WALUSDT Forming Falling WedgeWALUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 90% to 100% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching WALUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in WALUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

WALUSDT

Walrus is forming another structure WAL has dropped to lower levels, leaving behind a favorable imbalance in price action. The structure currently forming could offer a setup with a healthy risk-to-reward ratio. A confirmed Change of Character (CHoCH) would be the ideal signal to start building a position and anticipate a potential trend reversal. Ideally, we’d also want to see the total market cap reflect a similar signal for added confluence.

Both momentum and trend oscillators are showing signs of divergence — now, all that’s needed is a structural shift to confirm follow-through.

WALUSDT Forming Falling WedgeWALUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout in crypto trading pairs like this one. The price has been consolidating within a narrowing range after recent dips to the multi-year support zone around $0.19-$0.20, suggesting that selling pressure is weakening while buyers are beginning to regain control near key levels like $0.1924. With good volume confirming accumulation at these lower levels amid a 57% surge in 24-hour trading to over $64 million and staking rewards drawing inflows, the setup hints at a potential bullish breakout soon, especially as Walrus's decentralized storage innovations and Sui ecosystem integrations fuel renewed momentum. The projected move could lead to an impressive gain of 190% to 200%+ once the price breaks above the wedge resistance, targeting zones up to $0.57-$0.60 and beyond in this altcoin price action.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish for WALUSDT. Traders closely watching this crypto pair are noting the strengthening momentum as it nears a breakout zone around $0.21-$0.25, with technical indicators like RSI showing oversold bounces and fib retracement levels holding firm on the 4H and daily charts. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal, particularly with recent 11% weekly gains and node committee staking signaling ecosystem growth despite a -10% dip over seven days.

Investors’ growing interest in WALUSDT reflects rising confidence in the project’s long-term fundamentals, including its scalable blob storage for AI data and cross-chain compatibility, alongside current technical strength in this falling wedge setup. As of November 2025, trading activity spikes on Binance and community hype underscore real demand, making this a high-conviction opportunity for those hunting bullish reversal patterns in altcoins. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg, with projections eyeing $0.50+ for substantial medium-term gains as buying momentum accelerates in the broader crypto recovery.

✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

TradeCityPro | WALUSDT Could We See a 50% Move Soon?👋 Welcome to TradeCityPro Channel!

Let’s take a closer look at the WALUSDT chart on the 4-hour timeframe — a setup that might be preparing for a major move.

🌐 Overview of Bitcoin

Before we begin, let me remind you that we’ve moved the Bitcoin analysis section to a separate daily report at your request, so we can go into more detail about Bitcoin’s condition, price action, and dominance:

After the sharp breakdown from the 0.3633 level, WAL experienced a strong bearish wave that pushed the price down to a new support zone. Since then, the price has started to accumulate within a clear 4-hour range, suggesting that market participants are waiting for confirmation before the next big move.

This accumulation phase is important because such zones often act as the foundation for explosive movements once price breaks out — either upward or downward.

🔹 Bullish scenario (Long setup):

If price manages to break above 0.2520 with noticeable volume, it could trigger a strong bullish move. This breakout would signal that buyers have regained control, and we could see a rapid move toward higher resistance zones — potentially offering up to 50% upside from the current range. The key here is volume confirmation — without it, the breakout could turn into a fake-out.

🔹 Bearish scenario (Short setup):

On the other hand, the bearish trigger lies at the 0.1993 support. If the price decisively breaks and closes below this level, it would confirm that sellers are in control. However, before opening a short position, we want to see the price retest this zone (a rejection from below) to confirm the breakdown. This would reduce risk and provide a safer entry opportunity.

In summary, WALUSDT is currently in a neutral-to-accumulation zone — the breakout direction will define the next strong move. Traders should stay patient, monitor volume closely, and be ready to act once one of these key levels gives way.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

WALRUS/USDT – Descending Triangle at Critical Support!WALRUS/USDT is currently trading within a descending triangle pattern on the daily timeframe. This structure is formed by a series of lower highs pressing from above (descending trendline), while the 0.36–0.40 support zone (yellow box) acts as a major floor below.

This highlights strong selling pressure from the top, but at the same time buyers are still holding the support area. The price is now consolidating within a narrowing range, waiting for a decisive breakout that will dictate the next big move.

