GOLD(XAUUSD): New Potential Zone For Swing And Intraday Buyers! Gold fell below our previous analysis’s expectations rendering it invalid. Consequently, we’ve identified two potential zones for buyers. One is safer while the other is riskier. You can choose either or both depending on your trading strategy.

Like and comment for more! We appreciate your support and hope it continues.

Team Setupsfx_

Xauusdbuy

GOLD: Latest update 04/02/2026! Dear traders,

Our last update on gold has been successful and we’re currently up over 1968 pips. This presents a good opportunity for you all to consider a second entry as the price has corrected. It’s possible the price will reverse from the area we’ve highlighted. Please remember to manage your risk accurately when trading gold as the market conditions are extremely volatile.

Good luck and trade safely.

Team Setupsfx_

Selena | XAUUSD – 1H – Short-Term Corrective StructurePEPPERSTONE:XAUUSD FOREXCOM:XAUUSD

Following the strong sell-off from the highs, XAUUSD formed a base near the 4400 liquidity zone, triggering a corrective bullish move. Price is now moving in a rising channel but remains below the higher-timeframe resistance and prior supply. As long as price holds above intraday demand, continuation toward the upper channel and resistance zone remains valid. However, rejection from supply could lead to another pullback within the range.

Key Scenarios

✅ Bullish Case 🚀 →

Sustained support above 4850–4900 keeps the bullish correction active.

🎯 Target 1: 5050 – 5100

🎯 Target 2: 5200 – 5300 (Channel Resistance)

❌ Bearish Case 📉 →

Failure to hold 4850 would weaken structure.

🎯 Downside Target 1: 4700

🎯 Downside Target 2: 4500 – 4400 (Major Demand)

Current Levels to Watch

Resistance 🔴: 5050 – 5100 / 5200 – 5300

Support 🟢: 4900 / 4500 – 4400

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

Eliana | XAUUSD – 30M | Range Reaction & Conditional ReversalPEPPERSTONE:XAUUSD OANDA:XAUUSD

After a sharp sell-off, XAUUSD found demand and bounced, indicating short-term buyer interest. Price is currently consolidating below trendline resistance and within a defined range. This creates a decision zone: either a bullish breakout above trendline resistance or a rejection leading to another sell-off toward lower liquidity.

Key Scenarios

✅ Bullish Case 🚀

Hold above 4,650–4,680 demand

Break & close above descending trendline

🎯 Target 1: 4,950

🎯 Target 2: 5,050–5,100 (range high / supply)

❌ Bearish Case 📉

Rejection from trendline resistance

Loss of 4,650 support

🎯 Target 1: 4,500

🎯 Target 2: 4,400 (liquidity sweep zone)

Current Levels to Watch

Resistance 🔴: 4,950 – 5,100

Support 🟢: 4,650 – 4,680

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

Selena | XAUUSD – 30M | Intraday Recovery From DemandFOREXCOM:XAUUSD PEPPERSTONE:XAUUSD

After a strong bearish impulse, XAUUSD reached a major intraday demand zone and printed a sharp rejection. Price is now attempting a corrective recovery, but upside remains capped by a descending trendline and supply zone around 4,900–4,930. The move currently looks like a pullback within a broader corrective phase.

Key Scenarios

✅ Bullish Case 🚀 (Intraday)

Holding above 4,760–4,780 support

🎯 Target 1: 4,900

🎯 Target 2: 4,930–4,960 (trendline + supply zone)

❌ Bearish Case 📉 (Failure Scenario)

Breakdown below 4,760

🎯 Downside target: 4,640–4,600 demand zone retest

Current Levels to Watch

Resistance 🔴: 4,900 – 4,960

Support 🟢: 4,760 → 4,640

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

Gold - Preparing the final blow off top!💰Gold ( OANDA:XAUUSD ) will rally a final +20%:

🔎Analysis summary:

Just in January alone, Gold is up another +25% so far. Looking at this very bullish parabolic rally, Gold remains super strong and is still not done with the bullrun. Until Gold retests the ultimate resistance trendline, it can easily rally another +20% from the current levels.

