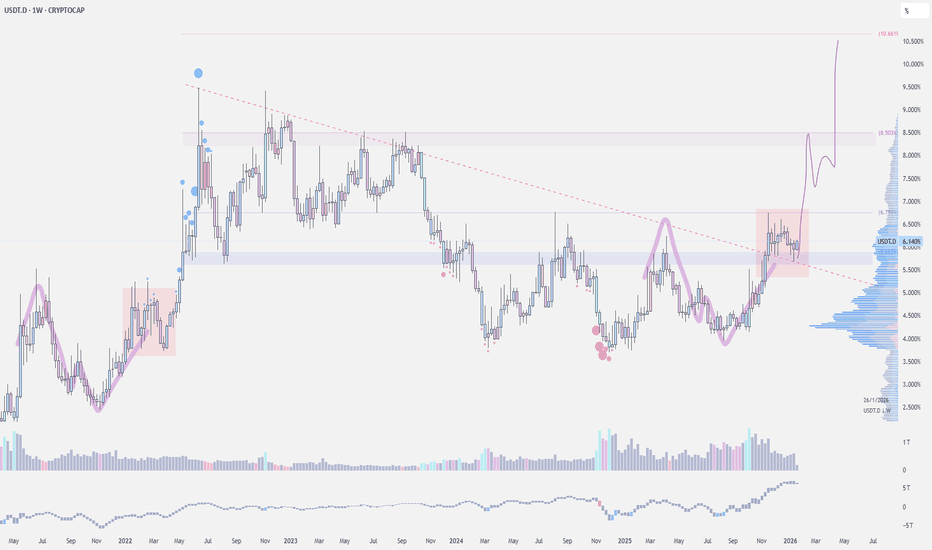

USDT Dominance - Wyckoff AccumulationCRYPTOCAP:USDT.D could be mirroring Tesla’s 2022–2024 Wyckoff structure. From 2022 to late 2024, NASDAQ:TSLA formed a clear Wyckoff Accumulation on the weekly chart: a Selling Climax set the range, an Automatic Rally confirmed resistance, and a brief Spring in early 2023 shook out bears before prices recovered on strong volume. The stock then established a Last Point of Support, followed by a Sign of Strength breakout in late 2024, signaling institutional accumulation and the start of a new uptrend.

Usdt

Bear Market Blues (USDT.D says more pain ahead!)USDT.D measures the % of USDT (stablecoin) vs total crypto market cap. It is essentially inversely correlated to crypto, and is therefore useful for trend confirmation. i.e. When this trends down, market is bullish (people selling USDT for crypto), when it's trending up, market is bearish (people are selling crypto for stables)

This just broke above major resistance and is aiming for "Deep Bear Market" territory, which is an area I marked a few years ago I think. This still has 10-20% to go before we get there, and I think it makes sense that we go lower before a new cycle into crypto begins.

My one small caveat is that the precision / relevance of exact price targets of this chart gets somewhat diluted over time from competition/usage of other stablecoins. i.e., this chart may never reach my "Deep Market Territory" again, but if this measured all stables, it would. Speaking of which, is there a chart like this for Stablecoin dominance? Let me know in comments. Regardless, Tether is still the most popular stablecoin, so directionally this chart is still very useful.

I'm no expert (who is?) but based on this I think we can guesstimate that BTC/crypto can and likely will go down 10-20% (to roughly $70k or $67k). Fortunately, I exited around 115k and will mostly stay in stables and non-crypto assets until then.

Remember, with crypto, it can always go higher AND lower than you expect.

keep stops in place!

CD

ZEC: bounce or trap? key levels and targets for todayZECUSDT. Thinking this old privacy coin is dead, or is this where the dead cat actually jumps? Fresh headlines about regulators circling privacy projects again plus weakness across alts pushed ZEC into a real flush, but today we finally got a sharp bounce off the lows and traders woke up.

On the 4H chart price knifed down into a demand area near 210 and snapped back, with RSI coming out of extreme oversold - classic short squeeze setup. VPVR on the right shows a low volume pocket above, then chunky volume around 250-270 that can act like a magnet if buyers keep pressing. I lean long for a relief move, not a full trend reversal.

My base plan: look for dips toward 230-235 to build a small long with invalidation under 215, first target around 253, stretch target 270 ✅. If 215 fails and price falls back into the lows, the door opens to the next support zone near 190 ⚠️. I might be wrong, but for me this is a spot where bears start to get greedy and I prefer to fade that.

