The Only Stop Loss and Take Profit Strategy You Need

This stop loss and take profit strategy is unique: being very efficient, safe and accurate , it can be applied for day trading, swing trading and scalping.

In this article, I will teach you how to easily place stop loss and target, applying just one basic technical tool.

Imagine that you are planning to open a trading position. You may decide to open a swing trade on a daily, a day trade on an hourly time frame, or a scalping trade on 15 minutes time frame.

For the sake of the example,

we will take a short position on GBPUSD on a daily,

a short position on NZDUSD on an hourly time frame,

and a long position on USDCHf on 15 minutes time frame.

In order to identify safe levels for TP and SL on GBPUSD, identify the closest key horizontal support and resistance on a daily time frame.

When you underline key structures, make sure that you consider the candle closes and the wicks , so that the key structure would represent the area .

Your safe stop loss will be strictly above the closest horizontal resistance,

while your target will be the upper boundary of a key horizontal support.

Selling NZDUSD on an hourly time frame, identify the closest key horizontal support and resistance on an hourly time frame.

Your safe stop loss will lie above a key resistance,

and your take profit will be the upper boundary of a key support.

Buying USDCHF on 15 minutes time frame, you do the same thing.

You identify the closest support and resistance.

Your safe stop loss will be below a key support, while your take profit will be a lower boundary of a key resistance.

Planning your trade, always remember to assess th e reward to risk ratio of your trade.

If the risk is bigger than the reward, such reward to risk ratio will be called negative .

Such a trade is better not to take.

While, the trade where reward exceeds risk will have a positive r/r ratio.

Such a trade we can take.

This stop loss and take profit placement technique is not perfect.

With experience, you will learn to set even safe stop loss and take profits, but for beginners, that is one of the safest strategies to follow.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Tradingforbeginners

DON'T TRADE THESE SUPPORTS AND RESISTANCES (FOREX GOLD)

When it comes to technical analysis,

the understanding of which support and resistance levels to not trade can be as important as knowing which ones to trade.

In this article, I will show you the structure levels that professional traders avoid to maximize their profits and minimize losses.

Invalidated support and resistance

Invalidated support/resistance is the structure that has a clear historical significance, but that lost its strength and was neglected by the market during the last 2 tests.

Have a look at that key horizontal support.

We can see that in the recent past, the price bounced from that multiple times, confirming its significance.

Then, the price suddenly broke and closed below that support.

According to the rules, that structure should turn into a resistance after a violation.

However, after its test, the price bounced and violated that to the upside.

The structure became invalid , and you should not trade that in future.

Resistance in a Bullish Trend

If the market is trading in a bullish trend, according to the rules its last higher high composes a key horizontal resistance.

USDJPY is trading in a strong bullish trend.

The price dropped once it set a new higher high higher close.

It composes a key horizontal resistance.

Always remember, that in a bullish trend, the price tends to set new higher highs and higher lows over time.

Quite often, the test of the level of the last high leads to a further bullish continuation and a formation of a new higher high.

For that reason, it is better not to trade such resistances.

Support in a Bearish Trend

In a bearish trend, the last lower low is always considered to be a key horizontal support.

Above is a price action on USDCHF.

The pair is bearish and recently set a new lower low.

It is a key horizontal support now.

However, in a bearish trend, the price tends to set a new low after a retracement. Most of the time, it does not respect the support based on the last lower low.

I recommend you not to trade such supports.

I always repeat to my students that key levels work, but they are not equal in their significance. While some of them are very strong, some are better to be avoided.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

How to Set a Stop Loss in Price Action Trading Forex Explained

Wrong stop loss is one of the main reasons why newbie traders lose money.

I will share with you a proven stop loss strategy for price action trading Forex.

I will explain how to identify a safe stop loss level for any chart part, trend line and a breakout that you trade.

Learn how to set a safe stop loss easily on any time frame and no matter whether you are day trading, scalping or swing trading.

To correctly put a stop loss for trading price action in forex market, first, let's discuss 2 major types of price action patterns that you should know.

Trend line based patterns

The first type of patterns is called trend line based patterns.

In this category, we put all the patterns where trend lines are used as entries or confirmations.

Here is the list of these patterns:

Rising/falling parallel channels,

Rising/falling wedges,

Rising/falling expanding wedges/channels.

For example, in a rising parallel channel, its support is a strong vertical structure. It provides a safe place to buy the market from.

Alternatively, its breakout will provide a strong confirmation to sell.

Horizontal neckline based patterns

The second type of patterns is called neckline based patterns.

In this category, we include all chart patterns that lie on a horizontal neckline.

A signal that we rely on to trade these patterns is a breakout of their necklines.

Here is the list of these patterns:

Double top/bottom,

Head and shoulders and inverted one,

Ascending/descending triangle,

Cup and handle and inverted one.

Here is how we set a stop loss in trend line based patterns.

If we buy the market from a support line of a wedge or a channel, expecting a growth, we will need to the last bearish movement from the high of the pattern to the point where it touches a support line - our entry.

Our safe stop loss will be 1.272 fibonacci extension (from its high to low) of this movement.

If we sell the market after a breakout of a support line of a wedge or a channel, we will take the last bearish movement from the high of the pattern to the low of a breakout candle.

Our safe stop loss will be 1.272 fibonacci extension (from its low to high) of this movement.

Look how it works in practice:

If we sell the market from a resistance line of a wedge or a channel,

we will take the last bullish movement from the low of the pattern to the point where it touched a resistance line.

Our safe stop loss will be 1.272 fibonacii extension (from its low to high) of this movement.

Look how it works in practice:

Here is a safe stop loss for selling USDJPY forex pair from a resistance of a falling wedge.

If we buy a bullish breakout of a resistance line of a wedge or a channel, we will take a bullish movement from the low of the pattern to a high of the breakout candle.

Our safe stop loss will be 1.272 fibonacci extension (from its high to its low) of this movement.

Here is how easily we can set a stop loss, using this strategy, buying a breakout of a resistance line of a falling channel on NZDUSD forex pair.

And here is how we set stop loss for neckline based patterns.

If we see a breakout of a neckline of a bearish pattern, and we want to sell, we will need to find a pattern range: a low of the neckline of the pattern and highest high of the pattern.

Based on that, we will draw fibonacci extension (from its lows to high).

Our safe stop loss will be 1.272 extension.

That is how we put a stop loss, using this method on EURUSD, trading head & shoulders.

If we buy a breakout of a neckline of a bullish pattern, our safe stop loss will be based on 1.272 extention (from high to low) of the range of the pattern - the highest high of the neckline and the lowest low of the pattern.

