ES (SPX, SPY) Analysis, Key-Zones, Setups for Fri (Jan 23)

Macro sentiment shifted bullish this week. Trump reached "framework deal" with NATO on Greenland at Davos, dropping tariff threats on 8 European nations. Markets rallied on de-escalation.

Breaking overnight: China greenlights tech firms to prep Nvidia H200 orders - major reversal, risk-on for tech sector.

Asian markets hit new highs. MSCI Asia Pacific +0.4%. Gold near $5,000. Dollar plummeted most in a month. Investors rotating out of US assets into emerging markets at record pace.

European PMIs came in better than expected. German Manufacturing 48.7 vs 47.8 forecast. UK Services 54.3 vs 51.7 - strong beat. UK Retail Sales +2.5% vs +1.1% expected.

BOJ held rates at 0.75% as expected. Japan PM Takaichi dissolved parliament, snap election Feb 8th.

TODAY'S ECONOMIC CALENDAR (ET)

9:45 AM - US Manufacturing PMI Flash (Forecast 52.1)

9:45 AM - US Services PMI Flash (Forecast 52.8)

10:00 AM - Michigan Consumer Sentiment Final (Forecast 54.0)

PMIs are the main catalyst today. Services PMI is the bigger market mover.

MULTI-TIMEFRAME STRUCTURE

4H Chart:

Price at Equilibrium ~6940 after recovering from LL at 6825 (Jan 20-21 selloff). CHoCH confirmed mid-January around 6900. Still printing LH structure - needs break above 6964+ for bullish confirmation. Oscillator readings neutral with slight bearish bias.

1H Chart:

HH formed at 6964.5 on Jan 22. Multiple LH prints developing. BOS marked - structure attempting bullish shift. Price sitting at PWL area. Oscillator showing bearish divergence developing.

30M Chart:

Tight consolidation between session levels. Price hovering around VWAP 6948 and Prior Close 6946. Waiting for PMI catalyst to determine direction.

RESISTANCE:

7040-7045 - Prior 4H HH, swing target

7015-7020 - 1H Strong High, 707K volume node

6990-7010 - Major HTF zone. 4H PWH/PQH cluster. 1H PMH. 651K volume node (39%). Premium zone entry.

6958-6970 - Primary resistance cluster. 4H LH 6964.5. 1H HH 6964.5. PDH 6969. ONH 6958.5. Y-VAH 6958.5. NYAM.H 6964.5. AS.H 6960.75. 120K volume zone (7%).

SUPPORT:

6930-6940 - Primary support cluster. 4H Equilibrium 6940. 1H Equilibrium 6940. Y-VAL 6932.5. NYPM.L 6932.5. PWL zone. 38K volume node (2%).

6920-6928 - Secondary support. PDL 6925.5. NYAM.L 6925.5.

6905-6915 - Deep pullback zone. ONL 6911.25. Thursday LO.L 6914.75. 1H HL structure.

6895-6905 - 1H CHoCH+ zone, structure support.

6820-6830 - 4H LL from Jan 20-21. 145K volume shelf (9%).

6795-6810 - HTF liquidity target. 4H PML. Weak Low zone.

SESSION GAME PLAN

Pre-9:45 AM: Expect consolidation 6930-6958. No forced trades. Mark levels and wait.

9:45 AM PMI Release: If PMI beats, look for 6930-6940 buy on any flush. If PMI misses, look for 6958-6970 rejection short. Initial move often fades - don't chase.

10:00 AM Post-Michigan: True directional move typically emerges after initial volatility settles. Best setups at confluence zones with CVD confirmation.

Friday Afternoon: Reduced position sizing after 2 PM. Watch for end-of-week flows. Book profits before weekend.

BIAS

Neutral-to-Bullish. Macro backdrop improved significantly. Technical structure shows recovery from Monday selloff. However 4H/1H still printing LH pattern - needs 6970+ break for bullish confirmation. PMI data is the wild card.

Price sitting exactly at 4H/1H Equilibrium - decision point. Wait for CVD confirmation at the 5-star confluence zones for highest probability entries

Tradinganalysis

XAUUSD (Gold) Short Setup | Trendline RejectionGold has reached a strong rising trendline resistance after an aggressive bullish move. Price is showing signs of exhaustion near the top, forming a potential pullback structure.

🔴 Sell Zone: Near trendline resistance

🎯 Take Profit: 4802 area (previous demand zone)

🛑 Stop Loss: Above recent high / resistance

📊 Timeframe: 1H

This setup follows trendline rejection + pullback continuation, offering a clean risk-to-reward opportunity. Wait for confirmation before entry and manage risk properly.

⚠️ Always follow your risk management. This is not financial advice.

ES (SPX, SPY) Analysis, Key Zones, Setups for Wed, Jan 21

Today was the worst session since April - S&P 500 dropped 2.1%, wiping out 2026 gains. The catalyst? Trump's Greenland tariff escalation ahead of Davos. 10% tariffs on 8 EU countries starting Feb 1, rising to 25% by June 1. Supreme Court declined to rule on tariff authority today, extending uncertainty at least another month.

Critical Event Tomorrow: Trump's Special Address at Davos runs 8:30-9:15 AM ET - directly overlapping cash open. This is the primary catalyst. Any headline could swing markets 50+ points.

ECONOMIC CALENDAR - JAN 21

- 8:30 AM ET: Housing Starts & Building Permits

- 8:30-9:15 AM ET: TRUMP DAVOS SPEECH

- 10:00 AM: Pending Home Sales

Housing data releases simultaneously with Trump's speech - expect it to be overshadowed entirely.

TECHNICAL STRUCTURE

Daily: Price at 6,848.50 holding above 1.618 fib (6,834.50). Premium-to-discount transition in progress after rejection at HH near 7,040.

4H: CHoCH+ triggered at 6,923 confirming bearish shift. Price trading in discount below Equilibrium (6,923.25). Key fibs: 1.272 (6,873.50) | 1.618 (6,834.50) | 2.0 (6,791.25). PWL at ~6,923.25.

1H: Clear LH → LL sequence. PWH at 7,020 (premium trap). BOS confirmed. PML at 6,764.75.

KEY ZONES

RESISTANCE (Shorts):

- 6,865-6,875: VWAP + 1.272 Fib - first rejection zone

- 6,896-6,905: NYAM.H (6,904.75) + Asian resistance

- 6,920-6,935: CHoCH+ origin + Equilibrium - strong supply

- 6,960-6,975: Major liquidity wall (Davos relief rally target)

SUPPORT (Longs):

- 6,834-6,843: 1.618 Fib + AS.H - first bounce zone

- 6,815-6,822: NYPM.L (6,822.25) + 1.272 extension

- 6,791-6,800: 2.0 Fib - psychological confluence

- 6,764-6,780: PML (6,764.75) - STRONG BID expected

SCENARIOS

BEARISH CONTINUATION (60%)

Trump hardlines, no diplomatic progress, EU threatens retaliation.

- Break below 6,834 → 6,791 → 6,764

RELIEF BOUNCE (30%)

"Constructive dialogue" headlines, Feb 1 deadline pushed.

- Squeeze to 6,905-6,920, potential 6,960 extension

CHOP (10%)

Markets await clarity, range 6,820-6,880.

TRADE SETUPS

SHORT @ Premium Rejection

- Entry: 6,896-6,920

- Stop: 6,940

- T1: 6,865 (31-55 pts)

- T2: 6,834 (62-86 pts)

- T3: 6,791 (105-129 pts)

- Confirmation: CVD divergence, absorption failure

LONG @ Discount

- Entry: 6,791-6,800

- Stop: 6,764

- T1: 6,834 (34-43 pts)

- T2: 6,865 (65-74 pts)

- Confirmation: CVD divergence, institutional absorption

RISK NOTES

1. Headline risk EXTREME - size 50-75% of normal

2. Cash open = speech overlap (8:30-9:15 ET)

3. Watch EUR/USD as leading indicator

4. VIX elevated - mean reversion could fuel squeeze

WATCHLIST

- NFLX: Beat earnings, pausing buybacks for Warner deal

- 10Y: 4.29% - above 4.35% = pressure, below 4.20% = relief

- Gold: $4,700+ record - risk-off barometer

- Bitcoin: Cracked $90K

Bearish bias with headline optionality. Structure says lower but Davos = binary risk. Focus 6,920 resistance for shorts, 6,791-6,800 for longs. Let order flow confirm. NOT a session to overtrade.

Good Luck !!!

ES (SPX, SPY) Analysis, Key Levels, Setup for Tue (Jan 20)U.S. cash markets paused on Monday in observance of Martin Luther King Jr. Day, but trading on the Globex platform displayed pronounced volatility amid soaring U.S.-EU trade tensions focused on Greenland. The E-mini S&P 500 (ES) saw a decline of approximately 1.1% from Friday's close, while the Nasdaq-100 (NQ) lagged further, dropping 1.4%. In a shift towards safe-haven assets, gold prices surged to an all-time high of $4,660, driven by a weakening U.S. dollar and strong performance from the Swiss franc.

The catalyst behind the market's movement was President Trump’s announcement of a 10% tariff on eight European NATO allies specifically Denmark, the UK, France, Germany, the Netherlands, Norway, Sweden, and Finland set to take effect on February 1. This tariff is scheduled to escalate to 25% by June 1 unless an agreement regarding Greenland is reached. In response, the EU has activated an emergency protocol and is deliberating potential countermeasures.

Treasury Secretary Bessent, speaking at the World Economic Forum in Davos, expressed optimism about the U.S. economy, stating, “We expect investment to accelerate this year.”