The key is whether the USDT and USDC gap downtrend will stop

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

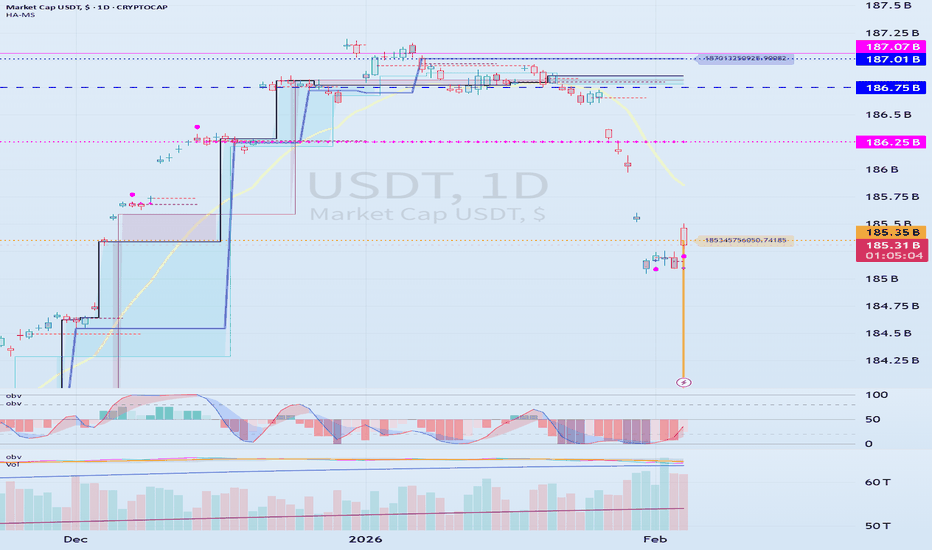

(USDT 1D chart)

USDT is showing a gap downtrend, leading to a decline in the coin market.

A gap downtrend in USDT or USDC can be interpreted as a sign of capital outflow from the coin market.

The key question is whether this gap-up will lead to another upward trend.

(USDC 1D chart)

USDC is also showing a gap-up trend.

It's worth paying attention to the movements of USDT, which has a significant impact on the coin market.

-

(USDT.D 1M chart)

USDT is showing a gap-down trend, leading to an increase in USDT dominance.

A rising USDT dominance is likely to lead to a downward trend in the coin market.

Therefore, it's beneficial to see a declining USDT dominance.

This means that funds are flowing into the coin market through USDT, and the inflow of USDT is used to purchase coins, causing USDT dominance to decline.

-

(BTC.D 1M chart)

As BTC dominance rises, I believe funds will flock to BTC, creating a BTC-led market.

Therefore, we expect an altcoin bull market to emerge when BTC dominance and USDT dominance coincide.

For this to occur, BTC dominance must fall below 55.01 and either remain stable or exhibit a downward trend.

-

Currently, USDT dominance is rising, while BTC dominance is falling.

I believe this movement is best interpreted as altcoins focusing on price defense.

The decline in BTC dominance indicates that funds are flocking to altcoins, while the rise in USDT dominance indicates a downward trend in the coin market.

-

Therefore,

we need to determine whether the upward trend of USDT and USDC can be sustained,

starting with the recent gap-up,

see whether the upward trend of USDT dominance has stalled,

and whether BTC dominance can support the price of BTC.

While the USDT, USDC, BTC.D, and USDT.D charts only provide a rough idea of the fund flow in the coin market, I believe this information alone is a valuable resource for individual investors who trade with limited information.

Therefore, I believe this is one of the reasons why the coin market is more transparent than any other investment market.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

USDT.D VS BTC With BTC testing April 2025 tariff war lows, many will be searching for the low/bottom of the move down.

The Tether dominance chart is often a good indicator of potential turning points in Bitcoins price. Looking at 2023 onwards which was roughly the end of the bear market and start of this bull market cycle, USDT dominance sat around 9% before a sharp drop to kick off the bull run.

Throughout the chart this pattern continues, with each high in USDT.D it means BTC puts in a relative low. However, the charts are not just opposites in that if USDT tops then BTC bottoms, the Tether chart is a clearly defined range compared to Bitcoins trending chart. It's because of the predictable nature of a range where price reacts at the extremes, the support and resistance areas can be estimated on the BTC chart.

