US Dollar: Bearish! Sell The Rip!Welcome back to the Weekly Forex Forecast for the week of Dec 15 - 19th.

In this video, we will analyze the following FX market: USD Dollar

The USD is bearish. I will look for a short term pullback to the -FVG and sell it from there. I expect price will hold from the -FVG and act as resistance.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Usdollarshort

USDCAD SELL SETUP OPPORTUNITY IF PULLBACKHello traders I wish you a great WEDNESDAY, Here's my point of view about CMCMARKETS:USDCAD

TECHNICALLY:

HIGHER TIME FRAMES such as DAILY WEEKLY show a liquidity grab before a bearish momentum near the 2-3 previous weekly highs around the 1.38800. This liquidity grab was released last week on Thursday- Friday. Then price re-integrated and gave us a valid sell setup that was aligned with our strategy to sell at the H4 GAP RETEST. Right now, price is very over extended and we are all waiting for pullbacks. Either way, we all have to wait for FOMC to be released today & CAD rates released. This will invalidate or confirm our setup. Next target is the previous monthly low at 1.37250. I am interested to sell close the 1.3800O OR ABOVE THE PREVIOUS DAILY HIGH.

FUNDAMENTALLY

All eyes on today's FOMC! a change in the US DOLLAR SENTIMENT can invalidate the setup! However, if we stick with the same tone, then US will likely continue bearish!

You may find more details in the chart!

Thank you and Good Luck! MAKE SURE TO STAY STRICT WITH YOUR RISK MANAGEMENT!

PS: Please support with a like or comment if you find this analysis useful for your trading day.

Bearish drop formation?The US Dollar Index (DXY) is rising towards the pivot and could reverse to the 1st support.

Pivot: 98.63

1st Support: 97.12

1st Resistance: 100.21

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

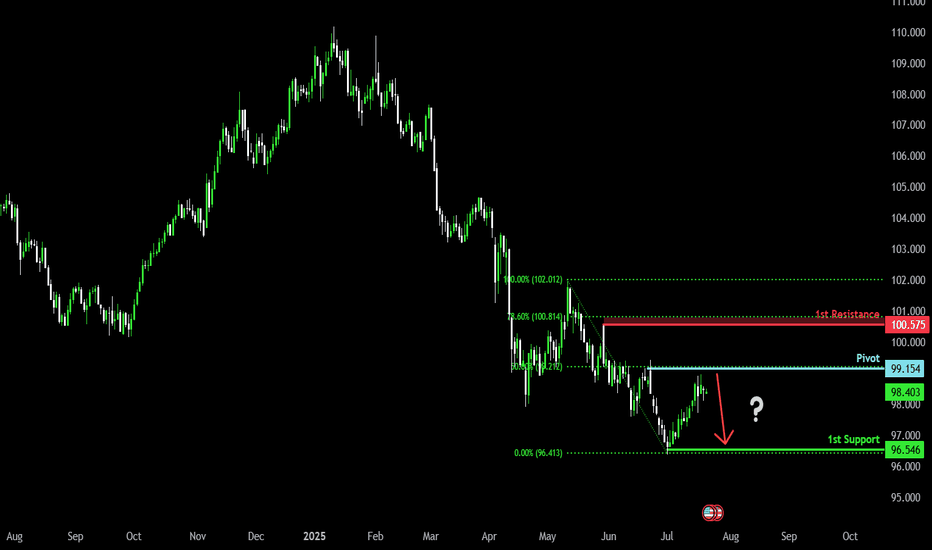

Bearish drop off 50% Fibonacci resistance?The US Dollar Index (DXY) is rising towards the pivot which acts as a pullback resistance and could drop to the 1st support.

Pivot: 99..15

1st Support: 96.54

1st Resistance: 100.57

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish reversal?US Dollar Index (DXY) is rising towards the pivot and could reverse to the 1st support which acts as an overlap support.

Pivot: 99.26

1st Support: 97.81

1st Resistance: 100.26

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?US Dollar Index (DXY) has reacted off the pivot, which has been identified as a pullback resistance and could drop to the 1st support.

Pivot: 97.80

1st Support: 95.40

1st Resistance: 99.36

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Overlap resistance ahead?The US Dollar Index (DXY) is rising towards the pivot, which is an overlap resistance and could reverse to the 1st support that lines up with the 127.2% Fibonacci extension.

Pivot: 98.50

1st Support: 97.21

1st Resistance: 99.30

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?US Dollar Index (DXY) has reacted off the pivot and could drop to the 1st support.

