Unhlong

UNH Swing Alert: $365 Call Ready to Run!

🚀 **UNH Swing Trade Alert | 2025-09-11** 🚀

**📈 Directional Bias:** Moderately Bullish (60% Confidence) ✅

**Why This Trade?**

* 🔹 Strong short-term momentum: Daily RSI 82.3 → overbought but bullish

* 🔹 Multi-timeframe gains: 5d/10d +15%/+18%

* 🔹 Low VIX favors directional call trades

* ⚠️ Weak volume (1.0x avg) → caution, risk of mean reversion

* ⚠️ Options flow neutral → no institutional confirmation

**💡 Recommended Trade:**

* **Instrument:** UNH

* **Strike:** \$365 CALL 💰

* **Expiry:** 2025-09-26

* **Entry Price (Mid):** \$5.55

* **Direction:** LONG ✅

* **Position Size:** 1 contract (scale to account risk)

* **Entry Timing:** Market open

**🎯 Targets & Stops:**

* **Profit Target:** \$10.00 (+80%)

* **Stop Loss:** \$3.60 (\~35% of premium)

* **Expected Hold:** 5–10 trading days (monitor daily; exit by Sep 24 if not hit)

**⚡ Key Risks:**

* Overbought RSI → potential mean-reversion pullback

* Weak volume → lack of institutional follow-through

* Put OI near \$350 → gamma friction may cap upside

* Naked call risk → premium-only loss possible if trade stalls

* Execution → use limit orders at mid to manage slippage

**💎 Trade Strategy:**

* Single-leg naked call

* Balanced delta (\~0.55–0.60) → probability vs leverage tradeoff

* Avoid deeper OTM or very cheap near-the-money calls

**📊 JSON Snapshot:**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 365.0,

"expiry": "2025-09-26",

"confidence": 0.60,

"profit_target": 10.00,

"stop_loss": 3.60,

"size": 1,

"entry_price": 5.55,

"entry_timing": "open",

"signal_publish_time": "2025-09-11 16:00:33 UTC-04:00"

}

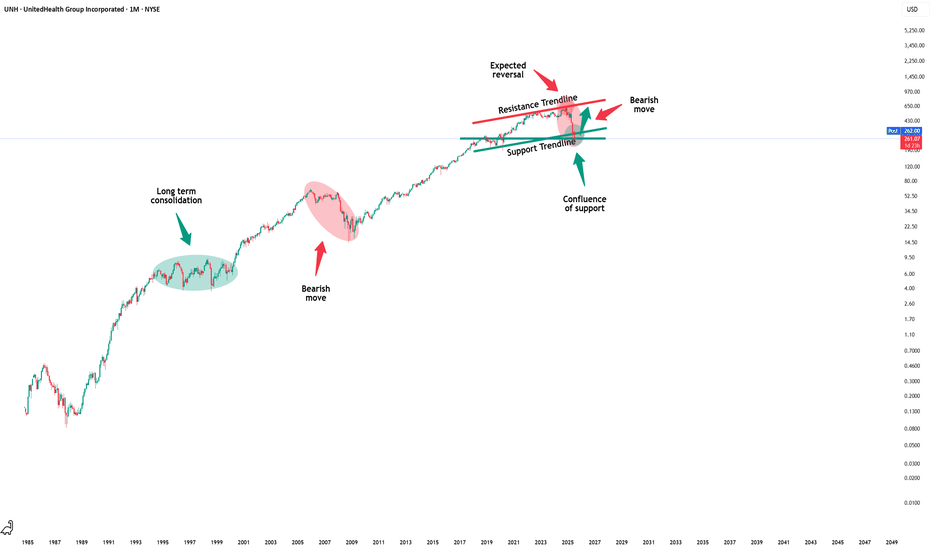

United Health - The ultimate prediction!🚑United Health ( NYSE:UNH ) will bottom now:

🔎Analysis summary:

Over the course of the past fourty years, we always witnessed strong drops on United Health. Each drop was expected though and always followed by new all time highs. Therefore history tells us that we now witnessed a bottom and United Health will rally quite soon.

📝Levels to watch:

$300

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

UNH Options Alert: $340 Call Targets 100% Gain by Thursday!

