WBA Walgreens Boots Alliance Options Ahead of EarningsIf you haven`t sold WBA here:

Then Analyzing the options chain of WBA Walgreens Boots Alliance prior to the earnings report this week,

I would consider purchasing the $32.5 strike price Calls with

an expiration date of 2023-10-20,

for a premium of approximately $1.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

WBA

WBA Walgreens Boots Alliance Options Ahead of EarningsLooking at the WBA Walgreens Boots Alliance options chain ahead of earnings , I would buy the $30 strike price Puts with

2023-6-16 expiration date for about

$1.01 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

Green on Walgreens. WBAConfirmed pivot.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

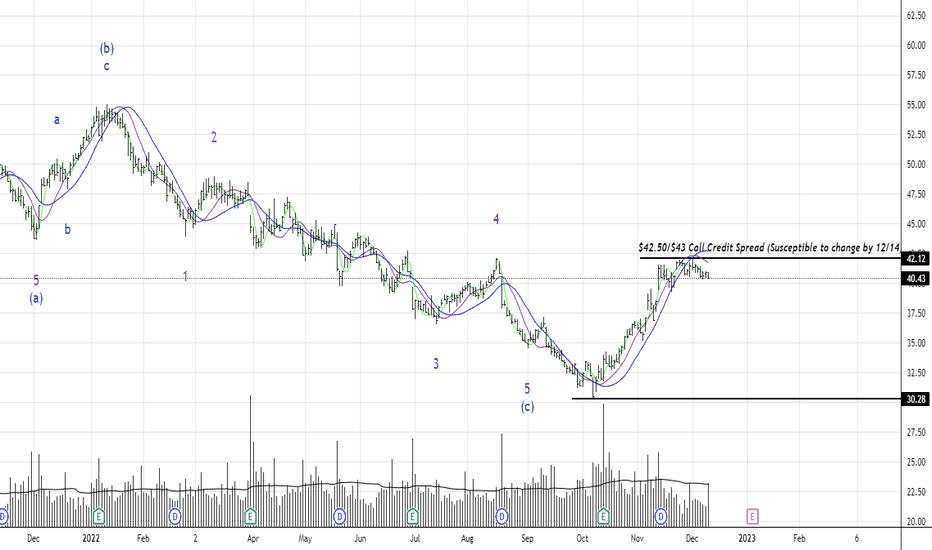

Walgreens Boots Alliance: Take Your Medicine 💊Walgreens Boots Alliance should take its medicine as the share needs some more strength to make it above the resistance at $42.29. From there, the course should rise into the green zone between $52.38 and $59.29 to conclude wave 3 in green before we anticipate a countermovement. A 38% chance remains, though, that WBA could drop below the support at $32.70 instead, subsequently slipping below the support at $30.39 as well.

$WBA: Trend signal spotted$WBA has a nice setup here, the blue and red lines are entry and stop respectively, target is shown by the box's upper edge, and time projection for the move by the time duration of the box.

Best of luck!

Cheers,

Ivan Labrie.

WBA (Range Trade)The last two times price touched $42 was in August ($42.10) and December ($42.03). Price hovered near $42 highs in November but didn't hold. Could also be a start of new impulsive wave to the downside. Might wait til the fed decision and cpi reports pass next week to get a second look.

WBA - Horizontal Support Leading to Double BottomWBA has formed a strong horizontal support

This provides a good support for price

Price has already bounced once off this area recently

Right now we are just waiting on the next test

This is on the Weekly timeframe but it would also be evident on the daily

WBAexcelente riesgo beneficio

patron armonico

Walgreens Boots Alliance, Inc. engages in the provision of drug store services. It operates through the following segments: Retail Pharmacy USA and Retail Pharmacy International. The Retail Pharmacy USA segment consists of the Walgreens business, which includes the operation of retail drugstores, health and wellness services, and mail and central specialty pharmacy services. The Retail Pharmacy International segment consists of pharmacy-led health and beauty retail businesses and optical practices. The company was founded in 1901 and is headquartered in Deerfield, IL.

RAD Swing Trade Setup LongNYSE:RAD

RAD is the Rite Aid drug store chain0 being in healthcare and

consumer staples it is relatively resilient in a recessionary context.

On the Chart, RAD is at swing lows sitting on support with

25% upside potential. The RSI indicator shows an impending

K & D line cross under the histogram.

A recent triple top helps mark the resistance while an

earlier double bottom shows the support. The order block

indicator provides confirmation.

I see this as nearly ready for a swing-long entry.

What is your opinion?

$WBA NICE ASS SET UP -gonna let this play out and wait for a pullback before taking an entry

-Looking to take a position off the 9-day ema 46.78 test

-if we break we enter if we bounce we wait for a rejection

Walgreens ~ WBAWalgreens on the weekly chart here is breaking out. I'd go long here anticipating a breakout over 52$ and if it holds it'll begin a nxt run up.

