TWT Analysis (4H)The price has made deep drops, and it appears that market makers have collected sufficient liquidity to change the trend.

After the drops, the price ranged at the bottom for a period, which seems to have been sufficient as an accumulation phase for an upward move on the hourly timeframe. Market makers also appear to have filled their orders.

The mid-term bearish trendline has been broken. The bearish C wave appears to be a diametric and has already ended. A proper pullback to the broken trendline has not yet occurred. A pullback is expected soon, after which the price is expected to enter the C wave.

We have marked two entry points on the chart where positions should be entered using a DCA approach. Targets have been specified on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

Trading is not hard or complicated if you have a professional coach.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

TWTUSDT

#TWT/USDT Ready to go higher#TWT

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.8680. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.8807

First target: 0.8893

Second target: 0.8992

Third target: 0.9092

Stop loss: Below the support zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

$TWT/USDT ANALYSISTWT/USDT on the 12-hour chart is still moving in a clear downtrend because price is trading below the descending trendline and also below the EMA, showing sellers are still controlling the market. Price is sitting inside a strong support demand zone around 0.95–1.00, and this zone has reacted before which means buyers are trying to defend it, but until the price breaks and closes above the trendline and 1.02–1.03 area with strength, upside continuation is not confirmed. If price keeps failing at the trendline it can stay weak and continue sideways or even push down toward the lower support area around 0.91, but if buyers manage to break out cleanly above resistance, then recovery toward higher levels becomes possible. Right now the structure is bearish but sitting on support where reaction can happen, so the next move depends on whether price breaks up from the trendline or gets rejected again.

#TWT/USDT — Descending Triangle at Demand Zone!#TWT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 1.21, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 1.25.

First target: 1.27.

Second target: 1.30.

Third target: 1.34.

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

TWT – Trending with a Strong Break of Structure (BOS) on 4HTWT has recently made a decisive Break of Structure (BOS) on the 4-hour timeframe, signaling a potential bullish continuation from a 50% Fibonacci retracement zone. This retracement confirms a solid area of demand and a great entry point.

The market cap has just crossed above 500M, qualifying it as a large-cap coin, which typically attracts significant attention from bigger players and institutional investors. This fundamental shift adds weight to the technical setup.

Key targets to watch:

TP1: 1.272 Fibonacci extension, the first likely resistance level

TP2: 1.618 extension, a strong follow-up target if momentum sustains

Important note: If price creates a new high before reaching 50% retracement, the current setup will be invalidated, so strict risk management is crucial.

Risk: Just 0.5% per trade, balancing opportunity and safety.

Trade smart, and good luck! 🚀

Support and Resistance Area: 0.9563-1.0036

Hello, traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

(TWTUSDT 1W Chart)

The key support and resistance area is 1.65-1.8839.

To break above this important support and resistance zone, we need to see if the price can maintain support near 1.0036 and rise above 1.4026.

-

(1D chart)

Since the HA-High indicator on the 1D chart was generated at 0.9563, it's crucial to see if the price can maintain above 0.9563-1.0036.

To achieve this, the key is whether the price can rise after finding support near 1.2224.

Therefore, if the price falls below 1.2224, support around 0.9563-1.0036 will be crucial.

------------------------------------

The basic trading strategy is to buy in the DOM(-60) ~ HA-Low range and sell in the HA-High ~ DOM(60) range.

However, if the price rises from the HA-High to DOM(60) range, it is likely to exhibit a step-like upward trend, while if it falls from the DOM(-60) to HA-Low range, it is likely to exhibit a step-like downward trend.

Therefore, the basic trading strategy should be a segmented trading strategy.

Buying when the HA-High to DOM(60) range shows support requires a short and quick response.

As mentioned earlier, the HA-High to DOM(60) range is considered a sell zone, or resistance zone.

Therefore, if possible, it's best to find a buying opportunity when the price declines and then rises.

1. The K indicator of the StochRSI indicator should be rising. If possible, it should not enter the overbought zone.

2. The On-By-Sign-Operative (OBV) indicator should be rising. If possible, it should remain above the High Line.

3. The TC (Trend Check) indicator should be rising. If possible, it should be above the 0 point.

When the three indicators listed above are met, the price is likely to continue its upward trend.

