Xauusdforecast

Bullish Continuation After BOS – Liquidity Sweep Into Support”Market Structure (HTF → LTF)

Overall bias: Bullish, but currently in a pullback / consolidation phase.

You can see a BOS (Break of Structure) to the upside earlier, confirming bullish intent.

After the impulsive move up, price is now correcting and ranging, not reversing yet.

2. Key Zones & Levels

🔵 Support Zone (Most Important)

Support range:

Upper: 4,972.93

Lower: 4,947.36

This is a demand / mitigation zone:

Previous structure support

Reaction zone after impulsive move

As long as price holds above this zone, bullish continuation remains valid.

👉 Loss of this zone = bullish idea weakens significantly.

🔴 Current Price Area (~5,014)

Price is sitting between support and resistance, showing:

Indecision

Liquidity grabs (wicking both sides)

The small zig-zag drawn suggests potential stop-hunt before expansion.

🟢 Resistance / Liquidity Above

Key resistance: ~5,046 – 5,050

This is where:

Prior highs formed

Sell-side liquidity was previously active

A clean break and close above this area is a strong continuation signal.

3. Target Area

Primary target: 5,060 – 5,065

Marked clearly as TARGET POINT

This aligns with:

Equal highs / liquidity pool

Premium area of the range

4. Fibonacci Confluence

The pullback respected:

0.5 – 0.618 retracement zone

This is classic bullish continuation behavior, not distribution.

5. Scenarios to Watch

✅ Bullish Scenario (Higher Probability if Support Holds)

Price dips into 4,972 – 4,947

Shows rejection / displacement up

Breaks 5,046

Expands toward 5,060 – 5,065

Gold Buyers Defending 4,990 – Upside Expansion AheadWe had a strong impulsive move up from the February low → clear bullish momentum.

Price created a higher low and is now pushing toward previous resistance.

The current structure looks like a bullish continuation within an ascending channel.

🟢 Support Zone

Key support: 4,988 – 4,940

This zone aligns with:

Previous resistance turned support

Structure retest area

Bullish demand block

As long as price holds above this zone, buyers remain in control.

🎯 Targets

First target: 5,116 – 5,120 (recent liquidity / minor resistance)

Second target: 5,200 – 5,204 (major resistance & psychological level)

A clean breakout above 5,120 with strong volume could accelerate price toward 5,200+.

🛑 Invalidation

Below 4,907, bullish structure weakens.

A strong close below support would shift bias back to neutral or short-term bearish.

Overall Bias

Right now, this looks like a bullish continuation setup, not a reversal.

Dips into support are buy opportunities — chasing at resistance is risky unless there's a confirmed breakout.

Gold 4H🧠 Market Structure

Price is currently moving in a sideways consolidation after a strong bearish move followed by a recovery.

EMA 9 & EMA 15 are flat and tight → indicating low momentum & upcoming volatility expansion.

Market is trading inside a mid-range zone, not at premium or discount extremes.

🔴 Supply / FVG Zone

5239 – 5400

Major imbalance area

Previous aggressive selling pressure

High probability liquidity reaction zone

📌 Expect:

Liquidity grab

Fake breakout possibility

Strong volatility if tapped

🟢 Resistance

5000 Psychological Level

EMA cluster acting as dynamic resistance

Break & hold above required for bullish continuation

⚪ Demand Zone

4650 – 4700

Institutional reaction zone

Potential bullish mitigation area

Liquidity resting below

🟥 Major Support

4400

Structure invalidation level

Break = bearish continuation scenario

📈 Bullish Scenario

If price:

Closes strongly above 5000

Holds above EMA cluster

Shows increased volume

Targets:

5239 FVG

Possible continuation toward 5500 – 5590 liquidity zone

📉 Bearish Scenario

If price:

Rejects from 5000 resistance

Fails to hold EMA support

Breaks demand zone

Targets:

4650 liquidity sweep

Possible continuation toward 4400 support

⚠️ Market Conditions (Fundamental Drivers)

Recent gold volatility driven by:

Extreme precious-metal price swings and investor uncertainty

Analysts increasing bullish gold forecasts due to global instability

Strong central bank demand & bullish long-term projections toward $6100–$6300

High geopolitical tensions & policy uncertainty fueling safe-haven demand

🧾 Summary

Market currently in compression phase

Major move expected after breakout

Mid-range trading risky — wait for zone reactions

Bias remains macro bullish but technically neutral

XAUUSD 30M Bullish Structure – Higher High IncomingStrong impulsive move from the lower channel base (around 4,700 zone).

