Mission Complete: 4245-4250:Time to Flip Short on Gold!Gold has already reached a high of around 4246, and its upward momentum has relatively weakened. To be honest, under the current market conditions, I do not advocate aggressively chasing gold above 4240, because as gold continues to rise, more and more callback risks are accumulated! We can also see that each surge in gold is followed by a clear pullback. So even if we choose to short gold, we can still get a good profit margin in the short term!

Although gold is on an overall upward trend, I still divide the rising channel into three areas; the first area: 4250-4220; the second area: 4220-4190, and the third area: 4190-4160. As gold rises, the technical traction of the lower area on the gold price becomes stronger. Therefore, according to the first area division, in the short term, gold has the need to at least retreat to the area near 4220. Even after falling below the area near 4220, it may continue the downward trend to the 4220-4190 area.

Therefore, in terms of short-term trading, I would prioritize trying to short gold in the 4245-4255 area, first targeting the short-term retracement area: 4230-4220 as the target.

If you’re following my trading strategy, don’t just watch — prepare your next move.

💬 Like & Follow for real-time updates and in-depth gold insights.

📈 Follow me for real-time gold insights &to my traders' channel for exclusive setups in bio!

Xauusdtradingview

Profit Both Ways — Double the Trades, Double the Thrill !After gold hit above 4210, it showed obvious signs of stagflation. First, after gold touched around 4218, it retreated to around 4164; secondly, after gold touched around 4212 during the rebound, it retreated again to around 4179.While the two pullbacks were limited, they also indicate that after gold's strong rally, the market is beginning to diverge and diverge.

We can use the ABC rule to determine the position of D. Based on the chart composition, D is around 4160. That is to say, in the short term, gold has the need to retreat to around 4160 again, and this area is also a strong defense line for bulls. If this defense area is broken, gold may continue its downward trend and test the bull-bear dividing line of 4140-4130.

So after a clear rejection signal appears, I think we can continue to try to short gold in the 4205-4215 area. The retracement target area is first located in the 4180-4160 area; and once gold retreats to the 4160-4150 area, we can wait for an opportunity to rejoin the gold long trade!

The 4200 Era Is Coming — Where Will the Next Bull Run Begin?Gold has reached new highs during its rebound, breaking through the recent technical resistance at 4180. In the short term, there is no significant resistance above, and no clear peak signal has emerged, demonstrating the continued strength of the bulls.

From the current technical perspective, gold has formed a clear W-shaped double bottom structure in the short term, combining the 4090 and 4097 levels, providing support for further gains. Therefore, the deep pullback that occurred yesterday is only regarded as a technical pullback in a strong pattern, and does not change its inherent bullish logic; coupled with the support of multiple risk-averse factors in the market, under the resonance of technical and news aspects, according to the previous fluctuation range, gold is expected to continue to rise to the 4210-4230 area.

As the center of gravity of gold continues to rise, the key now is to find the next reliable support level. The current short-term support has clearly moved up to the 4155-4140 area, which is the best position for bulls to re-accumulate strength before the next breakthrough. Therefore, the 4155-4140 area is the entry area for us to focus on building long positions in gold in batches; the short-term upward target area is 4200-4210.

If you’re following this rally, don’t just watch — prepare your next move.

💬 Like & Follow for real-time updates and in-depth gold insights.

📈 Follow me for real-time gold insights &to my traders' channel for exclusive setups in bio!

Volatility = Opportunity—Short Gold Now!Although gold is still maintaining a bullish trend, it has repeatedly fallen back to around 4030 after approaching or touching the 4050-4060 area many times, and has shown multiple high points with upper shadows in the candlestick chart. It can be clearly seen that after accelerating its rise, gold showed obvious signs of stagflation near the trend line resistance area of 4050-4060, and there were obvious signs of retracement after touching this resistance area.

In addition, from the short-term structure, we can see that the current high is near 4059, and the left high is near 4050. If gold cannot effectively hold above 4050 during the next rebound, there will be signs of forming a head and shoulders top in the short term. Combined with technical divergence and overbought conditions, gold may usher in a good retracement in the short term. Combined with technical divergence and overbought conditions, gold could experience a significant pullback in the near term. We should first focus on the support below at 4030-4020, followed by 4000-3990.

