USDCHF oversold bounce back support at 0.7957The USDCHF remains in a bullish trend, with recent price action showing signs of an oversold bounce back within the broader sideways consolidation.

Support Zone: 0.7957 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.7957 would confirm ongoing upside momentum, with potential targets at:

0.8050 – initial resistance

0.8068 – psychological and structural level

0.8094 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.7957 would weaken the bullish outlook and suggest deeper downside risk toward:

0.7940 – minor support

0.7915 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the USDCHF holds above 0.7913 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Usdchf!

USDCHF: Short Trade Explained

USDCHF

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short USDCHF

Entry - 0.8006

Sl - 0.8015

Tp - 0.7989

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USD/CHF BEARS WILL DOMINATE THE MARKET|SHORT

USD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.797

Target Level: 0.795

Stop Loss: 0.798

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USDCHF: Retail Overcrowded Long While Price Rejects SupplyUSDCHF is currently sitting in a highly sensitive technical area, where multiple high-probability factors are converging: a Daily supply zone, a descending trendline acting as dynamic resistance, an unbalanced retail sentiment, and a seasonal backdrop that often supports corrective moves. In this type of environment, I’m not interested in blindly anticipating the move—I want price to confirm weakness first, because when the market rejects supply while sentiment is already overcrowded, the rotation can become clean and fast.

Daily Chart – Structure & Key Levels

On the Daily chart, USDCHF has delivered a strong rebound from recent lows, but it is now losing momentum as it pushes into a major supply area around 0.8000–0.8040. This is not a “random” resistance zone: it’s an area where sellers previously reacted aggressively and where distribution often takes place.

The most important detail is that price is testing this supply while also reacting to a descending trendline, which has been acting as a dynamic ceiling. When supply and trendline resistance align in the same area, the probability of a reaction increases significantly: either the market absorbs supply and breaks higher with conviction, or it rejects and rotates back to the downside.

COT – Swiss Franc Positioning (Smart Money)

According to the COT report, Non-Commercials are heavily net short CHF. From a practical trading perspective, this means large speculators are meaningfully positioned against the Swiss Franc, which generally supports a broader CHF weakness narrative.

Seasonality – January Context

USDCHF shows a historical tendency to experience phases of weakness, and January in particular tends to be more “bearish” across multiple time windows. Seasonality alone is never enough, but when it aligns with a Daily supply zone and extreme retail sentiment, it becomes an additional probability layer supporting a bearish rotation.

FX Sentiment (Retail) – Strong Contrarian Signal

Currently, 78% of traders are LONG USDCHF, while only 22% are short. This is exactly the type of imbalance that, from a contrarian perspective, often precedes a move in the opposite direction.

When retail is heavily long right as price reaches resistance/supply, the market often:

sweeps liquidity above the highs

traps late buyers

then sells off with a sharp bearish rotation

That’s why this area is particularly interesting: sentiment is clearly one-sided, and price is sitting at a technically meaningful reversal location.

Bullish bounce off?Swissie (USD/CHF) is falling towards the pivot and could bounce to the 1st resistance, which has been identified as an overlap resistance.

Pivot: 0.7934

1st Support: 0.7898

1st Resistance: 0.7992

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDCHF breakout supported at 0.7938The USDCHF remains in a bullish trend, with recent price action showing signs of an oversold bounce back within the broader sideways consolidation.

Support Zone: 0.7938 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.7938 would confirm ongoing upside momentum, with potential targets at:

0.7990 – initial resistance

0.8000 – psychological and structural level

0.8020 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.7913 would weaken the bullish outlook and suggest deeper downside risk toward:

0.7913 – minor support

0.7880 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the USDCHF holds above 0.7938 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDCHFUSDCHF is in a sideways trading range. If the price can hold above 0.79248, I expect a potential rebound. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

This content is not financial advice. Always conduct your own financial due diligence.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

USDCHF Sellers In Panic! BUY!

My dear followers,

I analysed this chart on USDCHF and concluded the following:

The market is trading on 0.7974 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.7991

Safe Stop Loss - 0.7965

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDCHF: post-NFP setup🛠 Technical Analysis: On the H4 chart, USDCHF is rebounding into a key resistance cluster around 0.7990–0.8000, where price meets the prior supply zone and the MA area (SMA200 ~0.7976). The structure still carries a broader bearish tone (global bearish signal), and the current rally looks like a retest rather than a clean trend reversal. It expected that a potential liquidity sweep (renewal of the local high) followed by a reversal — a confirmed close back below 0.79900 would be the trigger for continuation lower. If the rejection is validated, the downside path opens toward the marked support at 0.78787.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell after a sweep higher and a confirmed H4 close back below 0.79900 (approx. 0.79809 – 0.79900)

🎯 Take Profit: 0.78787

🔴 Stop Loss: 0.80488

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

USDCHF H4 | Bearish Reversal?The price has rejected off our sell entry level at 0.7992, which acts as an overlap resistance that aligns with the 61.8% Fibonacci retracement.

Our stop loss is set at 0.8025, which is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Take profit is set at 0.7942, which is a pullback support that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

Potential bullish reversal?Swissie (USD/CHF) could make a short-term pullback to the pivot, which acts as a pullback support and could bounce to the 1st resistance.

Pivot: 0.7959

1st Support: 0.7855

1st Resistance: 0.8104

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDCHF I Technical Analysis and Long Opportunity ExplainedWelcome back! Let me know your thoughts in the comments!

** USDCHF Analysis - Listen to video!

We recommend that you keep this on your watch list and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

USDCHF WILL GO UP|LONG|

✅USDCHF has displaced cleanly above the prior range high, confirming bullish market structure shift. Breakout is supported by strong impulsive delivery and acceptance above the former demand, suggesting continuation toward resting liquidity above. Time Frame 5H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Potential bullish rise?USD/Chf could make a short-term pullback to the support level, which has been identified as a pullback support, and could bounce from this level to our take profit.

