#XMR Just Flipped Control – Bears Are Running Out of Time

Yello Paradiser!, are you aware that #XMR has been signaling the exhaustion of its bearish cycle long before the recent breakout even occurred? The structure has been quietly transitioning from distribution into accumulation, and the market is now starting to reveal that change.

💎#XMR shows a clear deceleration of downside momentum from one descending channel into another. In Elliott Wave theory, this behavior is commonly seen during the late stages of a corrective or impulsive decline, particularly as wave 5 begins to lose strength. This structural compression strongly suggests that the downtrend was nearing completion.

💎The recent breakout from the descending channel is technically critical. Price has decisively crossed above the top of wave 4, which confirms a Change of Character (CHoCH). A bullish divergence on the RSI between wave 3 and wave 5. This is a classic confirmation of wave 5 termination and increases the probability that a trend reversal is already in progress.

💎The breakout occurred with a sharp and impulsive move to the upside, which is characteristic of a wave 1 or wave A advance. Such price behavior reflects strong demand entering the market and confirms that buyers have regained control of the short-term structure.

💎From here, two primary Elliott Wave scenarios remain valid. #XMR may be starting a new impulsive bullish cycle in the form of a 1–2–3–4–5 structure, or it may be developing a corrective ABC or WXY rally within a larger-degree bearish trend. Regardless of the macro labeling, both scenarios point toward one more strong upside expansion before any meaningful correction occurs.

💎Key resistance is located at the top of the larger-degree wave 4, around the $650 region. This level represents the natural target for the current advance and could be exceeded if the move develops impulsively. On the downside, major structural support is located near $410.

Strive for consistency, not quick profits Paradisers. Treat the market as a businessman, not as a gambler. This is the only way you will make it far in your crypto trading journey. Be a PRO💰

MyCryptoParadise

iFeel the success🌴

Xmrusd

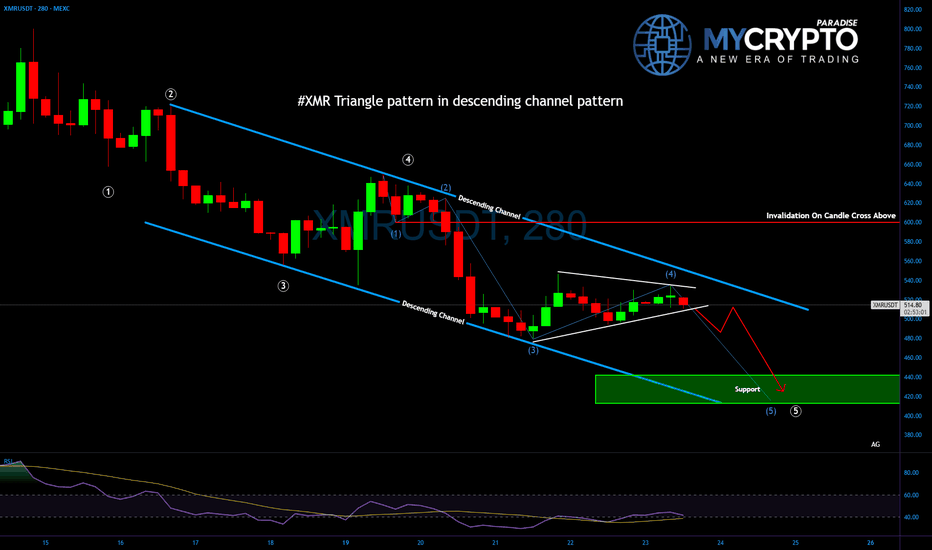

#XMR Triangle Is Almost Complete — The Final Flush Could Be Brut

Yello Paradiser! Are you watching closely, or are you going to be late again to one of the cleanest wave-based setups on #XMR? We may be approaching the final stages of a larger corrective cycle, but the trap is being set — and only those with patience and discipline will be ready when the real move begins.

💎#Monero has been unfolding in a textbook five-wave decline from its major high near $800, and right now, we are deep in wave 4 of an extended wave 5 — a critical stage where most traders either overcommit too early or get completely shaken out before the actual reversal. The current structure is forming a contracting triangle, which is a classic characteristic of wave 4. These patterns are notorious for building tension and compressing volatility before a sharp final move in the direction of the prevailing trend.

💎The price action is also perfectly respecting a well-defined descending channel, reinforcing the idea that the broader bearish structure remains intact. This channel, along with the triangular consolidation, suggests that there’s one final flush to come — the terminal wave 5 of the extended fifth — which could complete the entire corrective cycle from the macro top.

💎Our projected completion zone for this entire move lies in the $400–$420 region. This area isn’t just a psychological round number zone; it also represents the convergence of structural channel support and historically reactive levels from earlier phases of the trend. This makes it a high-probability demand zone, where we expect long-term buyers to step in, especially if broader market sentiment hits capitulation.

💎It’s important to highlight that the invalidation level for the current count is sitting around the $600 mark. A sustained move above that level would negate the triangle and invalidate the current interpretation of this being a final wave 4–5 sequence. Until then, however, the structure remains technically valid and offers a clear road map.

💎As with all wave 4 triangles, we must remain extremely cautious. These patterns are designed to frustrate both sides of the market, producing multiple fake breakouts and whipsaws. Acting prematurely — especially in a late-stage wave structure — can be extremely dangerous, and most traders lose capital here not because they’re wrong, but because they’re impatient.

💎If the final wave 5 unfolds as expected, we’ll likely see sharp liquidation and emotional selling that clears out weak hands. That would align with the psychology of a terminal move — marked by panic, exhaustion, and climax volume. It’s at that moment, when everyone gives up, that we’ll begin hunting for the reversal confirmation.

💎A big liquidation event, which will first take both longs and shorts and fully get rid of all inexperienced traders before the real move happens, is very close to happening again, so make sure you are playing it safe, Paradisers. It will be a huge money-maker for some and a total disaster again for the majority.

Stay focused Paradisers , follow the structure, and avoid emotional decisions. As always — timing and disciplined execution will separate those who succeed from those who just watch the market move without them.

MyCryptoParadise

iFeel the success🌴

Structure Still Bullish On XMR (3D)📈 Bullish Market Structure

From the point where the green arrow is marked on the chart, price has clearly entered a strong bullish phase. Based on the current price behavior, market structure, and wave development, this movement strongly resembles a Bullish Diametric pattern, which typically appears during complex corrective structures before continuation.

At the moment, price is moving inside Wave F, which is the current active leg of this pattern. Importantly, Wave F has already delivered a healthy and controlled correction, both in price and structure. This correction is constructive and aligns well with the characteristics expected in a valid Diametric formation.

