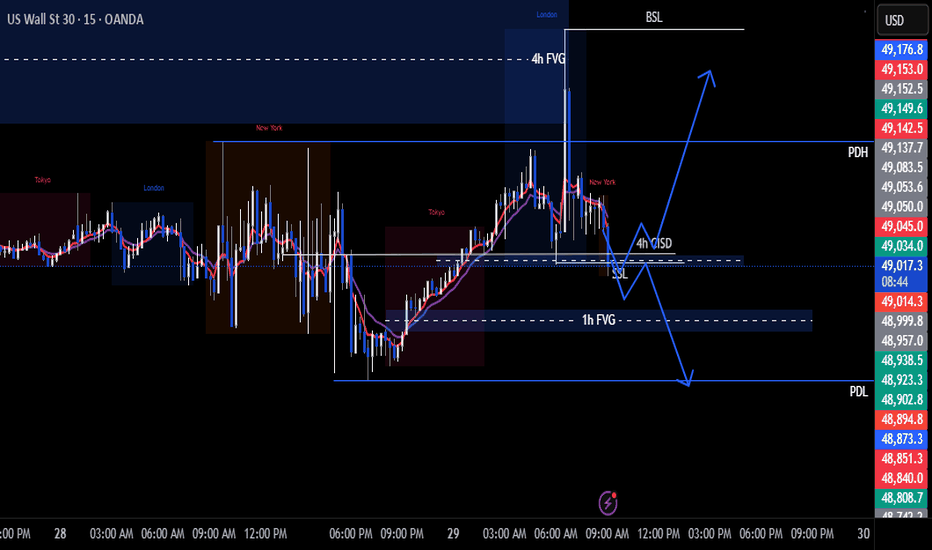

US30 Trade Set Up Jan 29 2026Price has pushed up swept PDH and respected a bearish 4h FVG. Price is within 1h range but making HL so if we get a sweep of London lows and respect the 1h FVG i will look for 1m-5m IFVG/CISD to trade higher to London high BSL but if price trades through the 1h FVG and makes bearish structure i will look for sells to PDL

Us30index

Dow 30 Outlook :: Trend Continuation Or Exhaustion?🎯 US30 (Dow Jones) - BULLISH PULLBACK SETUP | Day/Swing Trade 📈

💎 ASSET OVERVIEW

US30 Index CFD (Dow Jones Industrial Average)

The legendary Wall Street benchmark - 30 blue-chip giants moving markets worldwide 🏛️

🔥 TRADE SETUP - THIEF'S BLUEPRINT

📊 BIAS: Bullish Momentum Confirmed ✅

🎯 STRATEGY: Simple Moving Average (SMA) Pullback Play

⏰ TIMEFRAME: Day Trade / Swing Position

🚀 ENTRY ZONE

ANY PRICE LEVEL ENTRY - Flexibility is power, fam! 💪

Smart thieves don't chase - they position strategically at current market levels

🎖️ TARGET ZONE

TP: 50,600 🎉

Why this level? 🤔

✅ Police force resistance (strong institutional selling zone)

✅ Overbought territory - RSI screaming "TAKE PROFITS!"

✅ Correlation trap zone detected

✅ Historical rejection area

⚠️ THIEF'S WISDOM: Dear Ladies & Gentlemen (Thief OG's) 👑 - I'm NOT recommending you set ONLY my TP. It's YOUR choice, YOUR money, YOUR risk! Scale out, lock profits, be smart! 💰

🛡️ STOP LOSS

SL: 48,800 🚨

Risk Management = Survival 🎲

⚠️ THIEF'S DISCLAIMER: Dear Ladies & Gentlemen (Thief OG's) 👑 - I'm NOT recommending you set ONLY my SL. Adjust based on YOUR risk tolerance and account size. Protect that capital like it's gold! 🔐

🔗 CORRELATED PAIRS TO WATCH 👀

🇺🇸 US Dollar Pairs:

DXY (US Dollar Index) - Inverse correlation: If DXY falls, US30 typically rallies 📉➡️📈

EUR/USD - Risk-on sentiment boosts both

GBP/USD - Cable follows risk appetite

📊 US Indices Family:

NAS100 (Nasdaq) - Tech-heavy cousin, leads risk sentiment 🖥️

SPX500 (S&P 500) - Broader market confirmation 📊

Russell 2000 - Small-cap risk gauge

💹 Other Key Assets:

Gold (XAU/USD) - Safe haven inverse play 🥇

Crude Oil (WTI/Brent) - Energy sector impact ⛽

VIX (Fear Index) - Low VIX = Bullish equities 😌

📰 FUNDAMENTAL & ECONOMIC FACTORS 🌍

🔑 KEY DRIVERS TO MONITOR:

✅ Latest Considerations:

Fed Interest Rate Policy - Rate cut expectations boost indices 💵

US Employment Data - Strong jobs = bullish markets 💼

Corporate Earnings Season - Dow components reporting (Boeing, Apple, Microsoft, etc.) 📊

Inflation Data (CPI/PPI) - Lower inflation = rally fuel 🔥

GDP Growth Figures - Economic expansion supports equities 📈

📅 Upcoming News Events to Watch:

FOMC Minutes Release - Fed policy hints 🏦

NFP (Non-Farm Payrolls) - First Friday monthly jobs bomb 💣

Retail Sales Data - Consumer spending strength 🛍️

PMI Manufacturing/Services - Economic health check 🏭

Presidential Economic Policies - Trade deals, tariffs, fiscal stimulus 🇺🇸

⚠️ Risk-Off Events:

Geopolitical tensions (watch Middle East, China-US relations) 🌐

Banking sector stress signals 🏦

Unexpected Fed hawkish pivot 🦅

🎭 THIEF'S FINAL MESSAGE 💬

Yo fam! 🎩✨

If you made it this far, you're one of the REAL ONES! 🔥

Remember: The market doesn't care about your feelings - it only respects discipline, strategy, and risk management! 🎯

This setup is MY analysis, but YOUR money is YOUR responsibility. Take profits when they're green, cut losses when they're red. No hero holding here! 💯

🙏 THIEF'S BLESSING:

"May your entries be clean, your exits be profitable, and your stop losses never get hit!" 🚀💰

"Trade smart, stay sharp, and let the market pay you!" 💸

👇 SUPPORT THE THIEF SQUAD! 👇

If this idea helped you or gave you clarity:

✅ SMASH that LIKE button 👍💎

✅ DROP a COMMENT below with your thoughts or questions! 💬🔥

✅ HIT FOLLOW to catch the next heist setup! 🎯📲

Your support fuels more FREE alpha! 🚀

⚡ Let's rob the markets LEGALLY together! ⚡

#US30 #DowJones #TradingView #DayTrading #SwingTrading #TechnicalAnalysis #BullishSetup #ThiefTrader #MarketHeist #ProfitTakers #StockMarket #ForexTrading #Indices #WallStreet 📊💰🎯

US30 Trade Set Up Jan 22 2026Price Is making HH/HL on the 1h indicating a bullish trend but price has swept PDH/London highs so if price forms a 1m-5m IFVG/CISD to the downside, i will take sells to Asia lows and the 1h FVG but if price continues to make HH/HL on the 1m-5m above PDH i will take buys to higher BSL levels

Is US30 Setting Up a Major Bullish Reversal? Layer Plan Inside🚀 US30 BULLISH SWING LAYER STRATEGY | "The Thief" Entries 🚀

BROTHERS & SISTERS OF THE MARKET! 👋 Welcome back, Thief OG's! 🦸♂️🦸♀️ A powerful Bullish setup is forming on the US30 (DOW JONES), and I'm sharing my layered entry plan to strategically position for the next leg up.

📈 Asset: US30 (Dow Jones Industrial Average)

⚡ Bias: Bullish | Style: Swing Trade

🎯 The Strategic Plan (The "Thief" Method)

This isn't a gamble; it's a calculated siege. We use a "Thief" Layering Strategy to scale into the position, reducing average entry cost and managing risk. We don't chase price; we let price come to us!

