USDCHF Box Range — Don’t Miss the BreakLadies and gentlemen, if you're as obsessed with box breakouts as I am, this analysis is custom-built for you. We're tearing into USDCHF together—nailing those triggers and slipping in some solid education mid-way. No delays, straight fire. 🔥

I’m Skeptic , founder of Skeptic Lab . If you want to elevate your long-term performance through genuine psychology, data-driven insights, and proven strategies, you’ve landed in the right spot.

First, daily timeframe glance: We're deep in a huge consolidation box—ceiling at 0.81013 , floor at 0.79047 . A confirmed break of either side could ignite a months-long trend. After that savage rejection from 0.80829 (and even slicing through the box midline), we've been chopping in tight range for 11 straight days.

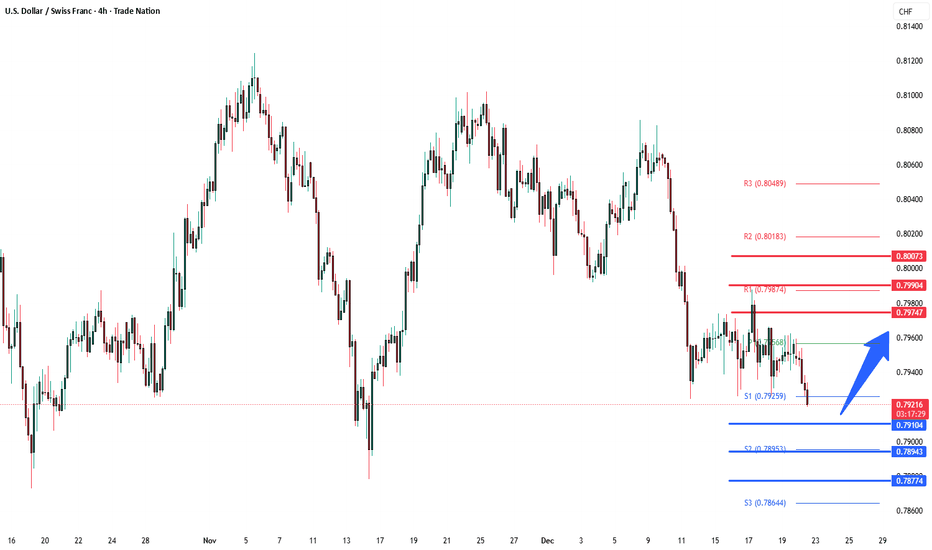

Now drop to 4H: The range box here is crystal clear. Upside break above 0.79653 lights up our long trigger —first aiming for the daily consolidation midline, then resistance at 0.80677.

Quick lesson (don't skip this) : For box breakout targets, always measure the box height (here ~0.38%) and project it upward from the breakout point. Lands us a first target at 0.79961. Why bother? It lets you manage risk surgically—set a tight stop so you hit R/R before target, banking partial profits early like a pro.

Short side: Break below 0.79352 looks tasty, but caution—we're hugging the bigger consolidation floor. Take profits quick, no greed.

Thanks for riding this idea—if it delivered value, hit that boost to keep the momentum rolling and follow to build the squad. Toss any symbol you want dissected in the comments, I'll handle it. 🩵

Now get outta here.

USDCHF

USDCHF Will Go Down From Resistance! Short!

Please, check our technical outlook for USDCHF.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.795.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.792 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

Stop!Loss|Market View: USDCAD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the USDCAD currency pair☝️

Potential trade setup:

🔔Entry level: 1.37491

💰TP: 1.38922

⛔️SL: 1.36831

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: The USD will likely remain under pressure from its major peers until early next year. Short-term selling of the USD is being considered. However, the USDCAD currency pair stands out as the best option for medium-term buying of the USD today. A potential false breakout at 1.37335 could provide an excellent entry point for this. The upside target is currently seen near the nearest key resistance level of 1.39000.

