XMR Accumulation Time, dont miss the entrySUMMARY - DW no longer accepts BTC, the demand for this has increased significantly as many more users must acquire this to transact on that platform. Technicals lean bull

This post will be broken down by

Section 1 - Metcalfes law X XMR

Section 2 - Technical Overview

1. Quick refresher: Metcalfe’s Law (applied correctly)

Metcalfe’s Law says:

Network value ∝ (number of active users)²

Key word: active.

Not holders.

Not speculators.

Participants who actually need the network to function.

This distinction matters a lot for XMR.

2. Forced migration ≠ organic adoption — but it still counts

If BTC is no longer accepted on a platform and users are forced to use XMR, you get:

Immediate increase in:

Active wallets

Transactions

Liquidity demand

Not just “interest” — usage

From a Metcalfe perspective:

This is high-quality node growth

Each new user must interact with others using XMR

That creates real network connections, not passive edges

This is actually stronger than speculative onboarding.

3. Why XMR benefits more than BTC under Metcalfe’s Law

BTC already has:

Massive user base

Diminishing marginal network effects

Many users who don’t transact

XMR has:

Smaller but high-intent user base

Utility-driven usage (privacy, censorship resistance)

Much higher marginal value per new user

In Metcalfe terms:

Adding 100k forced users to BTC barely moves the needle

Adding 100k forced users to XMR can reshape the network graph

This is convex growth.

4. The “forced-use flywheel”

Here’s where it gets interesting.

When a platform forces XMR usage:

Users acquire XMR

Merchants hold or recycle XMR

Liquidity deepens

Infrastructure improves (wallets, bridges, rails)

Friction drops

XMR becomes default elsewhere (DW)

That’s second-order network expansion, which Metcalfe’s Law underestimates.

BTC already ran this loop years ago.

XMR is still early in it.

5. Price impact vs network value

Metcalfe’s Law explains value, not price timing.

Forced adoption increases velocity

Velocity increases liquidity premiums

Liquidity premiums reduce risk

Reduced risk raises valuation multiples

Price pressure increases because XMR must be held and circulated

Supply is relatively inelastic (tail emission still small vs demand spikes)

This is why XMR often moves in step-function jumps, not smooth curves.

6. The critical risk (and limitation)

Metcalfe’s Law only holds if:

Users stay after the forcing function

They reuse XMR beyond that platform

OTHERWISE DW may also start accepting ZEC

If users:

Enter → transact → exit immediately

Or use custodial wrappers that abstract XMR away

Then the network graph does not densify, and the effect fades.

Persistence matters more than onboarding count.

7. Net assessment

If BTC is banned and XMR is forced:

MOST LIKELY SCENARIO

Structural demand increase

Durable network expansion

Nonlinear valuation impact

WORST CASE

Temporary volume spike

Short-term price volatility

Minimal long-term effect

but with a long term floor at 200, the R:R is favorable

But asymmetry favors XMR.

Metcalfe’s Law applies extremely well to XMR in forced-adoption scenarios because:

XMR users are active by necessity

Each new user adds disproportionate network value

Privacy coins scale through usage density, not hype

TECHNICALS

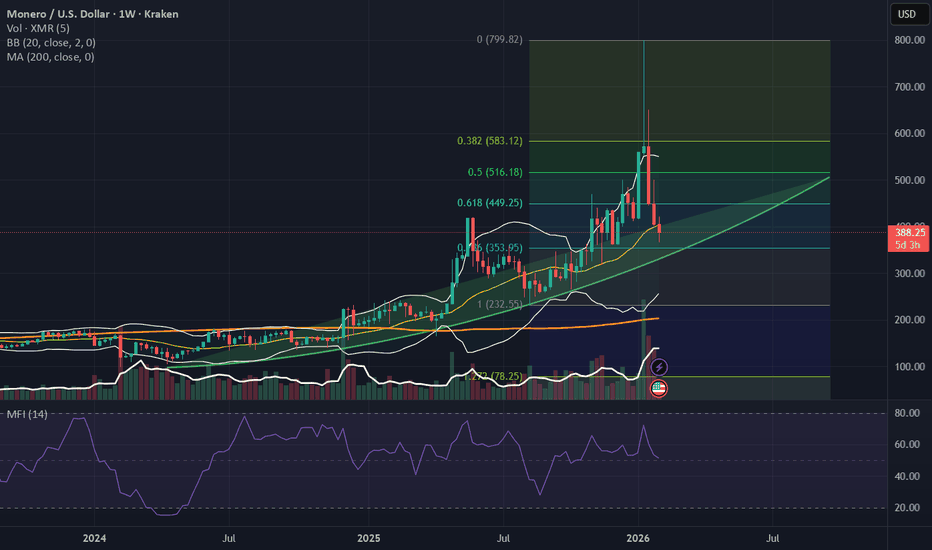

1. Trend & Structure (Weekly)

Primary trend: Still up on the higher timeframe.

Price is well above the 200-week MA (~203) → long-term bull structure intact.

the last 3–4 candles show distribution / pullback behavior after a blow-off top near ~$600–650. This appears to be a retracement rather than a trend reversal as there are still signs of price acceleration.

This looks like a healthy weekly pullback, not a trend break—yet.

2. 200-Week Moving Average (Orange)

Strong historical cycle support

3. Bollinger Bands (20, 2)

Upper band expansion preceded the spike = classic volatility expansion

Price tagged the upper band hard, then snapped back inside

Current candle closing near the BB midline (~403)

This is mean reversion, not breakdown

This is textbook post-impulse behavior.

4. Volume

Huge volume spike on the recent sell-off candle

Volume spike occurred above the 200-week MA

Often this marks local bottoms, not tops, on higher timeframes

**Watch next 2–3 weekly candles**

Falling price + falling volume = bearish continuation

Flat price + declining volume = consolidation

Green candle + solid volume = next leg setup

5. MFI (Money Flow Index – 14)

Currently around 51

Previously overheated near 70+

Now reset to neutral without entering oversold

MFI holding 40–50 zone = accumulation range

6. Key Levels to Watch

Support

~$400 → BB midline + psychological

~$350 → prior structure + consolidation zone

~$300 → must-hold for bull continuation

~$200 → macro support

Resistance

~$450–480 → local supply

~$550–600 → prior high close

TLDR; Im going to ACCUMULATE. Not financial Advice and for research/entertainment purposes only =)

Xmr

Monero at support, I get a feeling that it isn't overJust as there is a reaction at resistance; whenever a strong resistance level is hit, the market always produces a retrace or correction. In reverse, when the action reaches support a reversal can happen even if only a small one.