So in short-term trading, I still will not give up short trading to gain short-term retracement profits. Therefore, I still advocate considering shorting gold in the 4045-4055 area. As long as gold can effectively fall below 4030, it will inevitably continue its downward trend to the 4010-4000 area.

Fed Catalyst: The Bear AwakensGold rebounded after touching 3660 and is currently fluctuating in a narrow range around 3685. Gold is currently trading relatively cautiously, apparently waiting for the Federal Reserve's interest rate decision to indicate its short-term direction.

How to formulate a trading plan for the Federal Reserve interest rate decision market? In fact, in the short term, I think there will not be much room for gold to continue to rise, and the short-term peak may be in the 3705-3715 area; in addition, regarding the expectation of interest rate cuts, I think the Federal Reserve will adopt a step-by-step approach to announce a 25 basis point interest rate cut, and as for Powell’s attitude, I think it may rely more on the feedback from US employment data and inflation data to decide whether to continue to cut interest rates within the year. The attitude may not be obviously dovish, so I think there is limited room for short-term increases.

Since I think the short-term peak of gold is in the 3705-3715 area, and the short-term resistance area is around 3690. Therefore, I will definitely ambush and short gold before the news is announced. Of course, the transaction needs to be set up in combination with the risk resistance ability of my account.

At present, I tend to divide the upper space into two areas, namely 3685-3695 and 3705-3715. I will mainly short gold in batches around these two areas. Once gold falls as expected, I think it will first test the intraday low around 3660. Once it falls below this area, I think gold is likely to continue to test the area around 3635-3625.

As for whether gold can take advantage of this opportunity to test the area around 3600. I believe I will overcome my greed and will not take risks to gamble for gains beyond my cognition. I will need to make a secondary judgment based on market fluctuations at that time.In any case, I would favor a short gold setup, so let’s hope for a bearish recovery!

Bulls and Bears Poised to StrikeGold is currently fluctuating in a narrow range around 3635-3655, with no clear signs of a breakthrough. However, judging from the current structure, gold has been showing an overall volatile upward trend since it rebounded near 3615.

What needs to be paid close attention to at present is the support performance near 3635. If gold can stand firmly above 3635, it will perfectly maintain the volatile upward structure and provide the prerequisite for breaking through the short-term resistance area of 3655-3665. Once gold uses this as a basis and breaks through the 3655-3665 area, then gold is expected to set a new high again, and even hit the area near 3700.

Since the bulls are still in an advantageous position and the overall structure of the market is oscillating upward, we have no reason not to execute long trades based on the long structure. Therefore, I think that in short-term trading, we can consider going moderately long on gold in the 3640-3630 area.

Bulls vs Bears: Race to 3700 or 3600 ?!Currently, gold is fluctuating above the 3640 line. We can clearly see that gold has not effectively fallen below 3640 during multiple pullbacks in the short term. This proves that during the pullback period of gold, a lot of funds have entered the market, thereby pushing the gold price to fluctuate upward. However, during the upward fluctuation, gold encountered resistance and fell back in the 3655-3660 area many times, exacerbating the short-term volatility trend!

But we need to note that gold has rebounded since 3620 and formed a band-like low point structure; and it has tested 3640 many times and has not fallen below it, showing signs of forming a band-like secondary low point structure. Judging from the characteristics of the low point gradually rising, the current bullish force has a slight advantage, so short-term trading is still dominated by going long on gold.

Judging from the current structure, the short-term support area below is located in the 3635-3625 area, followed by the 3615-3605 area; and the short-term resistance is located near 3660. If gold breaks through the area near 3660 during the volatile upward process, gold may test the high point area near 3675. Once the high point near 3675 is refreshed again, it is expected to directly touch around 3700.

Therefore, it is not completely certain that gold has peaked at present, and we should not blindly chase short gold in trading; on the contrary, when gold retreats to the support area of 3635-3625, we can try to go long on gold, first aiming at the target area: 3660-3670, and once it breaks through this area, the target area will be postponed to the 3690-3700 area.

