Us30idea

US30 Forecast: Target Locked, Buy Zones in Sight!Good morning friends ☀️

I've prepared a fresh analysis for US30 (Dow Jones).

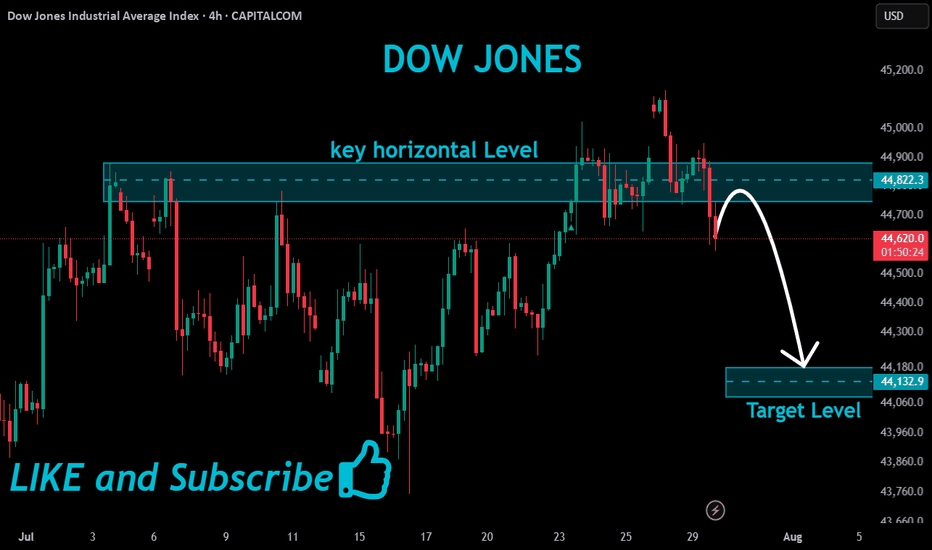

My current target is 45,470. Even if the price dips to 45,050 or 44,800, I fully expect it to reach that 45,470 mark.

These levels represent strong buying zones and powerful retest regions—don’t forget that.

Every like from you is my biggest source of motivation to keep posting these insights. 💬📊

Big thanks to everyone supporting with a thumbs-up.

