The price fell as expected. Waiting for a rebound?Gold prices fell as expected. Quaid recommends maintaining the strategy and waiting for a rebound before continuing to short.

The 1-hour moving average has begun to turn downward, and gold bullish momentum is gradually weakening. US data is slightly bearish, and short-term fluctuations and declines will continue. Despite a slight rebound to 3745, downward pressure remains. Currently, the price is suppressed by the downward trend line, so shorting is still necessary for rebounds.

Gold bullish momentum is gradually weakening. Following the market trend and executing a short-selling strategy at the rebound high is market insight.

The short selling strategy near position 3755 remains unchanged, waiting for a rebound to continue short selling. If you want to trade aggressively, you can go long with a light position around 3715, and the profit point is above 3735.

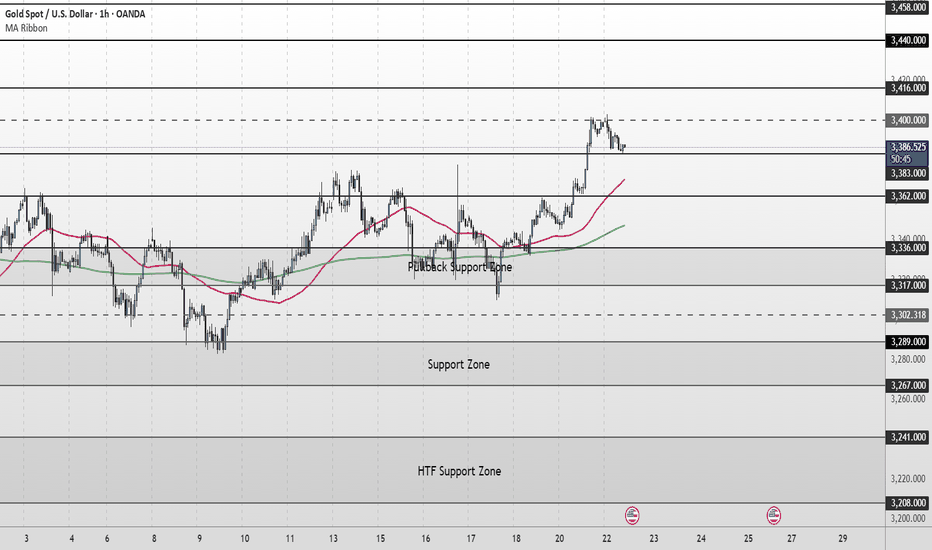

Xauusd1h

A weak rebound? Bearish sentiment persists.Gold saw a correction in the market on Wednesday, starting to decline after rebounding from the high of around 3778 in the European session and continuing into the U.S. session. The lowest point was around 3717, a drop of about 60 US dollars, which was also a heavy blow to the bulls in the recent continuous market.

In a pattern of significant gains, without a significant correction, upward momentum will eventually falter. The previous day's high and Wednesday's early Asian session levels also act as key resistance points for bulls. After hitting 3717 in the US market, prices are currently rebounding.

Considering the previous gains, the current pullback is not significant. Key resistance is currently around 3755, a key short-term watershed. In the short term, try to short at this position and wait for the second pullback correction. Quaid recommends maintaining short positions near 3755. If there is a significant upward movement in the European session, consider adjusting positions before the US market opens.

Trading strategy:

Short around 3755, stop loss at 3765, profit range 3730-3720-3700.

Gold prices are correcting and entering a period of volatility.Gold prices rebounded slightly after a sharp drop on Wednesday and are currently fluctuating slightly.

From a news perspective, speculation about the continued effectiveness of the Federal Reserve's rate cuts and the entry of global central banks into an era of monetary easing have led to a depreciation of the US dollar, while non-US currencies have temporarily appreciated due to the depreciation of the US dollar. Excessive money supply will also lead to global currency depreciation.