FORECAST

BIAS: Neutral-to-Bearish (Short-Term)

OVERNIGHT THOUGHTS: The Asia and Europe trading sessions are anticipated to test recent overnight lows, with potential for unsuccessful dip-buying efforts at resistance levels.

TUESDAY NY SESSION OUTLOOK: As U.S. traders return to the markets, they will react to the weekend’s accumulated news. An initial attempt at short-covering is expected, likely followed by renewed selling pressure. Failed rallies in the 6920-6935 range may further exacerbate the downward trend.

BULLISH SCENARIO (30% likelihood): A retraction back to 6923 that holds could lead to a gap fill toward the 6950-6960 area.

BEARISH SCENARIO (50% likelihood): A failed rebound at resistance may signal a continuation down to the 6870-6850 discount zone.

CHOPPING SCENARIO (20% likelihood): The market may remain range-bound between 6887-6920 while awaiting clearer catalysts.

INVALIDATION POINT: A sustained break above 6950 would shift the bias towards bullish.

HIGH-IMPACT SCHEDULED ITEMS (ET)

09:30 - US cash equities reopen after MLK Day closure (gap-and-go risk; repricing of Greenland tariff headlines that built up while cash was shut)

10:00 - Supreme Court session begins. Oral arguments scheduled: Wolford v. Lopez (2A), M&K Employee Solutions v. Trustees (pension). Opinions possible but not guaranteed - the tariff case (Learning Resources v. Trump) ruling could drop any session. Court did not pre-commit which decisions will be released. Last courtroom session until Feb 20.

11:30 - Treasury bill auctions (supply event; can jolt front-end yields and spill into ES via rates):

6-week bill auction (announced Thu prior)

4-week/8-week bills settle Tuesday per standard pattern

52-week bill auction possible (every 4 weeks on Tues)

16:01 - Netflix (NFLX) Q4 earnings release - HIGH IMPACT

16:15 - Fed H.10 Foreign Exchange Rates (pushed from holiday)

16:45 - Netflix earnings interview begins

After the close (earnings beta into index futures):

Netflix (NFLX) - major index weight, sentiment driver

United Airlines (UAL)

Interactive Brokers (IBKR)

US Bancorp (USB)

Fifth Third (FITB)

KeyCorp (KEY)

Before the open (also relevant if you trade the open):

3M (MMM)

DR Horton (DHI)

Fastenal (FAST)

WHAT IS NOT ON THE CALENDAR (STILL IMPORTANT)

No top-tier BEA macro prints (GDP/PCE/Income) scheduled for Tue Jan 20 per BEA release schedule

No major BLS releases scheduled for Tue Jan 20 per BLS January schedule

No FOMC meeting - next meeting is Jan 27-28

Fed note: Daily/weekly statistical releases scheduled on the holiday (Mon) are pushed to Tuesday - H.10 at 4:15 PM, H.8 on Thu. Can nudge rates/liquidity expectations.

Trump v. Cook (Fed's Cook firing case) oral arguments are Wednesday Jan 21 - could create Fed-related headline risk heading into that session

WATCH LIST (UNSCHEDULED BUT HIGH PROBABILITY)

EU tariff retaliation announcement - emergency meeting concluded, response expected

Trump/Bessent comments from Davos

Any SCOTUS tariff ruling leak or rel

Good Luck !!!

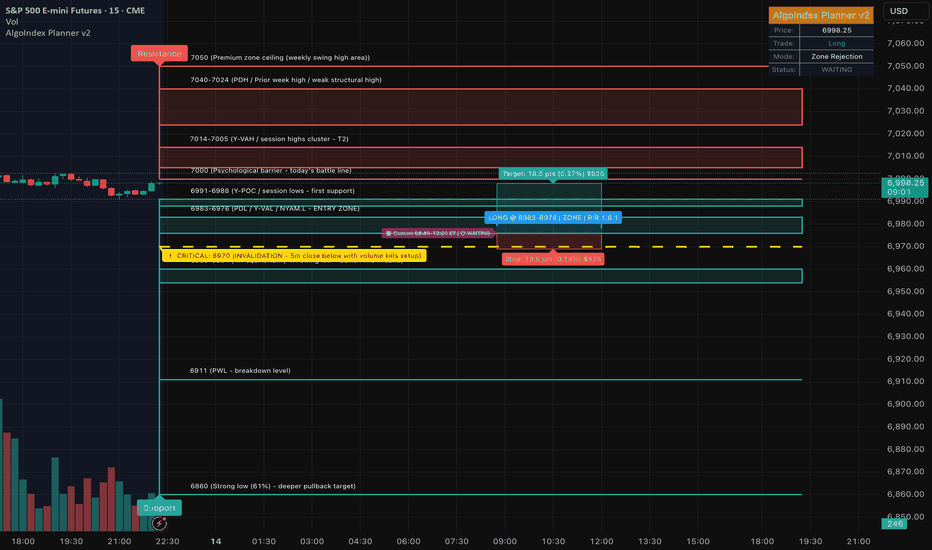

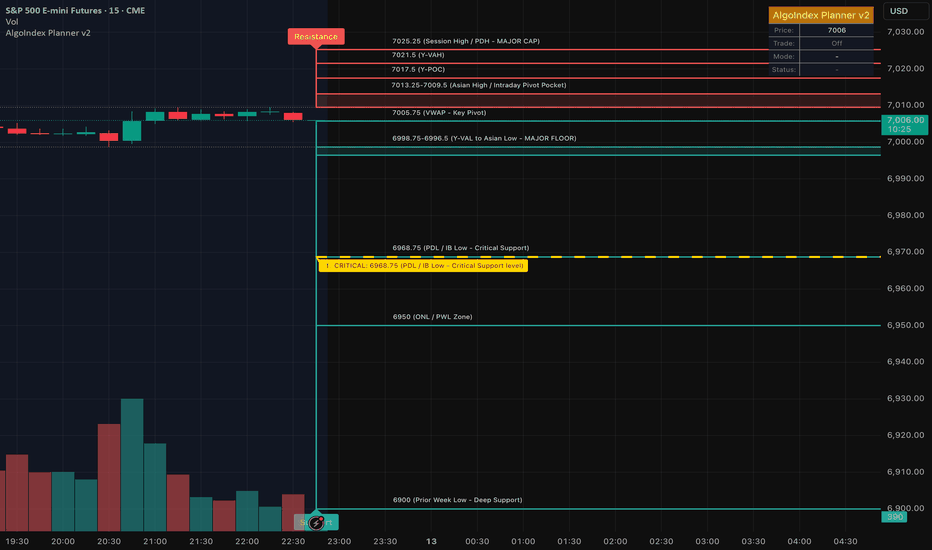

ES (SPX, SPY) Analysis, PMI, Key Levels, Setups for Wed, Jan 14Overnight-to-NY Session Forecast: Market Consolidation with Bearish Sentiment

In the latest market outlook, a consolidation phase with a bearish tilt is anticipated (60% probability) as prices are expected to remain capped below the resistance levels of 7,000 to 7,014 during the Globex trading hours. This comes amid a risk-off sentiment observed as the market approaches the close. Traders should prepare for a trading range between 6,976 and 7,005 overnight, particularly aware of the potential for false breakouts typical of the thinner trading volumes in the Asian session. Pre-PPI positioning could keep prices compressed around the value area of 6,988 to 6,993 established yesterday.

Should the Producer Price Index (PPI) report come in soft either in-line with expectations or below 0.2% a rally towards the 7,014 to 7,024 range might be seen in the New York morning session. Conversely, if the PPI indicates rising prices, a move below 6,976 could target the equilibrium range of 6,954 to 6,960.

In a bullish scenario (25% probability), a soft PPI reading would bolster the disinflation narrative, potentially triggering a squeeze that pushes through the 7,000 mark, with upward momentum likely aimed at the 7,024 to 7,040 zone. For this to materialize, a sustained bid above the volume-weighted average price (VWAP) of 6,998 and a breach of the overnight high will be crucial. Traders should look for a cumulative volume delta (CVD) divergence as confirmation, where prices make higher lows while the CVD registers higher highs.

On the other hand, the bearish scenario (15% probability) could develop with a hot PPI release or heightened geopolitical tensions, such as a response to Iran’s tariffs. A break below 6,976 would pave the way towards the 6,954 to 6,960 range, with further bearish pressure potentially targeting the 6,911 price level if the equilibrium fails to hold. This scenario may gain traction, especially if the Nasdaq leads the downturn, reflecting the broader tech sector's sensitivities to changing rate expectations.

ES (SPX, SPY) Analysis, CPI, Levels for Tue (Jan 13)

CPI Day Setup: Key Levels, Scenarios & Trade Ideas

FUNDAMENTAL BACKDROP

Increasing Pressure on Federal Reserve Independence

The political landscape surrounding the Federal Reserve is growing increasingly turbulent, as recent developments have raised concerns about potential interference in monetary policy. The Department of Justice served Fed Chair Jerome Powell with grand jury subpoenas on Friday, prompting Powell to defend the integrity of the Fed in a video statement, labeling the subpoenas as a "pretext" for a concerted effort to pressure the central bank into lowering interest rates. Senator John Thune has commented on the challenges this investigation poses for any future confirmation of Powell.

In a recent address, Fed President John Williams emphasized a cautious outlook, projecting U.S. economic growth to land between 2.5% and 2.75% for 2026. He noted that inflation is anticipated to peak in the first half of the year at rates between 2.75% and 3.0%, with a return to the 2% target expected by 2027. Williams reassured markets, stating that the Fed is “not under strong pressure to change rates,” and he acknowledged that the current market calm reflects an underlying uncertainty regarding these developments.

