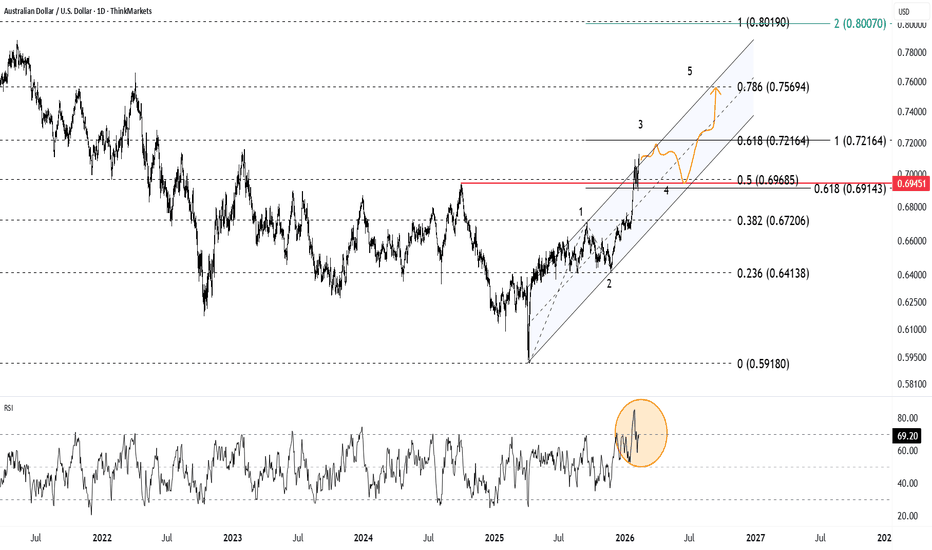

AUD/USD breaks twds Fibo cluster ahead of NFP, CPIAUD/USD is the key pair to watch right now ahead of critical US data releases, with Non-Farm Payrolls today and CPI on Friday. The pair has rallied significantly off the 0.69 bottom recently, sitting between two powerful forces.

On one side, the US dollar has weakened following softer-than-expected retail sales and reports of China urging banks to curb exposure to US Treasuries. On the other, the Australian dollar has been buoyed by the RBA’s unique hawkish stance.

From a technical perspective, the break above 0.7000 brings a critical "Magnet Zone" at 0.7216 into focus—a level where multiple Fibonacci projections converge. A clear break here could signal a medium-term structural shift towards 0.7300.

Key topics covered

USD weakness : How missed retail sales and China’s directive on US Treasuries have pressured the greenback, fuelling the move away from the 0.6940 support.

RBA hawkishness : Why the RBA remains the only major bank outside Japan maintaining a tightening cycle, with markets pricing a 70% chance of another hike in May following Deputy Governor Hauser’s comments.

The Magnet Zone : Why the 0.7216 level is a critical target, representing both the 61.8% Fibonacci retracement and the 100% extension of two different legs.

Elliott Wave structure : Identifying the current move as a potential 3rd wave impulse, but why RSI divergence suggests a correction (Wave 4) may be likely after hitting the magnet zone.

AUD/USD scenarios

Bullish : A sustained push through the 0.7216 magnet zone signals strong momentum, targeting the 0.7300 analyst forecast and potentially the 0.8000 structural high in the medium-long term.

Bearish : RSI divergence triggers a rejection at the 0.7216 cluster, leading to a Wave 4 correction back towards the 0.7000 handle before any further upside.

Are you buying the dip or fading the rally at the magnet zone? Share your thoughts in the comments.

This content is not directed at residents of the EU or UK. Any opinions, news, research, analysis, prices or other information provided are for general market commentary only and do not constitute investment advice. ThinkMarkets accepts no liability for any loss or damage, including loss of profit, arising directly or indirectly from reliance on this information.

Weakdollar

EUR/USD rally: "Sell America" targets 1.18 – Buying Wave 4 dip?We are witnessing a strong repricing in EUR/USD, driven by a "Sell America" trade that is crushing the dollar across the board. The pair is up 1.6% this week alone, breaking out of a bullish flag and confirming a vertical impulsive move. But the question is: with Wave 4 near the 100% extension as support, is it time to buy the dip?

We analyse the shift driven by President Trump's tariff threats at Davos, which has intensified the selling pressure on the greenback. We overlay this geopolitical risk with a classic Elliott Wave setup on the 4-hour chart, mapping out the path to 1.1800 and potentially 1.1900.

Key topics covered :

"Sell America" intensifies: How Trump's double-down on the February 1st tariff deadline at Davos triggered a second wave of dollar weakness, sending gold to $4,850 and the euro soaring.

Elliott Wave analysis :

Wave 3 peak: The impulsive leg from Monday's open was rejected exactly at the 161.8% Fibonacci extension (1.1767), signalling a temporary top.

