XAUUSD Gold Intraday Setup 02.09.2025Gold is currently trading at 3473, after hitting new ATH around 3508, now testing into a key demand zone. Price has shown a corrective move after the recent bullish impulse and is reacting from a consolidation order block.

Key Levels:

First buy zone: 3469–3473 → aligns with immediate demand and prior accumulation.

Second buy zone (deeper retracement): 3449–3454 → lower demand zone + strong support base.

Structure & Bias:

Market structure remains bullish with higher highs and higher lows intact.

Current pullback is corrective in nature, tapping into demand zones.

Liquidity below minor lows (around 3470 and 3450) could be swept before a strong bullish continuation.

Targets:

First target: 3492 (recent high/intraday resistance).

Second target: 3508 (swing high, liquidity pool).

Trade Plan:

Look for bullish confirmation (rejection wick, engulfing, or structure shift) in the 3469–3473 zone for a buy entry.

If price breaks below decisively, next long entry should be considered from the 3449–3454 zone.

Stop-loss ideally below 3460 for the first zone, and below 3435 for the second zone.

👉 In short: Bias is bullish; buy dips into 3469–73 or 3449–54, aiming for 3492 & 3508.

Xauusdprediction

XAU/USD Bullish Setup – Buy from POI Zone Towards 3545 TargetXAU/USD (15M Chart) Analysis

Trend Analysis:

Price is in a clear uptrend, supported by higher highs and higher lows above the EMA 70 & EMA 200. Both EMAs are pointing upward, confirming bullish momentum.

POI & FVG Zone:

A POI/FVG buying zone (highlighted in pink) is marked between 3481 – 3491, acting as a strong demand area for re-entry if price retraces.

Chart Pattern:

Price has broken out of a rising wedge formation and is retesting the breakout zone, showing potential continuation to the upside.

Support & Resistance:

Support: 3481 – 3491 zone (FVG & EMA confluence).

Resistance/Target: 3545.608 (major target point).

Entry & Risk Management:

Entry: Buy near 3491 or 3481 (within POI/FVG zone).

Stop Loss: Below 3480 (to protect against false break).

Target: 3545 (approx. +55 points).

Strategy Confirmation:

Trend-following: Bullish continuation above EMAs.

FVG/POI: Perfect re-entry buying zone.

Breakout strategy: Price broke wedge → retest → continuation expected.

Risk-Reward Ratio: Around 1:4, favorable trade setup.

✅ Summary:

XAU/USD remains bullish above EMAs. Ideal trade is to buy the dip at 3481–3491 zone with a target at 3545 and stop loss below 3480. Multiple strategies align for upside continuation.

Gold XAUUSD Intraday Analysis 01.09.2025Structure: Gold has broken upward impulsively, forming a higher-high structure, suggesting continuation toward 3500 and possibly 3525.

The immediate support zones (3469–3472 and 3452–3455) are valid demand areas aligning with recent consolidation and order blocks.

If price retraces into 3469–3472, a bullish rejection candle or structure shift on lower timeframes (5m/15m) would validate buys.

If liquidity is swept below 3469, the deeper demand zone 3452–3455 offers a safer long entry with reduced downside risk.

Upside targets remain:

3500 (first liquidity pool / round number resistance)

3525.00 (next extension target)

Invalidation: A sustained close below 3450 would weaken the bullish setup and open room for further downside.

Buying Idea 1:

Entry: 3469–3472

Stop: Below 3460

Target 1: 3500

Target 2: 3525

Buying Idea 2 (safer but deeper):

Entry: 3452–3455

Stop: Below 3440

Target 1: 3500

Target 2: 3525

Aggressive Continuation Buy:

If gold breaks above 3490 with strong momentum and volume, consider chasing continuation toward 3500, but with tighter risk management.