---

Bullish Scenario (Upside Breakout)

If WALRUS can break above the descending trendline with a daily close above 0.422–0.452, this descending triangle may flip into a bullish reversal. That would signal buyers regaining control.

Bullish Targets:

Target 1: 0.485

Target 2: 0.539

Target 3: 0.633 – 0.729 (if momentum continues strongly)

Validation: breakout with high volume + successful retest of breakout level as support.

---

Bearish Scenario (Downside Breakdown)

If WALRUS closes daily below 0.36, the descending triangle will confirm as a bearish continuation. This shows sellers overwhelming buyers at support.

Bearish Targets:

Target 1: 0.31 – 0.30

Target 2: 0.255 (long-term demand zone)

Validation: strong bearish daily close with volume, without quick recovery above 0.36.

---

Pattern & Interpretation

The descending triangle often acts as a bearish continuation pattern.

But in strong support zones, it can turn into a reversal pattern if an upside breakout occurs.

WALRUS is at a decision point: the tighter the consolidation, the bigger the potential explosive move once a breakout happens.

---

Conclusion

Bias: Neutral → Bearish as long as WALRUS remains below the descending trendline.

Bullish confirmation: daily close above 0.422–0.452 → potential rally to 0.485 – 0.539.

Bearish confirmation: daily close below 0.36 → possible drop to 0.31 and 0.255.

Traders should wait for volume-backed breakout confirmation before positioning. WALRUS is now at a make-or-break level: will it bounce or break?

---

#WALRUS #WALRUSUSDT #CryptoAnalysis #TechnicalAnalysis #DescendingTriangle #Breakout #SupportResistance #PriceAction

WALUSDT — Breakout or Breakdown? Golden Pocket the Key!Quick Context: Since May, price has formed a series of lower highs connected by a descending trendline (yellow). Beneath it lies a strong demand zone at 0.406–0.420, aligning with Fibonacci 0.5 (0.419) and 0.618 (0.407) — the golden pocket. Current price is around 0.435, pressing against the trendline and approaching the apex of the pattern.

Pattern & Key Levels

Main Pattern: Descending Triangle (downward-sloping top, relatively flat base/zone). Theoretically slightly bearish, but since it sits right on the golden pocket with compression, the probability of an impulsive breakout in either direction is high.

Major Demand / Support: 0.406–0.420 (golden pocket + base).

Immediate Resistance: descending trendline + 0.44–0.46 area.

Next resistance targets (yellow dashed lines): 0.484 → 0.542 → 0.674 → 0.732.

Downside supports if broken: 0.380 → 0.350 → 0.296.

Bullish Scenario

1. Confirmation: Daily close above the trendline and ideally > 0.460 (clear breakout confirmation).

2. Healthy Retest: Pullback to 0.44–0.46 / trendline, now acting as support.

3. Step Targets:

T1: 0.484

T2: 0.542

T3: 0.674

T4: 0.732

4. Bullish Invalidation: Daily close back below 0.420; strong invalidation if < 0.406 (loss of golden pocket).

Bearish Scenario

1. Rejection: Fails to break 0.44–0.46 / trendline and turns down.

2. Weakness Confirmation: Daily close below 0.406 (loss of base + golden pocket).

3. Downside Targets:

S1: 0.380

S2: 0.350

S3: 0.296

4. Bearish Invalidation: Daily close above 0.460 with a successful retest flips bias to bullish.

Execution Notes

Apex Break: The closer price gets to the apex, the higher the risk of false breaks — always wait for a daily close to confirm.

Volume: A valid breakout should be accompanied by increasing volume.

Risk Management: Place stops beyond the invalidation zones of your chosen scenario (below 0.406 for breakout longs; above 0.460 for rejection shorts).

> Summary: WALUSDT is being squeezed between the descending trendline and golden pocket 0.406–0.420. A daily close above 0.460 could open the path to 0.484/0.542, while a breakdown below 0.406 may trigger a drop towards 0.380–0.350.

Not financial advice; purely for educational and technical reference.

#WALUSDT #Walrus #CryptoTA #PriceAction #DescendingTriangle #Fibonacci #SupportResistance #Breakout #RiskManagement

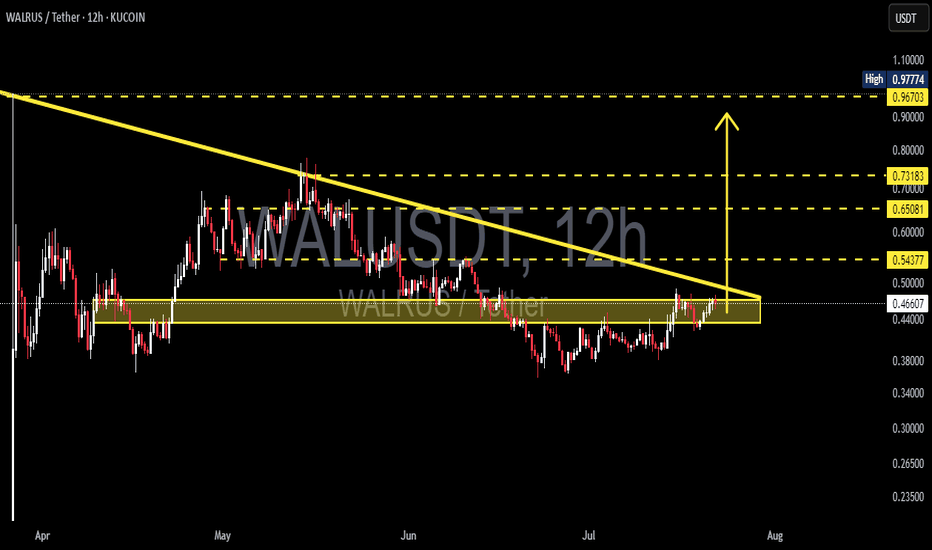

WAL/USDT – Major Breakout Unfolding! 70% Upside Potential?After weeks of compressed price action and relentless seller pressure, WAL is showing signs of a potential explosive move. Is this the breakout bulls have been waiting for?

🧩 Chart Pattern: Descending Triangle — With a Bullish Twist

Over the past 3 months, WAL has formed a descending triangle, typically known as a bearish continuation pattern.

But here’s the twist — WAL is breaking out upwards, signaling potential trend reversal instead.

The pattern shows higher lows meeting a horizontal resistance around $0.47–$0.48, a classic sign that buyers are gaining strength.

This setup suggests buyers are slowly overpowering the selling pressure, leading to a high-probability breakout scenario.

🟡 Strong Accumulation Zone: $0.42–$0.45

This range has consistently acted as a strong support base since mid-April.

Every dip into this zone has been met with strong buyback and increasing volume.

It likely represents a smart money accumulation zone before a larger markup phase.

🚀 Breakout Target: Where Could Price Go?

Measured move from the triangle's height projects a move of ~$0.25. From the breakout level at ~$0.48, this gives a technical target around $0.73.

🎯 Bullish Price Targets:

1. TP1: $0.543 — First breakout validation zone

2. TP2: $0.650 — Previous May resistance level

3. TP3: $0.731 — Measured move target from triangle

4. Extended Target: $0.967 – $0.977 — Prior liquidity and local high zone

With sustained volume, $1.00+ isn’t off the table.

---

🔻 Bearish Scenario:

If this breakout turns into a fakeout:

Price may revisit the support zone at $0.45–$0.42.

Breakdown below this zone opens risk toward:

🧨 $0.36 — Mid-range demand zone

Further breakdown could lead to $0.30–$0.28

Confirmation of a fakeout: A strong 12H close below the yellow box support with increasing sell volume.

🔍 Additional Bullish Confirmation Signals:

Volume should spike significantly above average to validate breakout.

RSI, MACD, or EMA crossover can help strengthen the bullish thesis if aligned.

✅ Summary

WAL/USDT is currently at a pivotal breakout moment. A confirmed move above the descending triangle could trigger a major trend reversal, with targets between $0.65 and $0.73 in sight. This setup could be one of the cleanest breakout opportunities on the charts right now.

#WALUSDT #CryptoBreakout #TechnicalAnalysis #BullishSetup #DescendingTriangle #AltcoinWatch

WALUSDT - Change in the trend and let's capture itWAL is currently showing a change in the trend, after a continous downtrend finally we are seeing change in the trend.