That is how a safe stop loss for a cup & handle pattern on EURUSD looks. I drew fib.extension from the neckline's high to pattern's low.

This simple method will help you to always put a safe stop loss.

Integrate that in your trading plan and avoid losses, trading price action.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

5 Elements of the Best Key Level in Forex, Gold Trading

What are the best key levels to trade?

This year I analyzed more than 1500 key structures on Forex, Gold, Crypto and Indexes.

In the today's article, I prepared for you a list of 5 elements of a perfect support and resistance for trading.

As always, remember that the best key levels are always on a daily time frame . So all the structures that we will discuss will be strictly on a daily .

Also, all the structures that I analyzed and traded are available on my TradingView page, so you can back test them by your own.

1. Clear historical significance

The structure that you spotted should act as a significant historical support or resistance.

Here are the important historical support and resistance that I spotted on USDCAD on a daily time frame.

2. Psychological significance

The structure that you identified should match with round numbers.

All the structures that we spotted on USDCAD match with psychological numbers.

3. Confluence with other technical tools

The best structure should align with other trading tools such as trend lines or Fibonacci levels , strengthening its significance.

After adding fibonacci levels and a significant falling trend line on the chart, the confluence was found in Resistance 6, Resistance 3, Resistance 2, Resistance 1, Support 2. Other structure does not match with technical tolls.

4. Volume

The level experiences high trading volumes, indicating strong participation and interest from market participants, especially smart money.

All the structures that we underlined show significant volume spikes. By volume spike, I mean a volume being higher than the average volume - a blue curve on volume.

5. Multiple touches

The more, the better. There are numerous instances where price has respected and reacted to the structure, confirming its strength (at least 2).

Only these 3 structures were confirmed by the multiple touches. These resistances will be considered the strongest ones.

That checklist will help you to identify the most significant structures from where you will be able to catch impulsive movement and make nice profits.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

6 Best Tips for Small Trading Accounts (Forex, Gold)

This useful trading tips will help you to efficiently start trading with a small trading account.

A quick note: by a small account, I mean an account size from 10$ - 2000$.

1 - Trade less often

Small account implies a limited amount of money for trading. It means that among dozens of trading opportunities that you spot during a trading day, you should carefully pick only the most promising ones.

I recommend opening maximum 3 trades per day.

2 - Stick to one strategy

One of the ways to trade less frequently is to stick to one single trading strategy. Most of the traders do completely opposite: instead of focusing on one approach, they prefer to trade multiple ones simultaneously.

Trading various strategies requires a lot of capital. The more strategies you follow, the more margin is needed.

With a small trading account, you are risking being left without a free margin for all the trading opportunities that the strategies provide.

3 - Trade liquid instruments with low spreads

When you are picking the financial instruments for your trading, make sure that you select the most liquid ones. You can assess the liquidity of the instrument by a spread. The bigger is the spread, the less liquid is the asset.

Take a look at a spread difference between EURUSD and CHFJPY.

The spread on EURUSD is 0.1 pip.

While the spread on CHFJPY is 2.7 pips.

Spreads directly affect the costs of trading. Bigger spreads reduce the potential profits and increase the risks.

Make sure that you choose the assets with the lowest spreads possible.

4 - Shorten the list of trading instruments

One more option to trade less often is to narrow down the list of your trading instruments. I recommend choosing the maximum of 7 instruments.

7 USD Major Forex Pairs:

EURUSD,

GBPUSD,

USDJPY,

USDCAD

NZDUSD

AUDUSD

USDCHF

is a perfect watch list for a small account trader.

5 - Don't trade higher time frames

Be careful when deciding a time frame to trade.

Remember that the higher is the time frame, the bigger are the stop losses for your traders.

On the left chart is the swing trade that I took with my students on EURUSD chart on a daily. While on the right is the scalping trade taken on 30 minutes time frame.

A stop loss for swing trade is 90 pips and a stop loss of scalping position is 19 pips.

Big stop losses require more free margin and limit the amount of the trades that you can take simultaneously.

For that reason, prioritize lower time frame trading with a small trading account.

6 - Don't risk more than 2% per trade

When traders trade with a small trading account, they often risk a huge portion of their trading account per a single trade.

If you have 100$ trading account, and you risk 20$ per trade, the nominal value of that risk does not look huge. But from a percentage standpoint, it is 20% of the total balance.

Just a 5 trades losing streak will blow such an account.

Make sure that you apply a position size calculator and risk no more than 2% of your account per trade.

Following these recommendations, you will be able to build an effective trading plan that will help you to grow your capital quickly.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn 2 Essential Elements of Forex Gold Trading

In the today's post, we will discuss how Forex Gold trading is structured, and I will share with you its 2 key milestones.

Trading with its nuances and complexities can be explained as the interconnections of two processes: trading rules creation and trading rules following.

1️⃣ With the trading rules, you define what you will trade and how exactly, classifying your entry and exist conditions, risk and trade management rules. Such a set of consistent trading rules compose a trading strategy.

For example, you can have a following trading plan:

you trade only gold, you analyze the market with technical analysis,

you buy from a key support and sell from a key resistance on a daily, your entry confirmation is a formation of a reversal candlestick pattern.

You set stop loss above the high/low of the pattern, and your target is the closest support/resistance level.

Here is how the trading setup would look like.

In the charts above, all the conditions for the trade are met, and the market nicely reached the take profit.

2️⃣ Trading strategy development is a very simple process. You can find hundreds of different ones on the internet and start using one immediately.

The main obstacle comes, however, with Following Trading Rules.

Following the rules is our second key milestone. It defines your ability to stay disciplined and to stick to your trading plan.

It implies the control of emotions, patience and avoidance of rationalization.

Once you open a trade, following your rules, challenges are just beginning. Imagine how happy you would feel yourself, seeing how nicely gold is moving to your target after position opening.

And how your mood would change, once the price quickly returns to your entry.

Watching how your profits evaporate and how the initially winning position turns into a losing one, emotions will constantly intervene.

In such situations, many traders break their rules , they start adjusting tp or stop loss or just close the trading, not being able to keep holding.

The ability to follow your system is a very hard skill to acquire. It requires many years of practicing. So if you believe that a good trading strategy is what you need to make money, please, realize the fact that even the best trading strategy in the world will lose without consistency and discipline.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn the 3 TYPES of MARKET ANALYSIS in Gold Forex Trading

In the today's post, we will discuss 3 types of analysis of a financial market.

