Weekly Gold Market Forecast Accuracy SummaryGold staged a strong rally with wide-range fluctuations this week, oscillating in the early days and gradually surging to a new all-time high of 4,967 US dollars. Despite short-term pullbacks, the bullish trend remained intact. I delivered pinpoint forecasts on the week’s trend direction, key support and resistance levels as well as swing trading rhythms, providing a highly certain directional guide for trading positioning. The core points of the accurate forecasts are as follows:

1.Pinpoint Trend Forecast:

I pre-judged that spot gold would trade in an overall strong bullish pattern this week, clarifying that short-term consolidation would not reverse the bullish trend. I accurately captured the weekly swing rhythm of "rally - pullback - new high", pointing out that pullbacks were merely short-term corrections in the strong uptrend and affirming the bullish positioning strategy, which was highly consistent with the actual market movement.

2.Pinpoint Key Level Forecast:

I clearly defined the core support and resistance range for the week in advance, identifying 4,900 as the critical swing support – holding this level would sustain the bullish trend. On the resistance side, I pinpointed 5,000 as the key psychological resistance. The weekly price fluctuated firmly within this core range, and the perfect validation of the forecast came with price rebounding from support levels and pulling back on tests of resistance.

3.Pinpoint Trading Rhythm & Strategy ForecastIn response to the market characteristic of high-range consolidation after hitting a new high this week, I formulated the core trading strategy of "primarily buying the dips at support levels and secondarily selling the rallies at resistance levels" in advance.Meanwhile, I warned of amplified volatility in Friday’s market and recommended focusing on trading during the Asian session to avoid extreme fluctuations. This strategy was highly aligned with the actual tradable opportunities of the week, facilitating steady profit realization.

Overall, I provided a comprehensive and accurate forecast on gold’s trend direction, key levels, market nature and trading strategies this week. The forecasts were fully consistent with the actual market performance throughout the week, delivering professional and precise operational guidance for real trading activities.

Xauusdwave

XAUUSD/GOLD INTRADAY TRADING LEVELS 16.01.26BUY Setup (Bullish Breakout)

✅ Condition: 4H / 15m candle 4613 above close (break + close)

🎯 Targets:

T1: 4622

T2: 4632 (Day Swing High zone)

T3: 4640

🛑 SL:

4607 below (safe SL) / aggressive SL = 4610

📌 Best entry:

4613 breakout → retest → buy

🔻 SELL Setup (Bearish Breakdown)

✅ Condition: Price 4607 below close (break + close)

🎯 Targets:

T1: 4596

T2: 4584

T3: 4576

🛑 SL:

4613 above

📌 Best entry:

4607 breakdown → retest → sell

ElDoradoFx – GOLD ANALYSIS (14/01/2026, ASIA SESSION)CHECK OUT OUR YOUTUBE FORECAST LIVE NOW!!!!

⸻

Gold is trading around $4,585–$4,590 after yesterday’s CPI-driven liquidity sweep above $4,630 followed by strong rejection and distribution. Price is now consolidating below the prior high inside a corrective bearish structure while still holding above the major higher-timeframe bullish trend.

Asia opens inside a compression zone between demand at $4,575 and supply at $4,600–$4,615.

As long as price remains below $4,615–$4,630, sellers remain in control intraday.

⸻

📊 Technical Outlook (D1, H1, 15M–5M)

🔹 D1

• Macro trend remains bullish but price is correcting after rejection from channel highs.

• Failure above $4,630 suggests short-term exhaustion.

• No continuation unless price holds above $4,630.

🔹 H1

• Liquidity sweep above PDH confirmed, followed by CHoCH to downside.

• Lower highs forming below $4,600.

• Price trading under 50 EMA, indicating weak bullish control.

🔹 15M–5M

• Multiple BOS to downside post-CPI.

• Weak bullish attempts failing below $4,600.

• Buyers active only at $4,575 demand.