Currently with BTC's price falling and testing April 2025 low, Tether has climbed and will soon be hitting the Bearish Orderblock/ origin of the October 2023 rally. For me that is a high probability area of resistance for USDT.D and so a potential bottom for BTC around $68,000.

IF that is to be the case Tether would be rangebound between grey and red zones with a relief rally from BTC being capped off by the grey zone, perhaps around $80,000.

USDT Dominance: an indicator to forecast Bitcoin’s directionUSD Tether, or USDT, came into existence as a digital version of the U.S. dollar, and it succeeded. USDT is pegged to the U.S. dollar and is the top and most used stable coin in the crypto market. USDT is also being used for transferring money or other means of payment, although mostly in the crypto market. Many others tried to capture a piece of this huge market: USDC, BUSD, DAI, TUSD, and UST. We all know what happened to the last one, UST (Terra USD) depegged from the U.S. dollar and crashed.

Anyway, since USDT is the most used stable coin in the crypto market, its dominance can reveal important info about the crypto market, and mostly about the Bitcoin.

So, let's start with the plain USDT Dominance chart; it shows the percentage of the total crypto markets in the form of USD Tether. As can be seen, the USDT Dominance chart shows two ascending channels. The first is steeper than the second, and the reason for that is Tether's totalitarian nature, as back then there were no other worthy competitors, and most notably its quick acceptance by the crypto community—the traders.

Now, the second ascending channel is closer to the norm and, as such, can be used as a revealing indicator. It's easy, 1) when USDT Dominance goes down, that means most people are buying Tether, so there is a shortage of Tether in the market. 2) When USDT Dominance goes up, that means most people are selling Tether, so there is a surplus of Tether in the market. So what do these mean?

When people are buying more Tether than before, USDT Dominance decreases, and that means they are converting their fiat money, such as U.S. dollars, Euro, British Pound, Franc, etc., to Tether in order to buy crypto assets such as Bitcoin. Now, here is the important part: If more people are converting their fiat money into Tether to buy crypto coins, the demand for crypto assets will go up, and when demand goes up, so does the price.

When people are selling their crypto assets more than before, they are converting their crypto assets, such as Bitcoin, into Tether, so there is a surplus of Tether in the market, and as a result, the USDT Dominance increases. This happens when traders/people want to save profits or think the market could go into a downtrend/correction, so they sell their crypto assets and prefer to hold a stable coin like Tether.

Here, the USDT Dominance chart is compared with the Bitcoin price chart. As can be seen, when USDT Dominance went down, the Bitcoin price went up, and vice versa. So, when the Bitcoin price was decreasing, more people were selling Bitcoin and converting their crypto assets into Tether; thus, more Tether became available in the market, and as a result, the USDT Dominance went up.

The USDT Dominance chart can be used as a simple indicator to forecast Bitcoin's possible future movements.

USDT: are we due for a relief rally? key levels to monitorMarket Cap USDT Dominance. Ready for a crypto relief rally or is fear just getting started? While majors cooled off after the latest macro jitters and profit taking, traders have been hiding in stables, and dominance spiked hard according to market data. Now price is stalling right at the local highs, so this level suddenly matters a lot.

On the 4H chart we’ve got a vertical pump into 7.1–7.3% plus RSI sitting in overbought and already curling down – classic “too much, too fast” vibes. Biggest volume shelf is down around 6.3–6.4%, so any unwind of fear can send dominance back into that value zone, which usually means a bounce for BTC and alts. I might be wrong, but current structure looks more like a blow‑off than the start of a calm uptrend.

My base case ✅ rejection below 7.2% and a pullback toward 6.4% and possibly 6.2%, where I’d look to add risk on strong coins. Trigger for me is a 4H close back under 7.0% with RSI dropping from overbought. ⚠️ If buyers smash through 7.3% and hold above, then I’ll respect the squeeze, expect 7.5%+ on dominance and stay defensive on alt exposure.

USDT.D Signalling Crypto Crash Zone & Bear Market Revisiting this study again that I originally shared months ago as a possible 'path' to either the new ATH targets and/or the Crypto Crash & Bear Market zones...

We can see the the Blue bars from the last cycle are an important fractal to follow.

USDT.D (Tether Dominance) clearly shows the inverse relationship it has with Bitcion and TOTAL market cap, which I have hidden here.

But the Yellow line is the midpoint and can be considered the 'Mean' in the 'reversion to the mean' equation.

