A-Book vs B-Book: What Every Retail Trader Needs to KnowMost retail CFD traders have never even heard the terms “A-Book” and “B-Book,” yet almost all of them are directly affected by how these models work. Your broker’s choice between the two can change the prices you see, how your orders are filled, and even whether your stop loss gets hit. Let’s break it down so you know exactly what’s going on behind the scenes.

█ What is A-Book?

An A-Book broker routes your orders straight to external liquidity providers, such as banks, market makers, or directly to an exchange in the case of futures or spot markets. Your broker is essentially the middleman, passing your trade along and matching it with a real counterparty.

⚪ How they make money:

Spreads (the difference between the bid and ask prices).

Commissions on each trade.

Occasionally a small markup on the feed.

Because they don’t profit when you lose, an A-Book broker’s ideal client is a trader who trades frequently and consistently, your activity is their revenue stream.

█ What is B-Book?

A B-Book broker keeps your trades “in-house,” meaning they take the other side of your position. If you buy, they sell; if you sell, they buy, but all within their own system. Your trades don’t reach the real market at all.

⚪ How they make money:

Your losses are their profits.

They may still earn on spreads and commissions, but the main income is the net loss of their client base.

Xauusdforex

XAUUSD/GOLD 4H & 1H SELL PROJECTION 11.02.26Today we are analyzing Gold (XAUUSD) on the 4-hour and 1-hour timeframe, and I’m looking for a sell limit opportunity based on a bearish continuation pattern.

Let’s break this down clearly.

On the 4H timeframe, price is forming a descending triangle structure with a clear lower high trendline. The market is respecting this downtrend line consistently, which indicates strong bearish pressure.

We also have a Resistance R1 zone around 5080–5085. This area aligns perfectly with the descending trendline and creates a confluence zone for a potential liquidity sweep.

Now here is the important part:

Before the drop, price may push slightly higher to sweep liquidity above the trendline and resistance. This is a typical smart money move — grabbing buy-side liquidity before continuing downward.

After the liquidity sweep, I’m expecting a bearish continuation move.

📉 Entry Plan:

Sell Limit near the trendline resistance zone (around 5080 area).

🛑 Stop Loss:

Above the recent swing high and above the liquidity sweep zone.

🎯 Target:

Support S1 area around 5045.

This is a strong demand/support zone where price previously reacted.

Risk-to-reward on this setup looks very attractive because we are trading:

With the higher timeframe trend

At a strong resistance

With liquidity confirmation

Inside a bearish continuation structure

XAUUSD – Bullish Continuation After Strong ExpansionStrong bullish expansion candle breaking previous structure.

Price holding above the 5,065–5,070 support zone.

Current movement appears to be a bullish continuation pattern after the impulse.

Higher lows forming, suggesting buyers remain in control.

📈 Bullish Scenario:

As long as price holds above the marked stop-loss zone (~5,064–5,065), the bias remains bullish.

Targets:

🎯 Target 1: 5,094

🎯 Target 2: 5,104

🎯 Final Target: 5,116

The projected move suggests continuation toward the previous high liquidity area near 5,116.

📌 Key Levels:

Support: 5,065

Resistance: 5,094 → 5,104 → 5,116

Invalidation: Strong close below 5,064

💡 Conclusion:

Gold remains structurally bullish after the breakout. If consolidation holds above support, continuation toward the upper liquidity targets is highly probable.