Gold’s Power Play: Bubble or Break?After gold touched around 3659 during the day, it retreated to our primary target area as expected: 3640-3630 area. In this short transaction, we actually made a profit of 200pips, which is a relatively good trade.

There is no doubt that gold is still in a unilateral upward trend and may continue to around 3670 in the short term, but at the current stage, I would rather wait and see on the sidelines than rush to chase the rise in gold, because I really don’t want to be hanging on a tree and swinging.

What is unstoppable is that I will still try to short gold by touching the top in the high area along the current trend line. Judging from the recent fluctuations, since I don’t have the courage to chase the rise of gold, in order to participate in market transactions, I will try to short gold based on the principle of touching the high point of the trend line. It is not too difficult to earn a profit margin of 100-200 pips in short trading. According to the current trend line constructed, the current upward extension space is around 3670, while the intraday high is around 3660.

Therefore, in short-term trading, we can still continue to try to short gold by using the short-term high point area of 3660-3670 as resistance. The primary short-term target is still the 3640-3630 area. Once gold falls below this area, the target area will be moved to the 3610-3600 area.

Cyclic Patterns Point to 600-Pip Downside in GoldUnfortunately, gold failed to reach the expected 3620 target area during the pullback. It only touched around 3628 in the early morning hours before rebounding again. During this period, because I saw that gold could not fall below 3628, and even could not fall below 3630 at one point, I promptly closed all short positions near 3630. Although the two transactions suffered losses due to the slightly lower entry price, because we added short positions near 3636 and 3646, the overall profit was still $10K.

Gold has now rebounded again and continued its upward trend to around 3657, continuing its upward trend. However, aside from opportunities to enter the long position in the 3630-3628 area, there are virtually no other good long entry opportunities. Judging from the current trend, gold still has the potential to continue to rise to around 3665, but since I missed the opportunity to enter the long position at 3630-3628, I will never choose to chase the rise of gold now.

Although the current uptrend is strong, even if you short gold, there are always opportunities to exit safely and profit during the day. Therefore, I still plan to try to short gold in the 3655-3665 area. Of course, keep my tips from yesterday in mind when shorting. When you first try shorting gold today, try to use a small lot size. When adding positions, you can appropriately increase the number of trading lots to increase the average price and increase profit margins. From a shorting perspective, it is relatively safer!

At present, I will pay close attention to the short-term support area of 3640-3630, followed by the area of 3610-3600. Don’t subjectively think that gold will not pull back to the 3610-3600 area, because in the previous band, after gold experienced three 200pips fluctuation retracements, the fourth retracement reached 660pips; and now gold has experienced three 200pips fluctuation retracements again. If it follows the cycle, gold may usher in another retracement of about 600pips, that is, reaching the 3610-3600 area.

Turning the Tables: Bears’ Guide to Profit in GoldDriven by the dual influence of interest rate cut expectations and the job market, gold prices continue to rise and reach new highs. This is entirely a game played by big money at this stage. Buying sentiment in the gold market is currently so high that most of the time, there's no opportunity to even enter a long position. Therefore, after considering the possible phenomenon of "buying expectations and selling facts", while controlling risks, I carefully tried to short gold. Although I suffered losses frequently, I also made a good profit overall because I successfully captured the volatility.

Currently, gold continues to rise and has reached a high of around 3637. In fact, according to its wave pattern, gold may experience a pullback at any time. This is why I insist on shorting gold today.

The 1st wave: Gold rose from around 3405 to around 3508, a 3.1% increase with a fluctuation of $105.

The 2nd wave: Gold rose from around 3470 to around 3578, a 3.16% increase with a fluctuation of $108.

The current wave: Gold rose from around 3512 to its target of around 3637, a 3.5% increase with a fluctuation of $124.

According to the trend of price fluctuations, gold has reached and, to a certain extent, exceeded the previous two waves, so a pullback is possible at any time.

Furthermore, given that intraday fluctuations have been between $30 and $50 in recent days, and the intraday fluctuation of gold from around 3580 to around 3637 reached $57, a short-term pullback is highly likely.

However, because the bullish momentum of gold is strong, I will continue to try to short gold before a clear peak signal appears, but I may appropriately lower my expectations for gold's pullback, that is, appropriately lower my expectations for profit margins. My current short position entry prices are: 3612, 3621 and 3636. Basically, I add positions every time the fluctuation is 100-150pips. I currently hope that gold can retreat to the area around 3610-3600.

Critical Zone 3610–3620:Shorts Get Ready!After retreating to around 3579, gold rebounded again and has now reached a high of around 3614. Fortunately, the gold retracement gave us the opportunity to safely exit our previous short positions, and we accurately seized this pullback opportunity to close all our previous short positions at a break-even point.

As I said, closing my short position does not mean that I am not optimistic about the gold pullback, but in the process of executing swing trading, we need to constantly adjust to make our short entry price more favorable to us. Therefore, closing the short position entered at a relatively low price previously gives us the flexibility to enter the short position again at a higher price.

Gold was quickly pulled up to around 3614 in the short term. There was almost no headwind in the short term. Driven by the dual expectations of interest rate cuts and risk aversion demand, the bullish momentum was strong. However, in the short term, we are currently facing the 3610-3620 trend line resistance area, so I still do not advocate continuing to chase more gold; on the contrary, no matter what, I will continue to try to execute swing trading to short gold in the 3610-3615 area.

Although the bulls have risen strongly, it does not actually provide a good position to enter the market to go long on gold. Since we cannot participate in long transactions, we can only try to short gold in waves during constant adjustments. On the premise of controlling trading risks, as long as we are not afraid of short-term floating losses, once gold begins to collapse, we will be the first traders to reap the benefits of the short position. Therefore, when gold is facing the trend line resistance area of 3610-3620, I first considered and executed a short trade at 3610-3615 as planned, hoping that the gold market will have a good retracement as some unsteady funds show signs of profit-taking!

Gold’s Next Move: DOWN!!!Although gold continues its strong upward trend, it still provides opportunities for pullbacks during the day. For example, it hit a low of 3470-3467 yesterday. Currently, the highest price of gold has reached around 3550. Gold continues to set new historical highs. There is no price behavior and technical resistance above it as a reference. But obviously, as long as gold remains above 3540, I will not choose to aggressively chase gold at high levels.

On the contrary, while gold is rising, I will still try to short gold at the top while setting protection. In terms of price behavior, gold started to rise from around 3322 and has reached around 3550 so far, with an increase of up to $228. Although there has been no decent retracement during this period, this strong momentum is indeed easy to form a combined force. However, once the market returns to rationality, the decline will definitely not be small. So at the current stage, I do not advocate going long on gold. On the contrary, I will actively look for opportunities to short gold!

In the short term, we first need to observe gold's performance in the 3540-3530 area. If gold cannot fall below this area during the retracement, it may have the potential to continue to rise. If gold falls below the 3540-3530 area, the first retracement target will be the 3525-3515 area. If this area is broken, it is likely to continue to 3500-3490.

Final Bear Profit—Then Gold Turns BullishSupported by Trump's statement and geopolitical tensions, gold continued to rise to around 3394 and is currently fluctuating narrowly around 3390.

Although the upward momentum of gold seems strong, the bulls are not resolute during the rise. Instead, they will launch an attack again after repeatedly testing the support. It is expected that the market is not highly unanimous in its agreement on the continuation of the strong bull market stimulated by the news, so the short-term volatility of gold will be exacerbated during the rise.

As gold continues to rise, it is clearly under pressure in the 3400-3410 area in the short term. Moreover, the bullish sentiment of gold has obviously weakened before facing this area, so we must consider that gold may still retreat after being under pressure in the short term. Below, we should first note the short-term support area of 3385-3375. If gold fails to effectively break below this area during a pullback, it will likely retest 3400.

Therefore, in short-term trading. At present, we can consider shorting gold appropriately in the 3390-3400 area. If gold retreats as expected, we will first observe the performance of gold in the 3385-3375 area. If it cannot effectively fall below this area, we can adjust the trading strategy and re-enter the long trade!

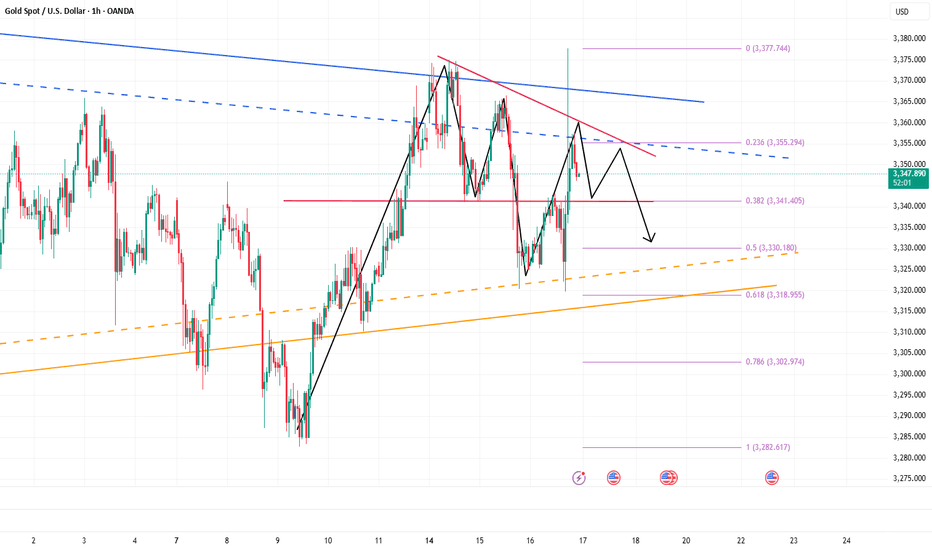

XAUUSD 15m – EW Short SetupHi fellow traders,

On the 15m XAUUSD chart, I am applying Elliott Wave principles to identify a short opportunity. The current structure suggests a continuation to the downside after the corrective move.

An additional confluence here is the red-shaded supply zone, which aligns with my projected entry area and strengthens the setup.

I am entering at 3347.26, with a Stop Loss at 3351.87 and a Take Profit at 3322.53, targeting the next support level.

Good luck and trade safe.

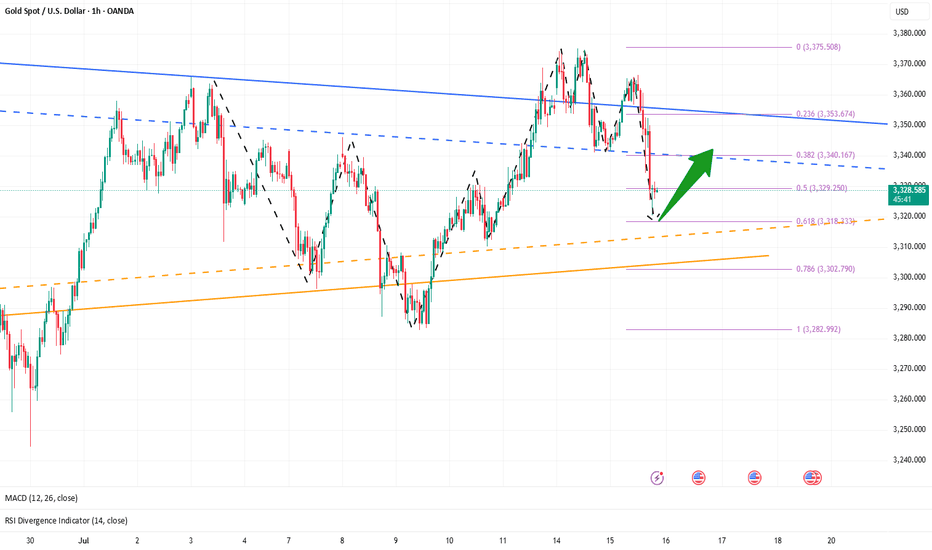

Last chance to go long on goldAlthough the initial jobless claims and PPI data were bearish for gold, it still failed to break below 3340-3330 area. After touching 3340, it rebounded to around 3356, demonstrating that a significant amount of buying capital was still entering the gold market during the pullback, limiting the downside while also providing strong support.

Although gold has experienced several setbacks in its short-term upward trend, the bullish pattern has not completely failed. It remains within an ascending triangle structure in the short term. As long as this structure remains intact, gold could potentially rebound to the 3365-3375 area, or even to the 3380-3390 area, leveraging structural support.

Currently, there is a fierce game between bulls and bears in the short term for gold, which brings considerable difficulties to our short-term trading, but why do I keep insisting on going long on gold? What I want to say is that when you are uncertain in the short term, you can zoom in on the chart period and observe. In fact, the trend is clear at a glance, but there are some twists and turns in the short term!

Therefore, in the short term, I still advocate seeking to go long on gold with the 3345-3335 area as support, first looking at the target 3365-3375 area. If gold breaks through this area strongly during the rebound, the upward trend can continue to around 3380.

Next Stop 3420? Gold Bulls Push the Limit!Gold has shown a step-by-step rise in the short term, and has stood above 3,400 many times, and the bullish force is relatively strong. However, correspondingly, after gold stood above 3400, it fell under pressure several times, so the shape was not particularly good, which increased the risk of pullback in the short term.

However, we do not need to worry. Gold is still running in an ascending wedge structure. Although it has been under pressure and fallen back several times during the attack on 3400, the bullish structure has not been effectively destroyed so far. Moreover, with the sharp increase in gold buying, the 3380-3370 area below has become an obvious intensive trading area, which has greatly limited the gold retracement space.

In addition, after gold broke through 3340, market sentiment tended to be optimistic. If gold experiences a short-term pullback, more funds will flow into the gold market, especially for those who have missed out on long trades before, who will rush into the gold market even more frantically. Under the resonance of the current technical structure and market optimism, gold still has the potential to hit 3400, and bulls are even expected to stand firm at 3400 and make further efforts.

So in terms of short-term trading, I still advocate that gold pullbacks are buying opportunities. And I cherish the opportunity to enter the market and go long in the 3385-3375 area, and am optimistic that gold will hit 3400 again, and may even continue the bull trend to the 3420-3430 area.

OANDA:XAUUSD FOREXCOM:XAUUSD TVC:GOLD FX:XAUUSD CAPITALCOM:GOLD

Don’t Blink — Gold Charging Toward 3400!Overnight, we entered a long trade at 3365 and successfully closed the trade by hitting TP: 3395, locking in nearly 300pips of profit. This was a very successful and accurate trading strategy.

Just now, gold became very crazy after rising, and plunged directly from around 3397 to around 3372. It was a very scary and crazy diving action. In fact, I am not worried about it. On the contrary, I am very happy that it provides me with another opportunity to enter the market and go long on gold. I've already entered a long position in gold again, as planned, in the 3375-3365 area.

Regarding the recent plunge in gold, I think it was intended to scare off the long positions that were somewhat loose in their intentions. Although gold has fallen sharply, it is still in a recent volatile upward structure. The volatile upward structure has not been destroyed in the short term, so I believe that gold will not have much room for retracement for the time being under the support of the bullish structure. On the contrary, I believe that after gold touches around 3397, even if it is weak, it will try to hit the 3400 mark, and it is even expected to continue the bullish trend to the 3420-3430 area.

There may be many friends in the market waiting for the opportunity to enter the long market at 3350 or even 3340, but what I want to say is that under the support of the gold bull structure, the downward space has been greatly limited. In the short term, gold may not go to such a low position at all, so relatively speaking, I prefer to go long on gold in the 3375-3365 area, and I have indeed done so!

False breakout? Gold reverses sharply after news surgeBecause of the news that Trump hinted at firing Powell, gold surged strongly in the short term and passed to 3377, recovering the recent decline in one fell swoop. We went long on gold near 3323 in advance, and went long on gold near 3340 again after gold retreated, hitting TP: 3345 and 3355 respectively. The two long trades successfully made a profit of 370pips, with a profit of more than $18K.

Although gold has risen sharply in the short term and effectively destroyed the downward structure, it is mainly news that drives the market. After Trump denied firing Powell, gold rose fast and fell fast. So we can't chase long gold too much. First, the sustainability of the news-driven market needs to be examined, and second, the certainty of Trump's news is still unreliable. He always denies himself the next day.

After the gold price retreated quickly, a long upper shadow appeared in the candlestick chart, indicating that the upper resistance should not be underestimated. Therefore, we should not rush to buy gold. We can still consider shorting gold in the 3355-3365 area. We should first focus on the area around 3340. If gold falls below this area during the retreat, gold will return to the short trend and test the area around 3320 again, or even fall below this area after multiple tests and continue to the 3310-3300 area.

Golden Support Holds — Bulls Poised for Another Leg Higher"If gold cannot break through the 3365-3375 area, gold will fall under pressure again, or refresh the recent low of 3341, and continue to the 3335-3325 area." Gold's performance today is completely in line with my expectations. Gold just retreated to a low of around 3320, but soon recovered above 3325, proving that there is strong buying support below.

From the current gold structure, the short-term support below is mainly concentrated in the 3320-3310 area. If gold slows down its downward momentum and its volatility converges when it approaches this area, then after the gold bearish sentiment is vented, a large amount of off-site wait-and-see funds will flow into the gold market to form strong buying support, thereby helping gold regain its bullish trend again, thereby starting a retaliatory rebound, or a technical repair rebound.

Therefore, for short-term trading, I still insist on trying to go long on gold in the 3330-3320 area, first expecting gold to recover some of its lost ground and return to the 3340-3350 area.

Continue to try to find the top of the band to short goldGold maintained a slow and volatile rise structure during the day. The highest has reached 3348, and it is only a step away from 3350. Will gold continue its upward momentum as usual?

In fact, it was beyond my expectation that gold could break through 3345 in the short term. According to my original expectation, the intraday high of gold was almost around 3345. Although the rebound of gold exceeded expectations, it is currently located near the resistance of 3348-3350, so I will definitely not give priority to chasing gold at high levels in short-term transactions.

Moreover, gold is currently in the resistance area of 3348-3350. The volatility of gold has converged, and the upward momentum has declined. As gold continues to rebound and faces the key resistance area again, the bulls are relatively more cautious. In this context, this resistance area may act as a catalyst, and the bears will react, leading the decline in gold. However, as gold rebounds and the support below gradually stabilizes, we can appropriately reduce the expectation of gold's decline and adjust the decline target to the 3330-3320 area.

So for short-term trading, I will still short gold based on the resistance area, trying to find a swing top in the 3340-3350 area, and look at the target area of 3330-3320.

Golden Trap: Bulls Exhausted, Bears Ready to StrikeToday, the gold market is in a stalemate between long and short positions, with the market fluctuating sideways for a long time and maintaining an overall volatile trend. Although the rebound of gold has won a respite for the bulls, the rebound of gold during the day is not enough to completely reverse the decline. I think that before the 3325-3335 area is stabilized, the bears still have spare power to dominate the market!

According to the current structure, although gold rebounded again after touching 3310 during the retracement, it has retreated many times during the rebound. The candle chart is interspersed with obvious negative candle charts, indicating that the rebound strength is weak. In the short term, it is under pressure in the 3330-3340 area, and it is difficult to break through in a short time.

So I think the role of the gold rebound may be to trap more buyers, so we try not to chase gold after the rebound. The area near 3310 is not a key support in the short term. 3305-3300 is the current key support area. Once the bears regain control of the situation, gold may test the 3305-3300 area again. Once it falls below the reformed area, it may test 3280 again, or even refresh the recent low to around 3270.

So the downward potential of gold is not over yet. We can still look for opportunities to short gold in the 3325-3335 area and look at the target 3305-3295 area.

Start buying gold, a rebound may come at any time!Gold is undoubtedly weak at present, and bears have the upper hand. However, since gold touched the 3290-3280 area, gold bears have made more tentative moves, but have never really fallen below the 3290-3280 area, proving that as gold continues to fall, bears have become more cautious.

From the perspective of gold structure, multiple technical structural supports are concentrated in the 3285-3275 area, which makes it difficult for gold to fall below this area easily. After gold has failed to fall below this area, gold is expected to build a short-term bottom structure with the help of multiple supports in this area, thereby stimulating bulls to exert their strength and a rebound may come at any time.

Therefore, in the short term, I do not advocate chasing short gold; instead, I prefer to try to find the bottom and go long gold in the 3290-3280 area; but we should note that because gold is currently in an obvious short trend, we should appropriately reduce the expectation of gold rebound, so we can appropriately look at the rebound target: 3305-3315 area.

GOLD - The One That Survived All Ages - Trading PsychologySummer light reading between trades💫

From Ancient Gods to modern banks — Gold never needed marketing to be priceless.

Gold was never invented.

It was found, worshipped, stolen, buried, and bled for.

Long before charts, before forex pairs, before brokers — it was power.

So if you're wondering why this metal moves the world?

Let’s take it back — way back.

But before we dive into history, here’s why traders are addicted to XAUUSD:

It’s fast. Ruthless. Liquid. It can deliver a week’s profit in one candle — or wipe you out in seconds.

If you understand structure, it will reward you like nothing else.

If you’re lazy, impulsive, or just guessing?

It’ll humble you fast and without mercy.

The Discovery – Gold Before Currency

• Gold was first discovered in Paleolithic caves (~40,000 B.C.), admired purely for its beauty.

• Ancient Egyptians called it “The flesh of the Gods” — Pharaohs were buried with it, because in their mind, you couldn’t enter the afterlife without gold.

• No value was assigned — it simply was value.

Empire Fuel – Gold as the Engine of War

• The Roman Empire used Gold Coins (Aureus) to expand its reach.

• Spain and Portugal built fleets just to steal it from the Americas.

• Entire wars were started and sustained by it — Gold wasn’t a luxury; it was national survival.

Gold & the Banks – Trust in a Metal

• 1816: The UK made Gold its official standard.

• By the early 1900s, most major economies followed — every currency was tied to the physical rulling metal .

• Why? Because you can’t print trust. But you can weigh it.

• Even today, central banks don’t hoard crypto or tech stocks — they hoard Gold, quietly, relentlessly.

Collapse, Rebirth, and Chaos – The Modern Era of Gold

• 1971: U.S. President Nixon kills the gold standard.

➤ Until then, every dollar had to be backed by real gold in U.S. vaults.

➤ After that? Dollars became promises, not assets.

• Welcome to the fiat era — where money has no anchor, just hope.

• Gold, no longer “money,” became something more powerful:

➤ The panic button, the global fallback, the last honest asset when everything else crumbles.

• And crumble it did:

🔹 2008: Banks collapse — Gold soars.

🔹 2020: Global lockdown — It explodes.

🔹 2022–2024: War, inflation, debt ceilings, de-dollarization — Gold reclaims the throne.

When fear wins, this metal doesn’t blink. It rises.

From Ancient Tombs to 2025 – Gold’s Unshakable Throne

• Today, you stare at candlesticks.

You mark order blocks, gaps, and key level zones.

But beneath that technical setup is a story written in blood, empire, and survival.

• Gold has outlived Kings. Outlasted currencies. Outsmarted every attempt to replace it.

You can crash a stock. You can ban a coin.

But you can’t cancel this number 1.

• And now? It’s 2025.

The world is uncertain. Digital assets are volatile.

And Gold is still the most traded, most hoarded, most feared asset on Earth.

• You’re not here by accident. You chose to trade this beast — not because it’s easy, but because you know what it means to master chaos.

So you’re not trading a metal.

You’re trading a legacy, so pay respect.

Every setup is a whisper from history — and every move on Gold is just the past repeating itself…

Only this time, the empire isn’t outside.

It’s YOU.

And your chart is your battlefield. So make an effort and study XAUUSD before trading it.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.