USDCHF Oversold and approaching an 11-year Low.The USDCHF pair has been trading within a Channel Down since its November 2022 High rejection on the 1M MA200 (orange trend-line). This month isn't only approaching the bottom of that pattern but also Support 1, which consists of the January 2015 Low (0.74250).

With the 1M RSI almost oversold and similar to December 2020 (every oversold 1M RSI has historically been a massive long-term buy signal), we don't technically believe that this decline has much more room to extend to, beyond at least the -17.86% of the previous Bearish Leg.

Instead, we treat this as an excellent long-term buy opportunity, with a first Target on the 0.5 Fibonacci retracement level (again similar as the previous Channel Down rebound) at 0.83450. Note that this is more suited to long-term investors and not shorter term traders.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Usdchfsignals

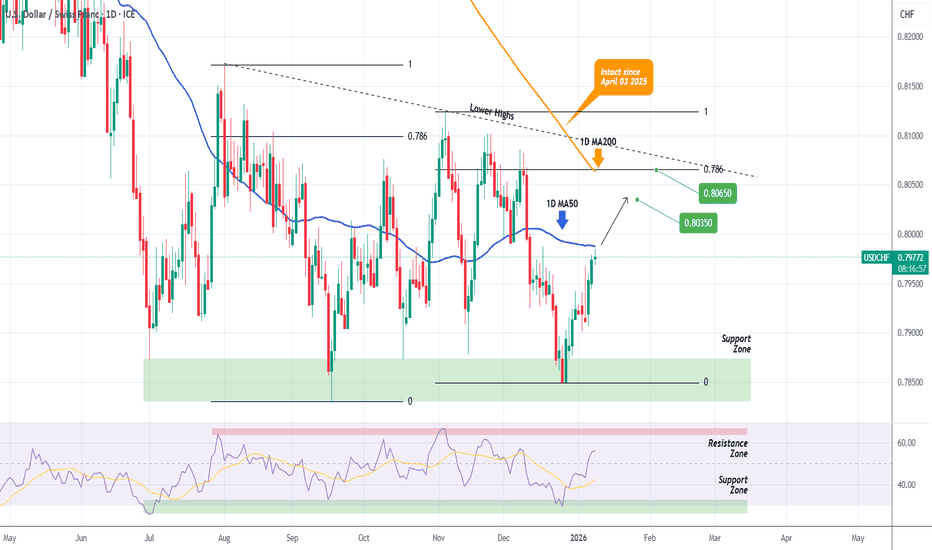

USDCHF Short-term bullish + potential break-out.Early this month (January 08, see chart below) we gave a strong buy signal on the USDCHF pair, which shortly after hit our 0.80350 Target:

As it got rejected just below the 1D MA200 (orange trend-line), the price pulled back to the 7-month Support Zone and turned into a buy opportunity again.

Now, we have Target 1 at 0.80100, just below the Inner Lower Highs trend-line. If we close a 1D candle above that as well, re-buy with Target 2 at 0.80650 (Fibonacci 0.786) just below the Lower Highs trend-line.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF Moment of truth on the 1D MA200 is coming.The USDCHF pair is on a strong rise since its December 26 2025 Low, which is technically the Bullish Leg of the long-term Descending Triangle. Today it is testing the 1D MA50 (blue trend-line) and if broken, will be the perfect buy continuation signal.

If it breaks, buy and target a potential 1D MA200 (orange trend-line) test at 0.80350. This will be the market's most important test for 2026 as the 1D MA200 has been untouched since April 03 2025.

If it breaks, the long-term trend most likely shifts to bullish, but even on the short-term we can again engage into a quick buy, targeting the top (Lower Highs trend-line) of the Descending Triangle at 0.80650, which is also the 0.786 Fibonacci retracement level (where the previous Lower High was priced).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF: High Chance for Recovery?! 🇺🇸🇨🇭

USDCHF may continue recovering after a test

of a strong intraday horizontal support.

It looks like we got a bearish trap below that

and we see a relatively strong bullish momentum now.

Goal will be 0.7985

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF Megaphone started its new Bullish Leg.The USDCHF pair has been trading within a 2-month Bullish Megaphone that was initiated after the huge 1D RSI Bullish Divergence of Higher Lows caused a market bottom in September and the price flipped the Lower Lows to Higher Lows and started rising.

Having broken above its 1D MA50 (blue trend-line) today, the new Bullish Leg has been confirmed and we expect it to make contact with the 1D MA200 (orange trend-line) around 0.81500.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF Perhaps the best buy opportunity in the market!The USDCHF pair is staging a strong bullish reversal following last week's 1W candle closing above the 1D MA100 (red trend-line). The reason is that every time in the past 3 years (since November 07 2022) the price broke and closed a week above that level, the pair rallied towards the 1W MA200 (orange trend-line).

This time is doing so also at the back of a huge 1W RSI Bullish Divergence of Higher Lows against the prices Lower Lows since April 2025.

We estimate that contact with the 1W MA200 can be achieved around $0.8800 and that is our long-term Target for USDCHF.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF Break-out or rejection? How to trade each case.The USDCHF pair is about to hit the top (Lower Highs trend-line) of the 3-month Triangle pattern it's been trading in since the August 01 High.

If rejected, as long as the price is closing 1D candles below it, we expect a new Bearish Leg to start and target the 0.786 Fibonacci retracement level at 0.79100, like the previous one did.

If however it closes a 1D candle above the Triangle, there are strong probabilities for a new long-term Channel Up pattern to prevail. In that case, we expect the rally that has already started to complete a +3.15% move (similar to the previous Bullish Leg) and target 0.81200.

The fact that the price is so close to this break-out level (the top of the Triangle) favors the use of a tight SL strategy for the short in case of a reversal to long.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF Huge Bullish Divergence like 2020.The USDCHF pair has recently broken above its 1D MA50 (red trend-line) for the first time since March 2025, following a long-term sharp decline. The multi-year pattern is a Channel Down and the current price action is taking place right on its bottom.

At the same time, while the price is on Lower Lows, the 1W RSI has been rising on Higher Lows, showcasing a huge Bullish Divergence. The last time we saw this happening at the bottom of this Channel Down, was between August - December 2020. That was the pattern's previous Lower Low bottom formation and after the 1D MA100 break-out took place, the pair started its new Bullish Leg that exceeded the 0.618 Fibonacci retracement level, while smashing through its 1W MA200 (orange trend-line).

As a result, we have turned bullish long-term on USDCHF, targeting the 0.618 Fib at 0.86750, expecting a contact with its 1W MA200 there.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF is about to enter a new multi-month Bull Cycle.The USDCHF pair has been under heavy pressure all year long since the January 13 2025 High rejection on its 2-year Resistance Zone.

However, for the first time in years, its 1W RSI is on Higher Lows against the price's Lower Lows since April, which is a massive Bullish Divergence. This is an occurrence that technically emerges on market bottoms and is a huge Buy Signal.

Our confirmation signal will be once the price breaks above its shorter term 1D MA100 (green trend-line), which has been intact as a Resistance since March 03. If broken, we will target a potential 1W MA200 (orange trend-line) test at 0.88000. The 1W MA200 is critical as a Resistance because it has formed the last 4 massive High rejections since February 27 2023.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF Strong buy signal on a 2024 fractal.Last time we looked at the USDCHF pair (June 19, see chart below), we took the most optimal sell at the top of the Channel Down, which easily hit the 0.80565 Target:

This time we are getting a strong buy signal as not only is the price supported on the 1D MA50 (blue trend-line) in what seems like a Bull Flag, but also the 1D RSI is on a huge Bullish Divergence (Higher Lows against the price's Lower Lows), similar to he August 2024 pattern.

That sequence rose all the way to the upper Resistance (even broke it), so we do expect the pair to resume the rally and Target 0.84750. That might also be just in time to test the 1D MA200 (orange trend-line) for the first time since April 03.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD/CHF: Order Block Rejection Signals Downtrend ContinuationFenzoFx—USD/CHF started a new bearish wave after it reached the order block at approximately 0.817. Today, the pair is filling the bearish fair value gap by approaching the immediate resistance at 0.8113.

From a technical perspective, if this level holds, USD/CHF will likely resume its bearish trajectory. In this scenario, the price has the potential to target the 'buy-side' liquidity zone at 0.7955.

USD/CHF Tests Critical Resistance at 0.804FenzoFx—USD/CHF is testing the critical resistance level at 0.804, a demand zone that coincides with the descending trendline.

A new bearish wave would form if the price remains below this level. In this scenario, USD/CHF will likely retest the previous support level at 0.787.

USDCHF LONG TERM UPUSDCHF Live Trading Session/ USDCHF analysis #forex #forextraining #forexHello Traders

In This Video USDCHF HOURLY Forecast By World of Forex

today USDCHF Analysis

This Video includes_ (USDCHF market update)

USDCHF Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on USDCHF Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

USDCHF Channel Down reached its top. Sell signal.The USDCHF pair has been trading within a Channel Down pattern since the May 12 High and today the price hit its top again. Trading above its 4H MA50 (blue trend-line) but still below the 1D MA50 (red trend-line), that maintains the medium-term bearish trend.

This is a strong bearish signal as it technically indicates that the new Bearish Leg is about to start. Support 1 at 0.80565 is a low risk Target. The previous 2 Bearish Legs have both gone for -3.40% declines, so technically the downside can be extended beyond Support 1.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF: Correctional Movement Ahead?! 🇺🇸🇨🇭

USDCHF may continue a correctional movement after

a release of the today's US CPI data.

A technical price action confirmation that I spotted is a

valid Change of Character CHoCH on an hourly time frame.

We can expect a bearish continuation to 0.8358

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF Confirmed bottom Buy SignalLast time we looked at the USDCHF pair was three months ago (February 05 2025, see chart below) and it gave us the best sell signal possible, easily hitting our 0.8400 Target:

This time the long-term price action has transitioned into a Megaphone pattern, whose bottom was reached on the April 21 Low. At the same time the 1D RSI hit the 18.90 Support, which has been the Ultimate Buy Signal for the August 05 2024 and December 28 2023 Lows.

Since the price has been rebounding since, we view this as a confirmed buy signal and the start of the Megaphone's new Bullish Leg. The previous two rose by +10% and +10.67% respectively so a mere repeat of the +10% rally, will hit at least 0.88000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF: Your Next Bearish Signal 🇺🇸🇨🇭

USDCHF is consolidating after a massive selloff that we saw last week.

The price formed inside bar candlestick pattern and is currently

stuck within the range of the mother's bar.

Your next confirmation to sell will be a violation and a candle close

below 0.8098.

With a high probability, the pair will continue falling then

and reach at least 0.8 psychological level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/CHF "The Swissy" Forex Market Heist Plan Bearish🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.90500 (swing Trade) Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.88000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

USD/CHF "The Swissy" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🌟Fundamental Analysis

The USD/CHF pair is influenced by:

Interest Rate Differential: The difference between the Federal Reserve's interest rates and the Swiss National Bank's interest rates.

Economic Growth: The US GDP growth rate and the Swiss GDP growth rate.

Inflation Rates: The US inflation rate and the Swiss inflation rate.

🌟Macroeconomic Analysis

Key macroeconomic indicators to watch:

US GDP Growth Rate: Expected to slow down in 2025.

Swiss GDP Growth Rate: Expected to remain stable in 2025.

US Inflation Rate: Expected to decrease in 2025.

Swiss Inflation Rate: Expected to remain low in 2025.

🌟COT Data Analysis

The latest Commitment of Traders (COT) report shows:

Net Long Positions: Decreased by 10,000 contracts.

Net Short Positions: Increased by 5,000 contracts.

🌟Market Sentimental Analysis

Market sentiment for USD/CHF is:

Bearish: 55% of investors expect the pair to fall.

Bullish: 30% of investors expect the pair to rise.

Neutral: 15% of investors remain neutral.

🌟Positioning Analysis

Traders are advised to:

Consider short-term investments: As the USD/CHF pair is expected to experience high volatility.

Monitor market news: As central bank decisions and global economic data may impact the pair.

🌟Quantitative Analysis

Technical indicators show:

Moving Averages: The 50-day and 200-day moving averages are indicating a bearish trend.

Relative Strength Index (RSI): The RSI is indicating an oversold condition.

🌟Intermarket Analysis

The USD/CHF pair is highly correlated with:

EUR/USD: A stronger euro may boost the Swiss franc against the US dollar.

USD/JPY: A weaker US dollar may boost the Swiss franc against the yen.

🌟News and Events Analysis

Upcoming events that may impact the USD/CHF pair include:

Federal Reserve Monetary Policy Decision: March 19, 2025

Swiss National Bank Monetary Policy Decision: March 20, 2025

🌟Next Trend Move

The USD/CHF pair may experience a:

Bearish move: Driven by the interest rate differential and economic growth.

