VIRTUAL/USDT – Descending Triangle at Major Demand Zone!VIRTUAL/USDT on the 12-hour timeframe is currently in a bearish consolidation phase after a strong decline from its previous peak. Price continues to form lower highs and is now approaching a major demand zone, highlighted by the yellow box between 0.702 – 0.640 USDT.

This area acts as a critical decision zone for the next market direction.

---

Pattern Explanation

The price structure clearly forms a Descending Triangle pattern:

A descending upper trendline indicating consistent selling pressure

A relatively flat lower support line around the demand zone, showing buyer defense

Descending Triangle is typically a bearish continuation pattern, however, since it is forming directly above a strong demand zone, a technical rebound or reversal remains possible.

---

Key Levels

Support (Demand Zone):

0.702 – 0.640 USDT (major demand area)

A clean break below 0.640 would confirm bearish continuation

Resistance Levels:

0.818

0.985

1.145

1.500

1.825 – 1.900 (major supply & previous high)

---

Bullish Scenario

Price holds above the 0.640 – 0.702 demand zone

A confirmed breakout above the descending trendline

Ideal confirmation: 12H candle close above trendline with rising volume

Bullish targets (step by step):

1. 0.818

2. 0.985

3. 1.145

4. 1.500 (if strong momentum follows)

This scenario reflects a potential reversal from demand, leading to a solid relief rally.

---

Bearish Scenario

Price breaks and closes below 0.640

Descending Triangle confirms as bearish continuation

Buyers fail to defend the demand zone

Bearish continuation targets:

0.580

0.520

Deeper downside possible if selling pressure accelerates

---

Conclusion

VIRTUAL/USDT is currently trading at a key decision area.

The 0.702 – 0.640 USDT demand zone will determine the next major move:

Hold + breakout above trendline → bullish reversal potential

Breakdown below 0.640 → bearish continuation confirmed

Patience is required, as this zone offers high risk–high reward opportunities depending on confirmation.

---

#VIRTUALUSDT #CryptoAnalysis #Altcoin #TechnicalAnalysis #PriceAction

#DescendingTriangle #ChartPattern #SupportAndResistance #DemandZone #CryptoTrading

Virtualusdtsignal

False Breakout Above Triangle — Expecting Real Breakdown to 0.25Price has been compressing inside a large symmetrical triangle for an extended period. Recently, we saw a false breakout to the upside , which was quickly rejected and followed by a return back inside the structure — a classic sign of bull trap.

At the moment, price is holding near the lower boundary of the triangle. After a small corrective bounce, I expect the true move to start with a breakdown below the triangle support, confirming bearish continuation.

If the breakdown is confirmed, the next downside targets are 0.25$ as the first support zone and 0.15$ as the extended target. These levels align with previous structure and potential demand areas.

The bearish scenario remains valid while price stays below the upper trendline of the triangle. A clean breakdown with acceptance below support would confirm the setup.

VIRTUAL/USDT – Rebound Incoming or Deeper Collapse?🔍 Overview: Bearish Pressure, But Structure Holds

VIRTUAL/USDT is currently consolidating within a well-defined Descending Channel pattern that has been forming since early May 2025. While the trend is bearish, price action remains within a controlled structure — a potential sign of hidden accumulation or smart-money positioning.

What makes this setup compelling is that price has just touched the lower boundary of the channel while also interacting with a historical demand zone around 1.20–1.25 USDT, which previously triggered a strong rally back in May.

---

🧠 Key Technical Pattern: Descending Channel + Historical Demand Zone

Descending Channel → Suggests consistent selling pressure but within a structured range — no real breakdown yet.

Demand Zone (1.20 – 1.25 USDT) → A historically strong support level that has launched sharp upward moves in the past.

Decreasing Volume → Could indicate weakening bearish momentum as price approaches key support.

---

📈 Bullish Scenario (Bounce from Support):

If the price manages to hold and forms a reversal signal (such as a bullish engulfing or hammer candle), we could see a relief rally toward key resistance levels.

🎯 Potential Bullish Targets:

1. 1.6787 USDT – Mid-channel resistance

2. 1.9000 USDT – Psychological and structural resistance

3. 2.0848 – 2.4571 USDT – Horizontal resistance zone and top of the channel

4. 3.7620 – 4.6267 USDT – Extended targets if breakout occurs with volume

📌 Bullish Confirmation Needed: A strong breakout above the channel midpoint + increasing volume to confirm a potential trend reversal.

---

📉 Bearish Scenario (Breakdown from Channel):

If the price fails to hold above the 1.20–1.25 support and breaks below the channel support, we may see increased selling pressure and a continuation of the downtrend.