⸻

✨ Fibonacci Golden Zones

SELL Swing: $4,630 → $4,570

• 38.2% = $4,593

• 50% = $4,600

• 61.8% = $4,607

🟥 SELL Golden Zone: $4,593 – $4,607

BUY Swing: $4,570 → $4,610

• 38.2% = $4,595

• 50% = $4,590

• 61.8% = $4,585

🟩 BUY Golden Zone: $4,595 – $4,585

⸻

🎯 High Probability Zones

📉 SELL Scenario (Main Bias)

Sell Zone: $4,593 – $4,607

🎯 Targets → $4,585 → $4,575 → $4,560

🛑 SL: Above $4,630

⚡ Confirmation:

• Rejection in zone

• Bearish BOS on 5M

• Failure to hold above $4,600

—————————

📉 SELL Breakout Setup

Trigger: Break & close below $4,575

Retest: $4,580 fail

🎯 Targets → $4,560 → $4,545 → $4,520

🛑 SL: Above $4,590

—————————

📈 BUY Scenario (Countertrend Only)

Buy Zone: $4,595 – $4,585

🎯 Targets → $4,600 → $4,615 → $4,630

🛑 SL: Below $4,570

⚠ Only valid if bullish structure forms.

—————————

📈 BUY Breakout Setup

Trigger: Break & close above $4,630

Retest: $4,625 hold

🎯 Targets → $4,650 → $4,680 → $4,720

🛑 SL: Below $4,605

⸻

📰 Fundamental Watch

• CPI release caused liquidity grab and reversal, setting the tone for today’s range.

• Asia likely to remain range-bound unless liquidity is swept again.

• Watch early Tokyo for fake breakouts before London volume enters.

⸻

📌 Key Levels

Resistance: 4,600 / 4,607 / 4,615 / 4,630

Support: 4,585 / 4,575 / 4,560 / 4,545

Break-Buy Trigger → > $4,630

Break-Sell Trigger → < $4,575

⸻

📌 Summary

Gold is in post-CPI consolidation with sellers controlling below $4,600 while buyers defend $4,575. Asia is likely to remain corrective unless one of these levels breaks. Patience is key — wait for structure before committing.

Trend-defining level: $4,600

—

🥇 ElDoradoFx PREMIUM 3.0 — PERFORMANCE 13/01/2026 🥇

⚡️ Clean structure. Controlled risk. Strong execution.

📉 SELL +40 PIPS

📈 BUY +110 PIPS

📈 BUY +40 PIPS

❌ SELL LIMIT −60 PIPS (SL)

📈 BUY +60 PIPS

📈 BUY +160 PIPS

📈 BUY +20 PIPS

📉 SELL +50 PIPS

📈 BUY LIMIT +150 PIPS

━━━━━━━━━━━━━━━

💰 TOTAL PIPS GAIN: +570 PIPS

🎯 9 Trades → 8 Wins | 1 SL

🔥 Accuracy: 89%

━━━━━━━━━━━━━━━

Another disciplined session — trend alignment and patience delivered consistent gains.

— ElDoradoFx PREMIUM 3.0 Team 💼📈

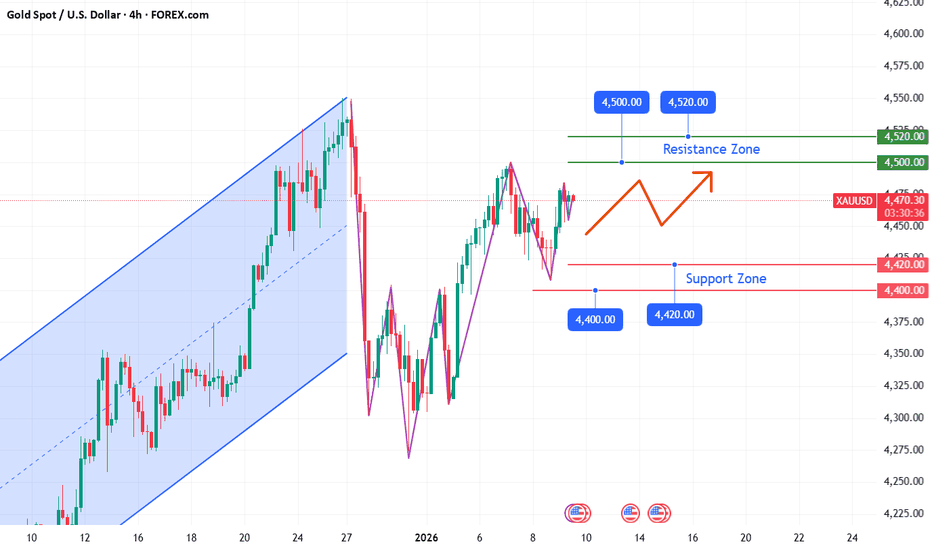

Gold: Consolidating In a narrow range at high levels Gold has been consolidating in a narrow range at high levels today, with bulls and bears locked in a tug-of-war within the key range, and no clear unilateral trend has emerged yet.