⚔️ Trade Execution Details

✅ ENTRIES (Buy Limit Layers):

We are setting multiple buy orders at key support levels. This is the core of the "Thief" method:

▶️ Layer 1: 46,400

▶️ Layer 2: 46,600

▶️ Layer 3: 46,800

▶️ Layer 4: 47,000

💡 Pro Tip: You can INCREASE or ADJUST these layers based on your capital and risk appetite.

❌ STOP LOSS (RISK MANAGEMENT):

A consolidated stop loss is placed below a major support zone to protect our capital.

➡️ SL: 46,200 (or lower based on your personal risk tolerance)

⚠️ Disclaimer (PLEASE READ): I am NOT a financial advisor. This SL is a suggestion. You MUST adjust your Stop Loss based on your own risk management strategy. Protect your capital at all costs!

🎯 PROFIT TARGET:

We are targeting a significant resistance zone where the market might see a pullback.

🎯 TP: 48,800

Rationale: This area aligns with a confluence of factors including Moving Average resistance and a potential overbought trap. The goal is to "escape with profits" before a potential reversal.

🤑 Take Note: You are free to take profits earlier! If you're in profit, you can never be wrong for taking money off the table.

🔍 Market Analysis & Key Drivers

Bullish Structure: The overall trend structure on higher timeframes remains intact.

Layered Advantage: This strategy smooths out the entry, preventing a single, potentially poor, entry point.

Risk Defined: Our maximum risk is clearly defined from the start.

🌐 Related Pairs & Correlations to Watch

Diversify your view! The US30 doesn't move in a vacuum. Keep these key assets on your watchlist:

SP:SPX (S&P 500): 🟢 High Positive Correlation. The SPX is the broader market leader. A strong SPX often pulls the DOW higher. This is your #1 confirmation.

NASDAQ:NDX (Nasdaq 100): 🟢 Positive Correlation. Tech strength can fuel overall market sentiment, but watch for divergence.

TVC:DXY (US Dollar Index): 🔴 Generally Inverse Correlation. A strengthening dollar can be a headwind for US equities. If DXY rallies sharply, be cautious.

/ES (S&P 500 Futures): 🟢 High Positive Correlation. Tracks the SPX almost tick-for-tick. Great for real-time sentiment.

✅ Conclusion

This "Thief" layered strategy provides a disciplined, low-stress approach to catching a potential US30 upswing. Remember, the market is about probabilities, not certainties.

👑 Your Capital, Your Rules. Trade Safe!

📌 Hashtags for Maximum Visibility:

#TradingView #US30 #DOW #TradingStrategy #SwingTrading #Stocks #Investing #Finance #Bullish #LayerStrategy #RiskManagement #ThiefStrategy #MarketAnalysis #SPX #DXY

👉 LIKE & FOLLOW if you found this idea helpful! Your support keeps the research coming! 💪

US30 | Liquidity, Structure & MA Confluence Support Bulls🚨 US30 (Dow Jones Industrial Average) CFD | Bullish Breakout Setup 📈

📊 MARKET OVERVIEW

Asset: US30 Index CFD (Dow Jones Industrial Average)

Trade Type: Day/Swing Trade Opportunity

Bias: 🟢 BULLISH - Confirmed by Moving Average Pullback & Price Action

Timeframe: H4/Daily Chart Analysis

🎯 TRADE PLAN BREAKDOWN

📍 ENTRY ZONE

Flexible Entry: ANY current price level accepted ✅

Strategy: Moving Average pullback confirmation with momentum continuation

Ideal Entry: Wait for minor retracement to key support levels for better R:R ratio

🛑 STOP LOSS (SL)

Suggested SL: @ 42,800 🔒

⚠️ DISCLAIMER: This is MY personal risk management level. NOT a recommendation! Adjust SL based on YOUR risk tolerance, account size, and trading plan. Trade at your own risk!

💰 TAKE PROFIT (TP) TARGET

Primary Target: @ 50,000 🎯

Resistance Factors:

🔴 Strong psychological resistance zone

📈 Overbought RSI conditions expected

⚡ Potential bull trap area - watch for reversal signals

🔗 Correlation with related markets may trigger profit-taking

⚠️ DISCLAIMER: This is MY target based on technical analysis. Scale out profits at YOUR discretion! Consider partial profit-taking at key levels (48,500 / 49,000 / 49,500). Protect your capital first!