At the lows of the USDT.D multi-year trendline going back to 2018, when touch the trendline, crypto is rallying and hitting all time highs.

In contract, when USDT.D is pushing higher (Money flowing into Stablecoins) we see markets correcting and crashing.

I've labeled the corresponding areas, which we can see that USDT.D is now forming support above the 6.5% prior resistance, indicating a deeper crash is likely coming.

Tomorrow is a Triple Witching expiration, so expect volatility.

However, in the past these usually mark reversal points in the markets.

So we'll have to watch and see...

However, most other technical signals are flagging bearish like the Monthly MACD and mult-month Bearish Divergences on the RSI, MFI, and Stoch/RSI

Good time to be out of the markets IMO until this clarifies.

Even if we get a 'Santa Rally' I'll be selling into it, b/c the USDT.D has plenty of room to run to the upside... And we're unlikely to see liquidity return to the markets without more interest rate cuts, QE, and money printing.

All eyes are on Japan's Fed Rate meeting tomorrow, where there's rumored to be a .25 rate HIKE which also has the markets on edge.

USDT.D — Weekly ChartUSDT.D — Weekly Chart |

• USDT dominance trading around 6.88%

• Price pushing toward descending trendline resistance

• Holding above key range support zone

• A clean breakout could signal risk-off / consolidation phase

• Rejection here may favor altcoin continuation

Market at an inflection point — watch the trendline closely

Will Short Sellers SL Hunt Microstrategy?Strategy sits with an average BTC price of $76,038 after acquiring ₿2,932 and spot price is getting dangerously close to this level. I don't do fancy math with the share value, but basic logic tells me that if Michael Saylor raises funds ( i.e borrow's money ) to buy bitcoin, and strategy's premium on returns is what the shareholders get, if the price of Bitcoin stays below this level, Will there be any willing investors to back stop the company ( i.e lend Money to Strategy ) if share prices are declining? If Bitcoin drops to $60K? 50K? Dare I Say $40K?

Will big short sellers see this and actively stop hunt Strategy to liquidate holdings? Maybe I'm missing something here...

Before one of you Maxi's get laser-eyed, Im just a trader who trades the charts; To me I see, weakness on the Daily.

Feel free to comment below...

On-Chain Markets looking Defensive Normally, I just mark up charts and don't publish them ( I figure a lot of us do this ).

With all the fervor going on in the markets, I decided to see how capital is rotating on Chain; Lo' & behold, USDT and USDC ( Largest USD-Pegged Stablecoins by market cap ) are seeing dominance. Surely one could say that because BTC price is going down, other crypto's dominance will rise - The dollar tends to be inversely correlated to Crypto so It only makes sense that those profit-taking are moving money onchain.

Not sure what the next catalyst will be but Stablecoins on this chart look bullish ( which is probably a tell-tale sign crypto might be taking a dip in the near future...

NOT FINANCIAL ADVISE

$USDT & $USDC vs. $ETH - Warning a Funeral could occur. 💀 💀 💀

Watch the Stablecoin/ETH Market Cap ratio carefully.

A spike here isn't always 'Dry Powder' waiting to buy.

The Trap: If ETH breaks the $2,400 support level, we could see a 'Liquidation Spiral' that sends the ratio to all-time highs.

This isn't new money coming in—it's ETH value vanishing.

Safe Haven: Cash is King until ETH reclaims its 200-day SMA at $3,400."

#ETH #Ethereum #Stablecoins #MarketCrash #LiquidityTrap #CryptoAnalysis @thecryptosniper #HVF

what does AI say:

📉 The Doomsday Ratio: (USDT + USDC) / ETH

In a crash, this ratio spikes vertically. But unlike a "healthy" spike (where new money enters), this is a "Deleveraging Spike."

1. The ETH Collapse (The Denominator Shrinks)

Revenue Compression: Layer 2s are so efficient now that they are starving the Mainnet of fees. Without a high "burn" rate, ETH is becoming slightly inflationary again, losing its "Ultra Sound Money" appeal.

The ETF "Exodus": If institutional investors see ETH as a "leveraged claim on ecosystem activity" that isn't growing, they may rotate back to Gold or Bitcoin. A sustained outflow from spot ETFs could trigger a -40% re-rating.

The Liquidation Spiral: Since many "loopers" use ETH as collateral to borrow stablecoins, a price drop below $2,400 could trigger a cascade of liquidations on Aave/Compound, forcing more ETH onto the market and crushing its market cap.

