Eliana | XAUUSD · 15M – Trendline Break & Decision ZoneOANDA:XAUUSD PEPPERSTONE:XAUUSD

Following a clean sell-side liquidity sweep, XAUUSD printed a strong impulsive bullish leg, reclaiming multiple intraday highs. The current pause near 5,000 suggests healthy consolidation rather than weakness, keeping bullish continuation valid as long as price holds above the mitigation zone.

Key Scenarios

✅ Bullish Case 🚀 →

• Sustained hold above the demand zone supports continuation

• 🎯 Target 1: 5,050

• 🎯 Target 2: 5,090

• 🎯 Target 3: 5,125

❌ Bearish Case 📉 →

• Failure to hold support may trigger deeper correction

• 🎯 Downside Target 1: 4,880

• 🎯 Downside Target 2: 4,760

• 🎯 Downside Target 3: 4,657

Current Levels to Watch

Resistance 🔴: 5,050 – 5,100

Support 🟢: 4,950 – 4,880

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

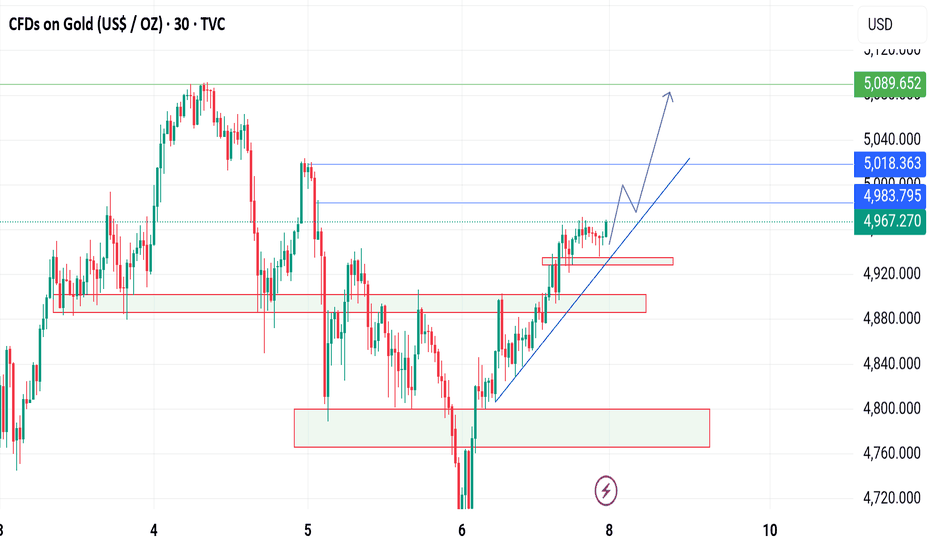

Xauusdshort

XAUUSD – High Volatility, Trading by Reaction Zones (M30)Gold is currently experiencing strong volatility on the M30 timeframe after a sharp rebound from the recent lows. At this stage, the market is no longer trending smoothly but is shifting into a liquidity-driven, two-way environment, where price reacts aggressively at key Supply & Demand zones.

👉 This is not a FOMO market. Priority should be given to trading by levels and waiting for confirmation.

📌 Market Context

The broader structure is still capped by a descending trendline from above.

The latest bullish leg shows active demand, but no clear trend reversal confirmation yet.

Price is ranging within a wide band, making liquidity sweeps on both sides highly likely.

➡️ Short-term bias: Neutral → trade reactions at key zones.

📊 Structure & Price Action (M30)

Price is consolidating between well-defined demand and supply zones.

Each touch of a zone has produced sharp reactions → ideal for short-term MMFlow-style trades.

No confirmed CHoCH yet to validate a sustained bullish trend.

🎯 Trading Plan – MMFlow Style

🔵 BUY Scenario – Focus on Demand Reactions

Only look for BUY setups after bullish confirmation (bullish candles / Higher Low structure on M30).

BUY Zone 1: 4,819 – 4,800

(Short-term demand, multiple strong reactions)

BUY Zone 2: 4,733 – 4,710

(Major demand zone + liquidity low)

Target Zones (TP):

TP1: 4,900

TP2: 4,955

TP3: 5,018

Extended TP: 5,100 – 5,105 (major supply above)

🔴 SELL Scenario – Supply Reaction Trades

If price rallies into supply and fails to sustain bullish momentum:

SELL Zone 1: 4,955 – 4,965

SELL Zone 2: 5,018 – 5,105

Downside Targets:

TP1: 4,900

TP2: 4,819

TP3: 4,733

❌ Invalidation Conditions

Strong M30 close above 5,105 → bearish structure invalidated, reassess overall bias.

M30 close below 4,710 → risk of deeper downside expansion.

🧠 Summary

Gold is in a high-volatility, structure-building phase. The edge comes from:

Trading precise price zones, not chasing candles

Waiting for clear confirmation

Prioritizing risk management over trade frequency

📌 In volatile markets, discipline always beats prediction.

XAUUSD – Pullback into Resistance, Bearish Continuation Setup🔴 Resistance Zones (Sell Area)

Major Resistance: 5,120 – 5,180

Previous support turned resistance

Multiple rejections visible

Liquidity resting above

Upper Resistance: 5,500 – 5,600

Strong supply zone

Marked by previous Higher High

Unlikely to be reached without a trend break

🟢 Support Zones (Targets)

Mid Support: 4,850 – 4,900

Minor reaction area

Major Support / Target: 4,420 – 4,500

Marked as Higher Low support

Strong demand zone

Likely downside objective 🎯

🔁 Current Price Action (~5,008)

Price is stalling at resistance

Momentum is weakening

Formation suggests:

Lower high possibility

Distribution before continuation down

🔮 Probable Scenarios

🧨 Scenario 1: Bearish Continuation (High Probability)

Rejection from 5,050 – 5,120

Break below 4,900

Move toward 4,450 support zone

Matches channel direction + structure

Gold Spot (XAU/USD) – 2H Technical AnalysisGold Spot (XAU/USD) – 2H Technical Analysis

Gold experienced a strong and extended uptrend, moving cleanly inside a rising channel. This phase showed strong bullish control and momentum buying. However, that structure has now failed, which is the most important change on the chart.

The break of the rising channel signals that the bullish trend is over for now. What we are seeing is not a healthy pullback, but a transition from trend to consolidation, often seen before a deeper correction.

Current Market Phase

Price is now moving sideways in a range, showing indecision and balance between buyers and sellers.

Buyers defend the lower area

Sellers cap price near resistance

Momentum is compressed, not expanding

This behavior typically appears before a strong move, not during one.

Key Levels That Matter

Resistance (Sell Zone)

5,100 – 5,120

Price has been rejected here multiple times

As long as price stays below this zone, upside is limited

Support (Decision Level)

4,850 – 4,900

This level is holding the market together

A clean break below it changes everything

Direction Scenarios

1. Bearish Continuation (Higher Probability)

Breakdown below 4,850

Confirms sellers in control

Likely move toward 4,600 → 4,550

Momentum expected to increase quickly

2. Bullish Recovery (Lower Probability)

Strong break and hold above 5,120

Would invalidate the bearish structure

Opens room for trend continuation, but needs strong volume

What Traders Should Focus On

Do not chase price inside the range

Wait for a confirmed breakout

Bias stays bearish below resistance

Risk management is critical during consolidation

Final Take

Gold is no longer trending upward. It is in a distribution and consolidation phase after trend exhaustion. Until proven otherwise, downside risk is higher than upside, and the next decisive move will come from a break of the current range.

XAUUSD on bullish streak XAUUSD is printed CHOCH & Rising pattern is intact.The short-term bias for gold remains bullish.

We are still holding the previous Buy orders & waiting for new order.

-Currently if Price-action remains above 4940-30 then stay focused on buy towards 5045 & 5080 on intraday extension target.

⚠️ Keep in mind any Candle close below lower trendline no more Buys

till the lower liquidity till 4755-4745.

Selena | XAUUSD · 30M – Market Structure Shift & Intraday ExpanPEPPERSTONE:XAUUSD FOREXCOM:XAUUSD

Market Overview

After a strong impulsive drop, XAUUSD rebounded sharply from demand and reclaimed multiple intraday highs, indicating short-term bullish intent. The market is now consolidating just below resistance, suggesting either a breakout continuation toward HTF supply or a pullback for re-accumulation.

Key Scenarios

✅ Bullish Case 🚀 →

• Acceptance above the mitigation zone opens upside expansion

• 🎯 Target 1: 5,040

• 🎯 Target 2: 5,240

• 🎯 Target 3: 5,360

❌ Bearish Case 📉 →

• Rejection from resistance may trigger a corrective pullback

• 🎯 Downside Target 1: 4,880

• 🎯 Downside Target 2: 4,760

Current Levels to Watch

Resistance 🔴: 5,040 – 5,240

Support 🟢: 4,880 – 4,760

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

Selena | XAUUSD – 30M – Intraday Bullish CorrectionFOREXCOM:XAUUSD PEPPERSTONE:XAUUSD

After the aggressive sell-off, XAUUSD found strong demand near the 4720–4750 zone, triggering a corrective bullish structure. Price is respecting the ascending channel, printing higher lows, but remains below the higher-timeframe descending trendline. A clean hold above intraday support could push price toward the next resistance, while rejection from the trendline may lead to another pullback.

Key Scenarios

✅ Bullish Case 🚀 →

If price holds above 4950–4970, bullish continuation is expected.

🎯 Target 1: 5050 – 5070

🎯 Target 2: 5150 – 5180 (Major Resistance Zone)

❌ Bearish Case 📉 →

Failure below 4950 would invalidate the bullish correction.

🎯 Downside Target: 4850 → 4750

Current Levels to Watch

Resistance 🔴: 5050 / 5150 – 5180

Support 🟢: 4950 / 4750

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

XAUUSD 30-min – High Probability Short Setup (SMC/ICT)🚨 HIGH PROBABILITY SHORT SETUP – XAUUSD 30-min

Entry Zone: 4,985 – 4,995

(Confluence: Order Block + FVG Fill + Previous Resistance)

Stop Loss: 5,010

(Above recent high and FVG)

Target 1: 4,880 (Liquidity Pool)

Target 2: 4,840 (Support Zone)

Target 3: 4,720 (Break of Structure Extension)

✅ WHY THIS SETUP WORKS:

BOS Confirmed – Market structure broken bearish

Order Block Resistance – Strong supply zone at 4,988.85

FVG Above Price – Likely to be filled before continuation down

Liquidity Below – Price drawn to 4,880 liquidity pool

CHoCH Present – Momentum shifted bearish

🎯 EXECUTION PLAN:

Wait for price to fill FVG/Order Block zone (4,985-4,995)

Enter short on bearish 30-min rejection candle

Stop Loss at 5,010 (above structure)

Move to breakeven after hitting 4,940

Take partial profits at 4,880 & 4,840

⚠️ RISK WARNING:

Only trade with confirmed rejection

Avoid if price breaks above 5,010

Monitor lower timeframe for entry timing

Gold prices recover - wave A around 4900Related Information:!!! ( XAU / USD )

Gold (XAU/USD) maintains a modest intraday upward momentum during the early part of Friday’s European trading session, although it continues to trade below the $4,900 level amid conflicting market signals. A shift in global risk appetite has prompted investors to seek safe-haven assets, providing support for gold ahead of the upcoming US-Iran nuclear negotiations. In addition, expectations of further interest rate reductions by the US Federal Reserve in 2026—strengthened by indications of softness in the US labor market—also contribute to underpinning demand for the non-interest-bearing precious metal.

personal opinion:!!!

!!!!!! Gold prices recovered in a wave A, continuing to consolidate and trade sideways around 4900-4800.

Important price zone to consider : !!!

Resistance zone point: 4901 , 4942 zone

Gold next move?Gold is facing a strong resistance around the 4900 level, and the price has been repeatedly rejected from this zone, causing it to move downward each time it reaches this area. As long as the market does not achieve a confirmed close above this level, it will remain difficult for price to sustain any upward movement.

Additionally, the market has already collected liquidity on the downside, which increases the probability of further consolidation or corrective moves. Therefore, it is advisable to wait for a clear market close above the 4900 level. Once a strong close is established above this resistance, gold may then continue its move toward the upside.

Gold Analysis - Key Levels & Trade SetupGold is currently moving inside a rising channel maintaining a short term bullish structure after forming a base near the 4600 zone. Price is now testing a major resistance confluence around 5080-5120 where the upper channel boundary previous supply and horizontal resistance meet. Momentum is slowing near the top and multiple rejections from this zone suggest buyers are losing strength. If gold fails to break and hold above this area a strong corrective drop toward lower demand zones is likely.