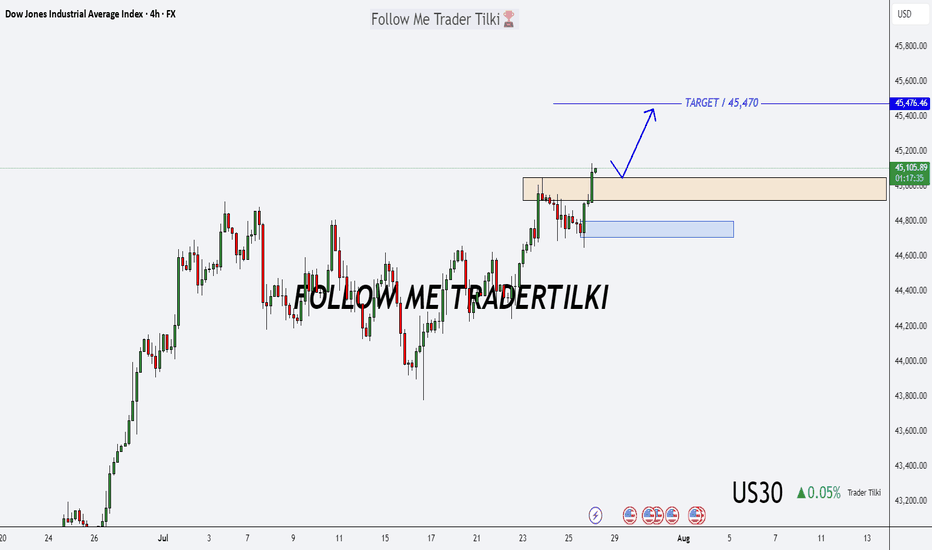

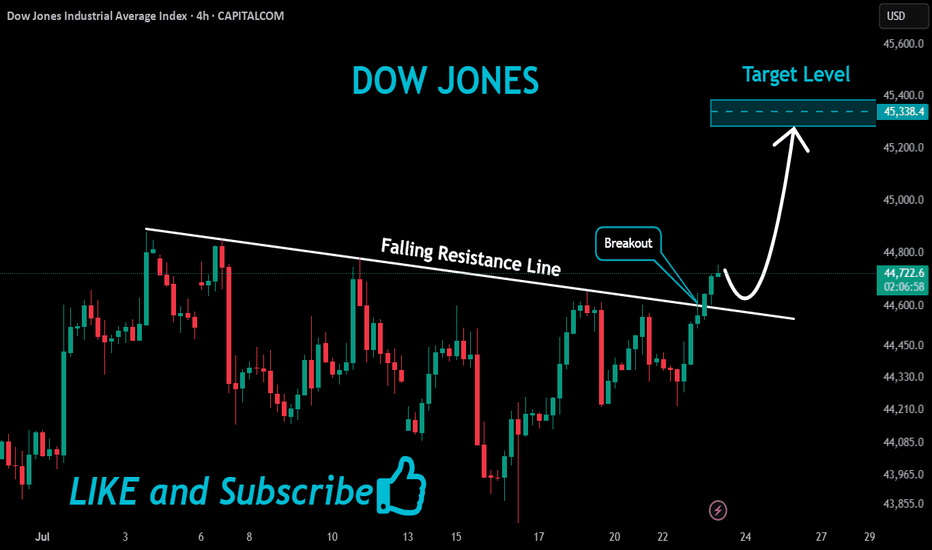

US30 Massive Bullish Breakout!

HI,Traders !