Higher highs + higher lows confirmed.

Price recently pulled back after tapping near 5,050–5,080 resistance area.

Current movement looks like a bullish continuation setup inside the channel.

🟦 Key Levels

Support Zone: 4,950 – 4,960

This area aligns with:

Previous structure breakout

Minor demand zone

Mid-channel dynamic support

Stop Loss Area: Below 4,930

Break below this would weaken short-term bullish momentum.

Target Zone: 5,090 – 5,102

This is:

Channel upper boundary

Previous rejection zone

Liquidity resting above highs

📈 Trade Idea Logic

As long as price holds above the 4,950 support area, bullish continuation toward 5,100 is valid.

However…

If price breaks and closes below 4,930 with momentum, expect:

Deeper correction

Possible move toward lower channel support

⚡ Momentum Insight

The recent push shows strong buyers stepping in after minor pullbacks. No major bearish structure shift yet — bulls are still in control.

Overall bias: Bullish continuation unless 4,930 breaks.

Support Zone Reaction with Upside Liquidity TargetMarket Read (from your chart)

Price swept sell-side liquidity and reacted strongly from the support zone

Clear BOS to the downside, then bullish reaction → looks like short-term bullish retracement / reversal

You’ve marked:

Support zone: ~4,800 – 4,826

Target / liquidity: ~4,940 – 4,943

This favors a scalp / intraday long with tight risk, not a swing.

🎯 Trade Setup (Small SL)

✅ Entry (Best & Safer)

Buy on pullback into demand

Entry: 4,826 – 4,830

Confluence area: prior reaction + support zone top

Wait for bullish candle close / rejection wick on lower TF (1–5m)

❌ Stop Loss (Tight)

SL: 4,800

Risk: ~26–30 points

If price closes cleanly below 4,800, the setup is invalid

This is a true small SL — no room for chop.

🎯 Take Profit Levels

TP1 (safe): 4,858 (range high / first liquidity)

TP2: 4,900

TP3 / Final: 4,940 – 4,943 (your marked target liquidity)

👉 After TP1, move SL to BE to protect capital.

⚠️ Aggressive Entry (Only if experienced)

Entry: 4,805 – 4,810

SL: 4,785

Higher R:R, but lower win rate

Invalidation

❌ No longs if:

Strong bearish close below 4,800

No bullish reaction inside the support zone

Summary

Bias: Intraday bullish retracement

Entry: 4,826–4,830

SL: 4,800

Target: 4,858 → 4,900 → 4,940

XAUUSD 1H Bullish Channel Breakout – 5,300 Target in SightPair: XAUUSD

Timeframe: 1H

Structure: Bullish channel continuation

🔎 Market Structure

Price is moving inside a well-defined ascending channel.

Higher highs + higher lows are intact.

Recently, gold bounced strongly from the channel support + demand zone.

Current price around 5,069 is sitting above short-term support and retesting breakout structure.

The trend is clearly bullish unless we lose that channel support.

📍 Key Levels

Support Zone (Buy Area):

5,015 – 5,000 (trend support + structure base)

Stop Loss (below invalidation):

4,985

If price closes below that, bullish structure weakens.

🎯 Upside Targets

Based on measured move + channel projection:

Target 1: 5,164

Target 2: 5,238

Target 3: 5,313

The 5,300+ area is major resistance and aligns with the 6% projected move shown on your chart.

📊 Trade Idea Logic

This looks like a classic:

Pullback

Consolidation

Break + continuation inside bullish channel

As long as price respects the trendline, dips are buy opportunities.

