VIRTUAL Price Jumps 105%, But Here's Why A Reversal Is NextAt the time of writing, VIRTUAL trades at $1.50 after a 105% rise in just four days. The token has received notable support from investors. Strong on-chain activity and trading volume continue to support its current valuation.

However, based on market conditions, VIRTUAL could soon face a short-term pullback. If selling pressure intensifies, the token might fall below the $1.37 support level, extending losses toward $1.14 or even lower.

If investors choose to hold their positions, VIRTUAL could maintain its momentum. A sustained rally above $1.54 may push the token toward $1.65 or even $2.00. Breaking this barrier would invalidate the bearish outlook.

Virtualusdtlong

VIRTUAL/USDT – Rebound Incoming or Deeper Collapse?🔍 Overview: Bearish Pressure, But Structure Holds

VIRTUAL/USDT is currently consolidating within a well-defined Descending Channel pattern that has been forming since early May 2025. While the trend is bearish, price action remains within a controlled structure — a potential sign of hidden accumulation or smart-money positioning.

What makes this setup compelling is that price has just touched the lower boundary of the channel while also interacting with a historical demand zone around 1.20–1.25 USDT, which previously triggered a strong rally back in May.

---

🧠 Key Technical Pattern: Descending Channel + Historical Demand Zone

Descending Channel → Suggests consistent selling pressure but within a structured range — no real breakdown yet.

Demand Zone (1.20 – 1.25 USDT) → A historically strong support level that has launched sharp upward moves in the past.

Decreasing Volume → Could indicate weakening bearish momentum as price approaches key support.

---

📈 Bullish Scenario (Bounce from Support):

If the price manages to hold and forms a reversal signal (such as a bullish engulfing or hammer candle), we could see a relief rally toward key resistance levels.

🎯 Potential Bullish Targets:

1. 1.6787 USDT – Mid-channel resistance

2. 1.9000 USDT – Psychological and structural resistance

3. 2.0848 – 2.4571 USDT – Horizontal resistance zone and top of the channel

4. 3.7620 – 4.6267 USDT – Extended targets if breakout occurs with volume

📌 Bullish Confirmation Needed: A strong breakout above the channel midpoint + increasing volume to confirm a potential trend reversal.

---

📉 Bearish Scenario (Breakdown from Channel):

If the price fails to hold above the 1.20–1.25 support and breaks below the channel support, we may see increased selling pressure and a continuation of the downtrend.

🎯 Downside Targets:

1.00 USDT – Psychological support

0.90 – 0.70 USDT – Previous accumulation range

0.4110 USDT – All-time low and ultimate downside target

🚨 A strong breakdown with high volume could trigger panic selling and a prolonged bearish leg.

---

🎯 Conclusion:

> VIRTUAL/USDT is at a pivotal decision point — hold and bounce, or break and slide.

The structure is still intact, and the price is testing two critical technical zones simultaneously: the descending channel support and a major demand area.

This is not the time to chase price, but to observe and prepare for confirmation. A strong signal here could set the tone for the next major move.

#VirtualUSDT #CryptoTechnicalAnalysis #DescendingChannel #DemandZone #ReversalSignal #AltcoinAnalysis #CryptoTradingSetup #PriceActionTrading #SupportResistance