Core Support Levels:

Intraday Primary Support: 4450 (the dividing line for short-term strength and weakness, where price has stabilized and rebounded multiple times today)

Key Strong Support: 4420–4410 (previous high-volume trading zone, serving as trend support)

Core Resistance Levels:

Intraday Primary Resistance: 4480–4485 (where price has faced repeated pressure today, acting as the first take-profit target)

Strong Resistance Level: 4500 (dual resistance from both psychological and technical perspectives, acting as the second take-profit target)

For short-term trading, continue to focus on the 4450 support and 4480–4485 resistance. If the price stabilizes above 4485 and breaks through 4500, we can ride the trend for further bullish movement. If it breaks below 4450 and further tests the 4420–4410 zone, investors can deploy long positions in batches near this strong support level, with a stop-loss set below 4400. In case of prolonged narrow-range consolidation, it is advisable to stay on the sidelines and wait for a clear breakout signal.

The US Nonfarm Payrolls data will be released this evening, which may trigger sharp market volatility. It is recommended to optimize position sizing in advance, set appropriate stop-loss orders, and avoid risks arising from the data impact.

Trading Strategy:

Buy 4450 - 4460

SL 4440

TP 4480 - 4490 - 4500

Sell 4485 - 4480

SL 4495

TP 4460 - 4450 - 4440

Gold pulls back from highsGold exhibited a trend of rallying then pulling back and correcting from highs during the intraday session today, continuing the profit-taking momentum. After opening in the Asian session, gold staged a brief rally to hit the intraday high before oscillating downward, and pulled back to the 4420–4440 range for consolidation ahead of the European session. Overall momentum remained weak with no sustained upward drive, which is consistent with the market pattern characterized by profit-taking after a breakout plus passive position-adjustment selling pressure.

Resistance Levels:

Immediate Resistance: 4470–4475 (intraday rally resistance + upper band of the 4-hour Bollinger Bands; a breakout will open the way to further upside toward 4490–4500)

Primary Resistance: 4490–4500 (round-number level + previous breakout level; a valid breakout confirms a bullish trend, with a medium-term target pointing to 4510–4520)

Support Levels:

Immediate Support: 4410–4420 (5-day moving average on the daily chart + upper edge of last week’s consolidation range; a breakdown will significantly heighten short-term correction risks)

Key Support: 4400 round-number mark (psychological support + lower boundary of the medium-term bullish structure; a valid breakdown will shift the price into a weak-range oscillation, with a downside target looking to 4370–4380)

Trading Strategy:

Buy 4410 - 4420

SL 4400

TP 4450 - 4460 - 4470

Sell 4465 - 4470

SL 4480

TP 4440 - 4430 - 4420

GOLD: high-level volatility with a rally followed by a pullbackGold traded in a pattern of high-level volatility with a rally followed by a pullback today. Supported by rate cut expectations and geopolitical safe-haven demand, the price was offset by profit-taking triggered by overbought RSI readings and thin pre-Christmas liquidity. It hit an intraday high of 4525.48 before pulling back to around 4468.

Intraday Key Support and Resistance Levels:

Support Levels:

Core support: 4420, a former breakout level turned support, whose validity needs to be confirmed by pullback tests.

Secondary support: 4470–4480, the intraday consolidation platform that serves as a buffer for short-term selling pressure.

Resistance Levels:

Primary resistance: 4500, a psychological round number and a dense zone for profit-taking.

Secondary resistance: 4520, the trend extension target near the intraday high.

