WLDUSDT – Market Bias & Trade Idea WLD has maintained a strong bullish structure since the start of the new year, supported by sustained buying pressure and positive sentiment.

However, price is now approaching a higher-timeframe (Daily) supply zone. Before reaching that level, we’ve already seen liquidity swept, which increases the probability of a potential reversal.

For a bearish move to be confirmed, I’m watching for price to tap into the 4H supply zone. A clean reaction from that area could be the trigger for a move to the downside.

📌 Trade Plan:

• Bias: Short from supply

• Confluence: Liquidity sweep + HTF supply

• Risk-to-Reward: 1:3 (3RR)

I’ll post a follow-up once price reacts to the zone.

Happy Trading 🚀📈

Wldusdtsignal

#WLD/USDT Pump Anticipated#WLD

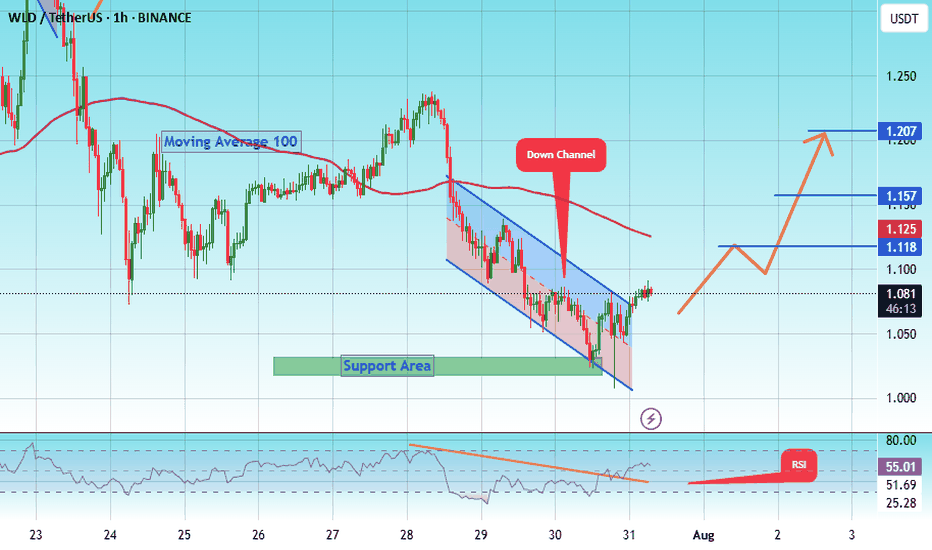

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.4776. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.4994

First target: 0.5078

Second target: 0.5215

Third target: 0.5400

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

#WLD/USDT Pump Anticipated#WLD

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.4750. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.4816

First target: 0.4976

Second target: 0.5130

Third target: 0.5284

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#WLD/USDT Pump Anticipated#WLD

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.563. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.580

First target: 0.591

Second target: 0.604

Third target: 0.620

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

WLD/USDT — Falling Wedge: : Reversal or Final Capitulation?WLD/USDT on the 5D timeframe is entering the most critical phase of its long-term structure. Price action has formed a large Falling Wedge, a classic pattern that appears when bearish momentum fades while smart money quietly accumulates liquidity.

The upper trendline continues to slope downward sharply, but the lower boundary is flattening — a clear sign that sellers are losing strength, even though volatility remains elevated.

The long downside wick signals an aggressive liquidity sweep — often a precursor to a major move.

Price action is tightening, volatility is compressing, and WLD is now sitting right at the decision zone.

This type of structure rarely lasts long — it usually ends with a violent breakout or a final capitulation flush.

---

📈 Bullish Scenario (High-Potential Reversal Setup)

If WLD manages to bounce and break above the upper wedge trendline, it would be the first structural sign that multi-month selling pressure is exhausted.

Bullish confirmation requires:

A clean 5D close above 0.65–0.75

Strong volume expansion

A successful retest of the breakout trendline

If all criteria align, WLD could enter a medium-term trend reversal phase.

🎯 Bullish Targets:

1.00 – 1.20 → first major swing resistance

1.70 – 2.50 → extended targets if momentum accelerates

Potential formation of the first higher-high since the downtrend began

Large wedges often produce explosive upside once broken due to long-term volatility compression.

---

📉 Bearish Scenario (Final Breakdown & Capitulation Risk)

If the wedge support fails to hold (0.45 – 0.50 area), WLD may enter a capitulation phase.