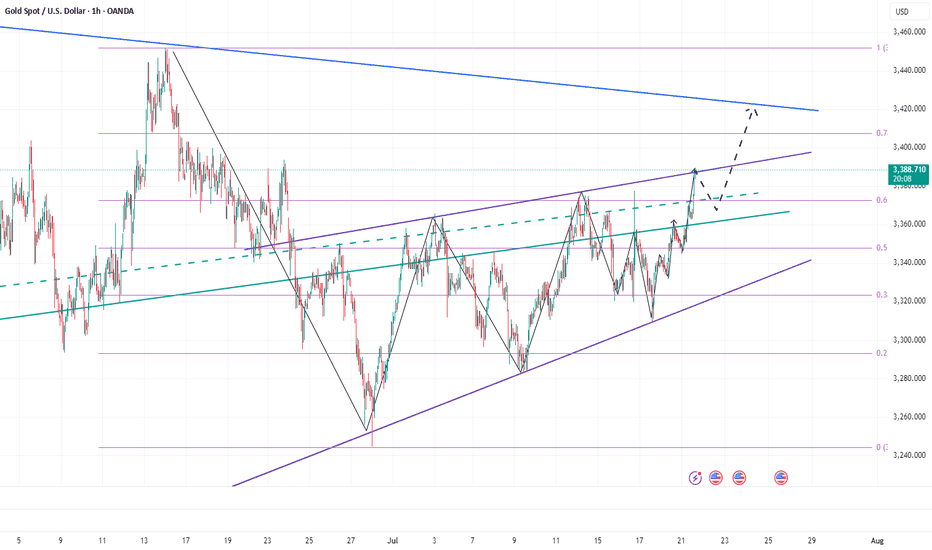

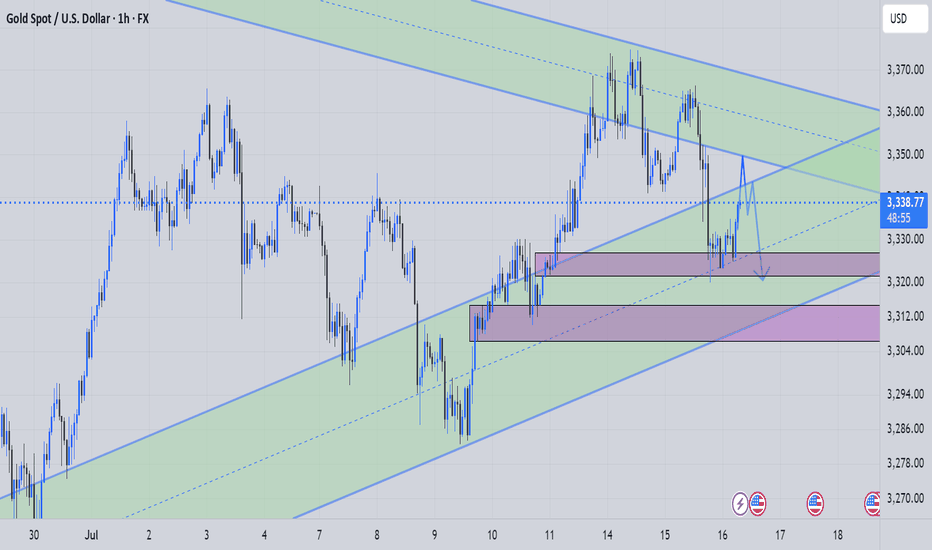

XAUUSD Weekly outlook 25-29 Aug, 2025XAUUSD Weekly Outlook (Swing Trading Perspective)

Gold has broken out of the descending channel after Powell hinted at potential rate cuts on Friday, which has shifted market sentiment bullish.

Currently, price is hovering at 3371 above a key demand zone around 3349 – 3355, which also aligns with the channel breakout & retest. A pullback into this zone would provide a high-probability swing entry, supported by demand structure and market fundamentals.

Trading Plan (Swing Buy Setup):

Entry Zone: 3349 – 3355 (retest of channel line + demand area)

Stop Loss: Below 3325 (invalidates demand structure)

Target: 3430 (major supply zone / weekly resistance)

Risk/Reward: ~2.3

Price has confirmed a bullish breakout of the falling channel.

The retest + demand area aligns with structure support and liquidity grab.

As long as price holds above 3350 zone, bias remains bullish.

First upside objective is 3390–3400, followed by a weekly swing target of 3430.

Bias: Bullish

Confirmation Needed: Clean retest and rejection from 3350 demand area before continuation.

Gold XAUUSD Intraday Analysis 29.08.2025Gold has been trading in a bullish trend, moving higher without any significant retracement yesterday. Currently, price is holding around 3405–3407 after rejecting higher levels.

Looking at the chart, a potential retracement zone lies at 3393–3396, which aligns with a demand area and prior consolidation. If price retraces into this zone, it may provide a strong opportunity to join the ongoing bullish trend.

The upside target remains at 3415, which corresponds to the next resistance area, while invalidation of this setup lies below 3386 support.

Trading Idea:

Entry (Buy Zone): 3393–3396

Stop Loss (SL): 3386

Take Profit (TP): 3415

Risk-to-Reward ratio: ~1:2

Plan: Wait for retracement into the 3393–3396 zone, and find confirmatoin before entering long.

Gold XAUUSD Intraday Analysis 28.08.2025Gold volume has been shrinking over time, signaling reduced momentum. The price is approaching the 3403–3405 resistance zone, which aligns with a well-respected trendline. This area can serve as a potential reversal point for a short setup.

If price rejects this zone, downside movement toward 3384 becomes likely. A stop loss above 3414 protects against invalidation of the idea.

Trading Plan (Educational Idea)

Entry Zone (Sell): 3403 – 3405

Stop Loss: 3414

Take Profit: 3384

Notes.

Confirmation is required at the resistance (such as wick rejection, bearish close, or momentum shift).

Invalidation occurs on a sustained break above 3414.

This is a trendline-based counter-trade setup with defined risk.

Gold Surge to 3400 in Sight? FX:XAUUSD is gearing up for a potential bullish run on the 4-hour chart, with an entry zone between 3315-3325 near a key support level and rising trendline.

Targets at 3390-3400 align with the next resistance zone , offering a strong upside move. Set a stop loss below 3300 on a daily close to manage risk effectively.

Following the previous analysis , it’s wise to risk-free your gold position and wait for this new entry point.

A break above 3330 with solid volume could trigger this surge, fueled by USD weakness and gold demand. Keep an eye on upcoming economic data as a catalyst.

Ready to ride this gold wave? Share your thoughts below!

#XAUUSD #GoldTrading #ForexSignals #TechnicalAnalysis #TradingView #DayTrading #MarketAnalysis

XAUUSD Gold Intraday Setup 21.08.2025Gold has broken out of its bearish channel and is now showing signs of retesting the broken trendline. Price action suggests that the 3332/34 zone (highlighted with confluence from structure support and channel retest) will be key for buyers to step in. As long as price holds above this area, bullish momentum is likely to resume.