#US30 is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

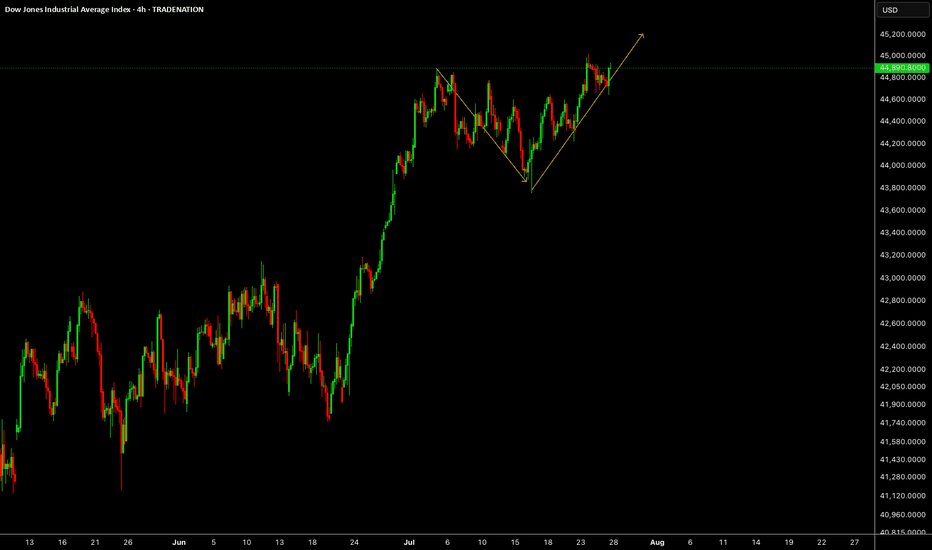

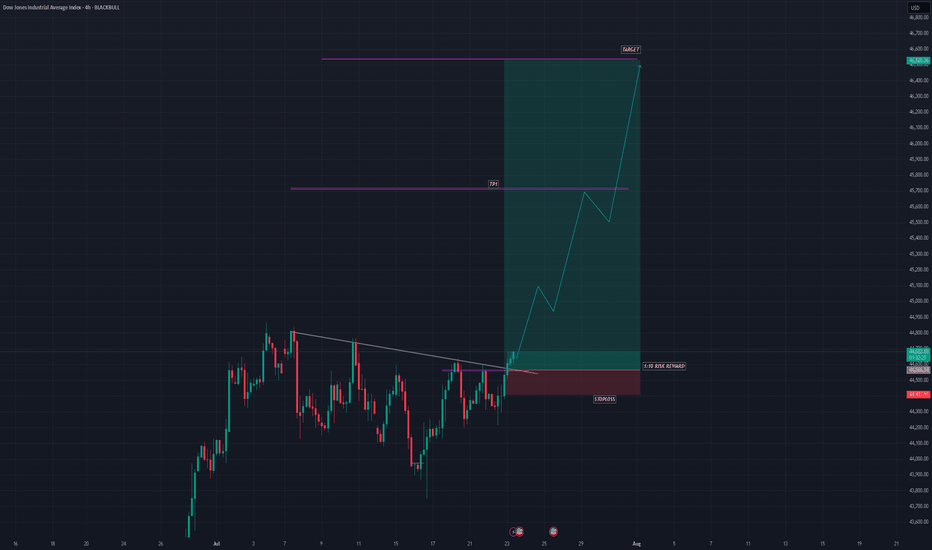

US30 SHOWING A GOOD UPWARD MOVE WITH 1:10 RISK REWARDUS30 SHOWING A GOOD UPWARD MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follows good risk reward

please dont use more than one percentage of your capital follow risk reward and tradeing rules

that will help you to to become a better trader

thank you

Dow Jones Industrial Average Index - 4 Hour Chart4-hour chart of the Dow Jones Industrial Average (US30) shows a recent price movement as of July 13, 2025. The index is currently at 44,315.0, reflecting a decline of 285.5 points (-0.64%). The chart highlights a sell signal at 44,312.0 and a buy signal at 44,318.0, with a shaded area indicating a potential downward trend from a recent peak. Key price levels include 44,855.7 (high) and 43,902.2 (low), with a support level around 44,315.0.

US30 - Short SellThe Dow Jones aka US30

* Overall trend is bullish

* Currently trading the retracement with the following points.

1. Valid OB

2. Liquidity to the sell side

3. Imbalance to the sell side

4. Price failed to break the previous HH activating the Bear positions, the question is How Deep The Retracement Will Be ? So we are closely monitoring the price action to adjust at any changes that the market might face.

US30 Very Near Strong Res Area , Short Setup To Get 500 Pips !Here is my US30 Daily Chart , the price very near the highest price area , this res area forced the price to go down very hard 2 times so i think this time will be the biggest movement to downside , so i`m waiting the price to touch it and give me a good bearish price action and then we can enter a sell trade and targeting at least 500 pips . if we have a daily closure above then this idea will not be valid .

US30We expected US30 to give us a reaction from above 43.5K, market has given us more than 2K points move, now we will wait for the correction before any more buys.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.

Dow Jones Industrial Average Index - 4h Chart (FOREXCOM)4-hour chart of the Dow Jones Industrial Average Index (US30) shows the price movement from late June to early July 2025. The current value is 43,057.7, reflecting a slight increase of +78.0 (+0.18%). The chart highlights key price levels, including a resistance zone around 43,324.1 and a support zone near 42,875.8, with recent price action showing a breakout above the resistance level.

Why I’m Sitting Out: US30 Reaches Critical Range HighI’m currently keeping a close eye on the US30, along with the other major indices 🧐. What stands out the most right now is how overextended this rally has become across the board 📈.

The key concern here is that price has now pushed into a previous external range high, sweeping liquidity resting just above that level 💧. This area is a textbook zone where big money often steps in to offload positions — it’s the perfect place for institutions to find willing counterparties after prior accumulation 📍💼.

Given the aggressive nature of this move and how far price has stretched, I’m extremely hesitant to get involved at this stage 🚫. I have zero interest in buying into a market that’s trading at a premium and sitting at a potential reversal zone ⚠️.

The prudent move here is to wait for a retrace, followed by a bullish break in structure before considering re-entry 🔁📈. Sometimes, the most powerful edge in trading is knowing when not to trade — and for me, today is one of those days.

⚠️ This is not financial advice — just sharing my current perspective on the market.

US30 Potential Rebound from Key Support Zone

US30 Potential Rebound from Key Support Zone 🚀📊

📉 Analysis Overview:

The US30 (Dow Jones Index) is currently testing a major support zone near the 41,800–41,900 range, a level that has held firm multiple times in the past (highlighted with green arrows and orange circles). This area has acted as a demand zone, leading to strong bullish reactions previously.