🛠1 - Technical Analysis

Technical analysis focuses on p rice action, key levels, technical indicators and technical tools for the assessment of a market sentiment.

Pure technician thoroughly believes that the price chart reflects all the news, all the actions of big and small players. With a proper application of technical strategies, technical analysts make predictions and identify trading opportunities.

In the example above, the trader applies price action patterns, candlestick analysis, key levels and 2 technical indicators to make a prediction that the market will drop to a key horizontal support from a solid horizontal resistance.

📰2 - Fundamental Analysis

Fundamental analysts assess the key factors and related data that drive the value of an asset.

These factors are diverse: it can be geopolitical events, macro and micro economic news, financial statements, etc.

Fundamental traders usually make trading decision and forecasts, relying on fundamental data alone and completely neglecting a chart analysis.

Price action on Gold on a daily time frame could be easily predicted, applying a fundamental analysis.

A bearish trend was driven by FED Interest Rates tightening program,

while a strong bullish rally initiated after escalation of Israeli-Palestinian conflict.

📊🔬 3 - Combination of Technical and Fundamental Analysis

Such traders combine the principles of both Technical and Fundamental approaches.

When they are looking for trading opportunities, they analyze the price chart and make predictions accordingly.

Then, they analyze the current related fundamentals and compare the technical and fundamental biases.

If the outlooks match , one opens a trading position.

In the example above, Gold reached a solid horizontal daily support.

Testing the underlined structure, the price formed a falling wedge pattern and a double bottom, breaking both a horizontal neckline and a resistance of the wedge.

These were 2 significant bullish technical confirmation.

At the same time, the escalation of Israeli-Palestinian conflict left a very bullish fundamental confirmation.

It is an endless debate which method is better.

Each has its own pros and cons.

I strongly believe that one can make money mastering any of those.

Just choose the method that you prefer, study it, practice and one day you will make it.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

What is Dynamic Support and Resistance Levels & Zones in Forex

Dynamic supports and resistances play a crucial role in technical analysis.

Unlike classic supports and resistances, these zones change and adapt to a market price action in real time.

Learn what is dynamic support and resistance in Forex, Gold trading and how to find it easily.

Discover its main types and real market examples.

Let's start with the basics.

There are 2 major types of supports and resistances in technical analysis.

The first type is called static .

Such supports and resistances are fixed and don't change with time.

It should be strictly horizontal key levels or the zones.

Market price action and momentum beyond them do not affect these supports and resistances.

In the example above, you can find static supports and resistances on Gold. The market may return to one of those levels or the zones today, tomorrow or in a month, but it will not move.

In comparison to static supports and resistances, the dynamic ones shift with time. They constantly change and adjust as the time flies.

One of the obvious types of dynamic supports and resistances is a trend line.

Above is the example of a dynamic rising support based on trend line.

As the time goes, a support shifts and becomes higher and higher.

I found a great example of a dynamic resistance on Dollar Index.

Depending on the moment when the price tests that, the resistance will be on different levels.

The later the price tests the trend line, the lower is the resistance.

When newbie traders learn dynamic supports and resistances, they usually stop on trend lines.

But it is just a beginning.

Really significant dynamic supports are resistances will be the zones .

The areas based on static horizontal supports and resistances and trend lines.

Examine a price action on GBPCHF forex pair.

We have a static horizontal support area and a dynamic rising trend line.

Two supports intersect, composing a contracting dynamic support zone.

With time, it will become narrower, accumulating buy orders within.

On NZDCAD forex pair, I underlined a contracting dynamic resistance zone that is based on an intersection of a static horizontal resistance area and a falling trend line.

Selling orders will be distributed within.

The 2 dynamic support and resistance zones that we discussed are narrowing , but that is not always the case.

A dynamic support zone that I found on GBPNZD is expanding and broaden with time.

It is based on a dynamic falling trend line and a static horizontal support.

With time its boundaries will be wider and a bullish reaction may initiate from any level within that.

A dynamic resistance area that I spotted on EURCAD forex pair is a great example of an expanding resistance.

It is based on a static horizontal resistance and a rising trend line.

We can easily recognize how it grows with time.

Of course, another types of dynamic supports and resistances exist. But they are more nuanced and rare.

As soon as you learn to recognize the clusters that we discussed in this article, you will be able to recognize the less obvious ones as well.

Next time, when you execute a support and resistance analysis, try to find a dynamic zone. You can find it on any time frame, and forex pair and gold, and it will completely change your perspective on the market.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

9 Essential TIPS For Newbie Traders (Learn from my Mistakes!)

In the today's article, I will reveal trading secrets I wish I knew when I started trading.

1️⃣ Forget about becoming a pro quickly

Most of the traders believe, that you can learn how to trade easily and that it takes a very short period of time in order to master a profitable trading strategy.

The truth is, however, that trading is a long journey.

I spent more than 3 years, trying different strategies and looking for a profitable technique to trade. Once I found that, it took more than a year to polish a trading strategy and to learn how to apply that properly.

Be prepared to spend YEARS before you find a way to trade profitably.

2️⃣ Focus on One Strategy

While you are learning how to trade you will try different techniques, tools and strategies. And the thing is that newbies are trying multiple things simultaneously. The more strategies you try at once, the more setups you have on your chart. The more setups you have on your chart, the more complex and difficult is your trading.

Remember that in this game, your attention is the key.

You should meticulously study each and every trading setup.

For that reason, I highly recommend you to focus on one strategy, one approach, one technique. Test it, try it and look for a new one only when you realize that it doesn't work.

Here is the example how the same price chart can provide absolutely different trading opportunities depending on a trading strategy.

Price action pattern trader would recognize a lot of a patterns, while indicator based trader could spot absolutely different bullish and bearish signals.

Now, try to imagine how hard it would be to follow both strategies simultaneously.

3️⃣ Start with small capital that you can afford to lose

You will lose your first trading deposit and, probably, the second one and potentially the third one as well.

Losses are the only way to learn real trading. While you are on a demo account, you feel like a king, but once you start risking your savings, the perspective completely changes .

For that reason, make sure that you trade with an account that you can afford to lose. The fact of blowing such an account should be unpleasant, but that should not affect your daily life.

4️⃣ Use stop loss

I am doing trading coaching for more than 4 years.

What pisses me off is that the main reason of the substantial losses of my mentees is the absence of stop loss. Why can it be if naturally everyone: from your broker to Instagram trading gurus repeat that day after day.

Set stop loss, know in advance how much you risk per trade, and know the exact level on a price chart where you become wrong.

Imagine what could be your loss, if you shorted USDJPY and hold the trade while the market kept going against you.