The target at 3357 aligns with previous resistance, making it a logical upside objective. A stop-loss below 3323 protects against a deeper retracement back into the bearish structure.

Trading Plan (Buy Setup):

Entry: 3332/34

Stop-Loss: 3323

Target: 3357

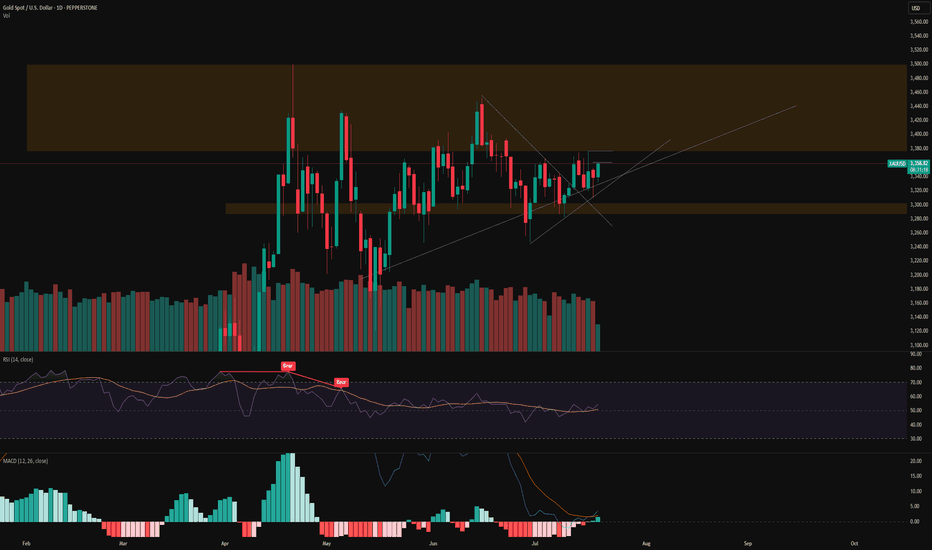

XAUUSD Setup: Key Levels to Watch Before the Next Big Swing1. Chart Type & Indicators

Instrument : XAUUSD (Gold vs USD)

Timeframe: Likely Daily or 4H (based on structure)

Indicators:

Zig Zag (5, 10) – Helps visualize swing highs/lows and trend reversals.

RSI (14) with signals marked (R for Reversal points).

Price: 3,338.34 USD (at the time of the snapshot).

2. Trend Structure (Price Action)

Previous High: Around 3,500.

Current Price: 3,338, which is down ~4.6% from the recent high.

Key Swings:

Uptrend from 3,167 → 3,499 (+10.5%).

Correction down to 3,120 (-10.8%).

Subsequent swings are smaller, showing reduced volatility.

Observation:

Price is consolidating in a range between 3,250 and 3,450 after a strong rally.

ZigZag indicates lower highs and lower lows recently, signaling a mild downtrend.

3. RSI Analysis

Current RSI: 45.18 (Neutral zone, slightly bearish bias).

Overbought zone (70+) was tested multiple times in the past but failed to hold, causing corrections.

Recent green dot (R) indicates possible oversold bounce near 30 RSI in early August.

Observation:

RSI is not yet bullish, suggesting the price could range or test support before trending up.

4. Key Levels

Resistance Zones:

3,450 – 3,500 (major resistance from previous highs).

Support Zones:

3,300 – 3,250 (strong demand zone).

Below that, 3,120 acts as major support.

5. Volume

Higher volumes were observed during the strong rally (March-April).

The recent volume is lower, indicating a weakening trend strength.

6. Possible Scenarios

Bullish Scenario:

If the price breaks above 3,450 with strong momentum, it can retest 3,500 and potentially move beyond.

Bearish Scenario:

If the price falls below 3,300, we could see 3,250 and 3,120 next.

7. Trading Plan

Long Position: Only on breakout above 3,450 with volume confirmation (target 3,500–3,600).

Short Position : If price closes below 3,300 (target 3,250–3,120).

Range Trading: Between 3,300–3,450 (buy dips near 3,300, sell near 3,450).

Summary: Market is in sideways consolidation after a strong uptrend. RSI suggests neutral to slightly bearish. Watch for a breakout above 3,450 or a breakdown below 3,300.

XAU/USD – Institutional Outlook 15 August 2025Gold continues to grind through a tight mid-$3,300 range after Thursday’s hot U.S. PPI print boosted the dollar and dented large Fed rate-cut bets. Despite the short-term pullback, the broader 4H structure remains intact — giving traders both an upside and downside opportunity today.

This is not a scattergun approach. We work with only ONE Buy Zone and ONE Sell Zone with full institutional confluence. Every level here is refined using Price Action, Smart Money Concepts, ICT core principles, Order Blocks, Fair Value Gaps, Premium/Discount arrays, and liquidity mapping.

Primary Buy Zone ($3,325–$3,330) – The Golden Zone

This is today’s highest-probability trade location. Price sits in structural discount, right on top of a fresh 4H Rally-Base-Rally demand zone with a refined bullish Order Block. An unmitigated Fair Value Gap overlaps perfectly with the Optimal Trade Entry (0.705–0.79 retracement) of the last bullish leg.