📝Levels to watch:

$6,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

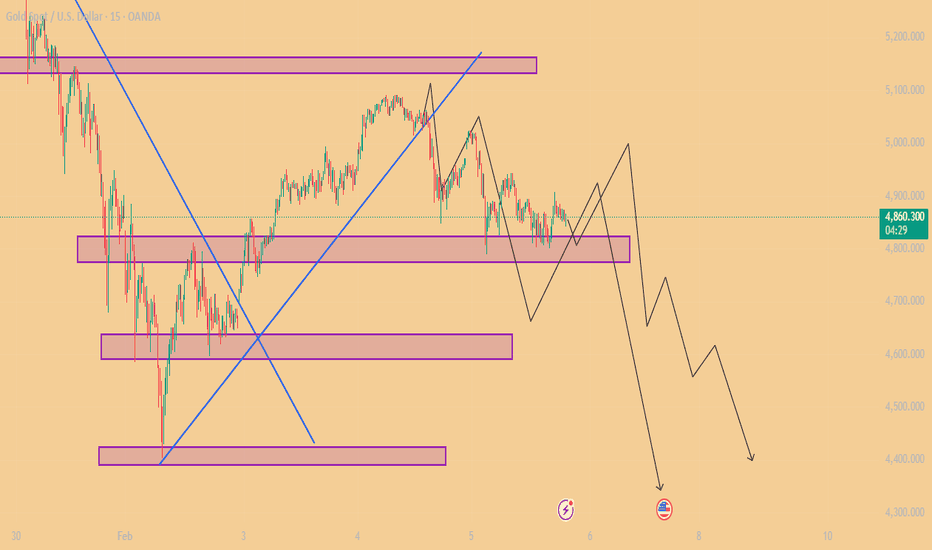

XAUUSD: Potential Bearish Structure and Key Retest LevelsMarket Overview: Gold (XAU/USD) is currently trading within a critical decision zone on the 15-minute timeframe. After a period of volatility and a sharp recovery from the 4,400 area, the price is now testing an established horizontal resistance zone near 4,860 - 4,870.

Technical Observations:

Supply Zones: We have a clear supply zone established around the 5,100 level and an immediate resistance block currently being tested at 4,863.

Trend Dynamics: The price recently broke through a descending trendline (blue), but the subsequent price action suggests a potential weakening of bullish momentum as it hits horizontal resistance.

Price Action Path: The projected path (black lines) indicates a high probability of a "Double Top" or a lower high formation if the current resistance holds. A failure to sustain above 4,800 could lead to a liquidity grab toward the lower support clusters.

Key Levels to Watch:

Immediate Resistance: 4,863 - 4,900

Major Resistance: 5,100 - 5,150

Support Level 1: 4,800 (Psychological level)

Support Level 2: 4,600 - 4,650

Demand Zone: 4,400

XAUUSD analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAU/USD Bullish Thesis Supported by Market Structure🔱 XAU/USD — Gold vs U.S. Dollar

Metals Market | Institutional Edge Plan (Day / Swing Trade)

📌 Market Bias

Primary Plan: 🟢 Bullish Continuation

Gold remains supported by macro flows, liquidity positioning, and risk-hedging demand. This plan focuses on buy-side participation with controlled risk, aligned with institutional behavior.

🧠 Execution Framework (Entry Logic)

Entry Method: 🧩 Layered Limit Entries (Liquidity-Based)

You may enter at any preferred price level,

however this strategy is designed around scaled limit entries to reduce emotional execution and improve average pricing.

Preferred Buy Zones (Limit Layers):

4900

4800

4700

4600

📌 Concept: Institutions rarely enter at one price.

They scale into positions where liquidity is resting and volatility shakes out weak hands.

🎯 Target Zone

Primary Objective: 5400

🔎 Target Logic Includes:

🚓 Strong Institutional Resistance Zone

📈 Overbought Conditions on higher timeframes

Potential Late-Buyer Trap

🔗 Intermarket Correlation Alignment

➡️ At this zone, probability favors profit protection over greed.

