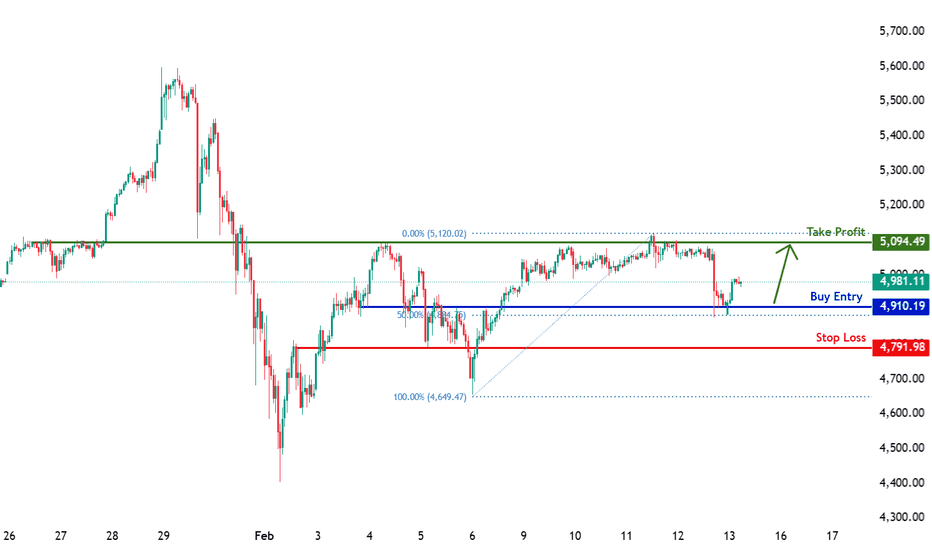

GOLD H1 | Bullish Bounce Off Key SupportThe price has bounced off our buy level entry at 4,910.19, which acts as an overlap support slightly above the 50% Fibonacci retracement.

Our stop loss is set at 4,791.98, whichis a pullback support.

Our take profit is set at 5,094.49, which has been identified as an overlap resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLChttps://fxcm.com/en: Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Xau-usd

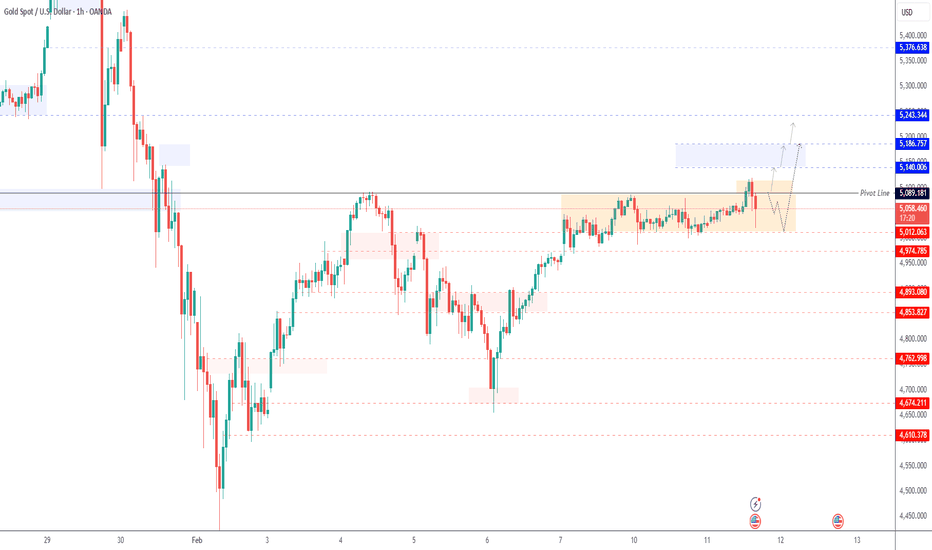

GOLD | Rebounds Ahead of U.S. CPI DataGOLD | Rebounds Ahead of Key U.S. Inflation Data

TVC:GOLD bounced from a near one-week low as markets prepare for the U.S. CPI release, which could shape expectations for the Federal Reserve’s next move after strong jobs data reduced rate-cut hopes.