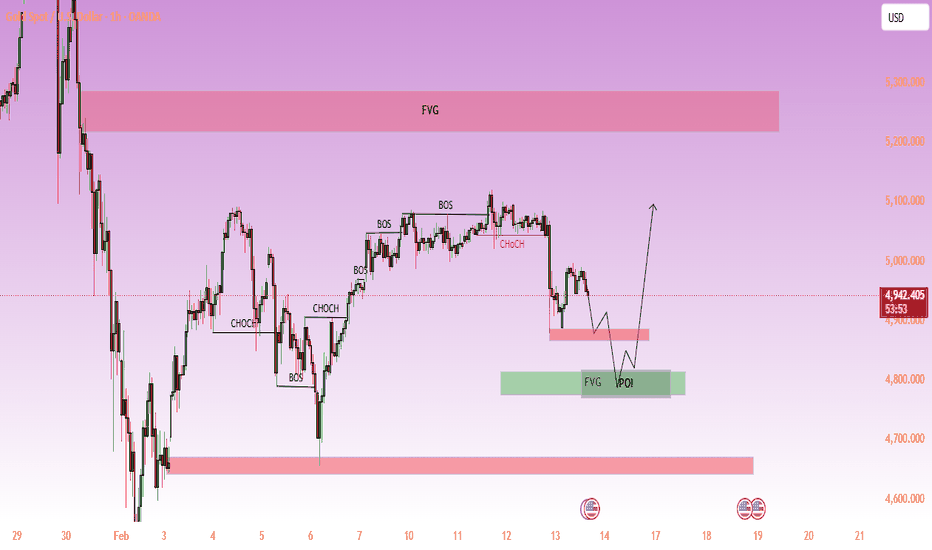

XAUUSD H1 – Pullback Into Discount Before Bullish Continuation?🧠 Market Structure Overview

Gold recently shifted structure after forming multiple Break of Structure (BOS) to the upside, confirming a short-term bullish phase.

However, price printed a Change of Character (CHOCH) at the recent high — signaling a temporary bearish retracement rather than a full trend reversal.

Current movement appears to be a corrective displacement targeting inefficiencies below.

🔎 Key Technical Observations

📉 Strong bearish impulse from range high suggests liquidity sweep + mitigation move

📦 Price reacting near minor supply / mitigation zone (~4,900 area)

🟢 Major Discount POI + FVG confluence below current price

🔴 Higher timeframe Premium FVG remains untouched above (~5,200–5,300)

Structure Context:

Previous BOS sequence = bullish bias intact

Current CHOCH = internal correction phase

Expectation = seek liquidity in discount before continuation

🎯 Trading Scenarios

🟢 Primary Bullish Scenario

Price retraces into Discount FVG / POI zone (~4,780–4,820)

Liquidity sweep + bullish confirmation (LTF BOS / CHOCH)

Continuation toward:

5,000 psychological resistance

5,100 internal highs

5,250–5,300 Premium FVG target

🔴 Alternative Bearish Scenario

Failure to hold Discount zone

H1 close below major demand

Structure shifts bearish → continuation toward lower liquidity pools

📍 Key Levels

Resistance: 5,050 – 5,100

Premium Target: 5,250 – 5,300

Mitigation Zone: ~4,900

Discount POI / FVG: 4,780 – 4,820

Invalidation: Sustained break below discount demand

🧭 Trading Bias

➡️ Short-term: Bearish retracement

➡️ Mid-term: Bullish continuation bias while structure holds

⚠️ Notes

Wait for confirmation inside POI — don’t chase mid-range entries

Combine with sessions + news volatility

Manage risk — this is structural analysis, not financial advice

XAUUSD 30M: Bullish Continuation After Liquidity Sweep – 5,060 🔎 Market Structure

Higher timeframe (left side) shows strong bullish momentum.

We had a sharp selloff into the 4,900–4,920 zone.

Price formed a strong rejection + impulsive bullish move from the low.

Now we’re seeing a bullish pullback + higher low formation.

This looks like a classic continuation setup after a liquidity sweep.

📈 Current Setup Logic

Entry Zone: Around 4,970–4,980 (current consolidation area)

Price is:

Holding above previous minor structure.

Forming a small ascending channel / bullish flag.

Showing higher lows on the lower timeframe.

That’s bullish pressure building.

🎯 Targets

TP1: 4,980–4,990 → First resistance / minor structure

TP2: ~4,999–5,000 → Psychological level + internal resistance

TP3: ~5,020 → Previous structure level

Final Target: ~5,060 → Major resistance / range high

If momentum expands, 5,060 is very realistic.

🛑 Stop Loss

Below 4,946 (as marked)

Below the recent demand + structure low

If price breaks that cleanly, the bullish idea is invalid.

🧠 What Makes This High-Probability?

✔ Liquidity grab below prior lows

✔ Strong impulsive bullish displacement

✔ Pullback holding structure

✔ Clear risk-to-reward (very clean R:R profile)

⚠️ What Could Go Wrong?

If price:

Fails to break 4,990 with momentum

Or starts making lower highs on 15M

Then this becomes a fake breakout and could rotate back to 4,950 zone.

Overall?

This is a solid bullish continuation idea with clean structure and defined risk.

If buyers step in with volume, 5,020+ is very achievable.