Wave 4 entry: We are now looking for a corrective pullback to the 100% Extension and 50% Retracement near 1.1700—a major psychological support and our "buy zone."

Wave 5 targets: If 1.1700 holds, the net distance projection targets 1.1784, 1.1807, and potentially 1.1830.

Risk Factors : Tomorrow's US PCE data (expected steady at 2.8%) is the wild card. A hot print could deepen the correction, while an in-line result supports the higher grind.

Are you buying the Wave 4 dip at 1.17 or fading the rally? Let us know in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Dollar Index: Vulnerable Support Ahead of CPI Inflation Data Ahead of this week’s CPI inflation print, the US Dollar Index has moderately bounced back from support at 102.78. Despite benefiting from additional channel support (taken from the low of 103.65) and the Relative Strength Index (RSI) recently shaking hands with oversold space (< 30.00), bullish resolve from the support has been uninspiring.

Lacklustre Rebound from Support

The lacklustre reply from support could be due to sentiment favouring bears; since topping at 106.13 in late June, sellers have dominated price action, pushing the unit through the 200-day Simple Moving Average (SMA) at 104.21.

Further Downside?

Should bulls change gears and extend the pullback from support, resistance at 104.02 calls for attention. This base also shares chart space with channel resistance (extended from the high of 106.13), and the 200-day SMA underlined above. Alternatively, in light of the feeble response from current support and sentiment favouring downside at this point, breaching current support could be on the table this week, with the pendulum swinging in favour of reaching support from 101.78 and 101.01.

Bitcoin Headed To The Golden Zone From swing low to swing high, we can see more than 78% retracement happened. Next is swing high to swing low, that's where i marked off the golden zone so 40K is possible again.

Also with the mighty dollar approaching its supply zone and heading into retracement, the market must take advantage of the momentum, as they should.

Patience wins all.

Keep rising.

Always Due Diligence!

BLong

$USDJPY YEN rollover Q2! LONG YENThis is not a test!!!

Yen is going to gain maximum strength in the next 90 days during the 2nd QTR.

I cannot legally say as to why but the hunch is strong. Looking for a soft rollover to close the month around 130 flat (3/31/23)

Q2 2022 we saw a major short begin on Yen pairs (USDJPY 122-150!)

We are now seeing the retracing PLUS to create a very strong Japanese economy.

THIS SHORT CAN GO ALL THE WAY TO 115! That is how overbought UJ is as a pair.

The Weekly + monthly shows this slow retrace gaining traction.

My FAV is USDJPY and GBPJPY both looking to short.

130.4 is a good entry to prepare for Q2. This can be volatile as many US trading platforms heavily short Yen as a makeshift safe haven.

133.5 can invalidate this short sell.

TP1: 125.1

TP2: 122.1

TP3: 117.2

****NOT FINANCIAL ADVICE****

XAUUSD ReversalHello traders.

Today's news for weak USD and falling yields impacted on this huge move for gold.

I 've change my point of view for the pair due to this vigorous price action.

But such a big candle means that the price has being fueled with big orderblocks and in someway left a 'gap' back.

I expect at least 50% retracement which will be a great entry point for long continuation as my first path line indicates (169x area).

What is more, the price may correct lower to 1683 area as for the retest which will be again great for buy (neglect in this case the resistance).

In a daily perspective, the bearish trendline has been violated and retested!! Which meant nothing until the moment of Gold bullish price action indicating reversal.

DXY has still further space for lower lows. Treasury yields too.

P.s. it may correct a little e.g. 1705 area and continue straigh up. My overall targets are 1730 - 1761-1802.

With such power I believe the recent supply of 1730 level will be past in the coming days. Important news from USA coming so keep an eye.

Awaiting your feedback!

Goodluck everybody!

The Fall of Dollar is Around the Corner ... Bearish Dollar?DXY is close to a premium array (-OB)

Dollar Price is Bearish Long Term. The Open of the OB (116.457) would be ideal to expect the sell come in...

Confirmation is vital in my trading so won't just enter straight away.

I will post another idea for the sell entry.

This is just to call y'all attention to what I see on DXY.

If the sell does come in then the First Target on Monthly TF would be 88.493.

Follow for more quality trade Ideas...Trade Safe ;)

DXY: TIME for USD PULLBACKS?Hey traders, in this week we are monitoring DXY for a selling opportunity around 104 zone, once we will receive any bearish confirmation the trade will be executed.u

we highly recommend to take a look at DXY at the beginning of every trading week if not everyday, that will help you to trade USD pairs more professionally and spot their direction!

Trade safe, Joe.

