USDCHF: Wave structure at a trend forkUSDCHF: Wave structure at a trend fork

USDCHF Wave Overview (D1 and H4)

As a trader who has been practicing wave analysis for over ten years, I note that the USDCHF pair is currently demonstrating the completion of an extended corrective formation and is poised to form a new impulse.

Chart D1: The global picture indicates that the market is ending a sideways phase. The wave structure appears to be the end of a corrective sequence, which serves as the foundation for the next trend movement.

Chart H4: Local dynamics confirm the formation of key entry points. Here, the first signs of an impulse are visible, which could mark the beginning of a larger wave.

Main Scenario

After the completion of the corrective phase, a downward impulse sequence is expected to develop. This movement will be accompanied by increased seller activity and a gradual shift in priority to the downside.

Alternative Scenario

If the price holds above recent highs and forms a stable upward impulse structure, the priority will shift to continued growth. In this case, the correction will be considered incomplete, and the pair may experience a further rebound.

Trading Idea

Conservative approach: wait for confirmation of a breakout of key levels and enter with the trend.

Aggressive approach: use local impulses on H4 for earlier entries, but with tight stops.

In both cases, it is important to maintain strict risk management and adjust the plan as new impulses emerge.

Results

USDCHF is at the transition point between a correction and a new impulse. The wave structure on D1 and H4 provides clear guidelines for trading: watch for confirmation of the scenario and act with discipline.

Usdchfsell

The franc strengthens its position: pressure on the dollarAfter recent strengthening, USDCHF has shifted into a declining phase. The chart shows that upward impulses are losing momentum, while the movement is gradually transitioning into a bearish structure. Sellers are beginning to dominate, limiting growth attempts and pushing the price lower.

Fundamental factors add pressure to the pair. Dollar weakness is linked to expectations of a dovish Federal Reserve policy and the decline of the DXY index, which is losing ground amid weak U.S. economic data. At the same time, the Swiss franc gains support as a safe-haven asset, especially under conditions of geopolitical uncertainty.

An additional signal favoring the downside comes from the technical picture: the breakdown of key levels and the price holding within a bearish channel confirm seller interest.

Thus, USDCHF remains under pressure, and the market’s next steps will determine whether the current decline develops into a sustained downtrend.

USDCHF - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

USD/CHF: Bearish Drop to 0.7988?FX:USDCHF is showing bearish potential on the 4-hour chart , with price testing a downward trendline as resistance, converging near a good entry point and resistance zone, setting up for a possible downside continuation if sellers regain control amid recent consolidation. This alignment suggests weakening upside momentum in the safe-haven pair.

Entry zone between 0.8051-0.8061 for a short position. Target at 0.7988 near the support zone, providing a risk-reward ratio of approximately 1:2 . Set a stop loss on a close above 0.8084 to safeguard against a reversal. 🌟 Watch for confirmation via a rejection at the entry with increasing volume, driven by USD dynamics against CHF.

Fundamentally , today we have the US PCE annual and monthly indices , released on October 31, 2025, at 12:30 UTC, which could influence USD strength. Additionally, on November 3, 2025, Switzerland's Consumer Price Index will be published, potentially creating volatility in this pair. 💡

📝 Trade Plan:

🎯 Entry Zone: 0.8051 – 0.8061 (short setup near resistance & trendline)

❌ Stop Loss: Close above 0.8084

✅ Target: 0.7988 (support / take profit zone)

💎 Risk-to-Reward: Approximately 1:2, ideal for a clean technical play.

What's your take on this setup? Share below! 👇

USDCHF - Looking To Sell Pullbacks In The Short TermH4 - Strong bearish move.

Uptrend line breakout.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation after pullback until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

SHORT ON USD/CHFUSD/CHF is pulling back to a major supply area/zone

News today for the dollar (PCE) will most likely push price into these zone before dropping.

If news for the dollar comes out negative we might see a drop without the rise to supply.

But its always better to SELL HIGH so set sell limit orders in these zones to take full advantage.

150-200 pips on the table.

Enjoy!