Geopolitical Tensions Rising

President Donald Trump has initiated a significant trade move, imposing 25% tariffs on nations conducting business with Iran, effective immediately. In a swift response, Iran’s foreign minister stated that Tehran is prepared for either “war or dialogue,” adding a layer of geopolitical risk that could influence market volatility in overnight trading sessions.

Foreign Exchange and Global Market Insights

In the global currency markets, the Dollar/Yen pair has reached a one-year high, trading at 158.25. Meanwhile, the Chinese Yuan continues to weaken, with the People’s Bank of China’s mid-point rate floating around 6.9734. Additionally, gold prices remain buoyed near record highs, driven by persistent demand for safe-haven assets amidst ongoing political and economic uncertainties.

TUESDAY'S KEY EVENT: CPI REPORT SET FOR 8:30 AM ET

Consensus Expectations:

- Headline CPI MoM is expected at 0.3%, up from the previous 0.2%.

- Headline CPI YoY is anticipated to remain steady at 2.7%.

- Core CPI MoM is projected at 0.3%, an increase from last month’s reading of 0.2%.

- Core CPI YoY is forecasted at 2.7%, slightly up from 2.6% previously reported.

Important Context:

Recent data collection for October and November has been impacted by the government shutdown, leading to some analysts warning of potential upside risks due to a "payback" effect from previous artificially low readings. Shelter inflation continues to be stable at around 3.0% year-over-year. The Core CPI month-over-month figure is expected to be the most immediate market mover, making it a critical focus for investors.

CPI Scenario Matrix:

- Much Lower (<0.2% Core MoM): Potential market rally of 30-50 points.

- Lower (0.2%): Anticipated rally of 15-25 points.

- In-Line (0.3%): Expected to result in market fluctuations of ±10-15 points.

- Higher (0.4-0.5%): Predicted market sell-off of 25-40 points.

- Much Higher (>0.5%): Market "flush" could lead to a drop of 40-60 points.

Technical Structure:

- Daily: Current prices are at a "Strong High 90%," indicating an extended phase while still maintaining trend integrity. Multiple higher high structures are currently showing signs of exhaustion, with a key support level at 6,900.

- 4-Hour: A change in character has been confirmed from the lows of 6,968, resulting in a sequence of higher lows at 6,950, 6,968, and 6,998. A higher low at 6,988 must hold for bullish continuation.

- 1-Hour: Prices are currently in a premium zone above 7,009, with a break of structure confirmed following recovery from the morning lows. Consolidation is forming ahead of the CPI catalyst.

Overnight Market Forecast

In the Base Case scenario, traders are positioned for a consolidation phase within the range of 7,004 to 7,013, driven by thin liquidity and pre-CPI positioning. As market participants reduce risk ahead of key data releases, expect choppy price action.

On the Bullish Case front, there’s a 25% likelihood of probing levels between 7,017 and 7,021, fueled by short covering prior to the CPI announcement. The calming tone from Fed's Williams is supporting risk appetite, but a stall is expected below the 7,025 mark.

Conversely, the Bearish Case carries a 20% probability of a dip to the 6,996 to 6,998 range, influenced by headline risks related to the Fed and tensions in Iran. There is pre-CPI hedging pressure that could lead to a bounce at the Y-VAL.

Post-CPI Scenarios

Scenario A Bullish Acceptance (35% Probability)

- Trigger: A 15-minute close above 7,025.25.

- Targets: 7,040 and then 7,058-7,065.

- Invalidation: Falling back below 7,021.

Scenario B Rejection/Fade (40% Probability)

- Trigger: A sweep above 7,021-7,025 followed by a failure to hold above 7,021.

- Targets: 6,996.50, moving down to 6,968.75.

- Invalidation: Acceptance above 7,025.

Scenario C - Breakdown (25% Probability)

- Trigger: A 15-minute close below 6,996.50.

- Targets: 6,968.75 and then 6,950.00.

- Invalidation: A reclaim and hold above 6,996.50.

BIAS & SUMMARY

Overall Lean: Slight bearish into CPI, but data-dependent

Bull Case: Cool CPI + Williams' calm tone = squeeze to 7,040+

Bear Case: Hot CPI + Fed/Iran headlines = flush to 6,968 or lower

Key Zones to Watch:

7,025 cap - break = bullish continuation

7,005 VWAP - pivot zone

6,996 Y-VAL - break = bearish acceptance

6,968 PDL - critical support

Risk Management Note: CPI releases create significant volatility. IV crush post-print is real if trading options, take profits quickly on directional moves rather than holding for extended targets.

ES (SPX, SPY) Analysis, Key Levels, Setups for Mon, (Jan 12)MACRO/FUNDAMENTAL OVERVIEW

Primary Driver: Fed Independence Crisis Signals Major Risk-Off Environment

The predominant headline today revolves around a significant development concerning Federal Reserve independence. Fed Chair Jerome Powell revealed that the Justice Department issued a subpoena to the central bank, intimating the possibility of a criminal indictment. Powell described this as part of the administration's ongoing pressure to influence rate decisions, emphasizing, "The threat of criminal charges arises when the Federal Reserve prioritizes its best assessments for public service over the President's preferences."

Market Implications:

Analysts at Evercore ISI anticipate a "sell-America" narrative reminiscent of last April's peak tariff shock, predicting declines for the dollar, bonds, and equities in Monday's trading. Following the news, the markets showed muted initial responses; the U.S. dollar slipped 0.2% against a basket of currencies, while S&P 500 futures decreased by 0.5% and Nasdaq 100 futures fell 0.8%.

Political Risk Calendar:

In a noteworthy legal development, the Supreme Court is scheduled to hear arguments regarding Fed Governor Lisa Cook's potential removal on January 21. Additionally, former President Trump is reportedly interviewing BlackRock's Rick Rieder for a Fed chair position this week. Sen. Thom Tillis (R-NC) has indicated he will oppose any Trump nominee for the Fed "until this legal matter is fully resolved."

Safe Haven Flows:

Gold witnessed a notable rise of over 1%, surpassing $4,590 per ounce, reaching record highs as concerns over Federal Reserve independence and geopolitical tensions stoked demand for safe-haven assets. Silver also experienced a significant uptick, climbing 4.4% in spot trading to $83.50 an ounce after briefly reaching $83.96. The Swiss Franc emerged as the strongest performer among G10 currencies.

Secondary Drivers:

Ongoing unrest in Iran has intensified, with reports of protests resulting in hundreds of fatalities and Trump hinting at military strikes, propelling oil prices to a one-month high (Brent above $63, WTI above $58). The banking and financial sectors experienced weakness amid Trump's intentions to freeze credit card interest rates. Meanwhile, 30-year Treasury yields climbed 4 basis points to 4.86%, driven by inflation concerns. Lastly, December's weak non-farm payroll figures (averaging just 29,000 jobs per month in Q4 compared to 57,000 in Q2-Q3) complicate the Fed's path, although inflation risks remain a significant factor.

Market Analysis: SMC Structure Overview (4H/1H)

Daily Overview: The market has recently seen a rejection from the premium zone, exceeding 7,000, leading to a sequence of lower highs following a recent higher high at approximately 7,020. A break of structure (BOS) was confirmed at these recent highs, with the market now retracing.

4-Hour Perspective: The higher-low (HL) structure remains intact, with key support located in the 6,950-6,960 range. The pivotal weekly low (PWL) at 6,900 is a crucial level that must be maintained for bullish continuation. The premium zone is clearly delineated above 7,000.

1-Hour Insights: A change of character (CHoCH) is apparent, with an HL being constructed around 6,956. However, the recent sequence of lower highs/lower lows suggests prevailing short-term bearish pressure, with an equilibrium around 6,940.

The oscillator matrix indicates a bearish momentum divergence across multiple timeframes, particularly with the RSI remaining compressed within the 50-70 range.

Primary Sentiment: Bearish to Neutral

The prevailing risk-off sentiment is underscored by the technical structure reflecting distribution from the premium zone.

Scenario 1: Fade Rally into Y-POC/Prior Close (High Probability)

The overnight gap down sets the stage for the potential to fade any rally toward the 6,995-7,005 area, which encompasses the Y-Point of Control (POC) and the prior close, contingent on confirming order flow rejection.

- Entry Zone: 6,995-7,005

- Confirmation: Look for cumulative volume delta (CVD) divergence, iceberg selling on Bookmap, and any failed breakouts at the Y-Volume Area High (VAH).

- Targets: 1) 6,968 (overnight low), 2) 6,950-6,955 (prior day low/London low), 3) 6,900 (PWL).

- Stop Loss: Above 7,020 (previous day high, PDH).

Scenario 2: Long from Discount Zone (Countertrend Play)

Should price sweep past the prior day low (PDL) and reach the 6,950 HL zone or delve deeper to the 6,900 PWL, traders should monitor for absorption signals and CVD reversal to consider a countertrend long position.

- Entry Zone: 6,945-6,955 (initial attempt) or 6,890-6,910 (PWL area).

- Confirmation: Look for robust bid absorption, CVD divergence, and visible iceberg buying.

- Targets: 1) 6,970-6,975 (mid-range), 2) 6,995 (Y-POC).

- Stop Loss: Below 6,880 for PWL entries.

Headline Risk: The market remains sensitive to headlines related to further Federal Reserve/Department of Justice developments, comments from former President Trump regarding Powell, or any rulings from the Supreme Court. Traders are advised to adjust positions in light of potential volatility.