⚠️ What Could Invalidate?

Strong bearish H1 close below 5,000

Break and close outside lower channel

Until then, momentum favors buyers.

Gold 15M Structure Holding Strong – Buy the Dip SetupPair: XAUUSD (15M)

Structure: Clean ascending channel

Bias: Bullish continuation

Price is respecting a well-defined rising channel, making higher highs and higher lows. We just saw a strong push toward the upper boundary, which shows buyers are still in control.

🔍 What’s Happening Now?

Current price around 5058

Strong impulsive move from mid-channel to near the upper trendline

No major bearish rejection yet

Momentum favors continuation

This looks like a bullish breakout attempt from consolidation inside the channel.

📈 Bullish Scenario (Primary)

If price holds above 5027–5030 support zone, we can expect continuation toward:

🎯 Target 1: 5085

🎯 Target 2: 5105–5110 (major resistance / channel high)

That 5105–5106 area is key — previous projected resistance and target zone.

⚠️ Pullback Scenario

If price retraces:

Watch 5027–5030 (channel mid/support zone)

Deeper support near 5004–5005

As long as price stays above 5000 psychologically, bulls remain in control.

❌ Bearish Invalidation

A clean break and close below 5000–4995 would weaken the bullish structure and possibly shift momentum short-term.

📌 Overall Idea

Trend = Up

Structure = Healthy

Momentum = Bullish

Strategy = Buy dips inside channel, target upper boundary.

This is a textbook continuation setup — just don’t chase the top blindly. Let the market give you either a breakout confirmation or a controlled pullback entry.

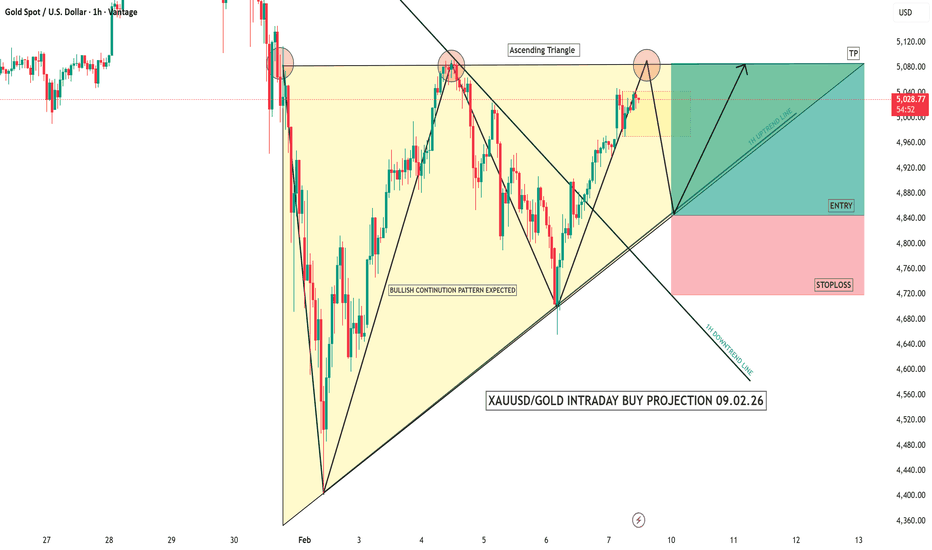

XAUUSD/GOLD ASCENDING TRIANGLE BUY PROJECTION 09.02.26In this chart, we can clearly see an Ascending Triangle formation.

Price is making higher lows, while the resistance level on top remains flat.

This shows that buyers are getting stronger and pushing the market upward step by step.

Each time price pulls back, it respects the ascending trendline, confirming bullish pressure.

At the same time, sellers are unable to break below this support.

Once price breaks and closes above the resistance, it confirms a bullish breakout.

This is where we look for buy entries.

Entry: After the breakout or a small pullback to the trendline

Stop Loss: Below the ascending trendline

Take Profit: Measured move toward the next resistance zone

This pattern usually acts as a bullish continuation, especially when it forms after a strong move.