🔥 **UNH Weekly Options Alert — Asymmetric Upside Play!**

**Directional View:** **Moderate Bullish** 💹

**Confidence:** 70%

**Trade Setup:**

* **Instrument:** UNH

* **Strategy:** BUY CALL (single-leg)

* **Strike:** \$340

* **Expiry:** 2025-09-12 (4 DTE)

* **Entry Price:** \$0.70

* **Entry Timing:** Market Open

* **Size:** 1 contract

**Targets & Risk:**

* **Profit Target:** \$1.40 (\~100% gain)

* **Stop Loss:** \$0.35 (\~50% loss)

* **Max Hold:** Close by Thursday midday/EOD to avoid gamma/theta acceleration

**Why This Trade?**

✅ Options Flow: Heavy call OI (11,025) and volume (10,119) → institutional directional bias

✅ Daily Momentum: RSI 73.5 — strong near-term bullish signal

✅ Volatility: Low VIX (\~15.3) supportive for directional buy

✅ Asymmetric Risk/Reward: Low premium, high upside potential

**Key Risks:**

⚠️ High gamma/short DTE → exit by Thursday mandatory

⚠️ Overbought daily RSI → potential mean reversion

⚠️ Weak weekly cash volume → trade may fail if stock doesn’t follow options flow

⚠️ Wide bid/ask on small OTM weekly calls → manage fills carefully

**Alternate Strikes:**

* \$337.50 call at \$0.91 → higher delta, slightly more expensive

* \$325 call at \$3.32 → near-ATM, higher probability but more capital required

**Quick Takeaway:**

* Strong options-driven setup for **short-term momentum play**

* Manage risk strictly with **50% stop + time-based exit**

* Exploit institutional call flow and low-cost asymmetric upside

---

📊 **TRADE DETAILS (JSON for precision)**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 340.0,

"expiry": "2025-09-12",

"confidence": 0.70,

"profit_target": 1.40,

"stop_loss": 0.35,

"size": 1,

"entry_price": 0.70,

"entry_timing": "open",

"signal_publish_time": "2025-09-08 12:38:03 UTC-04:00"

}

```

UNH Options Alert – $310 Calls Gearing for Breakout

# 🚨 UNH Options Alert – \$310C (Aug 22) 🚀🔥

📊 **Volume:** 2.5x last wk (institutional flow 💼)

📈 **Options Flow:** C/P 2.67 → bullish momentum 💎

📉 **Weekly RSI:** bearish ⚠️ | 📈 **Daily RSI:** bullish ✅

---

### 🎯 Trade Setup

* 🏦 **Ticker:** UNH

* 🚀 **Direction:** CALL

* 💎 **Strike:** \$310C

* 💵 **Entry:** 0.79 (at open)

* 🎯 **Target:** 1.20

* 🛑 **Stop:** 0.47

* 📅 **Expiry:** Aug 22 (⚡ 2DTE – high gamma)

* 📈 **Confidence:** 65%

⚠️ **Risk:** High gamma volatility + mixed weekly trend → use tight exits.

UNH Options Momentum Heating Up – Big Gains in Sight!

# 🚀 UNH Weekly Options Analysis (2025-08-17) – Don’t Miss Out!

### 🔎 Market Overview

UNH shows **strong bullish momentum**: Call/Put ratio at 2.56, rising daily RSI at 71.9, and institutional volume up 1.8x from last week confirm the bullish outlook. Weekly RSI at 37.5 suggests moderate resistance, so caution is advised. Low VIX (\~15) keeps gamma risk low, creating an optimal environment for directional trades.

---

### 📊 Key Model Insights

* **Call/Put Ratio:** 2.56 → strong bullish flow

* **Daily RSI:** 71.9 → strong short-term momentum

* **Weekly RSI:** 37.5 → moderate upward trend, watch resistance

* **Volume:** 1.8x previous week → institutional buying confirmed

* **Volatility:** Low VIX → low gamma risk

---

### 📊 Recommended Trade

* **Direction:** CALL (Long)

* **Strike:** \$310.00

* **Expiry:** 2025-08-22

* **Entry Price:** \$5.10 (aim for better at market open)

* **Stop Loss:** \$2.05 (\~60% of premium)

* **Profit Target:** \$7.65 – \$10.20 (50–100% gain)

* **Entry Timing:** Market Open

* **Confidence:** 75%

---

### ⚠️ Key Risks

* Momentum changes → monitor for trend reversal

* Gamma exposure → watch for VIX spikes approaching expiry

* Weekly close → exit by Thursday to avoid gamma decay Friday

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 310.00,

"expiry": "2025-08-22",

"confidence": 0.75,

"profit_target": 7.65,

"stop_loss": 2.05,

"size": 1,

"entry_price": 5.10,

"entry_timing": "open",

"signal_publish_time": "2025-08-17 12:11:11 EDT"

}