Bearish confirmation includes:

A decisive 5D close below the wedge

No immediate recovery (no reclaim)

Increasing selling volume

If breakdown occurs, expect:

🎯 Bearish Targets:

0.33 → mid-level support

0.20 → extreme support (already marked on the chart)

Large wedge breakdowns often trigger a sharp liquidity flush before any meaningful recovery.

---

📌 Key Takeaways

WLD is at the most critical zone within its long-term falling wedge.

Tightening volatility = major accumulation or distribution underway.

Breakout = potential trend reversal.

Breakdown = potential capitulation phase.

When multi-month compression breaks, the move is usually fast and aggressive.

#WLD #WLDUSDT #Worldcoin #FallingWedge #CryptoAnalysis #PriceAction #BreakoutSetup #ReversalPattern #CryptoTrading

#WLD/USDT Pump Anticipated#WLD

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.623. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.628

First target: 0.633

Second target: 0.641

Third target: 0.652

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#WLD/USDT Pump Anticipated#WLD

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at the price of 0.683, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.698

First target: 0.708

Second target: 0.726

Third target: 0.740

Don't forget a simple money management rule:

Place your stop-loss order below the support zone in green.

Once the first target is reached, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#WLD/USDT — The Final Defense Zone: Decision Time for Worldcoi#WLD

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at the 0.770 price level, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.786

First target: 0.801

Second target: 0.820

Third target: 0.842

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once the first target is reached, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

WLD/USDT – Decision Point: Major Reversal or Bear Continuation?WLD/USDT is now sitting right at one of the most critical accumulation zones of the year, between 0.73–0.595 — the same area that previously triggered two significant rallies.

However, this time the setup looks different. The price structure remains in a clear downtrend, and the recent long lower wick signals a liquidity sweep — a battle zone between smart money accumulation and panic selling.

This yellow zone is the make-or-break level for WLD’s broader trend.

If it holds, we could witness the early stages of a major trend reversal.

But if it breaks cleanly below, the market may enter a distribution and continuation phase toward the historical lows near 0.33–0.26.

---

Bullish Scenario – Reversal from Demand Zone

A strong reaction from 0.62–0.73, followed by a confirmed 3D/weekly close above 0.875, could mark the first sign of bullish control returning.

A successful retest of 0.73 as new support would offer an ideal confirmation entry.

Upside targets:

→ 1.125 – 1.36 (first reaction zone)

→ 1.905 (major resistance and key pivot)

→ If momentum extends, next zone around 3.76 becomes reachable.

Bullish Narrative:

“If this accumulation base holds once again, WLD could be setting up one of the most interesting bottom reversal structures of Q4 2025.”

---

Bearish Scenario – Breakdown and Capitulation

A confirmed 3D/weekly close below 0.595 would invalidate the accumulation zone.

A failed retest afterward could accelerate the decline toward 0.33, and potentially retest 0.262 as a historical support level.

Such a move could mark a final capitulation phase before long-term accumulation resumes.

Bearish Narrative:

“If 0.595 gives way, it’s not just a technical breakdown — it’s a loss of short-term structural confidence. The market could seek deeper liquidity before finding stability again.”

---

Technical Structure & Pattern

Primary trend: Medium-term downtrend with a descending price structure.

Yellow zone: Key demand/accumulation area repeatedly tested, reflecting an institutional tug-of-war.

Liquidity sweep: The deep lower wick beneath the zone indicates a stop-hunt event — typical before major reversals or continuation breakdowns.

---

Strategic Notes

Watch higher timeframes (3D/weekly) for confirmation; avoid reacting to intraday noise.

Conservative entries: wait for a confirmed close and retest above 0.875 (bullish) or below 0.595 (bearish).

Stop-loss strategy: place it outside the accumulation zone boundaries to avoid being swept by volatility.

Volume confirmation is crucial — breakouts without volume risk turning into false moves.

---

Conclusion

WLD is currently balancing between accumulation and distribution — a tipping point where market direction for the coming quarter will be decided.

If buyers defend 0.73–0.595, a strong reversal structure could form.

If not, sellers will likely regain control and drive price into new low territories.

Either way, this zone defines the next major trend for WLD.

---

#WLDUSDT #Worldcoin #CryptoAnalysis #TechnicalAnalysis #PriceAction #SupportResistance #DemandZone #BreakoutOrBreakdown #ReversalZone #CryptoMarket #SmartMoney #TrendAnalysis

#WLD/USDT#WLD

The price is moving in an ascending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.883, representing a strong support point.