5️⃣ Forget about getting rich quick

That is the iconic fallacy. I believe that around 90% of people who come in this game want to get rich quick , want easy money.

And no surprise, when I share a trading setup in my free telegram channel, and it loses I receive dozens of messages that I am a scammer.

People truly believe that professional trading implies 100% win rate and quick and easy money.

The truth is, traders, that trading is a very tough game. And with a good trading strategy, you have just a little statistical edge that will give you the profits that would slightly overcome your losses.

6️⃣ Train your eyes

Professional trading implies pattern recognition: it can be some technical indicators pattern, the price action or candlestick formation, etc.

Your main goal as a trader is to learn to identify these patterns.

Pattern recognition is a hard skill to acquire.

You should spend dozens of hours in front of the screen in order to train your eyes to identify certain patterns.

Here is how many patterns you would spot on GBPUSD chart, paying close attention.

7️⃣ Track and analyze your trades

Study all the trades that you take, especially the losing ones.

Look for mistakes, look for the reasons why a certain setup played out and why a certain one didn't. Journal your trades and make notes.

8️⃣ Don't use technical indicators

Newbies believe that technical indicators should do the work for them.

They are constantly looking for one or a bunch that will accurately show where the market will go.

However, I always say to my mentees that technical indicators make the chart messy and distract.

If you just started trading, focus on a naked chart, learn to analyze the market trend, key levels, classic price action patterns.

Learn to make accurate predictions relying on a price chart alone.

Only then add some technical indicators on your chart.

They won't do the work for you, but will help you to slightly increase the accuracy of a certain setup.

Above is the classic chart of a newbie trader.

A lot of indicators and a complete mess

The same chart would look much better without technical indicators.

9️⃣ Find a Mentor

There are hundreds of trading mentors on Instagram, YouTube, TradingView. Find the one with a trading style that you like.

Follow him, learn from his trading experience, listen to his trading recommendations.

11 years ago I found a guy on YouTube, his name was Jason.

I really liked his free teachings, and they were meaningful to me.

I decided to purchase his premium coaching program.

It was 200$ monthly - a huge amount of money for me at that time.

However, with his knowledge I saved a lot, I learned a lot of profitable techniques and tricks that helped me to become a professional forex trader.

Of course, this list could be much bigger.

The more I think about different subjects in trading, the more important tips come to my mind. However, I believe that the tips above are essential and I truly wish I knew all that before I started.

I hope that info will help you in your trading journey!

Good luck to you.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn 6 Common Beginner Trading Mistakes (FOREX, GOLD)

In the today's post, we will discuss very common beginner's mistakes in trading that you should avoid.

1. No trading plan 📝

That is certainly the TOP 1 mistake. I don't know why it happens but 99% of newbies assume that they don't need a trading plan.

It is more than enough for them to watch a couple of educational videos, read some books about trading and Voilà when a good setup appears they can easily recognize and trade it without a plan.

Guys, I guarantee you that you will blow your trading account in maximum 2 months if you keep thinking like that. Trading plan is the essential part of every trading approach, so build one and follow that strictly.

2. Overtrading 💱

That mistake comes from a common newbies' misconception: they think that in order to make money in trading, they should trade a lot. The more they trade, the higher are the potential gains.

The same reasoning appears when they choose a signal service: the more trades a signal provider shares, the better his signals are supposed to be.

However, the truth is that good trades are very rare and your goal as a trader is to recognize and trade only the best setups. While the majority of the trading opportunities are risky and not profitable.

3. Emotional trading 😤

There are 2 ways to make a trading decision: to make it objectively following the rules of your trading plan or to follow the emotions.

The second option is the main pick of the newbies.

The intuition, fear, desire are their main drivers. And such an approach is of course doomed to a failure.

And we will discuss the emotional trading in details in the next 2 sections.

4. Having no patience ⏳

Patience always pays. That is the trader's anthem.

However, in practice, it is extremely hard to keep holding the trade that refuses to reach the target, that comes closer and closer to a stop loss level, that stuck around the entry level.

Once we are in a trade, we want the price to go directly to our goal without any delay. And the more we wait, the harder it is to keep waiting. The impatience makes traders close their trades preliminary, missing good profits .

5. Greed 🤑

Greed is your main and worst enemy in this game.

It will pursue you no matter how experienced you are.

The desire to get maximum from every move, to not miss any pip of profit, will be your permanent obstacle.

Greed will also pursue you after you close the profitable trades. No matter how much you win, how many good winning trades you catch in a row, you always want more. And that sense main lead you to making irrational, bad trading decision.

6. Big Risks 🛑

Why to calculate lot size for the trade?

Why even bother about risk management?

These are the typical thoughts of the newbies.

Newbie traders completely underestimate the risks involved in trading and for that reason they are risking big.

I heard so many times these stories, when a trading deposit of a trader is wiped out with a one single bad trade.

Never ever risk big, especially if you just started.

Start with a very conservative approach and risk a tiny little portion of your trading account per trade.

Of course there are a lot more mistakes to discuss.

However, the ones that I listed above at the most common

and I am kindly recommending you to fix them before you start trading with a substantial amount of money.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

How Forex Brokers Manipulate Your Trading. Real Examples

Your Forex broker could be manipulating your trades right now - and you would not even know it.

They can rig your charts, trap you in losing trades and steal your money.

In this article, I will expose how they do it, I will show you a real example how broker's manipulations can lead to bad trading decisions and significant losses.

What I’m about to show you will change the way you trade forever, and you’ll never look at your trading charts the same way again.

The story started with a trading live stream in my academy with my students.

We spotted a nice setup to trade.

We found a strong 4H support on Silver with a confirmed liquidity grab after its test.

As a confirmation, we identified a cup & handle pattern on an hourly time frame and a breakout of its neckline with a bullish imbalance.

When I got my entry signal, I opened my trading terminal to execute the trade.

And the way I trade is very specific: I use TradingView for chart analysis BUT I have a separate trading terminal for trade execution.

When I opened the same setup in my trading terminal, I saw a completely different picture and a strong bearish signal.

The broker that I use for technical chart analysis is OANDA , while my trading terminal uses ICMarkets quotes.

On the right is the price chart of SILVER with IC.

There we can see a valid breakout and a candle close below the support with its consequent retest.

From a price action perspective, it is a strong signal to sell .

I got a strong feeling that some kind of manipulation is going on here, so I decided to check Silver charts of other brokers.

Only the broker that I used for market analysis on TradingView provided a bullish signal, while other brokers had very bearish charts on Silver.