Liquidity is positioned just below at equal lows near $3,322, inviting a possible stop-run before reversal. Volume imbalance on the prior up-leg confirms smart-money participation.

Entry: $3,325–$3,330

Stop-Loss: Below $3,318 (liquidity + swing low)

Take-Profit Targets:

TP1: $3,357 (local structure)

TP2: $3,380 (Fib 1.272 projection)

Kill Zone: London open into New York overlap

Primary Sell Zone ($3,355–$3,360)

Gold’s upside is capped by a 4H Drop-Base-Drop supply zone nested in premium pricing. A refined bearish Order Block aligns with a Fair Value Gap from the last impulsive sell-off. Equal highs around $3,360 offer liquidity for a potential sweep before distribution.

Entry: $3,355–$3,360

Stop-Loss: Above $3,370 (EQH cluster)

Take-Profit Targets:

TP1: $3,330

TP2: $3,305 (Fib 1.272 extension)

Fallback Zones – In Case of Manipulative Displacement

Fallback Buy: $3,315–$3,320 → Demand zone + OTE + minor FVG; SL below $3,308; same TPs as Primary Buy.

Fallback Sell: $3,365–$3,370 → Secondary supply + OTE + OB; SL above $3,375; same TPs as Primary Sell.

Why the Golden Zone Matters Today

Among all four levels, the Primary Buy Zone at $3,325–$3,330 stands out. It sits at the crossroads of structural discount, smart-money footprints, and liquidity positioning. If price sweeps the equal lows at $3,322 during the London or early NY session, the probability of a sharp, institution-led reversal increases dramatically.

Institutional Consensus

Market commentary from FXStreet, FXEmpire, and DailyForex all acknowledge mid-$3,320s as a key support zone, with resistance forming near $3,355–$3,400. This alignment reinforces our bias: sellers control the premium zone, but buyers are poised to defend structural discounts.

Execution Reminder

Trade only the defined zones with precise risk control. These are institution-level liquidity plays, not mid-range chases. If price fails to respect the primary zone, step aside or switch to the fallback. Patience is part of the edge.

💬 If you find this level-by-level breakdown useful, drop a comment below. Let’s see how the Golden Zone plays out in real time.

Gold XAUUSD Analysis 12.08.2025 IntradayGold is currently moving sideways within the range of 3341/44 to 3356/59. Price is consolidating between these levels, creating a clear short-term support and resistance zone. Unless price breaks out and retests on either side of this range, no trades should be taken. Watch CPI data and other confirmations before entering in the breakout direction.

Trading Signal

Buy Scenario: Break and retest above 3356/60, targeting 3375–3380 zone.

Sell Scenario: Break and retest below 3341/44, targeting 3315–3320 zone.

Gold (XAU/USD) 4H Institutional Analysis — August 6, 2025As of August 6, 2025 (12:23 UTC), Gold (XAU/USD) is trading around 3,367.60, according to Kitco’s live spot price feed. After a sustained bullish recovery from the 3,320–3,330 demand zone, gold finds itself at a structural inflection point. Institutional footprints across the board — from order blocks to liquidity maps — are signaling one dominant message: the bulls are setting the stage.

In today’s breakdown, we deliver a high-conviction execution plan using a fusion of Smart Money Concepts (SMC), ICT methodology, and 4H structural dynamics — isolating only the strongest Primary Buy and Sell zones, along with their fallback counterparts. At the center of this framework is our Golden Zone, the most institutionally-aligned, high-probability area of the day.

🔍 Market Structure & Directional Bias

The 4-hour chart has shown a clear Change of Character (CHoCH) to the upside after a bullish Break of Structure (BOS) above the 3,355 level. This signals a phase shift from consolidation into accumulation and potential expansion, likely aiming toward the 3,400 psychological magnet and beyond.

The presence of volume imbalances, fair value gaps, and unmitigated order blocks across multiple structural layers further supports a bullish directional bias. Liquidity has been swept below previous equal lows (EQL), creating an environment ripe for institutional accumulation.

Directional Bias: Transitional → Bullish

🎯 Primary Execution Zones

✅ Primary Buy Zone (Golden Zone) — 3,355 to 3,360

This zone represents the highest-quality long opportunity on the chart today. Sitting in the discount array (below 50% of recent swing), the zone is built on a fresh Rally-Base-Rally (RBR) demand structure formed after a decisive CHoCH.

The 3,355–3,360 range aligns with a valid unmitigated Order Block, an embedded Fair Value Gap, and an OTE retracement between 0.705–0.79 Fib levels. Beneath this zone lies a sweepable liquidity pocket just under 3,350, further increasing the magnetism of the area.

Entry: 3,355–3,360

Stop Loss: Below 3,350 (liquidity invalidation)

Take Profits:

TP1: 3,395–3,400 (1.272 extension)

TP2: 3,420 (1.618 extension)

Confluences: RBR Demand, OB, FVG, OTE, Volume Imbalance, EQL Sweep, Discount Array, Structural Support

Kill Zone Timing: London-NY Overlap

✅ Golden Zone of the Day

✅ Primary Sell Zone — 3,395 to 3,400

While the broader bias is bullish, gold remains capped by a strong Drop-Base-Drop (DBD) supply zone around 3,400 — also the 1.272 fib extension from prior bullish legs. A pocket of equal highs (EQH) just above 3,405 serves as a liquidity magnet and stop-loss hunting zone — making this supply level extremely attractive for short-term reversion plays.

Entry: 3,395–3,400

Stop Loss: Above 3,405

Take Profits:

TP1: 3,360

TP2: 3,350

Confluences: DBD Supply, OB, FVG, OTE Retrace, EQH Sweep, Premium Array, Structural Resistance

⚠️ Secondary Execution Zones (If Primary Fails)

🟢 Fallback Buy Zone — 3,325 to 3,330

If the market manipulates lower and invalidates the primary buy zone with a deep liquidity sweep, this deeper zone offers a second chance. It contains a secondary demand block, a valid FVG, and lies cleanly within a deep discount retracement.

SL: Below 3,320

TPs: 3,360 and 3,380

🔴 Fallback Sell Zone — 3,445 to 3,450

If gold breaks cleanly above 3,405, likely invalidating the primary sell idea, the next institutional level of interest is 3,445–3,450 — sitting on a higher timeframe premium OB and major liquidity shelf.

SL: Above 3,455

TPs: 3,395 and 3,370

🌐 Institutional Consensus: Bullish Convergence

Institutional analysts across major platforms confirm a bullish bias, with targets hovering around the 3,400–3,420 area:

Reuters reports that gold is near a one-week high, supported by weaker U.S. data and increased rate-cut bets.

MarketPulse highlights the “return of the bulls” amid sustained momentum and light CPI expectations.

Citi has raised its medium-term gold target to $3,500, citing negative U.S. macro headwinds.

TradersUnion confirms support at 3,320 and resistance at 3,400 — mirroring our execution levels.

There is no significant divergence in sentiment or structure, validating today's trade zones with confidence.

📌 Final Thoughts

In a liquidity-driven market, price is engineered — not discovered. Today, that engineering points to one thing: 3,355–3,360 is the Golden Zone — the strongest execution area, supported by eight institutional confluences, favorable structure, and widespread sentiment confirmation.

Gold has re-entered its institutional kill-box. The next move? Likely engineered to deliver smart money profits while trapping the uninformed. Don’t chase price. Let it come to your zone. Execute with discipline.

Next Stop 3420? Gold Bulls Push the LimitBecause the U.S. non-farm payroll report performed worse than expected, gold rebounded strongly last Friday and recovered half of its losses in one fell swoop. The bulls returned strongly. Today, after consolidating at a high level, gold continued to choose to break upward, reaching a high of around 3385.

There is no doubt that bullish forces still hold the upper hand. From a fundamental perspective, the Federal Reserve is currently facing greater pressure to cut interest rates; and it can also be clearly seen from the candlestick chart that a significant "W"-shaped double bottom structure has been constructed near 3268 and 3280, which has limited the gold's retracement space while also playing a key structural support role in the rise of gold. With the combined effects of news and technical factors, gold still has the potential to continue its upward trend. And I think there is still a great possibility that gold will test the 3400 mark again. Once gold stabilizes at 3400, it will definitely hit the 3420-3430 area.

As the center of gravity of gold gradually shifts upward, the lower support area also moves up. The current short-term support is obviously in the 3365-3355 area, while the relatively strong support is in the 3345-3335 area. According to the current pattern structure, the bulls may not allow gold to retreat to the 3345-3335 area. So in terms of short-term trading, we first consider the opportunity to enter long positions in the 3365-3355 area!

XAU/USD Breakout Playbook – Rob the Market!🚨💰 GOLD HEIST IN MOTION! | XAU/USD Thief Trading Strategy (Breakout Edition) 🏴☠️

🧠 Strategic Mindset | Not Your Average Chart Talk

Yo Market Bandits & Pip Hunters – welcome to the underground playbook!

This isn't your grandma’s chart breakdown – it’s a Thief Trading Takedown on XAU/USD (Gold), where we’re not chasing the market… we’re outsmarting it.

THE MASTER PLAN: Enter Like a Ghost, Exit Like a King 👑

📍 ENTRY POINT – The Break-In Begins!

💥 Breakout Level: Watch for 3370.00 resistance to crack – this is our green light.

🕵️♂️ Entry Style:

• Buy Stop above MA resistance zone (fast & clean)

• OR Buy Limit near swing low zones after confirmation pullback (sniper entry)

🧠 Thief Tip: Wait for the breakout to happen. No orders, no SL before it. Patience is profit.

🔄 Layer the Entry:

• Deploy DCA (Dollar Cost Averaging) or scaling entries with precision

• Build positions like stacking cash bags — smart, silent, and calculated

🛡️ PROTECT THE LOOT – Stop Loss Logic 💣

📍 SL Guide: 3310.00 (4H swing low – update as price structure evolves)

🔥 SL ONLY comes after breakout. Set it too early? That’s how you get caught.

⛔ No pre-breakout orders. No early SL. Stay invisible till it's go time.

🎯 THE ESCAPE – Profit Like a Phantom 🚀

💸 Take Profit: 3450.00

📉 Scalpers: Trail SL as price pushes – never give back stolen pips

🌀 Swing Traders: Monitor resistance layers – don’t let the bulls turn on you

🧭 CONTEXT – Why This Setup?