-

Thank you for reading to the end.

We wish you successful trading.

--------------------------------------------------

TWTUSDT – Buy the DipTWTUSDT looks like it’s offering a solid dip-buying opportunity. Pullback seems healthy, and if support holds, we could see a strong recovery move.

EASY – Quick Flush, Quick Bounce? ⚡️

EASY had a little flush this morning, but that might just open the door for a fast rebound. Classic dip-buy setup — watching for momentum to kick back in. 👀🚀

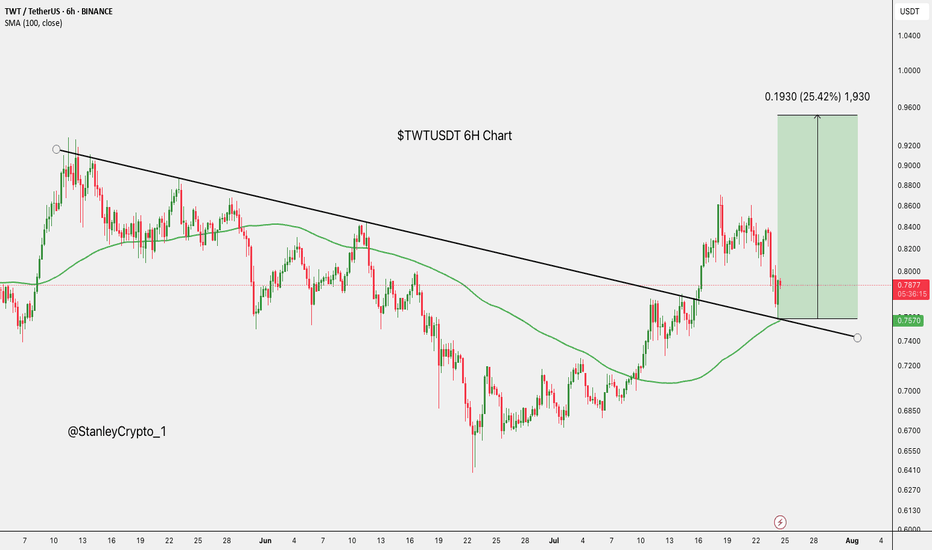

TWTUSDT Forming Powerful BreakoutTWTUSDT has recently shown a powerful breakout, backed by strong volume and investor confidence. The pair has been consolidating for a while, forming a clear accumulation zone before this sudden upward momentum. This breakout suggests the beginning of a new bullish phase, with potential for impressive gains if the momentum sustains.

Currently, the chart indicates a possible continuation pattern with projected targets pointing toward a 20% to 30%+ gain. Such wide potential reflects both the strength of the bullish move and the volatility that comes with high investor interest. If buyers continue to step in and market sentiment remains positive, TWT could easily test higher resistance zones and push toward new highs.

Investor activity is clearly rising, which often fuels liquidity and strengthens the sustainability of a trend. With technicals favoring upside momentum, this setup presents a strong opportunity for traders watching for breakout continuation patterns.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

$TWT Soars to 0.9050: Join the Breakout Boom!BINANCE:TWTUSDT

SEED_DONKEYDAN_MARKET_CAP:TWT Soars to 0.9050: Join the Breakout Boom!

Entry Level:

Marked at 1 (0.9050 USDT), suggesting a potential buy point near the current price.

Take Profit (TP) Levels:TP1: 0.786 (0.8644 USDT)

TP2: 0.618 (0.8326 USDT)

TP3: 0.5 (0.8102 USDT)

TP4: 0.7154 (0.7154 USDT)

Stop Loss (SL): Set at -1.272 (0.9566 USDT), indicating a level to exit if the price moves against the trade.

Dead Cat Bounce (DCB): Marked at -1.135 (0.9306 USDT), possibly indicating a minor reversal point.

RSI (Relative Strength Index)

Current RSI: Around 82.51, which is in the overbought territory (above 70), suggesting the asset may be overvalued and could be due for a pullback or consolidation.