Risk management is key — never risk more than a small percentage per trade.

Follow the structure, wait for confirmation, and trade with discipline. 📈🔥

XAUUSD/GOLD 1H BUY PROJECTION 09.02.26This is Gold on the 1-hour timeframe.

First, we can see a clear rounding bottom pattern, which shows that selling pressure is weakening and buyers are slowly entering the market.

After this, price broke a key resistance level and then came back to retest the same area.

This retest was successful, confirming that resistance has now turned into strong support.

Price is currently moving inside an ascending channel, which indicates a healthy bullish trend with higher highs and higher lows.

Near the support zone, we can also see a liquidity sweep, where the market briefly moved down to trap sellers before pushing higher.

The price is now holding above the support area, and as long as this level is respected, the buy bias remains valid.

The upside target is placed near Resistance R1, as marked on the chart.

The green zone shows the profit target, and the red zone represents the risk or invalidation area.

Overall, the market structure is bullish, and buy setups are favored.

Always trade with proper risk management and never risk more than a small percentage of your capital.

Gold 15M Ascending Channel Breakout Setuparket Structure

Strong impulsive move up from the bottom of the channel.

Now consolidating near the mid–upper channel area.

Higher lows are intact → short-term bullish structure still valid.

🟢 Bullish Scenario

Price is holding above the 4,860–4,862 support zone, which aligns with:

Channel midline

Recent higher low

Intraday demand area

As long as price stays above this zone, momentum favors continuation toward:

👉 4,920 – 4,922 target zone

That’s your next liquidity pool / resistance area.

If buyers step in strongly, we could even see a push toward the channel high.

🔴 Bearish Risk

If price breaks and closes below 4,860, structure weakens.

That would invalidate the higher-low setup.

Could trigger a deeper pullback toward the lower channel boundary.

⚠️ Important Detail

There’s a visible rejection area (your circled zone) — sellers reacted there before.

If price struggles again under 4,890–4,900, expect short-term volatility before continuation.

💡 Overall Bias

Short-term bias: Bullish continuation above 4,860

Invalidation: Clean breakdown below support

Target: 4,920+

Pero – Daily Trading Plan | XAUUSD (06/02/2026)1️⃣ Market Context (Macro Narrative)

Gold remains in a corrective phase after a strong impulsive sell-off. Price is currently stabilizing inside a broader ascending structure, respecting a rising trendline from the recent swing low.

However, upside momentum is still weak and corrective, meaning rallies are likely to be sold until a clear breakout occurs.

👉 Primary bias:

Buy pullback at strong support (trend-following)

Sell is allowed only as short-term scalp near resistance

2️⃣ Technical Breakdown (Multi-Timeframe Logic)

Structure

Market completed a sharp downside leg → now forming range-to-corrective price action

Price is oscillating between Support Zone (4,579 – 4,682) and Mid-Range Resistance (4,963)

Trendlines

Primary ascending trendline (yellow dashed): long-term bullish structure

Upper channel / projection (white dashed): defines bullish expansion if breakout happens

Momentum (RSI)

RSI around mid-level (~45) → neutral to slightly bearish

Confirms range trading, not impulsive trend yet

3️⃣ Key Levels (Must Respect)

🟢 Support Zones

4,579 – 4,682 → Major BUY reaction zone (trendline + demand)

4,410 → Last defensive support (structure invalidation below)

🔴 Resistance Zones

4,963 → First sell reaction / rejection zone

5,157 → Mid-range resistance

5,380 – 5,423 → Strong resistance zone

5,400 → Major supply / structural ceiling

4️⃣ Trading Bias (Pero Rules)

Main direction: BUY (trend-following)

Sell: Scalping only, counter-trend, quick in & out

No chasing price

Wait for reaction on M5–M15

Strict SL – never widen

5️⃣ Execution Plan (Pero Style)