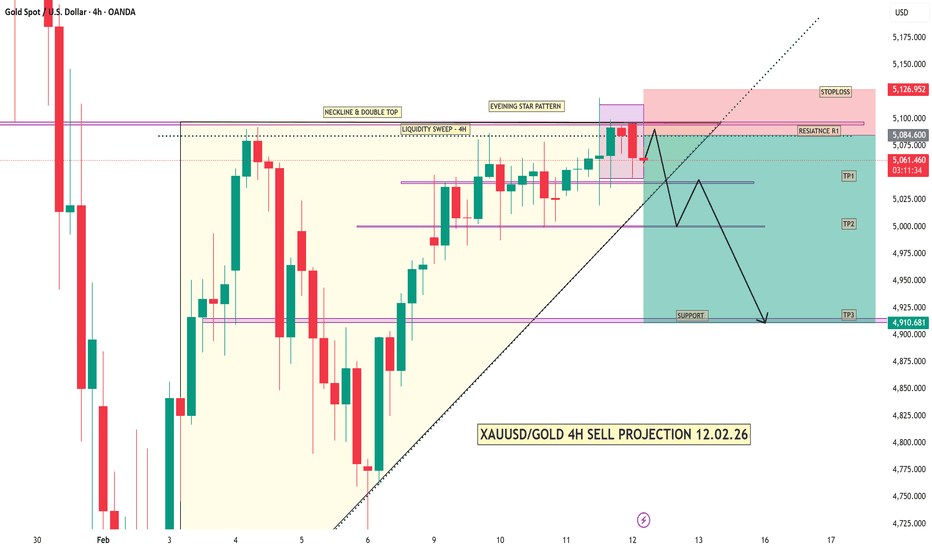

xauusd/gold 4h sell projection 12.02.26On the 4-hour timeframe, Gold has formed a Double Top near resistance, and we clearly saw a Liquidity Sweep above the previous high. That means smart money grabbed buy-side liquidity… and now the market is showing weakness.

Right after that, we got an Evening Star pattern — a strong bearish reversal confirmation.

🔥 What does this mean?

Buyers tried to push higher…

Liquidity was taken…

But price failed to continue up.

Now sellers are stepping in.

📍 Entry Zone

We are looking for sell positions below the resistance zone around 5085–5100 area.

📍 Stop Loss

Above the recent high near 5126.

📍 Targets

TP1 – First intraday support

TP2 – Psychological level near 5000

TP3 – Major support around 4910

If momentum increases, we can expect a strong bearish continuation towards the lower support zone.

XAUUSD/GOLD 1H SELL PROJECTION 11.02.26In today’s analysis, we are looking at XAUUSD on the 1-hour timeframe, and the market is showing a strong potential sell setup.

First, the market has been moving sideways this week, forming a clear range structure. Price is respecting both resistance and support levels.

Now, look at the top area — we can clearly see a Double Top formation near the resistance zone. This is a strong bearish reversal pattern, especially when it forms at a key resistance level.

Not only that…

We also have an Evening Star pattern, which is another powerful bearish confirmation signal. This increases the probability of a downward move.

📌 Current Situation:

Price is reacting from Resistance R1

Rejection candles are forming

Bearish structure is building

If price respects this resistance zone and fails to break above it, we can expect a strong downward movement.

🎯 Target Levels:

First target: Support S1

Final target: Support S2

As shown in the projection, the market may drop strongly toward the lower support zone if sellers take control.

XAUUSD Bullish Continuation Within Ascending Channel🔎 Market Structure (1H – Gold / XAUUSD)

Gold is trading inside a well-defined ascending channel, and price is currently consolidating near the upper mid-range after a strong impulsive recovery from the February low.

We had:

A sharp selloff

Strong V-shaped recovery

Now forming higher lows inside the channel

That tells us buyers are still in control structurally.

🟢 Bullish Scenario

Price is compressing just under the 5,100 – 5,105 resistance zone.

If we get:

A clean breakout above 5,105

Followed by continuation momentum

Then upside targets are:

🎯 5,198 – 5,200 (near-term objective)

🎯 Extended move toward channel high around 5,450 – 5,500 if momentum expands

The internal structure shows higher lows forming — that’s quiet accumulation behavior.

🔴 Bearish Risk

The key invalidation area is:

❌ 4,911 support zone

If price breaks and closes below 4,911:

Channel structure weakens

Deeper retracement toward 4,850–4,800 becomes possible

But right now? Sellers aren’t strong enough.

📊 Overall Bias

As long as price holds above 4,911 and respects the ascending channel, the bias remains bullish continuation.

This looks like:

Accumulation before expansion.