We are heading for stability above the 100 moving average.

Entry price: 0.900

First target: 0.912

Second target: 0.938

Third target: 0.963

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#WLD/USDT Pump Anticipated#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.875, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.889

First target: 0.904

Second target: 0.923

Third target: 0.942

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

WLD/USDT — The Final Defense Zone: Decision Time for Worldcoin!Worldcoin (WLD) is currently testing its final line of defense, sitting firmly inside the key demand zone between 0.877 – 0.75 USDT.

This area has historically acted as a major accumulation base and a strong bounce zone for months.

However, the latest 2D candles are revealing growing selling pressure, as buyers attempt to defend the level once again.

The market structure shows a gradual loss of bullish momentum, yet this zone still holds the potential for a significant structural reversal — if buyers can reclaim control with volume confirmation.

At this stage, WLD is standing at a make-or-break point, and the next reaction here could define its direction for the rest of the quarter.

---

Technical Structure & Pattern

Price has been trading in a wide consolidation range since March 2025.

A sequence of lower highs confirms sustained bearish pressure.

The 0.877 – 0.75 USDT zone remains the most critical demand area where previous accumulation took place.

Recent candles indicate a liquidity sweep / false breakdown, suggesting the presence of smart money accumulation beneath support.

Overall, WLD is now in a critical inflection phase — preparing for either a rebound or a continuation breakdown.

---

Bullish Scenario

Confirmation: Strong bullish rejection or engulfing candle within 0.75–0.877 zone on the 2D timeframe, supported by rising volume.

Upside Targets:

1️⃣ 1.344 USDT → minor structure retest

2️⃣ 1.524 USDT → first resistance cluster

3️⃣ 1.947 USDT → key resistance zone

A decisive close above 1.95 USDT would confirm a trend reversal and potentially open a mid-term rally toward 3.80 – 4.20 USDT.

---

Bearish Scenario

Confirmation: 2D candle closes below 0.75 USDT with high volume — confirming a full breakdown of the demand zone.

Downside Targets:

1️⃣ 0.45 USDT → major liquidity pool & historical support

2️⃣ 0.25 – 0.30 USDT → final accumulation zone

Such a move would confirm a macro downtrend continuation, possibly marking a capitulation phase before the next long-term bottom forms.

---

Conclusion

The 0.877 – 0.75 USDT range is the most critical price zone for WLD right now.

If buyers manage to defend this area, a strong recovery rally could emerge toward 1.3–1.9 levels.

But if it breaks down, the market could witness another leg of bearish continuation, targeting deeper support zones unseen since early cycle lows.

> This isn’t just a support zone — it’s Worldcoin’s Final Defense.

---

#WLDUSDT #Worldcoin #CryptoTA #TechnicalAnalysis #BreakoutWatch #SupportZone #MakeOrBreak #ReversalSetup #AltcoinAnalysis #SmartMoney #CryptoTrading

#WLD/USDT LONG SET UP ALERT#WLD

The price is moving in a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a major support area in green that pushed the price higher at 0.919.

Entry price: 0.942.

First target: 0.969.

Second target: 1.01.

Third target: 1.06.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#WLD/USDT — Retest at the Golden Zone. Bullish Momentum#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 1.54, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 1.57.

First target: 1.59.

Second target: 1.63.

Third target: 1.67.

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

WLD/USDT — Bullish triangle breakout (1H)WLD formed a symmetrical triangle after a sharp advance. The price has broken above the triangle’s descending trendline with bullish follow-through candles. Buyers have been defending the rising lower trendline, and RSI has recovered from mid-range to ~59 — momentum is building but not overbought.

Key observations

Pattern: Symmetrical triangle → breakout to the upside on the hourly chart.

Candles: Breakout candle followed by bullish follow-through; watch for a clean retest of the breakout trendline as confirmation.

Momentum: RSI ~59 (room to run).

Support: 1.53 (strong demand area and triangle base).

Immediate resistance cluster: 1.87 → 2.02 → 2.23.

Trade plan (if you choose to take it)

Entry: 1.65 – 1.70

Stop loss: 1.53 (invalidation of triangle breakout)

Targets:

T1: 1.87 — Expected profit ≈ 10.00% – 13.33% (entry 1.70 → 1.65).

T2: 2.02 — Expected profit ≈ 18.82% – 22.42%.

T3: 2.23 — Expected profit ≈ 31.18% – 35.15%.

Risk if stopped: loss ≈ 7.27% – 10.00% (depending on entry within the range).

