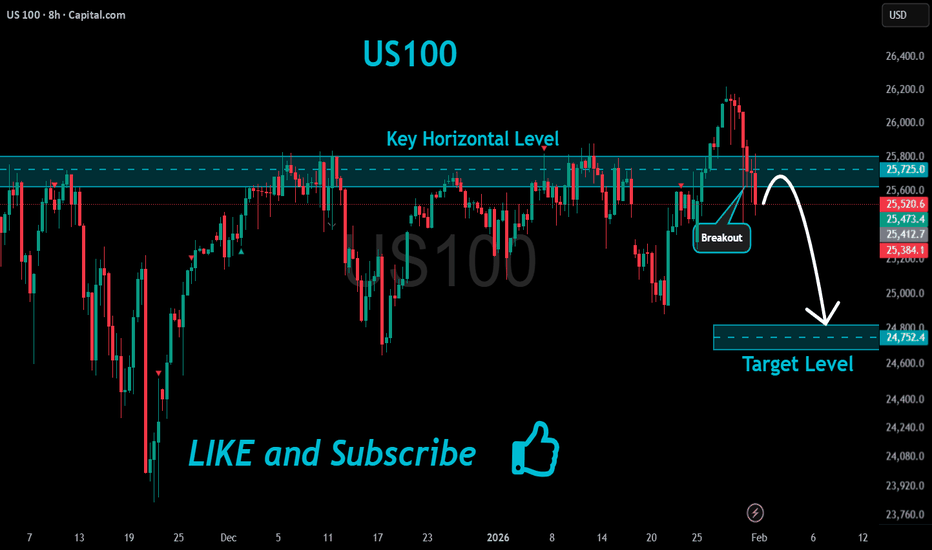

NAS100 Weekly Outlook: Watch This Liquidity Sweep Before SellingNAS100 🌍

The macro narrative heading into this week is dominated by a sudden reassessment of the AI investment cycle following a string of high-stakes earnings reports 🏦. While Big Tech giants like Meta and Microsoft have delivered "on-paper" beats, the underlying sentiment is shifting toward exhaustion as investors start demanding immediate monetization from massive AI capital expenditures. Interestingly, general online sentiment is showing a "buy-the-dip" mentality reaching near-extreme levels, suggesting a potential liquidity hunt before the real move lower can materialize. This retail eagerness to catch the falling knife often provides the perfect fuel for a deeper sweep of the lows 🧹.

We are seeing a Bearish Market Structure on the H4 after a significant rejection at the 26,000 psychological level 📉. While the long-term trend remains structurally bullish, the prevailing community chatter is heavily leaning toward a bounce, which tells me retail is likely positioned poorly and trapped in early long positions. The recent break of the 25,200 support zone has shifted the immediate momentum to the downside, and I am watching for the market to exploit this "crowded long" positioning before settling into a more sustainable range.

Key Zone: The confluence of the bearish Parallel Channel and the Fibonacci 50% retracement level (near 25,293) is the primary area of interest 📉.

We are currently trading just below the mid-point of the recent sell-off, and the price action is carving out a corrective flag within a descending channel. I am watching for a 'run on liquidity' to sweep the late buyers I'm seeing across various social forums who are aggressively longing this minor pullback 🧹. If we see a failure to reclaim the 50% Fibonacci level accompanied by a bearish "Break of Structure" (BoS) on the lower timeframes, it will confirm that the sellers are still firmly in control of the weekly range.