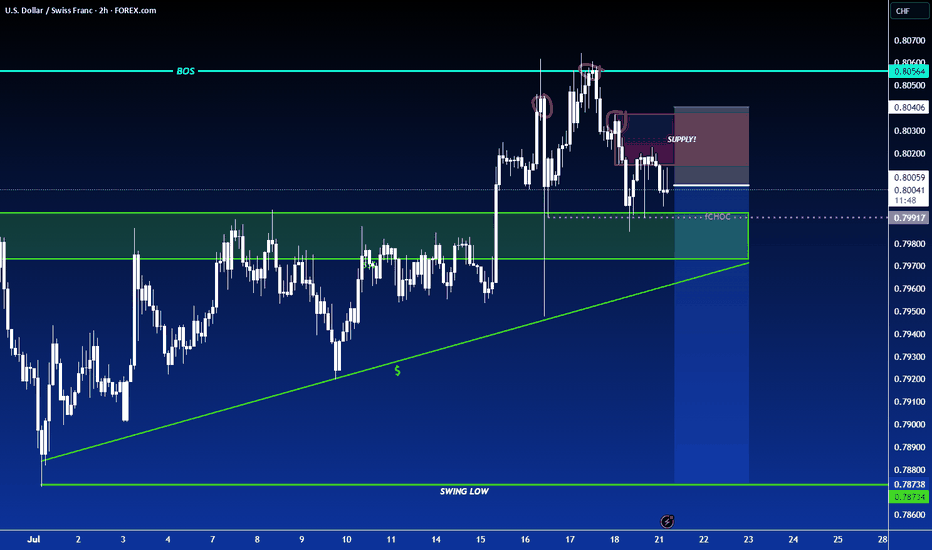

USD/CHF – Bearish Channel Rejection | Short Setup Towards 0.7800 Pair & Timeframe

Pair: USD/CHF (U.S. Dollar / Swiss Franc)

Timeframe: 4H (4-hour chart)

2. Pattern

Falling Channel:

Price has been trending downwards inside a descending channel (highlighted in blue).

Recently, price bounced from the lower boundary of the channel, indicating a short-term bullish retracement.

3. Key Levels

Entry Zone (Sell Area): Around 0.79727 – 0.80080 (gray + green box).

This is a supply zone / resistance area where sellers might step in.

Stop Loss: Just above 0.80080 (green zone suggests a safe stop loss).

Take Profit: Around 0.78021 (bottom of the channel, marked with blue line).

4. Trade Idea

This looks like a sell setup:

Expectation is price will move slightly higher into the resistance box.

Then reverse back down, continuing the main bearish trend toward the lower channel boundary.

5. Risk-Reward

Risk: Small (green zone is tight, just above resistance).

Reward: Large (target is far below near 0.7800).

This gives a good risk-to-reward ratio, which is attractive for swing traders.

6. Confirmation

The setup assumes rejection from the resistance zone.

Confirmation might come from bearish candlestick patterns (pin bar, engulfing) on the 4H chart before entering short.

✅ Summary:

This is a bearish continuation setup inside a descending channel. The plan is to sell around 0.797–0.801 zone with a stop loss above 0.801 and target near 0.7800. Good R:R ratio — but entry should wait for rejection/confirmation.

USDCHF - Short Term Sell IdeaH4 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

USD/CHF: Swiss Slide to 0.79795 Ahead? FX:USDCHF is showing signs of a bearish move on the 4-hour chart , with an entry zone at the red box around 0.8065 near a key resistance level. The target at 0.79795 aligns with the next support zone, offering a clear downside potential. Set a stop loss at 0.81 on a close above to manage risk effectively.

A break below 0.805 with increasing volume could confirm this slide, driven by USD weakness and CHF strength. Watch Swiss economic data and global risk sentiment as catalysts.

Ready for this move? Do you see this USD/CHF slide coming? Share your view!