Gold prices have continued to fluctuate at high levels, testing support at 3750 and 3715. However, they are still some distance from a top-bottom reversal. However, the upward rebound in early Asian trading coincided with a new top-bottom reversal, with resistance concentrated around $3750.

There are currently two positions that need attention, the pressure position of 3750 and the support position of 3710. If either direction is broken within this range, the trend will continue. Short-term volatility is a normal trend, and we should accept this periodic correction.

On Thursday, Quaid recommends a light short position at 3750, with a move to long positions appropriate if the price touches 3710-3715. Focus on a breakout of the 3750-3710 range.

Gold is under pressure. Is a correction underway?Gold is fluctuating at a high level on the daily chart, but short-term weakness is evident.

On the 4-hour chart, prices have fallen below the range and are currently under pressure near 3750. The candlestick chart continues to trade below the short-term moving average, indicating a generally volatile and weak pattern. The recent rebound has approached a key resistance zone, and a correction is likely after the rebound correction is complete.

Although a reversal has formed on the 1-hour chart, the price has stagnated near the pressure band, and the MACD technical indicator has shown a divergence signal. The price is gradually approaching the lower track of the Bollinger band, indicating that the short-term momentum is gradually weakening and there is a probability of turning to adjustment.

From a comprehensive technical perspective, gold faces downside risks in the short term. The strength of the correction and the performance of key support levels are key. Focus on the resistance level of 3750 on the upside and the support level of 3715 on the downside.

Trading Strategy:

Short around 3755, stop loss at 3765, profit at 3730-3720-3710.

Long around 3710, stop loss at 3700, profit at 3740 or above.

Gold continues to fluctuate. Will it hit a new high?Information Summary:

Federal Reserve Chairman Powell delivered his first public speech since the September policy meeting. He stated that the Fed faces a challenging situation, with the risk of faster-than-expected inflation remaining. Job growth remains weak, raising questions about the health of the labor market.

Compared to the tone of the gold market last week, Powell's speech contained no significant content that could alter gold's upward trajectory. Geopolitical developments also provided support for gold prices. Expectations of rate cuts, concerns about the Fed's independence, and geopolitical developments all contributed to gold's strength.

Market Analysis:

Overall, gold's upward trend remains unchanged. After a slight pullback to 3750 on Wednesday, prices rebounded around 3780 before falling under pressure. In the short term, as long as gold does not fall below this week's 3735 starting point, the 3800 high remains a possibility. The upward trend remains intact, and long positions remain the main driver.

Looking at the 1-hour chart, the price retreated after encountering pressure at 3780, continuing to fluctuate slightly. Long positions are still possible around 3750 in the US market. If the US market continues to fluctuate, the 3800 mark may not be far behind.

Trading strategy:

Long positions at 3755-3750, stop loss at 3745, profit range 3780-3800.

Continued volatility? What to do?Gold surged and then retreated on Tuesday, reaching a high near 3790 before retracing during the US trading session. While the gains were significant, even with the pullback, they haven't wiped out yesterday's gains. Therefore, the current trend isn't weakening, but rather remains strong. The slight pullback is merely accumulating upward momentum, not a top signal.

Gold rebounded after testing 3750 in early Asian trading. Short-term strength remains strong, and the pullback hasn't continued, leaving the overall trend strong. If prices stabilize above 3750 in the short term, there's a high probability of another surge. As long as they don't fall below 3730, long positions are still viable. Currently, there are no valid topping or bearish signals, nor are there any negative news.

Trading strategy:

Go long near 3750, add to your position at 3730, set a stop-loss at 3725, and target profit ranges between 3780-3790-3800.

Gold rebound weak? A sharp correction?Information Summary:

NATO issued a strong warning regarding Russia's violation of Estonian airspace, heightening uncertainty in international relations. Gold, as a non-sovereign, default-free safe-haven asset, attracted significant safe-haven inflows.