🔍 Macro Snapshot:

• Trend: Neutral/Bullish Lean

• Influencers: COT reports, geopolitical tension, dollar flows

• Sentiment Shifting – watch the herd, but don’t run with it

🗞️ News Risk: Don’t get wrecked by events! Avoid entries during high-impact news.

🚨 Trailing SL is your best weapon during volatility.

⚡ POWER UP THE CREW – Support the Movement

💬 Drop a comment, hit the 🔥 like button, and share with your trading gang

More Thief Trading blueprints coming soon – bigger breakouts, cleaner setups

⚠️ STAY SHARP, THIEVES!

This ain't financial advice – it’s an outlaw’s edge on the market.

Trade smart. Risk well. Protect the bag.

🏴☠️ XAU/USD GOLD HEIST IN PROGRESS... Join the Movement. Let’s Rob the Market.

XAU/USD Intraday Plan | Support & Resistance to WatchGold has continued its rally, breaking through the 3,416 resistance and pushing into the next upside zone.

Price is now trading around 3,421, just below the 3,440 resistance cluster.

The structure remains bullish with price holding firmly above both the 50MA and 200MA, which are acting as dynamic support.

A confirmed break and hold above 3,440 would open the path toward 3,458 and potentially the higher‑timeframe target at 3,478 if momentum extends.

If price fails to sustain above 3,416–3,440 and begins to fade, watch the initial pullback toward 3,400.

A deeper move below that would shift focus to 3,383 - 3,362 and then the Pullback Support Zone.

Failure to hold there could expose price to the lower Support Zone if bearish pressure builds.

📌 Key Levels to Watch

Resistance:

‣ 3,440

‣ 3,458

‣ 3,478

Support:

‣ 3,416

‣ 3,400

‣ 3,383

‣ 3,362

‣ 3,336

🔎 Fundamental Focus

⚠️Not much on the calendar today. Still, manage your risk and stay prepared for any unexpected volatility.

Warning Signs After Gold’s Sharp Rise — Is a Pullback Coming?Today, gold rebounded from around 3345, and has now rebounded to around 3389, which is only one step away from the 3400 mark. Gold has hardly retreated during the rise, and the rise is strong. However, we can see from the small-level candle chart that gold suddenly accelerated its rise after consolidating around 3365, and continued to around 3390, and is now oscillating near the recent high trend line.

After gold accelerated its rise and oscillated near the recent high trend line, this made me have to be more cautious, because we must be careful that the acceleration of gold's rise in the short term is a trap for buyers, so even if we are bullish on gold in the short term, we should not directly chase gold at a high level; according to the current structure of gold, I think it is necessary for gold to retest the 3370-3360 area support before continuing to rise and hitting 3400. Only after verifying that the support in this area is effective can it be conducive to a better rise in gold!

So for short-term trading, I think we can still try to short gold now, and then wait patiently for gold to retest the 3370-3360 area.

Xauusd Bullish 18 July 2025 $4085 Prediction📍Kuala Lumpur, Malaysia – 18 July 2025

GOLD (XAUUSD) INSIGHT – First Accumulation Entry Begins

Today marks the first leg of bullish territory for Gold (XAUUSD) as price begins its early accumulation phase ahead of the Federal Reserve’s rate decision in 11 days. Using a refined OHLC strategy alongside my proprietary Chrono Conditioned Trading (CCT) method, I foresee a strategic retest around $3357 to $3360, which could unlock the momentum needed to approach $3400 and eventually $3500 a key psychological resistance before price makes its way to the $5000 projection.

🧠 Technical Insight: OHLC Strategy

The OHLC (Open-High-Low-Close) method is vital for identifying precision entries:

Open shows the market’s first reaction;

High and Low define intraday volatility boundaries;

Close indicates market sentiment and real direction.

In today's setup, early accumulation begins near the previous daily open, and a break above yesterday's high signals that buyers are returning in strength.

⏱ CCT – Chrono Conditioned Trading Approach

My CCT method focuses on timing-based entries combined with price conditioning:

Entries are planned around event timelines like the upcoming FOMC rate release (FedWatch).

CCT waits for the “right time and right structure” not just price but when price moves.

Today fits that condition: early cycle, pre-news sentiment, and a clean OHLC break structure.

💡 Trading Tip:

“Never chase gold. Let the structure and time align. When OHLC confirms and CCT conditions are met only then, you strike.”

🗓 Fed Expectations:

Although rate cuts are projected for September and December 2025, it is unlikely the Fed will move in July. That uncertainty fuels speculative accumulation—making today a strategic entry point.

Stay sharp. Watch for OHLC rejections or continuation signals above $3360.

If bulls defend $3357 well, gold may reclaim the $3400 range soon setting the stage for the ultimate test at $3500.