Trade Plan - Sell Setup

Sell Zone: 5080 – 5130

Sell Trigger: Strong H1 or H4 bearish engulfing candle - Close back below 5080

Targets: 4950 → 4800 → 4650

Invalidation: Daily or strong H4 close above 5200

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Gold Price Outlook – Trade Setup (XAU/USD)📊 Technical Structure

OANDA:XAUUSD Gold has broken lower from a descending channel, with price action failing to reclaim the upper boundary and repeatedly rejecting near the $4,847–4,877 resistance zone. The rebound seen after the sharp sell-off appears corrective, as momentum remains capped below channel resistance and prior structure support has turned into resistance. As long as price stays below this zone, the short-term structure favours bearish continuation toward lower support.

🎯 Trade Setup (Bearish)

Entry Zone: 4,847 – 4,877

Stop Loss: 4,896

Take Profit 1: 4,686

Take Profit 2: 4,659

Risk–Reward (R:R): Approximately 1 : 3.87

📌 Invalidation:

This bearish setup is invalidated if price closes firmly above 4,900.

🌐 Macro Background

From a macro perspective, Gold is under pressure as profit-taking intensifies amid broader market weakness, while easing geopolitical tensions between the US and Iran reduce immediate safe-haven demand. In addition, higher margin requirements in precious metals futures have forced position adjustments, adding to downside pressure. Although concerns over Fed independence could limit USD strength, current flows favor consolidation-to-lower behaviour for Gold.

🔑 Key Technical Levels

Resistance Zone: 4,847 – 4,877

Support Zone: 4,659 – 4,686

Bearish Invalidation Level: Above 4,900

📌 Trade Summary

Gold remains technically weak below descending channel resistance, with rallies viewed as selling opportunities. Unless price reclaims and holds above the $4,900 level, the bias remains skewed toward a retest of the $4,686–4,659 support zone.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

XAUUSD Bearish Outlook: Rejection from Major Resistance ZoneMarket Context: Following a recent bullish retracement, Gold (XAUUSD) has reached a critical structural resistance level on the 15-minute chart. The price is currently showing signs of exhaustion as it interacts with a well-established supply zone.

Technical Analysis:

Price Action: After testing the upper liquidity zone around 5,100, we are seeing a sharp rejection. This suggests that sellers are regaining control at these elevated levels.

Trendline Dynamics: The price has broken below the immediate ascending trendline (blue line), which often serves as an early signal for a trend reversal.

Key Levels: * Resistance: The immediate ceiling is held at the 5,100 - 5,150 range.

Support Targets: The projected path suggests a move towards the intermediate support at 4,700, with a final target at the major demand zone near 4,400.

Market Structure: A lower high formation is expected if the price attempts a small pullback, confirming the bearish bias for the upcoming sessions.

Trading Thought: I am monitoring for a sustained move below the 4,900 psychological level to confirm the continuation of this bearish momentum. Risk management is essential as volatility remains high near the US session.

XAUUSD Potential Bearish Reversal at Key Resistance ZoneMarket Overview: Gold (XAUUSD) is currently approaching a significant resistance area after a strong recovery from recent lows. The price action on the 15-minute timeframe suggests that we are entering a high-interest supply zone where sellers have historically stepped in.

Technical Observations:

Resistance Zone: The price is testing the upper purple horizontal box (supply zone) near the 5,045 - 5,100 level.

Trendline Analysis: We are seeing an intersection of a descending trendline and a recent ascending structure, indicating a potential "squeeze" or exhaustion of the current bullish momentum.

Price Action: The projected path (black line) indicates a possible double-top formation or a rejection from the current liquidity zone.

Target Levels: If the bearish rejection is confirmed, the primary target remains the previous support zones near 4,700 and potentially the lower liquidity pool at 4,400.

Conclusion: I am looking for a shift in market structure on lower timeframes (1m/5m) within this red zone to confirm a short entry. The Risk-to-Reward ratio for this setup looks favorable if the resistance holds.

[XAUUSD] Bearish Bias sellsFundamental Point of View:

We are having some strong usd data currently.