Monero is now trading at support after three red weeks. The session that produced the all-time high can also be considered negative.

Now, trading at support, there can be a reversal and this reversal can lead to a challenge of the same resistance from last month. It works in two ways.

If the bullish reversal stops around $600-$650 we know a lower high will result followed by lower prices. If the rise can go beyond this level, we know the ATH range can be tested as resistance once more.

If Monero can go toward a new all-time high fully depends on price action—live. It is hard to make such a prediction because the market already produce outstanding growth so anything goes.

Lower high, double-top or higher high, the chart calls for a reaction at support. This means some sort of bullish action before XMRUSDT moves lower. There is growth potential on this chart.

Since the entire market is turning bullish now, this supports the signals here present for a new rising wave.

Namaste.

XMR Trade Setup – Eyes on the Reversal ZoneXMR is currently ~50% below its ATH, with recent price action unable to hold above the critical $410 resistance. This breakdown has opened the door to further downside, with the next major support zone becoming a key area to watch. If sentiment improves, this zone could act as a reversal base.

🔍 Potential Entry Zone: $323 – $343

This range aligns with historical demand and may attract fresh buyers. It's where I'm looking for a reaction before confirming any setup.

🎯 Targets:

TP1: $410

TP2: $480

TP3: $620

🛑 Stop-Loss: $296

Below key structure – protects against deeper breakdowns.

Waiting for confirmation in the zone. Risk management is key.

🕒 Patience wins. Let price come to you.

#XMR Just Flipped Control – Bears Are Running Out of Time

Yello Paradiser!, are you aware that #XMR has been signaling the exhaustion of its bearish cycle long before the recent breakout even occurred? The structure has been quietly transitioning from distribution into accumulation, and the market is now starting to reveal that change.

💎#XMR shows a clear deceleration of downside momentum from one descending channel into another. In Elliott Wave theory, this behavior is commonly seen during the late stages of a corrective or impulsive decline, particularly as wave 5 begins to lose strength. This structural compression strongly suggests that the downtrend was nearing completion.

💎The recent breakout from the descending channel is technically critical. Price has decisively crossed above the top of wave 4, which confirms a Change of Character (CHoCH). A bullish divergence on the RSI between wave 3 and wave 5. This is a classic confirmation of wave 5 termination and increases the probability that a trend reversal is already in progress.

💎The breakout occurred with a sharp and impulsive move to the upside, which is characteristic of a wave 1 or wave A advance. Such price behavior reflects strong demand entering the market and confirms that buyers have regained control of the short-term structure.

💎From here, two primary Elliott Wave scenarios remain valid. #XMR may be starting a new impulsive bullish cycle in the form of a 1–2–3–4–5 structure, or it may be developing a corrective ABC or WXY rally within a larger-degree bearish trend. Regardless of the macro labeling, both scenarios point toward one more strong upside expansion before any meaningful correction occurs.

💎Key resistance is located at the top of the larger-degree wave 4, around the $650 region. This level represents the natural target for the current advance and could be exceeded if the move develops impulsively. On the downside, major structural support is located near $410.

Strive for consistency, not quick profits Paradisers. Treat the market as a businessman, not as a gambler. This is the only way you will make it far in your crypto trading journey. Be a PRO💰

MyCryptoParadise

iFeel the success🌴

[LOI] - Levels of Interest - SCRT - SCRT

Key Points

Secret Bridge for XMR Enhances Privacy in Cross-Chain Transfers: It addresses exposure risks in standard bridges by enabling confidential bridging of Monero (XMR) to Secret Network as sXMR, preserving anonymity while allowing DeFi participation without revealing transaction details.

Long-Term Bullish Outlook for SCRT: Driven by growing demand for programmable privacy in DeFi and AI.

Crypto Macro Influences: Recent oil seizures and tariffs may boost illicit trade (estimated at $2-3 trillion globally), increasing need for privacy tools like SCRT; pro-crypto shifts under Trump could spark altcoin growth, but economic pressures like inflation might delay it.

AI Push in Privacy Landscape: Secret Network leads with confidential AI via TEEs, ensuring private data processing; this aligns with rising enterprise adoption (projected 60% by 2027) amid data breach concerns, potentially positioning SCRT as a hub for secure AI.

Please note that this is a preliminary research paper and you should continue to do your own research (DYOR). Information about assets can change rapidly, and it's essential to stay updated with the most recent developments.

Notes on how I personally use my charts/NFA:

Each level L1-L3 and TP1-TP3 (Or S1-S3) has a deployment percentage. The idea is to flag these levels so I can buy 11% at L1 , 28% at L2 and if L3 deploy 61% of assigned dry powder. The same in reverse goes for TP. TP1: 61%, TP2:28% and TP3:11%. If chart pivots between TP's, in-between or in Between Sell levels these percentages are still respected. I like to use the trading range to accumulate by using this tactic.

Just my personal way of using this. This is not intended or made to constitute any financial advice.

This is not intended or made to constitute any financial advice.

NOT INVESTMENT ADVICE

I am not a financial advisor.

The Content in this TradingView Idea is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within this idea constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this idea post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the idea/post constitutes professional and/or financial advice, nor does any information on the idea/post constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the idea/post before making any decisions based on such information.

TheBitcoinGeneration

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by

Structure Still Bullish On XMR (3D)📈 Bullish Market Structure

From the point where the green arrow is marked on the chart, price has clearly entered a strong bullish phase. Based on the current price behavior, market structure, and wave development, this movement strongly resembles a Bullish Diametric pattern, which typically appears during complex corrective structures before continuation.

At the moment, price is moving inside Wave F, which is the current active leg of this pattern. Importantly, Wave F has already delivered a healthy and controlled correction, both in price and structure. This correction is constructive and aligns well with the characteristics expected in a valid Diametric formation.