Risk notes / invalidation

Loss of 1.53 would invalidate the breakout and likely push price back to lower supports; treat 1.53 as the key invalidation level.

Ideal confirmation: retest of breakout trendline with clean rejection and/or volume confirmation.

Not Financial Advice | DYOR !!

WLD/USDT — Retest at the Golden Zone. Bullish Momentum Continue?📝 Full Analysis & Narrative

The WLD/USDT chart (2D timeframe, Binance) is showing one of the most exciting moves in recent months. After being pressured in a prolonged downtrend, the price finally printed an explosive breakout, breaking through significant resistance with a strong bullish candle, and leaving a long upper wick up to the 1.93 USDT area.

However, the euphoria quickly faded with a strong rejection at that resistance zone. At present, price is once again testing the Golden Zone (Fibonacci 0.5–0.618 at 1.357–1.519), which also coincides with a new support area after the role flip from previous resistance.

This makes the yellow zone a critical level:

If the zone successfully holds selling pressure, WLD has strong potential to continue its bullish rally.

On the other hand, if the zone breaks down, the market may treat the previous breakout as a false breakout, opening the way for a deeper decline.

---

🔎 Structure & Pattern

Previous trend: Long bearish phase → accumulation stage → impulsive breakout.

Current pattern: Breakout + Retest (confluence support at the Golden Zone).

Liquidity event: The long wick above 1.93 indicates a stop-hunt before retracement.

Confluence: Fibonacci retracement 0.5–0.618, historical support, and psychological level at 1.5.

This setup is commonly referred to as a “Breakout-Retest-Continuation” in price action, but it is also prone to becoming a bull trap if the support fails.

---

🚀 Bullish Scenario

1. Price holds within the 1.357–1.519 zone with a bullish rejection candle → potential rebound.

2. Additional confirmation: A 2D close above 1.93 → validates bullish momentum.

3. Step-by-step upside targets:

2.316 (minor resistance)

2.794 (major supply zone)

3.780 → 4.397 → 5.913 (mid-to-long-term Fibonacci extension and historical resistance levels).

---

📉 Bearish Scenario

1. Price breaks down and closes 2D below 1.357 → invalidation of the Golden Zone.

2. Selling pressure intensifies, opening room for further downside:

1.00 (psychological support)

0.80 (minor support)

0.573 (historical swing low, last demand zone)

3. Such breakdown would confirm a false breakout and likely trigger distribution.

---

📊 Conclusion

The Golden Zone (1.357–1.519) is the ultimate key area.

As long as price holds above this zone, the bullish trend remains valid with potential towards 1.93 and beyond.

Failure to hold opens the risk of a sharp correction back to the 1.00–0.57 area.

The 2D candle close & volume are the most important confirmations to watch.

Remember: this is an area full of both opportunity and risk. Proper risk management is essential.

---

#WLDUSDT #WLD #Altcoin #Crypto #Breakout #Fibonacci #GoldenZone #PriceAction #TechnicalAnalysis #SupportResistance #Bullish #Bearish #SwingTrade #DYOR

WLDUSDT — Decision Point at the Edge of the TriangleChart Structure:

WLD/USDT has been forming a large descending triangle for months.

The chart shows a series of lower highs pressing down against a flat base support at $0.80–$0.90 (yellow box).

Current price sits around $0.87, right at the critical zone where a decisive move is highly likely.

---

🔎 Technical Pattern

Descending Triangle → typically a bearish continuation pattern, but it can also trigger a false breakdown before a major reversal.

This area now acts as a battlefield of accumulation vs distribution. If buyers hold the line, a bullish reversal is possible.

---

🚀 Bullish Scenario (Potential Reversal)

1. Key trigger: 2D candle close above the descending trendline and hold >$1.08.

2. Validation: Successful retest of $1.08 as new support.

3. Upside targets:

$1.21 → first resistance

$1.63 → strong supply zone

$2.32 → mid-term target

$3.80–$4.20 → major supply zone if momentum continues

4. Invalidation: Failure to stay above $0.95 after breakout.

---

📉 Bearish Scenario (Potential Breakdown)

1. Main trigger: 2D close below $0.80 (triangle base breakdown).

2. Validation: Retest $0.80–$0.85 as resistance.

3. Downside targets:

$0.63 → minor support

$0.57 → historical low

4. Invalidation: Quick reclaim and hold above $0.90–$0.95.

---

⚖️ Conclusion

WLD is entering a make-or-break phase.