Risk Advisory:

1.Amid thin liquidity, price gaps and slippage are likely to occur. It is recommended to reduce position sizes and strictly enforce stop loss orders.

2.A breakdown of the 4420 support level could trigger an accelerated pullback to 4400–4420, requiring timely strategy adjustments.

Trading Strategy:

Buy 4470 - 4480

SL 4450

TP 4500 - 4510 - 4520

Sell 4495 - 4500

SL 4510

TP 4470 - 4460 - 4450

Gold: Bullish Gold Holds High GroundThe gold maintained an overall strong upward trend today. After surging in the early trading session, it consolidated at a high level, with prices consistently trading above the recent key resistance levels, reflecting a pronounced bullish bias. Its price action is strongly underpinned by favorable fundamental factors, while technical indicators also signal a clear uptrend.

The price extended its rally in the morning and did not experience a sharp pullback afterward. However, hampered by resistance around the 4290 level in the short term, there was no unilateral skyrocketing movement.

Key Levels:

Resistance Zones: Immediate short-term resistance is concentrated in the 4290–4300 range. A decisive breakout above this zone would pave the way for a further advance toward the next key resistance at 4320–4330.

Support Zones: Support levels have been gradually shifting upward. The 4250 mark, once a resistance level, has now evolved into a key support zone. The core support range stands at 4220–4230, with an additional robust support at the psychological integer level of 4200,a price point that previously triggered a swift rebound, underpinned by ample buying interest.

Trading Strategy:

Buy 4250–4255

SL 4245

TP 4280 - 4290 - 4300

Sell 4295–4300

SL 4305

TP 4280 - 4270 - 4260

Gold 4200 Range: Key Levels & Trade PlanGold traded in a narrow range around the key 4,200 mark throughout the day, with fierce tug-of-war between bulls and bears. Market attention remained highly focused on the outcome of the Federal Reserve’s December FOMC meeting.

Resistance Levels

Primary Resistance Zone: 4,220 – 4,225. Constrained by the pressure of the 5-day moving average, price rebounds to this zone are prone to selling pressure.

Strong Resistance Zone: 4,240 – 4,245

This is a level where multiple upward attempts were rejected in previous sessions, with heavy selling interest making a short-term breakout extremely challenging.

Support Levels

Intraday Critical Support: 4,200, As a key psychological round-number level, it acts as the primary intraday support.

Additional Strong Support Zones: 4,170 and the 4,155–4,160 range

The latter represents a confluence support area of the daily pivot midline and the 30-day moving average, which is expected to serve as a crucial floor in the event of a pullback.

Trading Strategy:

Buy 4200 - 4205

SL 4185

TP 4220 - 4225 - 4230

Sell 4220 - 4225

SL 4235

TP 4200 - 4195 - 4190

XAUUSD(GOLD): View Remain The Same Major Swing Sell! Gold dropped to $4030 today, filling up the liquidity gap. However, it reversed nicely. Looking at smaller time frames, we notice heavy selling pressure, which is likely to push the price down towards our target one or two, if fundamentals support the view. Furthermore, we believe the price still has a high chance of going around our top entry around $4380. That area remains a key level if the trend is bearish in the longer term. We advise you to wait for further correction before making any decisions.

Good luck and trade safely!

Team Setupsfx_🏆❤️

Watch for support and entry point for long positions: 4020.Negative news has been priced in; be wary of consumer data.

In the short term, from now until the next three months, gold is an overcrowded trade. Any information next week will be a risk for gold; only renewed hopes for an interest rate cut can boost prices. The meeting is scheduled for December 9-10, during which one or two additional data points may be released. Nevertheless, if expectations for a rate cut do not increase, gold prices are likely to remain stagnant.

The market expects investment demand to remain stagnant until the Fed clearly outlines its path. We need to be cautious whether a longer pause could catalyze a larger outflow of funds from the precious metals market.

After two rounds of pullbacks and sharp rises on Friday, gold prices consolidated slightly around 4065 at the close. Currently, there's no clear distinction between upward and downward momentum, and the market is likely to remain range-bound. A clear direction is unlikely in the first half of next week, and we'll have to wait for data releases before making new trades. One key level to watch next week is the area around 4030, which is the potential entry point for our entry strategy on the second day of next week.

On the hourly chart, gold is currently holding above 4020. If a pullback doesn't break this level next week, we can wait for a pullback to enter long positions. Similarly, if there's an initial rise, we'll still look at the resistance at 4100. Without a clear trend, we can focus on range trading for now. Market conditions are volatile, so please follow our real-time trading strategies.

Short-term trading strategy:

Buy around 4025-4030, stop loss below 4020, take profit at the 4080-4100 resistance level.

GOLD: Range Trading Between 4040-4125Gold is trading sideways in a narrow range today, influenced by multiple factors including Federal Reserve policy expectations and divergent capital flows. Technically, the market is at a critical juncture of bull-bear confrontation.

Despite a strong rebound last night, gold failed to test the 4,110 level, where short-term resistance remains significant. With successive lower highs in rebounds, gold shows a mild bearish bias. We recommend selling on rallies during the early session.

From the 4-hour chart perspective, gold is expected to trade range-bound during the Asian session. On the upside, focus on the short-term resistance zone of 4,110 - 4,125. A decisive break above this range will open up further upside momentum toward 4,150 - 4,180. On the downside, the short-term support lies at 4,040 - 4,050. Holding above this level will prevent a deeper short-term correction, while a break below could trigger a further decline to the key support of 4,000.

Technically, the bias remains tilted toward consolidation and pullback. We will patiently wait for opportunities to enter positions at key levels.

Sell 4110 - 4120

SL 4125

TP 4080 - 4070 - 4060

Buy 4050 - 4060

SL 4040

TP 4090 - 4100 - 4110

XAUUSD — Deep Narrative Breakdown Through Liquidity & Imbalance🔶 Welcome to “Imbalanced” — A Market Logic Space

This page is focused on clean charting, liquidity behavior and imbalance-based price delivery.

I share structured narratives, premium/discount zones, and disciplined execution models for XAUUSD.

No signals.

No promotions.

Just pure market logic.

If you value clarity over noise, you’ll feel at home here.

The current structure on Gold continues to respect algorithmic delivery, with price moving between well-defined inefficiencies and liquidity pockets.

After the previous displacement, price began building a distribution inside premium, leaving a clear trail of imbalances above and sell-side liquidity resting below.

The chart highlights multiple areas of interest:

• Imbalance & BISI above:

Price has yet to revisit these inefficiencies, suggesting unmitigated zones remain inside premium. These areas represent where the algorithm last delivered impulsively and where future reactions may form once liquidity conditions shift.

• Equal lows (EQL) & Sell-side liquidity:

Beneath the current range sits a cluster of equal lows—textbook liquidity. These resting lows often act as a magnet for engineered pushes, creating clean narrative continuation toward discount levels.

• SIBI in discount:

The lower imbalance zone aligns with a logical draw, given the repetitive taps at the mid-range and the market’s tendency to rebalance inefficiencies left behind during fast moves. This SIBI remains a major reference point for understanding how the next leg might unfold.

Overall, the chart is not about predicting but about reading the story the market is writing:

liquidity creation, imbalance expansion, and the delivery toward areas where inefficiency and resting liquidity coexist.

This is a narrative-driven read, focusing solely on structure, flow, and algorithmic footprints—nothing more, nothing less.

The market leaves the clues; our job is to decode them.

— Imbalanced | Precision in Price Delivery

XAUUSD: Gold $3500 NextGold currently trading at a very key level from where we think price can reverse, there are three targets if the trade setup get activated. Remember to risk appropriately based on your own risk management. If you like our idea then do consider liking and commeting it means a lot to us.

For further information, please read the chart thoroughly which will give you better idea.

good luck

Team Setupsfx_

XAUUSD/GOLD 1H BUY PROJECTION 06.11.25XAUUSD (Gold/USD) on the 1-hour timeframe, dated 06.11.25. Here’s a clear breakdown of what the analysis suggests:

🟢 Overall Bias: BUY Projection

The setup shows a bullish outlook for Gold, following a trendline breakout and retest.

🔍 Key Technical Details:

Trendline Break & Retest:

A downward (bearish) trendline was broken to the upside.

Price retested the broken trendline, confirming potential for upward continuation.

Temporary Resistance:

Around 3989–3990 level (current price area).

If this zone is broken cleanly, further upward movement is expected.

Uptrend Line (1H):

An ascending trendline is drawn, suggesting the current bullish momentum.

The projection follows this uptrend structure.

Resistance Levels:

Resistance R1: Around 4000–4010

Resistance R2: Around 4020–4030

These are potential target zones for buyers.

Support / Stop-Loss Area:

Below 3970, marked in the red shaded region, is the invalidation level if price drops below it.

🧭 Projected Path:

The arrows indicate the expected movement:

Minor pullback from temporary resistance.

Bounce off the trendline.

Continuation up through R1 and potentially toward R2.

💡 Summary:

Bias: Bullish (Buy)

Entry Zone: Near 3980–3990 after retest confirmation.

Targets:

TP1 = 4000–4010 (R1)

TP2 = 4020–4030 (R2)

Stop-Loss: Below 3970 support.

Would you like me to calculate the risk-to-reward ratio (RRR) based on these zones

XAUUSD/GOLD 1H SELL PROJECTION 04.11.25sell limit projection for XAU/USD (Gold) on the 1-hour timeframe, dated November 4, 2025.

Here’s the breakdown of the setup:

Trend Context:

The blue diagonal line labeled “BROKED 1H UPTREND CHANNEL” indicates that the price has broken below a previous uptrend, suggesting a potential bearish reversal.

Sell Entry Zone:

The “BREAKED ZONE” (around 4,007.863) is the projected sell limit entry area. The trader expects price to retest this level before continuing downward.

Stop Loss:

Placed above the resistance zone at approximately 4,023.449, protecting against a false breakout.

Target / Take Profit Levels:

Support S1: Around 3,984.000, likely the first take-profit (TP1).

Support S2: Around 3,966.380, the main target price (TP2) for the sell setup.

Trade Plan Summary:

Entry: ~4,007.86

Stop Loss: ~4,023.45

Take Profit: ~3,966.38

Bias: Bearish (sell after retest of broken trendline and resistance)

#XAUUSD: Massive Drop Is In Making! Bears In ControlDear all,

We are seeing significantly increased bearish volume since yesterday now we think price is likely to remain bearish for couple of days or week so price could make major correction. Please wait for price to settle down.

Good Luck

Team Setupsfx_

XAUUSD/GOLD SELL LIMIT PROJECTION 27.10.25Pattern Context

There’s a descending triangle or M-pattern that has been broken to the downside.

Labels such as “BREAKED M PATTERN NECKLINE HERE” and “BREAKED TRIANGLE PATTERN” indicate bearish structure.

Trade Setup

The chart projects a sell limit order in the region around 4,062–4,083 (highlighted red zone).

Stop loss is above the recent high — around 4,083.185.

Entry appears to be at the retest zone near 4,062.189 (“BREAKER ZONE RETEST & SELL”).

The target (take-profit area) points toward temporary support at approximately 4,031.150, suggesting a bearish continuation.

Trend Lines

A broken uptrend line and triangle breakout support the short bias.

The blue uptrend line and black triangle structure confirm the confluence zone where the retest and rejection may occur.

Summary of Bias

Direction: Bearish (Sell setup).

Confirmation: Triangle & M-pattern breakdown, retest expected.

Risk Management: Stop above 4,083; target near 4,031 (risk-reward ratio ≈ 1:2 depending on entry).

Today's gold trading strategyExpectation of policy easing "stable with growth": Despite the presence of hawkish voices within the Federal Reserve, core officials have expressed clear signals of easing measures - the President of the St. Louis Federal Reserve, Musalem, explicitly stated that if there are further risks in the labor market, he might support another rate cut. More importantly, the probability of a rate cut at the October 28-29 interest rate meeting remains above 90% in the market. This policy expectation provides a solid support for gold. As an interest rate-sensitive asset, gold's attractiveness will continue to rise in an environment where the easing expectation is clear.