Us100analysis

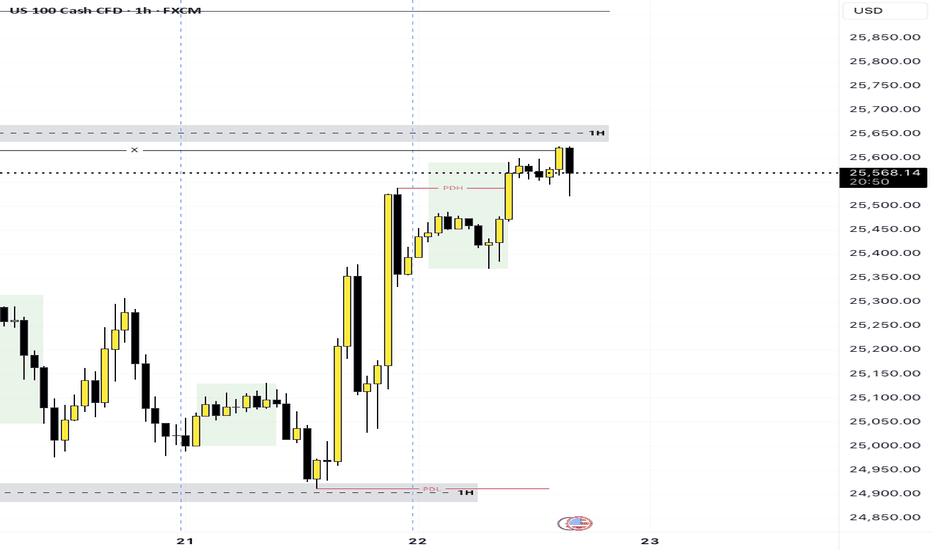

NASDAQ NAS100 Technical Analysis and Trade IdeaMy bias remains bullish on the NAS100 🐂, but patience is the name of the game today. Fundamentally, the index is struggling for oxygen as the market digests the "no rate cut" reality for January, causing a temporary decoupling from the broader risk-on flows 📉. Technically, we are trapped in a corrective flag, and the rejection at 25,600 confirms that the bears are still defending the highs.

If the setup triggers, aim for a 5R return to start 🎯. If the price action reclaims 25k within our optimal entry zone. Look to close partial profits (50%) at 25,400 (1R) 💰, then let the rest run and use a trailing SL. Patience pays on this one, let the setup come to us. ⏳ This trade is invalidated if we lose the 24,550 structural pivot 🛑.

NASDAQ100 Breakout Watch — Is a New Upside Leg Starting Now?📈 NASDAQ100 Swing Trade Opportunity — Bullish Breakout Play

🟩 Asset: NASDAQ100 (Index CFD)

⚡ Trade Type: Swing Trade — Bullish Plan Confirmed

🧭 Trade Thesis

The index has confirmed a bullish setup following a Triangle + Moving Average breakout, strengthening upward momentum and favoring dip-buying behavior.

To reflect the Thief layering method, this plan uses multiple staggered limit orders to accumulate positions efficiently across volatility pockets.

📌 Entry Plan (Thief Layering Method)

💰 Entry Style: “Any price level allowed — Thief uses layers”

Buy Limit Layers:

24,900

25,000

25,100

25,200

(Feel free to increase or customize layers to fit your personal risk and liquidity preference.)

🛑 Stop-Loss (SL)

🔻 Thief SL: 24,500

Dear Ladies & Gentlemen (Thief OG’s), adjust SL based on your personal risk and strategy.

This is not a fixed recommendation, only a reference zone.

🎯 Target (TP)

⚡ The High-Voltage Electric Gate Zone around 26,200 acts as major resistance because of:

Overbought readings

High-liquidity trap behavior

Historical reversal probability

Exit with profits before heavy sellers activate.

Again — you decide your own TP based on your risk tolerance, not mine.

📊 Market Logic Behind the Move

Breakout structure confirmed

Trend continuation supported by triangle compression

Index ETF flows show short-covering + rotation back into tech

Momentum accelerates above 25,200 zones

Cleaner upside path until liquidity wall at 26,200

🔎 Related Pairs to Watch (Correlation Insight)

1️⃣ NASDAQ:NDX / NASDAQ:QQQ

Direct ETF mirror of NASDAQ100

Useful for checking volume, market depth, and real-time breakout confirmation

2️⃣ SP:SPX / NYSE:ES (S&P 500)

High correlation (approx. 0.85+)

A strong SPX supports tech continuation; weakness warns of index-wide pullback

3️⃣ TVC:VIX (Volatility Index)

Inverse correlation

If VIX stays below key volatility thresholds, bullish NASDAQ continuation is more reliable

4️⃣ FX:USDOLLAR / DXY

Tech usually performs better when the Dollar weakens

A rising Dollar can slow or cap NASDAQ bullish momentum

5️⃣ TVC:US10Y / Yields

NASDAQ moves inversely with yields

If yields drop, NASDAQ accelerates

If yields spike, prepare for turbulence or failed breakouts

📘 Summary

Bullish plan confirmed via Triangle + MA Breakout

Thief layering entries positioned smartly into volatility

SL/TP guidance flexible for trader customization

Strong correlation checks available across SP:SPX , TVC:VIX , TVC:DXY & yields

NASDAQ100 Market Structure & Pullback Strategy📈 NAS100 / US100 — NASDAQ100

Index Market Trade Opportunity Guide (Day / Swing Trade)

🔵 Market Bias

Bullish Plan Active 🟢

Momentum structure remains positive with buyers defending higher demand zones on pullbacks.

🎯 Entry Strategy (Pullback-Based Execution)

Pullback-1: Buy above 25200 🔁

Pullback-2: Buy above 24900 🔁

📌 This plan focuses on buying controlled retracements within a bullish structure rather than chasing highs.

🛑 Risk Management (Stop Loss)

SL for Pullback-1: 25000

SL for Pullback-2: 24700

⚠️ Risk Disclaimer:

Dear Ladies & Gentlemen (Thief OG’s), adjust your Stop Loss based on your own strategy and risk tolerance.

I am not recommending using only my SL — risk management is fully your responsibility.

🏁 Take Profit / Exit Zone

Target: 26000 🎯

🚨 Police Force zone ahead:

Strong resistance + overbought conditions + potential bull trap + corrective risk detected.

➡️ Kindly escape with profits once price reacts in this zone.

⚠️ TP Disclaimer:

Dear Ladies & Gentlemen (Thief OG’s), I am not recommending using only my TP. Protect profits based on your own execution rules.

👀 Related Pairs & Assets to Watch ($ Correlation)

CAPITALCOM:US30 (Dow Jones) 🏭

Confirms broader US equity strength; divergence may warn of NAS100 slowdown.

FOREXCOM:SPX500 (S&P 500) 📊

Healthy correlation — continuation supports bullish NAS100 bias.

TVC:DXY (US Dollar Index) 💵

Sharp USD strength can pressure tech valuations.

TVC:US10Y / US Treasury Yields 📉

Rising yields = headwind for growth & tech stocks.

🧠 Fundamental & Economic Factors to Consider

🔹 Federal Reserve Outlook:

Rate-cut expectations or dovish commentary tend to support NASDAQ upside.

Hawkish tone or delayed cuts may trigger volatility or pullbacks.

🔹 Inflation Data (CPI / PCE):

Cooling inflation = bullish for growth stocks

Sticky inflation = risk of corrective moves

🔹 US Labor Market (NFP / Jobless Claims):

Weakening data supports rate-cut narrative → bullish NAS100

Overheating labor data may pressure equities

🔹 Big Tech Earnings & Guidance:

NAS100 is highly sensitive to mega-cap tech outlooks (AI, cloud, semiconductors).

Positive guidance fuels continuation; cautious outlooks invite corrections.

🔹 Upcoming High-Impact Events:

FOMC statements

US CPI / PCE releases

Major US tech earnings weeks

📌 Always reduce risk or lock profits ahead of high-impact economic releases.

🧩 Final Trading Insight

📈 Trend favors buy-the-dip, not emotional breakouts.

🎯 Respect resistance zones, secure profits early, and let structure — not emotions — guide execution.

👍 If this setup adds value, support with a LIKE, BOOST, or FOLLOW for more professional index trade plans.

Trade smart. Protect capital. Let the market pay you. 💼📊

Falling towards 50% Fib support?US100 is falling towards the support levle which has been identified as an overlap support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 25,253.06

Why we like it:

There is an overlap support that aligns with the 50% Fibonacci retracement.

Stop loss: 24,919.12

Why we like it:

There is a pullback support level that aligns with the 78.6% Fibonacci retracement.

Take profit: 25,723.79

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NAS100 Shows Strong Bullish Structure After Pullback📈 NASDAQ100 (NAS100) | Bullish Swing Trade Opportunity 🎯

Market Trade Opportunity Guide — SMA Pullback Strategy

🔥 TRADE SETUP SUMMARY

Asset: NAS100/US100 (NASDAQ-100 Index)

Timeframe: Swing Trade

Strategy: Bullish Simple Moving Average (SMA) Pullback

Bias: 🟢 BULLISH CONFIRMED

📍 ENTRY POINTS

Flexible Entry Strategy:

✅ Any price level entry acceptable (DCA approach recommended)

✅ Optimal entry zones: SMA support pullback levels

✅ Consider scaling into positions on dips

✅ Volume confirmation at entry crucial for momentum

🛑 STOP LOSS MANAGEMENT

Primary SL Level: 25,200

⚠️ DISCLAIMER: This is a reference level only. Adjust your stop loss based on:

✓ Your personal risk management strategy

✓ Individual account risk tolerance

✓ Position sizing preferences

✓ Your trading experience & capital allocation

Your responsibility: Set SL that fits YOUR risk profile. Don't rely solely on suggested levels.

🎯 PROFIT TARGETS

Primary Target: 26,100

Key Resistance Factors:

📊 High voltage resistance zone

📈 Overbought conditions detected

⚡ Trap risk at elevated levels

💡 Recommend: Take partial profits, don't go all-in

⚠️ DISCLAIMER: TP level is reference only. Manage profits based on:

✓ Your personal trading objectives

✓ Risk/reward ratio preferences

✓ Market momentum confirmation

✓ Your own technical analysis

Exit Strategy: Capture gains systematically. Don't be greedy—take money when available.

📊 RELATED PAIRS TO MONITOR (Correlation Analysis)

Major USD Pairs to Monitor:

EUR/USD 💶 — Current: 1.1713 | Bias: 🔵 Bearish $ | Correlation: INVERSE (Risk sentiment driver)

GBP/USD 🇬🇧 — Current: 1.3381 | Bias: 🔵 Bearish $ | Correlation: INVERSE (Tech growth proxy)

USD/JPY 🇯🇵 — Current: 155.00 | Bias: 🟢 Bullish $ | Correlation: INVERSE (Carry trade impact)

USD/CAD 🇨🇦 — Current: 1.38 | Bias: 🔵 Bearish $ | Correlation: INVERSE (Risk-off correlation)

Correlation Insights:

Weaker USD = Better for tech stocks (positive NAS100). Stronger JPY carry = Risk-off mood (negative NAS100). Watch EUR/USD & GBP/USD for broader sentiment shifts—these are your early warning indicators for tech sector rotation.

🌍 FUNDAMENTAL & ECONOMIC FACTORS (December 2025)

Fed Monetary Policy 🏦

✅ Latest Decision (December 10, 2025):

Rate cut: 25 basis points (0.25%)

New target range: 3.50%-3.75%

3rd consecutive rate cut in 2025

Divided vote: 9 for cuts, 3 dissenting

Market Implication: Powell signals "patience" on further cuts—limited cuts expected in 2026 (only 1-2 projected). This is a headwind for aggressive tech rallies but supports intermediate tech strength.

Inflation Status 📊

PCE Inflation (September 2025): 2.8% (above 2% target)

Trend: Inflation moved UP since earlier 2025, remains "somewhat elevated"

Outlook: Expected to remain above 2% through 2026

Tariff Risk: Trump tariffs expected to push inflation higher in 2026

Market Implication: Persistent inflation limits Fed's ability to cut rates aggressively. Tech valuations face pressure from higher rates. Expect volatility from tariff-related inflation surprises.

Employment & Labor Market 👥

Job gains: Slowed significantly in 2025

Unemployment rate: Edged up through September (at 4.4%)

Fed assessment: "Downside risks to employment rose in recent months"

Tone: Labor market showing weakness, supporting rate cuts

Market Implication: Weaker jobs data = positive for equities (lower rates). But lack of October/November data due to govt shutdown creates uncertainty going into 2026.

Economic Growth 📈

GDP Growth (Fed projection 2026): 2.3% (raised from 2.0%)

Current pace: "Moderate expansion" of economic activity

Outlook: Modest growth expected, not recessionary

Market Implication: No recession expected. Growth supports equity rallies like NAS100, but tariffs could dampen 2026 growth trajectory.

Key Macro Risks for 2026 ⚠️

Tariff Impact: Trump tariffs likely to increase inflation and reduce growth

Rate Uncertainty: Fed Chairman succession unclear; policy direction murky

Government Data Gaps: October/November data delayed; information asymmetry high

Market Expectations Divergence: Fed members divided on future rate path

Bond Yields: Higher yields = headwind for high-multiple tech stocks

📅 KEY UPCOMING EVENTS TO WATCH

January 2026: Fed Chair decision; delayed employment/inflation data releases

Q1 2026: Tariff implementation timeline clarity

2026 FOMC Meetings: Only 1-2 rate cuts priced vs. 3+ in 2025

🎯 TRADE BIAS CONCLUSION

Technical: 🟢 Bullish (SMA support confirmed)

Macro: 🟡 Cautious (Fed pause, tariff uncertainty)

Composite: 🟢 BUY dips toward 25,200 | Target 26,100 | Manage risk aggressively

📌 RISK DISCLAIMER

✅ All trading involves risk. No guarantees on outcomes.

✅ Past performance ≠ future results

✅ Use proper position sizing & risk management

✅ Trade with only capital you can afford to lose

✅ This is analysis, not financial advice

NAS100 Trade Opportunity: Will Buyers Defend the Pullback?📊 NAS100 (NASDAQ-100) Swing Trade Opportunity 🚀

Bullish Pullback Setup | Super Trend ATR + TMA Confirmation

🎯 TRADE SETUP OVERVIEW

Instrument: NAS100 (NASDAQ-100 Index)

Timeframe: Swing Trade (4H-Daily)

Bias: BULLISH ✅

Setup Type: Super Trend ATR Line Pullback + Triangular Moving Average (TMA) Confirmation

🎬 ENTRY STRATEGY - "LAYERING METHOD" 📍

This strategy employs multiple limit order placement (Layer Entry Technique) to optimize entry points during the pullback phase.