2. The TradFi Standoff (The Numerator Stagnates)

The "Trust Gap": If the ratio increases simply because ETH is dying, TradFi institutions won't "buy the dip" with new USDC. They will wait for more regulatory "Supervision" rather than just "Legislation".

The Yield Trap: If stablecoins like USDT/USDC don't offer higher yields than risk-free US Treasuries (currently highly competitive in 2026), there is no incentive for a corporate treasurer to move cash onto the blockchain.

USDT Dominance(USDT.D%) RoadmapUSDT.D% ( CRYPTOCAP:USDT.D ) is one of the crucial indexes in the crypto market. Alongside token analysis, it’s important to consider this metric because an increase in USDT.D% often leads to a decrease in crypto asset prices.

Currently, USDT.D% has successfully broken through its support lines and even created a fake breakout above the resistance lines.

From an Elliott Wave perspective, it appears that USDT.D% has completed its 5 impulsive waves over the past 10 to 12 days, and we can expect a corrective downward movement.

Additionally, we can observe a negative Regular Divergence(RD-) between two consecutive peaks.

I anticipate that USDT.D% will begin to decline, potentially reaching the Fibonacci support levels. This decline could lead to an increase in crypto asset prices, especially Bitcoin .

Notes: If USDT.D% drops below the support zone(6.234%-6.090%), we can expect a significant upward trend in the crypto market.

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Market Cap USDT Dominance% Analyze (USDT.D%), 8-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

USDT.D Dominance analysis📊 Let’s talk about CRYPTOCAP:USDT .D (Stablecoin Dominance)

With cautious optimism, it looks like the worst phase for the crypto market may already be behind us.

👉 USDT.D tried hard, but failed to secure itself above the critical 6.5% resistance.

Right now, a potential reversal pattern is forming on the chart — and this often marks a shift in market regimes.

👉 USDT.D down = Altcoins up — a classic rule that rarely fails.

⚠️ The only concern:

The Fear & Greed Index jumped too fast — from 26 yesterday to 48 today.

Growth is healthy, but slow and steady would look much better than instant euphoria.

Because of that, we still allow one more corrective move in crypto to cool things down.

☀️ As long as USDT.D stays below 6%, chances are high that the market “spring” will arrive earlier than the calendar one 😉

🤔 Do you think this is already the start of an altcoin recovery — or is the market just teasing us again?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

$USDT Dominance Breakout + RetestThis CRYPTOCAP:USDT dominance weekly chart honestly looks bullish, and that’s kinda bad news for the crypto market.

If this move is a true breakout + retest, then the follow-through expansion isn’t a great sign for Bitcoin. It’s the kind of structure you see when risk-off starts creeping in and liquidity shifts away from crypto.

The 6% zone is the key level I’m watching here. It already flipped into support, and as long as it holds as a base, it keeps the higher timeframe trend intact.

If we continue building above it, I think the next big move is CRYPTOCAP:BTC running liquidity and sweeping the 80k low.

Stablecoin Dominance Pullback = Risk ReturningChart: STABLE.D (Crypto Stablecoin Dominance) vs OTHERS.D

Timeframe: 1D

Context: Crypto market risk appetite

Thesis

Stablecoin dominance has rolled over after an extended uptrend, while OTHERS.D has stabilized and begun to base. This suggests capital is rotating out of stables and back into risk assets, particularly altcoins.

🔍 What the Chart Shows

STABLE.D put in a strong impulsive move higher, signaling prior risk-off behavior

Recent price action shows loss of momentum and a pullback from local highs

At the same time, OTHERS.D stopped making lower lows and is attempting to stabilize

This inverse relationship often marks a transition phase in market structure.

📈 Why This Matters

Rising stablecoin dominance = capital sidelined, defensive positioning

Falling stablecoin dominance = capital redeploying into crypto assets

If STABLE.D continues to trend lower, it supports:

Improved risk appetite

Better conditions for alts to outperform

Less demand for “parking capital” in stables

❌ Invalidation

This view would weaken if:

STABLE.D reclaims recent highs with expansion

OTHERS.D loses its current base and breaks down

That would signal a return to risk-off behavior.

🎯 Takeaway

Stablecoin dominance is a macro sentiment gauge.

This pullback suggests the market may be shifting from defensive to selective risk-on, especially outside BTC.

Watch follow-through — rotations take time.