#USDCHF #ForexTrading #TechnicalAnalysis #TradingView #CurrencyPairs #DayTrading #MarketSignals

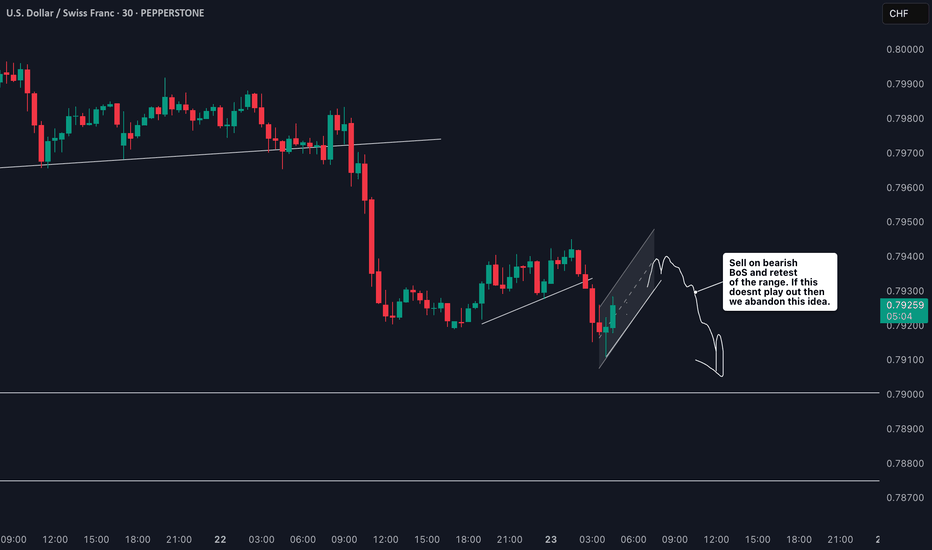

Is USDCHF Ready to Drop? Short Setup Explained📉 USDCHF Trade Idea Breakdown

Taking a close look at USDCHF, we’re currently in a clear downtrend 🔻. Price is under pressure on the higher timeframes, but on the lower timeframes (15m & 30m), we’re seeing a pullback 🌀.

What I’m watching for now is a rejection at resistance 🔄 followed by a bearish break in market structure ⛔️. If that confirms, I’ll be looking to take a short entry with targets set at the two previous lows marked out in the video 🎯📉.

Stop loss placement would be just above the recent swing high for risk management 🛑.

As always — this is not financial advice ⚠️.

USDCHF – Two Levels, One PlanWe’re watching two key resistance zones for a potential short.

If the first level holds and gives a signal, we’ll short from there.

If that level breaks, we may switch to a short-term buy up to the next level.

Once price reaches the second resistance, we’ll be ready for another sell opportunity.

No predictions — just following the flow.

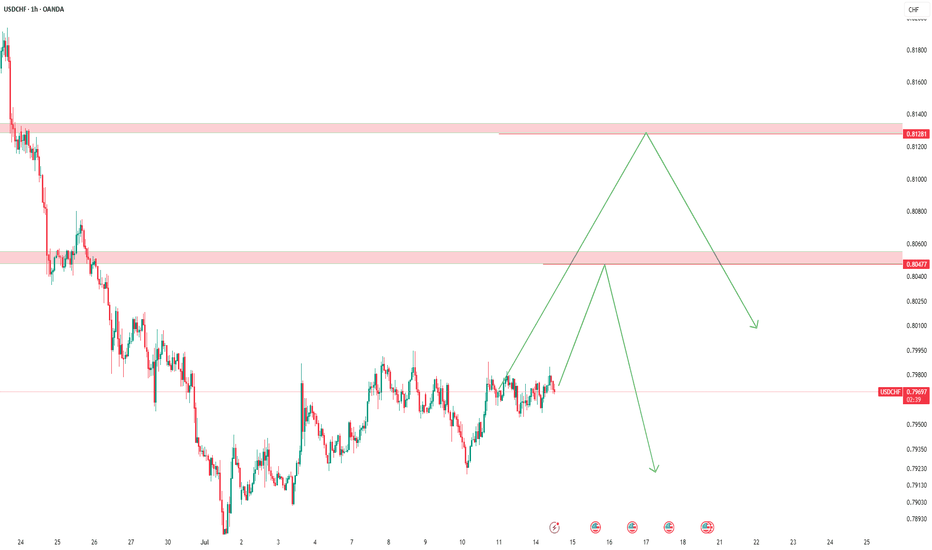

#USDCHF: Will USD Breakthrough The Strong Bearish Downtrend? The USDCHF currency pair has experienced significant volatility due to the ongoing trade dispute between the United States and China, which has led to a substantial decline in the DXY index. Consequently, CHF and JPY have emerged as the most stable currencies in the market.