🛑 Risk Management

Protective Stop (Extreme Invalidation): 4500

📌 This level represents a structural failure of the bullish narrative.

⚠️ Risk parameters are personal.

Use this level as a reference, not a command.

⚖️ Trader Responsibility Notice

Dear Ladies & Gentlemen (Thief OGs),

You are not required to use only my TP or SL

Adjust position size, partials, and exits based on your own risk model

Capital preservation always comes before ego

💼 Professional traders manage risk first, profits second.

🔗 Related Markets to Watch (Correlation Dashboard)

💵 USD-Based Assets

DXY (U.S. Dollar Index):

⬇️ Weak USD = ⬆️ Supportive for Gold

USD/JPY:

Yen strength often aligns with risk-off flows benefiting XAU

📉 Bonds & Rates

US10Y Treasury Yields:

Falling yields = lower opportunity cost → bullish for Gold

📊 Risk Sentiment

S&P 500 / NASDAQ:

Equity stress or volatility spikes often redirect capital into Gold

🌍 Fundamental & Macro Factors in Play

Key Drivers Supporting Bullish Bias:

🏦 Central bank gold accumulation (reserve diversification)

📉 Real yield pressure amid policy uncertainty

🌍 Geopolitical & macro risk hedging demand

🧾 Sticky inflation narratives keeping Gold relevant as a hedge

Upcoming Factors to Monitor:

High-impact U.S. inflation data

Federal Reserve policy commentary

Labor market volatility & growth outlook signals

Global risk events influencing safe-haven flows

📌 Gold moves when confidence in fiat wobbles.

🧠 Institutional Mindset Reminder

Retail chases price

Institutions build positions

Liquidity tells the truth

Patience pays the premium

Thief Trader Wishes

“Take profits without noise.

Respect risk without fear.

Let the market pay you — don’t beg it.”

📈 Trade smart.

🧠 Stay disciplined.

💰 Secure the bag, protect the capital.

Gold (XAUUSD) 15M – Liquidity Sweep & Buy Reaction ZoneMarket Structure Overview

Overall structure shifted from bullish to bearish

Price made a lower high after the rejection near 5,070

Strong impulsive bearish leg broke prior support → confirms trend change

Current price is in a demand / liquidity zone around 4,800 – 4,770

📉 Key Observations

Previous bullish move failed → distribution phase

Clear break of structure (BOS) to the downside

Price is now compressing inside demand, showing slowing momentum

Wicks + consolidation suggest sell pressure is weakening

🟦 Support & Demand Zone

Major demand zone: 4,805 – 4,770

This zone previously caused a strong bullish reaction

Liquidity has already been swept below minor lows → good sign for a bounce

📈 Trade Idea (Based on Your Markup)

Bias: Short-term bullish retracement (counter-trend)

Entry zone: ~ 4,816

Stop-loss: ~ 4,767

Target: ~ 4,875

RR: Clean and favorable

📌 The projected move aligns with:

Demand reaction

Pullback into previous minor supply

Liquidity grab → reversal scenario

⚠️ Invalidation

A strong 15M close below 4,760

High-volume bearish continuation → bullish idea fails

🧠 Conclusion

This is a technical bounce setup, not a full trend reversal.

Best suited for:

XAUUSD: Bullish Push to 5340?FX:XAUUSD is eyeing a bullish breakout on the 1-hour chart , with price rebounding from the 0.786 Fib level near cumulative short liquidation, converging with a potential entry zone that could ignite upside momentum if buyers hold against short-term dips. This setup suggests a continuation opportunity amid recent volatility, targeting higher resistance levels with 1:2 risk-reward .🔥

Entry between 4840–4750 for a long position. Target at 5340 . Set a stop loss at a 4-hour close below 4590 , yielding a risk-reward ratio of 1:2 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging gold's momentum near the Fib level.🌟

Fundamentally , gold is trading around $5,052 in early February 2026, with key US Dollar events this week potentially weakening USD if data underperforms, favoring gold upside. On February 4 at 8:15 AM ET, ADP Employment Change (Jan, forecast 41K) could pressure USD on soft private hiring. February 5 at 8:30 AM ET brings Initial Jobless Claims (week of Jan 31, forecast 209K), with higher claims undermining USD strength. February 6 at 8:30 AM ET features the Employment Report (Jan, forecast 50K Non-Farm Payrolls, 4.4% Unemployment Rate), the week's highlight—weak figures could trigger USD selloff amid Fed cut bets. 💡

📝 Trade Setup

🎯 Long Entry Zone:

4750 – 4840

(Entry from current price is valid with proper risk & position sizing.)

