Can Regulatory Barriers Create Defense Monopolies?The Geopolitical Catalyst Behind Draganfly's Transformation

Draganfly Inc. (DPRO) is executing a strategic pivot from commercial drone innovation to a defense infrastructure supplier, a transformation driven by geopolitical necessity rather than market competition. The National Defense Authorization Act (NDAA) has created a regulatory moat that mandates the exclusion of foreign-made technology from U.S. critical supply chains, immediately disqualifying dominant players like China's DJI. As one of the few NDAA-compliant North American manufacturers, Draganfly gains exclusive access to billions in government contracts. The company's Commander 3XL platform, featuring a 22-lb payload capacity, patented modular design, and specialized software for GPS-denied environments, is already deployed across Department of Defense branches, validating its technical credibility in high-stakes military applications.

Strategic Positioning and Defense Ecosystem Integration

The company has de-risked its defense market entry through strategic partnerships with Global Ordnance, a Defense Logistics Agency prime contractor that provides crucial logistical expertise and regulatory compliance capabilities. The appointment of former Acting Defense Secretary Christopher Miller to the board further strengthens institutional credibility. Draganfly is rapidly scaling capacity through a new Tampa facility strategically located near major military clients, while maintaining an asset-light model with just 73 employees by leveraging AS9100-certified contract manufacturers. This approach minimizes capital expenditure risk while ensuring responsiveness to large government tenders. The company's intellectual property portfolio, 23 issued patents with a 100% USPTO grant rate, protects foundational innovations in VTOL flight control, modular airframe design, AI-powered tracking systems, and morphing robotics technology.

The Valuation Paradox and Growth Trajectory

Despite Q1 2025 comprehensive losses of $3.43 million on revenue of just $1.55 million, the market assigns Draganfly a premium 16.6x Price-to-Book valuation. This apparent disconnect reflects investor recognition that current losses represent necessary upfront investments in defense readiness facility expansion, manufacturing certification, and partnership development. Analysts forecast explosive growth exceeding 155% in 2026, driven by military contract execution. The military drone market is projected to more than double from $13.42 billion (2023) to $30.5 billion by 2035, with defense ministries worldwide accelerating investments in both offensive and defensive drone technologies. Draganfly's competitive advantage lies not in superior endurance or range AeroVironment's Puma 3 AE offers 2.5 hours flight time versus the Commander 3XL's 55 minutes but in heavy-lift payload capacity essential for deploying specialized equipment like Long Range LiDAR sensors and the M.A.G.I.C. demining system.

The Critical Question of Execution Risk

Draganfly's investment thesis centers on strategic governmental alignment outweighing current operational deficits. The company recently secured a U.S. Army contract for Flex FPV drone systems, including embedded manufacturing capabilities at overseas U.S. Forces facilities, a validation of both technical capability and supply chain flexibility. Integration projects like the M.A.G.I.C. minefield clearance system demonstrate mission-critical utility beyond conventional reconnaissance. However, the path to profitability depends entirely on execution: successfully scaling production capacity, navigating lengthy government procurement cycles, and converting the defense pipeline into realized revenue. The company is positioned to become a major player, specifically in the secure, NDAA-compliant, heavy-lift multirotor segment, not to dominate generalized fixed-wing ISR or mass-market commercial applications. The fundamental question remains whether Draganfly can execute its defense strategy fast enough to justify its premium valuation before competitors develop comparable NDAA-compliant capabilities.

UAV

How Does a Silent Giant Dominate Critical Technologies?Teledyne Technologies has quietly established itself as a formidable force across defense, aerospace, marine, and space markets through a disciplined strategy of strategic positioning and technological integration. The company recently reported record Q2 2025 results with net sales of $1.51 billion (10.2% increase) and demonstrated exceptional organic growth across all business segments. This performance reflects not market timing but the culmination of deliberate long-term positioning at the intersection of mission-critical, high-barrier-to-entry markets where geopolitical factors create natural competitive advantages.

The company's strategic acumen is exemplified by products like the Black Hornet Nano micro-UAV, which has proven its tactical value in conflicts from Afghanistan to Ukraine, and the emerging Black Recon autonomous drone system for armored vehicles. Teledyne has strengthened its market position through geopolitically aligned partnerships, such as its collaboration with Japan's ACSL for NDAA-compliant drone solutions, effectively turning regulatory compliance into a competitive moat against non-allied competitors. The 2021 acquisition of FLIR Systems for $8.2 billion demonstrated horizontal integration mastery, with thermal imaging technology now deployed across multiple product lines and market segments.

Teledyne's competitive advantage extends beyond products to intellectual property dominance, holding 5,131 patents globally with an exceptional 85.6% USPTO grant rate. These patents span imaging and photonics (38%), defense and aerospace electronics (33%), and scientific instrumentation (29%), with frequent citations by industry giants like Boeing and Samsung indicating their foundational nature. The company's $474 million annual R&D investment, supported by 4,700 engineers with advanced degrees, ensures continuous innovation while building legal barriers against competitors.

The company has proactively positioned itself to meet emerging regulatory requirements, particularly the Department of Defense's new Cybersecurity Maturity Model Certification (CMMC) mandate, which takes effect in October 2025. Teledyne's existing cybersecurity infrastructure and certifications provide a crucial advantage in meeting these standards, creating an additional "compliance moat" that will likely enable the company to capture increased defense contract opportunities as competitors struggle with new requirements.