🔗 CORRELATED ASSETS TO WATCH

📌 Direct Correlations:

SPX500 (S&P 500) - Major US equity index correlation ✅

NAS100 (Nasdaq 100) - Tech-heavy index showing similar momentum

US500 CFD - Broad market sentiment indicator

💵 USD-Related Pairs:

DXY (US Dollar Index) - Inverse correlation; watch for USD weakness = US30 strength 📉💹

EUR/USD - Risk-on sentiment boosts equities when EUR/USD rises

USD/JPY - Yen weakness typically supports US equity rallies

GBP/USD - Cable strength indicates risk appetite

🏆 Key Market Drivers:

VIX (Volatility Index) - Low VIX = bullish for US30 🟢

Gold (XAU/USD) - Inverse safe-haven correlation

10Y US Treasury Yields - Rising yields may pressure equities; monitor closely ⚠️

📰 FUNDAMENTAL & ECONOMIC FACTORS

🔥 Recent Economic Data (Impact on US30):

Federal Reserve Policy 🏦

Current stance: Monitor FOMC statements for rate cut signals

Lower rates = bullish for equities ✅

Any hawkish surprise = bearish risk ⚠️

US Jobs Data (NFP/Unemployment) 📊

Strong labor market = corporate earnings support = US30 bullish

Weak data = recession fears = potential reversal

Inflation Reports (CPI/PPI) 💹

Cooling inflation supports Fed rate cuts = equity rally continuation

Hot inflation = Fed stays tight = headwinds for US30

Corporate Earnings Season 🏢

Watch major Dow components: Apple, Microsoft, Boeing, Goldman Sachs

Strong earnings = momentum fuel 🚀

📅 UPCOMING NEWS EVENTS TO WATCH:

⏰ FOMC Minutes Release - Fed policy direction

⏰ US Retail Sales - Consumer spending strength

⏰ GDP Growth Data - Economic health indicator

⏰ Geopolitical Risks - Trade policies, global tensions affect sentiment

🌍 Global Market Sentiment:

Risk-On Environment: Positive for US30 📈

Safe-Haven Flows: Watch Gold/JPY for early warning signs 🚨

China Economic Data: Impacts global growth outlook

⚡ KEY TECHNICAL POINTS

✅ Bullish Signals:

Price above major moving averages (50/200 EMA)

Higher highs & higher lows structure intact

Volume confirmation on breakout candles

RSI showing bullish momentum (not yet overbought)

⚠️ Risk Factors:

Approaching major psychological resistance @ 50,000

Potential exhaustion at extended levels

Correlation breakdown if USD strengthens aggressively

Geopolitical shocks or unexpected Fed hawkishness

💡 TRADING WISDOM

🎓 Risk Management is KING:

Never risk more than 1-2% of your account per trade

Position size according to YOUR stop loss distance

Markets reward patience and discipline 🧠

🔄 Profit Protection:

Move SL to breakeven once +100 pips in profit

Scale out 50% at intermediate resistance levels

Let runners ride with trailing stops

🚀 FINAL THOUGHTS

This US30 setup combines technical confluence + fundamental tailwinds for a high-probability bullish scenario. However, markets are NEVER guaranteed! 🎲

👉 YOUR MONEY = YOUR RULES

👉 MY ANALYSIS = EDUCATIONAL PERSPECTIVE

👉 TRADE RESPONSIBLY = PROTECT YOUR CAPITAL

📣 ENGAGEMENT REMINDER:

💬 Drop a comment with YOUR analysis!

👍 Smash that LIKE button if this helps!

🔔 FOLLOW for daily market breakdowns!

📊 Share your trades - let's grow together! 🤝

🔥 Good luck, traders! May the pips be with you! 🔥

#US30 #DowJones #TradingView #DayTrading #SwingTrading #ForexTrading #IndexTrading #TechnicalAnalysis #BullishSetup #TradingIdeas #MarketAnalysis #CFDTrading #PriceAction #RiskManagement 📊💹🚀