AST SpaceMobile: The High-Stakes Race for Global CoverageAST SpaceMobile ( NASDAQ:ASTS ) is currently redefining the orbital telecommunications landscape. On December 24, 2025, the company achieved a historic milestone with the successful launch of BlueBird 6. This satellite represents the largest commercial communications array ever deployed in Low Earth orbit (LEO). Despite this technical triumph, investors are closely monitoring recent volatility. A significant share sale by American Tower Corporation ( NYSE:AMT ) has introduced a complex narrative to the stock’s 250% year-to-date rally.

Geostrategy: The US-India Aerospace Alliance

The launch of BlueBird 6 via India’s LVM3-M6 rocket underscores a strategic shift in aerospace logistics. By leveraging Indian launch capabilities, AST SpaceMobile reduces its dependence on domestic providers like SpaceX. This diversification strengthens the company's supply chain resilience. It also aligns with broader US geostrategy to deepen technological ties with India. This move secures reliable access to space amid a global shortage of heavy-lift launch windows.

Technology: The Patent Moat and AST5000 ASIC

AST SpaceMobile holds a formidable intellectual property portfolio with over 3,800 patents and pending claims. At the core of their technical advantage is the AST5000 ASIC. This proprietary chip enables peak speeds of 120 Mbps per coverage cell. Such capacity allows standard, unmodified smartphones to connect directly to broadband from space. This innovation effectively bypasses the need for specialized hardware, creating a massive competitive moat against traditional satellite providers.

Macroeconomics: Navigating Strategic Divestments

The mid-December sell-off by American Tower ( NYSE:AMT ) caught the market's attention. American Tower reduced its position by approximately 49%, generating nearly $160 million in proceeds. While some analysts view this as routine profit-taking after a massive run, others see a cautionary signal. However, AST SpaceMobile maintains a robust cash position of $3.2 billion as of late 2025. This liquidity supports the planned ramp-up to producing six satellites per month by early 2026.

Industry Trends: The MNO Integration Model

The company's business model relies on 50/50 revenue-sharing agreements with Mobile Network Operators (MNOs). Strategic partnerships with AT&T and Verizon have solidified AST SpaceMobile’s lead in the US market. These carriers provide the licensed spectrum necessary for space-based cellular service. As the "Direct-to-Device" (D2D) trend accelerates, AST SpaceMobile is positioned as a wholesale provider. This model allows for rapid scaling without the high cost of customer acquisition.

Management & Leadership: Executing the Scaled Vision

Founder and CEO Abel Avellan has transitioned the company from a visionary R&D firm to a manufacturing powerhouse. The Midland, Texas, facility now operates at nearly 500,000 square feet across five sites. This vertical integration allows for 95% of satellite components to be produced in-house. Management's ability to hit launch milestones in late 2025 has restored confidence following earlier delays. The leadership's focus remains on achieving continuous US coverage by the end of 2026.

---

Impact Summary for Traders

The successful BlueBird 6 launch validates the technology, but institutional selling suggests a near-term valuation peak.

* Bullish Factors: Successful orbital deployment of 2,400 sq ft array, $3.2B liquidity, and proprietary ASIC technology.

* Bearish Factors: High price-to-book ratio and significant discretionary selling by a strategic partner (American Tower).

* Key Watch: Launch frequency in Q1 2026 and the commencement of commercial beta testing in the US.

Techinnovation

A10 Networks (ATEN) — DDoS, ADC, and Edge Security TailwindsCompany Overview

A10 Networks NYSE:ATEN provides advanced cybersecurity and application delivery across cloud, hybrid, and carrier networks—direct exposure to rising demand for DDoS protection, secure networking, and cloud infra security.

Key Catalysts

Threat Landscape & Compliance: Escalating global cyberattacks + stricter regs are accelerating adoption of Thunder ADC and ThreatX—mission-critical for high-performance, distributed environments.

Execution Momentum: Q3’25 revenue $75M (≈+5.6% beat) and EPS $0.17 (≈+9.7% beat) underscore resilient demand and leverage to a recovering IT spend cycle.

5G & AI Infrastructure: A10’s load balancing, DDoS, and edge security sit in the flow of 5G rollouts and AI data center growth, supporting multi-year capacity upgrades.

Platform Differentiation: Carrier-grade performance, automation, and visibility help consolidate point tools while optimizing latency and throughput.

Why It Matters

✅ Direct play on cloud + telco capex (5G/edge)

✅ Beneficiary of AI-era traffic growth and low-latency requirements

✅ Balanced mix of appliance, software, and subscription helps cushion cycles

Investment Outlook

Bullish above: $14.75–$15.00

Target: $22.00–$23.00 — driven by enterprise/telco upgrades, AI/edge security demand, and continued operating discipline.

📌 ATEN — securing next-gen networks with high-performance ADC and DDoS protection.