CPI Preview: As markets position ahead of the CPI release on Wednesday, a hotter print could instigate a hawkish posture, supportive of the dollar but bearish for equities.

Good Luck

ES (SPX, SPY) Analysis, Levels, Setups for Tue (Jan 6)U.S. stock markets closed on a positive note today, buoyed primarily by gains in the energy sector and large banking institutions. This upside was propelled by headlines related to Venezuela, which invigorated both the energy market and investor risk sentiment. Meanwhile, the ISM Manufacturing Index for December showed a contraction, remaining below the 50 threshold, which reinforces the narrative of uneven economic growth and places increased emphasis on upcoming services data scheduled for release later this week.

Looking Ahead to Tuesday:

The macroeconomic calendar for Tuesday appears relatively light, suggesting that the equity markets may engage in a more directional trading pattern unless unexpected geopolitical developments emerge overnight. The primary risk window looms larger later in the week with significant reports on ADP employment, ISM Services, and the EIA energy outlook, culminating in the Nonfarm Payrolls report.

Overnight Outlook into New York:

The most probable scenario sees a rotation around the 6948.50 level (VWAP), with a two-sided trading dynamic expected. Key support is identified at the 6942.50/6940.00 range, while the first resistance ceiling is placed between 6955.25 and 6963.50. A bullish scenario would emerge with a stable hold above 6942.50 and a successful move through 6955.25, paving the way toward the 6963.50 resistance level and beyond. Conversely, bearish pressure may materialize if the index falls below 6940.00, with a failure to reclaim 6942.50 potentially exposing levels around 6932.75 and the 6912.75-6906.00 range.

Trade Setups for Tomorrow

A++ Long Setup (Preferred):

Entry: 6932-6935 (PDL / NYAM.L test)

Stop: 6927

Target: 6948-6955

B+ Short Setup (Fade Rally) :

Entry: 6950-6955 (VWAP / Y-POC rejection)

Stop: 6960

Target: 6935-6940

Deep Discount Long (If Major Flush):

Entry: 6906-6912 (LO.H / AS.H zone)

Stop: 6900

Target: 6940-6950

Good Luck !!!

ES (SPX, SPY) Analysis Week-ahead from Jan 5 to Jan 9, 2026Multi-Timeframe Market Analysis

Weekly Overview: The Big Picture

The E-mini S&P 500 (ES) continues to demonstrate an uptrend on a macro scale, characterized by a series of higher highs and higher lows. However, the recent market activity has resembled a gradual grind near the upper boundaries of a multi-month trading range—a behavior often referred to as “premium.” This indicates a slowdown in upward momentum, with pullbacks becoming increasingly pronounced. While the market does not exhibit extreme overbought conditions, the acceleration seen in prior weeks has noticeably diminished.

Daily Trend and Range Dynamics

On a daily basis, the market is operating within an upward trend that is currently exhibiting range-bound characteristics. We are witnessing repeated attempts to test the upper supply zone around the 6980-7000 level, followed by mean reversion toward the mid-to-lower 6900s. The latest daily swing reflects a pullback from this upper band, positioning prices now towards the center of this range, where liquidity zones take precedence over simply chasing trends.

4-Hour Perspective: Impulse vs. Correction

Analyzing the 4-hour chart reveals a distinct corrective move followed by a rebound that has yet to solidify a sequence of higher highs. While the overarching weekly trend remains bullish, the current 4-hour action feels more like a rebound effort, with the market in a phase of "repair" after experiencing a sharp decline.

1-Hour Intraday Context

At the intraday level, the latest 1-hour movement reflects a rebound from the lower 6800s towards the resistance zone in the low-to-mid 6900s. This places traders in a critical “decision zone” as we enter Monday's session, where the market faces a pivotal moment: it must either reclaim and sustain levels above these key resistance shelves (indicating bullish continuation) or risk further fading of rallies, which would suggest a return to range-bound or corrective trading.

Oscillator and Momentum Indicators (Weekly and Daily)

From a momentum perspective, the weekly oscillators point to a constructive yet cooling outlook, lacking signs of a fresh breakout structure. Daily momentum indicators are closer to neutral territory, indicative of a market that appears to be in a wait-and-see mode, poised for a catalyst to determine its next direction.

Volatility Metrics Analysis

VIX Overview

The CBOE Volatility Index (VIX) closed the previous session at 14.51, reflecting a decline throughout the day.

VIX Term Structure

The VIX term structure remains in contango, with an upward-sloping curve indicating that implied volatility is anticipated to rise over the coming months. Specifically, the implied volatility for January sits at 12.55, February at 15.38, and March at 17.34, with further increases projected for later months. This pattern is typically indicative of stable market conditions, suggesting that volatility is being priced higher down the line compared to the present.

Rates Volatility (MOVE)

The MOVE Index, which measures volatility in interest rates, is currently at 62.36 as we approach market close, also reflecting a decrease on the day. This level does not indicate significant stress within the market, aligning more with an environment in which investors are not exhibiting panic regarding interest rate fluctuations.

Options and Positioning Overview

Current Put/Call Ratios (Latest Daily Figures)

- Total Put/Call: 0.83

- Index Put/Call: 1.08

- ETP Put/Call: 0.85

- Equity Put/Call: 0.56

Analysis: The equity flow currently exhibits a call-leaning sentiment, as indicated by the lower equity put/call ratio. In contrast, index hedging remains active, with the index put/call ratio above 1. This duality is characteristic of late-cycle market behavior, where investors often purchase upside in individual stocks while simultaneously maintaining protective index hedges.

10-day Moving Average of Put/Call Ratios

Unfortunately, a definitive and authoritative 10-day moving average for the total put/call ratio is not readily available from the sources providing daily data in a machine-readable format. While the daily figures presented are confirmed, the 10-day averages cannot be securely sourced at this time.

SKEW - Tail Risk Pricing

The SKEW index closed at 141.86, a figure that Cboe describes as reflective of the pricing dynamics surrounding out-of-the-money SPX options, particularly those associated with tail risk. Typically, values for SKEW fluctuate within the 100-150 range. The implication is clear: despite a calm front-end volatility environment (as suggested by VIX levels), tail hedges are attractively priced.

Dealer Gamma Insights

Considering the current landscape of low spot volatility coupled with contango and a modest equity put/call ratio, market conditions suggest that dip buyers may defend the initial downside levels effectively. However, the elevated SKEW indicates that the demand for downside tail protection is increasing, meaning that if the market breaches key support levels (S4), panic-induced hedging activity could accelerate rapid downward movements. This interpretation is based on the metrics discussed and does not represent direct insights from dealer positioning.

Market Breadth and Internals Analysis

Advancers vs. Decliners (NYSE)

On January 2, 2026, the New York Stock Exchange recorded 1,882 advancing issues compared to 882 declining ones.

Breadth Oscillator (McClellan)

The NYSE’s McClellan Oscillator is currently at -18.826, a notable improvement from -76.414 previously. This indicates that while breadth remains slightly negative, the recent uptick suggests a reduction in selling pressure.

Sector Performance Snapshot

Recent market activity has highlighted leadership in the energy sector, along with notable strength in semiconductor stocks, while consumer segments have lagged behind. Should this trend continue, it would support a “grind/range” market environment rather than a drastic “waterfall selloff,” unless unexpected macroeconomic events disrupt the landscape.

Market Dynamics: Minor Wobble vs. Distribution Day

With breadth showing signs of improvement and credit markets not exhibiting significant stress, the current evidence leans towards a “minor wobble/consolidation” scenario rather than a full-scale distribution. This outlook holds, provided that key support levels remain intact and market internals do not deteriorate concurrently.

Credit and Funding Overview

High Yield ETFs

- HYG: 80.67

- JNK: 97.24

High Yield Spreads (OAS)

As of the last available print on December 31, 2025, the ICE BofA US High Yield OAS stands at 2.81%. This level is considered tight and typically signifies “orderly credit” conditions. It is important to monitor these spreads closely; a sharp widening could signal increased risk aversion, which often leads to more significant pullbacks in equity markets.

Sentiment and Crowd Positioning

AAII Sentiment (Latest)

- Bullish: 42.0%

- Neutral: 31.0%

- Bearish: 27.0%

The current sentiment readings indicate a notable tilt toward optimism. While this sentiment alone does not serve as a reliable timing mechanism for market reversals, it effectively diminishes the “wall of worry” that frequently fuels market squeezes.

Cross-Asset and Global Risk Tone

Crypto (Risk-On Proxy)

- BTC: 91,314

- ETH: 3,137.63

The resilience in cryptocurrency prices typically reflects a broader risk-on sentiment, although it should be noted that this is not a definitive indicator for daily movements in equities.

ES vs. NQ Relative Strength

The Nasdaq (NQ) continues to exhibit higher beta characteristics. If NQ consistently underperforms during market rallies, it may hinder attempts for the S&P 500 (ES) to push through resistance levels at R1 and R2.