🟢 Key Support Zone & Market Expectation

The green highlighted zone on the chart represents a high-probability support area. From this region, we expect price to:

Hold above support

Spend some time building a base (accumulation)

Complete a time correction rather than a deep price correction

After this consolidation phase, the market is expected to transition into Wave G.

🚀 Wave G Outlook – Bullish Continuation

In a Bullish Diametric pattern, Wave G is inherently bullish and often leads to a strong continuation move in the direction of the main trend. If the structure plays out as expected, Wave G could deliver a powerful impulsive move, pushing price toward the predefined upside targets.

🎯targets : Targets : 668$ _ 1100$

💡 Trading Strategy – Smart Risk Management

The green zone is considered an optimal DCA (Dollar-Cost Averaging) entry area

Avoid chasing price; let the market come to your levels

Scale into positions gradually to manage risk effectively

This approach allows traders to stay flexible while positioning themselves early for the anticipated bullish expansion.

❌ Invalidation Level – Risk Control Is Key

This analysis will be invalidated if:

A weekly candle closes below the invalidation level marked on the chart

A weekly close below this level would signal a structural failure of the pattern and require a full reassessment.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

Can LITECOIN replicate MONERO's rally??Just some fun chart trivia but we can't deny the obvious. And that's that Litecoin (LTCUSD) has been printing an (almost) identical price action since 2017 with Monero (XMRUSD).

That's up until a little less than a year ago when the two started to diverge aggressively as XMR (orange trend-line) entered a massive rally that broke above its ATH Resistance of the past 2 Cycles and made a new All Time High (ATH), while LTC has been under Lower Highs. However it hasn't broken below its Bull Cycle consolidation, which also shared with XMR before the latter broke aggressive to the upside.

So what do you think? Can LTC follow XMR's lead and make an ATH or it will continue dropping into the new Bear Cycle?

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Monero Price Action Report — Breakout Strength and Target ZoneXMR/USDT Bullish Breakout Blueprint! 🚀📈 (Swing & Day Trade Plan)

Description:

Monero is awakening! 🦋 A dynamic breakout is in play, offering a clear technical setup for both swing and day traders. Here’s your professional blueprint to navigate this opportunity.

📊 Trading Thesis: Bullish Breakout

The setup is confirmed by a breakout above the key Weighted Moving Average (WMA) dynamic resistance near 420.00. This signals a potential shift in momentum and opens the door for a bullish move.

🎯 Execution Plan

🟢 Entry Zone: Any price AFTER a confirmed breakout & close above 420.00. Look for a retest of the WMA as support for an optimal risk-reward entry.

⛔ Stop Loss (Risk Management): A logical stop loss can be placed below 390.00, which is under the recent support and WMA structure.

⚠️ Disclaimer: This is my suggested SL based on my strategy. You MUST adjust your position size and stop loss based on your own risk tolerance and capital. Always wait for breakout confirmation before placing your SL.

🎯 Profit Target (Take Profit): Our primary target is the 460.00 zone. This area represents a strong historical resistance level and could coincide with overbought conditions. Secure your profits proactively!

💡 Professional Note: This is my initial target. You are free to take partial profits earlier or trail your stop. "Make money, then take money" – manage your trade actively!

🔍 Key Levels & Rationale

Bullish Trigger: WMA Breakout > 420.00

Invalidation Level: < 390.00 (Bullish structure broken)

Target Zone: 460.00 (Major Resistance & Profit-Taking Zone)

🌐 Related Pairs & Market Correlations

Diversify your watchlist! The crypto market is highly correlated. Movements in XMR often relate to these assets:

CRYPTOCAP:BTC.D (Bitcoin Dominance): 📉 A decrease in BTC.D often fuels altcoin rallies, which is bullish for XMR.

BTC/USDT: 👑 The King leads, alts follow. A strong, stable, or rising Bitcoin is generally positive for the entire crypto market, including Monero.

Privacy Coin Sector:

CRYPTOCAP:ZEC (Zcash) & NASDAQ:DASH 📊

Key Point: Watch these for sector-wide momentum. A bullish move in XMR is often mirrored in other major privacy coins, confirming a sector trend.

Major Alts:

ETH/USDT 💙 & XRP/USDT ⚡

Key Point: Strength in large-cap alts like ETH and XRP creates a risk-on environment, which is beneficial for mid-cap coins like Monero.

✅ Final Checklist Before Entering:

✅ Breakout & close above WMA (420) confirmed?

✅ Volume supporting the move?

✅ SL set according to MY risk management?

✅ Related pairs (BTC, ETH) showing strength?

Let me know your thoughts in the comments! 💬 Are you bullish or bearish on XMR?

Like & Follow 👍 for more high-quality, actionable trade ideas!

#TradingView #XMR #Monero #Crypto #SwingTrading #DayTrading #TechnicalAnalysis #Breakout #WMA #BTC #Altcoins #DeFi

XMR/USDT — Post-Parabolic Structure: Correction OnlyAfter ~900 days of accumulation in the $100–180 range, Monero rallied to $800 on the privacy-coin narrative.

RSI may not look extremely overbought at first glance, but for this asset, the current zone has historically marked reversal territory.

Can it go higher? — Yes.

Is it worth buying after such a move? — No.

Shorting vertical moves like this is a bad idea.

The only reasonable approach here is to trade a corrective bounce.

One option is to scale in using a grid starting from the 0.5 Fibonacci level, which aligns with the previous ATH at $516.

The strategy is straightforward: sell the entire position on a bounce to the next level and step aside.

📌 Important note: historically, a breakdown below the accelerated dynamic trendline (blue line) has always signaled the end of the rally — especially after a retest from below.

For medium- or long-term positions, I wouldn’t consider XMR until price returns back into the prior accumulation range.

XMRUSD Bear Cycle starting. $215 possible Target.Last time we looked at Monero (XMRUSD) was exactly 3 months ago (October 14 2025, see chart below) giving a buy signal at the bottom of its long-term Channel Up, which quickly hit our Target:

This time we are turning bearish long-term as the price is not only approaching the top of its 2-year Channel Up (green) but also the Top Fib of its 8-year Channel Up. At the same time the 1M RSI is vastly overbought at 85.00, typical of the Cycle Top of the previous two Cycles.

With the last one bottoming on the 0.618 Fibonacci retracement level, just above the 1M MA100 (red trend-line), we estimate that the emerging Bear Cycle will hit at least $215 before bottoming.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Monero Breaks All-Time Highs As Bullish Structure Points HigherMonero (XMRUSD) is now aggressively breaking into new all-time highs, in line with expectations. On the monthly chart, price action continues to suggest significant room for further upside. Monero may be unfolding a five-wave bullish impulse, or alternatively, breaking out from a larger bullish triangle formation. In both scenarios, the technical picture supports much higher levels.