Recommended Layer Entry Points:

🔵 Layer 1: 24,500

🔵 Layer 2: 24,600

🔵 Layer 3: 24,700

🔵 Layer 4: 24,800

⚡ Pro Tip: Scale layers based on your account size and risk tolerance. Each layer reduces average entry price.

🛑 STOP LOSS (SL)

Primary SL Level: 24,300

Strategy: Placed below the latest swing low + Super Trend confirmation

⚠️ DISCLAIMER: This SL is a guideline only. You must adjust based on your personal risk management strategy and account equity. Risk is YOUR responsibility.

🎁 PROFIT TARGETS (TP)

PRIMARY TARGET (TP1): 25,700 🎯

First resistance zone

Ideal for taking partial profits

Recommended exit: 30-50% position

SECONDARY TARGET (TP2): 26,200 🔥

Strong resistance + Historical overbought zone

⚠️ TRAP ALERT: Expect potential reversal or consolidation

Recommended exit: Remaining 50-70% position

Use trailing stop for final portion

📈 TECHNICAL CONFIRMATION

✅ Super Trend ATR: Aligned bullish

✅ TMA (Triangular MA): Pullback to key level confirmed

✅ Higher Lows Pattern: Intact

✅ Volume Analysis: Supporting move

🔗 RELATED PAIRS TO WATCH 💡

Positive Correlation (Move Together):

🔴 SPY (S&P 500 ETF) - $380-395 Range

Correlation: +0.92 | Often leads NAS100 lower-cap stocks

Key Point: If SPY breaks $390, expect NAS100 momentum confirmation

Watch for divergence signals

🔴 QQQ (Invesco QQQ Trust - Nasdaq 100 ETF) - $450-470 Range

Correlation: +0.99 | DIRECT tracking of NAS100

Key Point: Primary barometer for Nasdaq sentiment

Use for volume + volatility confirmation

🔴 TECH Sector ETF (XLK) - $205-215 Range

Correlation: +0.88 | Tech-heavy holdings overlap

Key Point: Tech rotation affects Nasdaq flow

Monitor for sector strength/weakness

Inverse Correlation (Move Opposite):

🔵 DXY (US Dollar Index) - $103-106 Range

Correlation: -0.65 | Stronger dollar = Risk-off mood

Key Point: If DXY spikes, expect NAS100 pullback extension

Monitor Fed rate expectations

🔵 TLT (20+ Year Treasury ETF) - $75-80 Range

Correlation: -0.58 | Rising yields hurt growth stocks

Key Point: Check 10Y yield trend for rate pressure

Watch Fed policy announcements

Key Monitoring Points:

📌 Earnings Season Impact: Tech earnings can create ±2% moves

📌 Fed Minutes/Announcements: Watch for rate guidance changes

📌 Market Breadth: Compare Advance/Decline lines for confirmation

📌 Volatility Index (VIX): Levels above 20 = Caution; Below 15 = Risk-on

📋 BEFORE YOU TRADE - CHECKLIST ✅

Is price currently at/near Layer 1 entry (24,500)?

Does current 4H chart show TMA pullback + Super Trend confluence?

Is volume confirming the setup?

Have you set your SL below 24,300?

Do you understand you're risking X to make Y?

Is this aligned with your trading plan?

🎓 FINAL NOTES

This is a mechanical swing trade setup designed for traders who use limit orders and layering technique. The confluence of Super Trend ATR + TMA creates higher probability entries during bullish pullbacks.

Remember: Trading involves substantial risk of loss. This idea is shared for educational analysis. Your trading decisions are YOUR responsibility alone.

Happy Trading! 🚀💎

NASDAQ NAS100 Analysis and My Trade Plan📊 Currently analysing NAS100 (NASDAQ), we can see that price has broken structure to the upside, confirming bullish intent. Right now, NAS100 is retesting the value area and the Point of Control (POC) on the volume profile — a critical zone to watch 👀📈

⚠️ Price action is a bit precarious. After a strong impulsive move, we’ve now seen a deep and aggressive retracement, which opens the door for potential bearish movement this week.

📆 However, my higher-timeframe bias remains bullish, with the weekly chart still supporting upward continuation.

📌 My plan:

If price holds above the current POC, then breaks and retests cleanly, I’ll be looking for long opportunities. If it breaks below the POC, I will step aside and abandon the long bias 🚫

This is not financial advice — just my personal market outlook. 💬📉📈