Can United Spirits make a strong comeback?United Spirits Ltd. engages in the manufacturing, sale, and distribution of beverage alcohol. It operates through Craft Whisky and Luxury Spirits segments. The company offers brand portfolio of Scotch whisky, IMFL whisky, brandy, rum, vodka, and gin. It imports, manufactures, distributes, and sells various iconic Diageo brands such as Haig Gold Label, Captain Morgan, Johnnie Walker, J&B, Baileys, Lagavulin, Talisker, VAT 69, Black & White, Smirnoff and Ciroc. Closing price is 1429.40.

The positive aspects of the company are Companies with no Debt, Annual Net Profits improving for last 2 years and MFs increased their shareholding last quarter. The Negative aspects of the company are high Valuation (P.E. = 63.5), High promoter stock pledges, Increasing Trend in Non-Core Income, Declining Net Cash Flow: Companies not able to generate net cash and Companies with growing costs YoY for long term projects.

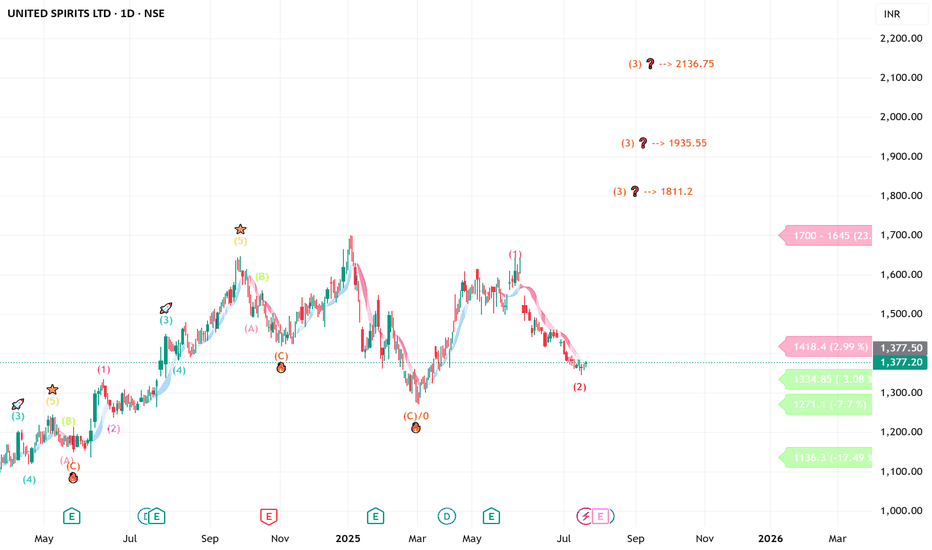

Entry can be taken after closing above 1436 Historical Resistance in the stock will be 1492 and 1547 PEAK Historic Resistance in the stock will be 1592 and 1656. Stop loss in the stock should be maintained at Closing below 1373 or 1338 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Unitedspiritsanalysis

UNITED SPIRITS looking good ( short to long investment)Daily counts indicate Excellent bullish wave structure

Both appear to be optimistic and this stock invalidation number (S L) wave 2 low

target short / long term are already shared as per charts

we assume correction wave leg seems completed

Investing in declines is a smart move for short/ long-term players.

Buy in DIPS recommended

Long-term investors prepare for strong returns over the next two to five years.

one of best counter

Every graphic used to comprehend & LEARN & understand the theory of Elliot waves, Harmonic waves, Gann Theory, and Time theory

Every chart is for educational purposes.

We have no accountability for your profit or loss.

United Spirits looks high in spiritsUnited Spirits ltd. (McDowell) is engaged in manufacturing of alcoholic beverages. It manufactures the collection of brands such as Royal Challenge whisky, McDowell, Signature, Black Dog, four Seasons, Honey Bee etc. brand. They have 50 manufacturing facilities across India. United Spirits CMP is 817.05.

Negative aspects of the company are high valuation (P.E. = 52.3), declining cash from operations annual, FIIs decreasing stake, promoters holding decreasing & high promoter pledge. Positive aspects of the company are improving annual net profits, no debt & MFs are increasing stake.

Entry after closing above 821. Targets in the stock will be 853 & 892. Long term target in the stock will be 912 & 950. Stop loss in the stock should be maintained at closing below 728.