US30 Technical Outlook | Bullish Bias Active📈 US30 – Dow Jones Industrial Average (CFD)

Bullish MA Pullback Setup | Day & Swing Trade Plan

Asset: US30 – Dow Jones Industrial Average (DJIA) CFD

Bias: 🟢 Bullish

Strategy Type: Moving Average Pullback Continuation

Trading Style: Structured Layered Entries

🔍 Market Structure & Technical Outlook

The US30 (DJIA CFD) is showing a healthy pullback into dynamic support (MA zone), maintaining overall bullish structure on higher timeframes.

We are trading trend continuation, not breakout chasing.

✅ Confirmation Factors:

Price holding above key higher-timeframe support

SMA acting as dynamic pullback support

Bullish market structure (HH & HL sequence intact)

Momentum cooling before potential expansion

🎯 Entry Plan – Layered Limit Structure

Rather than market chasing, structured limit positioning improves risk efficiency.

Layered Entry Zones:

49,200

49,400

49,600

This approach allows better average positioning within the pullback zone while respecting volatility.

🛑 Risk Management

Stop Loss: 49,000

If structure breaks below this zone, bullish thesis becomes invalid.

🚀 Target Plan

Primary Target: 50,400

Why this level?

Psychological round number

Prior reaction zone

Potential overbought expansion area

Supply/resistance confluence

⚠️ Partial profit booking before the final target is always professional practice.

🔗 Correlated Markets to Watch

Monitoring correlations increases probability alignment.

💵 TVC:DXY (US Dollar Index)

Strong dollar can pressure equities.

Weak dollar typically supports risk-on flows.

📊 S&P 500 ( SP:SPX / US500)

Strong positive correlation.

If S&P breaks higher, US30 likely follows.

📈 NASDAQ ( NASDAQ:NDX / US100)

Tech-driven momentum often leads overall US indices.

🛢 Crude Oil ( BLACKBULL:WTI )

Rising oil → inflation pressure → rate expectations → equity sensitivity.

🏦 US10Y Treasury Yield

Higher yields can cap equity upside.

Falling yields support bullish expansion.

📰 Fundamental & Economic Drivers

Key factors to monitor before and during this trade:

🇺🇸 US Inflation (CPI / PCE)

🇺🇸 Non-Farm Payrolls (NFP)

🇺🇸 Federal Reserve rate decisions & speeches

US Bond Yield movement

Corporate earnings from major Dow components

If inflation cools and yields soften → bullish continuation strengthens.

If yields spike aggressively → expect volatility.

🧠 Professional Trade Notes

Do not blindly follow TP or SL levels.

Always manage according to your own risk profile.

Consider scaling out at intraday resistance zones.

Avoid entering during high-impact news spikes unless planned.

💬 Trading Mindset

📌 “Discipline builds accounts. Impulse destroys them.”

📌 “We trade probabilities, not predictions.”

📌 “Structure first. Emotion last.”

📌 “Take money from the market — don’t donate to it.”

Stay sharp. Stay structured.

Execute with patience.

If this setup aligns with your plan, tap ❤️ and share your view below.

Let’s build disciplined traders, not gamblers.

Us30signal

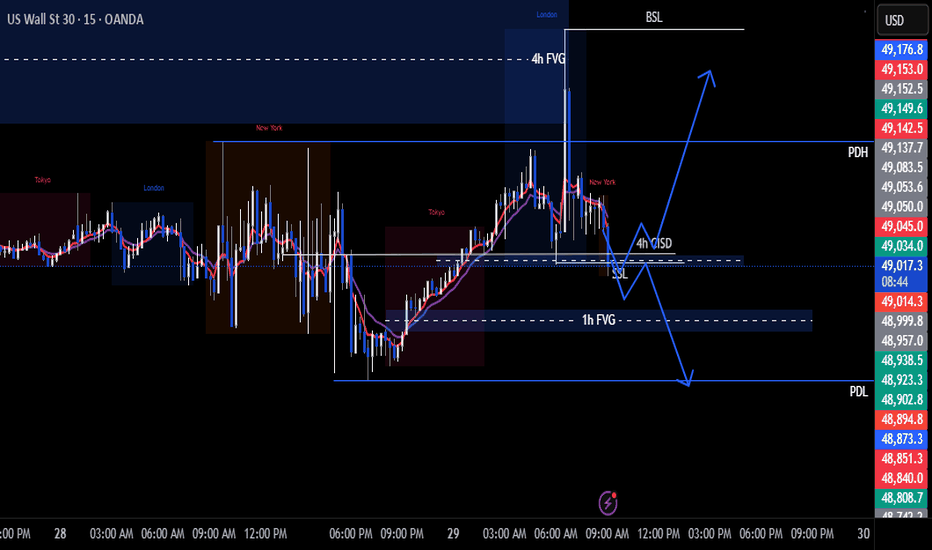

US30 Trade Set Up Feb 13 2026Price is overall bearish on the 4h but making HL on the 1h and 15m so i if prices inverts the 1h FVG i will expect price to trade higher to fill the 4h FVG otherwise if price respects the 1h FVG, makes bearish structure on the 5m with a 1m-5m IFVG/CISD i will take sells to London lows

US30: The Correction is Coming? (Dump) US30 just swept the 50,250 liquidity and is showing a clear rejection. After such an aggressive rally, a retracement is overdue to rebalance the market.

The Setup:

Target: The 8H Order Block (OB) at 48,650.

Reason: Price left a massive imbalance/gap that acts like a magnet. 🧲

Invalidation: A daily close above 50,300.

The Play:

Looking for a smooth ride down to the gray zone. If we hit the OB, I'll be looking for a potential long reversal, but for now, the bears are in control.

US30 Trade Set Up Jan 29 2026Price has pushed up swept PDH and respected a bearish 4h FVG. Price is within 1h range but making HL so if we get a sweep of London lows and respect the 1h FVG i will look for 1m-5m IFVG/CISD to trade higher to London high BSL but if price trades through the 1h FVG and makes bearish structure i will look for sells to PDL