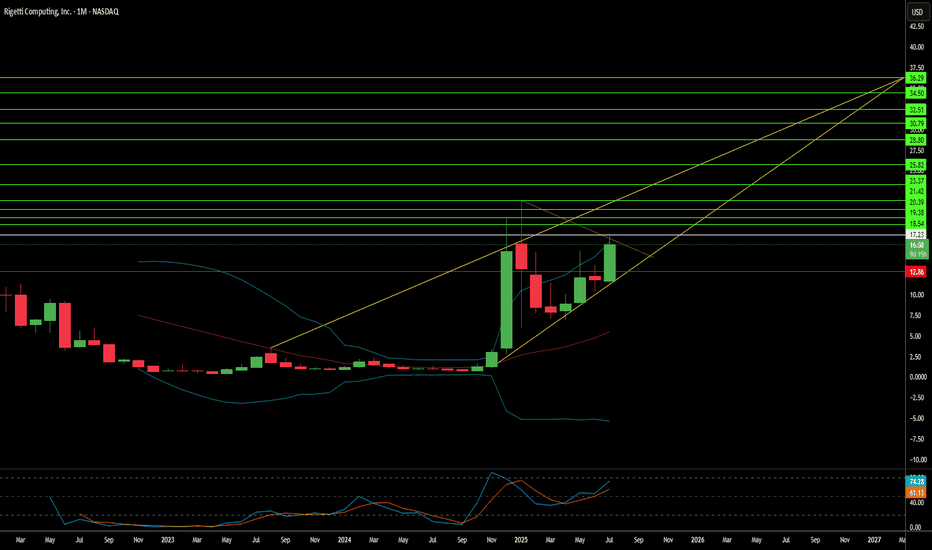

Rigetti: Quantum Mirage or Computing's Next Frontier?Rigetti Computing, a pioneer in quantum computing, recently commanded market attention with a significant 41% surge in its stock. This jump followed a critical technological breakthrough: achieving 99.5% median 2-qubit gate fidelity on its modular 36-qubit system. This represents a twofold reduction in error rates from previous benchmarks, a vital step toward practical quantum applications. Rigetti's superconducting qubits offer gate speeds over 1,000 times faster than competing modalities like ion traps, leveraging semiconductor industry techniques for scalability. The company plans to launch its 36-qubit system by mid-2025 and aims for a 100+ qubit system by year-end, underscoring its rapid technological roadmap.

Beyond technical achievements, strategic partnerships and government contracts bolster Rigetti's position. A substantial $100 million manufacturing deal and a $35 million equity investment from server giant Quanta validate Rigetti's modular architecture. Government backing also provides a stable revenue stream, including a $1 million DARPA award for developing "utility-scale quantum computing" and a $5.48 million Air Force consortium award for advanced chip fabrication. The company further secured three UK Innovate awards for quantum error correction. These collaborations signal confidence from both private industry and national defense initiatives, crucial for a sector still in its nascent stages of commercialization.

Despite these positives, Rigetti's financial metrics reflect the high-risk, high-reward nature of quantum investment. While its market capitalization stands at a robust $5.5 billion, Q1 2025 revenue declined over 50% year-over-year to $1.5 million. Operating expenses remain substantial, with the company operating at a loss. Rigetti's valuation hinges on future potential rather than current profitability, trading at a high price-to-sales ratio. This places immense pressure on the company to meet ambitious technological milestones and rapidly scale revenue in the coming years, transforming speculative bets into tangible commercial success.

The broader quantum computing landscape is marked by intense competition and geopolitical implications. Giants like IBM and Google, also leveraging superconducting qubits, race alongside Rigetti. The sector's projected market size varies wildly, reflecting ongoing uncertainty about widespread commercial adoption. From a geostrategic perspective, quantum computing poses both a national security threat to current encryption and an opportunity for military advancement, driving a global race in post-quantum cryptography. Rigetti's extensive patent portfolio, comprising 37 quantum computing patents, underscores its intellectual property differentiation. However, macroeconomic factors, including rising interest rates, could tighten venture capital funding for speculative high-tech ventures, adding another layer of complexity to Rigetti's path forward.

Why QuickLogic? Unpacking its Semiconductor Surge.QuickLogic Corporation, a vital developer of embedded FPGA (eFPGA) technology, currently navigates a rapidly evolving semiconductor landscape marked by intense technological innovation and shifting geopolitical priorities. Its recent inclusion in the Intel Foundry Chiplet Alliance signals a pivotal moment, affirming QuickLogic's expanding influence in both defense and high-volume commercial markets. This strategic collaboration, combined with QuickLogic’s advanced technological offerings, positions the company for significant growth as global requirements for secure and adaptable silicon intensify.

Critical geopolitical imperatives and a profound shift in semiconductor technology fundamentally drive the company's ascent. Nations are increasingly prioritizing robust, secure, and domestically sourced semiconductor supply chains, particularly for sensitive aerospace, defense, and government applications. Intel Foundry's efforts, including the Chiplet Alliance, directly support these strategic demands by cultivating a secure, standards-based ecosystem within the U.S. QuickLogic’s alignment with this initiative enhances its status as a trusted domestic supplier, expanding its reach within markets that value security and reliability above all else.