On the weekly timeframe, we are still tracking a projected extended wave (5) of wave 3. Fibonacci cluster targets continue to point toward the 1000 area before a higher-degree wave 4 correction is expected to unfold. At the moment, price appears to be rising within subwave 3 of an ongoing five-wave bullish impulse for wave (5). This suggests that additional gains are likely in the near term.

That said, traders should remain aware of a potential subwave 4 pullback, which would be a normal part of the structure, before a renewed bullish continuation in subwave 5 of wave (5) of 3.

XMRUSD: Multi-Year Monthly Breakout Signals New Macro CycleMonero (XMR) is breaking out on the monthly timeframe after a 105-month (~3,200 days) compression phase, forming a long-term ascending triangle.

Price has respected a rising support trendline since the 2016–2017 cycle while repeatedly testing a flat macro resistance zone, which has now been decisively broken with strong bullish momentum. The current monthly candle shows expansion in range and volume, signaling a potential regime shift rather than a short-term move.

Key observations:

- Multi-year higher lows against horizontal resistance

- Clean monthly close above resistance

- Long consolidation typically precedes impulsive moves

- Structure suggests price discovery phase may be beginning

If the breakout holds, XMR could be entering a new long-term bullish cycle, with upside targets extending significantly higher over the coming years.

Cheers

Hexa

Monero (XMR) Just Woke Up: Structural Breakout AnalysisWhile the market is distracted by the majors, Monero ( CRYPTOCAP:XMR ) has quietly engineered a massive structural shift on the daily timeframe.

Monero just broke its multi-month resistance with impulsive volume. The "Roof" has officially become the "Floor."

No wicks.

Pure demand.

Structure shift.

Is this the start of a new macro run? Let's wait and watch.

Monero XMR price analysisIs CRYPTOCAP:XMR preparing to break its ATH?

Looking at the #XMRUSDT chart, it feels like #Monero is approaching a critical moment.

After years of consolidation, a confirmed hold above $520 could mark the start of a real harvest season 🌾

🔓 This level may become the key trigger that shifts CRYPTOCAP:XMR into a new market phase.

🎯 So what’s the real target for #Monero?

▪️ $1250?

▪️ Or even much higher — $4300?

💰 Current market cap is around $7.9B.

Do you believe CRYPTOCAP:XMR is capable of growing to:

➡️ $23B

➡️ or even $80B?

🤔 Share your thoughts — is #Monero ready to surprise the market again?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

Movement comparisonBitcoin and Monero have approximately the same amount of coins in circulation. Bitcoin has an average of 500,000 transactions daily, while Monero has around 20,000. The Monero ownership centralization is obvious, but not provable.

The two assets have significantly opposite price movement.

The LTCBTC/XMRBTC pair is at the channel top.

The XMRUSD/LTCUSD is retesting long-term support.

The channel has been violated, which possibly means a strong corrective wave in the opposite direction is coming. LTCBTC pair isn't looking great for now, but LTCUSD has been in slow upside movement with quite high usage for payments. The upcoming LitVM hype might have impact on the price, and will be produced by Lunar Digital Assets company in deal with Bitcoin OS and Litecoin Foundation. The LDA is a marketing company and they have made a lot of damage through previous projects thus exercise extreme caution.

The BTCUSD is searching for support on 1W and appears to be completing Elliot five wave impulse, and forming a running flat.

The XMRBTC is at strong long-term resistance, the BTCUSD has more momentum for breakout while grinding at the channel top, and taking under consideration the BTCUSD and XMRBTC are inversed, the BTCUSD seems a better choice for investment at this moment.

However, XMRUSD does seem like it could get a correction, but in smaller magnitude than XMRBTC, thus the XMRUSD price might stay elevated for the period while BTCUSD is in bullish rally.

Furthermore, the BTCUSD versus GOLD is also finding significant support. Countries and private companies are holding the BTCUSD positions. It is possible that in this year people will realize it is easier to keep safe and spend Bitcoin rather than physical gold. Gold appears to be a fear hedge, around 50% of yearly mined gold being used for production of jewelry while around 10% used in electronics production. Silver appreciation is fair. The world will continue further into finance digitalization. Production of physical goods should also get more appreciation in the following years.

Opinion - Good time to move XMR to BTC, even though XMR might make another leg, but less likely.

XMRUSD - Privacy Rally Explodes +143% YTD

Executive Summary

KRAKEN:XMRUSD is trading at approximately $469.71 after an extraordinary year that has seen the privacy coin surge +143% YTD and +155% over the past 12 months. Monero recently hit a 52-week high of $497.75 and is now consolidating just below the critical $500 psychological resistance. The privacy narrative is on fire - Cardano's Midnight protocol launch, rising surveillance concerns, and the EU's 2027 privacy coin ban have created a perfect storm of demand. However, with RSI at 84 (overbought) and price near yearly highs, the question is: breakout to $1,000+ or pullback to consolidate gains?

BIAS: BULLISH - But Overbought Caution Required

The trend is undeniably bullish. The fundamentals support continued upside. But technicals warn of potential short-term pullback before the next leg higher.

Current Market Context - December 22, 2025

Monero's performance has been nothing short of spectacular:

Current Price: $469.71 (-0.25% on the day)

Day's Range: $453.05 - $483.69

52-Week Range: $183.02 - $497.75

52-Week High: $497.75 (hit last week)

Market Cap: $8.67 billion

24h Trading Volume: $171.27 million

Performance Metrics - ALL GREEN:

1 Week: +14.90%

1 Month: +40.05%

3 Months: +62.54%

6 Months: +49.34%

YTD: +143.09%

1 Year: +155.28%

This is the BEST performing major cryptocurrency of 2025. Monero has massively outperformed Bitcoin, Ethereum, and virtually every other top 20 coin.

THE PRIVACY NARRATIVE - Why XMR Is Exploding

1. EU Privacy Coin Ban (2027) - Bullish Paradox

The European Union confirmed plans to prohibit exchanges from listing privacy coins like Monero starting in 2027, citing anti-money laundering concerns. This follows increased scrutiny after high-profile hacks and ransomware attacks.

The Paradox:

Short-term BULLISH: Users accumulating XMR pre-ban

Creates urgency to acquire before restrictions

Validates Monero's core value proposition - if governments want to ban it, it must work

Long-term risk: Liquidity could dry up if major exchanges delist

Monero's fungibility remains key defense against regulatory sidelining

2. Midnight Protocol Sparks Privacy Rally (Dec 20, 2025)

Cardano's Midnight protocol launched NIGHT, a privacy token using zero-knowledge proofs. While not directly tied to Monero, the project reignited interest in privacy technology across the entire sector.

XMR rose 18% weekly alongside Zcash

Privacy tech is back in focus

Rising concerns over digital surveillance driving demand

Monero benefits from sector momentum

Competition from newer privacy solutions exists, but XMR remains the gold standard

3. Technical Breakout Gains Traction (Dec 22, 2025)

XMR surged past its 50-day EMA ($449)

Shielded transaction volume hitting ALL-TIME HIGHS

Analysts note bullish Wyckoff accumulation patterns

Rising open interest (+10% weekly) suggests leveraged bets on continued privacy demand

Added to CoinDesk 80 Index - reflecting growing market presence

4. Institutional Interest Growing

XMR added to CoinDesk 80 Index

Increased futures open interest

Growing market presence despite regulatory headwinds

Privacy as a feature becoming more valued, not less

Development Updates - Bullish Fundamentals

Monero developers have been extremely active in late 2025:

Security Patches (November 2025):

Ledger hardware wallet vulnerability patched (view-key export bug)

CLI v0.18.4.4 update addressed critical edge case

Strengthens trust in hardware wallet integrations

Spy Node Defense - "Fluorine Fermi" Upgrade (October 2025):

IP subnet filtering introduced to counter surveillance

Disrupts tactics used by firms like Chainalysis

Complements existing Dandelion++ protections

Directly reinforces untraceable transactions

RPC Fuzzing Milestone (November 2025):

Achieved 100% fuzzing coverage for RPC endpoints

Funded by MagicGrants

Reduces attack vectors for hackers

Hardens nodes against exploits

FCMP++ Scaling Prep (November 2025):

Full-Chain Membership Proofs alpha testing finalized

Beta stressnet expected Q1 2026

Could enable lighter nodes and better scalability

Aims to solidify Monero as most private Layer 1

2026 Roadmap - Major Upgrades Coming

FCMP++ Beta Stressnet (Q1 2026) - Scaling decisions finalized

Bulletproofs++ (2026) - 30% smaller transactions, 40% faster verification

Seraphis & Jamtis (2026) - Enhanced anonymity protocols

GetMonero.org Redesign (2026) - Improved user experience

Technical Structure Analysis

Price Action Overview - 2 Hour Timeframe

The chart shows a textbook bullish structure:

Ascending Channel Pattern:

Clear ascending channel established over past weeks

Higher highs and higher lows consistently forming

Channel support: Rising trendline from lows

Channel resistance: Parallel line at highs

Price currently in upper half of channel

Recent Price Action:

Price hit resistance zone near $490-$500

Pulled back and now consolidating

Currently in a smaller consolidation range ($455-$490)

Fibonacci retracement levels visible (0.5 and 0.6 levels)

Testing mid-channel support

Key Observations:

52-week high of $497.75 represents immediate resistance

$500 psychological level is THE level to watch

Support zone at $407-$410 area (channel bottom)

Strong uptrend intact - no signs of reversal yet

Consolidation after 52-week high is healthy, not bearish

Key Support and Resistance Levels

Resistance Levels:

$483-$490 - Immediate resistance (recent highs)

$497.75 - 52-week high

$500 - CRITICAL psychological resistance

$550 - Next major resistance if $500 breaks

$600 - Secondary target

$1,000 - Major psychological target (community expectation)

Support Levels:

$453-$460 - Immediate support (day's low area)

$449 - 50-day EMA (key moving average)

$430-$440 - Secondary support

$407-$410 - MAJOR SUPPORT ZONE (channel bottom)

$380-$390 - Deep support

$350 - Extended support if correction deepens

Moving Average Analysis

Price trading well above 50-day EMA ($449)

All major moving averages sloping upward

Golden cross patterns on multiple timeframes

MAs providing dynamic support on pullbacks

Trend structure extremely bullish

RSI Analysis - OVERBOUGHT WARNING

RSI currently at 84 - OVERBOUGHT territory

This is the primary caution signal

Overbought RSI doesn't mean immediate reversal

In strong trends, RSI can stay overbought for extended periods

However, pullbacks from overbought levels are common

Watch for RSI divergence as potential warning sign

Volume Analysis

24h volume: $171.27 million

Volume supporting the uptrend

Shielded transaction volume at ALL-TIME HIGHS

Open interest rising (+10% weekly)

Healthy volume profile for continuation

Community Sentiment - Extremely Bullish

Bull Case - $1,000+ Targets

@olgerd_butko: "Monero screams insta teleportation above 1k. Privacy by default. No hype. Just real facts."

@soontzu: "Monero has only 0.2% of total crypto value. With XMR supply matching BTC's, $90k BTC implies massive XMR upside." - This comparison suggests theoretical $1,500+ XMR price if adoption parity occurs.

Bear Case - Regulatory Concerns

@Nicat_eth: "Monero edged lower as exchange delistings and privacy scrutiny intensify."

Bearish pressure stems from shrinking liquidity on some exchanges, though price action has defied this concern.

Regulatory Landscape - Double-Edged Sword

Delistings and Restrictions:

Kraken halted XMR for UK users (late 2024)

Kraken halted XMR for EEA users (November 2025)

Exodus wallet ended XMR support (August 2025)

EU ban coming in 2027

Why This Is Actually Bullish (Short-Term):

Validates Monero's privacy effectiveness

Creates urgency to accumulate before restrictions

Proves the technology works as intended

Decentralized exchanges and P2P trading remain available

Monero's fungibility makes it resistant to blacklisting

SCENARIO ANALYSIS

BULLISH SCENARIO - Breakout Above $500

Trigger Conditions:

Daily close above $500 with volume

RSI holds above 70 without major divergence

Continued privacy narrative momentum

Bitcoin remains stable or bullish

Ascending channel breakout to upside

Price Targets if Bullish:

Target 1: $550 - First resistance above $500

Target 2: $600 - Secondary target

Target 3: $750 - Extended target

Moon Target: $1,000+ (community expectation)

Bullish Catalysts:

FCMP++ beta stressnet success (Q1 2026)

Continued privacy rally momentum

EU ban fears driving accumulation

Shielded transactions continuing to hit ATHs

Altcoin season rotation

Bulletproofs++ and Seraphis upgrades

BEARISH SCENARIO - Pullback to Support

Trigger Conditions:

Rejection at $500 with bearish candle

RSI divergence forms (lower highs on RSI, higher highs on price)

Break below ascending channel support

Broader crypto market weakness

Major exchange delisting announcement

Price Targets if Bearish:

Target 1: $449 - 50-day EMA retest

Target 2: $430-$440 - Secondary support

Target 3: $407-$410 - Channel bottom / major support

Extended: $350-$380 if channel breaks

Bearish Risks:

RSI at 84 - overbought

Near 52-week high - profit-taking likely

Regulatory headlines could spook market

Thin liquidity on some exchanges

Broader crypto correction risk

NEUTRAL SCENARIO - Consolidation

Most likely short-term outcome:

Price consolidates between $450-$490

RSI cools off from overbought levels

Builds base for next leg higher

Healthy consolidation after massive rally

Watch for breakout direction

MY ASSESSMENT - BULLISH WITH CAUTION

The weight of evidence strongly favors bulls:

+143% YTD performance speaks for itself

Privacy narrative is the strongest it's been in years

Development activity is robust

Shielded transactions at ATH

Community sentiment extremely bullish

Ascending channel intact

All timeframes showing bullish structure

However, caution is warranted:

RSI at 84 is overbought

Near 52-week high - natural resistance

$500 is major psychological barrier

Some profit-taking expected

Regulatory headlines could cause volatility

My Stance: BULLISH - Buy Dips Strategy

I believe XMR will eventually break $500 and continue higher. The fundamentals and narrative support it. However, I would not chase at current levels with RSI at 84. Instead:

Wait for pullback to $449-$460 area for better entry

Or wait for confirmed breakout above $500 with volume

Avoid buying in the middle of the range

Trade Framework

Scenario 1: Breakout Trade Above $500

Entry Conditions:

Daily candle closes above $500

Volume exceeds recent average

RSI holds above 65 (not diverging)

Trade Parameters:

Entry: $505-$515 on confirmed breakout

Stop Loss: $475 below recent support

Target 1: $550 (Risk-Reward ~1:1)

Target 2: $600 (Risk-Reward ~1:2)

Target 3: $750 (Extended)

Scenario 2: Buy the Dip at Support

Entry Conditions:

Price pulls back to $449-$460 zone

RSI cools to 50-60 range

Bullish rejection candle at support

Ascending channel support holds

Trade Parameters:

Entry: $450-$460 on support test

Stop Loss: $420 below channel support

Target 1: $490-$500 (Risk-Reward ~1:1.5)

Target 2: $550 (Risk-Reward ~1:3)

Target 3: $600 (Extended)

Scenario 3: Channel Bottom Buy

Entry Conditions:

Price tests $407-$410 major support zone

Strong bounce with volume

RSI oversold or near oversold

Trade Parameters:

Entry: $410-$420 at channel bottom

Stop Loss: $385 below support zone

Target 1: $460-$470 (Risk-Reward ~1:2)

Target 2: $500 (Risk-Reward ~1:3.5)

Target 3: $550+ (Extended)

Risk Management Guidelines

Position sizing: 2-3% max risk per trade

Respect overbought RSI - don't chase

Use hard stops - privacy coins can be volatile

Scale into positions rather than all-in entries

Take partial profits at each target (33% each)

Move stop to breakeven after first target

Monitor regulatory news closely

Be aware of lower liquidity on some exchanges

Invalidation Levels

Bullish thesis invalidated if:

Price closes below $407 (channel bottom)

Ascending channel breaks down

RSI divergence confirms with lower price

Major exchange delisting causes panic

Bitcoin crashes below $85,000

Bearish thesis invalidated if:

Price closes above $500 with volume

RSI makes new highs with price

Shielded transactions continue hitting ATHs

Privacy narrative accelerates further

Conclusion

KRAKEN:XMRUSD is the standout performer of 2025 with +143% YTD gains. The privacy narrative is firing on all cylinders - EU ban fears, Midnight protocol launch, surveillance concerns, and development upgrades have created a perfect storm for Monero.

The Numbers:

YTD Performance: +143.09%

1-Year Performance: +155.28%

52-Week High: $497.75

Current Price: $469.71

RSI: 84 (Overbought)

Market Cap: $8.67 billion

Key Levels:

$500 - CRITICAL resistance / breakout level

$497.75 - 52-week high

$449 - 50-day EMA support

$407-$410 - Major support zone (channel bottom)

The Setup:

Monero is consolidating just below its 52-week high after an incredible rally. The trend is bullish, fundamentals are strong, and the privacy narrative is the best it's been in years. However, RSI at 84 warns of potential short-term pullback.

Strategy:

Don't chase at current levels

Buy dips to $449-$460 support

Or buy confirmed breakout above $500

Targets: $550, $600, $750+

Stop below $420 or channel support

The path of least resistance is higher. Privacy is becoming more valuable, not less. Monero's technology is proven, development is active, and the community is committed. The EU ban paradoxically validates everything Monero stands for.

$1,000 XMR is not a meme - it's a matter of when, not if.

This is not financial advice. Always conduct independent research and manage risk appropriately.

Monero Confirmed BreakoutMonero CRYPTO:XMRUSD has broken the local high at 470 with a Weekly closing bar of 470.38.

Even if by 0.38 this is still a rule followed to confirm the breakout.

The next Resistance will be at the All Time High at 517.60. Given the breakout confirmation and momentum it is the highest probability that price will test the ATH and then we will see if it that weekly bar closes to confirm it as well.

How High Can Monero Go?

I do not presume to accurately call tops.

Given the progression of ATHs the most likely next high would be around 593. Using a projection of 3 Year Historic Volatility the target could be 793.

Caveat: Such a fast rise in price means inheirent high volatility and a look at Monero's long term history shows that a dramatic snap back is eventually very likely. This is a very difficult ticker to go long at this point.

That being said - I still continue to believe that Monero is the best asymmetric bet in cryptocurrency right now.

Monero: "Delisting is a Feature"What if NOT being listed on major Centralized Exchanges is Monero's greatest bull case?

Most investors assume the same thing:

Assets go up because they attract speculative capital.

Liquidity, listings, leverage, and visibility are treated as prerequisites for valuation.

So Monero’s biggest “problem” — being delisted from major centralized exchanges due to its privacy guarantees — is usually framed as fatal.

But what if that assumption is backward?

What if removal from the speculative casino is precisely why Monero behaves differently — and arguably better — than the rest of crypto?

The common criticism (and why it persists)

The standard argument goes like this:

Monero’s privacy features make it non-compliant with evolving regulations.

That forces centralized exchanges to delist it.

Without exchange access, speculative inflows dry up.

Without speculation, price stagnates.

That narrative has circulated for years. It sounds logical.

It’s also increasingly contradicted by reality.

Despite repeated delistings, Monero has emerged as one of the most uncorrelated assets in the entire crypto market.

And correlation — not volatility — is what quietly destroys portfolios.

