Can America Break China's Rare Earth Monopoly?USA Rare Earth (Nasdaq: USAR) stands at the center of America's most ambitious industrial gamble in decades. The company pursues a vertically integrated "mine-to-magnet" strategy designed to break China's stranglehold on rare earth elements, critical materials that power everything from electric vehicles to F-35 fighter jets. With China controlling 70% of global mining and over 90% of refining capacity, the United States faces a strategic vulnerability that threatens both its defense capabilities and its energy transition. Recent Chinese export restrictions on gallium and germanium have accelerated USA Rare Earth's timeline, with commercial production now targeted for late 2028, two years ahead of previous guidance.

The company's success hinges on extraordinary government backing and massive capital infusions. A $1.6 billion letter of intent from the Department of Commerce, combined with a $1.5 billion private investment, provides $3.1 billion in potential funding. The government will take a 10% equity stake, signaling an unprecedented public-private partnership in critical infrastructure. This funding supports the entire value chain: extraction at the Round Top deposit in Texas, chemical separation in Colorado, and advanced magnet manufacturing in Oklahoma. The Round Top deposit itself is geologically unique, a 1-billion-metric-ton laccolith containing 15 of 17 rare earth elements, processable through cost-effective heap leaching rather than traditional roasting.

Beyond minerals, the project represents a test of American industrial resilience. The Trump administration's "Project Vault" initiative establishes a $12 billion strategic mineral reserve modeled after the Strategic Petroleum Reserve. International alliances with Australia, Japan, and the United Kingdom create a network of "friend-shored" supply chains designed to counter Beijing's leverage. USA Rare Earth's acquisition of UK-based Less Common Metals provides critical refining expertise currently unavailable outside China. The company achieved a milestone in January 2026 by producing its first batch of sintered neodymium magnets at its Oklahoma facility, proving its technical capabilities.

The path forward remains treacherous. Critics point to timeline delays, insider selling, and the volatility inherent in pre-revenue mining ventures. Short sellers have claimed a potential 75% downside, questioning equipment age and promotional tactics. Yet the strategic imperative is undeniable: without domestic rare earth capacity, the United States cannot maintain technological superiority in defense or achieve energy independence. USA Rare Earth's 2030 goal of processing 8,000 tons of heavy rare earths and producing 10,000 tons of magnets annually would fundamentally reshape global supply chains. The billion-dollar race for magnet supremacy will determine whether America can reclaim industrial sovereignty or remain dependent on geopolitical rivals for the minerals of the future.

USAR

USAR — Building America’s Rare Earth-to-Magnet Supply ChainCompany Overview

USA Rare Earth NASDAQ:USAR is developing a fully domestic, vertically integrated rare earths + permanent magnet supply chain—anchored by the Round Top (TX) resource and the Stillwater, OK magnet facility slated for commercial production in early 2026. The model spans mine → refine → finished magnets for EVs, wind, and defense—directly aligned with U.S. supply-chain security.

Key Catalysts

Round Top Acceleration: One of North America’s largest heavy REE deposits; PFS targeted for late 2026 brings forward project value and funding optionality.

Magnet Plant Ramp: U.S.-based NdFeB capacity addresses a critical domestic gap, enabling offtakes with auto, energy, and defense OEMs.

Policy Tailwinds: U.S. industrial policy and defense priorities support onshore materials, permitting, and potential grant/loan access.

Vertical Integration Advantage: Internalized processing + magnet making can improve margins, quality control, and supply assurance vs. import dependence.

Investment Outlook

Bullish above: $16.50–$17.00

Target: $42–$44 — supported by magnet plant commercialization (2026), Round Top de-risking, and strong geopolitical/DOE-DoD tailwinds.

📌 USAR — from ore to magnet, a strategic U.S. cornerstone for EVs, wind, and defense.