Technologically, the industry's embrace of chiplet-based architectures plays directly into QuickLogic’s strengths. As traditional monolithic scaling faces mounting challenges, the modular chiplet approach gains traction, allowing for the integration of separately manufactured functional blocks. QuickLogic's eFPGA technology provides configurable logic, perfectly suited for seamless integration within these multi-chip packages. Its proprietary Australis™ IP Generator rapidly develops eFPGA Hard IP for advanced nodes like Intel’s 18A, optimizing power, performance, and area. Beyond defense, QuickLogic's eFPGA integrates into platforms like Faraday Technology's FlashKit™-22RRAM SoC, offering unparalleled flexibility for IoT and edge AI applications by enabling post-silicon hardware customization and extending product lifecycles.

Membership in the Intel Foundry Chiplet Alliance offers QuickLogic tangible advantages, including early access to Intel Foundry's advanced processes and packaging, reduced prototyping costs through multi-project-wafer shuttles, and participation in defining interoperable standards via the UCIe standard. This strategic positioning solidifies QuickLogic’s competitive edge in the advanced semiconductor manufacturing landscape. Its consistent innovation and robust strategic alliances underscore the company’s strong future trajectory in a world hungry for adaptable and secure silicon solutions.

$NKE: Nike – Sprinting to Gains or Stumbling?(1/9)

Good evening, everyone! 🌙 NYSE:NKE : Nike – Sprinting to Gains or Stumbling?

With NKE at $73 ahead of Q3 earnings, is this sportswear giant ready to run or tripping up? Let’s lace up and find out! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 73 as of Mar 19, 2025 💰

• Recent Move: Down from $102.49 high, above $68.63 low, per data 📏

• Sector Trend: Footwear sector volatile with trade tensions 🌟

It’s a rocky track—value might be in stride! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $116B (web ID: 15) 🏆

• Operations: Global leader in footwear, apparel ⏰

• Trend: Strong brand, innovation focus, per data 🎯

Firm in sportswear, but facing headwinds! 🏃♂️

(4/9) – KEY DEVELOPMENTS 🔑

• Q3 FY2025 Earnings: Due Mar 20, $11.02B revenue expected, per data 🌍

• Market Sentiment: Bearish short-term, per posts on X 📋

• Price Action: Down 9.78% in 10 days, per data 💡

Racing toward earnings with caution! 🏁

(5/9) – RISKS IN FOCUS ⚡

• Trade Tensions: U.S.-China tariffs hit margins, per data 🔍

• Economic Slowdown: Consumer spending at risk 📉

• Competition: Adidas, Skims gaining ground ❄️

It’s a tough race—watch the pace! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Brand Power: Global sportswear leader 🥇

• Innovation: NikeSKIMS, new products, per data 📊

• Dividend: 2.03% yield draws income fans 🔧

Got the gear to win! 🏀

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Bearish sentiment, volatility 📉

• Opportunities: Q3 earnings beat, tech rebound 📈

Can it jump the hurdles or stumble? 🤔

(8/9) – POLL TIME! 📢

NKE at $73 your take? 🗳️

• Bullish: $85+ soon, earnings spark 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $65 looms, market slips 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

NKE’s $73 price tags a volatile sportswear play 📈, but brand strength keeps it in the race 🌿. Dips are our DCA sweet spot 💰—buy low, run high! Gem or bust?

Can AI Revolutionize Our World Beyond Data?Palantir Technologies has not merely emerged but soared in the financial markets, with shares rocketing 22% after an earnings report that surprised Wall Street. The company's fourth-quarter results for 2024 were a testament to its strategic placement at the heart of the AI revolution, exceeding expectations with revenue and earnings per share. This performance underscores the potential of AI not only to enhance but potentially redefine operational paradigms across industries, particularly in defense and governmental sectors where Palantir holds significant sway.

The growth trajectory of Palantir is not just a story of numbers; it's a narrative of how AI can be harnessed to transform complex data into actionable insights, thereby driving efficiency and innovation. CEO Alex Karp's vision of Palantir as a software juggernaut at the inception of a long-term revolution invites us to ponder the broader implications of AI. With a 64% growth in U.S. commercial revenue and a 45% increase in U.S. government revenue, Palantir demonstrates the power of AI to bridge the gap between raw data and strategic decision-making in real-world applications.

Yet, this success story also prompts critical reflection. How sustainable is this growth, especially considering Palantir's heavy reliance on government contracts? The company's future might hinge on its ability to diversify its clientele and continue innovating in a rapidly evolving tech landscape. As we stand at what Karp describes as the "beginning of the first act" of AI's influence, one must ask: Can Palantir maintain its momentum, or will it face challenges in a market increasingly crowded with AI contenders? This question challenges investors, technologists, and policymakers alike to consider the long-term trajectory of AI integration in our society.