WBA ready for take off ? 🚀Just a stock that could give a good profit if it continues this trend

but because its not all positive, then remember your stop loss

its all on the chart

Remember to do your own analysis

WalgreensI see a possible M pattern forming here. I'm thinking about more people being sick and pharmacy visits over the cold winter season. Walgreens is a great convenience store with solid customer service from my experience. They've been around for a long time. I want to see price retrace the previous high up to 38 - 61%. We are currently in consolidation. However, I believe that since that previous was broken and the current low being higher than the previous, I can see WBA respecting that sentiment on a long term scale. The win goes to the longest holder. On the weekly , we are on the bottom of the Mac D as well and looks to be losing its bearish momentum.

Not advice!

WBA bearish flag might formpattern shows a bearish flag will form in coming days. i'm learning so let me know if i analyzed wrong

WBA setting up nicely - $51 incomingWBA broke a key resistance level and is now testing as support. I'm expecting a bounce off it and a push to $51 next week. In on $50 calls expiring 8/27. Options are super cheap, low risk setup.

WBA shortWaiting for the continuation of the downtrend after a local bounce. On the daily chart, the price rested against MA200, on weeks - in MA100. Looks weak in terms of sector analysis.

WBAWhat do you think? I purchased 1 share today in the midst of the red sea. I plan on averaging down down the line if price starts falling towards support #2.

WBA LONG L >56.00

WBA is going to push the price to 59.20

I see, that there is a good chance to long if price will go higher 56.00

i put an alert on 56.00$ and will try to long.

I see that 53.92 is a place, where buyers put there orders. I think, if 1D candle will close below 53.92 that will cause a giant sellout of long positions.

AMZN to open up physical pharmacy's WBA breaks trendline$WBA was on a nice upward trend. Today after $AMZN announces opening up pharmacy's $WBA breaks its upward trendline and maybe headed to lower support line

WBA 1D BEAR FLAGBear Flags are a Range pattern that is a repeatable trading chart patterns.

Ascending Bear Flag chart patterns will have a directional bias (short) depending on the previous incoming trend.

Each chart pattern will have defining trendlines of the support/resistance levels creating the pattern.

What ever time frame you are trading this chart pattern, wait for a candle close outside of the trendline in the direction of the breakout candle. (Our time frame preference is the Daily chart).

Add volume indicator - Volume is the amount of $ that went into a particular candle or in Forex the # of trades that took place.

Add ATR indicator - Volatility is the amount of price movement that occurred. Use the ATR to measure the price movement.

When you see descending Volume bars and descending ATR line (which indicates volatility) this shows

a dis-interest in traders to invest in this pair creating consolidation which creates the chart pattern.

Trade Management after there is a breakout candle close.

1 - Position size (compare volume bar to volume ma line).

a - Breakout candle must be 100% of volume average for a full position size.

b - If 75% of volume average then ½ position size. (To find 75% of Volume

look at the charts volume settings – divide smaller # into larger # = 75%+)

If not 75% then stand aside from the trade.

2 – If candle breaks out of a trendline, 15m before the close of the day prepare your buy/sell order.

Enter two trades. 1st trade will have a SL & TP. It will close automatically when the 1st TP is hit. 2nd

trade only has a SL and will be allowed to run. When 1st TP is hit move the SL to breakeven. Look

at ATR and prepare SL at 1.5 of ATR. Prepare 1st trade TP at 1 of ATR.

3 - SL for both trades will be 1.5 x ATR.

4 - 1st trade TP will be 1 x ATR.

5 - No TP on 2nd trade – letting profit run and adjusting SL to follow price.

6 - When 1st TP hit – move 2nd trade SL to breakeven.

7 - Adjust the 2nd trade SL to follow price.

*8 – After Breakout candle – if price closes back into chart pattern close trade don't wait for SL to be hit.

*9 - When breakout candle is more than 1 ATR from breakout candle open.

a - Enter 1st trade at candle close with ½ position size.

b - Enter 2nd trade with a pending limit order that is 1 ATR of breakout candle open.

c – Price should pullback to that pending limit order for 2nd trade.

d – If Price returns back into chart pattern close trade before SL is hit.

WBA. From watchlist. Pullback setup. Worth some attention.More time with the watchlist. I will be convinced of it's value eventually.

Trying to identify a good turning point here is a little difficult because the 2nd peak of wave (5) tells us there's a higher probability this Elliot cycle could be finished and entering a deeper correction. But if it's not, then it is getting to a really good support area with incoming confluence from trendline support, 50 MA support, and previous price support.

I will keep an eye on it. I'm not crazy to jump in just yet. I think I can find some that haven't put in the fifth wave already and have similar supporting confluences. It kills me being so picky sometimes. I might have to take a small size.