It looked very suspicious and felt like OANDA broker was inducing me to buy, knowing that the price is going to drop. So I made a decision not to take a trade.

Look what happened then.

After a retest of a broken support, Silver dropped sharply.

Checking the same trading setup on different brokers' charts can help you to avoid the manipulation.

My simple decision to examine more charts helped to avoid a losing trade.

I strictly recommend you doing the same thing before you place a trade.

IF you see a strong deviation of your charts from other brokers, stay alert and vigilant. Probably it is not a good idea to open the trade.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

4 Profitable Bullish Patterns EVERY TRADER Must Know Forex, GOLD

In the today's post, we will discuss accurate bullish price action patterns that you can apply for trading any financial instrument.

1️⃣Bullish Flag Pattern

Such a pattern appears in a bullish trend after a completion of the bullish impulse. The flag represents a falling parallel channel. The market corrects itself within.

Bullish breakout of the resistance line of the channel is a strong bullish signal that can be applied for buying the market.

Best entries should be placed immediately after a breakout or on a retest.

Safest stop loss is below the lows of the flag.

Target - the next key resistance.

Here is the example of a bullish flag pattern that was formed on Gold on a 1H time frame. As you can see, after the breakout of the resistance of the flag, a strong bullish rally initiated.

2️⃣Ascending Triangle

Such a pattern forms in a bullish trend on the top of the bullish impulse. The market starts consolidation, respecting the same highs and setting higher lows simultaneously.

The equal highs compose a horizontal resistance that is called the neckline.

Its breakout is an important sign of strength of the buyers.

Buy the market aggressively after a violation, or set a buy limit order on a retest.

Stop loss should lie at least below the last higher low within a triangle.

Target - the next strong resistance.

Take a look at that ascending triangle formation on EURUSD.

Bullish breakout of its neckline was a perfect bullish signal.

3️⃣Falling Wedge

That formation is very similar to a bullish flag pattern.

The only difference is that the price action within the wedge is contracting so that the trend line of the wedge are getting closer to each other with time.

Your signal to buy is a bullish breakout of the resistance of the wedge.

Stop loss is strictly below its lows.

Target - the next key resistance.

GBPUSD formed a falling wedge on a 4H time frame, trading in a strong bullish trend.

You can behold how nicely the price bounced after a breakout of its upper boundary.

4️⃣Horizontal Range

Similarly to the ascending triangle, the horizontal range forms at the top of a bullish impulse in a bullish trend.

The price starts consolidation , then, setting equal highs and equal lows that compose a horizontal channel.

Breakout of the resistance of the range is a strong trend-following signal.

Buy the market aggressively after a breakout or conservatively on a retest.

Stop loss will lie below the lows of the range.

Target - the next strong resistance.

Dollar Index formed a horizontal range, trading in a strong bullish trend.

Breakout of the resistance of the range triggered a bullish rally.

The best part about these patterns is that they can be applied on any time frame. Whether you are a scalper, day trader or swing trader, you can rely on these formations and make consistent profits.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn the 4 Best Strategies to Maximize Your Profits in Trading

In the today's article, we will discuss 4 classic yet profitable forex and gold trading strategies.

1️⃣Pullback Trading

Pullback trading is a trend-following strategy where you open the positions after pullbacks.

If the market is trading in a bullish trend, your goal as a pullback trader is to wait for a completion of a bullish impulse and then let the market correct itself. Your entry should be the assumed completion point of a correctional movement. You expect a trend-following movement from there.

In a bearish trend, you wait for a completion of the bearish impulse, let the market retrace, and you look for short-entry after a completion of the retracement leg.

Here is the example of pullback trading.

On the left chart, we see the market that is trading in a bearish trend.

A pullback trader would short the market upon completion of the correctional moves.

On the right chart, I underlined the buy entry points of a pullback trader.

That strategy is considered to be one of the simplest and profitable and appropriate for newbie traders.

2️⃣Breakout Trading

Breakout trading implies buying or selling the breakout of a horizontal structure or a trend line.

If the price breaks a key support, it signifies a strong bearish pressure.

Such a violation will trigger a bearish continuation with a high probability.

Alternatively, a bullish breakout of a key resistance is a sign of strength of the buyers and indicates a highly probable bullish continuation.

Take a look, how the price broke a key daily resistance on a daily time frame. After a breakout, the market retested the broken structure that turned into a support. A strong bullish rally initiated from that.

With the breakout trading, the best entries are always on a retest of a broken structure.

3️⃣Range Trading

Range trading signifies trading the market that is consolidating .

Most of the time, the market consolidates within the horizontal ranges.

The boundaries of the range may provide safe points to buy and sell the market from.

The upper boundary of the range is usually a strong resistance and one may look for shorting opportunities from there,

while the lower boundary of the range is a safe place to buy the market from.

EURCAD pair is trading within a horizontal range on a daily.

The support of the range is a safe zone to buy the market from.

A bullish movement is anticipated to the resistance of the range from there.

Taking into considerations, that the financial instruments may consolidate for days, weeks and even months, range trading may provide substantial gains.

4️⃣Counter Trend Trading

Counter trend trading signifies trading against the trend.

No matter how strong is the trend, the markets always trade in zig-zags. After impulses follow the corrections , and after the corrections follow the impulses.

Counter trend traders looks for a completion of the bullish impulses in a bullish trend to short the market, and for a completion of bearish impulses in a downtrend to buy it.

Here is the example of a counter trend trade.

EURJPY is trading in a bullish trend. However, the last 3 bearish moves initiated from a rising trend line. For a trader, shorting the trend line was a perfect entry to catch a bearish move.

Such trading strategy is considered to be one of the most complicated , because one goes against the crowd and overall sentiment.

With the experience, traders may combine these strategies.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Your ULTIMATE Guide For Time Frames in Gold, Forex Trading

If you just started trading, you are probably wondering what time frames to trade. In the today's post, I will reveal the difference between mainstream time frames like daily, 4h, 1h, 15m.

Firstly, you should know that the selection of a time frame primarily depends on your goals in trading. If you are interested in swing trading strategies, of course, you should concentrate on higher time frames analysis while for scalping the main focus should be on lower time frames.

Daily time frame shows a bigger picture.

It can be applied for the analysis of a price action for the last weeks, months, and even years.

It reveals the historical key levels that can be relevant for swing traders, day traders and scalpers.

The patterns that are formed on a daily time frame may predict long-term movements.

In the picture above, you can see how the daily time frame can show the price action for the last years, months and weeks.

In contrast, hourly time frame reflects intra week & intraday perspectives.