Trend: The RSI has risen sharply with the recent price increase, indicating strong momentum but also potential overextension.

Key Observations

The chart shows a bullish breakout with significant upward momentum, but the overbought RSI suggests caution. Traders might consider taking profits at the marked TP levels or waiting for a pullback to the entry or lower TP levels.

The SL is set above the recent high, providing a buffer against a potential reversal.

The analysis uses a Fibonacci-based strategy, with levels derived from a recent swing high and low.

TWT/USDT — Long-Term Accumulation or Imminent Breakdown?📌 Overview

Trust Wallet Token (TWT) has been forming a major pattern on the weekly timeframe for over 3 years. The current price hovers around 0.81 USDT, sitting right inside the multi-year demand zone that has repeatedly acted as a key accumulation area since 2021.

This zone is more than just sideways price action — it’s a critical inflection point that could determine the medium-to-long-term trend.

---

📊 Market Structure & Key Pattern

Multi-Year Demand Zone (0.67 – 0.90 USDT): A golden area that has historically prevented further downside multiple times since 2021.

Series of Lower Highs (since 2022): Every rally has failed to break higher, showing sellers still dominate the mid-term structure.

Sideways Battle Zone: Buyers are defending hard, sellers are capping every move. This is a textbook accumulation vs. distribution phase.

---

🔑 Key Levels

Main Support: 0.67 – 0.90 USDT (demand zone).

Layered Resistances:

1.08 USDT → first critical resistance.

1.26 USDT → mid-level target.

1.60 USDT → strong structural resistance.

2.66 – 2.74 USDT → major supply zone / high target.

Downside supports if breakdown occurs: 0.55 → 0.30–0.40 USDT.

---

🚀 Bullish Scenario

1. Rebound from Demand: Strong weekly rejection (pin bar / bullish engulfing) inside the zone could trigger a rally toward 1.08 → 1.26 USDT.

2. Confirmed Breakout: A weekly close above 1.08 USDT with strong volume would be the first real reversal signal.

Step targets: 1.26 → 1.60 USDT.

Sustained breakout may unlock upside toward 2.66–2.74 USDT.

3. Market Narrative: Long-term buyers see this area as a “multi-year discount” accumulation zone. If BTC turns bullish, TWT could become one of the altcoins that follow explosively.

---

🩸 Bearish Scenario

1. Weekly Breakdown below 0.67: A decisive close would confirm the failure of demand.

Downside targets: 0.55 → 0.30–0.40 USDT.

2. False Pump: A rejection from 1.08–1.26 could trigger another sell-off back into support, increasing breakdown risk.

3. Market Narrative: If the global crypto market turns bearish, this demand zone may no longer hold.

---

📖 Pattern Interpretation (Deeper Look)

Accumulation or Distribution?

This yellow zone can only mean one of two things:

If buyers hold → it’s a multi-year accumulation base before the next bull leg.

If buyers fail → it’s a long-term distribution zone leading to deeper lows.

Key: Only a confirmed weekly close can separate a real move from a fake-out.

---

🎯 Potential Strategies

Conservative (Swing Traders): Enter after a confirmed breakout above 1.08. Targets 1.26–1.60.

Aggressive (Accumulation Play): Buy within 0.70–0.80 demand zone with tight stop below 0.65. First target 1.08–1.26.

Bearish Setup: Short after weekly close below 0.67. Targets 0.45–0.30.

⚠️ Risk management is essential: limit position risk to 1–2% of capital per trade.

---

📝 Conclusion

TWT is standing at the most decisive support zone since 2021. The market will soon reveal whether this is:

Bullish: a multi-year accumulation before the next expansion.

Bearish: a long-term distribution phase before deeper losses.

📌 Main Key: Wait for a confirmed weekly close with volume. Until then, the yellow box remains the battlefield of accumulation vs. distribution.

---

#TWT #TrustWalletToken #TWTUSDT #CryptoAnalysis #TechnicalAnalysis #PriceAction #Altcoin #SupportResistance #Accumulation #BreakoutOrBreakdown

TWT ANALYSIS🚀#TWT Analysis :

🔮As we can see in the chart of #TWT that there is a formation of "Falling Wedge Pattern". Some time ago the same structure was made and it performed well and this time also the same is happening with a perfect breakout

🔰Current Price: $0.8464

🎯 Target Price: $1.0865

⚡️What to do ?