US President Trump's statement, stating that Ukraine is expected to retake its former territory with NATO support, and his tough rhetoric regarding the Russia-Ukraine situation further rattled market sentiment. Meanwhile, during the UN General Assembly, he met with Muslim leaders from various countries to discuss the Gaza conflict and other issues, and these developments also caused significant fluctuations in gold prices.

Market Analysis:

Gold rose and then retreated on Tuesday, closing with a bullish candlestick pattern with an upper shadow. This candlestick pattern reveals two signals. From a bullish perspective, the real body of the bullish candlestick indicates that the overall market still has upward momentum, and the rise and fall have not completely reversed the short-term strong trend. However, the trend indicates resistance near 3790. Selling pressure has significantly increased near this key resistance level, and a brief tussle between bulls and bears has begun in this area.

Quaid believes that the short-term focus should be on market corrections. The current price correction is about to touch the lower track of the Bollinger band. If it stabilizes above 3750 in the short term, the price is expected to hit 3800 again. If the rebound in this correction is weak, the price will most likely retreat and touch 3700.

9/23: Focus on Shorts, Watch Support at 3712–3706Good morning everyone!

Gold extended its bullish momentum yesterday with a one-sided rally. After holding above 3680, price tested 3721 resistance, pulled back to 3712-3706 support without breaking, and then climbed further toward 3750.

📊 Technical Outlook:

30M chart shows bearish divergence, suggesting possible short-term pullback.

1H chart still supports the bullish structure, though momentum is slowing.

Daily close with a strong bullish candle confirms buyers remain in control, but profit-taking and psychological resistance near record highs could weigh on momentum.

📌 Trading Strategy:

Avoid chasing longs near 3750 and above; look for short opportunities in this zone.

Watch support at 3734-3728, with key zones at 3712-3706 / 3685. If support holds, consider long entries on pullbacks.

Gold is going crazy. Will it continue to break through?Gold hit a new all-time high near 3758 on Monday; on Tuesday, prices continued their relentless rise, currently reaching a high near 3791.

From a technical perspective, the Bollinger Bands have opened upward again, and the price is continuing to move within the upper Bollinger Bands, suggesting continued short-term gold gains. Gold is trading upwards, supported by the MA5 moving average. The trend is clear, with minimal room for correction. There's no strong resistance above. The 3780 resistance level I mentioned in the Asian session was strongly broken through in just five hours.

Short-term trading remains bullish, with support below the 1-hour line around 3735, and further retracement focusing on the 3725-3715 area. On the whole, the short-term operation strategy for gold is to mainly go long on pullbacks and short on rebounds. The short-term focus on the upper side is the 3790-3800 resistance, and the short-term focus on the lower side is the 3750-3740 support.

Gold fluctuated slightly. Waiting for an opportunity?Gold fluctuated upward on Monday, stabilized in the Asian session, and saw a sharp rise in the European and American sessions. The market on Monday continued the strong performance of last Friday, and gold performed strongly in the short term.

After recently breaking through the key resistance level of $3,703, gold broke through the previous high and set a historical high of $3,758. The $3,700 integer mark has changed from a resistance level to an important support level. The gold hourly moving average has formed a golden cross upward. The gold bulls are very strong upward. The gold highs are constantly being refreshed. The price pullback is an opportunity to go long.

From the 4-hour chart, the effective support below is maintained at around 3720-3725, and the key pressure above is maintained at 3770-3780. The resistance after breaking through will move up to the 3800 integer mark.

Trading strategy:

Go long around 3725, cover at 3715, stop loss at 3700, profit range 3750-3760-3780.

9/16: Watch Support at 3668–3652, Resistance at 3700✍️Good morning, everyone!

Key Support: 3668–3656

Key Resistance: 3700

Yesterday, gold repeatedly tested the 3643–3648 resistance area. During the pullback, the trend support held, and after consolidating, the price broke through resistance strongly. The overall move was in line with expectations (if it can stay above 3643–3658, it may test around 3668 with a chance of setting new highs).

