USDJPY Breakout and Potential RetraceHey Traders, in tomorrow's trading session we are monitoring USDJPY for a selling opportunity around 156.000 zone, USDJPY was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 156.000 support and resistance area.

Trade safe, Joe.

Usd-jpy-sell

USDJPY at Risk? Sell Zone at 158.600 as Intervention Fears Rise!Hey Traders,

In today’s trading session, we are monitoring USDJPY for a potential selling opportunity around the 158.600 zone. USDJPY previously traded in a strong uptrend but has successfully broken below that structure, signaling a potential shift in momentum. Price is now in a corrective pullback, approaching a key retracement level and the 158.600 support-turned-resistance area, which may act as a strong rejection zone.

From a fundamental perspective, recent comments from the Bank of Japan (BoJ) and Japan’s Ministry of Finance (MoF) continue to emphasize heightened intervention risk at elevated price levels. This ongoing threat of currency intervention adds downside pressure to USDJPY and supports the bearish technical bias.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

USDJPY Approaches Key Sell Zone at 156.60!!Hey Traders,

In today’s trading session, we’re closely watching USDJPY for a potential selling opportunity around the 156.600 zone.

From a technical perspective, the pair remains in a clear downtrend. Price is currently in a corrective rebound, retracing toward a key trendline and support/resistance confluence near 156.600—an area that could attract renewed selling pressure if the broader bearish structure holds.

This zone is critical: rejection here would reinforce the downside bias and open the door for trend continuation lower.

Waiting for confirmation and price reaction at the level before engaging.

Trade safe,

Joe

Big Week for USD: USDJPY Approaches Major Sell Zone!Hey Traders,

In today's trading session we are monitoring USDJPY for a selling opportunity around the 155.750 zone. USDJPY is trading in a downtrend and is currently in a correction phase, approaching the trend area at 155.750, which acts as a key support-turned-resistance level.

On the fundamental side, recent U.S. data continues to support a weaker Dollar as markets increasingly price in a 25bps cut heading into the FOMC. With traders front-running the event, USD momentum remains fragile. If the market over-prices the move ahead of Wednesday, be cautious of the classic "buy the rumor, sell the fact" dynamic.

This broader Dollar softening environment supports further downside in USDJPY as long as the pair remains below the trend structure.

Trade safe,

Joe.

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 155.900 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 155.900 support and resistance area.

Trade safe, Joe.

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 156.700 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 156.700 support and resistance area.

Trade safe, Joe.

USDJPY Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 154.700 zone, USDJPY was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 154.700 support and resistance zone.

Trade safe, Joe.

USD/JPY(20251105)Today's AnalysisMarket News:

The US government shutdown stalemate continues, and the 35-day record is about to be broken.

Technical Analysis:

Today's Buy/Sell Threshold:

153.81

Support and Resistance Levels:

154.97

154.54

154.26

153.37

153.09

152.66

Trading Strategy:

Consider buying if the price breaks above 153.81, with a first target price of 154.26.

Consider selling if the price breaks below 153.37, with a first target price of 153.09.

USD/JPY Rejection Expected from Key Resistance ZoneThis USD/JPY 1-hour chart shows price approaching a resistance zone around 154.8–155.0. After a recent bullish breakout (BoS), the analysis suggests a potential pullback from this resistance area, with a short-term bearish target around 153.300. The setup implies a possible short trade opportunity if price rejects the resistance zone.

USD/JPY(20251029)Today's AnalysisMarket News:

A survey by the London Bullion Market Association (LBMA) predicts gold prices will reach $4,980.3 per ounce and silver prices will reach $59.1 per ounce in one year.

Technical Analysis:

Today's Buy/Sell Threshold:

152.22

Support and Resistance Levels:

153.33

152.91

152.64

151.80

151.53

151.11

Trading Strategy:

If the price breaks above 152.22, consider buying with a first target price of 152.64.

If the price breaks below 151.80, consider selling with a first target price of 151.53.