👀Keep an eye on #TWT price action. We can trade according to the chart and make some profits⚡️⚡️

#TWT #Cryptocurrency #TechnicalAnalysis #DYOR

TradeCityPro | TWT: Navigating Trust Wallet's Market Moves👋 Welcome to TradeCityPro!

In this analysis, I'll be reviewing the TWT coin, a part of the Trust Wallet project, which is currently ranked 126th on CoinMarketCap with a market cap of $358 million.

📅 Daily Timeframe

As you can see in the daily timeframe, we're observing a very large range box from 0.7832 to 1.5725, where the price is currently near the bottom of this box.

✅ The floor of this box is a significant support range from 0.7832 to 0.8321 and is acting as a demand zone for the price.

🔽 Currently, the price has reached the 0.8321 area, tested it once with a shadow, and received support from it. If this area breaks, we'll enter the support zone, and we'll need to see how the price reacts to this zone.

📊 The market volume is very low, and for now, it seems there isn't enough strength and momentum in the market to break this area, but if a selling volume enters the market and the RSI goes into oversell, the likelihood of breaking this area increases. In this case, the next support will be at 0.6215.

🛒 For buying this coin, I recommend waiting until it exits the range box it has created, as this would indicate upward momentum entering the market. Currently, there is no momentum in the market. Thus, the best trigger from my perspective is the breakout at 1.5725.

📈 However, for a long position or a risky spot purchase, you could enter upon the breakout of 1.0556. I mainly consider this trigger for futures, and for spot purchases, I would wait until the main resistance is broken.

⏳ 4-Hour Timeframe

In the 4-hour timeframe, as you see, we had a box between 0.9395 to 1.0556, which has been cleanly broken from below, and you could open a short position with price consolidation below this area.

💥 Currently, the price has reached the next support at 0.8321 and has shown some reaction. The RSI is currently in oversell, and if it receives support from this area, it could return to the normal range.

📉 For short positions, the triggers at 0.8321 and 0.7832 are suitable. The 0.8321 trigger is riskier, and I suggest waiting until the 0.7832 support is lost before opening a more secure position.

🔼 For long positions, there's a very suitable ceiling at 1.0556, and breaking this area could lead to opening a long position.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | TWT: Trust Wallet Token's Market Moves👋 Welcome to TradeCityPro!

In this analysis, I want to examine the TWT coin for you. This coin is associated with Trust Wallet, which you are undoubtedly familiar with and have used. It's a very user-friendly wallet that even beginners can use easily. Currently, TWT has a market cap of $382 million and is ranked 142 on CoinMarketCap.

📅 Weekly Time Frame

In the weekly timeframe, after the price reached the area of 2.7081, which was also the ATH, a corrective phase in the market began and continued down to 0.7072.

🔍 During this period, we also had an ascending trendline accompanying the upward trend, which was broken. After a pullback to the trendline area at 1.6072, a price range box between 0.7072 and 1.6072 has formed, with several supports and resistances occurring at the box's floor and ceiling.

📊 The market volume has been decreasing since the pullback and is gradually declining, compressing the price further. A breakout above 1.6072 could potentially initiate an uptrend. If the box's support fails, there are two short-term supports at 0.5774 and 0.4761, though these are not very significant. The main support is at 0.2960.

⚡️ Moreover, the RSI in its chart has a support area at 38.44, which is also significant. A break of this area in conjunction with a break below 0.7072 in the chart could confirm the entry of significant bearish momentum.

🛒 For spot buying, the trigger at 1.6072 is appropriate. If the price consolidates above this area, we can expect it to move towards the ATH and test this area again.

🔽 As I mentioned, the ascending trendline has been broken and has been pulled back to, so if the trendline trigger at 0.270 activates and this support breaks, we can expect the price to move towards the trendline target of 0.2960.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#TWT/USDT Ready to go higher#TWT

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.23

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 1.24

First target 1.268

Second target 1.288

Third target 1.31