After yesterday’s breakout, the price is now consolidating at high levels. Whether the bullish trend can be maintained depends mainly on support in the 3668–3656 (3648–3643) area. As long as this support holds, bulls may remain in control until tomorrow’s interest rate decision, with the possibility of testing the psychological level of 3700.

During the consolidation, trading can be focused around the 3682–3662 area.

If the price breaks out, selling opportunities may appear near 3692–3702, while buying opportunities can be considered around 3648–3636.

9/15: Ahead of Rate Decision, Market Enters ConsolidatioGood afternoon, everyone!

Key Resistance: 3643–3652

Key Support: 3633–3623 / 3616–3607

Trading Strategy

Focus on selling at highs and buying at lows within 3658–3628;

This week will be anything but calm — Wednesday’s rate decision is expected to spark another wave of volatility. Whether it turns into big profits or losses depends entirely on risk management, so make sure you’re prepared.

On the 30M chart, price remains capped below the 3643–3648 (extended to 3652–3658) resistance zone. This level is crucial:

A sustained breakout above could trigger another push toward 3668, with room for fresh highs;

Failure to break higher will likely lead to a pullback toward the 3600 area.

Regarding the FOMC decision: the market consensus is for a 25bp move. Any result above or below that would be considered a “surprise.” After the announcement, gold is more likely to follow a spike-and-reversal path — either a brief rally followed by decline, or a direct drop with a rebound later, entering a consolidation phase with a bearish tilt.

⚠️ Reminder: With such a key event ahead, keep positions light and always use stop-loss orders.

9/10: Watch Support Around 3600Good morning everyone!

🔹 Key Support Levels

30M Chart: 3628 / 3614–3600

1H Chart: 3623 / 3608–3598

2H Chart: 3623 / 3589

4H Chart: 3606

1D Chart: 3598

🔹 Key Resistance Levels

3643 / 3668–3678

🔹 Intraday Strategy

Sell on rallies, buy on pullbacks at support

Yesterday, bullish data drove gold up to around 3673 before retreating. Technically, the market is now heavily overbought, but strong fundamentals keep fueling bullish sentiment. While chasing profits, don’t overlook the risks!

Today, focus on 3643–3658 resistance. If price fails to hold above, a pullback is likely. Key supports are at 3600, then 3589–3574 / 3558.

9/9: Expect a Main Pullback Today, Likely to Drop Below 3600🌅 Good morning everyone!

🔹 Key Support Levels

30M : 3632 / 3615–3598

1H : 3626 / 3614–3588

2H : 3608–3590 / 3560

4H : 3613–3598 / 3681–3664

1D : 3564 / 3507–3498

🔹 Key Resistance Levels

3650–3670

🔹 Intraday Trading Strategy

Sell on rallies, especially near 3650 and above

Buy on pullbacks at support, focus on the 1H support zones

Trade mainly in short-term swings, quick in and out, secure profits early

Yesterday, gold pulled back to around 3577 before rebounding strongly. Currently, the 30M chart shows a bullish alignment. In the short term, watch 3650 as a key resistance. If broken, price may extend to 3658–3670.

🎯 Overall Outlook: Buy the dips, sell the highs. Focus on key support and resistance levels, avoid holding positions too long.

9/4: Short Squeeze Nearing End, Watch Key Support at 3500Good morning everyone!

🔹 Key Support Levels

30M Chart: 3547 / 3532–3528

1H Chart: 3521 / 3516–3509

2H Chart: 3541 / 3523–3480

1D Chart: 3514 / 3450

🔹 Key Resistance Levels

3563–3568 / 3578–3588

🔹 Intraday Trading Strategy

Focus on selling at higher levels; avoid chasing the rally.

Watch 3516–3509 / around 3500 as the main support zone. A short-term buy may be considered if tested, but positions should be taken with caution and closed quickly.