With volatility elevated, major levels are likely to trigger accelerated price moves.

Technical Outlook

Gold remains bearish while trading below the 4983–5012 zone, with downside targets at 4893 and 4853.

A move above 5012 would shift momentum bullish toward 5090, followed by 5138.

CPI Scenarios

• Below 2.5% → bullish toward 5090 – 5138

• Above 2.5% → bearish toward 4893 – 4853

• At 2.5% → high volatility, bullish bias

Key Levels

• Pivot: 4983

• Support: 4893 – 4853 – 4762

• Resistance: 5012 – 5090 – 5138

GOLD | Consolidation Ahead of BreakoutGOLD | Consolidation Range Ahead of Breakout

Gold is currently trading in a consolidation range between 5089 and 5012, with traders watching for the next directional breakout.

Technical Outlook

A 15-minute candle close above 5089 would confirm bullish continuation toward 5140, followed by 5186 and potentially 5243.

A move below 5012 would invalidate the bullish scenario and shift momentum bearish toward 4974 and 4893.

Key Levels

• Pivot: 5089

• Support: 5012 – 4975 – 4893

• Resistance: 5140 – 5186 – 5243

GOLD | Climbs Ahead of U.S. Jobs and Inflation DataGOLD | Rises Ahead of Key U.S. Jobs and Inflation Data

Gold climbed above $5,010, reaching a one-week high as investors await key U.S. economic data that could shape expectations for the Federal Reserve’s rate path.

Markets now focus on the U.S. jobs report and inflation data, both of which could drive the next major move in precious metals.

Technical Outlook

Gold remains in a range-bound structure near the pivot.

While trading below 5023, price could dip toward 4974, where a potential bullish rebound may begin if support holds.

A 30min or 1H candle close above 5023–5035 would confirm bullish continuation toward 5098 and 5141.

Key Levels

• Pivot: 5023

• Support: 4975 – 4930 – 4893

• Resistance: 5065 – 5098 – 5141

GOLD H1 | Pullback Resistance AheadBased on the H1 chart analysis, we could see the price rise to our sell entry level at 5,180.00, which is a pullback resistance that aligns with the 78.6% Fibonacci projection and also slightly below the 127.2% Fibonacci extension.

Our stop loss is set at 5,336..28, which is a pullback resistance that aligns with the 100% Fibonacci projection.

Our take profit is set at 4,889.78, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Bearish reversal off key resistance?Gold (XAU/USD) is reacting off the pivot, which is an overlap resistance that aligns with the 61.8% Fibonacci retracement and could drop to the 1st support.

Pivot: 5,090.85

1st Support: 4,687.93

1st Resistance: 5,445.03

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party.

Bullish bounce off?Gold (XAU/USD) has bounced off the pivot and could potentially rise to the swing high resistance.

Pivot: 4,630.21

1st Support: 4,396.12

1st Resistance: 5,450.68

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Potential bullish rise?Gold (XAU/USD) has bounced off the pivot, which is an overlap support, and could rise to the 1st resistance, which is a pullback resistance.

Pivot: 4,766.74

1st Support: 4,600.24

1st Resistance: 5,091.71

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?XAU/USD has bounced off the support level, which is an overlap support that is slightly above the 50% Fibonacci retracement and could rise from this level to our take profit.

Entry: 4,776.71

Why we like it:

There is an overlap support that is slightly above the 50% Fibonacci retracement.

Stop loss: 4,989.79

Why we like it:

There is a pullback support level that is slightly below the 78.6% Fibonacci retracement.

Take profit: 5,077.47

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GOLD H1 | Bullish Bounce Off Key SupportThe price has bounced off our buy entry level at 4,793.14, which is an overlap support that is slightly below the 38.2% Fibonacci retracement.

Our stop loss is set at 4,618.83, which is a pullback support that is slightly below the 61.8% Fibonacci retracement.