🎯 Target:

5340

❌ Stop Loss:

4H close below 4590

⚖️ Risk / Reward:

≈ 1 : 2

💡 Your view?

XAUUSD 4H — Smart Money Breakout, Imbalance & Liquidity RoadmapThis XAUUSD analysis is built on structure, liquidity and smart money logic, not on guesswork.

After a long phase of accumulation, Gold printed a valid breakout and confirmed BOS, shifting the overall market narrative to the bullish side.

Price then created a higher high (HH) and respected previous structure, showing that institutions are in control of the flow.

During this move, the market left behind clear imbalances (FVGs) and order blocks (OB) — these are not random zones, they are areas where large orders were executed and price moved aggressively.

Markets rarely leave these inefficiencies unfilled, which is why they act as magnets for future price delivery.

The lower structure also shows a strong higher low (HL) with sell-side liquidity (SSS) already taken, confirming that weak sellers have been removed from the market.

This gives strength to the bullish continuation narrative.

The roadmap drawn on the chart highlights how price may react: • Price may revisit the imbalance + OB for mitigation

• After rebalancing inefficiency, continuation toward ATH and higher liquidity becomes possible

• Each pullback is not weakness — it is fuel for the next expansion

This is how smart money trades: They create breakouts, leave inefficiencies, return to them for rebalancing, and then continue in the true direction.

This analysis is not a signal — it is a story of how price is being engineered.

🧠 Final Thought

If you understand liquidity, imbalance and structure, you stop chasing price —

you start letting price come to you.

👉 Do you agree with this bullish roadmap, or do you see a different liquidity draw?

Comment your view below — let’s read the market together.

Selena | XAUUSD – 30M – Corrective Channel vs HTF TrendPEPPERSTONE:XAUUSD FOREXCOM:XAUUSD

After sweeping sell-side liquidity near 4,400 demand, price formed a controlled ascending channel. This move appears corrective rather than impulsive. Multiple internal supply blocks are present inside the channel, making this zone critical for either distribution and rejection or continuation toward HTF resistance.

Key Scenarios

✅ Bullish Case 🚀 →

Acceptance above channel resistance and internal supply opens upside continuation.

🎯 Target 1: 5,150

🎯 Target 2: 5,300 – 5,350

🎯 Extended: 5,550 – 5,600 (Major HTF Supply)

❌ Bearish Case 📉 →

Rejection from internal supply + trendline confluence resumes bearish continuation.

Current Levels to Watch

Resistance 🔴: 4,980 – 5,020 / 5,150 / 5,550 – 5,600

Support 🟢: 4,660 / 4,500 / 4,400

⚠️ Disclaimer: For educational purposes only. Not financial advice.

Eliana | XAUUSD – 15M – Intraday Market StructureOANDA:XAUUSD PEPPERSTONE:XAUUSD

After the sharp sell-off, XAUUSD formed a solid base near the 4600 liquidity zone, followed by a structured recovery. Price pushed into supply and got rejected, pulling back toward demand while still holding higher lows. As long as the demand zone holds, upside continuation toward higher resistance remains valid. A breakdown below demand would expose deeper liquidity before any continuation.

Key Scenarios

✅ Bullish Case 🚀 →

Holding above 4800–4850 keeps buyers in control.

🎯 Target 1: 5050

🎯 Target 2: 5140

🎯 Target 3: 5200+

❌ Bearish Case 📉 →

Failure to hold 4800 opens sell-side liquidity.

