NVDA to $170? AI Bubble Risk, Big Money Exits & Heavy Shorts !I f you haven`t bought NVDA before the previous earnings:

Now you need to know that NVIDIA has dominated 2023–2025, becoming the face of the global AI boom. But the higher the climb, the harder the fall. While NVDA is still seen as “untouchable,” several major signals suggest the stock could revisit levels near $170 — a healthy correction of 10–15% from here.

1. Major Investors Are Exiting — SoftBank Dumped Everything

SoftBank, one of Nvidia’s earliest and most influential institutional backers, sold its entire stake in late 2025, worth roughly $5.8 billion.

Smart-money exits near all-time highs should never be ignored.

SoftBank rarely sells unless it believes:

- the sector is overheated

- the valuation has run too far

- risk/reward becomes asymmetric

This mirrors their strategy in 2021–2022 when they unloaded overvalued tech before the correction.

SoftBank’s full exit is a red flag for anyone ignoring the possibility of an AI bubble.

2. Michael Burry Bought Massive Puts — A Direct Bet Against the AI Mania

Michael Burry — famous for predicting the 2008 crisis — has quietly increased his put positions on NVIDIA and other AI names.

Why does this matter?

Because Burry doesn’t short “normal” overvaluations.

He shorts bubbles.

His AI thesis:

- expectations are unrealistic

- revenue growth is priced as infinite

- companies are spending billions on AI with no short-term monetization

- chip demand could normalize faster than markets expect

When a contrarian with Burry’s track record bets against a trend, it’s worth paying attention.

3. NVIDIA’s Valuation Is Stretched Even for a Hyper-Growth Company

Even bulls agree: NVDA’s multiples are once again aggressively priced.

Key issues:

• Price-to-Sales historically elevated

NVDA is trading at a P/S ratio that would be insane for any company approaching a $5 trillion market cap.

• Revenue growth expectations assume perfect long-term AI adoption

If AI monetization slows or plateaus even slightly, NVDA’s valuation collapses fast.

4. Are We in an AI Bubble? Many Indicators Say Yes

Top analysts, academics, and even bullish investors admit:

AI has bubble-like behavior.

Evidence of a bubble:

- Stock prices rising faster than actual earnings growth

- Companies buying GPUs “because everyone else is doing it”

- Zero clarity on monetization for many AI firms

- AI startups valued at billions with no revenue

- Media hype similar to 1999 dot-com sentiment

Harvard Business Review, Wired, and Investopedia already discuss the “AI bubble thesis.”

If AI expectations don’t materialize fast enough, NVDA becomes the single most vulnerable stock on the market.

Tradinggroup

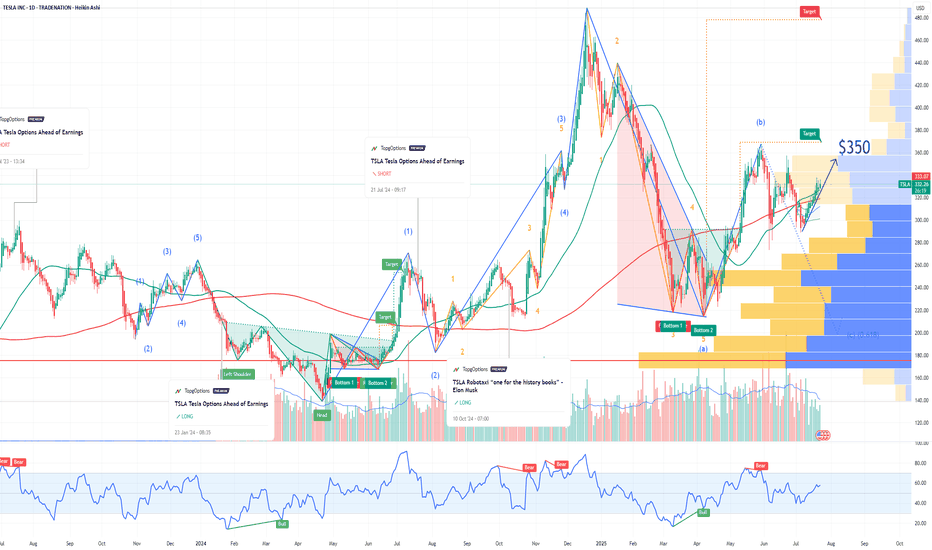

TSLA Tesla Options Ahead of EarningsIf you haven`t bought TSLA before the recent rally:

Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week,

I would consider purchasing the 350usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $14.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

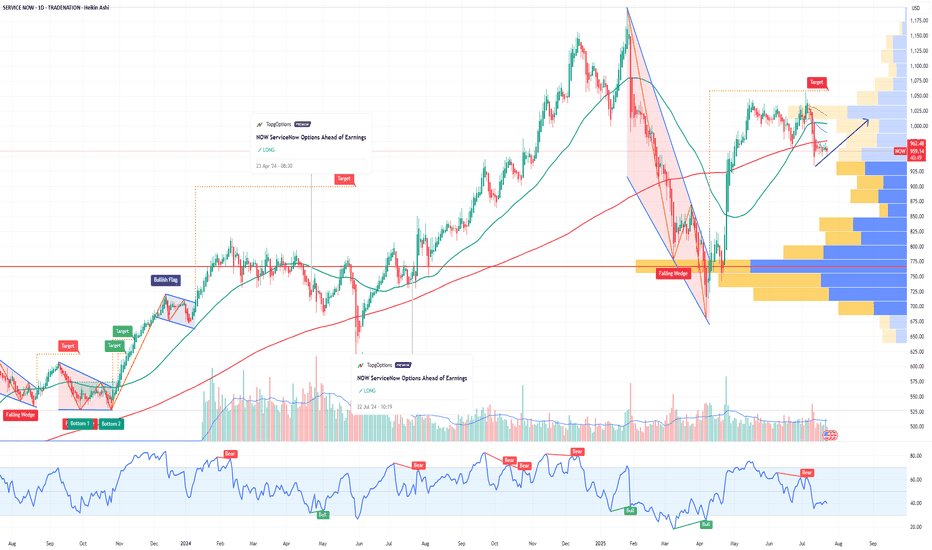

NOW ServiceNow Options Ahead of EarningsIf you haven`t bought NOW before the recent rally:

Analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 960usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $97.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ELF Beauty Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ELF Beauty prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $5.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.94.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PLTR Palantir Technologies Options Ahead of EarningsIf you haven`t bought PLTR before the major breakout:

Now analyzing the options chain and the chart patterns of PLTR Palantir Technologies prior to the earnings report this week,

I would consider purchasing the 42usd strike price Puts with

an expiration date of 2024-11-15,

for a premium of approximately $3.07.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PShort

BLK BlackRock Options Ahead of EarningsIf you haven`t sold BLK here:

or ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of BLK BlackRock prior to the earnings report this week,

I would consider purchasing the 640usd strike price Puts with

an expiration date of 2023-10-13,

for a premium of approximately $10.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

EURJPY SELL IN Resistence at 127.25EURJPY follows an uptrend, after different technical indicators, the price is going to take to the resistance at 127.25, from there we expect the price to retrace and change the trend.

📊EURJPY

SELL PRICE: 127.25

TP1: 126.90

TP2: 126.42

SL: 127.75

Signed by: FxProfitSignals Group