🟢 Key Support Zone & Market Expectation

The green highlighted zone on the chart represents a high-probability support area. From this region, we expect price to:

Hold above support

Spend some time building a base (accumulation)

Complete a time correction rather than a deep price correction

After this consolidation phase, the market is expected to transition into Wave G.

🚀 Wave G Outlook – Bullish Continuation

In a Bullish Diametric pattern, Wave G is inherently bullish and often leads to a strong continuation move in the direction of the main trend. If the structure plays out as expected, Wave G could deliver a powerful impulsive move, pushing price toward the predefined upside targets.

🎯targets : Targets : 668$ _ 1100$

💡 Trading Strategy – Smart Risk Management

The green zone is considered an optimal DCA (Dollar-Cost Averaging) entry area

Avoid chasing price; let the market come to your levels

Scale into positions gradually to manage risk effectively

This approach allows traders to stay flexible while positioning themselves early for the anticipated bullish expansion.

❌ Invalidation Level – Risk Control Is Key

This analysis will be invalidated if:

A weekly candle closes below the invalidation level marked on the chart

A weekly close below this level would signal a structural failure of the pattern and require a full reassessment.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

XMR +150% Since Last Analysis | Key Levels to WatchMonero (XMR) has delivered a strong performance, rallying over +150% since our last published idea. This momentum reflects growing demand for privacy-focused assets and resilience in the altcoin sector, even as broader market sentiment remains mixed.

That said, we’re closely watching Bitcoin’s structure — continued BTC weakness could trigger a pullback in XMR. Any sustained drop in BTC may weigh on alts and send XMR back toward lower support zones before the next bullish leg.

📌 Trade Setup

Entry Zone: $480 – $501

Targets: $555 / $605 / $690

Stop Loss: $438

Maintain a disciplined approach and adjust risk management according to broader market conditions. Monitoring BTC price action will be crucial here.

Can LITECOIN replicate MONERO's rally??Just some fun chart trivia but we can't deny the obvious. And that's that Litecoin (LTCUSD) has been printing an (almost) identical price action since 2017 with Monero (XMRUSD).

That's up until a little less than a year ago when the two started to diverge aggressively as XMR (orange trend-line) entered a massive rally that broke above its ATH Resistance of the past 2 Cycles and made a new All Time High (ATH), while LTC has been under Lower Highs. However it hasn't broken below its Bull Cycle consolidation, which also shared with XMR before the latter broke aggressive to the upside.

So what do you think? Can LTC follow XMR's lead and make an ATH or it will continue dropping into the new Bear Cycle?

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XMR/USDT — Post-Parabolic Structure: Correction OnlyAfter ~900 days of accumulation in the $100–180 range, Monero rallied to $800 on the privacy-coin narrative.

RSI may not look extremely overbought at first glance, but for this asset, the current zone has historically marked reversal territory.

Can it go higher? — Yes.

Is it worth buying after such a move? — No.

Shorting vertical moves like this is a bad idea.

The only reasonable approach here is to trade a corrective bounce.

One option is to scale in using a grid starting from the 0.5 Fibonacci level, which aligns with the previous ATH at $516.

The strategy is straightforward: sell the entire position on a bounce to the next level and step aside.

📌 Important note: historically, a breakdown below the accelerated dynamic trendline (blue line) has always signaled the end of the rally — especially after a retest from below.

For medium- or long-term positions, I wouldn’t consider XMR until price returns back into the prior accumulation range.

$DASH is consolidating inside a rising channel. As long as priceNASDAQ:DASH is consolidating inside a rising channel. As long as price holds above the 70–60 zone, this move looks like healthy consolidation rather than a top. A brief shakeout is possible, but the trend remains intact and higher levels are still in play.

XMRUSD Bear Cycle starting. $215 possible Target.Last time we looked at Monero (XMRUSD) was exactly 3 months ago (October 14 2025, see chart below) giving a buy signal at the bottom of its long-term Channel Up, which quickly hit our Target:

This time we are turning bearish long-term as the price is not only approaching the top of its 2-year Channel Up (green) but also the Top Fib of its 8-year Channel Up. At the same time the 1M RSI is vastly overbought at 85.00, typical of the Cycle Top of the previous two Cycles.

With the last one bottoming on the 0.618 Fibonacci retracement level, just above the 1M MA100 (red trend-line), we estimate that the emerging Bear Cycle will hit at least $215 before bottoming.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XMRUSD: Multi-Year Monthly Breakout Signals New Macro CycleMonero (XMR) is breaking out on the monthly timeframe after a 105-month (~3,200 days) compression phase, forming a long-term ascending triangle.

Price has respected a rising support trendline since the 2016–2017 cycle while repeatedly testing a flat macro resistance zone, which has now been decisively broken with strong bullish momentum. The current monthly candle shows expansion in range and volume, signaling a potential regime shift rather than a short-term move.

Key observations:

- Multi-year higher lows against horizontal resistance

- Clean monthly close above resistance

- Long consolidation typically precedes impulsive moves

- Structure suggests price discovery phase may be beginning

If the breakout holds, XMR could be entering a new long-term bullish cycle, with upside targets extending significantly higher over the coming years.

Cheers

Hexa

Monero (XMR) Just Woke Up: Structural Breakout AnalysisWhile the market is distracted by the majors, Monero ( CRYPTOCAP:XMR ) has quietly engineered a massive structural shift on the daily timeframe.

Monero just broke its multi-month resistance with impulsive volume. The "Roof" has officially become the "Floor."

No wicks.

Pure demand.

Structure shift.

Is this the start of a new macro run? Let's wait and watch.

Monero XMR price analysisIs CRYPTOCAP:XMR preparing to break its ATH?

Looking at the #XMRUSDT chart, it feels like #Monero is approaching a critical moment.

After years of consolidation, a confirmed hold above $520 could mark the start of a real harvest season 🌾

🔓 This level may become the key trigger that shifts CRYPTOCAP:XMR into a new market phase.

🎯 So what’s the real target for #Monero?

▪️ $1250?

▪️ Or even much higher — $4300?

💰 Current market cap is around $7.9B.

Do you believe CRYPTOCAP:XMR is capable of growing to:

➡️ $23B

➡️ or even $80B?

🤔 Share your thoughts — is #Monero ready to surprise the market again?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

XMRUSDT - Another push up… or time for a healthy reality check?Alright, XMR is absolutely trending like a maniac right now.