We can look for a consolidation or a start of sell trend after todays long consolidation.

no Negative news on USD from a week.

Technical Point of view

We have a strong Resistance of 5000 If it stays strong we can see a little bearish pressure till 4200.

Better Sells are after a retest of first liquidity takeout with sell confirmation.

setup fails if we break POI and break a new higher high in a small Time Frame like 1H or 15m.

**Key notes to keep in mind:**

1. XAUUSD is in a fresh Bearish trend.

2. we have broken a 4H Low which is the POI now and might get retested times before reaching playing the sell move.

3. we can look for 4000 in this week with strong nfp.

**Current Market Overview:**

Technically we have broken our last Low and its now a point of interest for sellers.

Fundamentally we are bearish as we dont got and weakness on usd.

lets take a look at different Time frames

**4H TF:**

We have a strong Resistance of 5000 and POI If it stays strong we can see a bearish pressure till 4k.

Better Sells are after a retest of POI and low break of consolidation.

setup fails if we break POI and break a new higher high in a small Time Frame like 1H or 15m.

**1H TF:**

We have POI that is respected. and sell side liquidity might taken out.

**15M TF:**

keeping eye on the concolidation zone breakout. if we break we have clean range on the left side.

**5M TF:**

If support is broken we might see sell side liquitidy taken out.

**Overall Scenario:**

we are looking for Sells only if we are respecting the 4H POI and breaking Sell side liquidity is another opportunity to trade.

**How will setup fail?**

simple if 4H Poi is broken and a small higher high breaks in 15 min or 1H.

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold printed a new all-time high before facing a sharp bearish rejection from the highlighted resistance zone. Following this strong sell-off, price dropped aggressively toward the 4400 support area, where buyers stepped in and prevented further downside.

After reacting positively to this key support, Gold rebounded and is now trading around the 4900 level. Based on the current price structure and Fibonacci retracement levels, we expect this recovery to extend toward the upper resistance zone near the 0.618 Fibonacci level.

However, this resistance area is considered a high-probability rejection zone, and from there, a bearish reaction could occur, potentially pushing price back toward the trendline support and lower Fibonacci targets.

Don’t forget to like and share your thoughts in the comments! ❤️

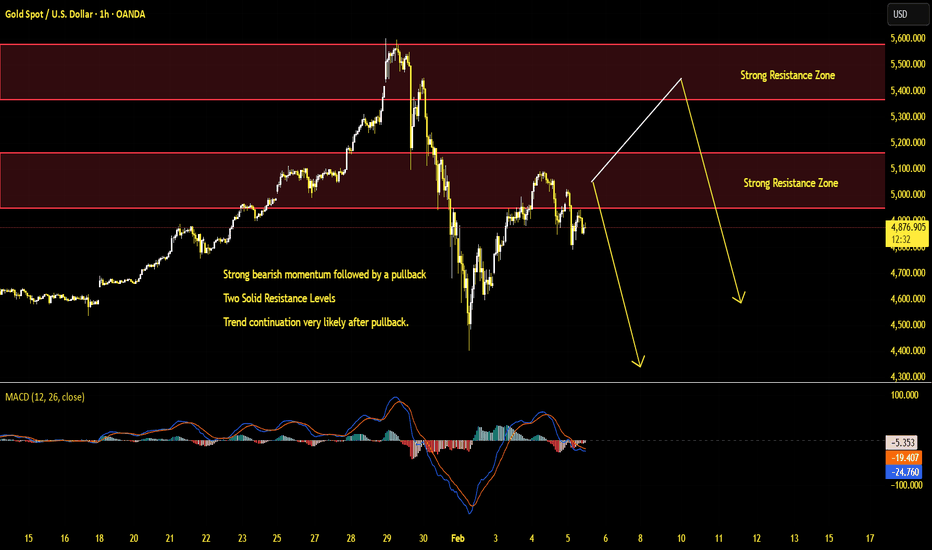

Gold Short Term Sell Trading Opportunity SpottedH1 - Strong bearish momentum followed by a pullback

Two Solid Resistance Levels

Trend continuation very likely after pullback.

👉 If you enjoy this analysis, please Like, Follow, and Support the profile! Your engagement motivates us to share more quality setups.