Scheduled Events(ET):

Mon Jan 5

• 10:00 AM - ISM Manufacturing PMI (Dec)

Tue Jan 6

• 9:45 AM - S&P Global Final Services PMI (Dec)

Wed Jan 7

• 8:15 AM - ADP Employment Change (Dec)

• 10:00 AM - ISM Services PMI (Dec)

• 10:00 AM - JOLTS Job Openings (Nov)

• Late afternoon - Fed speaker risk (watch headlines)

Thu Jan 8

• 8:30 AM - Weekly Unemployment Claims

• 8:30 AM - Productivity and Unit Labor Costs (Q3)

Fri Jan 9 (highest impact)

• 8:30 AM - Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings

• 10:00 AM - University of Michigan Consumer Sentiment (prelim)

Two A++ setups (Level-KZ Protocol 15/5/1)

A++ Setup 1 - Rejection Fade Short (R1/R2 cap)

Entry: 6934.75-6937.50

Hard SL: 6946.25 (above the 15m rejection wick)

TP1: 6906.50 (S1)

TP2: 6889.50 (S3 top)

TP3: 6875.50 (S4 top)

Invalidation: 15m acceptance above 6940.75 and holding (no immediate snapback)

A++ Setup 2 - Bounce Long (S4 defend)

Entry: 6869.00-6876.00

Hard SL: 6859.75 (below the reclaim wick and below 6861.75 fib magnet)

TP1: 6902.75 (S1)

TP2: 6938.50 (R1)

TP3: 6982.50 (R3 first tag)

Invalidation: 15m bodies holding below 6866.75

Good Luck !!!

ES (SPX, SPY) Analysis, Key Levels, Setups for Fri (Jan 2nd)Market Overview: Context for Friday

As the market transitions from year-end positioning, traders should anticipate a choppy session influenced by holiday-thinned activity. Initially, expect fluctuations without a clear directional trend, but anticipate more definitive movements once New York cash volume resumes its normal pace.

From a structural standpoint, higher timeframes continue to reflect an uptrend. However, a recent decline from the 6980s has initiated a fresh pullback, leading to a short-term bias focused on “repair mode.” A shift in sentiment could occur if prices can reclaim and hold the mid-6940s.

Currently, prices are stabilizing around the 6920 mark following a sharp decline and subsequent bounce. This positioning places the E-mini S&P 500 (ES) in a mean-reversion zone, where oscillations between key value levels are expected as traders navigate the current landscape.

Forecasting Potential Market Movements

Base Case: Expect a range-bound market with a focus on repairing price levels.

Overnight Activity: The market has shown rotation around key levels of 6916 and 6922.50, with buying interest emerging above 6908.50.

Opening Analysis: As the New York session begins, we anticipate attempts to breach the 6922.50 to 6935.25 range. Should buyers fail to maintain support above 6922.50 during retests, the market is likely to rotate back towards 6916, followed by support at 6908.50.

Bullish Scenario: A strong upward movement could materialize with a decisive breakout above 6922.50.

- Trigger Point: A 15-minute close above 6922.50, followed by pullbacks that maintain support above 6921.50.

- Target Levels: Initial target at 6935.25, with further upside potential towards 6947.50 to 6951.50.

Bearish Scenario: A downward failure could emerge if the market loses the 6908.50 level.

- Trigger Point: Persistent failures to sustain above 6916, accompanied by a 15-minute close below 6908.50.

- Target Levels: An initial downside target at 6895.25, followed by 6890.25 to 6888.00. If 6888 is breached and held, the next level of interest would be 6873.

Events to watch tomorrow (timing is ET)

• 09:45 - S&P Global US Manufacturing PMI (final)

• 16:30 - Fed H.4.1 balance sheet update (released on the next business day when the usual Thursday release falls on a federal holiday)

A++ SETUP 1 (LONG) - Rejection Fade

Entry: 6888.00-6892.25 (buy only after a flush into the pocket, then reclaim)

Stop: 6878.00

• TP1: 6922.50

• TP2: 6935.25

• TP3: 6947.50

• Invalidation: 15m body closes below 6888.00 and does not reclaim quickly

A++ SETUP 2 (SHORT) - Rejection Fade

Entry: 6947.50-6951.50 (sell only after a push up, then fail back under 6947.50)

Stop: 6962.00

• TP1: 6922.50

• TP2: 6916.00

• TP3: 6890.25

• Invalidation: 15m closes and holds above 6951.50 (or a clean push above 6962.00)

Good Luck !!!

ES (SPX, SPY) Analysis, Key Levels, Setups for Wed (Dec 31st)Market Outlook for December 31, 2025 (NY Session)

As we approach the end of the year, investors should be aware of key economic data slated for release that could influence the equity markets, particularly the E-mini S&P 500 (ES).

Economic Calendar (All Times Eastern)

07:00 – MBA Mortgage Applications

While typically seen as a low-impact indicator, this data will be closely watched for any surprises due to its sensitivity to interest rates.

08:30 – Initial Jobless Claims

This report has been advanced this week as Thursday is a federal holiday. Given its implications for labor market strength, it could have noteworthy effects on investor sentiment.

10:00 – NY Fed Corporate Bond Market Distress Index

This indicator serves as a pulse on credit market conditions. A significant change here could signal broader market stress.

10:30 – EIA Weekly Petroleum Status Report

The release of this report comes at a time of heightened scrutiny on energy prices and inflationary pressures. It's advisable to keep an eye on potential spillover effects into the broader indices.

Market Structure Note

Please note that while the US stock market will be open for regular trading hours, the US bond market will have an early close at 2:00 PM ET. This adjusted schedule may influence trading volumes and market dynamics as we wind down the year.

Market Analysis: The Path Ahead Amid Holiday-Induced Thin Trading

The trading session was marked by subdued yet erratic price movements, a natural consequence of reduced market participation during the holiday season. Despite some fluctuations, traders largely refrained from aggressively pursuing dips, while upward movements faced difficulties in maintaining momentum.

In the macroeconomic landscape, the recently released Federal Reserve minutes underscored significant internal divisions regarding prospective interest rate cuts. This lack of consensus diminishes certainty about future rate adjustments, extending uncertainty into early 2026.

As we approach year-end, upcoming trading dynamics will be affected. With Wednesday signaling the final trading day of the year, participants should anticipate a landscape characterized by uneven liquidity. This could lead to increased volatility, particularly around key support and resistance levels, with a heightened potential for stop hunts as markets test widely recognized highs and lows.

Overnight NY Market Forecast: A Scenario Analysis

As we observe the market dynamics, we present a scenario plan that outlines potential movements for the coming hours.

Base Case: Currently, the market is oriented towards a bearish sentiment while trading below the 6950-6953 range. We anticipate a two-way trading environment within the 6928-6950 band, characterized by sharper price fluctuations than typically expected as we approach year-end.

Bullish Scenario: A definitive reclaim and sustained trading above 6953.50 would open pathways for an upward movement into the 6958-6961 range, and potentially to the psychological level of 6969-6970 thereafter.

Bearish Scenario: Conversely, a significant breach below 6928.25 could trigger a cascade towards 6926.25, followed rapidly by 6918.00. Should selling pressure intensify, the 6900 mark may become the next focal point for traders.

SETUP 1 (A++) - Long - Reclaim and go (support to value)

Entry

• Buy 6934.00-6935.00 (only after the reclaim hold is visible)

Hard SL

• 6925.75 (below 6926.25, with extra buffer)

Targets

• TP1 6953.50

• TP2 6957.75

• TP3 6961.50

SETUP 2 (A++) - Short - Rejection fade from upper cap (premium to PDL)

Entry

• Sell 6956.75-6958.00

Hard SL

• 6964.00 (above the 6961.50/6960.75 cap with buffer)

Targets

• TP1 6940.75

• TP2 6930.00

• TP3 6918.00

Good Luck !!!

ES (SPX, SPY) Analysis, Key Zone, Setups for Fri (Dec 26)Market Overview: Context for Tomorrow

Trend Analysis: The market maintains a risk-on sentiment as we approach the holiday period, characterized by strong index performance accompanied by light trading volume. This condition often results in a “grind up or chop up” scenario, although we may witness abrupt price movements due to diminished liquidity.

E-mini S&P 500 (ES) Positioning: Currently, prices are situated in the upper range of the recent swing high, indicating a premium area. This positioning heightens the probability of a retracement towards mid-range levels before any further upward momentum takes place.

Looking Ahead to Tomorrow: Investors should anticipate one of two scenarios: (a) a decisive dip that finds support at the Volume Weighted Average Price (VWAP) or Value Area Low (VAL), followed by a re-acceleration towards the Previous Day High (PDH) or Value Area High (VAH), or (b) a definitive rejection at the PDH/VAH that results in a retracement back to the VWAP/VAL zone.

Event Risk - Friday Schedule (ET):

Macro Releases: No major U.S. economic data is scheduled for release tomorrow.

Notable Item: The NY Fed Staff Nowcast will be published at 11:45 a.m. ET, though it typically produces limited market impact relative to key indicators like CPI or NFP.

Implications for the Market: With fewer scheduled economic shocks on the calendar, we can expect a market environment driven more by trading flows than by significant data releases, indicative of a "holiday hangover" effect.

New York Session Forecast

As we head into the New York trading session, the anticipated price path for the day suggests a cautious approach.

The primary range rotation is centered around key levels at 6982.50 (Y-POC) and 6976.75 (VWAP). We expect two-way trading to persist within the confines of 6971.50 to 6988.50 until we see a clearer indication of cash volume dynamics in New York.

Bullish Scenario:

In a bullish scenario, we would need to maintain support in the range of 6976.75 to 6971.50 on any pullbacks. A sustained rally would then target upward moves, aiming for 6988.00 to 6988.50. A decisive break above 6988.50 could trigger a significant advance towards the 6996 to 7000 range.

Bearish Scenario:

Conversely, if we experience a failed attempt to break into the 6988.00 to 6996 area—indicative of a lack of acceptance—we may see a pullback towards 6976.75. A breach of the critical support at 6971.50 could lead to testing lower levels at 6962.75 and 6957.25.