#XAUUSD #GoldTrading #OHLCstrategy #ChronoConditionedTrading #FedWatch #GoldAnalysis #CCTMethod

Regards,

Zezu Zaza

2048

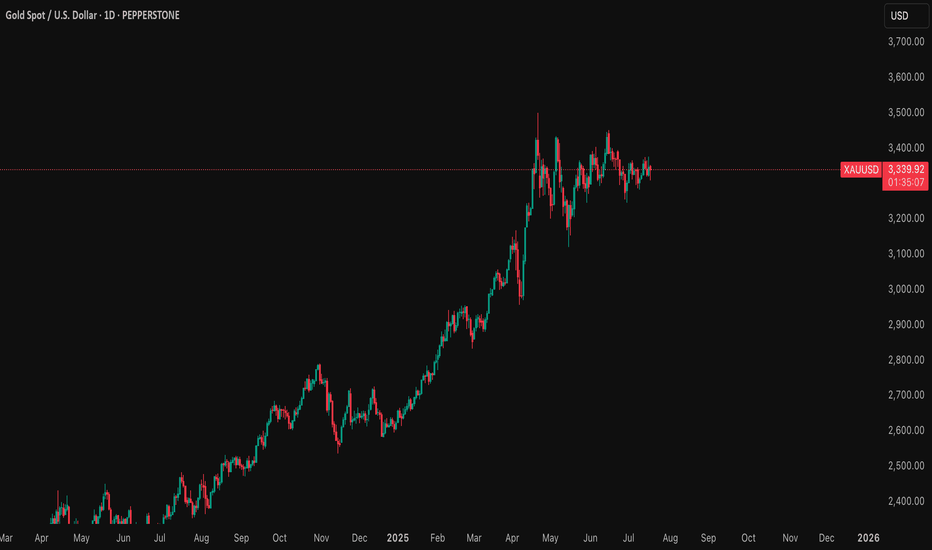

Gold Analysis – Why I’m Targeting $4,085Friday July 18 2025. Malaysia, Kuala Lumpur - Gold analysis done by Zezu Zaza to see the potential upcoming upside starting today this Friday.

I am using a CCT (Chrono Conditioned Trading) technique for my trading based analysis with mathematical strategy in the Xauusd pricing. We will cover the technical, fundamental and sentiment aspect as these are the three components pillars in trading before making any decision and movement trend.

1. Technical Setup (Daily Chart)

Gold is currently consolidating between the $3,300 to $3,375 range after a strong rally earlier this year.

The RSI sits near the neutral 50 level, while the MACD shows signs of a potential bullish crossover.

A confirmed breakout above the $3,375 to $3,400 resistance zone may lead to a surge toward $3,600 to $3,650, and possibly much higher.

Market structure remains bullish, with higher lows forming a solid base around $3,300.

2. Federal Reserve Outlook – 2025 Rate Cuts Expected

The market is now pricing in at least two interest rate cuts from the Federal Reserve by the end of 2025. A 25 basis point cut is expected in September, with another potentially coming in December. Recent CPI and PPI data indicate cooling inflation, giving the Fed more room to ease without reigniting price pressure. Labor market strength is weakening, wage growth is decelerating, and tighter credit conditions are emerging. Fed Chair Jerome Powell recently stated that the risks of over-tightening are now balanced, signaling a shift to a more dovish stance. Lower interest rates reduce bond yields and weaken the dollar, which historically fuels gold’s bullish momentum. If trump fired or Powell decision to step down, this will fire the gold even higher for the catalyze.

3. Market Sentiment (Speculative Positioning)

As of July 11, 2025, the latest CFTC Commitment of Traders report shows speculative net long positions on gold have surged to 203,000 contracts, the highest level in several months.

This signals a strong bullish sentiment among hedge funds and large traders.

In addition, gold ETFs saw over $38 billion in inflows in the first half of 2025, highlighting strong institutional demand as investors seek safety in uncertain times.

The positioning supports further upside as traders bet on a softer dollar and increased market volatility.

4. Macro Fundamentals and Hedge Fund Sentiment

Central banks around the world, especially in the BRICS nations, continue to increase their gold reserves in efforts to reduce reliance on the US dollar.

China has been actively accumulating gold for more than eight consecutive months, with unofficial estimates suggesting holdings of up to 5,000 metric tons.

Several hedge funds and institutional managers now classify gold as a core asset class due to rising fiscal uncertainty, geopolitical risk, and the deterioration of confidence in monetary policy. David Einhorn of Greenlight Capital emphasized that gold is not just about inflation but about the credibility of monetary and fiscal policies. His fund maintains a long gold position and expects higher prices as global deficits and structural imbalances persist.

5. Institutional Forecasts and Speculator Targets

Goldman Sachs has raised its end-of-2025 target to the $3,700 to $3,950 range, citing rising ETF inflows and a softer Fed stance. JPMorgan expects gold to average around $3,675 in the fourth quarter of 2025. Citi, in a bull case scenario, believes gold could trade well above $3,300. The World Gold Council has outlined a high-conviction scenario in which gold could reach $4,000 within the next six to nine months, driven by stagflation and global monetary instability. Greenlight Capital is reportedly aiming for the $3,500 to $3,800 range, though David Einhorn noted that he does not want prices to rise excessively too quickly.

Target Price: $4,085 first before turn the bullish sooners to $5000 price make this same year.

My target of $4,085 is supported by the convergence of multiple factors:

- A bullish technical structure with a potential breakout

- Fed interest rate cuts reducing yields and weakening the dollar. Fed will reduce the rates for the first time this year (12 more days) after this article is published today 18 July 2025.

- Strong speculative positioning and ETF demand

- Aggressive central bank accumulation

- Hedge fund sentiment aligned with rising gold exposure

- Persistent geopolitical and macroeconomic uncertainty

If these conditions hold, $4,085 is a realistic medium-term objective within six to nine months.

