buy low and sell high where is high and how low can it get; these areas give us an understanding about the Price position as per the Curve.

Price has come into the Demand making Lower Lows and then after reacting to the Weekly Demand Price has violated a previous High; which shows a possibility of Buyers upping their game vs the available sellers.

Finally we have a Demand formed in 45 mins which is the first Demand formed after Price has reacted to the Weekly Demand and we have a Buying momentum confirmation hence this is a Buy Trade favourable reward to risk ratio

TCS--@Breakout or Breakdown ??I am sharing the important levels of Support and Resistance. These levels plays a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

Take a look at these levels and trade accordingly. Recognizing and respecting these support and resistance levels can help traders make informed decisions and manage risk effectively. They serve as key reference points for technical analysis and are vital tools in successful trading strategies.

Trade safe...Thank you guys for your support

TCS TCS is currently moving in range at weekly timeframe for more than 3 years.

TCS has shown a decent performance in recent Q3 result.

TCS Q3 Results Live Updates | Key Highlights of the Quarter Ended December 31, 2023

Revenue at `60,583 crore, +4.0% YoY, +1.7% YoY in Constant Currency

Operating Margin at 25.0%*; an expansion of 0.5% YoY

Net Income at `11,735 crore*, +8.2%* YoY | Net Margin at 19.4%*

Net Cash from Operations at `11,276 crore ie 102% of Net Income

Diverse and inclusive workplace: Women in the workforce: 35.7% | 153 Nationalities

Investing in the workforce: 39.7 million learning hours YTD | 3.7 million competencies YTD

LTM IT Services attrition rate at 13.3%

Dividend per share: ` 27.00, including ₹ 18.00 as special dividend | Record date 19/01/2024 | Payment date 05/02/2024

TCS Daily timeframe analysis for long term

NSE:TCS is strong bullish after it has taken splendid bounce from golden zone and has reached first target since buying level 3534.

Next Buy Level is 3679 - 3534. We can see long term move above 3680 if it give pullback buy more near 3679 to 3534 range.

Major targets levels are highlighted in blue lines.

TCS--3200 Or 3500I am sharing the important levels of Support and Resistance. These levels play a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

They serve as key reference points for technical analysis

Look for buy side from 3200 to 3500.

TCS --Near its Demand Zones??I am sharing the important levels of Support and Resistance. These levels play a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

If price breaks the resistance, we have a chance of filling the bearish gap, soo keep in buyside until it touches the zone of resistance and bearish gap.

Take a look at these levels and trade accordingly. Recognizing and respecting these support and resistance levels can help traders make informed decisions and manage risk effectively. They serve as key reference points for technical analysis and are vital tools in successful trading strategies.

Trade safe...Thank you guys for your support

TCS--@Resistance Zone?? This stock has encountered persistent resistance within the 3460 range on multiple occasions. On the flip side, the price has consistently found support along a trendline, leading to upward movements.

It's advisable to maintain a bullish perspective as long as the price remains above this trendline. However, exercise caution, as there's a possibility of a false breakdown below the trendline, which could mislead traders and necessitate a prudent approach before considering short positions.

TCS--Will break 3400 ??observations::

facing resistance multiple times from this zone...3400 range...

if this range is broken will see a strong momentum towards upside is possible...

we have a trendline support as well...now price is at important level...

if price takes the help of trendline will be on buyside...keep track this levels...

3200 and 3400.

TCS Low Risk High Reward IdeaAs per my analysis NSE:TCS is now ready to move upside for big levels. My buy level is 3189-3195 with stop loss of 3155 (-44 Points Risk). My expected upside target would be 3234 (+45), 3275 (+85) & 3435 (+246). This could be very low risk and high reward opportunity.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.