```

UNH $280 Calls on Fire – Momentum Exploding Today!🚀 UNH Bulls Target \$280 – One-Day Call Sprint

**Sentiment:** 🟢 *Moderate Bullish*

* **Daily RSI:** 55.7 📈

* **Call/Put Ratio:** 2.82 → strong bullish flow

* **Volume:** Weak (0.5× last week) → watch for hesitation

* **VIX:** 15.0 → favorable for directional trades

* **Gamma Risk:** HIGH — expiry in 1 day ⚡

---

### 📊 **Consensus Snapshot**

✅ Multiple models highlight bullish options flow

⚠️ Weak volume & resistance near \$272.19 = caution

💡 High gamma requires tight risk management

---

### 🎯 **Trade Setup**

* **Type:** CALL (Single-leg)

* **Strike:** \$280.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.70

* **Profit Target:** \$0.91 – \$1.40 (+30–100%)

* **Stop Loss:** \$0.42 (≈40%)

* **Confidence:** 65%

* **Entry Timing:** Market open

---

💬 *High-risk, high-momentum expiry play — monitor closely.*

📌 *Not financial advice. DYOR.*

---

**#UNH #OptionsTrading #CallOptions #TradingSignals #DayTrading #StocksToWatch #GammaRisk #OptionsFlow**

United Health - The perfect time to buy!⛑️United Health ( NYSE:UNH ) finished its massive drop:

🔎Analysis summary:

Over the past couple of months, United Health managed to drop an incredible -60%. This drop however was not unexpected and just the result of a retest of a massive resistance trendline. Considering the confluence of support though, a bullish reversal will emerge quite soon.

📝Levels to watch:

$250

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

UNH a dead stock?After a 63% drop this year from its high, the stock has started seeing rebound.

- UNH's trailing P/E is near 10–11×, while forward P/E is compressed to ~15×

- The RSI had dropped to extreme oversold levels (~20) before rebounding above 39

- Despite current headwinds, UNH raised its dividend by 5%—marking 15 consecutive years of increases. Their current yield (~2.9%) is well above S&P 500 average.

- Q2 operations generated strong cash flow ($7.2B) and delivered a 20.6% return on equity, signaling disciplined capital allocation.

- High upside potential if earnings and sentiment recover.

- according to the quarterly call, New metrics set clearer expectations and reflect internal control.

This is a good stock to get into if you are looking at a 1-2 year horizon.

Big Money Is Betting on UNH — Are You In Yet?## 🚀 UNH Weekly Trade Idea: Bullish Momentum Brewing at \$260! 📈💥

UnitedHealth Group (\ NYSE:UNH ) is flashing bullish signals across the board:

📊 **Call/Put Ratio: 3.12** → Heavy institutional bullish flow

📈 **Daily & Weekly RSI: Rising**

💰 **Volume Increasing** → Accumulation Mode?

⚠️ **Gamma Risk HIGH** → Perfect storm for explosive moves!

---

### 🔥 Trade Setup:

🟢 **Buy 260 Call** (Exp: 08/08)

💵 Entry: \$0.69

🎯 Profit Target: \$1.03 – \$1.38

🛑 Stop Loss: \$0.34

📈 Confidence: 65%

All models aligned on this: **Bullish Bounce Likely**

Range of strikes (\$255–\$260) show heavy interest = 🚨 breakout setup

💡 **Risk Management:** High gamma = fast moves. Lock profits or cut quick. Stay nimble!