Strong momentum, clean structure, zero chill.

But let’s be honest — nothing goes up forever. Not even Monero.

What we’re looking for here:

• A retracement within the uptrend, not a trend reversal

• A chance to catch a better entry near the bottom

• Basically: buy fear, not euphoria

This is one of those trades where:

• If it triggers, it might take time

• Levels can shift

• And patience is part of the strategy (unfortunately 😅)

Why this makes sense:

• Similar setup to PIPPIN

• Strong trend intact

• Waiting for a pullback instead of chasing green candles like a tourist

Also — let’s talk black swan energy 🦢:

• If we get a sudden market panic

• Expect nasty wicks

• And yes, that’s actually part of the plan

We’re not predicting chaos — we’re just prepared for it.

So the idea is simple:

👉 Let XMR cool off

👉 Let panic do its thing

👉 Step in on the retracement

👉 Ride the trend continuation (if the market allows it)

This is a slow-cooker trade, not microwave money.

If it sets up, great.

If not — no FOMO, no drama.

Let’s see how it plays out 👀📊

XMR keeps failing at 450 resistance, is a major breakdown comingYello Paradisers— how many times can XMRUSDT hit the same wall before it collapses for good? The rejection from the 448 to 450 zone is starting to look like more than just noise.

💎XMRUSDT respected an ascending channel for a while but that structure has now clearly broken. The recent breakdown along with an internal CHoCH signals a shift in short-term momentum. The impulsive rejection has cooled off the buyers and the current consolidation just below the broken channel shows that sellers are gaining control while buyers struggle to hold ground.

💎After the breakdown, price made a corrective attempt but was quickly rejected again around the 0.5 to 0.618 Fibonacci retracement area. This zone has now become a supply region and continues to suppress any bullish attempts. As long as price stays under that structure with no strong bullish displacement the bias remains bearish with a likely push toward lower liquidity zones and key support levels.

💎This view changes only if price closes a strong candle above the 450 resistance. That would reclaim the previous range high, cancel the bearish structure shift and signal renewed bullish strength with potential to target higher liquidity above the current range.

🎖Right now is not the time for emotional moves. Stay calm and stay focused. We are only interested in the cleanest and most high probability setups. That is how you win in this game long-term.

MyCryptoParadise

iFeel the success🌴

XMRUSD - Privacy Rally Explodes +143% YTD

Executive Summary

KRAKEN:XMRUSD is trading at approximately $469.71 after an extraordinary year that has seen the privacy coin surge +143% YTD and +155% over the past 12 months. Monero recently hit a 52-week high of $497.75 and is now consolidating just below the critical $500 psychological resistance. The privacy narrative is on fire - Cardano's Midnight protocol launch, rising surveillance concerns, and the EU's 2027 privacy coin ban have created a perfect storm of demand. However, with RSI at 84 (overbought) and price near yearly highs, the question is: breakout to $1,000+ or pullback to consolidate gains?

BIAS: BULLISH - But Overbought Caution Required

The trend is undeniably bullish. The fundamentals support continued upside. But technicals warn of potential short-term pullback before the next leg higher.

Current Market Context - December 22, 2025

Monero's performance has been nothing short of spectacular:

Current Price: $469.71 (-0.25% on the day)

Day's Range: $453.05 - $483.69

52-Week Range: $183.02 - $497.75

52-Week High: $497.75 (hit last week)

Market Cap: $8.67 billion

24h Trading Volume: $171.27 million

Performance Metrics - ALL GREEN:

1 Week: +14.90%

1 Month: +40.05%

3 Months: +62.54%

6 Months: +49.34%

YTD: +143.09%

1 Year: +155.28%

This is the BEST performing major cryptocurrency of 2025. Monero has massively outperformed Bitcoin, Ethereum, and virtually every other top 20 coin.

THE PRIVACY NARRATIVE - Why XMR Is Exploding

1. EU Privacy Coin Ban (2027) - Bullish Paradox

The European Union confirmed plans to prohibit exchanges from listing privacy coins like Monero starting in 2027, citing anti-money laundering concerns. This follows increased scrutiny after high-profile hacks and ransomware attacks.

The Paradox:

Short-term BULLISH: Users accumulating XMR pre-ban

Creates urgency to acquire before restrictions

Validates Monero's core value proposition - if governments want to ban it, it must work

Long-term risk: Liquidity could dry up if major exchanges delist

Monero's fungibility remains key defense against regulatory sidelining

2. Midnight Protocol Sparks Privacy Rally (Dec 20, 2025)

Cardano's Midnight protocol launched NIGHT, a privacy token using zero-knowledge proofs. While not directly tied to Monero, the project reignited interest in privacy technology across the entire sector.

XMR rose 18% weekly alongside Zcash

Privacy tech is back in focus

Rising concerns over digital surveillance driving demand

Monero benefits from sector momentum

Competition from newer privacy solutions exists, but XMR remains the gold standard

3. Technical Breakout Gains Traction (Dec 22, 2025)

XMR surged past its 50-day EMA ($449)

Shielded transaction volume hitting ALL-TIME HIGHS

Analysts note bullish Wyckoff accumulation patterns

Rising open interest (+10% weekly) suggests leveraged bets on continued privacy demand

Added to CoinDesk 80 Index - reflecting growing market presence

4. Institutional Interest Growing

XMR added to CoinDesk 80 Index

Increased futures open interest

Growing market presence despite regulatory headwinds

Privacy as a feature becoming more valued, not less

Development Updates - Bullish Fundamentals

Monero developers have been extremely active in late 2025:

Security Patches (November 2025):

Ledger hardware wallet vulnerability patched (view-key export bug)

CLI v0.18.4.4 update addressed critical edge case

Strengthens trust in hardware wallet integrations

Spy Node Defense - "Fluorine Fermi" Upgrade (October 2025):

IP subnet filtering introduced to counter surveillance

Disrupts tactics used by firms like Chainalysis

Complements existing Dandelion++ protections

Directly reinforces untraceable transactions

RPC Fuzzing Milestone (November 2025):

Achieved 100% fuzzing coverage for RPC endpoints

Funded by MagicGrants

Reduces attack vectors for hackers

Hardens nodes against exploits

FCMP++ Scaling Prep (November 2025):