The patterns and key levels that are spotted there, will be important for day traders and scalpers.

The setups that are spotted on an hourly time frame, will be useful for predicting the intraday moves and occasionally the moves within a trading week.

Take a look at the 2 charts above, the hourly time frame perfectly shows the market moves within a week and within a single day.

4H time frame is somewhere in between. For both swing trader and day trader, it may provide some useful confirmations.

4H t.f shows intra week and week to week perspectives.

Above, you can see how nicely 4H time frame shows the price action on EURUSD within a week and for the last several weeks.

15 minutes time frame is a scalping time frame.

The setups and levels that are spotted there can be used to predict the market moves within hours or within a trading session.

Check the charts above: 15 minutes time frame shows both the price action within a London session and the price action for the last couple of hours.

It is also critical to mention, that lower is the time frame, lower is the accuracy of the patterns and lower is the strength of key levels that are identified there. It makes higher time frame analysis more simple and reliable.

The thing is that higher is the time frame, more important it is for the market participants.

While lower time frames can help to predict short term moves, higher time frames are aimed for predicting long-term trends.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn the Harsh Truth About Success & Failure in Trading

The picture above completely represents the real nature of trading:

We all came here because we all wanted easy money.

Being attracted by catchy ads, portraying the guys on lambos, wearing guccies and living fancy lives, we jump into the game with high hopes of doubling our tiny initial trading accounts.

However, the reality quickly kicks in and losing trades become the norm.

The first trading account will most likely be blown .

In just one single month, 40% of traders will be discouraged and abandon this game forever.

The rest will realize the fact that the things are not that simple as they seemed to be and decide to start learning.

The primary obstacle with trading education though is the fact that there are so much data out there, so many different materials, so many strategies and techniques to try, so the one feels completely lost .

And on that stage, one plays the roulette: in the pile of dirt, he must find the approach that works .

80% of the traders, who stay after the first month, will leave in the next 2 years. Unfortunately, the majority won't be able to find a valid strategy and will quit believing that the entire system is the scam.

After 5 years, the strongest will remain. The ones that are motivated and strong enough to face the failures.

With such an experience, the majority of the traders already realize how the things work. They usually stuck around breakeven and winning trades start covering the losing ones.

However, some minor, tiny component is still missing in their system. They should find something that prevents them from becoming consistently profitable.

Only 1% of those who came in this game will finally discover the way to make money. These individuals will build a solid strategy, an approach that will work and that will let them become independent .

That path is hard and long. And unfortunately, most of the people are not disciplined and motivated enough to keep going. Only the strongest ones will stay. I wish you to be the one with the iron discipline, titanic patience and nerves of steel.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DON'T Make This MISTAKE in MULTIPLE TIME FRAME Analysis

Most of the traders apply multiple time frame analysis incorrectly . In the today's article, we will discuss how to properly use it and how to build the correct thinking process with that trading approach.

The problem is that many traders start their analysis with lower time frames first . They build the opinion and the directional bias analyzing hourly or even lower time frames and look for bullish / bearish signals there.

Once some solid setup is spotted, they start looking for confirmations , analyzing higher time frames. They are trying to find the clues that support their observations.

However, the pro traders do the opposite .

The fact is that higher is the time frame, more significant it is for the analysis. The key structures and the patterns that are spotted on an hourly time frame most of the time will be completely irrelevant on a daily time frame.

In the picture above, I underlined the key levels on USDJPY on an hourly time frame on the left.

On the right, I opened a daily time frame. You can see that on a higher time frame, the structures went completely lost.

BUT the structures that are identified on a daily, will be extremely important on any lower time frame.

In the example above, I have underlined key levels on a daily.

On an hourly time frame, we simply see in detail how important are these structures and how the market reacts to them.

The correct way to apply the top-down approach is to start with the higher time frame first: daily or weekly. Identify the market trend there, spot the important key levels. Make prediction on these time frames and let the analysis on lower time frames be your confirmation.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Your Best Trading Signal Formula Revealed (Forex, Gold)

If you are looking for a way to increase the accuracy of your trades, I prepared for you a simple yet powerful checklist that you can apply to validate your trades.

✔️ - The trades fit my trading plan

When you are planning to open a trade, make sure that it is strictly based on your rules and your entry reasons match your trading plan.

For example, imagine you found some good reasons to buy USDJPY pair, and you decide to open a long trade. However, checking your trading plan, you have an important rule there - the market should strictly lie on a key level.

The current market conditions do not fit your trading plan, so you skip that trade.

✔️ - The trade is in the direction with the trend

That condition is mainly addressed to the newbie traders.

Trading against the trend is much more complicated and riskier than trend-following trading, for that reason, I always recommend my students sticking with the trend.

Even though USDCHF formed a cute double bottom pattern after a strong bearish trend, and it is appealing to buy the oversold market, it is better to skip that trade because it is the position against the current trend.

✔️ - The trade has stop loss and target level

Know in advance where will be your goal for the trade and where you will close the position in a loss.

If you think that it is a good idea to buy gold now, but you have no clue how far it will go and where can be the target, do not take such a trade.

You should know your tp/sl before you open the trade.

✔️ - The trade has a good risk to reward ratio

Planning the trade, your potential reward should outweigh the potential risks. And of course, there are always the speculations about the optimal risk to reward ratio, however, try to have at least 1.3 R/R ratio.

Planning a long trade on EURNZD with a safe stop loss being below the current support and target - the local high, you can see that you get a negative r/r ratio, meaning that the potential risk is bigger than the potential reward. Such a trade is better to skip.

✔️ - I am ok with losing this trade if the market goes against me

Remember that even the best trading setups may occasionally fail. You should always be prepared for losses, and always keep in mind that 100% winning setups do not exist.

If you are not ready to lose, do not even open the position then.

✔️ - There are no important news events ahead

That rule is again primarily addressed to newbies because ahead and during the important news releases we have sudden volatility spikes.

Planning the trade, check the economic calendar, filtering top important news.

If important fundamentals are expected in the coming hours, it's better to wait until the news release first.

Taking a long trade on Gold, you should check the fundamentals first. Only after you confirm, that there are no fundamentals coming soon, you can open the position.

What I like about that checklist is that it is very simple, but you can use it whether you are a complete newbie or an experienced trader.

Try it and let me know if it helps you to improve your trading performance.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HOW FOREX BROKERS MANIPULATE YOU TRADING? Real Example

Last month, I spotted a nice trading position on NZDCAD forex pair.

I shared that with my TradingView subscribers immediately after I placed the trade.