---

### 📌 Suggested Hashtags/Tags:

```

#UNH #OptionsTrading #CallOptions #BullishSetup #RSI #GammaRisk #WeeklyTrade #StockSignals #MomentumPlay #HealthcareStocks

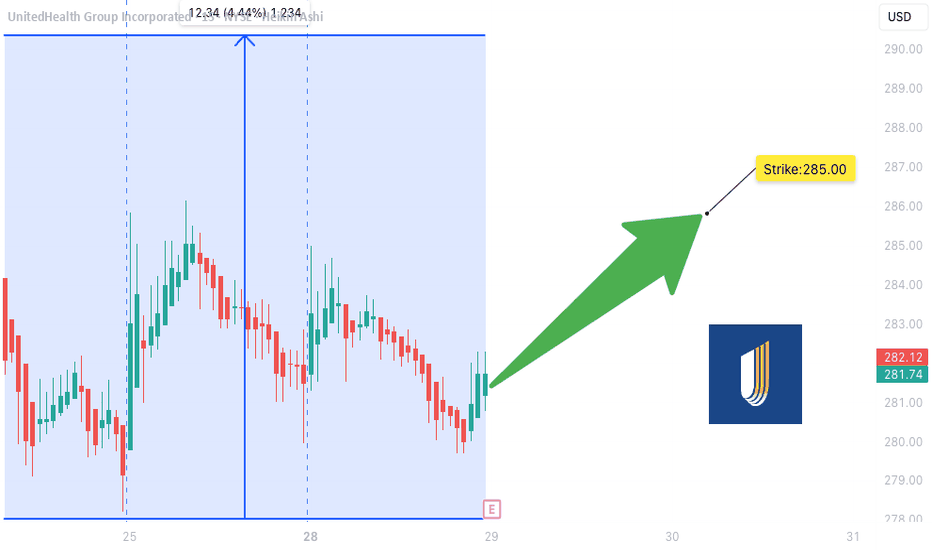

UNH Earnings Lotto Setup** (2025-07-28)

📊 **UNH Earnings Lotto Setup** (2025-07-28)

🎯 **Targeting a 2x return on post-earnings upside move**

---

### 💡 Trade Thesis:

**UnitedHealth (UNH)** is primed for a potential bounce on earnings:

* ✅ **Revenue Growth**: +9.8% YoY

* 🔥 **EPS Beat Rate**: 88% over last 8 quarters

* ⚠️ Margin compression risk from increased utilization

* 🧠 **Analyst Upgrades** trending positive

* 📉 RSI = **30.06** → Oversold territory

---

### 🔎 Options Flow & Technicals

* 🧲 Max Pain: **\$290**

* 🟢 Bullish call OI stacking at **\$285**

* ⚖️ IV Rank: **0.75** → Still has juice

* 🔻 Trading below 20D/50D MAs → Room for reversal

---

### 💰 Trade Setup

```json

{

"Instrument": "UNH",

"Direction": "Call (Long)",

"Strike": "$285",

"Entry Price": "$10.30",

"Profit Target": "$20.60 (2x)",

"Stop Loss": "$5.15 (50%)",

"Size": "1 contract",

"Expiry": "2025-08-01",

"Entry Timing": "Pre-Earnings Close (July 28)",

"Earnings Date": "2025-07-29 BMO",

"Expected Move": "±5%",

"Confidence": "70%"

}

```

---

### ⚖️ Risk/Reward

* Max Risk: 💸 \$1,030

* Max Gain: 🚀 \$1,030

* R/R Ratio: **1:2**

* Lotto-style with tight SL post-ER

---

### 🧭 Execution Plan

* 📅 Buy before close on **July 28**

* ⏰ Close same-day post ER **if target or SL hits**

* ❌ Exit manually if theta crush hits hard

---

### 🗣️ Final Note:

> “Oversold + Strong fundamentals + Positive consensus = Earnings bounce in the making.”

---

📌 Tag your UNH trades

💬 Drop your lotto setups

❤️ Like & repost if you're playing UNH this week!

\#UNH #EarningsPlay #OptionsTrading #TradingView #UNHEarnings #LottoTrade #CallOptions #HealthcareStocks #SwingTrade #RSI #IVRank #MaxPain

$UNH: With stock down more than 60%, is it in buy zone? NYSE:UNH with one after bad news lost 60% of its market cap from its ATH of 600$. NYSE:UNH the largest insurer in US has been in news for all the wrong reasons. The stock after losing 60% of the value has a dividend yield of 3.1% which is 2.5 times of the S&P Yield. The historical dividend growth of NYSE:UNH has been more than 8%. This makes NYSE:UNH a compelling story stock during the recent downturn. With recent insider buys of the NYSE:UNH stock most of the fundamental indicators indicate a positive outlook.

But what are the technical indicators telling us? Today we are looking at the historical chart of the stock. The last time the stock was down more than 60% was during the 2007-2008 Financial recession. In 2008 it did lose more than 64%. If we investigate the long term RSI then we see it below 25 which we also saw last during the Financial recession.

Verdict : Buy 1/3 @ 250, Buy 1/3 @ 275, Buy 1/3 now.

UNH - Took the GREEN PILL! 15% Move Inbound!NYSE:UNH 💊

H5_Swing Trade:

Playing small with one $560 Call heading into earnings. Fundamentally undervalued and beaten down stock since their CEO was murdered.

Good earnings and the fact they are a safety play make me really like this play.

H5 Trade and WCB look great too!

🎯$623

⏳Before March

Not financial advice