What to Fix in Your Trading Process Before 2026I’ve been stopped out more than 300 times.

After years of trial, error, and reflection, I realized there was one thing missing from my process.

If I had understood and fixed it earlier, I would have become profitable much sooner.

It’s probably very simple to you.

And I’m confident that around 90% of traders either don’t do it at all — or do it incorrectly.

That skill is scenario writing.

It doesn’t matter whether you’ve been in the market for one year or three.

Writing scenarios before the trade can significantly improve your win rate.

Let me explain how.

Imagine your trading day has started.

You’re analyzing the market when suddenly a symbol begins to move with strong momentum.

Your mind says: “This fits my strategy. I should enter.”

Your emotions say: “Wait for a pullback — you’ll get a better price.”

Then another thought appears: “What if this trade covers a year’s profit?”

Logic, FOMO, and dozens of parameters start competing.

The result is usually a position with much lower quality than what your strategy actually requires.

Now imagine a second trader.

The day before, they wrote down all possible scenarios and the exact actions required for each one.

When momentum appears and resistance breaks, they enter immediately — without hesitation.

Not because they are emotionless, but because the plan already exists.

Nothing is surprising.

Nothing feels urgent.

Emotions play a minimal role because the decisions were made in advance.

I believe many of you have experienced the first situation.

So let’s look at how scenario writing should actually be done.

I’ve prepared a simple template you can copy directly into Notion.

Duplicate it daily and use it for every pair you analyze.

At first, it may feel difficult.

It might even take hours.

But after one month of consistent use, analyzing a symbol will often take less than seven minutes.

If you’ve followed my daily analyses, this structure may already feel familiar — because all my analysis is built around clear triggers, scenarios, and defined risk.

⚙️ Trading Scenario Journal Template

🧩 Structure Overview

Each position should have six sections:

Start (Setup & Entry Logic)

End (Exit & Contingency)

Actors (Market Elements)

Storyline (Expected Path)

Mid-Scenarios (Adjustments)

Goal (Purpose & Awareness)

1. Start – Setup & Entry Logic

Market Direction: Uptrend / Downtrend / Range (Weekly / Daily / 4H)

Entry Trigger: What confirms the entry (e.g., break & retest, candle pattern, volume)

Alternative Conditions: Valid setups if the main trigger fails

🗝 Only trade within the defined structure — no guessing.

2. End – Exit Logic & Contingencies

Exit Trigger: Where and why the position will be closed

If the Trigger Never Happens: Wait, cancel, or partially close

Profit Management: When to secure profit or move stop to break-even

🗝 Every “if–then” must be decided before the market forces you to act.

3. Actors – Key Market Factors

Each element either supports or weakens the setup:

Candles (strength, volatility, dominance)

Volume (confirmation or rejection)

RSI (momentum or exhaustion)

DMI / ADX (trend and volatility strength)

Support & Resistance (decision zones)

Trendlines / Channels (structural bias)

P.S: These are my personal trading plan confirmations; you need to define your own

🗝 Align at least three confirmations.

4. Storyline – Expected Path

Write the ideal “movie” of price behavior.

Example:

“Pullback to 66.4k → rejection → retest → continuation to 68k.”

If the story does not unfold, there is no trade.

🗝 You don’t predict. You prepare.

5. Mid-Scenarios – Management Adjustments

All reactions are pre-defined, not emotional:

Add if structure breaks with volume

Reduce if momentum fades or divergence appears

Exit early if volatility disappears or major news hits

Avoid adding if RSI is already overextended

🗝 Responses are designed mathematically, not emotionally.

6. Goal – Purpose of the Trade

Core Goal: Why this trade exists (continuation, test, reversal)

Expected Learning: What this trade should teach you — even if it loses

“If something unexpected happens, it means the scenario wasn’t fully planned.

Next time, it gets written down.”

If you stop writing scenarios by day seven, understand this clearly:

You are not supposed to be profitable yet.

Trading is not a comfort skill.

And this environment is not designed for comfort.

It requires structure, discipline, and emotional control.

If journaling, scenario writing, and structured analysis feel unbearable, quitting early is actually more honest than pretending.

By the way — I’m Skeptic , founder of Skeptic Lab .

I focus on long-term performance through psychology, data-driven thinking, and tested processes.

If this was useful, feel free to support it.

If you know a trader struggling with the same issue, share it — growing together is one of the most human experiences we have.

And if you have your own insights, leave them in the comments.

Let’s learn from each other.

— Skeptic

Tradingjournal

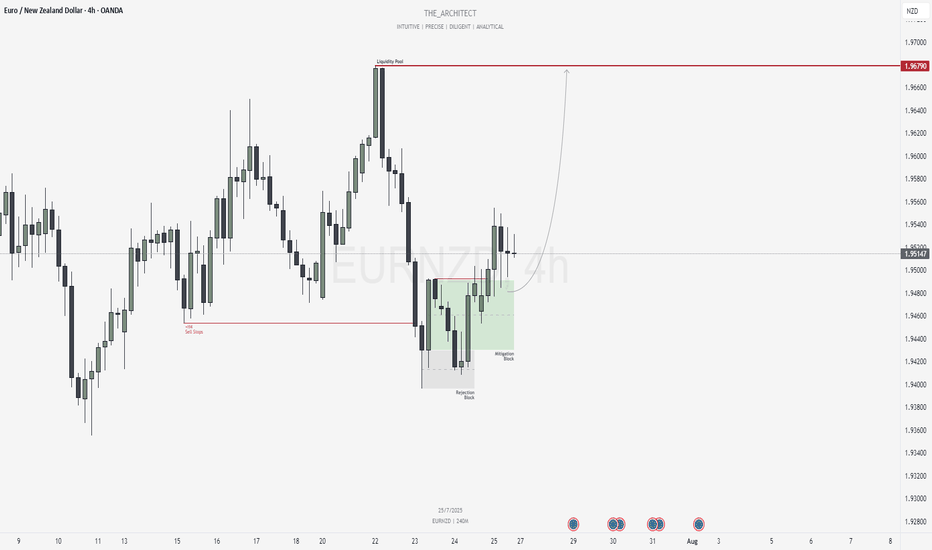

Weekly Trade Outlook | Lessons in Discipline, Risk & PerspectiveGreetings Traders,

In today’s video, I’ll be walking you through my end-of-week trade outlook, breaking down every setup I took throughout the week. This session is designed to offer insight into how I apply risk management, trading rules, and maintain psychological discipline in real-time market conditions.

Whether you're struggling with emotional trading, inconsistency, or overtrading, this video will give you a fresh perspective on how structure, faith, and discipline can shape a sustainable trading approach.

Remember: respect your trading rules, pray over them daily, and ask God for the strength to remain disciplined—so you don’t become your own worst enemy in the market.

Let’s grow together,

The Architect 🏛️📈

Master the Trio => to Level Up Your Trading🧠Most traders obsess over chart patterns and price action—but lasting success comes from mastering three pillars together:

Technical Analysis. Risk Management. Trading Psychology.

Miss one, and the structure collapses.

Let’s dive into each one, and see how they work together like a high-performance trading engine:

📈 1. Technical Analysis – Think in Layers, Not Lines

Most traders draw lines. Great traders read behavior.

Instead of asking “Is this support holding?”, ask “Why would smart money defend this level?”

Markets aren’t driven by lines—they’re driven by liquidity, trapped traders, and imbalances. That’s why:

A fakeout isn’t failure—it’s often a feature.

A breakout isn’t a buy signal—it’s bait.

Trendlines aren’t magic—they’re just visualizations of collective bias.

🔍 Advanced tip: When analyzing a chart, map out:

Where liquidity is resting (above equal highs/lows, tight consolidations)

Who’s likely trapped (late buyers at resistance, early sellers during accumulation)

Where the market must not go if your bias is correct (invalidations)

The real edge? Seeing the chart as a battle of intentions, not just candles.

🛡️ 2. Risk Management – Your License to Play the Game

Every trade is a bet. But without proper risk, it’s a gamble.

Risk management isn’t just about stop losses—it’s about position sizing, asymmetry, and survival.

I risk no more than 1% per trade , regardless of conviction.

I aim for 2R minimum —because even with a 50% win rate, I still grow.

I define my invalidation before I enter, never after.

You can’t control the outcome, but you can control your exposure. That’s professional.

🧠 3. Trading Psychology – Where Most Traders Break

You can have the perfect setup and smart risk, but still sabotage yourself.

Why? Because emotion overrides logic —especially when money is on the line.

Ever moved your stop? Chased a candle? Closed a trade too early, only to see it hit your TP later?

That’s not lack of skill—it’s lack of emotional discipline.

What works for me:

Journaling every trade—not just the result, but how I felt

Practicing “sit tight” discipline after entries

Reminding myself that no single trade matters—only the process does

You don’t trade the chart—you trade your beliefs about the chart. Master yourself first.

🔄 Final Thoughts

Trading isn’t just about entries.

It’s a mental game played on financial charts, where edge lies in understanding market mechanics, protecting capital, and staying emotionally grounded.

TA shows you the “what”

Risk shows you the “how much”

Psychology decides the “how well”

Master all three—and you’ll separate yourself from 95% of traders.

💬 Which of the three is your strongest? And which one needs more work?

Let’s grow together—drop your thoughts in the comments 👇

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Location 15m London & NY Session 6 May 2025There are 4 setups based on a 15 minute structure on 6th May 2025.

Location 1 :

- Trend buy

- Structure breakout buy

Location 2 :

- Trend buy

- Structure breakout buy

Location 3 :

- Trend buy

- Structure breakout buy

Location 4 :

- Trend buy

- Structure breakout buy

Exploring the Main Components of a Powerful Trading Journal

In one of the previous posts, we discussed the significance of a trading journal. In the today's article, I will share with you the key elements of a trading journal of a professional trader.

And first, a quick reminder that a trading journal is essential for your trading success. No matter on which level you are at the moment, you should always keep track of your results.

Let's go through the list of the things that you should include in your journal.

1 - Trading Instrument

The symbol where the order is executed.

You need that in order to analyze the performance of trading a particular instrument.

2 - Date

The date of the opening of the position. Some traders also include the exact time of the execution.

3 - Risk

Percentage of the account balance at risk.

Even though some traders track the lot of sizes instead, I do believe that the percentage data is more important and may give more insights.

4 - Entry Reason

The set of conditions that were met to open the trade.

In that section, I recommend to note as much data as possible.

It will be applied in future for the identification of the weaknesses of your strategy.

5 - Risk Reward Ratio

The expected returns in relation to potential risks.

6 - Results

Gain or loss in percentage.

And again, some traders track the pip value of the gain, however,

in my view, the percentage points are more relevant for studying the statistics.

Here is the example of the trade on Gold:

Here is how exactly you should journal the following trade:

Instrumet: Gold (XAUUSD)

Date: 03.07.2023

Risk: 1%

Entry Reason: H&S Pattern Formation,

Neckline Breakout & Retest

R/R Ratio: 1.77

Results: +1.77%

Of course, depending on your trading strategy and your personal goals, some other elements can be added. However, the list that I propose is the absolute minimum that you should track.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Crafting the Perfect 2025 Trading Journal: Here’s All You NeedThere’s something about cracking open a brand-new trading journal at the start of the year that feels downright ceremonial. A fresh page (or the blank spaces on your template) unmarred by the scribbles of bad trades or impulsive decisions.

The surge of excitement that goes through your veins as you imagine all potential profits and accumulated knowledge that could end up on that piece of paper (or pixels).

Still, despite all the wisdom and insight that a written record can give you, most trading journals end up looking like forgotten diaries. They get abandoned sometime around February, right next to that half-baked gym membership.

And that’s a bummer! Your trading journal isn’t just a log of wins and losses; it’s the roadmap to better decisions and a more profitable year.

If you’ve ever wondered why seasoned traders swear by this habit, it’s because those scribbles often hold the secrets to what’s working, what’s failing, and which psychological gremlins are hijacking your trades or causing you to miss opportunities.

✍️ Why Every Trade Deserves Ink (or Pixels)

Trading without documentation is akin to sailing without a map or running without setting checkpoints and an end goal. Every trade—good or bad—carries data.

Writing it down transforms fleeting market moments into permanent lessons. It highlights patterns that the eye glosses over in the heat of battle and reveals tendencies you didn’t even know you had.

For example, did you buy Dogecoin DOGE on impulse every time Elon Musk tweeted? Or maybe you overtraded small caps on Fridays because that’s when coffee hits hardest. Or maybe you didn’t bet enough when you had conviction on a forex pair?

These patterns hide in plain sight until they’re laid bare on paper. A journal bridges the gap between emotional trading and methodical refinement.

📖 What to Actually Write Down (Hint: More Than Just Numbers)

If your journal consists of a date, ticker, and a hasty “profit/loss” column, you’re barely scratching the surface. A trading journal should feel like a post-game analysis. Beyond the basic details (entry, exit, size, P&L), the real gold lies in your thought process.

Document why you entered the trade. What did you see? Was there a technical breakout, or were you chasing a Reddit-fueled rocket? Record the emotions that accompanied your trade—nerves, confidence, greed.

Were you following your system, or did you veer off course? Trades aren’t made in a vacuum; understanding the context around them provides clarity.

Even the trades you didn’t take deserve a mention. Hesitation to pull the trigger or missing a setup can reveal psychological patterns that hold back performance.

Here’s a sample set of columns that you may want to add to your template.

💡 Pro tip: make it a monthly template so you can break down the year by the month.

Trading Instrument

Trade direction

Position size

Your entry

Your exit

Your stop loss (yes, add that, too)

Your take profit

Your realized profit or loss

Your risk/reward ratio

Your reason to open the trade

Your state of mind (more on that in the next paragraph)

Transaction costs (fees, spreads, commissions)

Trade rating (e.g., 1-10, or “Good,” “Great,” “Needs More Work”)

Trade notes

Account balance at the start of the month

Account balance at the end of the month

Monthly profit/loss result

Year-to-date profit/loss result

Having a template like this will help you stay organized, improve your trading strategy, and identify patterns in your performance and results. So grab a pen and list (or go to an online graphic design platform) and get creative!

🤫 The Emotional Audit: Your Secret Weapon

A trader’s greatest adversary isn’t the market—it’s themselves. Emotional trades account for some of the most catastrophic losses. One poorly timed revenge trade can undo weeks of careful gains. This is why a portion of your journal should be reserved for emotional audits.

After every trading session, reflect on how you felt. Did anxiety creep in during a drawdown? Were you overconfident after a winning streak?

Emotions, when left unchecked, can drive irrational decisions. Journaling those feelings makes them tangible and easier to manage. It’s like therapy, but instead of lying on a couch, you’re documenting why you YOLO’d into Tesla TSLA .

😮 Spotting Patterns You Didn’t Know Existed

Patterns in trading journals are sneaky. Sometimes, the worst losing streaks aren’t the result of market volatility but bad habits we refuse to notice. Maybe you consistently lose on Mondays or after three consecutive wins. Perhaps you cut winners too soon but let losers run because hope dies last.

Journaling reveals these quirks in brutal detail. Reviewing your trades at the end of each month will expose recurring mistakes (or hidden strengths). Over time, you’ll be able to tighten risk management, adjust strategies, and weed out tendencies that silently bleed your account.

🤑 How to Stay Consistent (Even When You’re Lazy)

Let’s face it: journaling isn’t glamorous, especially when you wake up after a bad trade and you need to face Mr. Market again. But consistency is key. Set a 15-minute window after your trading day to jot down what happened—trades, thoughts, emotions, lessons. It’s short enough to stay manageable but long enough to capture the core of your experience.

🧐 Reviewing the Wreckage: Monthly Reflection Sessions

At the end of each month, conduct a full review of your journal. This isn’t just for performance metrics—it’s about personal growth. Ask the hard questions: What trades did I regret? What big moves did I miss? Where did I second-guess myself? Which trades followed my plan?

You’ll notice themes emerging. Maybe you trade best during certain hours or you lean more to specific assets and markets. This retrospective analysis creates a loop of constant improvement. The goal isn’t to trade more but to trade better.

🧭 Wrapping It Up: Your Trading Journal as a Compass

By the end of the year, your journal will read like a narrative of your trading journey—complete with victories, defeats, and lessons learned.

More importantly, you’ll know yourself better than anyone (except for Google maybe) — you’ll know your trading habits, psychological traits and the written record of your performance in case you want to open up a hedge fund and need the track record for the investors.

So, grab that journal, digital or otherwise, and start logging. Because while the market may be unpredictable, the reflections in your journal will chart the way forward.

And who knows? Maybe next year you’ll flip through it and laugh at the trades you once thought were genius. After all, growth is part of the game.