Can USDJPY Hold Below 152.000? Sellers on WatchHey Traders,

In today’s session, we’re monitoring USDJPY for a selling opportunity around the 152.000 zone.

The pair remains within a broader downtrend, and current price action shows a corrective move approaching a key resistance area.

A rejection from this level could reaffirm the prevailing bearish momentum, while a breakout above may challenge the current trend structure.

Trade safe,

Joe.

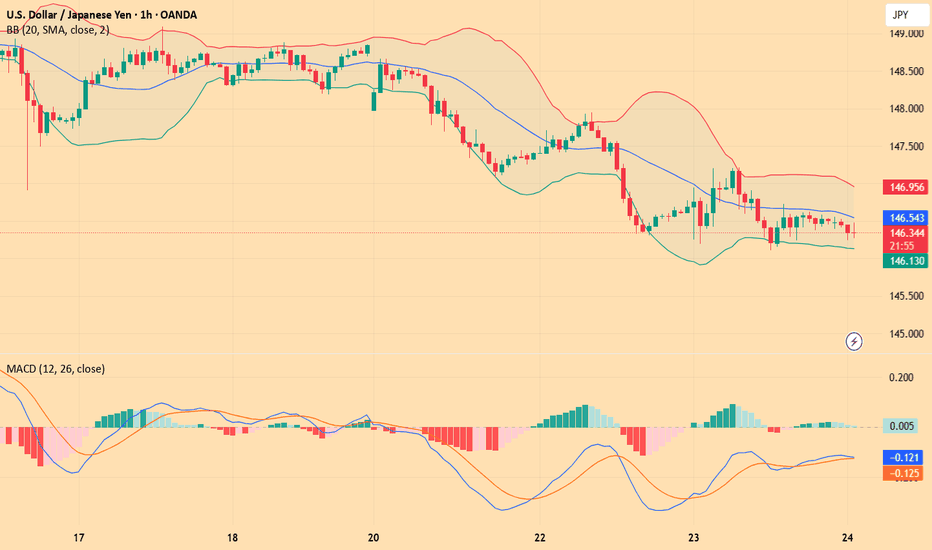

USDJPY Testing 146.700 as Market Awaits ReactionHey Traders, in today's trading session we are monitoring USDJPY for a potential selling opportunity around the 146.700 zone. The pair has been trading in an uptrend, but is currently in a correction phase, approaching this key support/resistance level.

Structure: While the broader bias has been bullish, the correction is bringing price back toward an area of interest.

Key level in focus: 146.700 — a zone where sellers may look to step in if momentum shifts.

Fundamentals: Market sentiment remains sensitive to U.S. data and Fed expectations, which continue to guide short-term USD moves.

Trade safe,

Joe.

USD/JPY(20250724)Today's AnalysisMarket news:

U.S. President Trump continued to lash out at the Federal Reserve on Tuesday, but seemed to back off from the remaining plan to fire Chairman Powell. "I think he's doing a bad job, but he's going to be out of office soon anyway," Trump said in an exchange with reporters at the White House. "In eight months, he'll be out of office."

Technical analysis:

Today's buying and selling boundaries:

146.60

Support and resistance levels:

147.70

147.29

147.02

146.18

145.92

145.51

Trading strategy:

If the price breaks through 146.60, consider buying in, with the first target price at 147.02

If the price breaks through 146.18, consider selling in, with the first target price at 145.92

USD/JPY(20250714)Today's AnalysisMarket news:

① Fed's Goolsbee: The latest tariff threat may delay rate cuts. ② The Fed responded to the White House's "accusations": The increase in building renovation costs partly reflects unforeseen construction conditions. ③ "Fed's megaphone": The dispute over building renovations has challenged the Fed's independence again, and it is expected that no rate cuts will be made this month. ④ Hassett: Whether Trump fires Powell or not, the Fed's answer to the headquarters renovation is the key.

Technical analysis:

Today's buying and selling boundaries:

147.02

Support and resistance levels:

148.39

147.88

147.55

146.49

146.15

145.64

Trading strategy:

If the price breaks through 147.55, consider buying, and the first target price is 147.88

If the price breaks through 147.02, consider selling, and the first target price is 146.49

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 144.200 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 144.200 support and resistance area.

Trade safe, Joe.

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 146.700 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 146.700 support and resistance area.

Trade safe, Joe.

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoringUSDJPY for a selling opportunity around 145.700 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 145.700 support and resistance area.

Trade safe, Joe.

USD/JPY(20250613)Today's AnalysisMarket news:

The number of initial jobless claims in the United States for the week ending June 7 was 248,000, higher than the expected 240,000, the highest since the week of October 5, 2024. The monthly rate of the core PPI in the United States in May was 0.1%, lower than the expected 0.30%. Traders once again fully priced in the Fed's two interest rate cuts this year.

Technical analysis:

Today's buying and selling boundaries:

143.73

Support and resistance levels:

145.09

144.58

144.25

143.21

142.88

142.37

Trading strategy:

If the price breaks through 143.73, consider buying in, the first target price is 144.25

If the price breaks through 143.21, consider selling in, the first target price is 142.88

USD/JPY(20250604)Today's AnalysisMarket news:

Fed Logan: We should focus on achieving the 2% inflation target rather than trying to make up for past inflation shortfalls; Bostic: We still think there may be a rate cut this year.

Technical analysis:

Today's buying and selling boundaries:

143.47

Support and resistance levels:

145.19

144.55

144.13

142.81

142.39

141.75

Trading strategy:

If the price breaks through 144.13, consider buying in, with the first target price of 144.55

If the price breaks through 143.47, consider selling in, with the first target price of 142.81

USD/JPY(20250516)Today's AnalysisMarket news:

Fed Chairman Powell: The Fed is adjusting its overall policy-making framework. Zero interest rate is no longer a basic situation. The wording of underemployment and average inflation rate needs to be reconsidered. PCE is expected to drop to 2.2% in April.

Technical analysis:

Today's buying and selling boundaries:

145.93

Support and resistance levels:

147.26

146.77

146.44

145.42

145.10

144.61

Trading strategy:

If the price breaks through 145.93, consider buying, the first target price is 146.44

If the price breaks through 145.42, consider selling, the first target price is 145.10

USD/JPY(20250514)Today's AnalysisMarket news:

The U.S. unadjusted CPI annual rate unexpectedly dropped to 2.3% in April, the lowest since February 2021.

Technical analysis:

Today's buying and selling boundaries:

147.76

Support and resistance levels:

148.83

148.43

148.17

147.34

147.08

146.68

Trading strategy:

If the price breaks through 147.76, consider buying, the first target price is 148.17

If the price breaks through 147.34, consider selling, the first target price is 147.08

USD/JPY(20250502)Today's AnalysisToday's buying and selling boundaries:

144.67

Support and resistance levels:

147.49

146.44

145.75

143.58

142.90

141.84

Trading strategy:

If the price breaks through 145.75, consider buying, the first target price is 146.44

If the price breaks through 144.67, consider selling, the first target price is 143.58

USD/JPY(20250428)Today's AnalysisMarket news:

The Fed's subsequent policy path considers two scenarios: First, there is no substantial progress in the negotiations between the United States and its trading partners. After 90 days, the US tariffs are still high. Weakened economic demand may prompt the Fed to cut interest rates starting in July, and the annual rate cut may reach 100 basis points; second, the negotiations are fruitful, tariffs are reduced, and the demand shock is small, but inflationary pressure continues. The Fed may postpone easing and only cut interest rates slightly in December. For the market, although the easing comes early in the first scenario, the "recession-style" rate cut may suppress risky assets.

Technical analysis:

Today's buying and selling boundaries:

143.40

Support and resistance levels:

144.89

144.33

143.97

142.83

142.47

141.91

Trading strategy:

If the price breaks through 143.97, consider buying, the first target price is 144.33

If the price breaks through 143.40, consider selling, the first target price is 142.83