Thanks for your support 🚀

Profits for all ✅

USDCHF: Bullish Push to 0.805?FX:USDCHF is eyeing a bullish breakout on the 4-hour chart , with price forming higher lows along an upward trendline after bouncing from support, converging with a downward trendline touch that could ignite upside momentum if buyers break through amid recent consolidation. This setup suggests a reversal opportunity post-downtrend, targeting higher resistance levels with risk-reward exceeding 1:3.🔥

Entry between 0.7900–0.79155 for a long position. Target at 0.80500 . Set a stop loss at a close below 0.78745 , yielding a risk-reward ratio of more than 1:3 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the pair's momentum near the trendlines.🌟

Fundamentally , USDCHF is trading around 0.796 in mid-December 2025, with recent central bank decisions shaping the pair's direction. For the US Dollar, the FOMC cut rates by 25 bps on December 10 to 3.50%-3.75% in a 9-3 split vote, with hawkish guidance signaling fewer future cuts amid labor resilience and inflation concerns. For the Swiss Franc, the SNB held its policy rate at 0% on December 11 despite low inflation , with forecasts indicating no changes through 2026 and a low bar for negative rates, potentially weakening CHF further. These outcomes could favor USD strength against CHF if Fed's hawkishness persists. 💡

📝 Trade Setup

🎯 Entry (Long):

0.7900 – 0.79155

🎯 Target:

• 0.80500

❌ Stop Loss:

• Close below 0.78745

⚖️ Risk-to-Reward:

• > 1:3

💡 Your view?

Will USDCHF break above the trendline and run toward 0.8050 — or does resistance hold for another rejection? 👇

Potential bearish continuation?Swissie (USD/CHF) could make a short-term pullback to the pivot, which is a pullback resistance and could drop from this level to the 1st support.

Pivot: 0.7933

1st Support: 0.7894

1st Resistance: 0.7965

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USD-CHF Free Signal! Sell!

Hello,Traders!

USDCHF breaks decisively below a well-respected horizontal supply zone, confirming smart money distribution after a failed bullish attempt. Buy-side liquidity has been cleared, and price acceptance below the level signals bearish continuation toward resting sell-side liquidity at lower imbalance zones.

--------------------

Stop Loss: 0.7938

Take Profit: 0.7907

Entry: 0.7927

Time Frame: 3H

--------------------

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bearish Pressure Dominates USD/CHF Structure!USD/CHF “THE SWISSY” 🐻 Bearish Opportunity (Day/Swing) — Correlation + Macro Watch 🚨

🔥 Asset: USD/CHF — “THE SWISSY”

⏱️ Timeframe: Day / Swing Trade Opportunity

📉 Bias: Bearish Plan

🎯 Trade Setup

🔹 Entry: ANY PRICE LEVEL ENTRY — Market or pullback

🔹 Stop Loss:

➡️ Thief SL: 0.79500 ❌

Adjust your SL based on your strategy & risk tolerance.

💡 This is NOT financial advice — YOU manage your risk.

🔹 Target Zone:

➡️ 0.78800 🎯 — strong support / oversold confluence / trap area

Take profits according to your plan.

💬 Remember: I do not insist on my SL or TP — trade YOUR risk. Your profits.

📌 Why This Setup Matters (Key Technical Points)

📉 Bearish structure forming

📌 Price near resistance + supply cluster

🌀 Momentum slowing

📌 RSI oversold approaching support

⚡ Liquidity sweep possible before drop

🔗 Related Pairs to Watch (Correlation Focus)

USD Strength Index Correlations:

🔹 USD/JPY – if USD weakens → pairs likely follow

🔹 EUR/USD – inverse correlation with USD/CHF

🔹 GBP/CHF – other CHF cross for confirmation

🔹 AUD/CHF – global risk sentiment reflection

📊 If CHF strengthens (risk off), bearish USD/CHF plays accelerate.

🌍 Macro + Economic Factors to Watch

📅 Economic Calendar Triggers

🔹 U.S. Data:

• GDP / CPI / PCE / NFP — volatility drivers

🔹 SNB (Swiss National Bank):

• Policy stance / rate expectations impact CHF strength

📈 Risk Sentiment:

👉 Safe-haven demand for CHF ↗ in risk-off

👉 USD moves with U.S. yield expectations

📊 Correlations to Monitor:

• USD Index (DXY) moves

• S&P 500 / equity risk trends

• CHF demand in flight-to-quality

📍 Quick Summary for Traders

✔ Bearish outlook

✔ Flexible entry

✔ Manage YOUR stops & targets

✔ Watch correlated pairs

✔ Monitor macro drivers

📣 Engagement Hooks:

👇 Comment Your Entry & Target Levels!

❤️ Like & Follow for more setups

📊 Share with other Traders — Let’s Grow Together!

USDCHF corrective pullback support at 0.7910The USDCHF remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 0.7910 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.7910 would confirm ongoing upside momentum, with potential targets at:

0.7975 – initial resistance

0.7990 – psychological and structural level

0.8010 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.7910 would weaken the bullish outlook and suggest deeper downside risk toward:

0.7895 – minor support

0.7877 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the USDCHF holds above 0.7910 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDCHF What Next? BUY!