A++ SETUP 1 - LONG (pullback reclaim)

Entry: 6976.75-6971.50

Trigger: 15m tags pocket and closes back above 6976.75 -> 5m higher-low -> 1m pullback holds then push

SL: 6966.00

• TP1: 6988.50

• TP2: 6996.00-7000.00

• TP3: 7006.00-7012.00

A++ SETUP 2 - SHORT (top rejection)

Entry: 6988.00-6996.00

Trigger: 15m pushes into band then closes back below 6988.50 -> 5m lower-high -> 1m pullback fails then drop

SL: 6999.00

• TP1: 6971.50

• TP2: 6962.75

• TP3: 6957.25

Good Luck !!!

ES (SPX, SPY) Analysis, Key Zones, Setups for Wed (Dec 24th)Market Overview: Insights from Today's Trading

U.S. equities closed higher once again, reaching fresh highs primarily driven by large-cap technology and AI stocks, although broader market participation appeared mixed. The momentum was fueled by stronger-than-expected Q3 GDP data, which, combined with a dip in consumer confidence, suggests that economic growth may remain robust even as interest rates trend lower in the future. As we approach the holiday season, thinner liquidity in the markets is becoming increasingly relevant, often resulting in subdued trading activity punctuated by abrupt moves in response to key economic releases.

Analyzing the structure, the E-Mini S&P 500 (ES) is positioned in the upper range of recent trading and is approaching a notable overhead supply zone, characterized by the recent swing highs. The recent upward movement was significant, demonstrating a rapid recovery from the low 6900s to the mid-to-high 6900s; however, the price is currently stalling beneath a well-defined resistance level. This scenario typically leads to one of two potential developments:

1. A prolonged period of consolidation beneath the resistance, followed by a sharp breakout, often triggered by key economic data released at 8:30 AM.

2. A failure to maintain support at mid-range levels, which could result in a downward rotation toward previous demand zones, commonly aligning with metrics such as VWAP, Y-VAL, or PDL.

Market Update: Key Economic Indicators and Early Closures

This Wednesday, investors should pay close attention to the following economic releases:

- 8:30 AM ET: Initial Jobless Claims report, adjusted for the holiday schedule.

- 8:30 AM ET: Advance Durable Goods Orders and the Philly Fed Non-Manufacturing Survey will also be released.

- 11:30 AM ET: Weekly Economic Index will provide additional insights into economic trends.

Please note that equity markets will close early at 1:00 PM ET, while bond markets are set for an even earlier close at 2:00 PM ET.

In noteworthy news from the energy sector, the EIA Weekly Petroleum Status Report will not follow its regular schedule this week. The next anticipated release is slated for December 29, 2025.

Overnight Forecast into the NY Session

Base Case Scenario:

Expect a period of consolidation overnight, with prices likely fluctuating within the range of 6948 to 6964. The key moment will come during the 8:30 AM ET data announcement, which should provide a clearer directional bias. If the support level at 6948-6938 holds through this data window, we anticipate another attempt to test the resistance levels at 6963.75 and 6968.75. However, a failure to surpass 6968.75 typically leads to a retraction back towards the 6947-6943 region, with a potential dip to 6938.

Upside Potential:

A decisive push above 6968.75, particularly if it sustains on a pullback rather than merely wicking through, could pave the way for movement toward the 6985-7000 range. Given that tomorrow marks a shortened trading session, these higher targets may be more suitable for “runner” strategies unless we see significantly robust momentum.

Downside Risk:

Conversely, if the 6938.50 level gives way and fails to rebound swiftly, the market is likely to rotate towards the 6919-6913 zone. This area represents the initial support level where buyers may have a viable opportunity to regain control.

A++ Setup 1 - Short rejection from the top

Entry: 6962.50-6966.00 (only after a test into 6963.50-6968.75 fails and price closes back below 6963.75)

Stop: 6974.25

TP1: 6943.50

TP2: 6938.50

TP3: 6919.25-6918.75

A++ Setup 2 - Long breakout and hold

Entry: 6970.50-6972.25 (only after a 15m close above 6968.75, then a pullback that holds above 6963.75)

Stop: 6961.75

TP1: 6998.75-7000.00

TP2: 7012.50

TP3: 7036.75-7040.00

If you enjoy our analysis, please consider boosting and sharing our post.

Good Luck !!!

ES (SPX, SPY) Analysis, Levels, Setup for Tue (Dec 23rd)MARKET OVERVIEW: Key Highlights of the Day

Investor sentiment remained resilient as equity markets advanced ahead of a holiday-shortened trading week, with large-cap technology and AI-related stocks driving the momentum. This robust performance sets a positive tone as we approach year-end. Notably, hard assets, particularly gold and silver, displayed continued strength, indicating that investors are still seeking hedges amid a rising equity environment. Meanwhile, oil prices remain sensitive to geopolitical developments. Interest rates held steady without causing significant disruptions.

For the E-mini S&P 500 (ES), the overarching trend remains upward; however, the holiday trading environment can lead to choppy price movements. Currently, the ES is testing the upper boundary of its range, making this nearby resistance level a critical point to watch as we progress into overnight trading and the New York session.

Nvidia's stock rose over 1% following a Reuters report indicating that the company plans to start shipping its H200 chips to China by mid-February. Micron Technology experienced a surge of approximately 4%, while Oracle's shares climbed more than 3%. This movement underscores Nvidia’s profound impact, as it now makes up a remarkable 8% of the S&P 500, marking the highest concentration for a single stock in over fifty years. Institutional investment flows continue to be fueled by ongoing developments in AI infrastructure.

The Federal Reserve concluded its December meeting with a 25 basis point reduction in the federal funds rate, adjusting it to a range of 3.50% to 3.75%. This marks the third consecutive rate cut, bringing rates to their lowest since November 2022. Notably, the committee exhibited a divide, with three members dissenting against the cut, reflecting the most disagreement since September 2019. The updated "dot plot" suggests only one additional 25 basis point cut in 2026, followed by another in 2027.

Equity markets have successfully recovered their December losses, positioning the S&P 500 for what could be its eighth consecutive month of gains, the longest winning streak since 2018. On Monday, nearly 400 stocks within the index posted gains as it approached record highs. Historically, the so-called Santa Claus rally has yielded positive results about 80% of the time, averaging a gain of 1.6% since 1928.

TOMORROW - EVENTS TO RESPECT (ET)

08:30 - GDP (Q3 estimate) + Corporate Profits

08:30 - Durable Goods (advance report)

10:00 - Consumer Confidence

10:00 - New Home Sales

16:30 - API crude oil inventory

Liquidity note: shortened week continues - moves can be sharp, then stall quickly.

NY PATH MAP: Overnight Analysis

The market is expected to navigate a range between 6908.50 and 6948.25. Notably, the “gravity pocket” is identified around the 6929.75 to 6925.75 range. Maintaining a position above 6920.50 is crucial for sustaining a bullish outlook. However, a decisive move between 6936.25 and 6948.25 would likely pave the way toward a target of 6983.00.

Bullish Scenario: For a bullish trajectory, it is imperative for the market to defend the 6920.50 level during the Asian and London trading sessions. A successful reclaim and sustain above 6948.25 in New York would open possibilities for a push towards 6983.00, with 7000.00 serving as an upper stretch target.

Bearish Scenario: On the downside, a rejection within the 6936.25 to 6948.25 range, coupled with a drop below 6908.50, would shift the odds in favor of a move towards 6891.00 to 6887.00. Continued selling pressure could then target levels between 6846.00 and 6840.00.

A++ SETUPS (Level-KZ 15/5/1 execution, two plays only)

A++ SETUP 1 - LONG - Break and hold above R1 (pop-and-go)

15m trigger: full body close above 6948.25

5m confirm: pullback holds 6948.25 and re-closes back above it

1m entry: buy 6946.75 to 6948.25 on the first pullback after the hold is proven

Hard SL: 6935.75

TP1: 6983.00

TP2: 7000.00

TP3: 7070.00

A++ SETUP 2 - SHORT - Rejection from R1 (pop-and-fail)

15m trigger: push into 6936.25 to 6948.25, then 15m close back below 6936.25

5m confirm: re-test of 6933.50 to 6936.25 fails and 5m re-closes lower

1m entry: sell 6932.75 to 6934.25 on the first lower-high after the failure is proven

Hard SL: 6949.75

TP1: 6889.00 (middle of S1)

TP2: 6846.00

TP3: 6820.00

If you enjoy our analysis, please consider boosting and sharing our post.

Good Luck !!!

ES (SPX, SPY) Week-ahead Analysis (Dec 22-26)This week is notably shortened due to the holiday, resulting in thinner liquidity and heightened volatility. Market participants should prepare for an early close on Wednesday, December 24, with the markets remaining shut on Thursday, December 25. Normal trading hours will resume on Friday, December 26.

Investors should approach breakouts with caution, demanding clearer confirmations at critical levels and exercising stricter time stops.

Multi-Timeframe Analysis (ES)

Weekly Overview:

The broader trend remains upward, suggesting that the larger swing is constructive; however, prices are testing a weekly supply cap near recent highs, entering a premium zone. Momentum has tempered from previous peaks, raising the risk of a "grind and fade" scenario rather than a straightforward continuation.

The market is currently experiencing a rebound leg, yet it is now hitting a daily supply band overhead, where previous selling pressure originated. Upside potential is limited by the upper band near prior highs, while downside risk is anchored by the last swing base and value areas below.