Trading Plan Summary

Component Strategy

Entry Zone Breakout above $3,375

Stop Loss $3,300 to $3,320 (below key support)

Take Profit Partial at $3,600 to $3,650, trail remainder to $4,085

Risk Triggers Dollar strength, unexpected Fed hawkish turn, resolution in geopolitics

Key Catalysts CPI done, PPI done, FOMC statements, nonfarm payrolls, war developments

Final Takeaway

This gold analysis blends a bullish technical pattern with the macroeconomic backdrop of an approaching Fed pivot, rising speculative positioning, and ongoing central bank purchases.

Hedge funds and institutions are increasingly viewing gold as an essential defensive asset, especially in the face of deteriorating fiscal credibility and geopolitical tensions.

If gold breaks and holds above the $3,375 level, the path toward $4,085 becomes significantly more probable.

18 July 2025 Friday is a starter ignition trend will born today. I will place some test lots today and will accumulate after from time to time.

Let me know if you what is your opinion or send email to me to reach me for the insitutional analyst or want to see live trade.

Regards,

Zezu Zaza

2048

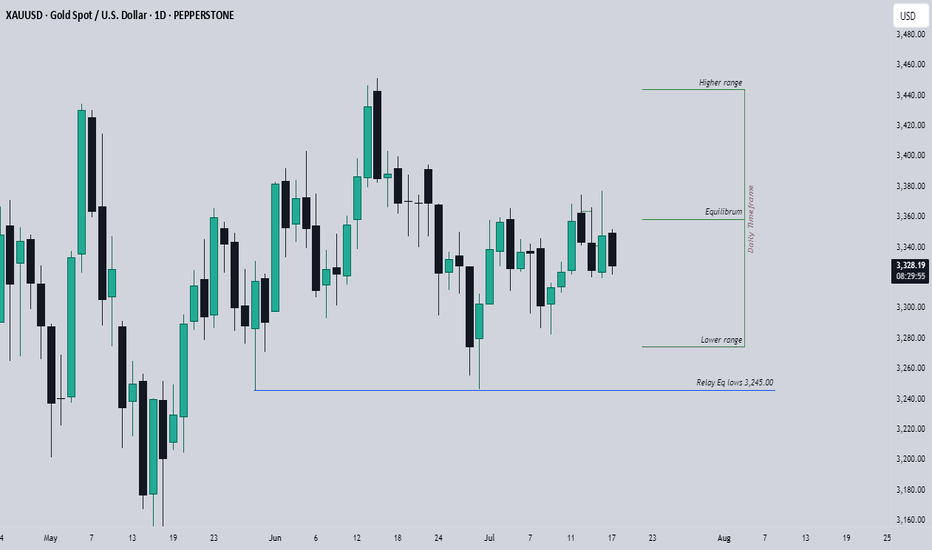

Expectations On GoldPEPPERSTONE:XAUUSD Looking at the daily Range, The market has reached the equilibrium level, is that a sign to go short? no, we could still see a drive to the upper side, but ultimately, the relative equal lows which are close to 3,245.00 big figure should likely be the draw.

I would love to see a drive below the 3,282.00 mark for perfect show to prove the obvious move below the 3,245.00, or seeing a consecutive break below each previous days low would also confirm the directive.

Seeing higher prices would of course negate this analysis, seeing a run into the 3,375.00 big figure yesterday makes me skeptical as this has also left some area of relatively equal highs, so I would give in to the idea of higher prices at least to that level to see what would like occur, but I strongly doubt that this would be the scenerio.

Generally, I am bearish on Gold till I see a run below that 3,245.00 big figure or prices closer to that level.

xauusd setup"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

XAUUSD Weekly Analysis 30 June 4 July 2025Gold has formed a Head and Shoulders (H&S) pattern on the H4 timeframe. While the pattern is not perfectly symmetrical, it is still valid and clearly recognizable. The price has broken below the neckline, confirming a potential shift in market structure to the downside.

Analysis Insight:

The 3340–3350 area, previously a support zone, is now acting as resistance following the neckline break. A pullback to this zone may present a high-probability short opportunity for swing traders, especially if price shows rejection or bearish structure in that zone.

Trade Type: Swing

Trade Setup – Sell on Retracement:

Bias: Bearish on confirmation of retracement rejection

Entry Zone: 3340 – 3350

Stop Loss: 3376 (above right shoulder/high)

Take Profit: 3320/3300/3285/3260

Risk-Reward Ratio: Approximately 1:2

Kindly follow, share, like, support and comment.

Trade Idea: XAUUSD Short (SELL LIMIT) 1. Trend Alignment: H1 shows a clear down-trend — lower highs at 3446 → 3397 → 3347. SMAs on H1/M15 have turned down.

2. High-Probability Pullback: Price has broken the 3340 support twice and pulled back. Resistance here is offering a tight stop and plenty of room to TP.

3. Structural SL: Stop sits just above the prior swing high (~3350–3352)

Entry

Sell Limit @ 3340.37

Prior day low (now resistance) on H1 & M15

Stop Loss

3352.00

Just above the swing high around 3350–3351

Take Profit

3293.07

Invalidation

15 min candle close < 3310

Time Expiry

8:30 AM PST

Cancel if not triggered by then

FUSIONMARKETS:XAUUSD