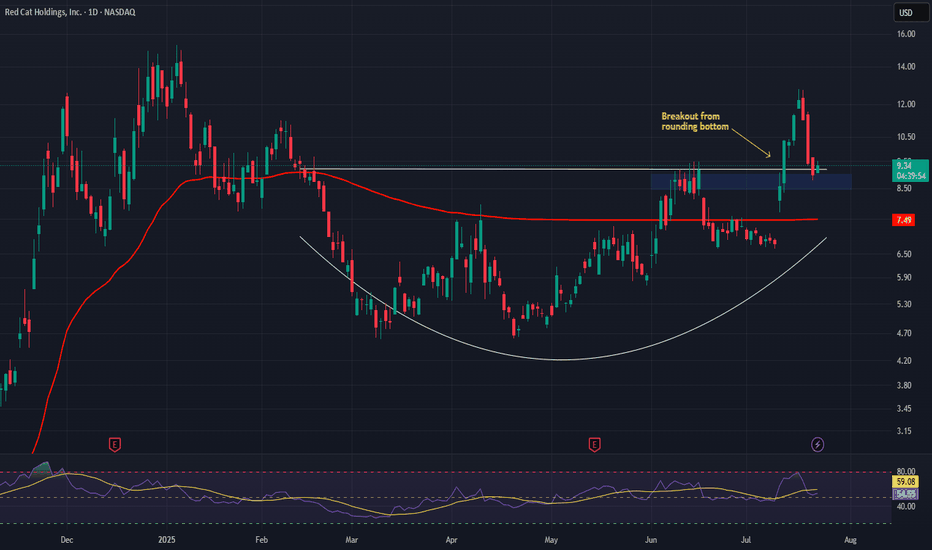

Red Cat Holdings (RCAT) – Soaring with Defense & Global DemandCompany Snapshot:

Red Cat NASDAQ:RCAT is an emerging UAV (drone) technology leader, rapidly scaling through defense-grade contracts, global expansion, and vertical integration.

Key Catalysts:

Defense Sector Traction 🎯

Recent U.S. DoD contract wins underscore RCAT’s credibility as a mission-critical UAV supplier.

Sequential revenue growth in earnings signals accelerating adoption in defense and commercial markets.

Global Expansion Strategy 🌐

RCAT is diversifying via allied procurement programs, reducing dependence on U.S. defense budgets and broadening international exposure.

Tech Stack Integration ⚙️

Strategic acquisitions are bolstering RCAT’s in-house capabilities—driving vertical integration, improving margins, and fueling innovation velocity.

Investment Outlook:

Bullish Entry Zone: Above $8.50–$9.00

Upside Target: $15.00–$16.00, supported by defense contract momentum, global reach, and a strengthened tech edge.

🛡️ RCAT is becoming a high-leverage play on modern defense tech with scalable, global upside.

#RCAT #DefenseStocks #UAV #DroneTechnology #MilitaryContracts #Innovation #DoD #Aerospace #Geopolitics #GrowthStocks #VerticalIntegration

Is the XRQ-73 the ultimate silent killer?The Unseen Predator

Imagine a drone so advanced it can slip past the most sophisticated defenses, a silent hunter in the sky. The XRQ-73, DARPA's latest X-plane, is not just a UAV; it's a harbinger of a new era in warfare.

The XRQ-73, a groundbreaking new drone from DARPA, could revolutionize the way wars are fought. With its advanced stealth technology and hybrid-electric propulsion, this unmanned aerial vehicle (UAV) is capable of performing a wide range of missions, from precision strikes to reconnaissance.

A Technological Marvel

Combining the best of electric and traditional propulsion, the XRQ-73 is a marvel of engineering. Its stealthy design and advanced capabilities make it a formidable asset for military operations. From precision strikes to intelligence gathering, its potential applications are vast.

Beyond the Battlefield

But the XRQ-73's impact extends beyond the battlefield. Its technology could revolutionize civilian sectors, aiding in disaster relief, search and rescue, and environmental monitoring.

The Future of Warfare

The XRQ-73 is a testament to human ingenuity and a glimpse into the future of warfare. As technology continues to evolve, we can expect to see even more groundbreaking advancements in unmanned aerial vehicles.

But what truly sets it apart?

Its ability to remain undetected, combined with its long-range capabilities and versatility, makes the XRQ-73 a formidable weapon. As technology advances, we can only imagine the possibilities that this and other similar drones hold for the future of warfare.

Are you ready for a world where drones rule the skies?

UAVsAeroVironment, Inc. is an American defense contractor headquartered in Arlington, Virginia, that is primarily involved in unmanned aerial vehicles (UAVs) (Wikipedia)

I have been eyeing the military industry for some time, but the stocks have never reached the price I would take. Anyway, AeroVironment looks among the best in the sector from both technical and fundamental perspectives.

The technicals:

There is a double top pattern that developed itself into a triangle. The bottom is specified by two significant lows exceeding a round number 100.0 to the downside. The most significant gap is in the location too.

I expect a lot of liquidity below the yellow rectangle. If we ever reach there without an overall market crash, I'll create the entry there. It's probably the last line of DEFENSE against the bear market. Remember, that the big players need that extra liquidity to open a significant position.

The fundamentals:

The drones were used in recent conflicts against both a professional army and militia/guerrilla force with great success. Even though, the army makes it clear that UAVs are not a replacement for any part of the military, the spendings on both the research and the development increases over time (Statista).

However, the coronavirus might cause some material issues, and increases in spending might be halted (Ibisworld), it is a kind of technology the US will not want to fall behind in. Well, it has already started to fall behind as Turkey develops the first 'dronecraft carrier'. I think the cuts are rather to hit other parts of the defense sector.

I like AeroVironment specifically because, with its focus on UAVs, it is likely to fight for the contracts in this category most hard and the price is as a result derived mostly from this growing part of the sector.

The crash:

The question is if there is enough time for the buying opportunity to develop & profit from before the markets crash. I will be looking for an opportunity between 95-100$, but might not decide to invest at all in the end.

DLong

D