Yesterday, gold’s rally exceeded expectations. Although it encountered resistance near 3562 and briefly pulled back, the bulls managed to push prices further, reaching around 3578. This marks the late stage of the short squeeze, and a counterattack from the bears is almost inevitable. Meanwhile, external buying interest will likely turn more cautious at these elevated levels.

That said, the 3500 psychological level remains a critical battleground. Bulls are unlikely to give it up easily, and a rebound is very possible if prices revisit this area. However, bears will also defend aggressively, leading to a tug-of-war in the sessions ahead.

Therefore, it is crucial not to chase the rally. Secure profits in time — better to miss an opportunity than to hold onto losing positions. After a rally of over $200, the market needs to consolidate, even if a fake downside move occurs. Based on this outlook, today’s core strategy remains: sell on rallies.

9/2: Selling Pressure at 3500, Stay ShortGood evening, everyone!

Yesterday, gold pulled back during the session but held above the 3368–3363 support zone. Today, the price tested the 3500 resistance level, triggering selling pressure and falling from around 3510 to 3470. For now, the 3468–3463 support zone remains intact. However, if prices revisit the 3500 level, another round of selling pressure is highly likely. Therefore, the preferred strategy remains to sell into strength at higher levels.

Key Technical Levels:

30M chart: Resistance at 3492, with additional pressure above 3500; support at 3480.

1H chart: Key support around 3460.

2H chart: Major support near 3428.

Trading Strategy:

Prioritize short positions near or above 3500.

Consider light long entries near support, with 1H/2H chart support zones as primary references.

This analysis reflects my personal view and is for reference only. If you need more precise trading signals, feel free to reach out.

9/1: Be Cautious Chasing Highs, Focus on SellingGood evening, everyone!

Driven by rate-cut expectations and geopolitical tensions, gold opened today with a slight pullback but held above key support, then rallied strongly to around 3490. If the 3368–3363 support remains intact during the U.S. session, a test of the 3500 level cannot be ruled out.

However, given the sharp rally and entry into historical highs, chasing the upside is not recommended. My trading bias continues to favor selling into strength.

During a correction, the 3452–3447 support zone will be crucial; holding above it keeps the bullish trend intact.

If broken, focus shifts to the 3437–3423 support area.

At the 3500 mark, strong resistance is highly likely. A pullback from this level is almost certain — the only uncertainty lies in the extent of the retracement. This presents a relatively high-probability shorting opportunity.

Trading Strategy:

Conservative traders → Focus on short positions at higher levels.

Aggressive traders → May attempt tactical longs, but above 3488, selling remains the preferred approach.

Given the heightened volatility, risk management is critical. If you need more specific guidance, feel free to leave me a message.

8/28 Focus on Selling Above 3412Good evening, everyone!

Gold pulled back near 3398 earlier today but held above the 3386–3378 support before rallying again and breaking through the 3400 level. Price is now above 3410, with the next major resistance zones at 3412–3419–3427 (and previous highs at 3433–3438). These levels are likely to be tested multiple times, but the closer price gets to 3419–3427, the heavier the selling pressure will be.

📌 Key Supports: 3404–3398–3386

📌 Trading Plan: Above 3412, focus on sell setups first; then look for potential buy opportunities after pullbacks confirm support.

Stay calm, trade with the trend, and capture profits wisely.

Gold support has been confirmed, buy with confidenceThe most anticipated outcome for the gold market this week is tomorrow's CPI data. After today's pullback during the Asian and European trading sessions, the current price has reached support levels. Before the CPI release, I believe volatility will be minimal, with a high probability of limited fluctuations.

The chart shows that 3350 is a key support level. After several hours of testing, 3350 has stabilized, so we can buy at this level, with the initial target being 3360, followed by 3380.

XAU/USD Intraday Plan | Support & Resistance to WatchGold broke above the 3,362 resistance and extended its rally into the 3,400 resistance zone, currently trading around 3,386. Price remains comfortably above both the 50MA and 200MA, which are sloping upward and acting as dynamic support—keeping short‑term structure bullish.