If momentum kicks in, this could move fast.

BTC 1H🧠 Market Context

Bitcoin has just completed a liquidity sweep after an extended move, tapping into a high-timeframe supply/demand reaction zone. Price action is currently compressing, signaling that we’re approaching a decision point where momentum traders and HTF participants collide.

The recent impulse leg shows aggressive positioning, but follow-through volume is starting to fade — typically a precursor to either consolidation or a sharp expansion move.

🔑 Key Levels To Watch

Major Resistance / Supply: Previous breakdown region + liquidity cluster

Mid-Range Pivot: Intraday structure flip area

Primary Support: Demand zone aligned with prior consolidation base

Invalidation Level: Clean break + acceptance beyond HTF structure

These zones are not just horizontal levels — they represent orderflow interest areas where reactions are statistically more likely.

📈 Bullish Scenario

If price holds above the mid-range structure and builds higher lows:

Expect continuation toward equal highs / resting liquidity

Break-and-retest of resistance could trigger expansion

Momentum confirmation: strong candle closes + increasing volume

Bias shifts bullish on structure confirmation, not anticipation.

📉 Bearish Scenario

Failure to reclaim reclaimed structure could signal:

Distribution inside resistance

Sweep-and-reverse pattern

Rotation back into lower demand zones

A clean breakdown below support with acceptance likely opens a fast-move liquidity vacuum.

⚠️ Trading Strategy

Avoid chasing mid-range noise

Let price come into levels

Focus on confirmations:

Structure breaks

Volume expansion

Reaction speed at zones

Remember: Location > Prediction.

🧭 Final Thoughts

Bitcoin is sitting at a high-probability reaction area. The next expansion move will likely come after liquidity is fully engineered around current consolidation.

Stay patient, trade the reaction — not the emotion.

Core Retail Sales m/m XAUUSD/GOLD FORCAST PROJECTION 10.02.26A negative reading indicates economic weakness, which puts pressure on the US Dollar and supports Gold.

Trade Plan:

Look for buy confirmation above the support zone

Expect higher highs and higher lows

Targets are placed near Resistance R1 and Resistance R2

Risk Management:

Risk–Reward Ratio: 1:4

Stop-loss below the support zone

Partial profit booking is advised near the first resistance

🔴 Scenario 2: If Core Retail Sales is POSITIVE – SELL GOLD

A positive reading strengthens the US Dollar, creating downside pressure on Gold.

Trade Plan:

Look for sell confirmation near resistance

Expect lower highs and strong bearish momentum

Targets are placed below Support S1, towards the lower demand zone

Risk Management:

Risk–Reward Ratio: 1:3

Stop-loss above resistance

Trail stop-loss after the first impulse move

XAUUSD Bullish Continuation Toward 5100 | Channel Respecting StrStrong impulsive leg up.

Followed by a controlled pullback (healthy correction, not a breakdown).

Price held above previous minor support and bounced.

Current consolidation looks like a bullish continuation flag inside the channel.

That orange circle area marks the rejection zone — buyers stepped in aggressively there.

📈 Trade Idea Breakdown

Entry: 5028.923

Stop Loss: 5018.312

Target: 5100.366

This setup makes sense technically because:

Entry is above short-term consolidation.

Stop is below structure support (not random — it protects against breakdown).

Target aligns with channel resistance and psychological 5100 zone.

Risk-to-reward is solid as long as structure holds.

🧠 What Needs to Happen for Bulls to Win

Price must hold above 5025–5020 zone.

Continued higher lows on lower timeframes.

Break above 5055–5060 area should accelerate momentum toward 5100.

⚠️ Invalidation

If price closes strongly below 5018–5020, that would:

Break minor structure.

Increase probability of a deeper pullback toward channel support.

Overall Bias

Still bullish as long as the ascending channel holds. This looks like a continuation setup, not a reversal.

If momentum kicks in, 5100 is very realistic.

Gold Buyers Defending 4,990 – Upside Expansion AheadWe had a strong impulsive move up from the February low → clear bullish momentum.

Price created a higher low and is now pushing toward previous resistance.

The current structure looks like a bullish continuation within an ascending channel.

🟢 Support Zone

Key support: 4,988 – 4,940

This zone aligns with:

Previous resistance turned support

Structure retest area

Bullish demand block

As long as price holds above this zone, buyers remain in control.