EURUSD Defends Key Support — A Broader Bullish Repricing On the H1 timeframe, EURUSD is showing a clear shift from bearish continuation into a bullish repricing phase, driven by strong rejection from a well-defined support zone. After an extended sell-off that systematically cleaned downside liquidity, price printed a sharp bullish displacement, signaling that sell-side pressure has likely been exhausted. Since that impulse, the market has transitioned into a consolidation phase above support, where price is holding its ground rather than retracing aggressively a behavior typically associated with accumulation rather than distribution. The current structure suggests that buyers are actively defending the support region around 1.1650–1.1647, using it as a base to build higher continuation legs. The projected path higher reflects a natural bullish expansion: initial push into nearby resistance, followed by shallow pullbacks and continuation toward higher liquidity pools. As price continues to respect support and avoids acceptance back below it, the bullish scenario remains dominant, with upside targets aligning toward the 1.1700, 1.1730, and ultimately the 1.1740–1.1750 region where resting buy-side liquidity is concentrated.

From a market structure perspective, this is not a random bounce but a post-liquidity-sweep rebalancing, where the market is repricing higher after filling sell orders at discount levels. Any short-term pullbacks into the support zone are likely to be corrective in nature, serving as fuel for the next expansion leg. A clean breakdown and sustained acceptance below support would be required to invalidate this bullish outlook; until then, EURUSD remains structurally positioned for continued upside.

EURUSD Hits Resistance After Sharp Rebound EURUSD Hits Resistance After Sharp Rebound — Correction or Just a Liquidity Grab?

EURUSD on the H1 timeframe remains within a broader bearish structure, with price continuing to trade below the declining moving averages that have consistently acted as dynamic resistance. The overall market context reflects sustained selling pressure, as the sequence of lower highs and lower lows remains intact despite short-term volatility.

The recent sharp bullish impulse from the lower liquidity range appears to be a liquidity-driven rebound rather than a confirmed structural reversal. Price aggressively swept sell-side liquidity near the 1.1620 area before rebounding, a move often associated with stop-hunting and short covering. However, this recovery has now carried price directly back into a clearly defined resistance zone, where prior selling activity and the descending EMA converge.

At this resistance area, bullish momentum has begun to stall, suggesting that buyers are encountering active supply. Without sustained acceptance above this zone, the current move is best interpreted as a corrective pullback within a bearish trend. In this context, a rejection from resistance could lead to renewed downside pressure, with price rotating back toward the lower liquidity range to retest the recent lows.

If sellers regain control, a continuation toward the 1.1620 support area remains the higher-probability scenario, aligning with the prevailing trend and the broader liquidity framework. Such a move would confirm that the rebound was corrective rather than the start of a trend shift.

Alternatively, only a clean break and sustained acceptance above the resistance zone and the declining moving averages would invalidate the bearish continuation outlook. Until that occurs, EURUSD remains technically bearish, with the market likely using rallies into resistance as opportunities for distribution rather than accumulation.

USDT Dominance vs Total Crypto Market CapIn trading and in life — there’s no need to overcomplicate things.

Just look at the chart and compare: when USDT.D falls - crypto starts to rise.

When USDT.D rises, capital flows out of altcoins into stablecoins.

After this phase, and once the market goes through a full bearish trend, altcoins eventually drop to their real bottom (probability) — the blue zone with white arrows.

As we can see now, many altcoins never recover after that — they simply don’t survive the cycle.

That’s why going forward, it makes more sense to ignore altcoins outside the top 100 and avoid investing in them if you don’t want to lose your capital.

OTHERS.D (3D) — Structural Outlook and Scenarios (TOTAL-TOP10)On the chart global horizontal support and resistance zones are marked.

From the ATH on January 16.2022, USDT.D has been moving within a global descending channel. Inside this structure, we can observe two completed triangles and potentially the formation of a new triangle boundary.

The yellow zone of the global descending channel is a key zone of uncertainty.

The price reaction to this area will determine the future direction of the move.

Each triangle contains its own internal descending channel, along which price has been developing.

Historically, a breakout from an internal channel within a triangle tends to push price toward the resistance of the larger global descending channel.