The most recent movement displays an impulsive rally from a base, followed by a controlled pause - though it does not indicate a full reversal at this stage. As long as pullbacks remain above the recently established reclaim shelf (mid to high 6800s), current price action is indicative of "healthy digestion." A breach below this shelf could signal a deeper correction.

1-Hour Context (Intraday):

Prices are currently positioned in the upper range of the recent trading day, approaching key overhead levels. This presents a pivotal moment for either a breakout continuation or a potential failure.

Momentum/Oscillator Analysis (Weekly + Daily):

- Weekly Perspective: Momentum is currently in a neutral zone—not excessively overbought, yet not undervalued either - as it has eased from earlier peak levels.

- Daily Perspective: Momentum has improved off the lows and is showing upward curvature, indicating that dips are being supported; however, the presence of overhead supply may lead to rapid stalls in momentum.

The key trend delineation, or "line in the sand," for market observers currently stands at 6760.

For trading positions resting above this benchmark, any pullbacks can still be classified as "corrections within an overarching uptrend." This suggests that the bullish sentiment remains intact as long as the market holds above this critical threshold. Conversely, a decisive move below 6760 - particularly if there’s acceptance level would signal potential damage to the rebound narrative, indicating that the market is showcasing areas of diminished demand.

NQ Intraday Reference Map:

For the Nasdaq (NQ), immediate resistance is noted between 25600 and 25645, aligning with prior highs and current push zones, followed by further resistance at 25800 to 26000, which serves as the next magnet zone for traders.

On the support side, key levels to watch include 25592 to 25568, which represents a value shelf, descending to the levels of 25504, and further extending to 25393 to 25357, marking the prior day’s low pocket. Should the market breach these levels, the overnight low at 25210 will be significant in assessing downward momentum.

Volatility Metrics Overview

VIX Analysis

The VIX has been trading in the mid-teens recently, with a notable decline observed late last week, indicating a growing risk appetite among investors, albeit with a continued sensitivity to market headlines. FRED's latest reported close was at 16.87 on December 18. However, a subsequent market data feed indicated a significant drop on December 19, with a low/close around 14.91. The takeaway here is that a lower VIX tends to support dip-buying strategies; however, sudden spikes in the VIX during a holiday week often result in sharp mean-reversions.

Rates Volatility - MOVE Index

The MOVE index is currently sitting at approximately 59, indicating a low-to-moderate level of stress in the rates market. This suggests that there is no acute funding stress present, which typically supports equities by mitigating the risk of disorderly sell-offs.

Tail Risk Pricing - SKEW Index

The SKEW index remains elevated in the mid-150s range. This suggests that while the market is not experiencing daily panic, investors are willing to pay a premium for crash insurance, indicating a cautious approach to tail risks.

Options and Positioning

The put/call ratios indicate a measured market sentiment, with the total put/call ratio currently at approximately 0.88 (based on a 10-day moving average), suggesting a balanced approach rather than extreme fear. On a daily basis, the total put/call ratio hovers around 0.86, while the equity put/call ratio is more subdued at about 0.59.

From a qualitative perspective, the VIX trading in the mid-teens, coupled with stable put/call ratios, suggests that dealers are likely positioned closer to long gamma in this range, indicating potential for pinning and mean-reversion behavior unless an external macro catalyst disrupts the current balance. This observation, while not rooted in explicit positioning reports, draws from the context provided by volatility and options data.

Market Breadth and Internals

The NYSE breadth snapshot reveals a positive market internal dynamic, with 1,424 advancing issues versus 1,338 declining, yielding a net advance of 86. The McClellan Oscillator stands at approximately +12.8, indicating that market breadth is not experiencing significant deterioration. Current data suggests we are witnessing a “minor wobble/digestion” phase rather than a full-blown distribution cascade.

Credit and Funding Environment

In the realm of credit markets, US high yield option-adjusted spreads (OAS) are around 2.95%, indicating a tight and orderly credit environment. The NAV of HYG is approximately 80.24, while JNK trades close to 96.82. These observations suggest that the credit markets are not currently signaling a risk-off narrative. However, any rapid widening of spreads may be interpreted as an indicator of shifting sentiment toward a more cautious stance.

Sentiment and Crowd Positioning

The latest reading from the AAII survey reflects a balanced sentiment landscape, with about 44% bullish, 23% neutral, and 33% bearish positions. This lack of overwhelming fear suggests reduced potential for a sustained market squeeze driven solely by under-positioning, unless the price action returns decisively above previous highs.

Cross-Asset and Global Risk Tone

In the cryptocurrency markets, Bitcoin is trading around $88,600, while Ethereum is near $3,000. This firmness in crypto typically aligns with a risk-on sentiment but may also serve as a precursor to heightened volatility should macro developments arise.

Lastly, recent trading has showcased strength in the Nasdaq and tech sectors. Should the Nasdaq (NQ) begin to underperform relative to the S&P 500 (ES) at these elevated levels, it may serve as an early warning signal for a potential fade in risk appetite.

MACRO AND DATA-CALENDAR (EVENT RISK)

Key US Economic Releases This Week (ET)

Monday, December 22

No significant economic data scheduled for release.

Tuesday, December 23

- 8:30 AM: Q3 GDP (delayed due to government shutdown)

- 8:30 AM: Durable Goods Orders (also delayed)

- 10:00 AM: Conference Board Consumer Confidence

Wednesday, December 24** *(Early market close at 1:00 PM ET)

- 8:30 AM: Weekly Jobless Claims

Thursday, December 25

Markets will be closed in observance of Christmas.

Friday, December 26

Markets will reopen with normal hours; however, no notable economic data is scheduled for release.

Event Impact Analysis:

- GDP and Durable Goods: Historically, these releases can lead to rapid volatility spikes, potentially mean-reverting if prices remain confined within established ranges. A breakout, however, could serve as fuel for further trends, particularly if it breaks through resistance levels R2/R3 or support levels S3/S4.

Good Luck !!!

- **Consumer Confidence:** This indicator typically influences equity markets based on growth expectations. A key point of analysis will be the NASDAQ index's reaction, which can provide a clearer picture of risk-on sentiment.

- **Jobless Claims on Early-Close Day:** Expect an increase in volatility, as lower liquidity may lead to exaggerated initial moves, potentially setting traps for traders.

As always, we advise close monitoring of these releases for potential market implications and trends.

ES (SPX. SPY) Analysis, Levels, Setups for Fri (Dec 19th)News + schedule

BoJ delivered a 25 bp hike to 0.75% - this can keep early-session volatility elevated via yen/carry-trade unwind and rate moves.

10:00AM Existing Home Sales (Nov), 10:00AM Michigan Consumer Sentiment (final).

ES is currently bracketed by a solid support level between 6820 and 6824 and a formidable resistance zone ranging from 6863 to 6872. Until either side manages to establish dominance with a convincing 15-minute close outside these boundaries, we can anticipate continued fluctuations and volatility within the midpoint range of 6840 to 6855.

A++ Setup 1 - LONG (Sweep-reclaim at the bottom)

Trigger (15/5/1): 15m sweep under 6820.50-6823.50 and close back above 6823.50 - 5m holds above 6823 - 1m first pullback that holds.

Entry: 6824.00-6826.00

Hard SL: 6810.75

TP1: 6854.50

TP2: 6863.00

TP3: 6872.00

A++ Setup 2 - SHORT (Rejection from the cap)

Trigger (15/5/1): 15m push into 6863-6872 and close back below 6863 - 5m fails to reclaim 6863 - 1m lower-high entry.

Entry: 6860.50-6862.50

Hard SL: 6870.75

TP1: 6842.25

TP2: 6823.25

TP3: 6811.75

Good Luck !!!

ES (SPX, SPY) Analysis, Key Levels, Setups for Thu (Dec 18)TOMORROW EVENT STACK (ET)

07:00 - Bank of England rate decision + statement

04:00 - Norges Bank rate decision (Norway)

08:15 - ECB policy statement release

08:30 - CPI (Nov) + Real Earnings (Nov)

08:30 - Initial Jobless Claims

08:30 - Philly Fed Manufacturing (Dec)

08:30 - ECB press conference begins (adds FX noise, CPI still dominates ES)

High-impact window: The peak whip risk occurs from 08:30 to 08:45 ET. After the market opens at 09:30, it often either continues the 08:30 trend or reverses back to fair value.

October CPI Release and Its Implications

The absence of the October CPI data from the Bureau of Labor Statistics (BLS) introduces significant complexity to the upcoming November CPI release. Notably, the November figures will omit certain one-month percent changes due to the missing October data. This gap is likely to lead to increased volatility in market reactions, as traders may rely more heavily on year-over-year comparisons and overarching narratives. It's important to emphasize that this presents a data-quality risk rather than a straightforward price forecast.

Current projections from Reuters indicate a CPI rise of 0.3% month-over-month, with a year-over-year increase of 3.1%. Additionally, core CPI is expected to mirror this 0.3% monthly change, while the year-over-year core figure is anticipated to remain at 3.0%. These benchmarks represent the market's baseline, and any significant deviation—either a miss or beat—could trigger a pronounced market reaction.

Navigating Market Dynamics: A Practical Guide for E-mini S&P Traders

- Hot Scenario: A core CPI increase of 0.4% or more, or any unexpected data that raises inflation concerns, is likely to drive yields upward. In this case, E-mini S&P futures may see selling pressure on initial rebounds, as traders react to renewed inflation fears and test support levels.