Pivot: 98.59

1st Support: 97.69

1st Resistance: 99.25

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

TOKYO knows something...SUS @ 0.8270OANDA:USDCHF

Tokyo opened as usual...but so hard to swallow...that they control direction of USD and more surprisingly CHF...

btw...just shorted USDCHF ...watch this 🙈

SUS @ 0.8270

and y'all what that means for Gold 🪙🥇 😉

sorry no trendlines OB or FVG or fib ...since unreliable for execution of investment grade...they monitor DD and other KPIs like RR and return in K/hr...

this is a system generated alert based on statistical significance...kinda like math.

can't predict manipulation magnitude...but usually -33p...our SL is $ value based on position size...

🥂

Bearish drop?US Dollar Index (DXY) has reacted off the pivot and could drop to the 1st support.

Pivot: 100.22

1st Support: 97.47

1st Resistance: 101.83

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

"Bearish Pressure on DXY: Key Levels to Watch"🔹 Technical Analysis of U.S. Dollar Index (DXY) - 4H Chart

▪️Market Structure & Trend Analysis:

- The chart shows a clear downtrend in the U.S. Dollar Index (DXY), with a series of lower highs and lower lows.

- The price is trading below the 200-period moving average (blue line) and 50-period moving average (red line), reinforcing bearish sentiment.

🔹Key Levels:

1. Strong Resistance Area ( 107.300 - 107.400)

- This is a significant supply zone where sellers have aggressively pushed the price down in the past.

- The price recently tested this area and failed to break higher, indicating strong resistance.

2. Resistance Level for Further Downside ( 106.700 - 106.800)

- The price is struggling to stay above this level, which has now become a short-term resistance zone.

- If price stays below this level, further downside is likely.

3. Target Area ( 105.453)

- This is the next major support level, where price could find buying interest and potentially reverse or consolidate.

▪️Market Expectation:

- Bearish Continuation:

- If price remains below the 106.700 resistance level, it is likely to continue downward towards the 105.453 target zone.

- Invalidation of Bearish Bias:

- If price breaks and closes above 107.400, it could signal a trend reversal or deeper retracement.

🔹Conclusion:

- Bias: Bearish

- Trading Plan: Look for sell opportunities below resistance zones and target 105.453 for a potential move lower.

😊Don't Forget To Hit The Like Button & Share Your Thoughts In Comments.

Bearish drop?US Dollar Index (DXY) has rejected off the pivot and could drop to the 1st support that line sup with the 161.8% Fibonacci extension.

Pivot: 107.49

1st Support: 105.44

1st Resistance: 108.67

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?US Dollar Index (DX is reacting of the pivot which aligns with the 61.8% Fibonacci retracement and could drop to the 1st support.

Pivot: 109.402

1st Support: 108.50

1st Resistance: 110.17

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?US Dollar Index (DXY) has reacted off the pivot and could drop to the 38.2% Fibonacci support.

Pivot: 109.64

1st Support: 108

1st Resistance: 110.93

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USD/JPY Bearish Pennant Breakout: Short Opportunity at ResistancWe’ve seen a strong breakout from the bearish pennant on USD/JPY. My idea is that when the price pulls back to the pink resistance zone, sellers could return to push the price lower. This would present a potential shorting opportunity from this zone, as the bears may step back in and reject the price at this level. Keep an eye on this zone for a possible short setup.

#USOIL 1DAYUSOIL 1 Day Trade Opportunity

Buy Opportunity:

Buy Level: 66.500

Target Levels: 67.500 / 68.500 / 69.500 / 71.500

Description:

Today's analysis of USOIL (Crude Oil) suggests a promising buy opportunity. With the current price at 66.500, the market shows potential for upward movement. Consider entering a long position at this buy level.

Target Levels:- 67.500: Initial target level where short-term gains might be realized.

68.500: A subsequent target indicating continued bullish momentum.

69.500: An intermediate level that may act as a resistance point but offers a chance for profit-taking.

71.500: The final target level, which represents a more extended bullish move.

Monitor the price action closely around these target levels for potential exit points or adjustments to your trading strategy. As always, ensure to implement proper risk management techniques.

bearish drop?The US Dollar Index (DXY) has reacted off the pivot which acts as a pullback support and could drop to the 1st support identified as a pullback support.

Pivot: 103.21

1st Support: 102.55

1st Resistance: 103.69

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDOLLAR - Double Top Within Up ChannelPrice is reaching the top of an up channel

I expect this to act as a rejection point for price as my current analysis. I have made other analyses in the past that differ from this but this is my latest thoughts.

Staying within the channel is the most likely scenario.