Our take profit is set at 5,094.49, which is an overlap resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

GOLD H4 | Could We See A Bounce?Based on the H4 chart analysis, we could see the price fall to our buy entry level at 4,854.29, which is a pullback support that is slightly above the 61.8% Fibonacci retracement.

Our stop loss is set at 4,530.22, which is an overlap support that aligns with the 78.6% Fibonacci retracement.

Our take profit is set at 5,557.89, whichis a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

GOLD | ATH at 5311 – Correction Below 5265 in FocusGOLD | New Record Above $5,300 as Dollar Pressure Intensifies

Gold prices surged to fresh record highs above $5,300, after President Donald Trump added pressure on the U.S. dollar by stating he was not concerned about currency declines. As a result, the most actively traded gold futures climbed to around $5,306 per ounce, marking a new intraday record and reinforcing strong safe-haven demand.

The combination of USD weakness, political pressure, and ongoing macro uncertainty continues to support gold, although short-term profit-taking is now emerging after the sharp rally.

Technical Outlook

Gold recorded a new all-time high at 5311 and is currently trading in a corrective phase.

While price trades below the 5265 pivot, a bearish correction is favored toward 5233 and 5216. From this zone, a bullish reaction is possible.

However, if price stabilizes below 5216, the correction could extend toward 5185 and 5163.

On the upside, a recovery above 5265 would support renewed bullish momentum toward 5282 and 5300.

A break above 5300 would reopen upside targets at 5328 and 5350.

Key Levels

• Pivot: 5265

• Support: 5233 – 5216 – 5185 – 5163

• Resistance: 5282 – 5300 – 5328 – 5350

previous idea:

GOLD | Breaks $5,100 as Shutdown & Geopolitical Risks RiseGOLD | Breaks Above $5,100 as Shutdown & Geopolitical Risks Fuel Rally

Gold surged above $5,100 per ounce, extending its historic rally after decisively breaking the $5,000 psychological level. The move comes as markets react to rising U.S. government shutdown fears, persistent geopolitical tensions, and expectations that the Federal Reserve may be approaching the later stage of its restrictive cycle.

With risk sentiment fragile and real yields under pressure, gold continues to attract strong safe-haven demand, keeping volatility elevated despite overextended conditions.

Technical Outlook

After the sharp upside move, price is expected to consolidate within the 5097–5077 zone before the next directional break.

A confirmed 15min or 1H close below 5077 would signal a deeper corrective move toward 5052, with further downside risk toward the 5000 psychological level.

However, price stability above 5052, and especially a hold above 5097, would keep the bullish structure intact and support a continuation toward 5140 and 5168.

Key Levels

• Pivot Zone: 5077 – 5097

• Support: 5052 – 5000

• Resistance: 5140 – 5168

Bullish continuation?Gold (XAU/USD) could fall towards the pivot, then bounce to the 1st resistance.

Pivot: 4,864.86

1st Support: 4,690.83

1st Resistance: 5,111.04

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish continuation?Gold (XAU/USD) is falling towards the pivot, which aligns witht he 38.2%Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 4,634.76

1st Support: 4,542.50

1st Resistance: 4,867.17

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

GOLD | New ATH Above $4,730 as Safe-Haven Demand SurgesGold Breaks Above $4,730 on Weaker Dollar & Safe-Haven Demand

Gold prices surged past the $4,730 level for the first time, supported by a weaker U.S. dollar and renewed safe-haven demand amid rising geopolitical and trade-related concerns.

The U.S. Dollar Index slipped to 98.70 (−0.7%), making gold more attractive for non-USD buyers.

At the same time, a mix of geopolitical uncertainty, concerns over central-bank independence, and elevated U.S. debt levels has unsettled investors, driving capital flows toward gold and silver over currencies and government bonds.

This comes after an already exceptionally strong performance for precious metals, reinforcing gold’s role as a hedge against policy and macro uncertainty.

Technical Outlook (GOLD)

The price pushed higher by approximately $110, exactly as outlined in the previous idea.