Today's gold trading strategy

xauusd @buy4060-4080

TP:4110-4130-4200

SL:4040

Gold: Focus on the 4000 markAfter gold prices recorded a sharp decline on Tuesday, they continued their correction on Wednesday. However, the downward momentum weakened significantly when approaching the 4,000 mark, with no effective break below this level.

The price tested this mark multiple times during the day but stabilized and rebounded each time, indicating that the 4,000 mark has initially formed short-term support. Based on this, today’s focus should be on whether the 4,000 mark can hold: if it remains intact, short-term price action is expected to be a wide-ranging oscillation at higher levels for a correction; if broken, it may open up further downside space.

On Wednesday, gold prices repeatedly tested the 4,010-4,000 range, and candlesticks with long lower wicks were formed each time. This candlestick pattern directly confirms the strong support nature of this range. Today trading should take this range as the core reference: on the premise that the 4,000 mark is not broken and the 4,010-4,000 support range remains intact, it is not advisable to blindly chase short positions at low levels, and short-term rebound risks should be guarded against.

💎Trading Strategy:

@Buy 4010 - 4015

SL 4000

TP 4030 - 4020 - 4070

@Sell 4120 - 4125

SL 4130

TP 4100 - 4080 - 4060

Daily-updated accurate signals are at your disposal. If you run into any problems while trading, these signals serve as a reliable reference—don’t hesitate to use them! I truly hope they bring you significant assistance

Gold: The M-top pattern indicates a downward risk📈Gold’s situation today is quite complex, marked by sharp volatility. Looking at the price trend, after a rare steep drop the previous night, the Gold continued to slide following today’s opening, touching a low of 4004.5. It then staged a short-term rebound of over $100, fluctuating around 4100 and peaking at 4161.It then continued to decline.

📝In terms of influencing factors:

The cooling of safe-haven sentiment is one of the key reasons for Gold’s decline. Europe’s support for Russia-Ukraine ceasefire negotiations, the expected resolution of the U.S. government shutdown crisis, and the easing of Sino-U.S. trade tensions have all led to a significant drop in market demand for safe-haven assets.

📈Gold had risen too sharply in the earlier stage, fueling strong sentiment among investors to take profits at high levels. A large number of sell orders pushed its price down sharply.

Additionally, the strengthening of the U.S. dollar during the day has also exerted certain pressure on gold prices.

📝From a technical perspective:

The Gold closed with a long bearish candlestick on the daily chart, accompanied by a simple M-top formation. This indicates the risk of the market continuing to move downward. The upper resistance zone is between 4150 and 4180, the key lower support level is at the 4000 integer mark, and further downside support lies between 3900 and 3904.

💎Trading Strategy:

Buy 4075 - 4085

SL 4060

TP 4115 - 4125 - 4135

Sell 4150 - 4160

SL 4175

TP 4085 - 4100 - 4115

Daily-updated accurate signals are at your disposal. If you run into any problems while trading, these signals serve as a reliable reference—don’t hesitate to use them! I truly hope they bring you significant assistance

Gold: Resistance at 4380 is significant📈Today, during the Asian session, the Gold continued its bullish trend, with the price once surging to 4375, but failed to hold steady afterward and pulled back.

📝From a technical perspective, the overall upward structure of London Gold on the daily chart remains intact, and the short-term technical pattern still shows a relatively strong momentum. However, there is certain resistance around the 4380 level, as the price failed to break through it in the previous two attempts,If the resistance at 4380 is broken, it will open the channel for further upward movement, we will focus on the resistance zone around 4400–4440; if this support 4280 fails to hold, gold prices may fall further to 4150 or even lower.

📝Looking at the 4-hour chart, the immediate focus above is on the short-term resistance zone of 4380-4383, while the support zone below is 4280-4290. If the bulls fail to achieve a sustained breakthrough, the market is likely to enter a consolidation phase later. In terms of operation, it is advisable to trade within this range. Refrain from excessive actions or chasing trades at mid-range levels; instead, wait patiently for key levels to enter positions.

💎Trading Strategy:

Buy 4290 - 4300

TP 4320 - 4330 - 4340

SL 4280

Daily-updated accurate signals are at your disposal. If you run into any problems while trading, these signals serve as a reliable reference—don’t hesitate to use them! I truly hope they bring you significant assistance