- Cool Scenario: Conversely, if the core CPI prints at 0.2% or below, or if there’s a clear downside surprise against expectations, we might witness a drop in yields. This scenario could facilitate a breakout for E-mini S&P futures, allowing for upward progression through resistance levels as shorts are squeezed.

- In-Line Scenario: The market may react chaotically to the initial news, but typically, direction stabilizes upon the first pullback following the 09:30 cash market open.

To ensure effective trading during the CPI release, adhere to the following guidelines:

1. Avoid initiating new positions in the final 60 seconds leading up to the 08:30 release.

2. Establish four key reference points: the high and low of the pre-CPI trading range (08:20-08:29) and the high and low resulting from the CPI spike (08:30-08:33). These levels frequently serve as pivotal points for price action during the first 30 to 90 minutes of trading post-release.

By keeping these dynamics in mind, traders can better navigate the potentially tumultuous waters of the upcoming CPI announcement.

Market Analysis: Short-Term Outlook

In the broader context, the recent trading action suggests a failure to maintain momentum after reaching the upper resistance band. The most recent price structure indicates a downward trend, with the market currently trading below key resistance levels. For upcoming sessions, this is critical; any attempts at upward movement will need to overcome the 6821-6835 range to signify a genuine reversal rather than mere corrective action.

On the 4-hour timeframe, we observe a distinct sell-off followed by a consolidation phase. There are several resistance zones left untested from the recent decline, which could hinder any potential rallies. The immediate resistance is located between 6812 and 6821, with a higher barrier at 6835. Should the price exceed 6835, it might have the potential to rally toward the 6865-6882 range.

The 1-hour perspective reveals a classic pattern characterized by a sharp decline followed by a basing phase. Notably, trading volume surged during the sell-off before tapering as prices stabilized near the close. This dynamic sets the stage for either a rebound toward immediate resistance levels or a further decline if the established support fails.

The oscillator is currently in a deeply oversold position, registering in the low teens and beginning to show signs of a potential upward turn. This development suggests some bounce potential, although it does not guarantee a trend reversal on its own. A credible shift in trend will require the price to reclaim the R1 resistance and maintain levels above R2.

Overnight Market Outlook: NY Session Forecast

Base Case Scenario (Pre-CPI): Anticipate a period of rotational trading between support level S2 at 6775.50 and resistance range R1 at 6812-6821.

Bullish Scenario: Should the market hold at S2, a reclaim of R1 would be crucial. A successful transition of R2 (6835) from a resistance level to a support floor could propel prices toward R3 (6865-6871), with the potential to reach 6882.50 if bullish momentum remains strong.

Bearish Scenario: Conversely, if the market slips below S2 and fails to reclaim the 6775.50 level, we could see a decline towards S3 at 6762, with a further slide to 6733.50 if selling pressure intensifies.

A++ Setup 1 - Short Position (Rejection at Resistance Level 1)

Entry Criteria: Monitor the market for a minimum of 30 minutes. The ideal entry is between 6816.00 and 6821.00.

- Stop Loss (SL): 6838.00

- Take Profit (TP) Targets:

- TP1: 6775.50

- TP2: 6762.00

- TP3: 6733.50

**Invalidation Point:** The setup will be invalidated if price sustains above 6835.00.

A++ Setup 2 - Long Position (Continuation through Resistance Level 2)

Entry Criteria: Again, monitor for a duration of at least 30 minutes. The target entry range is between 6830.00 and 6836.00.

- Stop Loss (SL): 6818.50

- Take Profit (TP) Targets:

- TP1: 6871.25

- TP2: 6882.50

- TP3: 6936.25

Invalidation Point: The trade will be considered invalid if there is a decisive drop back below 6821.50 after the reclaim action.

Good Luck !!!

ES (SPX, SPY) Analysis, Key Zones, Setups for Wed (Dec 17th)Market Update: ES Faces Critical Decision Point

The ES market is currently navigating a narrow “decision pocket” between 6850 and 6865, following a significant selloff and a subsequent bounce that has yet to establish a definitive trend. The situation is clear: buyers must defend the lower range of 6834 to 6817 to maintain market stability within this range. Conversely, sellers are focusing on the upper threshold between 6880 and 6892. With the Consumer Price Index report scheduled for release on Thursday morning, traders are likely to become more reactive, potentially taking profits swiftly and responding sensitively to any news regarding interest rates.

What can move ES tomorrow (high-impact catalysts, ET)

7:00 MBA Mortgage Applications - usually a modest mover, but it can nudge rates early.

8:15 Fed Governor Waller (Economic Outlook) - big rates sensitivity; ES can whip on any change in tone.

9:05 NY Fed President Williams - opening remarks at an NY Fed conference; still headline-capable.

10:30 EIA Weekly Petroleum Status Report - can move crude and inflation expectations, which can leak into ES.

11:00 Treasury buyback details (eligible bonds list) - rates pulse risk.

1:00 20Y Treasury auction (competitive bids) - one of the bigger intraday “rates steering wheel” moments.

1:40-2:00 Treasury buyback operation window - can add another yields swing in the early afternoon.

Macro and News Themes to Watch Ahead of Tomorrow’s Market

In the current environment, interest rates are proving to be the primary driver of market dynamics. Any increase in long-term yields exerts downward pressure on the equity markets, particularly when key indices like the S&P 500 are hovering near critical resistance levels.

The Federal Reserve's messaging remains notably inconsistent. While some officials are emphasizing the importance of maintaining inflation credibility and adopting a cautious stance towards future rate cuts, others suggest that monetary policy is already positioned effectively and anticipate a gradual cooling of inflation. This divergence creates a volatile atmosphere, leading to heightened market reactions surrounding Fed speeches.

On the geopolitical front, oil prices are responding to ongoing developments, particularly concerning Venezuela, which has raised supply-risk concerns. This uptick in crude prices has the potential to reinforce inflation narratives and influence equity market sentiment.

Additionally, the looming Bank of Japan (BOJ) meeting, where a rate hike is expected, adds another layer of complexity. Even ahead of this anticipated move, shifts in foreign exchange and global rates could significantly impact U.S. index futures and overall market positioning.

Overnight NY Market Forecast

Base Case Scenario: The market is expected to trade within a range of 6832.75 to 6880.50. Watch for potential retracements towards the 6849.00-6849.75 level, which appears to be a pivotal support point.

Bullish Scenario: Should the index manage to sustain a position above 6880.50, a decisive break above 6892.00 would likely drive prices towards 6936.25, a key resistance level.

Bearish Scenario: Conversely, a confirmed drop below 6817.50 would pave the way for a test of 6800.00 initially. If sellers maintain their grip on the market, further declines to 6767.75 and 6733.75 may follow.

A++ Setup 1 (Rejection Fade short from the upper shelf)

Entry: 6887.00-6891.75

Hard SL: 6896.25

TP1: 6863.50

TP2: 6849.75

TP3: 6834.50

A++ Setup 2 (Acceptance Continuation short under PDL)

Entry: 6814.50-6817.25

Hard SL: 6823.75

TP1: 6800.00

TP2: 6767.75

TP3: 6733.75

Good Luck !!!

ES (SPX, SPY) Analyses, Key Levels, Setups for Tue (Dec 16th)

As we head into Tuesday, ES is showing signs of structural weakness following a significant sell-off, culminating in a late dip into the 6845-6840 demand zone. The prevailing trend appears to be downward as long as prices remain beneath the resistance range of 6863-6874. However, the 6845-6840 support still has the potential to trigger a rebound. Traders should anticipate the most decisive price action around major data releases, followed by a phased, level-to-level approach in trading strategy.

EVENTS THAT CAN MOVE ES (ET)

2:00am UK labor data

3:15am-5:00am Eurozone PMI batch + ZEW sentiment window

8:30am US jobs data bundle + Retail Sales + Earnings + Unemployment

9:45am US Flash PMI

10:00am Business Inventories

4:30pm API oil stats (can hit energy tone into the close)

Market Outlook: NY Session Forecast

In the upcoming New York trading session, we anticipate a period of consolidation likely to include a modest rebound attempt. However, this upside movement is expected to face resistance within the range of 6859 and 6863-6874. Should sellers maintain pressure and keep prices below 6863 as we head into the session, we could see a subsequent pullback towards the 6845-6840 range, followed by a potential drop to 6825.

On the bullish side, if the market can decisively reclaim and sustain levels above 6874, we might open the door for a rally towards 6902 and possibly 6923.

Conversely, a clear breach below 6840 that lacks immediate recovery signals strengthens the bearish outlook, targeting 6825 initially, with the potential for a further decline to 6800-6790.

ES Short (A++) - Sell 6863-6874 - SL 6876.50 - TP1 6845-6840 TP2 6825 TP3 6800-6790

Key zones

Support - 6845-6840, 6825, 6800-6790

Resistance - 6851-6859, 6863-6874, 6902, 6923-6936

A++ Setup 1 - Short (ceiling fade)

Entry - Sell 6863-6866 after a rejection from 6863-6874

Stop - 6876.50 (above the rejection high)

TP1 - 6845-6840

TP2 - 6825

TP3 - 6800-6790

ES Long (A++) - Buy 6825 reclaim - SL 6814.25 - TP1 6863 TP2 6902 TP3 6923

A++ Setup 2 - Long (flush then reclaim)

Entry - Buy 6825-6828 only after price reclaims and holds above 6825

Stop - 6814.25 (below the flush low)

TP1 - 6863

TP2 - 6902

TP3 - 6923

Good Luck !!!

ES (SPX, SPY) Analysis, Levels, Setups for Wed (Dec 10th)Market Overview: