Why Traders Try to Recover Losses Too FastWhy Traders Try to Recover Losses Too Fast

“The market doesn’t care how quickly you want your money back.”

After a loss, something shifts.

The next trade feels different.

More urgent.

More important.

More emotional.

It’s no longer just a trade.

It becomes a mission.

The mission to recover.

What Happens After a Loss

Losses create discomfort.

The brain wants relief quickly.

So traders start thinking:

• “I need to get it back.”

• “One good trade will fix this.”

• “I just need a strong move.”

The goal quietly changes from following the plan

to repairing the damage.

This is where risk begins to grow.

How Recovery Turns Into Revenge

The recovery mindset causes:

• Larger position sizes

• Lower-quality setups

• Faster decision-making

• Less patience

• Emotional execution

The trader stops trading the market.

They start trading their P&L.

And the market never rewards urgency.

Why Speed Makes Losses Worse

Fast recovery attempts:

• Increase pressure

• Reduce objectivity

• Amplify emotional decisions

• Turn small losses into large ones

Trying to recover quickly often creates the very drawdown you feared.

Urgency replaces discipline.

How Professionals Handle Losses

Professional traders don’t rush recovery.

They slow down after losses.

They:

• Reduce size

• Trade less frequently

• Review behavior

• Wait for high-quality setups

• Focus on process, not balance

They know recovery is a process — not a trade.

The Real Way to Recover

Losses are recovered by:

• Consistency

• Patience

• Discipline

• Small, controlled gains over time

Not by one emotional decision.

The faster you try to recover,

the longer recovery takes.

📘 Shared by @ChartIsMirror

After a loss, do you slow down — or feel the urge to trade more?

Comment honestly.

Tradingmindset

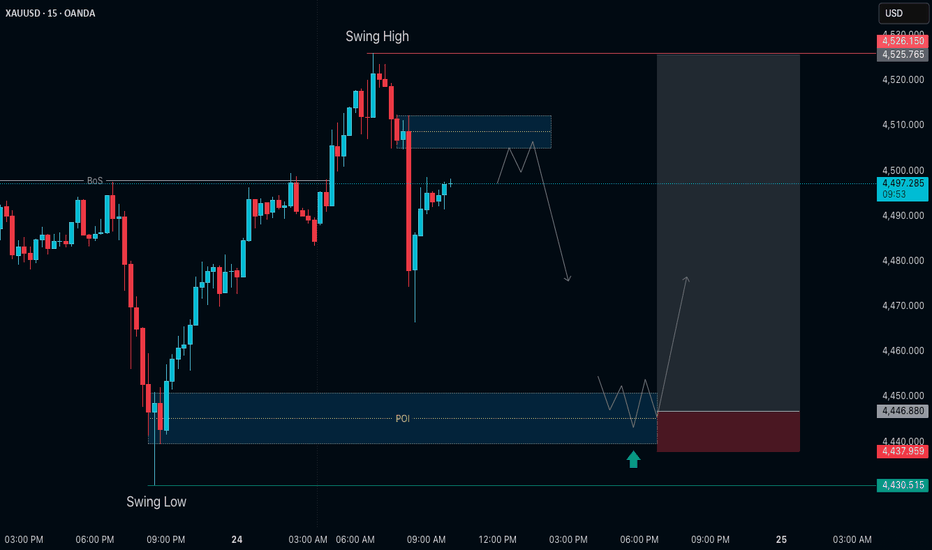

Gold (XAUUSD) - 9 Feb | Watching POI Zone 4821-4808Gold (XAUUSD) Analysis – 9 February

Hello Disciplined Traders,

Welcome to the Chart Is Mirror Community 👋

Market Context

• Gold experienced a strong pullback after reaching the new all-time high at 5600 on 26 January , mitigating a major unmitigated level.

• Price found strong support at the 4402 level , followed by a bullish M15 structure shift and break of structure , confirming that the H4 pullback has ended and the broader uptrend has resumed.

• Last Friday, the market revisited the 4672–4656 demand zone , respected it, and continued the bullish move.

Key Observations

• Gold is currently trading around 4965 . From this area, a healthy pullback is expected before continuation.

• Our POI for the next long setup lies at the 4821.468–4808.262 demand zone .

• If price revisits this zone and shows LTF bullish confirmation , we will plan our long setup accordingly.

Execution Plan

• Wait for price to pull back into 4821.468–4808.262 .

• Execute long trades only with clear LTF confirmation .

• From this zone, the next upside target is the 5197 level .

• Market volatility remains high — manage risk carefully .

Let the pullback return price to value — then let confirmation invite execution.

📘 Shared by @ChartIsMirror

Bitcoin Isn’t a Trap for Money — It’s a Trap for EmotionsBody / Analysis:

When traders look at Bitcoin, many think the biggest risk is financial loss. But in reality, Bitcoin isn’t just a trap for your money — it’s a trap for your emotions. The volatile nature of crypto markets triggers fear, greed, and impulsive decisions more than it threatens your actual capital.

1️⃣ Emotional Trading: The Real Trap

Bitcoin’s price can swing 5–10% in a single day. This volatility can make even experienced traders second-guess their strategies. Emotional reactions like panic selling during dips or FOMO buying during rallies often lead to losses, even for traders who understand market fundamentals.

2️⃣ Understanding Market Psychology

Success in Bitcoin trading isn’t just about numbers—it’s about mindset. Traders who control their emotions and stick to clear entry and exit strategies outperform those who react to price spikes. Recognizing the psychological traps of fear and greed is key to staying consistent.

3️⃣ Strategies to Avoid Emotional Traps

Plan your trades: Set clear entry, stop-loss, and take-profit levels.

Stick to your strategy: Avoid impulsive decisions based on market hype.

Journal your trades: Track decisions and emotions to learn patterns.

Use technical indicators wisely: RSI, FVG, and support/resistance levels can guide decisions without emotional bias.

4️⃣ Why Long-Term Mindset Wins

Traders focused solely on short-term profits are more prone to emotional mistakes. A long-term mindset, combined with disciplined risk management, can transform Bitcoin from an emotional trap into a strategic opportunity.

💡 Key Takeaway:

Bitcoin doesn’t steal your money—it exposes your emotional weaknesses. The best traders aren’t those who predict every price move, but those who control fear and greed, sticking to their plan regardless of market chaos.

Why Volatility Breaks Retail Traders?Why Volatility Breaks Retail Traders

“Volatility doesn’t destroy accounts.

It exposes them.”

When markets move fast, many traders feel lost.

Setups fail.

Stops get hit quickly.

Confidence disappears.

It feels like the strategy stopped working.

But volatility didn’t break the strategy.

It revealed the weaknesses around it.

What Volatility Actually Changes

During calm markets:

• Entries feel clean

• Stops feel respected

• Moves feel predictable

During high volatility:

• Price moves faster than decisions

• Pullbacks become violent

• Stops feel too tight or too wide

• Emotions accelerate

The environment changes — and so must behavior.

Why Retail Traders Struggle

High volatility exposes hidden habits:

• Position sizes that are too large

• Stops that are too tight for fast markets

• Emotional reactions to fast losses

• The urge to “recover quickly”

• The need to stay active

In slow markets, these weaknesses stay hidden.

In fast markets, they surface immediately.

Volatility removes the margin for error.

The Speed Problem

Retail traders make decisions emotionally.

Volatility speeds up emotion.

Fear appears faster.

FOMO appears stronger.

Revenge trading happens sooner.

The faster the market moves,

the harder it becomes to stay objective.

The Real Risk of Fast Markets

It isn’t direction.

It isn’t analysis.

It’s behavior.

• Overtrading increases

• Discipline weakens

• Risk expands

• Patience disappears

And small mistakes become expensive quickly.

How Professionals Adapt

Professionals don’t fight volatility.

They adapt to it.

They:

• Reduce position size

• Trade less frequently

• Accept wider stops or stay flat

• Focus on survival first

• Wait for clarity to return

They protect capital before chasing opportunity.

Volatility doesn’t create bad traders.

It reveals unprepared ones.

📘 Shared by @ChartIsMirror

Do you trade more during volatility… or become more selective?

Comment honestly.

Not Every Trade Will Happen — Discipline Comes FirstSometimes the market gives us a setup… but the conditions we need never appear.

Price may reach a zone that looks promising, show a small reaction, and then move away.

For me, that first touch is information, not a trade.

I wait for confirmation — absorption, commitment, and proper structure on lower timeframes.

This approach means:

-watching price move without me,

-missing what might look like a “perfect” trade,

-staying flat while others are active.

And that’s okay.

Activity is not the same as progress.

By waiting for confirmation, I trade less — but with intention.

Risk stays defined, decisions remain clean, and outcomes become repeatable.

Not trading is not hesitation.

It’s discipline.

And discipline is part of the system.

>If you want to see how I analyze setups in real time and share my thought process on each move, hit follow and join the journey.

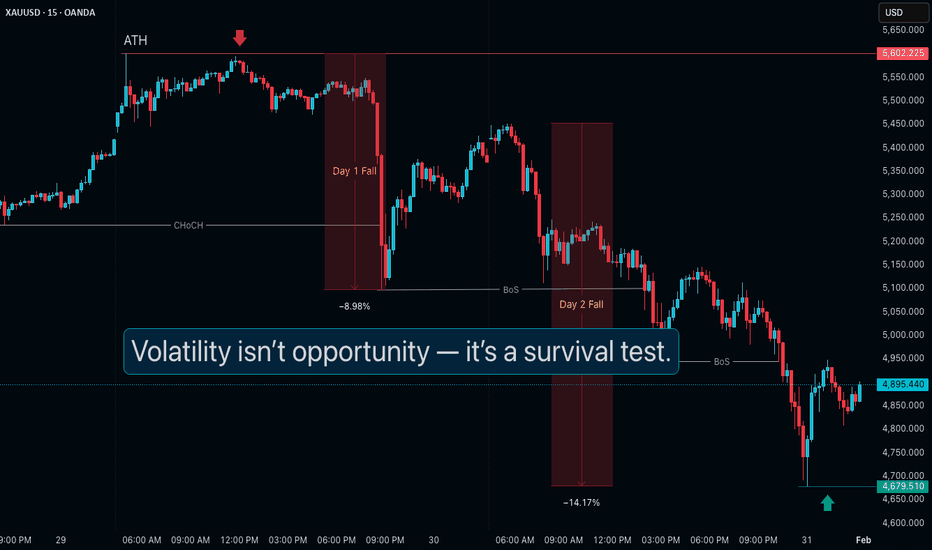

When Institutions Dump: What Retail Traders Must Remember?When Institutions Dump and Volatility Explodes: What Retail Traders Must Remember?

“Not every market condition is meant to be traded.”

Gold dropping from 5600 to 4700 in just two trading sessions

is not normal price action.

This is not retail-driven movement.

This is institutional liquidation.

And in such phases, most retail losses don’t come from bad analysis —

they come from being present when they shouldn’t be.

What Happens During Institutional Sell-Offs

When institutions unload positions:

• Volatility expands abnormally

• Spreads widen

• Stops get skipped or slipped

• Levels lose respect

• Momentum becomes violent

This is not a technical environment.

It’s a risk environment.

The market is not offering opportunity.

It is testing survival.

Why Retail Traders Get Hurt

Retail traders lose money in these phases because of:

• FOMO after large candles

• Oversized positions

• Trading without context

• Assuming “it can’t go further”

• Treating chaos like structure

Extreme volatility creates the illusion of opportunity.

In reality, it removes control.

Two Valid Choices for Retail Traders

There is no shame in either.

1. Stay Away Completely

If you don’t trade volatility professionally:

• Staying flat is a winning decision

• Protecting capital is the priority

• Waiting for structure to normalize is discipline

No trade is better than a forced trade.

2. Trade Smaller, Not Smarter

If you do participate:

• Reduce position size significantly

• Accept wider stops or don’t trade

• Avoid revenge and “catching bottoms”

• Trade only at higher-timeframe levels

• Expect slippage and imperfect execution

Risk management matters more than accuracy.

What to Avoid at All Costs

• Chasing big candles

• Trading emotionally charged news

• Assuming mean reversion

• Increasing size to “recover”

• Confusing volatility with edge

This is how accounts get wiped — not slowly, but suddenly.

The Professional Mindset in Extreme Markets

Professionals ask one question:

“Is this market tradable for my style?”

Retail traders ask:

“How can I profit from this move?”

That difference decides survival.

Capital saved during chaos

is capital available when clarity returns.

📘 Shared by @ChartIsMirror

In extreme volatility, do you step aside — or feel the urge to jump in?

Comment honestly. Awareness matters more than activity.

The Real Reason You Miss Good TradesThe Real Reason You Miss Good Trades

“You didn’t miss the trade.

You avoided the discomfort.”

Every trader knows this feeling.

You see the level.

You see the setup.

You even mark the zone.

And then price moves…

without you.

Later, you ask:

“Why didn’t I take that trade?”

The answer is rarely technical.

Why Most Traders Think They Miss Trades

They blame:

• Late entries

• Fast markets

• News

• Platform issues

• “Bad timing”

But those are excuses that feel safer than the truth.

The Real Reason

You miss good trades because they make you uncomfortable.

Good trades often:

• Look risky before they work

• Require waiting without certainty

• Enter near fear, not excitement

• Force you to accept possible loss

Your mind hesitates not because the setup is unclear —

but because the outcome is uncertain.

And uncertainty feels threatening.

Why Bad Trades Are Easier to Take

Bad trades feel comfortable.

They:

• Happen after momentum

• Come with confirmation overload

• Feel “obvious”

• Reduce fear in the moment

That’s why many traders take weak trades quickly

and hesitate on strong ones.

Comfort feels safe.

But safety rarely pays.

The Missed-Trade Pattern

It usually looks like this:

• You wait for “one more confirmation”

• Price moves slightly without you

• You hesitate again

• The trade runs

• You feel frustration — or chase late

The problem wasn’t speed.

It was self-trust.

How Professionals Don’t Miss Good Trades

Professionals don’t feel less fear.

They respect it differently.

They:

• Accept uncertainty before entry

• Execute when criteria is met — not when it feels good

• Size positions so fear doesn’t control them

• Trust repetition, not individual outcomes

They don’t wait to feel ready.

They act when conditions are ready.

A Simple Self-Check

Ask yourself:

“If this trade loses, am I okay with that?”

If the answer is no,

your size — not the setup — is the problem.

Good trades are often quiet, uncomfortable, and easy to miss.

Discipline is learning to step in anyway.

📘 Shared by @ChartIsMirror

What usually stops you from taking good trades —

fear, hesitation, or waiting for certainty? Comment honestly.

Gold (XAUUSD) - 22 Jan | Watching Key Sell & Buy ZonesGold (XAUUSD) Analysis – 22 January

Hello Disciplined Traders,

Welcome to the Chart Is Mirror Community 👋

Market Context

• Yesterday, on 21 January , Gold marked a new all-time high at 4888.5 , followed by a healthy pullback .

• Overall momentum remains strongly bullish — the H4 structure is bullish , and M15 also remains bullish despite the current pullback phase.

Key Observations

• For today, we have two key zones to observe — one for potential longs and one for potential shorts.

• As per current price action and internal structure, the market may pull back lower to mitigate the 4740.903 price level .

This zone could attract buyers. If price reaches this area and is respected with LTF bullish confirmation , we will plan a long setup accordingly.

• Alternatively, if the market first moves upward to mitigate the 4852.856 selling zone , this area acts as a strong supply level .

If price respects this zone with LTF bearish confirmation , we will plan a short setup , targeting the 4740.903 buying zone below, as marked on the chart.

• At the moment, price is trading between both zones , so patience is required. Wait for price to reach the zone and reveal intent.

Execution Plan

• Observe price reaction at 4852.856 for short opportunities.

• Observe price reaction at 4740.903 for long opportunities.

• Execute trades only with clear LTF confirmation .

• No confirmation, no entry .

Event Awareness

• Today is a CPI news day . Expect high volatility during the New York session .

• Reduce risk, avoid impulsive entries, and let volatility settle before execution.

Structure defines the zones — patience defines the outcome.

📘 Shared by @ChartIsMirror

Detachment Is a Skill, Not a FeelingDetachment Is a Skill, Not a Feeling

“Detachment isn’t about not caring.

It’s about not clinging.”

Many traders misunderstand detachment.

They think it means being cold.

Emotionless.

Disconnected.

That misunderstanding keeps them stuck.

True detachment is not the absence of emotion.

It is the presence of clarity.

Why Traders Struggle With Detachment

Attachment forms quietly.

To:

• A bias

• A winning streak

• A well-researched idea

• A trade that “should work”

The more effort you put into an analysis,

the harder it becomes to let go.

You don’t want to be wrong.

So you stop listening.

Engagement vs Attachment

Engagement is healthy.

Attachment is dangerous.

Engagement means you observe price closely.

Attachment means you defend your opinion.

Engagement adapts.

Attachment insists.

Professionals stay engaged.

Amateurs get attached.

What Attachment Does to Trading

• You ignore early warning signs

• You delay exits

• You justify holding longer

• You confuse hope with patience

• You feel personally affected by outcomes

The trade becomes about you,

not about price.

What Detachment Actually Looks Like

Detachment means:

• You accept invalidation quickly

• You respect structure changes

• You exit without emotional negotiation

• You treat each trade independently

• You care about execution, not outcome

You’re still focused.

You’re just not entangled.

How to Train Detachment

• Define invalidation before entry

• Journal emotional reactions, not just results

• Reduce position size to reduce attachment

• Pause after wins and losses

• Ask: “What is price telling me now?”

Detachment is not a personality trait.

It’s a practiced skill.

📘 Shared by @ChartIsMirror

Where do you feel the strongest attachment — entries, exits, or bias?

Comment honestly. Awareness begins there.

When the Market Speaks and Traders Don’t ListenWhen the Market Speaks and Traders Don’t Listen

“The market didn’t reverse suddenly.

You just stopped paying attention.”

Every trader has experienced it.

Price gives signs.

Structure weakens.

Momentum slows.

And yet… the trade is held.

The bias stays.

Hope replaces observation.

Why Traders Miss Clear Reversals

Most traders don’t miss reversals because they lack knowledge.

They miss them because they are emotionally invested.

By the time reversal signals appear, traders are already attached to:

• A bias

• A winning streak

• A prediction

• An opinion they don’t want to abandon

The market speaks softly first.

Ego drowns it out.

What the Market Actually Says

Before most reversals, price communicates clearly:

• Failed continuation

• Loss of momentum

• Liquidity grabs without follow-through

• Structure shifts

• Weak reactions from key zones

These are not surprises.

They are messages.

The market always warns before it turns.

Why Traders Choose Not to Listen

Because listening requires acceptance.

Acceptance that the idea is no longer valid.

Acceptance that being right has expired.

So traders wait for “one more push.”

One more candle.

One more confirmation.

That delay is costly.

Professionals Listen Early

Professional traders don’t predict reversals.

They respond to them.

They don’t argue with price.

They don’t defend bias.

They observe and adapt.

When structure changes, they change.

Without drama.

How to Start Listening Again

• Detach from your last analysis

• Ask what price is doing now , not what it should do

• Respect structure shifts immediately

• Treat hesitation as information

• Accept that clarity often arrives quietly

The market never stops speaking.

Only traders stop listening.

📘 Shared by @ChartIsMirror

Have you ever watched the market speak… and decided not to listen?

What made you stay?

Gold (XAUUSD) - 5 Jan | Watching Pullback to Key POI ZoneGold (XAUUSD) Analysis – 5 January

🎉 Happy New Year 2026, Disciplined Traders 🎉

Wishing you clarity, patience, and disciplined execution as we step into a new trading year.

Market Context

• On 26 December 2025 , Gold marked a new all-time high at 4550.150 , followed by sharp selling that developed into an H4 pullback .

• During this phase, the M15 structure shifted bearish .

• On 31 December , price found support at the 4274–4275 demand zone , and since then, Gold has been repeatedly taking support from the 4304–4310 zone .

• In today’s Asian session, price took out the previous H4 and M15 lower high at 4404.375 , confirming a clear bullish structure shift .

Key Observations

• With structure now shifted back to bullish, we will focus on long setups .

• As per current price action, our POI for today’s long setup lies at the 4332.3–4327.3 buy zone .

• If price retests this zone and shows LTF bullish confirmation , we will plan our long trade accordingly.

• For awareness, Gold may initiate a short-term pullback from the 4426–4427 zone if price reacts there.

• Additionally, there remains an unmitigated H4 demand zone at 4218–4205 .

• From a higher-timeframe perspective, before Gold continues its broader bullish journey toward the 5000 psychological milestone , a retest of this deeper zone is possible. This is shared as a structure-based expectation , not a trade call.

Execution Plan

• Focus on long setups while M15 bullish structure holds.

• Execute only on clear LTF confirmation .

• Be mindful of higher-timeframe unmitigated zones and potential pullbacks.

• No confirmation, no entry . Manage risk with discipline.

A new year begins — structure remains the compass.

📘 Shared by @ChartIsMirror

Consistency: The Real Market Hack Nobody Talks About

The Real Market Hack Isn't a New Indicator - It's Doing the Same Thing on Purpose

Everyone is hunting for the next edge:

New signal

New model

New AI feature

But if you look at traders who actually last in this game, they usually have something boring in common:

One or a few clear approaches

Defined rules

Years of showing up and doing the same thing

That's not an accident. That's the compounding effect of consistency.

---

Why Consistency Beats Constant Optimization

When you constantly change:

You never see what your edge really is

You never gather enough data on any one system

You end up chasing whatever just worked last month

In the AI era, this gets worse — because tools can generate infinite variations of a strategy in minutes. It's tempting to jump to the "latest best" version every time the equity curve dips.

Consistency looks like:

Choosing a system that is "good enough"

Defining exactly how you size, enter, and exit

Letting it play out over 50, 100, 200 trades before judging

---

Using AI to Enforce Consistency, Not Break It

AI and automation can be your enemy or your ally here.

Enemy when:

You constantly regenerate new strategies instead of refining one

You change parameters after every drawdown

Ally when:

You codify your rules into a bot and let it execute without emotion

You use AI to track execution quality ("Did I actually follow my plan?")

You schedule when you’re allowed to review and adjust — not in the middle of pain

The Illusion of Certainty: Why Traders Stop ListeningThe Illusion of Certainty: Why Traders Stop Listening to the Market

“The moment you feel certain,

you stop being accurate.”

Every trader wants clarity.

But many confuse clarity with certainty.

Clarity observes.

Certainty assumes.

And the market punishes assumptions.

How Certainty Is Born

Certainty doesn’t appear suddenly.

It builds quietly.

From:

• A few winning trades

• A strong analysis that worked before

• Repeated confirmation in one direction

• External validation from others

Soon, probability turns into belief.

And belief turns into blindness.

Why Certainty Feels So Good

Certainty removes doubt.

It removes hesitation.

It removes discomfort.

You stop asking questions.

You stop checking structure.

You stop waiting for confirmation.

You trade faster — not better.

What Certainty Does to Your Trading

• You ignore changing structure

• You dismiss opposite signals

• You hold losers longer than planned

• You average instead of reassess

• You confuse confidence with control

The market keeps evolving.

Certainty freezes you in place.

Certainty vs Professional Thinking

Professionals don’t trade certainty.

They trade probability.

They know:

• Being right is temporary

• Structure can shift

• The market owes nothing

They stay open, not convinced.

Prepared, not attached.

How to Break the Illusion

• Replace “I know” with “Let me see”

• Always define invalidation

• Respect structure over opinion

• Re-confirm bias after every session

• Treat certainty as a warning signal

The goal isn’t to feel sure.

The goal is to stay responsive.

📘 Shared by @ChartIsMirror

Do you trade to be right…

or to stay aligned with what price is doing now?

Gold (XAUUSD) - 22 Dec | Watching Pullback to Key POI ZonesGold (XAUUSD) Analysis – 22 December

Hello Disciplined Traders,

Welcome to the Chart Is Mirror Community 👋

Market Context

• Gold continues in strong bullish momentum . During today’s Asian session, price took out the previous all-time high 4381.440 and reached a new psychological level at 4400 .

• As per market structure, both H4 and M15 are in sync and bullish , confirming continuation bias.

Key Observations

• For intraday participation, we will remain patient and wait for price to pull back into key POI zones before planning any long setups.

• The first POI for long setup is the H4 breaker zone 4381.5–4374 .

This zone may act as support. If price retests this area and provides LTF bullish confirmation , we will plan our long setup accordingly.

• The second POI lies at 4355–4337 , a broader M15 fractal + H4 order block , making it a high-probability buying zone.

If price revisits this area and respects it with LTF confirmation , we will plan our long setup.

• The third POI remains the same 4304.3–4296.9 demand zone , as discussed and marked in our 18 December analysis .

However, note that the current M15 Higher Low (HL) is at 4309 , which sits above this zone.

If the market only sweeps sell-side liquidity below the HL and maintains bullish structure , we will consider long setups from this zone with confirmation.

If structure shifts bearish, this POI becomes invalid for long setups and we will reassess accordingly.

Execution Plan

• Focus only on pullback-based long setups aligned with structure.

• Execute trades only with clear LTF confirmation .

• No confirmation, no entry — discipline over impulse.

• Market volatility remains elevated — manage position size and risk carefully .

New highs invite excitement — pullbacks invite opportunity.

📘 Shared by @ChartIsMirror

The Attachment to a Bias: When Analysis Turns BlindThe Attachment to a Bias: When Analysis Turns Blind

“The market didn’t change.

Your attachment did.”

Every trader begins with a view.

Bullish or bearish.

That’s normal.

The problem starts when a view becomes an identity.

You stop observing.

You start defending.

How Bias Is Formed

Bias is rarely created by logic alone.

It forms from:

• A strong winning trade

• A painful loss you want to recover

• A convincing analysis or opinion

• News, narratives, or predictions

Slowly, analysis turns into belief.

Belief turns into attachment.

Why Bias Feels Like Confidence

Bias feels powerful because it removes uncertainty.

It gives comfort.

You stop questioning.

You stop waiting.

You start seeing only what supports your view.

But comfort is not clarity.

And certainty is not accuracy.

What Bias Does to Your Trading

• You ignore early warning signs

• You skip confirmation

• You hold losing trades longer

• You miss clean reversals

• You fight structure instead of reading it

The market keeps giving information.

Bias stops you from receiving it.

Flexibility vs Conviction

Professional traders are not directionless.

They are flexible.

They have a plan — but no attachment.

They follow structure, not opinions.

They let price speak first.

Conviction says, “I know.”

Flexibility says, “Show me.”

How to Detach From Bias

• Treat every trade as independent

• Update bias only after structure confirms

• Journal when you feel “sure” — that’s a warning

• Ask: “What would invalidate my view?”

• Let price lead, not belief

The market doesn’t reward conviction.

It rewards awareness.

📘 Shared by @ChartIsMirror

Have you ever held onto a bias even when price was clearly changing?

Awareness begins the moment you let go.

Gold (XAUUSD) - 24 Dec | Pullback to Key POI in FocusGold (XAUUSD) Analysis – 24 December

🎄 Merry Christmas, Disciplined Traders 🎄

Wishing you calm minds, steady execution, and disciplined risk management during the festive season.

Market Context

• Gold continues in strong bullish momentum , having achieved the 4500 psychological level .

• The recent all-time high stands at 4526 , confirming strength and continuation.

• As per market structure, both H4 and M15 remain aligned and bullish .

• Currently, price is trading in a M15 pullback phase after the strong upside expansion.

Key Observations

• For intraday participation, we will wait patiently for price to pull back into a defined POI zone before planning any long setup.

• As per the current structure, the POI for long setup lies at the 4450.9–4439.7 zone .

• If price revisits this zone and shows LTF bullish confirmation , we will plan our long setup accordingly.

• If the market fails to respect this POI and we see a M15 close below the Higher Low at 4430.5 , it will signal a bearish structure shift .

• In that case, this POI becomes invalid for longs and we will reassess the structure before planning further trades.

Execution Plan

• Focus only on pullback-based long setups aligned with structure.

• Execute trades strictly on LTF confirmation .

• No confirmation, no entry .

• Holiday volatility can be deceptive — manage position size and risk carefully .

Even during celebration, discipline remains the edge.

📘 Shared by @ChartIsMirror

The Psychology of Letting AI Trade for YouThe Hardest Part of AI Trading Isn't the Code - It's Letting Go

You can spend months building the perfect system.

You backtest it. Tweak it. Optimize it.

And then, the first time it takes three losses in a row, you override it.

In the era of AI and automation, the battlefield has shifted. The challenge is no longer just "Can I build a system?" — it's "Can I trust it enough to let it work?"

The New Psychological Game: Humans vs Their Own Bots

We tell ourselves we want robots to remove emotion.

What actually happens is more subtle:

We stop being emotional about individual trades

We start being emotional about the system itself

Instead of:

"Should I exit this trade?"

you think:

"Is the bot broken?"

"Should I turn it off?"

"Why did it take this trade? I wouldn't have."

The emotions don't vanish. They just move up a level.

The 5 Stages of AI Trading Psychology

Euphoria – Early wins, "this thing is a money printer."

Doubt – First real drawdown, "maybe it's not as good as I thought."

Intervention – You start skipping signals, closing early, or adding your own trades.

Confusion – You can no longer tell if results are from the system or from your meddling.

Integration (or Abandonment) – Either you learn your role vs the system… or you conclude "AI doesn't work" and go back to pure manual trading.

Most traders get stuck between stages 2–4. The goal is to move to stage 5 with eyes open .

Calibrated Trust: Between Blind Faith and Total Control

Two extremes kill AI trading:

Blind Trust – "The bot knows best, I'll never question it."

Zero Trust – "I'll override whenever I feel like it."

You want calibrated trust :

You understand how the system makes decisions

You know its expected win rate, drawdown, and losing streaks

You have written rules for when you will and won't intervene

Think of it as a partnership: the AI follows the rules; you manage the environment and the risk.

Designing Your Role Before You Turn the Bot On

Before you ever hit "start", write down:

Which signals you will take without second‑guessing

Which situations require human review (major news, tech issues, extreme volatility)

Your hard stop conditions:

Max daily loss

Max drawdown

Max number of consecutive losses

Your review schedule (weekly, monthly) for performance and logic

If your rules only live in your head, your emotions will rewrite them in real time.

Emotional Hacks for the AI Era

Trade Smaller Than You Think You Should

If you can't sleep, size is too big. No psychology trick beats position sizing.

Check Less Often

Every peek at P&L triggers a reaction.

Schedule times to review, rather than watching every tick.

Journal Your Urges, Not Just Your Trades

Write down: "Wanted to stop the bot after 3 losses, didn't."

Or: "Overrode this signal, why?"

Separate Process From Outcome

Good process + bad short‑term outcome is still a win .

Bad process + good short‑term outcome is a landmine.

Your Mind Is Still the Edge

AI can:

Scan faster

Execute cleaner

Track more variables than you ever could

But only you can decide:

What risk you are truly willing to take

When a drawdown is "normal" vs unacceptable

Whether the system still makes sense in the current regime

In the AI trading era, the real edge is a calm, knowledgeable person who knows when to trust the system - and when to step back.

After the Win: When Ego Takes OverAfter the Win: When Ego Takes Over

“Losses hurt the account.

Wins test the mind.”

A good trade works.

The plan was followed.

The market respected your level.

And then something subtle happens.

Confidence rises.

Rules soften.

The next trade feels easier to take.

That’s not growth.

That’s ego quietly stepping in.

Why Wins Are Dangerous

A win rewards behavior — but it also rewards emotion.

The brain links profit with personal ability.

You start trusting yourself more than your process.

Thoughts begin to shift:

• “I’m in sync with the market.”

• “I can see it clearly now.”

• “This one will work too.”

This is how discipline slowly erodes.

Confidence vs Ego

Confidence is calm.

Ego is loud.

Confidence respects rules.

Ego bends them.

Confidence accepts uncertainty.

Ego assumes control.

The moment a trader feels “special,”

the market prepares a lesson.

The Common Pattern

Many traders lose money not after losses,

but after a strong winning trade.

Why?

• Position size increases

• Entries become aggressive

• Confirmation is skipped

• Patience disappears

The account doesn’t collapse immediately.

It leaks slowly.

How to Stay Grounded After a Win

• Treat wins like losses — review them

• Take a short pause after big profits

• Reset size to default

• Ask: “Did I follow process, or did I get lucky?”

Your edge is consistency, not confidence.

The market doesn’t punish success.

It punishes arrogance.

📘 Shared by @ChartIsMirror

Do you feel more disciplined after a win…

or more confident than your rules allow?

Gold (XAUUSD) - 18 Dec | Waiting for Pullback to Key POI🟡 Gold (XAUUSD) Analysis – 18 December

Hello Disciplined Traders,

Welcome to the Chart Is Mirror Community 👋

Market Context

• Gold remains in strong bullish momentum .

• The M15 internal structure is in an uptrend , fully aligned with the broader H4 trend .

• Currently, price is moving sideways within the 4320–4349 range . This is a consolidation phase — patience is required until price expands out of this range.

Key Observations

• For intraday opportunities, our primary POI for long setup is the 4304.3–4296.9 demand zone .

• This zone is unmitigated , and we expect price to pull back into this area before attempting to break the 4349.280 higher-high .

• If price revisits this POI and shows LTF bullish confirmation , we will plan our long setup accordingly.

Execution Plan

• Wait for price to break out of the current range or pull back into the 4304.3–4296.9 zone.

• Execute longs only with clear LTF confirmation .

• No confirmation, no entry — stay calm and selective.

• The market is volatile — manage position size and risk carefully .

Stillness during consolidation prepares you for expansion.

📘 Shared by @ChartIsMirror

Important Note

Due to the Christmas and New Year holiday period, price action may remain choppy and unreliable over the next few weeks. False moves and stop-loss hits are more likely. Trade cautiously, reduce risk, or consider staying aside until around 15 January 2026 for clearer structure and smoother market behavior.

EURUSD – Liquidity Grab Before the Next Leg Up?HTF remains bullish on EURUSD. The structure is still intact, momentum favors buyers, and every major dip has been used as accumulation rather than distribution. Nothing has changed on the macro picture.

But on LTF, the market is doing what a bullish trend should do, pulling back, clearing stops, and looking for fresh liquidity before pushing higher.

What price is showing right now

• We recently took liquidity above the 1.17586 area

• Momentum stalled right after that sweep

• There’s an unmitigated demand pocket below current price

• And the clearest liquidity pool sits at 1.15887

That 1.15887 zone is important.

It’s the last un-swept swing low, sitting right under minor supports the kind of level the market loves to tap before building the next move.

Most likely path

The clean scenario here:

- Short-term retracement

- Sweep of 1.15887 liquidity

- Mitigation of the demand zone just below

- Accumulation

- Continuation into 1.1800–1.1850 targets

Still HTF bullish just expecting a corrective leg first.

The Reborn Trader Mindse t

This is where most traders get trapped.

HTF says up. LTF dips and they flip bias, panic, or chase shorts into demand.

A bullish market can drop without ever breaking the trend.

Understanding that is the difference between emotional reactions and intentional decisions.

Trade the story, not the noise.

Let the liquidity get taken. Then let the market show its hand.

If this breakdown helped, hit follow and drop a comment with your view.

The Break-Even Syndrome: Why Profitable Trades Die Early“Many traders are right about direction…

but wrong about patience.”

A trade moves in your favor.

Not much. Just enough to breathe.

Your mind reacts before price does.

“Let me move stop to break-even.”

“Now it’s safe.”

But what feels like safety is often fear wearing discipline’s mask.

What Is the Break-Even Syndrome?

The break-even syndrome is the habit of moving stop loss to entry

not because the market confirms it —

but because the trader cannot tolerate the possibility of being wrong again.

It’s not risk management.

It’s emotional relief.

Why Traders Do This

• Recent losses create fear of giving back profits

• Ego wants to avoid another red trade

• The brain seeks comfort, not expectancy

• A small win feels better than another loss

So traders protect their feelings

instead of protecting their edge.

How Break-Even Kills Good Trades

Markets breathe.

Pullbacks are normal.

Structure requires space.

By moving to break-even too early:

• You exit before the real move begins

• You train yourself to fear normal retracements

• You destroy positive expectancy

• You stay “safe” but never grow the account

Break-even doesn’t reduce risk.

It reduces potential.

When Break-Even Makes Sense

Break-even is valid only when:

• Structure has shifted clearly

• Liquidity is cleared in your favor

• Partial profits are secured

• The market has earned protection

Otherwise, break-even is premature.

The Deeper Issue

The real problem isn’t the stop.

It’s trust.

Trust in your analysis.

Trust in probability.

Trust that not every trade needs saving.

You don’t need to protect every trade.

You need to let your edge play out.

📘 Shared by @ChartIsMirror

Do you move to break-even because the market told you to…

or because fear did?

Gold (XAUUSD) - 12 Dec | Pullback to Key POIs in Focus🟡 Gold (XAUUSD) Analysis – 12 December

Hello Disciplined Traders,

Welcome to the Chart Is Mirror Community 👋

Market Context

• Gold continues in strong bullish momentum .

• In yesterday’s session, the H4 previous swing high 4264.6 was taken out, along with the M15 previous swing high 4247.8 , confirming bullish continuation on both timeframes.

• After this breakout, a healthy pullback is expected before the next leg upward.

Key Observations

• Our first POI for short-term long setup is the 4244.8–4230 OB zone .

If price pulls back into this zone and we get LTF bullish confirmation , we will plan our long setup accordingly.

• Our second POI is a high-probability, strong demand zone at 4198.7–4182.1 .

This zone is unmitigated and sits just below the recent HL at 4204, making it a key reaction level.

If price reaches this zone with LTF confirmation , we will plan our long setup from here.

Execution Plan

• Observe price reaction at 4244.8–4230 first.

• If invalidated, wait patiently for price to approach the deeper 4198.7–4182.1 demand zone.

• Maintain bullish bias while M15 structure remains intact.

• No confirmation, no entry.

Structure reveals the direction — confirmation reveals the timing.

📘 Shared by @ChartIsMirror

Important Note*

Over the next month, due to Christmas and New Year period, market conditions may become choppy and unpredictable. Price action may not form cleanly, and setups may fail more frequently. Trade cautiously, manage risk strictly, or consider staying on the sidelines until around 15 January 2026 for smoother conditions.