🎯 Targets

First target: 5,116 – 5,120 (recent liquidity / minor resistance)

Second target: 5,200 – 5,204 (major resistance & psychological level)

A clean breakout above 5,120 with strong volume could accelerate price toward 5,200+.

🛑 Invalidation

Below 4,907, bullish structure weakens.

A strong close below support would shift bias back to neutral or short-term bearish.

Overall Bias

Right now, this looks like a bullish continuation setup, not a reversal.

Dips into support are buy opportunities — chasing at resistance is risky unless there's a confirmed breakout.

XAUUSD 1H Bullish Channel Breakout – 5,300 Target in SightPair: XAUUSD

Timeframe: 1H

Structure: Bullish channel continuation

🔎 Market Structure

Price is moving inside a well-defined ascending channel.

Higher highs + higher lows are intact.

Recently, gold bounced strongly from the channel support + demand zone.

Current price around 5,069 is sitting above short-term support and retesting breakout structure.

The trend is clearly bullish unless we lose that channel support.

📍 Key Levels

Support Zone (Buy Area):

5,015 – 5,000 (trend support + structure base)

Stop Loss (below invalidation):

4,985

If price closes below that, bullish structure weakens.

🎯 Upside Targets

Based on measured move + channel projection:

Target 1: 5,164

Target 2: 5,238

Target 3: 5,313

The 5,300+ area is major resistance and aligns with the 6% projected move shown on your chart.

📊 Trade Idea Logic

This looks like a classic:

Pullback

Consolidation

Break + continuation inside bullish channel

As long as price respects the trendline, dips are buy opportunities.

⚠️ What Could Invalidate?

Strong bearish H1 close below 5,000

Break and close outside lower channel

Until then, momentum favors buyers.

Gold 15M Structure Holding Strong – Buy the Dip SetupPair: XAUUSD (15M)

Structure: Clean ascending channel

Bias: Bullish continuation

Price is respecting a well-defined rising channel, making higher highs and higher lows. We just saw a strong push toward the upper boundary, which shows buyers are still in control.

🔍 What’s Happening Now?

Current price around 5058

Strong impulsive move from mid-channel to near the upper trendline

No major bearish rejection yet

Momentum favors continuation

This looks like a bullish breakout attempt from consolidation inside the channel.

📈 Bullish Scenario (Primary)

If price holds above 5027–5030 support zone, we can expect continuation toward:

🎯 Target 1: 5085

🎯 Target 2: 5105–5110 (major resistance / channel high)

That 5105–5106 area is key — previous projected resistance and target zone.

⚠️ Pullback Scenario

If price retraces:

Watch 5027–5030 (channel mid/support zone)

Deeper support near 5004–5005

As long as price stays above 5000 psychologically, bulls remain in control.

❌ Bearish Invalidation

A clean break and close below 5000–4995 would weaken the bullish structure and possibly shift momentum short-term.

📌 Overall Idea

Trend = Up

Structure = Healthy

Momentum = Bullish

Strategy = Buy dips inside channel, target upper boundary.

This is a textbook continuation setup — just don’t chase the top blindly. Let the market give you either a breakout confirmation or a controlled pullback entry.

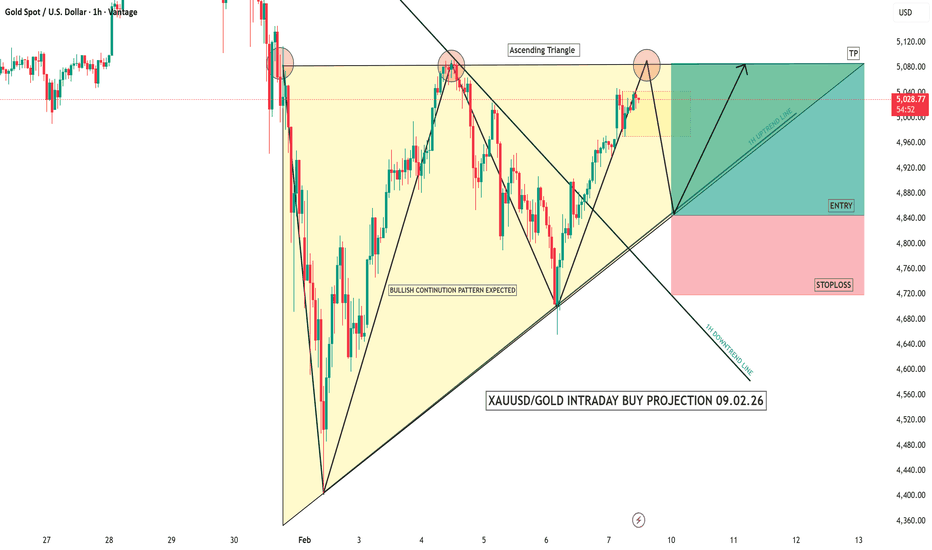

XAUUSD/GOLD ASCENDING TRIANGLE BUY PROJECTION 09.02.26In this chart, we can clearly see an Ascending Triangle formation.

Price is making higher lows, while the resistance level on top remains flat.

This shows that buyers are getting stronger and pushing the market upward step by step.

Each time price pulls back, it respects the ascending trendline, confirming bullish pressure.

At the same time, sellers are unable to break below this support.

Once price breaks and closes above the resistance, it confirms a bullish breakout.

This is where we look for buy entries.

Entry: After the breakout or a small pullback to the trendline

Stop Loss: Below the ascending trendline

Take Profit: Measured move toward the next resistance zone

This pattern usually acts as a bullish continuation, especially when it forms after a strong move.

Risk management is key — never risk more than a small percentage per trade.

Follow the structure, wait for confirmation, and trade with discipline. 📈🔥

XAUUSD/GOLD 1H BUY PROJECTION 09.02.26This is Gold on the 1-hour timeframe.

First, we can see a clear rounding bottom pattern, which shows that selling pressure is weakening and buyers are slowly entering the market.

After this, price broke a key resistance level and then came back to retest the same area.

This retest was successful, confirming that resistance has now turned into strong support.

Price is currently moving inside an ascending channel, which indicates a healthy bullish trend with higher highs and higher lows.

Near the support zone, we can also see a liquidity sweep, where the market briefly moved down to trap sellers before pushing higher.

The price is now holding above the support area, and as long as this level is respected, the buy bias remains valid.

The upside target is placed near Resistance R1, as marked on the chart.

The green zone shows the profit target, and the red zone represents the risk or invalidation area.

Overall, the market structure is bullish, and buy setups are favored.

Always trade with proper risk management and never risk more than a small percentage of your capital.

XAUUSD 30M Bullish Structure – Higher High IncomingStrong impulsive move from the lower channel base (around 4,700 zone).

Higher highs + higher lows confirmed.

Price recently pulled back after tapping near 5,050–5,080 resistance area.

Current movement looks like a bullish continuation setup inside the channel.

🟦 Key Levels

Support Zone: 4,950 – 4,960

This area aligns with:

Previous structure breakout

Minor demand zone

Mid-channel dynamic support

Stop Loss Area: Below 4,930

Break below this would weaken short-term bullish momentum.

Target Zone: 5,090 – 5,102

This is:

Channel upper boundary

Previous rejection zone

Liquidity resting above highs

📈 Trade Idea Logic

As long as price holds above the 4,950 support area, bullish continuation toward 5,100 is valid.

However…

If price breaks and closes below 4,930 with momentum, expect:

Deeper correction

Possible move toward lower channel support

⚡ Momentum Insight

The recent push shows strong buyers stepping in after minor pullbacks. No major bearish structure shift yet — bulls are still in control.

Overall bias: Bullish continuation unless 4,930 breaks.

XAUUSD 30-min – High Probability Short Setup (SMC/ICT)🚨 HIGH PROBABILITY SHORT SETUP – XAUUSD 30-min

Entry Zone: 4,985 – 4,995

(Confluence: Order Block + FVG Fill + Previous Resistance)

Stop Loss: 5,010

(Above recent high and FVG)

Target 1: 4,880 (Liquidity Pool)

Target 2: 4,840 (Support Zone)

Target 3: 4,720 (Break of Structure Extension)

✅ WHY THIS SETUP WORKS:

BOS Confirmed – Market structure broken bearish

Order Block Resistance – Strong supply zone at 4,988.85

FVG Above Price – Likely to be filled before continuation down

Liquidity Below – Price drawn to 4,880 liquidity pool

CHoCH Present – Momentum shifted bearish

🎯 EXECUTION PLAN:

Wait for price to fill FVG/Order Block zone (4,985-4,995)

Enter short on bearish 30-min rejection candle

Stop Loss at 5,010 (above structure)

Move to breakeven after hitting 4,940

Take partial profits at 4,880 & 4,840

⚠️ RISK WARNING:

Only trade with confirmed rejection

Avoid if price breaks above 5,010

Monitor lower timeframe for entry timing