A confirmed break and hold above 3,400 would open the path toward the next upside targets at 3,416 and 3,440, with 3,458 as a higher‑timeframe extension if momentum continues.

If price fails to sustain above 3,383–3,400 and begins to fade, watch the initial pullback toward 3,362.

A deeper move below that would shift focus to the Pullback Support Zone.

Failure to hold there could expose price to the Support Zone and potentially the HTF Support Zone if bearish pressure builds.

📌 Key Levels to Watch

Resistance:

3,383 ‣ 3,400 ‣ 3,416 ‣ 3,440

Support:

3,362 ‣ 3,336 ‣ 3,317 ‣ 3,302 ‣ 3,289

🔎 Fundamental Focus –

📌 Fed Chair Powell Speaks – key event that can move USD and gold sharply.

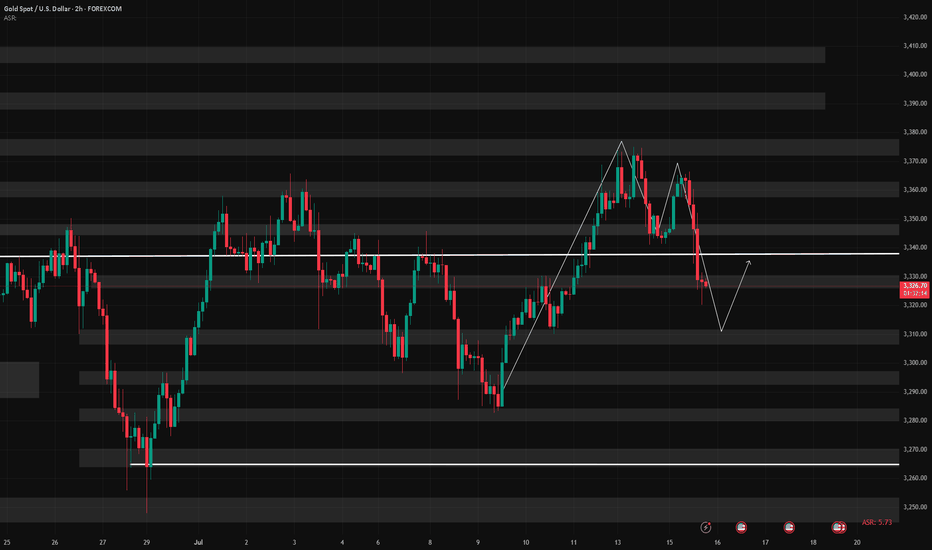

7/16: Will Gold Reclaim 3350 or Fall to 3250?During today’s session, gold briefly broke through the 3352–3358 resistance zone, but due to news-driven pressure during the pullback, bullish momentum weakened, and the price retreated to the MA60 support level on the daily chart.

Given the significant retracement, there is a possibility that a short-term bottom may form during the upcoming Asian session, potentially leading to a retest of the 3337-3343/3352-3358 resistance area:

If the price breaks above this zone and holds above it after a pullback, the bullish trend could resume;

However, if it fails to break through or is rejected again, caution is warranted, as this could signal a larger-scale downtrend on the weekly chart, possibly targeting the 3250 area.

7/15: Watch for Long Opportunities Around 3343 / 3332–3326Good morning, everyone!

Yesterday, gold rose into the resistance zone before pulling back, testing support around 3343. After today’s open, the price continues to consolidate near this support level.

On the 30-minute chart, there is a visible need for a technical rebound, while the 2-hour chart suggests that the broader downward movement may not be fully completed. The MA60 support area remains a key level to watch.

If support holds firm, the price may form a double bottom or a multi-bottom structure, potentially leading to a stronger rebound.

As such, the primary trading strategy for today is to look for long opportunities on pullbacks, with key levels as follows:

🔽 Support: 3343, and 3332–3326 zone

🔼 Resistance: 3352–3358, followed by the 3372–3378 upper resistance band