🌟Overall Summary Outlook

The USD/CHF pair is expected to:

Experience high volatility: Due to central bank decisions and global economic data.

Remain bearish: In the short-term, driven by the interest rate differential and economic growth.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CHF "The Swissy" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (0.90300) then make your move - Bearish profits await!"

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.90700 (swing Trade) Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.89310 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

USD/CHF "The Swissy" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🟤Fundamental Analysis

- The Swiss National Bank (SNB) has maintained a dovish stance, keeping interest rates negative to curb the Swiss franc's appreciation.

- The US Federal Reserve has also maintained a dovish stance, keeping interest rates low to support economic growth.

🔴Macro Analysis

- The US economy has shown signs of slowing down, with GDP growth rate decreasing to 2.1% in Q4 2022.

- The Swiss economy has also shown signs of slowing down, with GDP growth rate decreasing to 0.9% in Q4 2022.

🟠Sentimental Analysis

- Institutional investors have a bearish sentiment towards the USD/CHF pair, with 52% being bearish.

- Hedge funds have decreased their long positions, with a net short exposure of 15%.

- Retail traders have a bullish sentiment towards the USD/CHF pair, with 55% being bullish.

🟡COT Analysis

- The Commitment of Traders (COT) report shows that large speculators have increased their short positions, with a net short exposure of 10,000 contracts.

- Commercial traders have decreased their long positions, with a net short exposure of 5,000 contracts.

🔵Positioning

- The USD/CHF pair is experiencing a decrease in net-long exposure, which could be a sign of a potential trend reversal.

- The market positioning is also influenced by the US dollar positioning, which has seen a reduction in net-short exposure against G10 currencies.

🟢Overall Outlook

-Based on the analysis, the USD/CHF pair is expected to move in a bearish trend, with a 55% chance of a downtrend and a 35% chance of an uptrend. However, please note that market predictions can be unpredictable and influenced by various factors.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDCHF Be ready for these trades based on the 1D MA50.The USDCHF pair has been trading within a Channel Up pattern since the September 06 2024 bottom. This is inside a larger Rectangle in which the pair is consolidating for the past 1.5 year.

The bottom of the Channel Up is being tested again today for the 2nd time since January 27, which was a 1D MA50 (blue trend-line) test. This is the key of the pair's trend technically in our opinion.

The current level being so close to the 1D MA50, is the ideal short-term buy entry to target Resistance 1 at 0.92265 on the lowest risk. If the price breaks below the 1D MA50 however, we will quickly take the minimal loss and reverse to selling the bounce near 0.9100, as this bearish break-out took place on both previous Channel Up patterns on May 15 2024 and October 19 2023.

In that case the trade will be long-term, targeting just above Support 1 at 0.84000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF: Bullish Move Confirmed 🇺🇸🇨🇭

It looks like a local correctional movement is over on USDCHF

and the pair is returning to a bullish trend.

The release of the today's US fundamentals made the pair

violate a resistance line of a narrow consolidation range on an hourly.

The price will most likely go up to 0.9007 level.

❤️Please, support my work with like, thank you!❤️

USDCHF Short-term Channel Up targeting 0.88120The USDCHF pair is following very accurately our September 17 projection (see chart below) and is already half-way through our 0.90500 Target:

As mentioned then that was a long-term bottom buy opportunity, but that doesn't mean shorter ones don't exist on the lower time-frames. On this chart, we've identified one on the 4H time-frame where the price got rejected at the top of the October Channel Up and pulled back to the 0.382 Fibonacci retracement level.

This resembles the October 08 0.382 Fib rejection, which was also contained above the 4H MA50 (blue trend-line) and resumed the uptrend all the way to the -0.236 Fib extension. As a result, our short-term Target is 0.88120.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF Great long-term bottom buy opportunity.The USDCHF pair is trading considerably below its 1D MA50 (blue trend-line) since July 04 2024, as it was on a major 5-month Bearish Leg following the 1W MA200 (red trend-line) peak and rejection on May 01.

The 1D MACD however has formed its 2nd straight Bullish Cross and last time that took place was on January 04 2024, right after the pair's bottom from the 2023 Bearish Leg.

As a result, we treat the current levels as the most optimal long-term buy opportunity for the year, targeting again a potential 1W MA200 contact at 0.90500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