🎯 Downside Targets:

1.00 USDT – Psychological support

0.90 – 0.70 USDT – Previous accumulation range

0.4110 USDT – All-time low and ultimate downside target

🚨 A strong breakdown with high volume could trigger panic selling and a prolonged bearish leg.

---

🎯 Conclusion:

> VIRTUAL/USDT is at a pivotal decision point — hold and bounce, or break and slide.

The structure is still intact, and the price is testing two critical technical zones simultaneously: the descending channel support and a major demand area.

This is not the time to chase price, but to observe and prepare for confirmation. A strong signal here could set the tone for the next major move.

#VirtualUSDT #CryptoTechnicalAnalysis #DescendingChannel #DemandZone #ReversalSignal #AltcoinAnalysis #CryptoTradingSetup #PriceActionTrading #SupportResistance

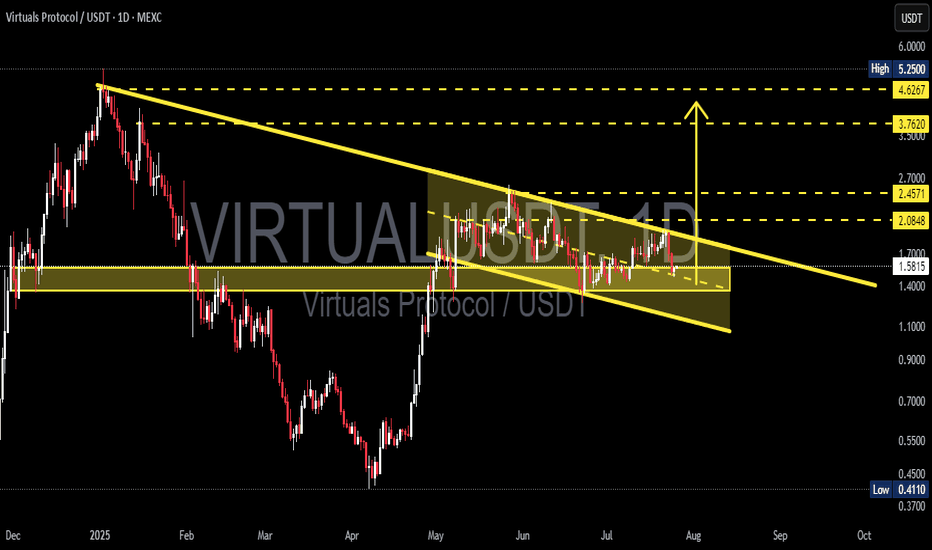

VIRTUALUSDT – Is the Wedge Nearing Its End? A Breakout Could!⏳ Current Situation:

VIRTUALUSDT is approaching a crucial moment after months of sideways price action. Following a steep decline from its all-time high ($5.25), price action has formed a Falling Wedge pattern — a well-known bullish reversal formation.

Now, as price consolidates toward the wedge's apex, the potential for a breakout grows stronger with each passing day.

---

📌 Pattern Structure:

Pattern: Falling Wedge (Bullish Reversal)

Duration: Since May 2025 (multi-month)

Support line: Ascending slope, catching lower dips

Resistance line: Descending pressure trendline

Price action: Trapped inside the wedge, signaling accumulation and shrinking volatility

This structure suggests that a large move may be right around the corner.

---

🔼 Bullish Scenario (Breakout):

If VIRTUALUSDT successfully breaks above the upper wedge boundary (~$1.70), the following key resistance levels could become major bullish targets:

1. $2.08 – Initial breakout confirmation level

2. $2.45 – Key resistance zone; breakout could accelerate here

3. $3.76 – Strong historical supply area

4. $4.62 – Major previous resistance

5. $5.25 (ATH) – Long-term bullish target if strong momentum follows

💡 Tip: A volume spike on the breakout adds confirmation and reduces the risk of a false breakout.

---

🔽 Bearish Scenario (Breakdown):

If the price fails to break out and instead falls below the wedge support (~$1.40):

1. Look for support near $1.20 – $1.10

2. Further downside could lead to $0.70 – $0.50

3. The ultimate support lies around $0.41, the current all-time low

⚠️ Note: A breakdown without volume can be a fakeout. Always wait for confirmation.

---

🎯 Conclusion & Strategy:

> VIRTUALUSDT is coiling inside a falling wedge pattern — typically a prelude to an explosive move. Whether bullish or bearish, the breakout direction will offer a strong trading opportunity.

Suggested Strategy:

Watch for breakout + volume confirmation before entering

Place tight stop-loss below wedge support if buying the breakout

Set tiered take-profits based on horizontal resistance zones

#VIRTUALUSDT #AltcoinBreakout #FallingWedgePattern #CryptoSetup #BullishReversal #BreakoutWatch #AltcoinAnalysis #CryptoTechnical #VolumeBreakout