Full-Chain Membership Proofs alpha testing finalized

Beta stressnet expected Q1 2026

Could enable lighter nodes and better scalability

Aims to solidify Monero as most private Layer 1

2026 Roadmap - Major Upgrades Coming

FCMP++ Beta Stressnet (Q1 2026) - Scaling decisions finalized

Bulletproofs++ (2026) - 30% smaller transactions, 40% faster verification

Seraphis & Jamtis (2026) - Enhanced anonymity protocols

GetMonero.org Redesign (2026) - Improved user experience

Technical Structure Analysis

Price Action Overview - 2 Hour Timeframe

The chart shows a textbook bullish structure:

Ascending Channel Pattern:

Clear ascending channel established over past weeks

Higher highs and higher lows consistently forming

Channel support: Rising trendline from lows

Channel resistance: Parallel line at highs

Price currently in upper half of channel

Recent Price Action:

Price hit resistance zone near $490-$500

Pulled back and now consolidating

Currently in a smaller consolidation range ($455-$490)

Fibonacci retracement levels visible (0.5 and 0.6 levels)

Testing mid-channel support

Key Observations:

52-week high of $497.75 represents immediate resistance

$500 psychological level is THE level to watch

Support zone at $407-$410 area (channel bottom)

Strong uptrend intact - no signs of reversal yet

Consolidation after 52-week high is healthy, not bearish

Key Support and Resistance Levels

Resistance Levels:

$483-$490 - Immediate resistance (recent highs)

$497.75 - 52-week high

$500 - CRITICAL psychological resistance

$550 - Next major resistance if $500 breaks

$600 - Secondary target

$1,000 - Major psychological target (community expectation)

Support Levels:

$453-$460 - Immediate support (day's low area)

$449 - 50-day EMA (key moving average)

$430-$440 - Secondary support

$407-$410 - MAJOR SUPPORT ZONE (channel bottom)

$380-$390 - Deep support

$350 - Extended support if correction deepens

Moving Average Analysis

Price trading well above 50-day EMA ($449)

All major moving averages sloping upward

Golden cross patterns on multiple timeframes

MAs providing dynamic support on pullbacks

Trend structure extremely bullish

RSI Analysis - OVERBOUGHT WARNING

RSI currently at 84 - OVERBOUGHT territory

This is the primary caution signal

Overbought RSI doesn't mean immediate reversal

In strong trends, RSI can stay overbought for extended periods

However, pullbacks from overbought levels are common

Watch for RSI divergence as potential warning sign

Volume Analysis

24h volume: $171.27 million

Volume supporting the uptrend

Shielded transaction volume at ALL-TIME HIGHS

Open interest rising (+10% weekly)

Healthy volume profile for continuation

Community Sentiment - Extremely Bullish

Bull Case - $1,000+ Targets

@olgerd_butko: "Monero screams insta teleportation above 1k. Privacy by default. No hype. Just real facts."

@soontzu: "Monero has only 0.2% of total crypto value. With XMR supply matching BTC's, $90k BTC implies massive XMR upside." - This comparison suggests theoretical $1,500+ XMR price if adoption parity occurs.

Bear Case - Regulatory Concerns

@Nicat_eth: "Monero edged lower as exchange delistings and privacy scrutiny intensify."

Bearish pressure stems from shrinking liquidity on some exchanges, though price action has defied this concern.

Regulatory Landscape - Double-Edged Sword

Delistings and Restrictions:

Kraken halted XMR for UK users (late 2024)

Kraken halted XMR for EEA users (November 2025)

Exodus wallet ended XMR support (August 2025)

EU ban coming in 2027

Why This Is Actually Bullish (Short-Term):

Validates Monero's privacy effectiveness

Creates urgency to accumulate before restrictions

Proves the technology works as intended

Decentralized exchanges and P2P trading remain available

Monero's fungibility makes it resistant to blacklisting

SCENARIO ANALYSIS

BULLISH SCENARIO - Breakout Above $500

Trigger Conditions:

Daily close above $500 with volume

RSI holds above 70 without major divergence

Continued privacy narrative momentum

Bitcoin remains stable or bullish

Ascending channel breakout to upside

Price Targets if Bullish:

Target 1: $550 - First resistance above $500

Target 2: $600 - Secondary target

Target 3: $750 - Extended target

Moon Target: $1,000+ (community expectation)

Bullish Catalysts:

FCMP++ beta stressnet success (Q1 2026)

Continued privacy rally momentum

EU ban fears driving accumulation

Shielded transactions continuing to hit ATHs

Altcoin season rotation

Bulletproofs++ and Seraphis upgrades

BEARISH SCENARIO - Pullback to Support

Trigger Conditions:

Rejection at $500 with bearish candle

RSI divergence forms (lower highs on RSI, higher highs on price)

Break below ascending channel support

Broader crypto market weakness

Major exchange delisting announcement

Price Targets if Bearish:

Target 1: $449 - 50-day EMA retest

Target 2: $430-$440 - Secondary support

Target 3: $407-$410 - Channel bottom / major support

Extended: $350-$380 if channel breaks

Bearish Risks:

RSI at 84 - overbought

Near 52-week high - profit-taking likely

Regulatory headlines could spook market

Thin liquidity on some exchanges

Broader crypto correction risk

NEUTRAL SCENARIO - Consolidation

Most likely short-term outcome:

Price consolidates between $450-$490

RSI cools off from overbought levels

Builds base for next leg higher

Healthy consolidation after massive rally

Watch for breakout direction

MY ASSESSMENT - BULLISH WITH CAUTION

The weight of evidence strongly favors bulls:

+143% YTD performance speaks for itself

Privacy narrative is the strongest it's been in years

Development activity is robust

Shielded transactions at ATH

Community sentiment extremely bullish

Ascending channel intact

All timeframes showing bullish structure

However, caution is warranted:

RSI at 84 is overbought

Near 52-week high - natural resistance

$500 is major psychological barrier

Some profit-taking expected

Regulatory headlines could cause volatility

My Stance: BULLISH - Buy Dips Strategy

I believe XMR will eventually break $500 and continue higher. The fundamentals and narrative support it. However, I would not chase at current levels with RSI at 84. Instead:

Wait for pullback to $449-$460 area for better entry

Or wait for confirmed breakout above $500 with volume

Avoid buying in the middle of the range

Trade Framework

Scenario 1: Breakout Trade Above $500

Entry Conditions:

Daily candle closes above $500

Volume exceeds recent average

RSI holds above 65 (not diverging)

Trade Parameters:

Entry: $505-$515 on confirmed breakout

Stop Loss: $475 below recent support

Target 1: $550 (Risk-Reward ~1:1)

Target 2: $600 (Risk-Reward ~1:2)

Target 3: $750 (Extended)

Scenario 2: Buy the Dip at Support

Entry Conditions:

Price pulls back to $449-$460 zone

RSI cools to 50-60 range

Bullish rejection candle at support

Ascending channel support holds

Trade Parameters:

Entry: $450-$460 on support test

Stop Loss: $420 below channel support

Target 1: $490-$500 (Risk-Reward ~1:1.5)

Target 2: $550 (Risk-Reward ~1:3)

Target 3: $600 (Extended)

Scenario 3: Channel Bottom Buy

Entry Conditions:

Price tests $407-$410 major support zone

Strong bounce with volume

RSI oversold or near oversold

Trade Parameters:

Entry: $410-$420 at channel bottom

Stop Loss: $385 below support zone

Target 1: $460-$470 (Risk-Reward ~1:2)

Target 2: $500 (Risk-Reward ~1:3.5)

Target 3: $550+ (Extended)

Risk Management Guidelines

Position sizing: 2-3% max risk per trade

Respect overbought RSI - don't chase

Use hard stops - privacy coins can be volatile

Scale into positions rather than all-in entries

Take partial profits at each target (33% each)

Move stop to breakeven after first target

Monitor regulatory news closely

Be aware of lower liquidity on some exchanges

Invalidation Levels

Bullish thesis invalidated if:

Price closes below $407 (channel bottom)

Ascending channel breaks down

RSI divergence confirms with lower price

Major exchange delisting causes panic

Bitcoin crashes below $85,000

Bearish thesis invalidated if:

Price closes above $500 with volume

RSI makes new highs with price

Shielded transactions continue hitting ATHs

Privacy narrative accelerates further

Conclusion

KRAKEN:XMRUSD is the standout performer of 2025 with +143% YTD gains. The privacy narrative is firing on all cylinders - EU ban fears, Midnight protocol launch, surveillance concerns, and development upgrades have created a perfect storm for Monero.

The Numbers:

YTD Performance: +143.09%

1-Year Performance: +155.28%

52-Week High: $497.75

Current Price: $469.71

RSI: 84 (Overbought)

Market Cap: $8.67 billion

Key Levels:

$500 - CRITICAL resistance / breakout level

$497.75 - 52-week high

$449 - 50-day EMA support

$407-$410 - Major support zone (channel bottom)

The Setup:

Monero is consolidating just below its 52-week high after an incredible rally. The trend is bullish, fundamentals are strong, and the privacy narrative is the best it's been in years. However, RSI at 84 warns of potential short-term pullback.

Strategy:

Don't chase at current levels

Buy dips to $449-$460 support

Or buy confirmed breakout above $500

Targets: $550, $600, $750+

Stop below $420 or channel support

The path of least resistance is higher. Privacy is becoming more valuable, not less. Monero's technology is proven, development is active, and the community is committed. The EU ban paradoxically validates everything Monero stands for.

$1,000 XMR is not a meme - it's a matter of when, not if.

This is not financial advice. Always conduct independent research and manage risk appropriately.

XMR Compressing Inside Symmetrical Triangle Near Breakout ZoneXMR is currently trading inside a well-defined symmetrical triangle, formed by a series of lower highs and higher lows after a strong impulse move. This structure reflects balanced pressure between buyers and sellers, signaling compression before a volatility expansion.

Price is now approaching the upper boundary of the triangle while holding above the rising support. A confirmed breakout above the descending resistance with acceptance can trigger a continuation move toward the 436 region, followed by the higher resistance near 480.

If price fails to break the upper boundary and loses the rising support, the triangle will resolve to the downside. In that scenario, the next demand areas are located near 360 and 319, where price previously reacted strongly.

This setup is driven by triangle compression, trendline interaction, and liquidity buildup. The breakout direction will define the next major move, making confirmation essential before bias selection.

XMR - Institutional Analysis: Channel Support Buy Zone | Dec 7XMRUSD - The Privacy Resistance: How Regulatory War Created The Perfect Parallel Channel Setup

by officialjackofalltrades

🟡 CAUTIOUSLY BULLISH December 7, 2025

Institutional Technical Analysis | Whale Signals Integrated

📈 Executive Summary - The Setup

Current Price: $372.78 | December 7, 2025

Monero is trading at a critical inflection point inside a well-defined parallel channel that has dictated price action for the past 90 days. After a spectacular +23% rally to $420 in the first week of December, XMR has pulled back to test lower channel support at $370-380 exactly where technical analysis suggests the next major move will be decided.

The Technical Setup:

Pattern: Ascending parallel channel (bullish structure)

Current Position: Lower channel support ($370-380)

Resistance: Upper channel boundary ($420-450)

Key Decision Level: $360 (below = channel break, above = bounce continuation)

The Fundamental Backdrop:

While retail focuses on regulatory FUD from 2024 delistings (Binance, Kraken, OKX), they're missing three critical developments:

XMR reclaimed privacy crown from Zcash on November 29, 2025

Fluorine Fermi upgrade enhanced network surveillance defenses on October 10

Early December saw 23% price surge despite broader crypto market liquidations

The Trade: Long from $360-380, target $420-480, stop $355 below ..

Monero's price on December 7, 2025, is fluctuating approximately between $390 and $400, with some reports indicating a notable 23% increase in the first week, pushing its average trading price to $406 and briefly reaching a short-run high of $420 .

What This Means:

The $420 short-run high demonstrates XMR's technical strength even as it tests the upper boundary of the channel. The current pullback to $372 is textbook technical behavior—price respecting the parallel structure.