Entry: 0.7966

Why we like it:

There is a pullback support level.

Stop loss: 0.7910

Why we like it:

There is an overlap support level.

Take profit: 0.8048

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD-CHF Bullish Breakout! Buy!

Hello,Traders!

USDCHF breaks above a well-defined horizontal demand, confirming a bullish SMC breakout. Strong displacement signals smart money accumulation, with price likely to continue higher toward premium and resting buy-side liquidity. Time Frame 8H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF H4 | Could We See A ReversalThe price is reacting off our sell entry level at 0.7992, which is an overlap resistance that lines up with the 61.8% Fibonacci retracement and the 78.6% Fibonacci projection.

Our stop loss is set at 0.8025, which is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Our take profit is set at 0.7942, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

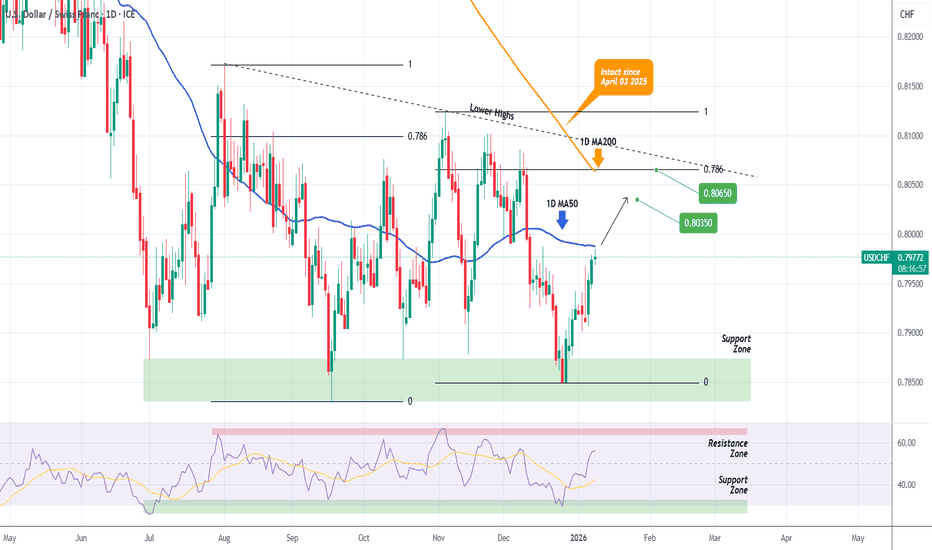

USDCHF Moment of truth on the 1D MA200 is coming.The USDCHF pair is on a strong rise since its December 26 2025 Low, which is technically the Bullish Leg of the long-term Descending Triangle. Today it is testing the 1D MA50 (blue trend-line) and if broken, will be the perfect buy continuation signal.

If it breaks, buy and target a potential 1D MA200 (orange trend-line) test at 0.80350. This will be the market's most important test for 2026 as the 1D MA200 has been untouched since April 03 2025.

If it breaks, the long-term trend most likely shifts to bullish, but even on the short-term we can again engage into a quick buy, targeting the top (Lower Highs trend-line) of the Descending Triangle at 0.80650, which is also the 0.786 Fibonacci retracement level (where the previous Lower High was priced).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF Is Very Bullish! Long!

Take a look at our analysis for USDCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.788.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.796 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

Stop!Loss|Market View: USDCHF🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the USDCHF currency pair☝️

Potential trade setup:

🔔Entry level: 0.79758

💰TP: 0.78838

⛔️SL: 0.80276

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: At the end of this week, at least until tomorrow's non-farm data release, we should expect further strengthening of the USD across all major currencies. However, the technical situation for USDCHF is different from the others, growth is also expected there, but the area around 0.79 will likely be tested before a more global strengthening of the USD. Targets around 0.78 are also being considered. The most reliable entry point for this could be a false breakout near the 0.8 resistance level.

Thanks for your support 🚀

Profits for all ✅

Bearish reevrsal off Fib confluenceSwissie (USD/CHF) is rising towards the pivot, which is an overlap resistance and could reverse to the 1st support, which is a pullback support.

Pivot: 0.7992

1st Support: 0.7934

1st Resistance: 0.8025

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDCHF 📉 OANDA:USDCHF Technical Analysis (4H Timeframe)

The overall trend for USD/CHF is currently bearish, as the price remains below the downward-sloping EMA 200 (black line) and has consistently formed lower highs 📉. Looking at the momentum, we saw large-bodied bearish candles during the previous impulsive waves, indicating strong selling pressure. However, the last 5 waves show a corrective pullback as the price bounces from the major grey demand zone at the bottom. Currently, the price is testing the EMA 50 (red line) and a local structural resistance at 0.79600 USD. Since the EMA 50 is cutting through the price without a clear slope, it suggests a short-term neutral or consolidating phase within the larger downtrend. A rejection here could signal a continuation of the bearish trend toward the lower liquidity zones.

🔑 Key Levels to Watch:

Major Resistance Zone (Grey Box): 0.81100 USD 🚩

Structural Resistance: 0.80500 USD (Dashed Line) 🎯

Dynamic Resistance / Flip Zone: 0.80100 USD (EMA 200 & Grey Box) ⚡

Immediate Pivot Level: 0.79600 USD (Dashed Line) 💡

Recent Support Level: 0.79000 USD 🛡️

Primary Demand Zone (Grey Box): 0.78300 USD – 0.78630 USD 📥

Ultimate Downside Target: 0.77900 USD 📉