What the charts are actually showing

INDEX:BTCUSD

CRYPTO:ETHUSD

CRYPTO:SOLUSD

CRYPTO:DOGEUSD

CRYPTO:XRPUSD

This morning’s sharp up/down move rippled across crypto almost uniformly.

Bitcoin, Ethereum, Solana, Doge, XRP — all displayed the same pattern:

A volatility spike

A break from bearish consolidation

A quick rejection back into the range or lower

It was a textbook “low-volume volatility quake.”

Monero barely reacted.

While the rest of the market moved as a single organism — pushed and pulled by the same algos, market makers, and thin liquidity — Monero’s bullish trend remained largely uninterrupted.

When everything moves together except one asset, that exception matters.

The delisting that changed the story

On February 6, 2024, Monero dropped over 30% overnight.

At first, I assumed the worst — a cryptographic failure or privacy compromise.

Instead, the cause was simple:

Binance delisted Monero for regulatory non-compliance with privacy coins.

In other words, Monero was punished for working exactly as designed.

I held.

This ended up being a market reaction quickly abated and Monero has rallied over 300%.

The selloff faded quickly.

Since that low, Monero has rallied more than 300%.

Being removed from the highest-volume exchange did not suppress Monero’s value.

If anything, it may have liberated it.

The overlooked mechanism

Most cryptocurrencies are now:

Heavily centralized around exchanges

Continuously arbitraged

Priced primarily through leverage and relative flows

That makes them efficient — and tightly correlated.

Monero exists increasingly outside that system.

With fewer algos, less leverage, and limited access to reflexive speculation, Monero’s price is influenced more by:

Actual usage

Holder conviction

Intrinsic demand for private settlement

That doesn’t make it exciting every day.

It makes it structurally different.

And markets eventually reward assets that don’t break the same way everything else does.

A thought worth sitting with

Most people believe delistings remove value.

That belief feels obvious — until you watch an asset stop reacting to the same forces that destabilize everything else.

Monero may not be underperforming because it lacks speculation.

It may be outperforming because it no longer depends on it.

In a market addicted to correlation, independence is not a bug.

It’s the feature everyone overlooks — right up until it matters.

XMR - Institutional Analysis: Channel Support Buy Zone | Dec 7XMRUSD - The Privacy Resistance: How Regulatory War Created The Perfect Parallel Channel Setup

by officialjackofalltrades

🟡 CAUTIOUSLY BULLISH December 7, 2025

Institutional Technical Analysis | Whale Signals Integrated

📈 Executive Summary - The Setup

Current Price: $372.78 | December 7, 2025

Monero is trading at a critical inflection point inside a well-defined parallel channel that has dictated price action for the past 90 days. After a spectacular +23% rally to $420 in the first week of December, XMR has pulled back to test lower channel support at $370-380 exactly where technical analysis suggests the next major move will be decided.

The Technical Setup:

Pattern: Ascending parallel channel (bullish structure)

Current Position: Lower channel support ($370-380)

Resistance: Upper channel boundary ($420-450)

Key Decision Level: $360 (below = channel break, above = bounce continuation)

The Fundamental Backdrop:

While retail focuses on regulatory FUD from 2024 delistings (Binance, Kraken, OKX), they're missing three critical developments:

XMR reclaimed privacy crown from Zcash on November 29, 2025

Fluorine Fermi upgrade enhanced network surveillance defenses on October 10

Early December saw 23% price surge despite broader crypto market liquidations

The Trade: Long from $360-380, target $420-480, stop $355 below ..

Monero's price on December 7, 2025, is fluctuating approximately between $390 and $400, with some reports indicating a notable 23% increase in the first week, pushing its average trading price to $406 and briefly reaching a short-run high of $420 .

What This Means:

The $420 short-run high demonstrates XMR's technical strength even as it tests the upper boundary of the channel. The current pullback to $372 is textbook technical behavior—price respecting the parallel structure.

Current Technical Position:

Support Levels (Where buyers defend):

$370-$380: Lower parallel channel + 50-day MA convergence (CURRENT LEVEL)

$360-$365: Channel absolute floor + psychological support

$320-$340: Major support cluster from Aug-Nov accumulation

$280-$300: Nuclear capitulation zone (10% probability)

Resistance Levels (Where sellers appear)

$400-$420: Recent high + upper channel boundary

$435-$450: Channel breakout zone + 2025 YTD high

$480-$500: Psychological resistance + near ATH

$517.62: All-time high (May 2021)

Not overbought (room to run higher)

Not oversold (not in panic selling zone)

Neutral = equilibrium before next directional move

MACD (Momentum):

Histogram: Positive but declining (losing steam short-term)

Signal line: Approaching bullish cross

Interpretation: Consolidation before next leg up

Volume Analysis:

24-hour trading volume of $114.56M - this is concerning. Volume has been declining since the December 3 peak, indicating:

Thin liquidity from exchange delistings

Lower participation = higher volatility potential

Breakouts need VOLUME confirmation

🔎 Fundamental Analysis - The Regulatory War Creates Opportunity

While technical analysis shows the "what" and "when," fundamentals explain the "why." Here's what's REALLY happening with Monero:

CATALYST #1: The Exchange Delisting Paradox

The Bearish Narrative (What retail sees):

Binance delisted XMR February 2024

OKX delisted XMR January 2024

Kraken delisted XMR in EEA October 2024

"Privacy coins are dying!"

The Reality (What institutions know):

Monero founder Riccardo Spagni said: "Kraken delisting Monero in Europe just goes to prove what we already know: Chainalysis et al. simply can't squeeze enough information out of Monero's privacy to be meaningful, otherwise regulators would want Monero to stay listed as a honeypot".

Read that again. The delistings PROVE Monero's privacy works.

If regulators could track Monero, they'd WANT it listed to monitor users. The fact they're forcing delistings means they can't break the privacy.

Market Impact:

Short-term: Liquidity crunch, price volatility

Long-term: Validates Monero's core value proposition

Institutional view: "Monero is the ONLY privacy coin that actually works"

CATALYST #2: FCMP++ Upgrade - The Game Changer

Network improvements such as FCMP++ (Full Chain Membership Proofs) represent the most significant privacy enhancement since Monero's creation.

What FCMP++ Does:

Removes the need for ring signatures with fixed size

Enables membership proofs over the ENTIRE blockchain

Makes transaction tracing mathematically impossible (not just difficult)

Reduces transaction size = lower fees

A breakout imminent now that we are about to hit the all-time high of $517 will take XMR to new heights, particularly with the successful implementation of network improvements such as FCMP++ .