My dear friends,

USDCHF looks like it will make a good move, and here are the details:

The market is trading on 0.7933 pivot level.

Bias -Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.7953

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDCHF Will Move Higher! Buy!

Here is our detailed technical review for USDCHF.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 0.794.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 0.795 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

Bullish bounce setup?USD/CHF is falling towards the support level, which is a pullback support and could bounce from this level to our take profit.

Entry: 0.7928

Why we like it:

There is a pullback support level

Stop loss: 0.7892

Why we like it:

There is a multi-swing low support

Take profit: 0.7992

Why we lik eit:

There is an overlap resistance level that is slightly below the 50% Fibonacci retracement

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDCHF: Short Signal Explained

USDCHF

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short USDCHF

Entry - 0.7951

Sl - 0.7955

Tp - 0.7944

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bullish reversal for the Swissie?The price is reacting off the support level, which is a pullback support and could rise from this level to our take profit.

Entry: 0.7928

Why we like it:

There is a pullback support level.

Stop loss: 0.7892

Why we like it:

There is a pullback support level

Take profit: 0.7992

Why we like it:

There is an overlap resistance level that is slightly below the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDCHF REBOUND AHEAD|LONG|

✅USDCHF swept sell-side liquidity into a higher-timeframe demand zone, where displacement confirms bullish intent. Expect mitigation and consolidation above the demand before a push toward buy-side liquidity resting at the marked target area. Time Frame 2H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

USDCHF H4 | Bullish Reversal SetupMomentum: Bearish

The price could make a short-term pullback to the buy entry, which acts as a pullback support.

Buy entry: 0.7961

Pullback support

Stop loss: 0.7922

Pullback support

Take profit: 0.8011

Overlap resistance that aligns with the 50% Fibonacci retracement

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Bullish reversal setup?Swissie (USD/CHF) is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance, which has been identified as an overlap resistance.

Pivot: 0.7931

1st Support: 0.7891

1st Resistance: 0.7993

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDCHF range trading supported at 0.7910The USDCHF remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 0.7910 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.7910 would confirm ongoing upside momentum, with potential targets at:

0.7975 – initial resistance

0.7990 – psychological and structural level

0.8010 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.7910 would weaken the bullish outlook and suggest deeper downside risk toward:

0.7895 – minor support

0.7877 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the USDCHF holds above 0.7910 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Potential bearish reversal?USD/CHF is rising towards the resistance level, which is a pullback resistance that is slightly below the 505 Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.7996

Why we like it:

There is a pullback resistance level, which is slightly below the 50% Fibonacci retracement.

Stop loss: 0.8027

Why we like it:

There is a pullback resistance that is slightly above the 61.8% Fibonacci retracement.

Take profit: 0.7953

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD/CHF Trades Below Key Moving Averages Amid Bearish BiasThe chart for USD/CHF highlights a persistent bearish structure, with price action currently below both the 50-day (blue) and 200-day (red) moving averages. This alignment suggests a dominant downtrend, reinforced by the following observations:

Moving Averages: The 50-day MA remains well below the 200-day MA, confirming a long-term bearish crossover. Price trading beneath both averages adds weight to the downside bias.

MACD: The MACD histogram shows subdued momentum, and the signal lines are positioned below the zero line, indicating continued bearish pressure. However, the histogram narrowing hints at potential weakening of the current trend.

RSI: The RSI hovers near the midline, suggesting neutral momentum rather than oversold conditions. This could imply consolidation before the next directional move.

Key Levels:

Support: 0.87461

Resistance: 0.94600

The pair remains in a range but under structural bearish pressure. A sustained break below support could extend the downtrend, while a recovery above the 50-day MA would be an early sign of trend reversal.

-MW

USDCHF: High Chance for Recovery?! 🇺🇸🇨🇭

USDCHF may continue recovering after a test

of a strong intraday horizontal support.

It looks like we got a bearish trap below that

and we see a relatively strong bullish momentum now.

Goal will be 0.7985

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Overlap resistance ahead?Swissie (USD/CHF) is rising towards the pivot, which has been identified as an overlap resistance and could reverse to the 1st support which is a multi swing low support.

Pivot: 0.7992

1st Support: 0.7891

1st Resistance: 0.8024

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party