🎯 Downside Target 1: 4600

🎯 Downside Target 2: 4400

Current Levels to Watch

Resistance 🔴: 5050 – 5140

Support 🟢: 4850 – 4800 / 4600

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

GOLD (XAUUSD) — SMC Accumulation Complete | Targeting New ATHThis GOLD (XAUUSD) analysis is based purely on Smart Money Concepts & market structure, not indicators or emotions.

Price spent a long time in a clear Accumulation range, where smart money quietly built long positions while retail traders stayed confused.

The marked HH inside accumulation shows where liquidity was engineered before expansion.

After accumulation, price executed a classic manipulation move, sweeping sell-side liquidity below the range (HL), trapping weak sellers and fueling smart money entries.

📌 Key Confirmation:

The aggressive bullish displacement from the manipulation zone confirms institutional intent. This was not random — this was planned.

Now price is reacting into a Mitigation Block / Distribution zone, where previous sell orders are getting mitigated.

As long as GOLD respects this mitigation block, the bullish narrative remains valid.

🔍 Bullish Scenario:

• Healthy pullback or consolidation inside the mitigation block

• Liquidity taken ➝ continuation higher

• Targeting new ATH around 4730 and above

⚠️ Invalidation:

Only a strong acceptance below the mitigation block would delay the upside. Until then, dips are viewed as opportunities, not reversals.

This is how smart money builds trends: Accumulation ➝ Manipulation ➝ Expansion ➝ Continuation.

💡 If you wait for perfect clarity, you enter late.

If you understand liquidity, you enter with confidence.

💬 YOUR TURN

Do you see GOLD continuing toward a new ATH,

or do you expect deeper mitigation first?

👇 Comment your bias (Bullish / Pullback / Neutral)

🔁 Share this idea if it helped your market perspective

⭐ Follow for more Smart Money GOLD breakdowns

GOLD—Smart Money Bullish Continuation|Liquidity-Driven ExpansionThis GOLD analysis is built purely on Smart Money Concepts, focusing on structure, liquidity, imbalance, and institutional behavior — not indicators, not emotions.

Price has already delivered multiple clean Breaks of Structure (BOS), confirming a strong bullish market regime. Each BOS is followed by healthy pullbacks into premium demand zones, showing that buyers are in full control and selling pressure is only corrective.

The most recent impulse created a clear BISI (Bullish Imbalance) along with a well-defined Order Block (OB). This area represents unfinished business in price — zones where smart money is likely to rebalance positions before continuation.

Below the current price, we still have resting sell-side liquidity (SSS), which can act as a temporary draw for a controlled pullback. However, as long as price respects the highlighted OB + imbalance region, the higher-timeframe bullish narrative remains intact.

The projected path illustrates manipulation → mitigation → continuation, which is a classic institutional delivery model. Once mitigation is complete, the probability favors expansion toward higher liquidity pools, opening the door for new highs above the psychological 5000 area.

This is not a “signal” —

This is price telling its story through liquidity.

📌 Smart money doesn’t chase price — it waits for price to return to value.

💬 Your Turn

Do you expect: 1️⃣ A deeper mitigation into the OB

2️⃣ Or a shallow pullback with direct continuation?

👇 Share your bias in the comments

🔁 Repost if this aligns with your market view

⭐ Follow for more clean SMC & liquidity-based GOLD ideas

Eliana | XAUUSD – 15M – Intraday Corrective Bullish StructurePEPPERSTONE:XAUUSD OANDA:XAUUSD

After sweeping sell-side liquidity near 4,400, price shifted into a structured recovery. Multiple pullbacks were absorbed by demand inside the channel, keeping bullish momentum intact. However, upside remains reaction-based, with higher-timeframe resistance still active above.

Key Scenarios

✅ Bullish Case 🚀 →

As long as price holds above internal demand, continuation toward channel highs remains valid.

🎯 Target 1: 5,050 – 5,100

🎯 Target 2: 5,140 – 5,200

🎯 Extended: 5,300+

❌ Bearish Case 📉 →

Failure to hold demand and a breakdown of the channel opens downside continuation.