A confirmed breakout could start a recovery trend with upside targets up to $2.32 and beyond.

A breakdown, however, could lead to capitulation toward $0.63–$0.57.

As price is now compressed at the tip of the triangle, a major move is imminent.

---

✍️ Suggested Caption for TradingView

“WLDUSDT is at a critical decision point inside a descending triangle.

Bullish case: Break and hold above $1.08 → targets $1.21 / $1.63 / $2.32.

Bearish case: Breakdown below $0.80 → targets $0.63 / $0.57.

The market is about to decide — accumulation or capitulation?”

#WLDUSDT #Worldcoin #CryptoAnalysis #TechnicalAnalysis #DescendingTriangle #SupportResistance #PriceAction #Breakout #Breakdown #CryptoTrading

WLD/USDT — Testing Major Demand Zone — Breakout or Bull Trap?Summary:

Price is sitting right inside a major demand zone (~0.90–1.10 USDT) after previously breaking above and then pulling back around the long-term descending trendline (yellow line). This zone has repeatedly acted as a strong floor — the next move (bounce & rally vs. breakdown) will set the medium-term direction.

---

Key Levels

Current price ≈ 1.014 USDT (dotted line).

Demand / support zone: ~0.90 – 1.10 USDT (yellow box).

Resistances / upside targets: 1.214, 1.401, 1.651, 1.895, 2.469 USDT.

Structural high: ~3.95 – 4.19 USDT.

Major low: 0.573 USDT.

---

Pattern Analysis

1. Multi-month descending trendline — the yellow line shows a sustained downtrend from Dec–Jan highs. Sellers have dominated until a potential structural shift.

2. Breakout & retest — price broke above the trendline earlier but fell back into the demand zone → this could be a breakout + retest (bullish) or a false breakout / bull trap (bearish) depending on confirmation from price & volume.

3. Range / consolidation — since March–May, price has been oscillating around the yellow box → a clear accumulation/demand area.

4. Lower highs structure is still visible on the higher timeframe — sellers are not fully out of the picture.

---

Bullish Scenario

Confirmation needed: Daily close above 1.214 USDT (stronger if backed by higher volume).

Conservative plan: Wait for a daily close > 1.214 and enter on a retest; stop below 1.01), stop tight at 0.88.

Example R:R (entry 1.014, stop 0.88):

Target 1: 1.214 → +19.7% upside, ~13.2% risk → R:R ≈ 1.5:1.

Target 2: 1.401 → +38.2% upside → R:R ≈ 2.9:1.

Target 3: 1.651 → +62.8% upside → R:R ≈ 4.8:1.

Note: Hold / trail stop after 1.401 break to maximize potential.

---

Bearish Scenario

Confirmation needed: Daily close below 0.90 with strong selling volume.

Downside targets: Next major support ~0.57 USDT, with intermediate zone around 0.63–0.75 likely tested first.

Example short setup: Entry after breakdown (<0.90), stop above 1.214. Entry 0.90, stop 1.214, target 0.573 → ~36.3% profit, ~34.9% risk → R:R ≈ 1.04:1 (less attractive unless strong confirmation).

Note: A breakdown of this demand zone could trigger a sharp sell-off — use stop-loss.

---

Key Confirmation Signals

Volume spike during breakout/breakdown (volume up = stronger validation).

Daily/weekly close above resistance or below support (avoid false wicks).

Momentum indicators: Bullish divergence on RSI / MACD cross for longs; bearish momentum (falling RSI, MACD cross down) for shorts.

Trendline reaction: Long upper wicks = rejection; clean close = strength.

---

Risk Management Tips

Confirm setups on daily + 4H before entry.

Limit risk per trade (e.g., 1–2% of capital).

Beware of bull traps — don’t overleverage on weak-volume breakouts.

Use trailing stops when in profit.

---

> WLD/USDT — Testing major demand zone (0.90–1.10).

Previous breakout failed to hold momentum → price is back inside the accumulation zone. Watch for daily close >1.214 (bullish) or breakdown <0.90 (bearish). Manage your risk.

#WLDUSDT #Worldcoin #CryptoAnalysis #SupportResistance #Breakout #Retest #BullVsBear #TechnicalAnalysis #RiskManagement

#WLD/USDT#WLD

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 0.890.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.900, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.939

First target: 0.959

Second target: 0.986

Third target: 1.016

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#WLD/USDT Approaching Breakout After Long-Term Downtrend !#WLD

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 1.00.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 1.02, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.08.