Despite the USDCHF currency pair reversing its bullish trend, we anticipate a potential reversal back to a bearish position. We believe this reversal may be a temporary trap, and the currency pair is likely to regain its bullish position in the future.

There are two potential areas where the USDCHF currency pair could reverse from its current trend. The first area is relatively early, and if the USDCHF currency pair crosses a specific region, we may have a second safe option that could provide greater stability.

We extend our best wishes and best of luck in your trading endeavours. Your unwavering support is greatly appreciated.

If you wish to contribute, here are several ways you can assist us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_🚀❤️

How to Trade USDCHF 's Downtrend with Precision📉 Market Breakdown: USDCHF Under Pressure

Currently keeping a close watch on USDCHF 💵🇨🇭 — the pair has been in a strong, sustained bearish trend 🔻, and the overall pressure remains clearly to the downside.

My bias is firmly bearish 📊, but I’m not rushing in. Instead, I’m patiently waiting for an optimal entry 🎯 — one that offers the right balance of confluence, structure, and reduced risk 🧠🛡️.

🎥 In today’s video, we dive into:

✅ Market structure

✅ Price action

✅ The prevailing trend

✅ Entry zones with minimized risk

I also walk you through my personal entry strategy and trading plan 📋, it's not just an idea drop.

📌 Disclaimer: This is not financial advice — the content is for educational purposes only.

USDCHF..SHORT📌 USDCHF – Multi-Scenario Setup

This pair has two key levels: one short-term, the other long-term.

If price reaches the first level and shows solid bearish reaction, I’ll enter a short.

If that level breaks and confirms, I’ll go long—but manage the long aggressively, since I’ll look to exit around the higher level.

If the price pushes beyond even the second zone, I’ll be ready to buy again.

❗️I’m never upset by a loss or a broken level.

The market leads—I follow.

Claiming “it must drop from here” or “it has to rise” is wishful thinking, not trading.

✅ Stay calm, stay flexible, and stay prepared for every scenario.

USD/CHF 4H Bearish Setup: FVG Rejection & EMA Resistance Strateg🔵 Chart Structure

🔻 Downtrend Identified

* Lower highs & lower lows forming.

* Resistance line sloping down 📉.

🧲 EMA 70 (0.82387)

* Acting as dynamic resistance 🔴.

* Price currently sitting just below it ⬇️.

💠 FVG (Fair Value Gap) — 0.82441 to 0.83097

* Price expected to fill the imbalance here.

* Confluence with resistance = 🔥 ideal sell zone.

🎯 Trade Plan (Short Setup)

🟦 Entry Point:

* 💥 0.82415

* Just under EMA + inside FVG zone.

🛑 Stop Loss:

* ❌ 0.83110

* Above FVG + above previous high = protected stop.

🎯 Take Profit:

* ✅ 0.80150

* Near prior demand zone + horizontal support.

* Target zone clearly marked in light blue 🧊.

⚖️ Risk-Reward Ratio

🎲 Estimated around 2.5:1 or better.

✅ High reward potential if resistance holds.

⚠️ Caution / Notes

🔎 Watch for bearish confirmation candles 🕯️ at entry zone.

📆 Be aware of economic news that could impact USD or CHF.

🧪 If price closes above 0.83110, setup becomes invalid ❌.

📌 Summary

Element Level Emoji

🔵 Entry 0.82415 💥

🛑 Stop Loss 0.83110 ❌

✅ Take Profit 0.80150 🎯

🔻 Trend Bias Bearish 📉

📐 Tools Used EMA, FVG, Resistance 📊

USD/CHF Short Trade Idea - UpdatedPrice capped beneath 100-day EMA; risk aversion + SNB rhetoric keep CHF firm; bearish momentum intact below 0.8200.

USD weakness persists triggered by fresh US tariff threats,

a deepening US-China trade rift, and US fiscal instability underpin

CHF demand.

Technically, strong bearish momentum remains below 0.8300.

Current trading around 0.8200 confirms downside bias.