Price has held the support strongly and now we are seeing the reversal.

We have decent trade opportunity here.

Entry Price: 0.4319

StopLoss: 0.3500

TP1: 0.4828

TP2: 0.5292

TP3: 0.6374

TP4: 0.7817

Cheers

GreenCrypto

WALUSDT – Classic Accumulation to Parabolic Playbook (?)📈📚 WALUSDT – Classic Accumulation to Parabolic Playbook 🚀

What we are witnessing on WALUSDT is a textbook example of the three market phases often seen before explosive moves:

1️⃣ Accumulation/Compression Phase

Price compresses into a falling wedge pattern, reducing volatility and building hidden momentum.

2️⃣ Consolidation/Bullish Continuation

Breakout confirmed, and price moves into a flag/channel. This is the classic "cooling off" before expansion.

3️⃣ Parabolic Advance (Expansion Phase)

With the flag breakout, expect potential acceleration toward higher targets:

📌 First Target: $0.6947

📌 Next Target: $0.7292

🚀 Parabolic Zone: $0.90+

📊 Historical Proof?

✅ BTCUSD 2020-2021: Compression → Flag → 10x Parabolic Rally.

✅ TSLA 2019: Same sequence, leading to one of its most aggressive bull runs.

⚠️ Disclaimer:

WALUSDT is a meme coin, highly speculative, and fundamentally different from assets like Bitcoin or Tesla. While the technical setup looks strong, please be aware that this asset can also go to zero. Trade responsibly, manage your risk, and never invest more than you can afford to lose.

One Love,

The FXPROFESSOR 💙

#WALUSDT continues its bearish momentum 📢 As long as the price stays under $0.6000 — short BYBIT:WALUSDT.P bias remains valid.

📢 Watch for further weakness!

📉 SHORT BYBIT:WALUSDT.P from $0.5794

🛡 Stop loss: $0.6000

🕒 Timeframe: 1H

✅ Overview:

➡️ The chart shows a clearly formed and broken Bearish Rectangle, confirming a short setup after price exited the range to the downside.

➡️ The $0.6090 support level has turned into strong resistance.

➡️ Entry at $0.5794 follows a textbook breakdown and retest structure.

➡️ Target area aligns with the volume-based support near POC $0.515, offering solid R:R.

🎯 TP Targets:

💎 TP 1: $0.5725

💎 TP 2: $0.5665

💎 TP 3: $0.5600

📢 Bearish structure confirmed with increased volume.

🚀 BYBIT:WALUSDT.P continues its bearish momentum — downside potential remains active!

TradeCityPro | WAL: Squeezing Tight Before the Breakout👋 Welcome to TradeCity Pro!

In this analysis, I want to review the WAL coin for you. This coin belongs to the Walrus project, which is part of the SUI ecosystem and falls under the DePIN and Storage categories.

⚡️ After its airdrop, this project’s token has managed to maintain its hype and, with a market cap of $589 million, is currently ranked 97th on CoinMarketCap. Since this token has just recently launched, the analysis will be done on the 4-hour time frame.

⏳ 4-Hour Time Frame

As you can see in the 4-hour time frame, after this token’s launch on March 27, the price has formed a low and a high at the 0.3899 and 0.5903 zones respectively. It is still trading between these two levels and has yet to start a clear trend.

✔️ Currently, a descending triangle has formed. The price is forming lower highs, while maintaining equal lows, and each time the price touches these lows, the probability of a breakdown from the triangle increases.

📉 So, for a short position, I suggest definitely having a position open if the 0.3899 zone breaks. You can open this position earlier by entering on a rejection from the descending trendline or the break of 0.4101, but keep in mind that these are not the main triggers—they're just early entries in anticipation of a breakdown, so you’ll have a position ready if the zone breaks.

🔼 For a long position, the first high formed was at 0.4362. The price is currently above this level, but the breakout candle isn’t very strong, and the price hasn’t confirmed stabilization above this level yet. Also, this zone is very close to the descending trendline, so it’s not logical to enter a long position while this trendline remains unbroken.

📈 Therefore, for a long, wait for the break of the descending trendline and a pullback to this dynamic level before entering. The next triggers for upward movement are the 0.5167 and 0.5903 zones.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️