Short-Term Structure

While trading below 4733, a retest is likely toward 4718–4710

From this zone, bullish momentum is expected to resume

Bullish Continuation

A rebound from support would target: 4742

A confirmed break above 4742 opens the way toward: 4757 - 4784

Bearish Risk

A bearish scenario becomes valid only if geopolitical tensions ease

Sustained price action and stabilization below 4710 would shift momentum bearish

Key Levels

Pivot Line: 4733

Resistance: 4742 – 4757 – 4784

Support: 4710 – 4695 – 4678

PREVIOUS IDEA:

GOLD H4 | Bullish ContinuationBased on the H4 chart analysis, we could see the price fall to our buy entry level at 4,634.64, which is a pullback support.

Our stop loss is set at 4,530.22, which is an overlap support.

Our take profit is set at 4,761.21, there is a resistance level at the 61.8% Fibonacci projection.

High Risk Investment Warning

Stratos Markets Limited (

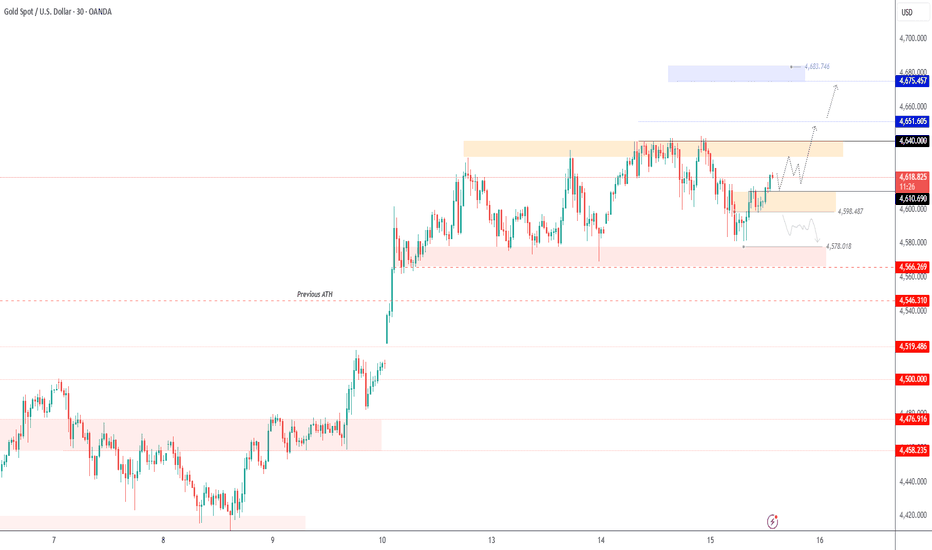

GOLD | Range-Bound Ahead of BreakoutGOLD | Overview

The price is consolidating between 4594 and 4612, awaiting a clear breakout.

Bearish Scenario

A confirmed 1H or 15-minute candle close below 4594 will support bearish continuation toward:

4578 - 4566

Bullish Scenario

Holding above 4612 supports bullish continuation toward: 4621 - 4640

Further upside extension may reach 4651

Key Levels

Pivot Line: 4612

Resistance: 4621 – 4640 – 4651

Support: 4594 – 4578 – 4566

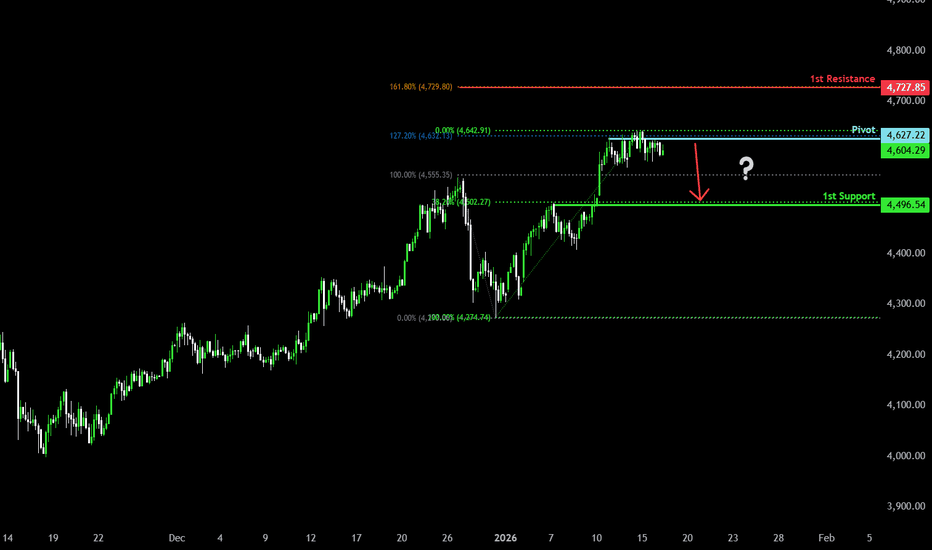

Could we see a reversal from this level?Gold (XAU/USD) is reacting off the pivot and could drop to the 1st support level which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Pivot: 4,627.22

1st Support: 4,496.54

1st Resistance: 4,727.85

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

GOLD | Profit-Taking Within Bullish StructureGold Falls on Profit-Taking as Iran Fears Ease

Gold prices slipped as investors booked profits after the metal posted a record high on Wednesday. Additional pressure came from easing concerns over imminent U.S. military action against Iran, reducing short-term safe-haven demand.

Sentiment was further weighed down by President Trump’s softer tone toward Federal Reserve Chair Jerome Powell. In an interview with Reuters, Trump stated that he has no plans to remove Powell, despite the ongoing Justice Department investigation.

Markets are now focused on U.S. weekly jobless claims for further clues on the Fed’s policy outlook, as expectations for lower interest rates tend to support non-yielding assets such as gold.

Technical Outlook (GOLD)

The broader structure remains bullish, though the market is currently undergoing a corrective phase.

Above 4610: Bullish momentum remains active

Upside targets: 4630 – 4640

A confirmed 15M or 1H close above 4640 would open the way toward:

4651 - 4675

Bearish / Corrective Scenario

A move below 4598 would shift momentum into a bearish correction, targeting:

4578 - 4566

A confirmed break below this zone would expose further downside toward:

4546 - 4519

Key Levels

Pivot Line: 4610

Resistance: 4630 – 4640 – 4675

Support: 4598 – 4578 – 4566

Could we see a reversal from here?XAU/USD is reacting off the resistance level, which aligns with the 127.2% Fibonacci extension and could reverse from this level to our take profit.

Entry: 4,637.70

Why we like it:

There is a resistance level at the 127.2% Fibonacci extension.

Stop loss: 4,718.74

Why we like it:

There is a resistance level at the 161.8% Fibonacci extension.

Take profit: 4,498.14

Why we like it:

There is a pullback support level that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GOLD | Bullish Structure Supported by Macro RisksGold and Silver Prices Expected to Shine Even Brighter

Renewed geopolitical tensions, ongoing concerns about the independence of the U.S. Federal Reserve, and weak fiscal discipline in the United States are expected to continue supporting strong investment inflows into precious metals.

While confirmation of a U.S. import tariff exemption could ease some short-term supply tightness, the market remains structurally undersupplied. Combined with China’s export controls and robust industrial demand, gold and silver prices are expected to stay well supported in the medium term.

Technical Outlook (GOLD)

The overall trend remains bullish while price trades above 4621

A confirmed 15-minute close above 4638 would support upside continuation toward:

4651 - 4675

Further extension could reach 4685

Corrective Scenario

A move below 4638 may trigger a short-term correction toward 4621

A confirmed 1H or 15-minute close below 4621 would extend the correction toward:

4598

Key Levels

Pivot Line: 4638

Resistance: 4651 – 4675 – 4685

Support: 4621 – 4598 – 4578

Falling towards pullback support?Gold (XAU/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 4,495.44

1st Support: 4,404.03

1st Resistance: 4,612.12

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party