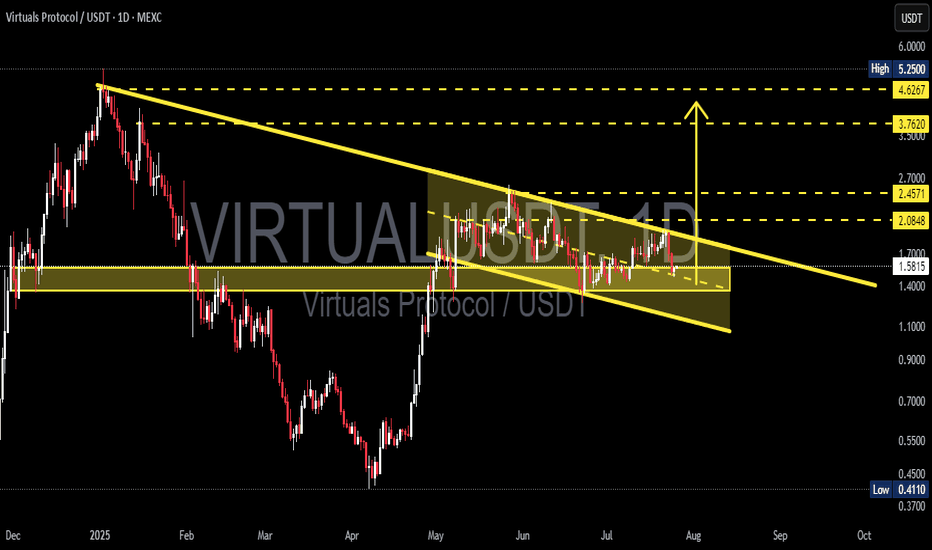

VIRTUALUSDT – Is the Wedge Nearing Its End? A Breakout Could!⏳ Current Situation:

VIRTUALUSDT is approaching a crucial moment after months of sideways price action. Following a steep decline from its all-time high ($5.25), price action has formed a Falling Wedge pattern — a well-known bullish reversal formation.

Now, as price consolidates toward the wedge's apex, the potential for a breakout grows stronger with each passing day.

---

📌 Pattern Structure:

Pattern: Falling Wedge (Bullish Reversal)

Duration: Since May 2025 (multi-month)

Support line: Ascending slope, catching lower dips

Resistance line: Descending pressure trendline

Price action: Trapped inside the wedge, signaling accumulation and shrinking volatility

This structure suggests that a large move may be right around the corner.

---

🔼 Bullish Scenario (Breakout):

If VIRTUALUSDT successfully breaks above the upper wedge boundary (~$1.70), the following key resistance levels could become major bullish targets:

1. $2.08 – Initial breakout confirmation level

2. $2.45 – Key resistance zone; breakout could accelerate here

3. $3.76 – Strong historical supply area

4. $4.62 – Major previous resistance

5. $5.25 (ATH) – Long-term bullish target if strong momentum follows

💡 Tip: A volume spike on the breakout adds confirmation and reduces the risk of a false breakout.

---

🔽 Bearish Scenario (Breakdown):

If the price fails to break out and instead falls below the wedge support (~$1.40):

1. Look for support near $1.20 – $1.10

2. Further downside could lead to $0.70 – $0.50

3. The ultimate support lies around $0.41, the current all-time low

⚠️ Note: A breakdown without volume can be a fakeout. Always wait for confirmation.

---

🎯 Conclusion & Strategy:

> VIRTUALUSDT is coiling inside a falling wedge pattern — typically a prelude to an explosive move. Whether bullish or bearish, the breakout direction will offer a strong trading opportunity.

Suggested Strategy:

Watch for breakout + volume confirmation before entering

Place tight stop-loss below wedge support if buying the breakout

Set tiered take-profits based on horizontal resistance zones

#VIRTUALUSDT #AltcoinBreakout #FallingWedgePattern #CryptoSetup #BullishReversal #BreakoutWatch #AltcoinAnalysis #CryptoTechnical #VolumeBreakout

VIRTUAL – Setting Up for a July Breakout - $4 in the Horizon!

Another coin worth bidding on: $VIRTUAL.

It's setting up nicely above the mid-range of the current trading range, with a clean S/R flip off the previous cluster zone.

The 3-day MA is holding well, and the downtrend from the local highs is set to expire on July 6th.

Expecting a strong trend to kick in during the second week of July, with potential to push toward the $4 mark.

$VIRTUAL Breakout Alert!!A clean inverse head and shoulders pattern has just triggered, and we’ve already seen a strong breakout above the neckline!

This is a classic bullish reversal signal, and the chart is screaming momentum

🟢 Key Levels:

• Entry around the neckline breakout

• Targets lined up: $2.36, $2.59, and $2.89

• SL below right shoulder: $1.91 for risk control

The 200 EMA is now sloping upward — further confirmation of trend shift!

#VIRTUALUSDT - Head and Shoulders Formation and Targets! Hey there, everyone! Next up, we’re looking at the position for #VIRTUALUSDT. When I combine the volume and RSI components and consider the price being very close to the trendline (with a small breakout on lower timeframes), I’m expecting an Inverse Head and Shoulders formation.

The exact targets will change depending on the breakout confirmation level, but I’ve tried to provide approximate targets in this analysis.

Wishing you all a green-filled day with my best wishes. 🌱

What do you think about my analysis? Drop your thoughts in the comments and let’s discuss!

#AlyAnaliz #TradeSmart #CryptoVision #VIRTUALUSDT