TELUSDT

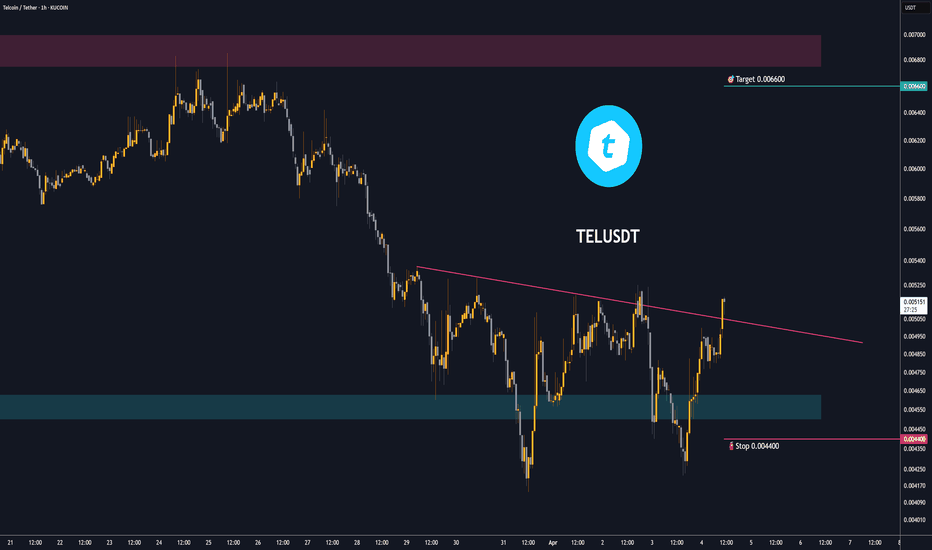

Major Level in Play: $TEL/USDT at Make-or-Break ZoneTEL/USDT is currently trading just above a key support zone, a level that previously acted as resistance.

The price structure is showing signs of improvement, but the descending resistance line above is still a strong hurdle for any continued upside.

This lower support zone remains critical, if price fails to hold this level, we could see further downside pressure.

Keep a close eye on this zone for potential bounce or breakdown confirmation.

DYOR, NFA

#PEACE

$TEL updateNYSE:TEL $0.012170-$0.012724 resistance range holding strong, Bullish engulfing on previous daily close, but current daily lacking volume, Currently heading towards $0.011174 support test, must avoid bearish engulfing on current 4h close, $0.010625 key support area, next key resistance at $0.014472, taking $0.012724 support will help test $0.013874. Watch given S/R

Telcoin Short Term AnalysisNYSE:TEL CHART Part 2

Short Term Analysis

NYSE:TEL Hourly Price Action Today

Volume has seen a minor increase.

100MA is still pointing down which indicates a downtrend.

The price has broken above the 100MA which is super bullish. That happened to XRP yesterday and I called it’s 8% breakout to $2.31. It is highly likely that will happen to $TEL. #Telcoin needs to take the $0.0063 Resistance and flip it back to support.

The BEAR Scenario would be coming close to the $0.0045 triangle bottom support. When looking at the Bitcoin Liquidation Heatmap on Coinglass we can see that CRYPTOCAP:BTC has liquidity down at $93.3k down to $92k. This is important because that would be the BEAR scenario for #Telcoin right now.

However. Bitcoin has much more liquidity at $96k so based on the market sentiment and end of the holidays, I believe we will go to $96k to eat up the leverage short liquidity. This will continue Telcoin’s momentum on the breakout to the upside.

That may happen if #BITCOIN

50MA has turned slightly bullish. If this continues over the next 12 hours we will see a bullish Golden Cross between the 100MA and the 50MA.

1️⃣Aroon Indicator: Determines if in trend or consolidation. Hourly - 🟩Strong Uptrend

2️⃣50/100 Day Moving Average Cross: Signals sustained trend strength and support.

Hourly - 🟩Break Above 100 MA is bullish, 50 MA is clawing its way towards Golden Cross

3️⃣On Balance Volume (OBV) Tracks buying/selling pressure accumulation.

Hourly - 🟩FLIPPED BULLISH

4️⃣Supertrend Indicator: Provides clear buy/sell signals.

Hourly - 🟩BUY Recommendation 5 hours ago

5️⃣Larry Williams VIX FIX Market Bottom Indicator: Identifies potential reversal points.

Hourly - 🟩Said the bottom was 12 hours ago

6️⃣Relative Strength Index (RSI): Highlights overbought/oversold conditions.

Hourly - 🟩OVERBOUGHT

7️⃣Average Directional Index (ADX): Measures the strength of the trend.

Hourly - 🟩STRONG UPTREND

8️⃣MACD: Helps identify trends and momentum

Hourly - 🟩STRONG BULLISH

My Jan #Telcoin Target is $0.03

My late 2025 NYSE:TEL target is $0.55

Telcoin Targets for 2025TARGETS:

$0.0063 - Key Level to confirm bullish breakout

$0.009 - Triangle Breakout Target

$0.15 - Resistance will become Wave 4 Corrective Wave Support

$0.025 Elliot Wave top of Impulsive Wave 3

$0.03 - Psychological Level

$0.065 - TEL/USDT All Time High

$0.10 - Psychological Level

$0.11 - TEL/BTC All Time High

$0.23 My Old Top Target for this Cycle

$0.35 Psychological Level

$0.55 My New Top Target for this Cycle

Telcoin (TEL): No Need to Panic!📊 Overview

Election Day Price: $0.00137

Local High: $0.0087 (550% rally in 25 days!)

Pullback: 30% retrace to $0.006—a healthy correction post-rally.

Key Levels: Back in the Accumulation Zone, and the daily low matches last week's low.

🧐 Should We Worry?