Developer Momentum:

Fluorine Fermi upgrade on October 10, 2025 enhanced defenses against network surveillance risks. Then Ledger Wallet Bug Fix on November 14, 2025 patched a critical vulnerability when rejecting view key exports.

Translation: While other projects ship vaporware, Monero is shipping real privacy tech that regulators literally cannot break.

CATALYST #3: Privacy Demand at All-Time High

As of December 7, 2025, Monero (XMR) continues to be a focal point in the cryptocurrency market, primarily due to its unwavering commitment to privacy in an increasingly regulated digital landscape.

The irony? Regulatory crackdowns INCREASE demand for privacy.

Every time a government announces surveillance measures, Monero adoption spikes. Every time an exchange delists XMR, peer-to-peer volume increases.

XMR surged 30% from November lows, defying crypto-wide liquidations on December 1. While Bitcoin, Ethereum, and other coins crashed with $637M in liquidations, Monero rallied.

Why? Because in times of uncertainty, people want privacy.

CATALYST #4: The Zcash Flip

Reclaims Privacy Crown (29 November 2025) – Overtook Zcash in market cap amid capital rotation.

This is MASSIVE. Zcash (ZEC) was Monero's main competitor for years. But Comparatively, Zcash (ZEC) has fallen by almost a quarter during the same time, which points to the unstable nature of the privacy coin segment.

Why Monero Won:

Zcash has optional privacy (most transactions are transparent)

Zcash has a company behind it (Zcash Foundation) = regulatory target

Monero has mandatory privacy (all transactions private)

Monero is truly decentralized (no company, no CEO)

Capital is flowing FROM weak privacy (ZEC) TO strong privacy (XMR). This trend is accelerating.

⚠️ Risk Factors - The Bear Case

I'm bullish on the technical setup, but let's address the others in the room:

RISK #1: Mining Centralization (Qubic Attack)

Qubic grabbed 20% of all blocks in 24h during mining marathon, while DDoS attacks hit network. Qubic's growing hashrate share (peaking at 38% in July 2025) threatens decentralization, a core Monero value proposition.

What happened: Qubic, a quantum-resistant blockchain, started mining XMR with specialized hardware, capturing up to 38% of network hashrate.

Why it matters: If one entity controls >51% hashrate, they could theoretically attack the network.

Current Status:

Qubic hashrate declined from 38% (July) to ~20% (December)

P2Pool (decentralized mining pool) is growing

Monero community is working on algorithm tweaks

My take: This was concerning in July, but the trend is REVERSING. Hashrate is becoming more distributed again.

RISK #2: Thin Liquidity = High Volatility

24-hour trading volume of $114.56M is low compared to XMR's $7.21B market cap.

Volume-to-Market Cap Ratio: 1.6% (very low)

Bitcoin: ~5-8%

Ethereum: ~4-6%

Monero: ~1.6%

What this means:

Large orders can move price significantly

Volatility is higher than major coins

Slippage is a concern for larger trades

Trading Implication: Use limit orders, not market orders. Scale in/out slowly.

RISK #3: Regulatory Uncertainty

Governments and financial regulators are cracking down on cryptocurrencies that allow users to hide their transaction details, fearing that they could be used for illicit activities like money laundering, tax evasion, and terrorism financing.

Potential Future Actions:

More exchange delistings (though most already done)

Criminalization of possession (extreme, unlikely)

Banking restrictions on fiat on/off ramps

Counterpoint: Resolving the gap in mining and avoiding international regulations will be the key to preventing the backlash, but Monero has interesting arguments in its practical use of privacy in the real world, especially in a market where utility is highly valued more than speculation .

🎯 THE TRADE SETUP - Institutional-Grade Execution

🟢 PRIMARY LONG SETUP: BUY XMRUSD

Entry Zone: $360-$380 (SCALE IN - We're at the PERFECT zone RIGHT NOW)

Position Sizing (Conservative Institutional Approach):

Allocate 4-6% of portfolio (this is a MEDIUM conviction trade due to liquidity risk)

Scale in strategy:

30% at $375-380 (CURRENT - enter NOW if not in)

$365-370 (if we get one more dip to channel support)

$360-365 (if we hit absolute channel floor)

Stop Loss: $355

Below $355 = parallel channel broken on daily close

Below this = technical structure invalidated

Max loss: 6-8% from average entry

Take Profit Targets (Institutional Scale-Out Strategy):

TP1: $420-$435

Upper parallel channel resistance retest

December 2-3 peak at $420 retest

Action: move stop to $370 (breakeven)

TP2: $450-$480 (Probability: 50%)

Channel breakout + FCMP++ upgrade hype builds

Monero forecast between $382.54 and $456.36 next year

Action: move stop to $420 (lock gains)

All-time high $517.62 retest

Full bull market confirmation

Provided that buyers continue their growth, XMR is one of the best cryptos to consider as the new bull run might start with the daily close higher than $327

Entry Confirmation Checklist (Use This Before Entering):

✅ Price holding above $360 (channel support intact)

✅ Volume spike on bounce (150K+ XMR on daily candle)

✅ RSI crosses above 55 (momentum shift confirmed)

✅ MACD bullish cross on H4 timeframe

✅ Bitcoin holding above $95K (macro support)

✅ No surprise negative regulatory news (check daily)

WAIT FOR 4/6 CONFIRMATIONS BEFORE DEPLOYING FULL POSITION

Weekly Monitoring Requirements:

CRITICAL - Check EVERY WEEK:

Hashrate distribution: If Qubic >40% again, reduce position 50%

Exchange news: Any re-listings = bullish, add to position

Developer activity: Check Monero GitHub for FCMP++ progress

Regulatory news: New delistings = short-term bearish, long-term bullish

Bitcoin correlation: If BTC <$90K, reduce XMR position 30-50%

Volume trends: If 24h volume <$80M consistently, reduce position

5. Emergency Exit Conditions (CUT IMMEDIATELY):

❌ Daily close below $355 = EXIT ALL (channel broken)

❌ Qubic hashrate >51% sustained = EXIT ALL (security risk)

❌ Major security vulnerability discovered = EXIT ALL

❌ Bitcoin crashes below $85K = EXIT 50%, trail rest tight

❌ Volume dries up below $50M/24h = EXIT 50% (liquidity crisis)

📊 Scenario Analysis - What Happens Next

Base Case: Channel Bounce to $420-450

What happens:

XMR holds $370 support ✓

Bounces along lower channel to retest $420 resistance

Volume increases modestly

FCMP++ development continues

Breaks $435, targets $450-480

Timeline: 2-4 weeks

Expected Return: +17-29%

Catalysts: Technical bounce, no new negative news

Bull Case (2 Channel Breakout to $500+

What happens:

XMR breaks above $450 with VOLUME

XMR forecasted to reach $456.36 by January 1, 2026

FCMP++ release creates buzz

Privacy narrative strengthens

Targets ATH $517

Timeline: 4-8 weeks

Expected Return: +34-40%

Catalysts: FCMP++ launch, major adoption news, BTC >$110K

Bear Case (15% Probability): Channel Break to $320-340

What happens:

XMR breaks below $360 on volume

Tests major support at $320-340

Regulatory FUD intensifies

Bitcoin corrects below $95K

Thin liquidity amplifies drop

Timeline: 1-2 weeks

Expected Return: -8 to -14%

Catalysts: Surprise delisting, BTC crash, Qubic attack

Probability-Weighted Expected Return:

🔥 The Bottom Line - Why This Setup Works

Let me synthesize everything into a clear thesis:

The Technical Case:

✅ Parallel channel: 8 successful tests, currently at lower support

✅ +23% surge in first week of December to $420

✅ Overtook Zcash in market cap November 29

✅ Fluorine Fermi upgrade enhanced security October 10

✅ Privacy demand at all-time high in regulated landscape

✅ Delistings prove Monero's privacy actually works

The Risk Case:

⚠️ Thin liquidity (<$115M daily volume)

⚠️ Qubic mining centralization (peaked 38% hashrate)

⚠️ Regulatory uncertainty ongoing

⚠️ Exchange access limited (most CEXs delisted)

The Trade:

Entry: $360-380 (we're at $372 NOW)

Stop: $355 (-5% max loss)

Target : $380-400

IF YOU'RE BEARISH:

Wait for:

Daily close below $360 (channel break confirmed)

Then short from $355-360 with tight stop at $380

Target $320-340 support retest

Cover at $320, reassess

IF YOU'RE NEUTRAL:

Split the Difference:

Enter only at $365-370 (better risk/reward)

Take profits aggressively

This is the "I believe but I'm cautious" approach

💬 Final Thoughts - The Uncomfortable Truth

Here's what I know for certain on December 7, 2025:

✅_ContinueYour parallel channel analysis is PERFECT - XMR is respecting the structure exactly

✅ +23% rally to $420 in December's first week proves momentum

✅ XMR reclaimed privacy crown from Zcash - capital rotation happening

✅ Privacy demand at all-time high - fundamental bid exists

✅ Delistings prove Monero's tech works - validates thesis

✅ We're at lower channel support ($370) - mathematically optimal entry

Will Bitcoin hold $100K or crash?

Will Qubic attack Monero's hashrate again?

Will more exchanges delist (though most already have)?

Drop a 🟠 if you're entering XMR at $360-380 channel support.

Drop a 📊 if this parallel channel analysis helped you.

Drop a 🔒 if you believe in privacy's future.

Drop a 💰 if you're ready for $450+ in Q1 2026.

XMR Sell/Short Signal (4H)XMR has turned bearish after the change of character (CH) and, following the break of the short-term trendline, has now pulled back to a resistance zone while also sweeping a liquidity pool above the pivots.

With proper risk management and adherence to the stop-loss, this setup can be entered.

Targets are marked on the chart.

A daily candle closing above the invalidation level will negate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

XMR -- Phase 2, eyeing a retap of ATH area plus more! SEED now!Monero (XMR) is outperforming other cryptocurrencies and traditional markets, with a 74% year-to-date increase, despite being delisted from major exchanges and banned in the EU. Its strong privacy features, such as untraceable transactions and upcoming updates like FCMP++, make it a preferred choice for financial privacy. Monero is widely used in peer-to-peer commerce, including dark web transactions and emerging marketplaces. Its growing adoption highlights its role as a private, decentralized alternative to traditional financial systems.

Based on recent metrics, XMR has been showing some decoupling behavior from the crypto space bringing forth a sense of price independence from the market.

Recent long term data is hinting of another basing season which hints of another accumulation period -- an impending round of growth season ahead.

We are currently on Phase 2 of this higher base shift at current price of 290.0. Phase 1 started from early 2024 on Q1 when it tapped the lows of 99.0 and went parabolic to tap the 400 zone early 2025 (12 months after). As with any overheated parabolic move, the coin was met with strong profit taking -- undergoing an extended corrective season and finally settling at the 200 range.

Now, based on recent metrics -- XMR is now ripe for another round of growth series from here on, targeting a retap of previous peak at 420 -- and eventually the ATH zone at 517.60.

Ideal seeding period is now. Based on our diagram -- discount darvas meter has been activated. Meaning, current pricing is now at bargain levels and price growth is expected from here on as we more forward.

Spotted at 290.

Interim target at previous peak 420.

Long term - ATH at 517 / then beyond at 800-1k levels.

TAYOR.

Trade safely always.

Monero: The best asymmetric bet in crypto"Your winners are never big enough."

I don’t recall who said it first, but I credit legendary trader Peter Brandt for popularizing this maxim — the one that comforts every risk-conscious trader whose conviction proves right but whose position size was too small.

A little over two years ago, I realized that Monero embodies the ethos Bitcoin once had: private, decentralized, uncensorable money free from government and corporate control.

Bitcoin has since drifted from that ideal. It may function as a store of value today, but it has surrendered most of its role as a medium of exchange on the internet. Monero has quietly taken that mantle. Watching major Bitcoin thefts be traced and seized — because Bitcoin is, in fact, traceable — only reinforced my view: Monero’s value as true private money would keep growing as the market caught on.

Since forming that conviction, I’ve seen two events that seemed to threaten Monero’s survival — yet ultimately proved its resilience.

The first was Monero’s delisting from Binance, forced by European regulations banning privacy coins. The market panicked; XMR dropped 30% overnight. At first, I feared its code had been compromised. But the truth was simpler — and far more bullish. Monero was being recognized as working exactly as intended: too private for governments to track.

The second came this year with an attempted 51% hashrate takeover. Confusion reigned, and even I questioned whether this was an existential threat. Yet I decided that if the world could no longer sustain private money, little else would matter. I held my conviction — and Monero endured.

Through all of it, Monero has proven to be the pluckiest cryptocurrency alive — rising now amid one of the most skeptical phases of the current bull cycle.

From a price-action standpoint, the weekly close above the prior $420 high (yes, that number) would confirm a breakout. But I don’t think it matters. As a trader, I’ve found Monero almost un-tradable — my usual methods simply don’t apply to XMR/USD. Its chart behaves unlike any other asset.

That doesn’t frustrate me anymore. It fascinates me. The best move with Monero isn’t to trade it — it’s to own it.

Monero remains the best asymmetric bet in crypto.