BUY GOLD 4682 - 4680

↠ Stop Loss 4657

→ Take Profit 1 : 50 ~ 100 pips

→ Take Profit 2 : 200 pips

→ Take Profit 3 : 500Pips - Open

SELL GOLD 5156 - 5158

↠ Stop Loss 5161

→ Take Profit 1 : 50 ~ 100 pips

→ Take Profit 2 : 200 pips

→ Take Profit 3 : 500Pips - Open

6️⃣ Invalidation

Strong H2 close below 4,579 → bullish structure weakens

Break & acceptance above 5,157 → bullish continuation toward 5,380 – 5,400

7️⃣Pero Mindset

⚡️ Psychology, discipline, and capital management are the three pillars that turn analysis into consistent profitability. ⚡️

GOLD (XAUUSD) 1H — Distribution, Not Reversal | Bearish Continua

This analysis is built on structure, liquidity, and market behavior — not opinions.

After a strong bearish displacement, Gold is showing signs of distribution beneath a descending trendline. The recent upside movement appears corrective rather than a true bullish shift, with price forming a lower high under a key SBR zone.

🔍 Market Structure:

• Strong impulsive selloff → bearish control remains intact

• Rejection from SBR resistance near 5100

• Descending trendline respected

• Current reaction around Support1 suggests a pause, not accumulation

📉 Execution Logic:

Primary Sell Bias remains valid while price trades below trendline resistance. The current structure reflects continuation behavior — not a “buy the dip” environment.

🎯 Liquidity Targets:

• TP1: 4797 — Near-term support liquidity

• TP2: 4546 — Major liquidity pool / higher timeframe support

Acceptance below Support1 increases probability of continuation toward lower targets.

🛑 Invalidation:

If price reclaims and holds above the trendline + SBR zone, bearish bias becomes invalid. No trade is also a position.

This is not about predicting tops or bottoms.

It’s about reading structure, waiting for confirmation, and executing with discipline.

If this breakdown aligns with your view, share your perspective below — always open to strong, logical discussion.

XAUUSD/GOLD Unemployment Claims &JOLTS Job Openings 05.02.2026XAUUSD (Gold) Trade Setup – News-Based Volatility Plan

“Let’s analyze the XAUUSD price action based on Unemployment Claims and JOLTS Job Openings data.

Gold is currently trading inside a high-impact news zone, and the market is clearly respecting key support and resistance levels.

Bullish Scenario – Buy Setup

If the news comes negative for the US dollar, gold is expected to move bullish.

Watch the Resistance R1 zone around 5100

Entry: Buy only after a clear breakout and retest above this level

Once price holds above resistance, we expect momentum continuation

Targets:

First move towards minor resistance

Final target near Resistance R2 / 5600 zone

Stop Loss:

Below the marked retest zone

Risk is clearly defined and controlled

Bearish Scenario – Sell Setup

If the news turns positive for the US dollar, gold can resume selling pressure.

Watch the Support S1 zone around 4566

Entry: Sell after breakdown and retest of support

Confirmation is required—no emotional entries

Targets:

Minor support first

Final target near Support S2 around 4277

Stop Loss:

Above the breakdown retest zone

Gold (XAUUSD) 15M | Sell Rally Setup from Channel ResistancePrice is moving inside a descending channel → clear bearish trend.

Overall structure shows lower highs & lower lows, so sellers are still in control.

📐 Key Technicals from the chart

Channel resistance rejected price multiple times.

The recent pullback failed near the midline / dynamic resistance of the channel.

Strong bearish impulse after rejection → confirms sell-on-rally behavior.

🎯 Trade Idea (as marked)

Sell entry: around 4900 – 4905

Stop loss: ≈ 4901 – 4910 (above recent structure & channel)

Targets:

TP1: 4860

TP2: 4823 (previous low / demand zone)

🧠 Confluence (why this works)

Descending channel resistance

Break & retest failure

Bearish continuation momentum

RR looks solid (~1:2+)

⚠️ Invalidation

A 15M close above channel resistance + holding above 4910 would weaken the bearish bias.

📌 Bias Summary

Intraday Bias: Bearish 🔴

Prefer sell rallies until channel breaks decisively.