-Bullish Liquidity Injection Scenario:

If the market experiences strong liquidity inflows, USDT.D may:

+Break above the internal descending channel

+Then attempt a breakout above the global descending channel

+In this case, price could move toward targets 1 → 2 → 3 → 4

Target interpretation:

1–2 (green/yellow zones): most probable and structurally justified

3: higher-risk extension

4: extreme / euphoric target with the highest risk

-Bearish / Weak Momentum Scenario

+If price fails to break out of the internal channel and instead gets rejected:

+A pullback toward the lower boundary of the internal channel becomes likely

+This scenario currently has an estimated probability of ~20%

At this stage, the structure suggests a higher probability of a breakout from the internal descending channel toward the outer (global) channel, rather than a deep corrective move.

However, all scenarios remain valid until a decisive structural break occurs.

CRYPTO GOES 'TETHERED & CIRCLED' AMID THE PERDITION OF BTC BULLSThe recent 'Tethering and Circling' of crypto assets amid the downturn of Bitcoin (BTC) bulls can be explained by several interconnected factors rooted in market dynamics, investor behavior, and regulatory pressures.

As BTC bulls face setbacks in sustaining their upward momentum in 2025, the crypto market as a whole tends to become more tethered and circled around stablecoins like Tether (USDT) and Circle's USD Coin (USDC).

This shift is due to the need for stability, liquidity, and risk mitigation in an environment of uncertainty.

Role of Stablecoins Amid BTC Bear Pressure

Stablecoins like Tether and Circle have become dominant anchors in the crypto ecosystem, controlling over 80% of the global stablecoin market capitalization. Their foundational role is to provide a stable medium of exchange and store of value pegged to fiat currencies, predominantly the US dollar. As Bitcoin bulls lose steam and volatility spikes, investors and traders increasingly move their capital into these stablecoins to avoid the sudden price swings of BTC and altcoins. This creates a "tethering" effect where a large portion of liquidity is parked in stablecoins, allowing market participants to quickly enter or exit positions while minimizing exposure to risk. Stablecoins thereby act as a safe haven within the crypto market during periods of bearish sentiment or market correction.

Market Sentiment and BTC Cycle Influences

The 2025 Bitcoin cycle differs significantly from previous bull runs seen in 2021. Analysts suggest the true peak of Bitcoin’s cycle was back in April 2021, and since then the market has entered a phase characterized by cautious consolidation rather than explosive growth. Key macroeconomic indicators such as inflation trends, Federal Reserve rate policies, and quantitative tightening play substantial roles in shaping this slower, more measured market behavior. With BTC showing signs of a shallow bear phase and mixed momentum, investors' confidence is dented, pushing them towards safer crypto assets like stablecoins and highly liquid tokens.

Increased Regulatory and Competitive Pressures

The crypto market environment in 2025 is also shaped by growing regulatory scrutiny, especially around stablecoins themselves. Regulations in regions such as the EU have introduced frameworks like MiCA, impacting how stablecoin issuers operate. Tether, for instance, has responded cautiously to some regulatory moves, even choosing not to comply with certain restrictive regulations, leading to delisting from some centralized exchanges and challenges in maintaining its dominance.

Meanwhile, Circle’s USDC has been slightly less affected due to wider regulatory acceptance but still faces limitations on certain yield-generating activities. These regulatory pressures influence market dynamics, prompting crypto participants to actively circle around the most trusted and compliant stablecoin options to secure their holdings.

Market Dynamics of Crypto Herd Behavior

Moreover, cryptocurrencies tend to move together due to their correlated trading patterns. Large market movements in BTC often trigger cascading effects in altcoins and other digital assets. When BTC bulls falter, a wave of stop-loss liquidations occurs, leading traders to sell off altcoins and consolidate holdings into stablecoins or less volatile crypto instruments. This communal movement is amplified by the relatively smaller market caps of altcoins compared to BTC and the 24/7 nature of crypto trading, intensifying the tethering phenomenon as market participants seek to safeguard their assets and maintain liquidity.

Technical challenge

The main technical chart is a sum of USDT and USDC dominance; they both in nowadays represent more then 80 percent of all stablecoins market cap.

Long term upside trend is still looks robust, with a potential of Bull extension due to 200-week simple moving average brekthrough.

In summary, the crypto market's increasing tethering and circling around stablecoins amid the recent bearish phase of BTC bulls in 2025 is mainly due to the need for stability during heightened volatility, the maturation and changing cycle of Bitcoin, regulatory developments around stablecoins, and the inherent herd behavior in crypto trading. This dynamic ensures that stablecoins remain central hubs in the crypto economy as investors navigate uncertain market conditions.