First target: 1.12.

Second target: 1.157.

Third target: 1.20.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

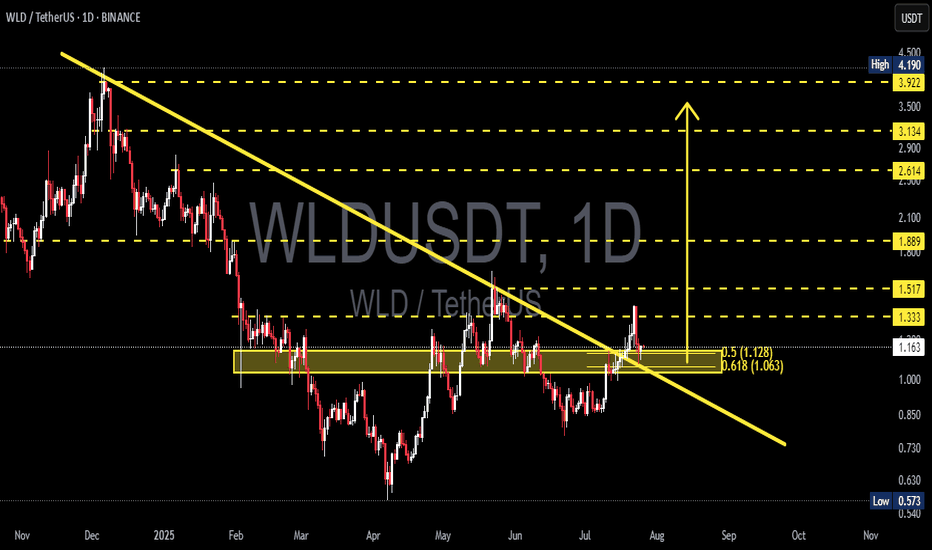

WLDUSDT at a Critical Level: Valid Breakout or Just a Fakeout?WLDUSDT is catching traders' attention after successfully breaking above a long-term descending trendline that has capped price since late 2024. But the big question now is — is this the start of a real trend reversal, or just a classic bull trap fakeout?

---

📌 Detailed Technical Breakdown

🟡 1. Major Trendline Breakout

The yellow trendline drawn from November 2024 has finally been broken to the upside.

This is a potential signal that bearish momentum is weakening significantly.

🟨 2. Key Demand Zone (Horizontal Yellow Box)

The area between 1.063 – 1.128 USDT has acted as a strong demand/support zone since March 2025.

Price is currently retesting this zone, which makes it a decisive level for validating the breakout.

🔁 3. Fibonacci Retracement Levels

Price is retesting the 0.5 (1.128) and 0.618 (1.063) retracement levels.

These fib levels could serve as a launchpad for a bullish continuation if held.

🧱 4. Layered Resistance Structure

If the bounce holds, WLD could target:

🔹 1.333 – Psychological resistance

🔹 1.517 – Previous structural resistance

🔹 1.889 – Key horizontal level

🔹 2.614 – 3.922 – Medium-term targets based on historical structure and fib extension

---

🟢 Bullish Scenario (Increasing Probability)

Price holds above the 1.063 – 1.128 zone and confirms a rebound.

A daily close above 1.333 would further confirm bullish continuation.

Formation of higher highs and higher lows would validate trend reversal.

🔴 Bearish Scenario (If Breakdown Occurs)

Price loses support at 1.063, invalidating the breakout and retest.

Possible targets to the downside:

Minor support: 0.85 – 0.75

Major support: 0.573 (Previous macro low)

---

📈 Interesting Chart Pattern

Potential formation of an Inverse Head and Shoulders, with the neckline around 1.333.

A confirmed breakout above the neckline could trigger a strong bullish impulse.

---

🎯 Conclusion

WLD is now in a golden zone that will decide its medium-to-long-term trend.

The 1.063 – 1.128 area is make-or-break. If bulls defend this zone, it confirms trend reversal. If it fails, WLD could slide back into a distribution range.

📌 Traders who wait for confirmation at this stage may have the strategic edge.

#WLDUSDT #WLDAnalysis #CryptoBreakout #TrendlineBreak #TechnicalAnalysis #InverseHeadAndShoulders #FibonacciSupport #AltcoinSetup #CryptoTrading #CryptoUpdate

#WLD/USDT Approaching Breakout After Long-Term Downtrend!#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 1.200.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.170, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.250.

First target: 1.288.

Second target: 1.321.

Third target: 1.373.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.