Absolutely not! These moves are normal market behavior after a parabolic rally. Fundamentals remain solid.

🎯 Targets:

Short-term: $0.009

Long-term cycle: $0.55

📈 Bitcoin Context:

BTC rallied 10% in 48 hours, crossing $100k before retracing to $93.7k.

This volatility impacts the altcoin market, but NYSE:TEL remains positioned for growth.

💡 Pro Tips:

Learn technical analysis for confidence during market volatility.

Rule of Thumb: 1 hour of learning per $100-1000 invested.

🙏 Final Thoughts:

NYSE:TEL is a great project with massive potential.

Stay focused: Research. Action. Patience.

Telcoin (TEL) - Symmetrical Triangle Breakout AnalysisChart Pattern: Telcoin is forming a symmetrical triangle over the past 3 days, with the support level at $0.0067. This pattern suggests a potential breakout, with a price target of $0.009 (33% potential return).

MFI Indicator: The Money Flow Indicator (MFI) has moved from oversold (10) to neutral (50) in the past 10 hours, indicating that the selling pressure has subsided, and the market is entering a more balanced or slightly bullish phase.

Liquidity:

There is strong liquidity below the current price, with 137M + 44M in buy orders just under the current price, suggesting potential support levels.

There is also 211M in red volume at the $0.0078 resistance level, which will be key to watch for any breakout confirmation.

Previous Breakout Attempts: The previous breakout attempt at $0.0073 was unsuccessful, with 20M red volume and an MFI of 85, signaling overbought conditions. The current MFI is more balanced, suggesting a higher chance for success on this attempt.

Pattern: Symmetrical Triangle (3 days)

Support Level: $0.0067

Target: $0.009 (33% return potential)

Liquidity: Strong buying interest below at 137M + 44M. Heavy resistance at $0.0078 with 211M in sell volume.

MFI: Improved from oversold (10) to fair value (50) in the past 10 hours, signaling reduced selling pressure and neutral momentum.

Previous Resistance: Previous breakout attempt failed at $0.0073 with 20M in red volume and an MFI of 85 (overbought).

Conclusion: Watch for breakout confirmation above $0.0073. Target of $0.009 with 33% upside. A failure to break above $0.0073 would invalidate the bullish scenario, with a potential revisit to $0.0067.

TEL Symmetrical Triangle or Bull Flag ComparisonIs this a Symmetrical Triangle or Bull Flag?

Here is how we decide. The triangle is in white, the flag is in pink.

Symmetrical Triangle:

higher lows and lower highs, representing a period of consolidation and indecision.

The breakout direction typically depends on the preceding trend

Bull Flag:

A bull flag appears after a strong upward move (the “flagpole”) and consolidates downward in a parallel or slightly sloping trend.

It signifies a continuation pattern, with a breakout expected to align with the prior uptrend.

Analysis

The prior move has seen strong upward momentum (55%, 44%, 33%), which supports the idea of a bull flag if the triangle is sloping slightly downward.

However, if the triangle is symmetrical with equal pressure from buyers and sellers (not tilted), it’s likely a symmetrical triangle signaling indecision. I believe this is tilted upwards, signifying bullish. This is confirmed by the fact that net volume is $11 million above sell volume at time of writing.

If it’s breaking above the triangle now and aligns with my target of $0.009, the breakout could validate it as a bull flag continuation pattern.

2. Key Factors Supporting the Analysis:

Bounce off the 100-day Moving Average:

A bounce off a significant moving average like the 100-day MA is typically bullish, indicating that buyers stepped in at a key support level.

Breakout Above Triangle:

Early signs of breakout above the triangle suggest bullish momentum building up. If confirmed with volume, this supports the bull flag hypothesis.

Upcoming Catalyst (Public Hearing):

The public hearing for Telbank approval on December 5 could drive speculative buying, adding bullish momentum. There may be a small sell the news effect, but if the hearing is positive this won't last for long.

Short-Term Target ($0.009):

If this really is a bull flag, the measured move target can be estimated by the height of the flagpole (the previous upward move) added to the breakout point.

Risks to Watch:

False breakouts are common in symmetrical triangles. Watch volume closely to confirm the breakout.

If the price falls back below the 100-day MA, it could invalidate the bullish setup.

Summary:

Given the price action and catalyst, the pattern appears more like a bull flag continuation. Monitor the breakout level and volume for confirmation. If the pattern holds, the short-term target of $0.009 seems reasonable.

TELCOIN 3 Ascending Triangles PatternTelcoin has been following a very distinct pattern with it's ascending triangles.

NOV TELCOIN TRIANGLES

NOV 12 - 9 Day Build, 48 Hour Pump, 55%

Nov 23 - 3 Day Build, 24 Hour Pump, 44%

Nov 28 - 2 Day Build, 12 hour Pump, 33%

It leads me to believe that

BASED ON THIS PATTERN

The next triangle "Breakout to peak" will be under 14 hours long and will be about 22% return.

Short term breakout target for Telcoin is $0.0092.

Telcoin (TEL)Telcoin is the native medium of exchange, reserve asset and protocol token of the Telcoin user-owned, decentralized financial platform. Anyway, Telcoin technical analysis is straightforward; when the upward phase ended, a correction phase started which ended at 0.618 Fib retracement. Then TEL made an inverted Head and Shoulders pattern and just recently TEL broke the Head and Shoulders' neckline; that means reversal confirmed. Let's see how high TEL can go.

TELCOIN (TEL) Looks like it's going to drop another 28%. The TELCOIN charts seem to indicate that a drop to the 0.001101 level could be in the cards after just being rejected off a 4H FVG (Fair Value Gap) on the daily chart.

I believe this coin could have a bright future, and being able to buy it at or below the previous low would be a great buying opportunity for those looking to invest for the long term.

Good luck!