XAUUSD swings higher to test 1810-1830!Last week we were able to test the lows of 1783. We ended the year above 1800 only to dip the first week of 2022 possibly creating a makeshift bottom for the month.

I anticipate gold to swing higher to test minimum 1801-1804 levels and if volume permitting to rolling into 1810+.

If you look to the left my fixed range volume profile has the POC tapped from NFP and looking to swing to its highest up volume area of 1802-1808.

NFP on 1/7/22 did not provide the fuel for a real gold move.

Weak DXY failing 96.4 gives me confidence it wants to test 95 flat or high 94 levels as the US gov struggles to pull the cord + potential tech market crash.

MA 200 is at 1794 on 4HR (which it fully closed above)

MA 200 is at 1800 on Daily

My entries:

1790.5

1796.7

buy stop @ 1798

Move is invalid if 4HR close under 1785 support zone.

IF FAIL NEXT LEVEL IS RED 1760S and lower to 1730s

DOLLAR INDEX TIME FOR SHORT BREAKOUTThe dollar has been on a mission, which has shocked a lot of investors considering the FED keeps printing money!

When will this strange rally end?

We would love to see a slight pullback with signs of rejection before we sell off a wipe out a good chunk of buyers.

Breakout of this descending formed channel It'll push price downward thereby affecting USD Pairs.

The price is moving between strong key resistance and the breakout will move to target of key support 92.50

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses

STRONG EURUSD LONG IN WEEKS TO COME? Maybe Good day Friends

Ive been looking at EURUSD BECAUSE IT HAS FALLEN INT0 A SIGNIFICANT AREA.

We clearly know the month has been overall bullish (beginni. Marked by the black line), The market has reach a clear bullish exhaustion area (highest high). Price has broken a level/zone(Marked Red) meant to push price back down but it found resistance/supply later on a mid zone(marked white) and has reversed to use the previously broken zone as ground to lift off.

You can mark down lines and monitor H4 for bullish reversal candles, **bullish eng. pinbar

Kindly Share your ideas and questions in the comment section

ELong

AUDUSD Correcting. Uptrend still intact.#AUDUSD:

(1D):

Also here the USD is getting weaker, resulting in a clear uptrend, which is confirmed by the 200 EMA as well. After last complex consolidation, the chart has been overextending for quite some time, so consolidation was to be expected.

(4H):

On a shorter period indeed, we have a downtrend. We recently had a fakeout to the downside, when sellers tried to accelerate without result.

(1H):

Right now, we have a range which means indecision in the market. This also means that we could see a deeper correction, as well as a strong uptrendtrend rebound if broken to the upside. This aligns with gold analysis (AUD positively correlates with XAU).

Bitcoin (BTCUSD) coming back to ATH?Recent price action is showing a 30% dip rejected by the 30k psychological level and proven support.

On the 4H we have a double bottom being broken to the upside, confirming the potential reversal. If we can see a break of the higher TF corrective structure, we will soon see ATH being touched once again.

EURUSD on the path to test 1.22#EURUSD:

(1D):

As expected from last week's analysis, EU came all the way back to support around 1.205 to bend to the upside once again, following the overall bullish direction. We are about to see 1.22 resistance being tested, where I will be looking for a bullish opportunity once broken to the upside.

(4H):

On the lower timeframe, we have more detailed information above the retracing leg down on 1D. Namely a falling wedge, eventually broken and retested.

(1H):

Price action has been quite choppy as of late. For this reason, i will be waiting for a bullish bullish continuation setup once across next resistance, aiming for the 4H wedge top. If developing on a larger scale, i will be interested to see 1.24 as next target.

short-term bullish dollar play UUPThe dollar has bounced off its bottom trend line. After having such a long period of weakening, it is due to bounce back a bit. It is extremely rare for the dollar to not reverse the trend after an extended period of strength or weakness.

It may not rally back much, but it will give you some gains in the short-term. Sell half when it hits the upper trend line and let the other half ride. There have been some contrarian calls on Wall Street for a surprisingly strong dollar.

UUP is a way to play the bullish dollar. I currently have a vertical call spread expiring 2/19 with the buy-strike being $24 and the sell-strike being $26.

US Dollar still bearish (USDJPY trade active)#USDJPY (Possible trade idea):

(1D):

The higher timeframe has been bearish for quite some time during 2020, and this trend hasn't changed. Still bearish bias confirmed by the 200 EMA and structure. Also fundamentally, US money printing won't stop any time soon. Technically, A wide range retest occurred, pushing the pair to the downside.

(4H):

Looking closer, the said retest on the daily timeframe resulted in a bearish continuation triangle, also broken to the downside.

(1H):

Recently, the price has been ranging in a smaller range and going through London session, it seems we have an interesting opportunity on its break and retest. Target would be at next support at 101.500