Though, the price moved exactly as it was predicted, the half of the members did not make any penny from this signal, while another half made a nice profit.

It happened because of one rare thing that I absolutely hate in trading.

Learn about a major frustration and market manipulation in trading, that no one will tell you about.

Here is the trading position that I spotted.

It was a classic price action trading setup based on a double top pattern.

Trade was taken on a retest of a broken neckline aiming at the closest strong support and stop loss lying about the tops.

Though, initially, the market started to fall rapidly. But it reversed, not being able to reach the target.

Watching that bullish rally resumes, I send the signal to my students to close the trade on entry, and I also did that personally.

I felt myself quite sad that I did not mange cash out from that trade.

Later on in the evening, surprisingly, I started to receive multiple thank you messages from my members that they made a good profit with that signal.

How could it be?

I decided to anonymously ask the members, how did they close the trade.

More than half of the members replied that the trade reached take profit.

Can it be possible? My TP was not reached and it was still quite far from the lowest low.

Now, examine the trading setup on NZDCAD on charts of different popular forex brokers.

On these 6 charts, you can see NZDCAD pair on OANDA, CAPITALCOM, IC MARKETS, ICE, FXCM, FOREX.COM brokers.

While in half of the instances TP was not reached, in other half, TP was reached and the price went even lower.

Why it happened?

There are the rare situations in Forex trading, when the price action on one broker can be very different from another.

It happens because different brokers have different liquidity providers, spreads, order execution methods and so on.

That is why the selection of a good broker is so vital in trading.

If you use TradingView for chart analysis, make sure that you watch all the instruments of one broker.

Moreover, once you start trading your strategy, always check how the price acted with different broker quotes.

If you will see a lot of instances that your tp is not hit, while on another broker it would, it will be a signal for you to change the broker.

When I started learning trading, no one told be that important nuance of Forex trading.

But knowing that is a very significant step in your trading journey.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

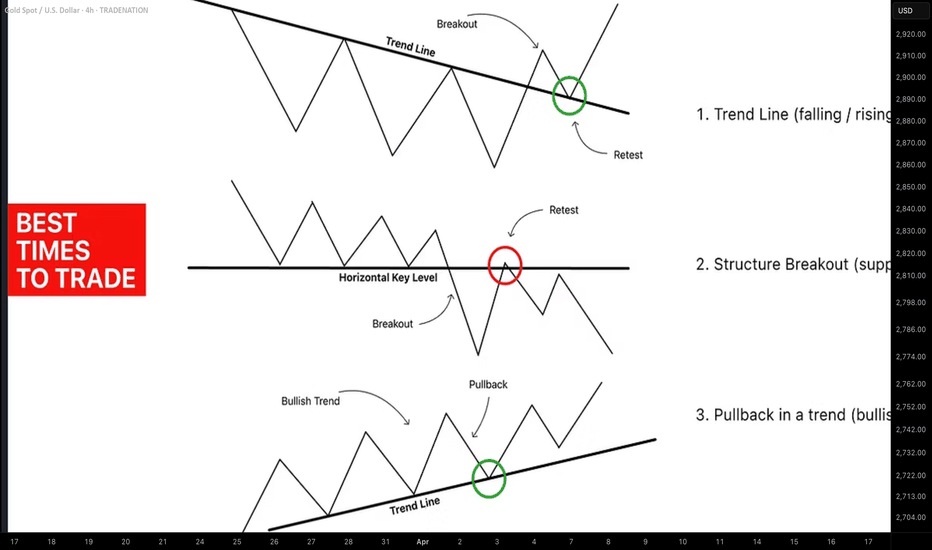

3 Best Trading Opportunities to Maximize Profit Potential

Hey traders,

In the today's article, we will discuss 3 types of incredibly accurate setups that you can apply for trading financial markets.

1. Trend Line Breakout and Retest

The first setup is a classic trend line breakout.

Please, note that such a setup will be accurate if the trend line is based on at least 3 consequent bullish or bearish moves.

If the market bounces from a trend line, it is a vertical support.

If the market drops from a trend line, it is a vertical resistance.

The breakout of the trend line - vertical support is a candle close below that. After a breakout, it turns into a safe point to sell the market from.

The breakout of the trend line - vertical resistance is a candle close above that. After a breakout, it turns into a safe point to buy the market from.

Take a look at the example. On GBPJPY, the market was growing steadily, respecting a rising trend line that was a vertical support.

A candle close below that confirmed its bearish violation.

It turned into a vertical resistance .

Its retest was a perfect point to sell the market from.

2. Horizontal Structure Breakout and Retest

The second setup is a breakout of a horizontal key level.

The breakout of a horizontal support and a candle close below that is a strong bearish signal. After a breakout, a support turns into a resistance.

Its retest is a safe point to sell the market from.

The breakout of a horizontal resistance and a candle close above that is a strong bullish signal. After a breakout, a resistance turns into a support.

Its retest if a safe point to buy the market from.

Here is the example. WTI Crude Oil broke a key daily structure resistance. A candle close above confirmed the violation.

After a breakout, the broken resistance turned into a support.

Its test was a perfect point to buy the market from.

3. Buying / Selling the Market After Pullbacks

The third option is to trade the market after pullbacks.

However, remember that the market should be strictly in a trend .

In a bullish trend, the market corrects itself after it sets new higher highs. The higher lows usually respect the rising trend lines.

Buying the market from such a trend line, you open a safe trend-following trade.

In a bearish trend, after the price sets lower lows, the correctional movements initiate. The lower highs quite often respect the falling trend lines.

Selling the market from such a trend line, you open a safe trend-following trade.

On the chart above, we can see EURAUD pair trading in a bullish trend.

After the price sets new highs, it retraces to a rising trend line.

Once the trend line is reached, trend-following movements initiate.

What I like about these 3 setups is the fact that they work on every market and on every time frame. So no matter what you trade and what is your trading style, you can apply them for making nice profits.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Exploring the Main Components of a Powerful Trading Journal

In one of the previous posts, we discussed the significance of a trading journal. In the today's article, I will share with you the key elements of a trading journal of a professional trader.

And first, a quick reminder that a trading journal is essential for your trading success. No matter on which level you are at the moment, you should always keep track of your results.

Let's go through the list of the things that you should include in your journal.

1 - Trading Instrument

The symbol where the order is executed.

You need that in order to analyze the performance of trading a particular instrument.

2 - Date

The date of the opening of the position. Some traders also include the exact time of the execution.

3 - Risk

Percentage of the account balance at risk.