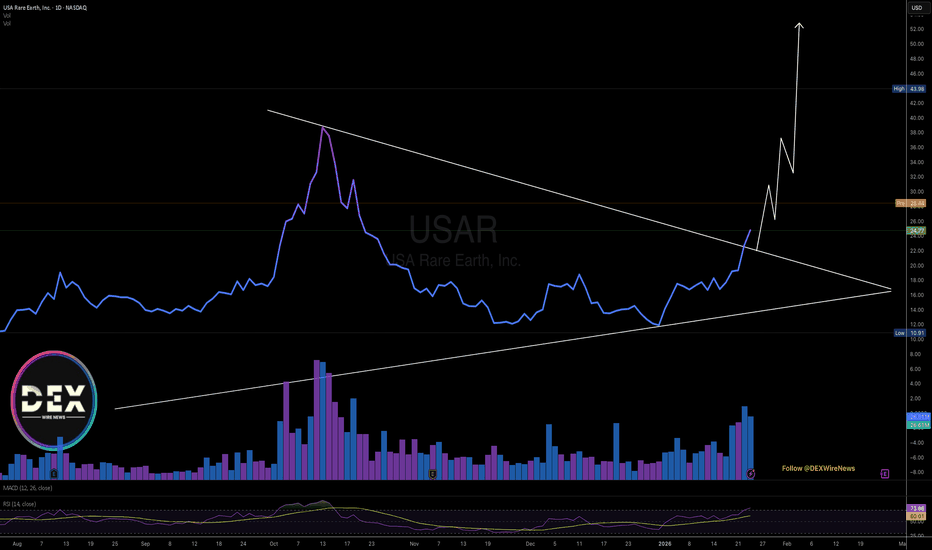

$USAR: The Rare Earth "W"🚀

USA Rare Earth is carving out a textbook Double Bottom (W-Pattern). This isn't just a technical fluke—it’s the "markup" following a major supply-chain shift toward domestic minerals.

Trend Shift: USAR crossed above its 50-day moving average on January 5, 2026—a signal that has a 90% historical success rate for short-term gains.

National Security Play: A recent grant from the U.S. Dept of Defense for samarium metal production is the fundamental fuel for this technical breakout.

The Target: Analysts have an average 12-month target of $22.75 (approx. 28% upside), with some bulls aiming as high as $40.00.

The Risk (Keep it Real)

High Volatility: This stock has a daily volatility average of over 12%. Use a tight stop-loss near $17.04 if you are trading the immediate breakout.

China's Move: Keep an eye on Chinese export restrictions on "heavy rare earths," as they can cause sudden price spikes or supply delays.

The Game Plan

A high-volume close above $18.45 confirms the "W" is complete. If that happens, the technical projection points toward a "mark-up" to the mid-$30s.

#USAR #RareEarth #DoubleBottom #TechnicalAnalysis #WPattern

USAR Shares Jump 20% As Commerce Department Takes Equity StakeUSA Rare Earth ( NASDAQ:USAR ) shares rallied on Monday after the critical minerals startup announced that the Department of Commerce will take an equity stake.

Commerce has issued a letter of intent that would provide USA Rare Earth with a $1.3 billion loan and $277 million in federal funding.

USA Rare Earth will issue Commerce 16.1 million shares of common stock and 17.6 million in warrants. Its stock soared more than 20% in premarket trading after the announcement Monday.

The agreement is subject to finalization of agreements and approvals.

The capital infusion from the Trump administration will help USA Rare Earth advance its plan to build a magnet manufacturing plant in Stillwater, Oklahoma and a mine at a rare earth deposit in Texas called Round Top.

About USAR

USA Rare Earth, Inc. engages in mining, processing, and supplying rare earths and other critical minerals in the United States. It explores for neodymium, dysprosium, terbium, gallium, beryllium, lithium, and other critical minerals. The company holds interests in the Round Top Mountain located near Sierra Blanca, Texas. USA Rare Earth, Inc. was founded in 2019 and is based in Stillwater, Oklahoma.

$USAR – Major Inflection Level at $18 as Rare Earths Heat UpNASDAQ:USAR – Major Inflection Level at $18 as Rare Earths Heat Up

Rare earth stocks are starting to pick up serious steam, and NASDAQ:USAR is now pressing into a key breakout level at $18 — a level that matters technically and psychologically.

🔹 The Setup:

NASDAQ:USAR has been building structure and is now approaching the $18 resistance zone.

A clean push through this level could trigger a momentum expansion, especially with the group waking up.

Price is riding above rising short-term averages — constructive behavior into resistance.

🔹 Sector Confirmation:

NASDAQ:CRML has already started to move, signaling early strength in the rare earth space.

AMEX:UAMY also looks constructive, reinforcing that this isn’t a one-stock move — it’s sector-wide rotation.

This is how themes start: leaders move first, then the rest follow.

🔹 My Trade Plan:

1️⃣ Entry: Watching for a breakout through $18 with volume.

2️⃣ Risk: Stop down to the 9 EMA — tight, clean, and mechanical.

3️⃣ Target: Riding the sector momentum if the breakout confirms.

Why I Like This Setup:

Clear level, defined risk, strong thematic tailwind.

Rare earths are strategic assets — when money flows here, moves can be fast.

NASDAQ:USAR looks ready to participate in the next leg.