🎯 Downside Target 1: 4,680 – 4,650

🎯 Downside Target 2: 4,600

🎯 Extended: 4,400 (Major Demand / Liquidity Zone)

Current Levels to Watch

Resistance 🔴: 5,050 / 5,140 – 5,200

Support 🟢: 4,780 – 4,750 / 4,600 / 4,400

⚠️ Disclaimer: For educational purposes only. Not financial advice.

XAUUSD — Smart Money Reload Before Continuation📊 Gold Bullish Continuation | Liquidity, Imbalance & Order Flow in Play

Gold has already shown its hand.

After a strong bullish expansion, price delivered a deep corrective move into higher-timeframe value, clearing internal liquidity and mitigating smart money orders. This drop was not random — it was engineered to rebalance order flow before continuation.

🔹 Multiple BOS confirmations on the left confirm a healthy bullish structure.

🔹 The impulsive sell-off acted as liquidity sweep + discount delivery, tapping into a higher-timeframe Order Block.

🔹 From that OB, price reacted aggressively, showing strong bullish intent and displacement.

🔹 Currently, price is trading inside a balanced range (BISI ↔ SIBI) — a classic reload zone for smart money.

This zone represents fair value, where institutions often accumulate positions before targeting external liquidity.

As long as price holds above the BISI demand, the expectation remains: ➡️ Continuation toward previous highs (CRT High)

➡️ Expansion into premium liquidity

➡️ Potential for new highs once imbalance is fully resolved

⚠️ Any short-term pullbacks into this zone should be viewed as opportunities, not weakness — unless structure is violated.

📌 Smart money doesn’t chase price.

They wait for balance — then expand.

💬 Let’s Discuss

Do you see a deeper mitigation first, or direct continuation from here?

👇 Drop your bias in the comments

🔁 Share if this aligns with your Gold outlook

✍️ — Jayartolentiono90

Smart Money | Liquidity | Order Flow

Gold-focused analysis

🚫 No signals — only structure & logic

⭐ Follow for consistent SMC insights

Volatility has increased. Start short-term trading.In Wednesday's Asian market, we noted that market volatility had slowed down. The 1-hour chart still showed high-level consolidation, but there was no rapid upward movement. Current market fluctuations remain significant, and it's uncertain whether the market will continue to rise after a pullback during the US trading session. However, the current trend is still biased towards the bulls. Overall, we should first focus on the resistance level at 5100. The support level is at 4900-4850. Please don't question whether the fluctuation range is too large. Observing the market on Wednesday, from the Asian session to the opening of the US session, the fluctuation range has reached $200.

The recent market trend is quite clear: there's a dip around the 50 mark, followed by a rebound to the next round number. When pressure comes, the price will fall and begin to pull back. If it breaks through a support level, it will need to rise by at least 50 points before it cools down. Overall, the trend is still ongoing, but you should never use this pattern as a standard for opening positions; it should only be used as a reference.

The short-term trading strategy remains unchanged: short sell in small amounts on a pullback to 5100-5150 and wait for a retracement. Observe the strength of the pullback before deciding whether to buy.

Strategy Suggestions:

Short at 5000-5150, profit target 30-50 points.

Buy at 4880-4900, profit target 30-50 points.

I will post more strategies on the channel.

XAUUSD 1H – Rising Channel Breakout Toward 5,116Market Structure

Previous strong sell-off formed a V-shaped recovery.

Price transitioned into a higher high – higher low sequence.

Current price is consolidating near channel resistance, suggesting a pause before continuation.

📐 Key Zones

Entry Zone: ~4,955 – 4,965 (minor pullback / demand area)

Stop Loss: Below 4,914 (channel + structure invalidation)

Target: 5,116 – 5,118 (clear liquidity & resistance zone)

🧠 Trade Idea

Expect a small pullback or consolidation near current levels.

Bullish continuation is favored as long as price holds above channel support.

A clean breakout with volume can accelerate price toward the target zone.

⚠️ Invalidation

A strong candle close below the channel and demand zone would invalidate the bullish setup and shift bias neutral to bearish.

📌 Bias: Bullish continuation

📌 Timeframe: 1H

📌 Instrument: XAUUSD