Even though some traders track the lot of sizes instead, I do believe that the percentage data is more important and may give more insights.

4 - Entry Reason

The set of conditions that were met to open the trade.

In that section, I recommend to note as much data as possible.

It will be applied in future for the identification of the weaknesses of your strategy.

5 - Risk Reward Ratio

The expected returns in relation to potential risks.

6 - Results

Gain or loss in percentage.

And again, some traders track the pip value of the gain, however,

in my view, the percentage points are more relevant for studying the statistics.

Here is the example of the trade on Gold:

Here is how exactly you should journal the following trade:

Instrumet: Gold (XAUUSD)

Date: 03.07.2023

Risk: 1%

Entry Reason: H&S Pattern Formation,

Neckline Breakout & Retest

R/R Ratio: 1.77

Results: +1.77%

Of course, depending on your trading strategy and your personal goals, some other elements can be added. However, the list that I propose is the absolute minimum that you should track.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

3 Best Entry Points For Swing Trading (Forex, Gold)

What is the best entry point for swing trading?

You will learn 3 safest places/zones to buy or sell the market from, best swing trading time frame, and the most accurate swing trading setups.

Best Entry 1

Swing Trading After a Confirmed Trend Reversal

It can be a bearish trend violation and a start of a new bullish trend.

Look at a price action on WTI Crude Oil on a daily.

The market violated a bearish trend and started to trade in a new bullish trend, confirming the reversal.

In such a case, your best entry will be the closest daily support.

Alternatively, it can be a bullish trend violation and an initiation of a new bearish trend.

USDCAD was in an uptrend, steadily growing within a parallel channel.

Its violation confirmed the change of sentiment and start of a downtrend.

In this situation, your safest entries will be from the closest daily resistance.

Best Entry 2

Swing Trading with the Trend After Pullback

In a bullish trend, you should wait for

a completion of a bullish movement,

wait for a pullback

swing buy the market after it completes.

AUDCAD is in a rising trend.

A pullback tends to complete on a key support.

That will be your zone for buying.

Otherwise, in a bearish trend, you should let the price:

finish a bearish impulse

start a correctional movement

sell the market after the correction ends.

USDCHF was in downturn and updated the low. A local bullish movement started then.

It usually completes after a test of a key resistance. That will be the area where you should look for swing selling.

Best Entry 3

Swing Trading After Key Level Breakout

Bearish violation of a key daily support is a perfect signal to sell.

It is an important sign of strength of the sellers and a strong indication that the price will continue falling.

NZDUSD broke and closed below a key daily support cluster. After a breakout, it turns into a potentially strong resistance.

For us, the best entry is a retest of a broken structure.

Bullish breakout of a key daily resistance is a reliable signal to buy.

After a violation of a horizontal resistance, it became a support on USDCHF Forex pair on a daily.

Your perfect entry for swing buying is its retest .

The entry zones that we discussed will provide the safest trading opportunities.

Learn to combine that with your trading strategy, it will help you to dramatically increase the profitability of your swing trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

How to Find Best Supply and Demand Zones/Areas in Forex & Gold

In this article, I will show you the strongest supply and demand zones.

These zones are called confluence zones.

I will teach you to identify these areas properly and explain how to apply it in Forex and Gold trading.

Let's start with a short but important theory.

In technical analysis, there are 2 types of supports and resistances.

Horizontal structures are supports and resistance that are based on horizontal key levels.

Vertical structures are supports and resistance that are based on trend lines.

A confluence supply or demand zone, will be the area of the intersection between a horizontal and vertical structures.

Look at GBPJPY pair. I underlined a significant horizontal support and a rising trend line - a vertical support.

We see a clear crossing of both structures.

The trend line and a horizontal support will compose a narrow, contracting area. It will be a confluence demand zone.

Within, with a high probability, a high volume of buying orders will concentrate, and a strong bullish movement will initiate after its test.

Above is one more example of a powerful demand zone.

It was spotted on a Gold chart.

Now let's discuss the supply zone.

There are 2 strong structures on GBPNZD: a vertical resistance - a falling trend line and a horizontal resistance.

These 2 resistances will constitute a confluence supply zone.

That is a powerful resistance cluster that will concentrate the selling orders. Chances will be high to see a strong bearish movement from that.

There is a strong supply zone on CHFJPY that is based on the intersection of a wide horizontal resistance and a falling trend line.

Supply and demand zones that we discussed are very significant. Very often, strong bullish and bearish waves will initiate from these clusters.

Your ability to recognize these zones will help you to make accurate predictions and identify a safe point to open a trading position from

❤️Please, support my work with like, thank you!❤️

Harsh Truth About Forex & Gold Trading: In Books VS In Reality

Most traders start their trading journey by studying theory first, reading books or taking video courses before putting these newfound skills into practice. But once they start trading on a real market, they quickly realize that things are not as straightforward as the books make them out to be.

In this educational article, we will take a critical look at the difference between theoretical knowledge and practical experience.

📍And first of all, do not get me wrong. I am not trying to imply that trading books or courses are bad.

Theoretical knowledge is essential for successful trading, and of course the books are the best source of that.

The problem is, however, that books can be misleading . The examples in books are always tailored. When the authors are looking for the examples of the patterns, of key levels, they are looking for the ideal cases.

📍The problem becomes even worse, when one start studying the trade examples in books. And of course, the authors choose the brilliant winning trades with huge take profits and tiny stop losses.

I guess you saw these pictures of "sniper" entry trades with 5/1 R/R.

The inexperienced trader may start thinking that the markets are perfect and act in total accordance with the books.

That all the trades that he will take will bring tremendous profits.

That the identified patterns will work exactly as it was described.

📍The harsh truth is that books and courses are simply the compositions of different examples, cases and market situations.

In reality, each and every trading setup is unique .

The reaction of the price to the same pattern will be always different .

Please, realize the fact that books are only good for acquiring the knowledge. But in order to survive on financial markets, you need the experience . And the experience will be gained only after studying thousands of real market examples in real time.

📍Here is the example of a double top pattern that we were trading with my students on AUDJPY.

In books, double tops are always perfect . Once the market breaks the neckline, the price retests that and then quickly drops.

So the one can set a tiny stop loss and a big take profit.

However, after a retest of a broken neckline, AUDJPY bounced and the market maker was stop hunting the newbies. Our stop loss was way above the head, and we managed to survive.

Even though the pattern triggered a bearish movement, the reaction of the market was far from perfect.

Be prepared, that the market will much different from what you see in the books.

Good luck to you!

❤️Please, support my work with like, thank you!❤️