🔍 Key Technical Highlights:

🔸 Support Zone: Clearly respected at ~41,800. Price is once again bouncing here.

🔸 Resistance Zone: Around 43,250–43,500. This area has acted as a ceiling, where price struggled to break through.

🟢 Reversal Indicators: Multiple successful defenses of the support zone suggest accumulation and possible bullish reversal.

📈 Target Projection: If support holds, the price may rally toward the target zone near 43,496.4, as shown by the purple arrow.

📌 Conclusion:

As long as the 41,800 support holds, US30 shows bullish potential toward the 43,500 resistance. A break below this zone would invalidate the bullish scenario and shift focus back to the lower support near 41,250.

🛑 Risk Management Tip: Watch for confirmation candles and volume before entering long positions. Always set a stop-loss below the support zone.

US30 Under Pressure: Possible Short Setup Brewing on the 4HI'm currently eyeing the US30 (Dow Jones Index) for a potential short opportunity based on multi-timeframe structure 📊.

🔍 Weekly Overview:

The weekly chart continues to show sustained pressure, with this week and last week both closing bearish. The sellers are clearly in control at the macro level. 🔻

📆 Daily & 4H Structure:

Drilling down to the daily and 4-hour charts, we can clearly see a break of structure (BOS). The 4H specifically is showing textbook signs of a bearish trend with lower highs and lower lows forming consecutively 🪜🔽.

🎯 Trade Plan:

I'm watching for a pullback into equilibrium, ideally near the 50% level of the recent Fibonacci range. If price revisits that zone, I’ll be looking for short confirmations to ride the momentum back toward the previous lows, as marked on the chart. 🧠💸.

DOW30/US30 - ACTIVE TRADE - PROFITABLE SET UP TRADETeam,

today I have provide LIVE trading today provide you i did a good trade for

NAS100, DOW30 AND DAX30 - in real LIVE trading

OK, I prefer to SET UP my limit order today only. Remember, the market will be very volatile in the next 4 hours.

I expect the RATE should cut 25 points at least. Why

the employment data come out remain the same

inflation last week look under control

Retails is poorly come out today

The FED does not care about the America, they just care about taking advantage of America.

Lets now focus on the SETTING BUY LIMIT ORDER

I order small volume at 41975-42075

However I will double up at LIMIT BUY ORDER

The 1st target are looking at 4227542300

Target 2 - 42575-42675

REMEMBER - IF IT DOES NOT HIT YOUR ENTRY, JUST WALK AWAY.

US30 – Bearish Setup Below Resistance Zone US30 – Bearish Setup Below Resistance Zone 🚨🟥

The US30 index is exhibiting signs of bearish momentum after repeated rejections from the key resistance zone near 43,200. Let's break down the technical picture:

🔍 Technical Analysis

📌 Resistance Zone (🟥 43,200 area)

Price was rejected twice from this resistance (marked by red arrows), showing strong seller presence.

Bearish candlesticks followed each touch, confirming exhaustion near this level.

📌 Support Zone (🟦 40,800 area)

The area around 40,800 has acted as a strong demand zone in the past (highlighted with green arrows and orange circles).

Price might revisit this area if current bearish structure continues.

📌 Intermediate Support (🟪 41,828)

This level serves as short-term support.

If broken, it could accelerate the decline toward the major support.

📌 Market Structure

Lower highs forming after each bounce indicate weakening bullish strength.

A potential bearish breakout pattern is forming (highlighted by the projected path).

📈 Conclusion & Trade Outlook

Bias: Bearish 📉

Trigger: Break below 41,828 support

Target: 40,800 zone

Invalidation: Break and close above 43,200 resistance

DOW/US30 - TIME FOR RECOVER DURING UK MARKET OPENINGTeam, very sad day to see Israel missle flying

We can only hope the world in peace

We are now finding opportunity to entry LONG DOW/US30

Please set your target 1 and 2 ranges

Make sure take 50-70% at first target and bring stop loss to BE

then second target

Please review the chart carefully and pricing target

Good luck.