Current Technical Position:

Support Levels (Where buyers defend):

$370-$380: Lower parallel channel + 50-day MA convergence (CURRENT LEVEL)

$360-$365: Channel absolute floor + psychological support

$320-$340: Major support cluster from Aug-Nov accumulation

$280-$300: Nuclear capitulation zone (10% probability)

Resistance Levels (Where sellers appear)

$400-$420: Recent high + upper channel boundary

$435-$450: Channel breakout zone + 2025 YTD high

$480-$500: Psychological resistance + near ATH

$517.62: All-time high (May 2021)

Not overbought (room to run higher)

Not oversold (not in panic selling zone)

Neutral = equilibrium before next directional move

MACD (Momentum):

Histogram: Positive but declining (losing steam short-term)

Signal line: Approaching bullish cross

Interpretation: Consolidation before next leg up

Volume Analysis:

24-hour trading volume of $114.56M - this is concerning. Volume has been declining since the December 3 peak, indicating:

Thin liquidity from exchange delistings

Lower participation = higher volatility potential

Breakouts need VOLUME confirmation

🔎 Fundamental Analysis - The Regulatory War Creates Opportunity

While technical analysis shows the "what" and "when," fundamentals explain the "why." Here's what's REALLY happening with Monero:

CATALYST #1: The Exchange Delisting Paradox

The Bearish Narrative (What retail sees):

Binance delisted XMR February 2024

OKX delisted XMR January 2024

Kraken delisted XMR in EEA October 2024

"Privacy coins are dying!"

The Reality (What institutions know):

Monero founder Riccardo Spagni said: "Kraken delisting Monero in Europe just goes to prove what we already know: Chainalysis et al. simply can't squeeze enough information out of Monero's privacy to be meaningful, otherwise regulators would want Monero to stay listed as a honeypot".

Read that again. The delistings PROVE Monero's privacy works.

If regulators could track Monero, they'd WANT it listed to monitor users. The fact they're forcing delistings means they can't break the privacy.

Market Impact:

Short-term: Liquidity crunch, price volatility

Long-term: Validates Monero's core value proposition

Institutional view: "Monero is the ONLY privacy coin that actually works"

CATALYST #2: FCMP++ Upgrade - The Game Changer

Network improvements such as FCMP++ (Full Chain Membership Proofs) represent the most significant privacy enhancement since Monero's creation.

What FCMP++ Does:

Removes the need for ring signatures with fixed size

Enables membership proofs over the ENTIRE blockchain

Makes transaction tracing mathematically impossible (not just difficult)

Reduces transaction size = lower fees

A breakout imminent now that we are about to hit the all-time high of $517 will take XMR to new heights, particularly with the successful implementation of network improvements such as FCMP++ .

Developer Momentum:

Fluorine Fermi upgrade on October 10, 2025 enhanced defenses against network surveillance risks. Then Ledger Wallet Bug Fix on November 14, 2025 patched a critical vulnerability when rejecting view key exports.

Translation: While other projects ship vaporware, Monero is shipping real privacy tech that regulators literally cannot break.

CATALYST #3: Privacy Demand at All-Time High

As of December 7, 2025, Monero (XMR) continues to be a focal point in the cryptocurrency market, primarily due to its unwavering commitment to privacy in an increasingly regulated digital landscape.

The irony? Regulatory crackdowns INCREASE demand for privacy.

Every time a government announces surveillance measures, Monero adoption spikes. Every time an exchange delists XMR, peer-to-peer volume increases.

XMR surged 30% from November lows, defying crypto-wide liquidations on December 1. While Bitcoin, Ethereum, and other coins crashed with $637M in liquidations, Monero rallied.

Why? Because in times of uncertainty, people want privacy.

CATALYST #4: The Zcash Flip

Reclaims Privacy Crown (29 November 2025) – Overtook Zcash in market cap amid capital rotation.

This is MASSIVE. Zcash (ZEC) was Monero's main competitor for years. But Comparatively, Zcash (ZEC) has fallen by almost a quarter during the same time, which points to the unstable nature of the privacy coin segment.

Why Monero Won:

Zcash has optional privacy (most transactions are transparent)

Zcash has a company behind it (Zcash Foundation) = regulatory target

Monero has mandatory privacy (all transactions private)

Monero is truly decentralized (no company, no CEO)

Capital is flowing FROM weak privacy (ZEC) TO strong privacy (XMR). This trend is accelerating.

⚠️ Risk Factors - The Bear Case

I'm bullish on the technical setup, but let's address the others in the room:

RISK #1: Mining Centralization (Qubic Attack)

Qubic grabbed 20% of all blocks in 24h during mining marathon, while DDoS attacks hit network. Qubic's growing hashrate share (peaking at 38% in July 2025) threatens decentralization, a core Monero value proposition.

What happened: Qubic, a quantum-resistant blockchain, started mining XMR with specialized hardware, capturing up to 38% of network hashrate.

Why it matters: If one entity controls >51% hashrate, they could theoretically attack the network.

Current Status:

Qubic hashrate declined from 38% (July) to ~20% (December)

P2Pool (decentralized mining pool) is growing

Monero community is working on algorithm tweaks

My take: This was concerning in July, but the trend is REVERSING. Hashrate is becoming more distributed again.

RISK #2: Thin Liquidity = High Volatility

24-hour trading volume of $114.56M is low compared to XMR's $7.21B market cap.

Volume-to-Market Cap Ratio: 1.6% (very low)

Bitcoin: ~5-8%

Ethereum: ~4-6%

Monero: ~1.6%

What this means:

Large orders can move price significantly

Volatility is higher than major coins

Slippage is a concern for larger trades

Trading Implication: Use limit orders, not market orders. Scale in/out slowly.

RISK #3: Regulatory Uncertainty

Governments and financial regulators are cracking down on cryptocurrencies that allow users to hide their transaction details, fearing that they could be used for illicit activities like money laundering, tax evasion, and terrorism financing.

Potential Future Actions:

More exchange delistings (though most already done)

Criminalization of possession (extreme, unlikely)

Banking restrictions on fiat on/off ramps

Counterpoint: Resolving the gap in mining and avoiding international regulations will be the key to preventing the backlash, but Monero has interesting arguments in its practical use of privacy in the real world, especially in a market where utility is highly valued more than speculation .

🎯 THE TRADE SETUP - Institutional-Grade Execution

🟢 PRIMARY LONG SETUP: BUY XMRUSD

Entry Zone: $360-$380 (SCALE IN - We're at the PERFECT zone RIGHT NOW)

Position Sizing (Conservative Institutional Approach):

Allocate 4-6% of portfolio (this is a MEDIUM conviction trade due to liquidity risk)

Scale in strategy:

30% at $375-380 (CURRENT - enter NOW if not in)

$365-370 (if we get one more dip to channel support)

$360-365 (if we hit absolute channel floor)

Stop Loss: $355

Below $355 = parallel channel broken on daily close

Below this = technical structure invalidated

Max loss: 6-8% from average entry

Take Profit Targets (Institutional Scale-Out Strategy):

TP1: $420-$435

Upper parallel channel resistance retest

December 2-3 peak at $420 retest

Action: move stop to $370 (breakeven)

TP2: $450-$480 (Probability: 50%)

Channel breakout + FCMP++ upgrade hype builds

Monero forecast between $382.54 and $456.36 next year

Action: move stop to $420 (lock gains)

All-time high $517.62 retest

Full bull market confirmation

Provided that buyers continue their growth, XMR is one of the best cryptos to consider as the new bull run might start with the daily close higher than $327

Entry Confirmation Checklist (Use This Before Entering):

✅ Price holding above $360 (channel support intact)

✅ Volume spike on bounce (150K+ XMR on daily candle)

✅ RSI crosses above 55 (momentum shift confirmed)

✅ MACD bullish cross on H4 timeframe

✅ Bitcoin holding above $95K (macro support)

✅ No surprise negative regulatory news (check daily)

WAIT FOR 4/6 CONFIRMATIONS BEFORE DEPLOYING FULL POSITION

Weekly Monitoring Requirements:

CRITICAL - Check EVERY WEEK:

Hashrate distribution: If Qubic >40% again, reduce position 50%

Exchange news: Any re-listings = bullish, add to position

Developer activity: Check Monero GitHub for FCMP++ progress

Regulatory news: New delistings = short-term bearish, long-term bullish

Bitcoin correlation: If BTC <$90K, reduce XMR position 30-50%

Volume trends: If 24h volume <$80M consistently, reduce position

5. Emergency Exit Conditions (CUT IMMEDIATELY):

❌ Daily close below $355 = EXIT ALL (channel broken)

❌ Qubic hashrate >51% sustained = EXIT ALL (security risk)

❌ Major security vulnerability discovered = EXIT ALL

❌ Bitcoin crashes below $85K = EXIT 50%, trail rest tight

❌ Volume dries up below $50M/24h = EXIT 50% (liquidity crisis)

📊 Scenario Analysis - What Happens Next

Base Case: Channel Bounce to $420-450

What happens:

XMR holds $370 support ✓

Bounces along lower channel to retest $420 resistance

Volume increases modestly

FCMP++ development continues

Breaks $435, targets $450-480

Timeline: 2-4 weeks

Expected Return: +17-29%

Catalysts: Technical bounce, no new negative news

Bull Case (2 Channel Breakout to $500+

What happens:

XMR breaks above $450 with VOLUME

XMR forecasted to reach $456.36 by January 1, 2026

FCMP++ release creates buzz

Privacy narrative strengthens

Targets ATH $517

Timeline: 4-8 weeks

Expected Return: +34-40%

Catalysts: FCMP++ launch, major adoption news, BTC >$110K

Bear Case (15% Probability): Channel Break to $320-340

What happens:

XMR breaks below $360 on volume

Tests major support at $320-340

Regulatory FUD intensifies

Bitcoin corrects below $95K

Thin liquidity amplifies drop

Timeline: 1-2 weeks

Expected Return: -8 to -14%

Catalysts: Surprise delisting, BTC crash, Qubic attack

Probability-Weighted Expected Return:

🔥 The Bottom Line - Why This Setup Works

Let me synthesize everything into a clear thesis:

The Technical Case:

✅ Parallel channel: 8 successful tests, currently at lower support

✅ +23% surge in first week of December to $420

✅ Overtook Zcash in market cap November 29

✅ Fluorine Fermi upgrade enhanced security October 10

✅ Privacy demand at all-time high in regulated landscape

✅ Delistings prove Monero's privacy actually works

The Risk Case:

⚠️ Thin liquidity (<$115M daily volume)

⚠️ Qubic mining centralization (peaked 38% hashrate)

⚠️ Regulatory uncertainty ongoing

⚠️ Exchange access limited (most CEXs delisted)

The Trade:

Entry: $360-380 (we're at $372 NOW)

Stop: $355 (-5% max loss)

Target : $380-400

IF YOU'RE BEARISH:

Wait for:

Daily close below $360 (channel break confirmed)

Then short from $355-360 with tight stop at $380

Target $320-340 support retest

Cover at $320, reassess

IF YOU'RE NEUTRAL:

Split the Difference:

Enter only at $365-370 (better risk/reward)

Take profits aggressively

This is the "I believe but I'm cautious" approach

💬 Final Thoughts - The Uncomfortable Truth

Here's what I know for certain on December 7, 2025:

✅_ContinueYour parallel channel analysis is PERFECT - XMR is respecting the structure exactly

✅ +23% rally to $420 in December's first week proves momentum

✅ XMR reclaimed privacy crown from Zcash - capital rotation happening

✅ Privacy demand at all-time high - fundamental bid exists

✅ Delistings prove Monero's tech works - validates thesis

✅ We're at lower channel support ($370) - mathematically optimal entry

Will Bitcoin hold $100K or crash?

Will Qubic attack Monero's hashrate again?

Will more exchanges delist (though most already have)?

Drop a 🟠 if you're entering XMR at $360-380 channel support.

Drop a 📊 if this parallel channel analysis helped you.

Drop a 🔒 if you believe in privacy's future.

Drop a 💰 if you're ready for $450+ in Q1 2026.

XMR Sell/Short Signal (4H)XMR has turned bearish after the change of character (CH) and, following the break of the short-term trendline, has now pulled back to a resistance zone while also sweeping a liquidity pool above the pivots.

With proper risk management and adherence to the stop-loss, this setup can be entered.

Targets are marked on the chart.

A daily candle closing above the invalidation level will negate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you